|

市场调查报告书

商品编码

1851339

穿戴式健康感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Wearable Health Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

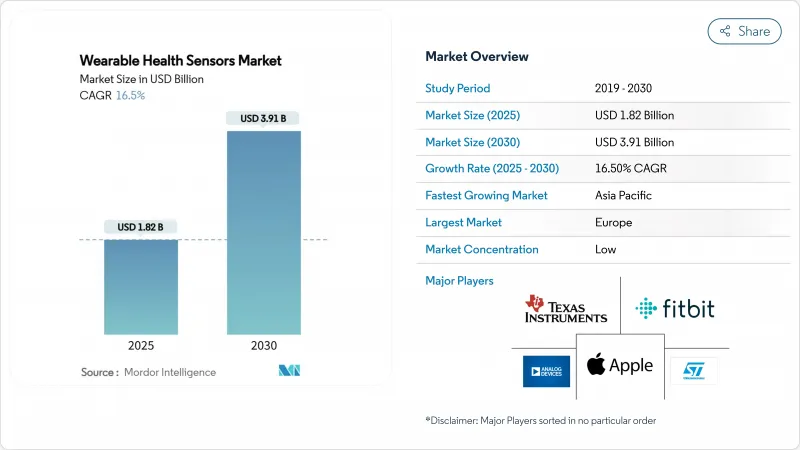

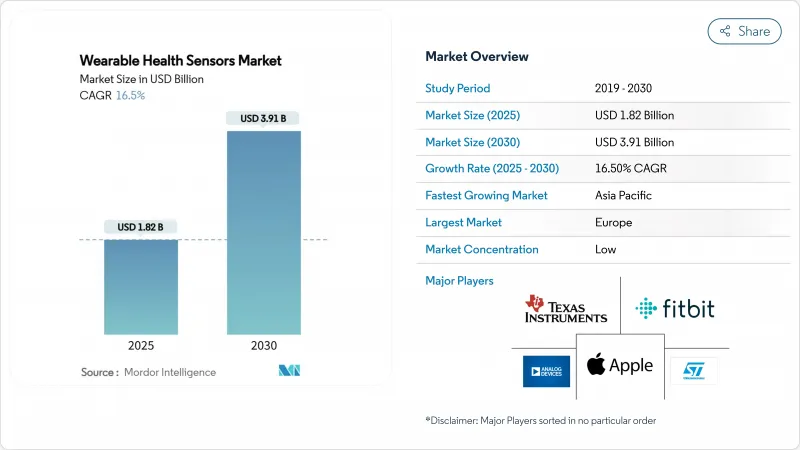

预计到 2025 年,穿戴式健康感测器市场规模将达到 18.2 亿美元,到 2030 年将达到 39.1 亿美元,年复合成长率为 16.5%。

随着支付方和医疗服务提供者看到早期疗育带来的显着成本节约,需求正从间歇性照护转向持续监测。小型感测器结合低功耗蓝牙、LTE-M 和 NB-IoT 技术,在将临床级资料传输到安全云平台的同时,保持了低功耗。北美地区受惠于远端患者监护(RPM) 的报销政策,推动了相关技术的应用;而印刷生物贴片的成本创新则拓展了其在欧洲和亚洲的应用。竞争的焦点在于非侵入式血糖检测、与肤色无关的光学感测以及能够在不影响电池寿命的前提下提高精度的混合 MEMS-光学堆迭。晶片供应商和设备品牌之间的伙伴关係正在加速多参数穿戴式装置在消费、临床和工业领域的上市。

全球穿戴式健康感测器市场趋势与洞察

获得FDA批准的远端患者监护线缆加速了美国处方笺级穿戴设备的发展

简化远端患者监护 (RPM) 计费流程已将强制性的 30 天週期从 16 天缩短至 12 天,从而释放了每年 51 亿美元的设备资金。现在,医疗服务提供者每年每位患者最多可获得 1,400 美元,用于购买企业级感测器平台,而非零售设备。一家大型医疗系统已组建专门的 RPM 团队,并扩大了智慧型手錶可与相关贴片和电子病历 (EHR) 控制面板配合使用。慢性病患者的再入院率下降了 30%,这增强了支付方的支持力道。

亚洲各国强制推行慢性病筛检,推动了连续血压监测仪和动态血糖监测套件的普及。

中国在最新的五年规划中累计87亿美元用于糖尿病和高血压筛检,设备需求年增率达22.3%。日本强制要求40岁以上公民每年进行心血管疾病筛检,并将穿戴式感测器纳入全民医疗保险。这些项目将产生用于人工智慧决策支援的纵向资料集,同时在全部区域推广居家诊断。

欧盟医疗器材法规 (EU MDR) IIa 类软体即医疗器材上市后监管的延误

分析型穿戴装置的平均审批时间从7个月增加到19个月,新兴企业的遵循成本增加了280%。许多公司推迟了在欧盟的上市计划,或转向健康标籤,这延缓了临床级可穿戴设备在各地区的上市时间;而规模较小的公司则寻求扩大规模以分摊监管成本,从而推动了行业整合。

细分市场分析

到2024年,加速计和惯性MEMS感测器将占据32.4%的市场份额,凭藉其在追踪身体多个部位运动模式方面的多功能性,它们将成为穿戴式健康感测器生态系统的基础。这些感测器的功能正在从简单的步数计数发展到能够进行高级步态分析和跌倒检测,这在老年护理应用中尤其重要。光学/光电容积脉搏波描记法(PPG)感测器预计将在2025年至2030年间以13.4%的最快速度成长,这主要得益于其功能不断扩展,从心率监测扩展到血氧饱和度、血压估算,甚至早期血糖监测应用。温度感测器在连续发热监测系统中重新焕发活力,而压力感测器则越来越多地应用于智慧鞋类,以预防糖尿病足溃疡。

将多种感测器整合到单一装置中代表着市场发展的重大变革,其中混合磁感测器感测器和光学感测器的组合在改善心血管监测方面展现出尤为广阔的应用前景。越南国家大学的最新研究表明,结合这些感测器可以克服光学感测器在检测细微心血管异常方面的局限性,从而有望实现对诸如房颤等疾病的早期疗育。电化学生物感测器在汗液分析等特定应用中日益普及,例如用于水合状态监测。同时,位置感测器和接近感测器能够提供情境感知讯息,透过校正身体姿势和运动的影响,提高其他感测器读数的准确性。

腕戴式设备凭藉其消费者熟悉度高、外形规格成熟以及能够在一个易于取用的位置集成多种感测器等优势,将在2024年继续保持45%的市场份额。这种部署方式的战略优势在于平衡用户接受度和感测器精度,苹果和三星等领先公司正利用其智慧型手錶平台推出日益复杂的健康监测功能。智慧服饰和纺织品将以15.2%的复合年增长率(2025-2030年)实现最快增长,因为柔性电子和导电材料的创新使得感测器能够无缝整合到日常服装中,而不会影响舒适度或耐洗性。

胸贴和皮肤穿戴式感测器在临床应用中日益普及,它们能够为慢性病患者提供持续监测功能,同时保持隐藏。不列颠哥伦比亚大学开发了一种低成本的压阻式感测器,可嵌入纺织品中,用于监测人体运动,包括心率和体温。穿戴式头戴装置和眼镜产品在神经监测和扩增实境(AR)健康介面等领域找到了专门的应用。同时,鞋类感测器能够提供关于步态模式和体重分布的独特见解,使其在糖尿病治疗和运动表现分析方面具有特别重要的价值。植入式和可摄入式感测器的兴起代表着市场前沿,它们能够提供前所未有的监测精度,但在监管和使用者接受度方面面临着巨大的挑战。

穿戴式健康感测器市场按感测器类型(压力感测器、温度感测器及其他)、配戴方式/外形规格(腕带、胸贴及其他)、应用领域(生命体征监测及其他)、最终用户(医疗服务提供者及其他)、连接方式(蓝牙、Wi-Fi及其他)和地区(北美及其他)进行细分。市场规模和预测均以美元计价。

区域分析

预计到2024年,北美将以38.71%的营收份额引领穿戴式健康感测器市场。远距病患监护(RPM)报销的广泛普及、人均医疗保健成本的不断上涨以及日益完善的生态系统正在刺激医疗机构的需求。美国医疗保险和医疗补助服务中心(CMS)允许医疗机构每年向每位接受监测的慢性病患者收取约1400美元的费用,这使得此类设备从消费级新奇产品转变为临床医疗资产。加拿大正在将远端医疗扩展到偏远省份,而墨西哥的社会安全体係正在试行为糖尿病持续监测(CGM)提供补贴。

到2030年,亚太地区将以13.8%的复合年增长率实现最快成长速度。中国的国家健康筛检预算推动了连续血压监测仪和血糖感测器的批量采购,同时本土半导体製造商也在扩大光晶片组的生产规模。日本的超老化社会将防跌倒和心律不整套件纳入社区诊所。印度的中产阶级开始使用中阶健身手环,而政府基层医疗中心则在测试穿戴式生命征象监测亭。韩国利用其代工技术,为全球品牌提供MEMS和ASIC核心。

欧洲的贡献举足轻重,但却面临医疗器材法规 (MDR) 的阻力。德国和法国正在为透过其 DiGA 或 PACTe 门户网站提交的数位疗法提供报销,鼓励进行心臟衰竭和慢性阻塞性肺病 (COPD) 监测的临床试验。德国、荷兰和英国的印刷电子中心正在降低贴片的成本,并帮助医院证明一次性感测器的合理性。然而,MDR 的上市后限制正在减缓 IIa 类软体的推广,导致一些新兴企业优先考虑在美国发布产品。在中东的油气产业劳动力计画中,该技术的应用正在加速推进;而在非洲,其应用能否成功取决于能否解决肤色较深人群在光电容积脉搏波描记法 (PPG) 的准确性和连接性方面存在的不足。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 获得FDA批准的远端患者监护线缆加速了美国处方笺级穿戴装置的普及

- 亚洲强制慢性病筛检推动了持续血压/动态血压监测套件的使用

- 在欧洲扩大印刷柔性生物贴片的生产规模,可将单位成本降低至1美元以下。

- 精英运动联盟采用人工智慧驱动的伤病预防穿戴设备

- 海湾合作委员会油气作业中的工人安全防热疲劳计划

- 非侵入式光学血糖感测器的创业融资激增

- 市场限制

- 欧盟医疗器材法规 (EU MDR) IIa 类软体即医疗器材上市后监管的延误

- 超小型贴片电池能量密度的限制

- PPG在非洲/加勒比海国家的召回:肤色差异导致准确性差距

- 巴西和哥伦比亚资料主权合规的成本

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术概览(感测器小型化、印刷及软性电子产品)

第五章 市场规模与成长预测

- 依感测器类型

- 压力感测器

- 温度感测器

- 加速计/惯性MEMS

- 光学/PPG感测器

- 生物感测器(电化学)

- 陀螺仪和磁力计

- 位置和接近感测器

- 其他的

- 透过佩戴位置/外形规格

- 腕錶

- 头饰和眼镜产品

- 胸部贴片和皮肤黏合剂

- 鞋类和鞋垫

- 智慧服饰/纺织品

- 植入式和可摄入式感测器

- 透过使用

- 生命征象监测

- 慢性病管理(糖尿病、心血管疾病)

- 运动与健身表现

- 远端患者监护和老年护理

- 心理健康与压力追踪

- 工人安全和环境暴露

- 最终用户

- 医疗保健提供者和医院

- 消费性电子品牌

- 运动队伍/健身中心

- 军人和初期应变人员

- 家庭护理服务提供者

- 透过连接技术

- Bluetooth/BLE

- Wi-Fi

- NFC/RFID

- 蜂窝网路(LTE-M/NB-IoT)

- 超宽频(UWB)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 北欧国家

- 瑞典

- 挪威

- 丹麦

- 芬兰

- 西欧

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 东欧

- 波兰

- 俄罗斯

- 其他欧洲

- 中东

- 海湾合作委员会(沙乌地阿拉伯、阿联酋、卡达、科威特、巴林、阿曼)

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东协(印尼、马来西亚、泰国、越南、菲律宾、新加坡)

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、资金筹措、伙伴关係)

- 市占率分析

- 公司简介

- Apple Inc.

- Alphabet Inc.(Fitbit)

- TE Connectivity Ltd.

- STMicroelectronics NV

- Texas Instruments Inc.

- Analog Devices Inc.

- TDK Corporation

- Infineon Technologies AG

- NXP Semiconductors NV

- Maxim Integrated Products Inc.

- Abbott Laboratories

- Medtronic plc

- Dexcom Inc.

- Garmin Ltd.

- Omron Corporation

- Masimo Corporation

- Huawei Technologies Co. Ltd.

- Samsung Electronics Co. Ltd.

- Robert Bosch GmbH

- Valencell Inc.

第七章 市场机会与未来展望

The wearable health sensors market is valued at USD 1.82 billion in 2025 and is forecast to reach USD 3.91 billion by 2030, advancing at a 16.5% CAGR.

Demand is shifting from episodic care toward continuous monitoring as payers and providers see clear cost savings from early intervention. Miniaturized sensors paired with Bluetooth Low Energy, LTE-M, and NB-IoT keep power draw low while moving clinical-grade data into secure cloud platforms. North American adoption benefits from Remote Patient Monitoring (RPM) reimbursements, while cost breakthroughs in printed bio-patches expand use in Europe and Asia. Competitive activity centers on non-invasive glucose detection, skin-tone agnostic optical sensing, and hybrid MEMS-optical stacks that raise accuracy without harming battery life. Partnerships between silicon vendors and device brands are accelerating time-to-market for multi-parameter wearables across consumer, clinical, and industrial settings.

Global Wearable Health Sensors Market Trends and Insights

FDA-reimbursed Remote Patient Monitoring codes accelerating U.S. prescription-grade wearables

RPM billing simplification that cut mandatory capture from 16 to 12 days per 30-day cycle unlocked a USD 5.1 billion annual device pool. Providers now receive up to USD 1,400 per patient yearly, funding enterprise-grade sensor platforms over retail gadgets. Major health systems formed dedicated RPM teams, expanding procurement pipelines for validated patches and smartwatches that feed EHR dashboards. Hospital readmission rates for chronic patients have fallen 30%, reinforcing payer support.

National chronic-disease screening mandates in Asia driving continuous BP and CGM kits

China earmarked USD 8.7 billion for diabetes and hypertension screening under its latest Five-Year Plan and posts 22.3% annual device demand growth. Japan mandates yearly cardiovascular checks for citizens older than 40, embedding wearable sensors into universal coverage. These programs create long-run datasets for AI decision support while normalizing at-home diagnostics across the region.

EU MDR Class IIa SaMD post-market surveillance delays

Average clearance for analytical wearables rose from 7 to 19 months, lifting compliance expense 280% for startups. Many postpone EU launches or pivot to wellness labeling, slowing regional access to clinical-grade wearables and prompting consolidation as small firms seek scale to absorb regulatory overhead.

Other drivers and restraints analyzed in the detailed report include:

- Scale-up of printed flexible bio-patches in the EU cutting unit cost below USD 1

- AI-enabled injury-prevention wearables adopted by elite sports leagues

- Battery energy-density limits in ultra-miniature patches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Accelerometers and inertial MEMS sensors command 32.4% of the market share in 2024, establishing themselves as the foundation of the wearable health sensors ecosystem due to their versatility in tracking movement patterns across multiple body locations. These sensors have evolved beyond simple step counting to enable sophisticated gait analysis and fall detection algorithms that are particularly valuable in elderly care applications. Optical/PPG sensors are projected to grow at the fastest rate of 13.4% from 2025-2030, driven by their expanding capabilities beyond heart rate monitoring to include blood oxygen saturation, blood pressure estimation, and even early-stage glucose monitoring applications. Temperature sensors have found renewed importance in continuous fever monitoring systems, while pressure sensors are increasingly deployed in smart footwear for diabetic foot ulcer prevention.

The integration of multiple sensor types within single devices represents a significant market evolution, with hybrid magnetic and optical sensor combinations showing particular promise for improved cardiovascular monitoring. Recent research from Vietnam National University demonstrates that combining these sensor types can overcome the limitations of optical sensors in detecting subtle cardiovascular abnormalities, potentially enabling earlier intervention for conditions like atrial fibrillation. Biosensors (electrochemical) are gaining traction in specialized applications like sweat analysis for hydration monitoring, while position and proximity sensors enable contextual awareness that improves the accuracy of other sensor readings by accounting for body position and movement artifacts.

Wrist-worn devices maintain their market leadership with 45% share in 2024, benefiting from consumer familiarity, established form factors, and the ability to house multiple sensor types in a single accessible location. The strategic advantage of this placement lies in its balance between user acceptance and sensor accuracy, with major players like Apple and Samsung leveraging their smartwatch platforms to introduce increasingly sophisticated health monitoring capabilities. Smart clothing and textiles are experiencing the fastest growth at 15.2% CAGR (2025-2030), as innovations in flexible electronics and conductive materials enable seamless integration of sensors into everyday garments without compromising comfort or washability.

Chest patches and skin-adhesive sensors are gaining prominence in clinical applications, offering continuous monitoring capabilities for patients with chronic conditions while maintaining a discreet profile. The University of British Columbia has developed a low-cost piezo-resistive sensor that can be embedded in textiles to monitor human movements, including heart rates and temperatures, with the added benefit of being washable and durable SCI. Headgear and eyewear placements are finding specialized applications in neurological monitoring and augmented reality health interfaces, while footwear sensors provide unique insights into gait patterns and weight distribution that are particularly valuable for diabetic care and athletic performance analysis. The emerging category of implantable and ingestible sensors represents the frontier of the market, offering unprecedented monitoring precision but facing significant regulatory and user acceptance challenges.

Wearable Medical Sensors Market is Segmented by Sensor Type (Pressure Sensors, Temperature Sensors and More), Body Placement/Form Factor (Wrist-Wear, Chest Patches and More), Application (Vital-Signs Monitoring, and More), End User (Healthcare Providers, and More), Connectivity (Bluetooth, Wi-Fi and More), and Geography (North America, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the wearable health sensors market with 38.71% revenue share in 2024. Widespread RPM reimbursement, high per-capita health spending, and ecosystem depth spur institutional demand. CMS allows providers to bill roughly USD 1,400 each year per monitored chronic patient, turning devices from consumer novelties into clinical assets. Canada expands telehealth to remote provinces, while Mexico's social security system pilots diabetes CGM subsidies.

Asia-Pacific records the fastest 13.8% CAGR through 2030. China's national screening budgets drive bulk procurement of continuous BP cuffs and glucose sensors, while local semiconductor fabricators scale optical chipsets. Japan's super-aged society integrates fall and arrhythmia patch kits into community clinics. India's middle class adopts mid-range fitness bands, and government primary-care centers test wearable vitals kiosks. South Korea leverages foundry expertise to supply MEMS and ASIC cores for global brands.

Europe contributes a significant slice yet faces MDR headwinds. Germany and France reimburse digital therapeutics that pass DiGA or PACTe portals, encouraging heart failure and COPD monitoring pilots. Printed-electronics hubs in Germany, the Netherlands, and the UK reduce patch cost, helping hospitals justify disposable sensors. However, MDR post-market rules slow Class IIa software deployments, leading several startups to prioritize United States release first. The Middle East accelerates adoption within oil and gas labor programs, while African uptake depends on addressing PPG accuracy in darker skin populations and connectivity gaps.

- Apple Inc.

- Alphabet Inc. (Fitbit)

- TE Connectivity Ltd.

- STMicroelectronics N.V.

- Texas Instruments Inc.

- Analog Devices Inc.

- TDK Corporation

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Maxim Integrated Products Inc.

- Abbott Laboratories

- Medtronic plc

- Dexcom Inc.

- Garmin Ltd.

- Omron Corporation

- Masimo Corporation

- Huawei Technologies Co. Ltd.

- Samsung Electronics Co. Ltd.

- Robert Bosch GmbH

- Valencell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 FDA-Reimbursed Remote Patient Monitoring Codes Accelerating U.S. Prescription-Grade Wearables

- 4.2.2 National Chronic-Disease Screening Mandates in Asia Driving Continuous BP / CGM Kits

- 4.2.3 Scale-up of Printed Flexible Bio-Patches in EU Cutting Unit Cost Below US$1

- 4.2.4 AI-Enabled Injury-Prevention Wearables Adopted by Elite Sports Leagues

- 4.2.5 Worker-Safety Heat-Strain Programs in GCC Oil and Gas Operations

- 4.2.6 Venture Funding Surge in Non-invasive Glucose Optical Sensors

- 4.3 Market Restraints

- 4.3.1 EU MDR Class IIa SaMD Post-Market Surveillance Delays

- 4.3.2 Battery Energy-Density Limits in Ultra-Miniature Patches

- 4.3.3 PPG Accuracy Gaps on Dark Skin Tones Recalls in Africa/Caribbean

- 4.3.4 Data-Sovereignty Compliance Costs in Brazil and Colombia

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Technology Snapshot (Sensor Miniaturization, Printed and Flexible Electronics)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Pressure Sensors

- 5.1.2 Temperature Sensors

- 5.1.3 Accelerometers / Inertial MEMS

- 5.1.4 Optical / PPG Sensors

- 5.1.5 Biosensors (Electro-chemical)

- 5.1.6 Gyroscopes and Magnetometers

- 5.1.7 Position and Proximity Sensors

- 5.1.8 Others

- 5.2 By Body Placement / Form Factor

- 5.2.1 Wrist-wear

- 5.2.2 Headgear and Eyewear

- 5.2.3 Chest Patches and Skin-Adhesive

- 5.2.4 Footwear and In-Shoe

- 5.2.5 Smart Clothing / Textiles

- 5.2.6 Implantable and Ingestible Sensors

- 5.3 By Application

- 5.3.1 Vital-Signs Monitoring

- 5.3.2 Chronic-Disease Management (Diabetes, CVD)

- 5.3.3 Sports and Fitness Performance

- 5.3.4 Remote Patient Monitoring and Elderly Care

- 5.3.5 Mental-Health and Stress Tracking

- 5.3.6 Worker Safety and Environmental Exposure

- 5.4 By End User

- 5.4.1 Healthcare Providers and Hospitals

- 5.4.2 Consumers and Consumer-Electronics Brands

- 5.4.3 Sports Teams / Fitness Centers

- 5.4.4 Military and First Responders

- 5.4.5 Home-care Agencies

- 5.5 By Connectivity Technology

- 5.5.1 Bluetooth / BLE

- 5.5.2 Wi-Fi

- 5.5.3 NFC / RFID

- 5.5.4 Cellular (LTE-M / NB-IoT)

- 5.5.5 Ultra-Wideband (UWB)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Nordics

- 5.6.3.1.1 Sweden

- 5.6.3.1.2 Norway

- 5.6.3.1.3 Denmark

- 5.6.3.1.4 Finland

- 5.6.3.2 Western Europe

- 5.6.3.2.1 Germany

- 5.6.3.2.2 United Kingdom

- 5.6.3.2.3 France

- 5.6.3.2.4 Italy

- 5.6.3.2.5 Spain

- 5.6.3.2.6 Netherlands

- 5.6.3.3 Eastern Europe

- 5.6.3.3.1 Poland

- 5.6.3.3.2 Russia

- 5.6.3.3.3 Rest of Eastern Europe

- 5.6.4 Middle East

- 5.6.4.1 GCC (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman)

- 5.6.4.2 Turkey

- 5.6.4.3 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Nigeria

- 5.6.5.3 Kenya

- 5.6.5.4 Rest of Africa

- 5.6.6 Asia-Pacific

- 5.6.6.1 China

- 5.6.6.2 Japan

- 5.6.6.3 India

- 5.6.6.4 South Korea

- 5.6.6.5 ASEAN (Indonesia, Malaysia, Thailand, Vietnam, Philippines, Singapore)

- 5.6.6.6 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Apple Inc.

- 6.4.2 Alphabet Inc. (Fitbit)

- 6.4.3 TE Connectivity Ltd.

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 Texas Instruments Inc.

- 6.4.6 Analog Devices Inc.

- 6.4.7 TDK Corporation

- 6.4.8 Infineon Technologies AG

- 6.4.9 NXP Semiconductors N.V.

- 6.4.10 Maxim Integrated Products Inc.

- 6.4.11 Abbott Laboratories

- 6.4.12 Medtronic plc

- 6.4.13 Dexcom Inc.

- 6.4.14 Garmin Ltd.

- 6.4.15 Omron Corporation

- 6.4.16 Masimo Corporation

- 6.4.17 Huawei Technologies Co. Ltd.

- 6.4.18 Samsung Electronics Co. Ltd.

- 6.4.19 Robert Bosch GmbH

- 6.4.20 Valencell Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment