|

市场调查报告书

商品编码

1851340

建筑资讯模型(BIM):市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Building Information Modeling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

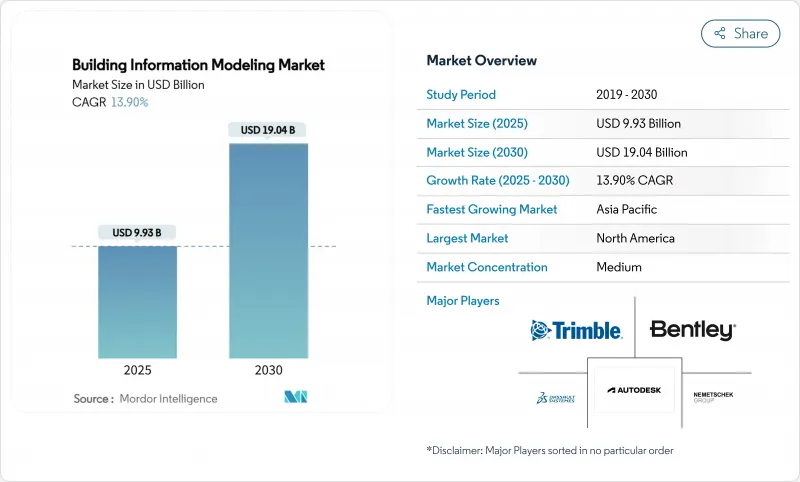

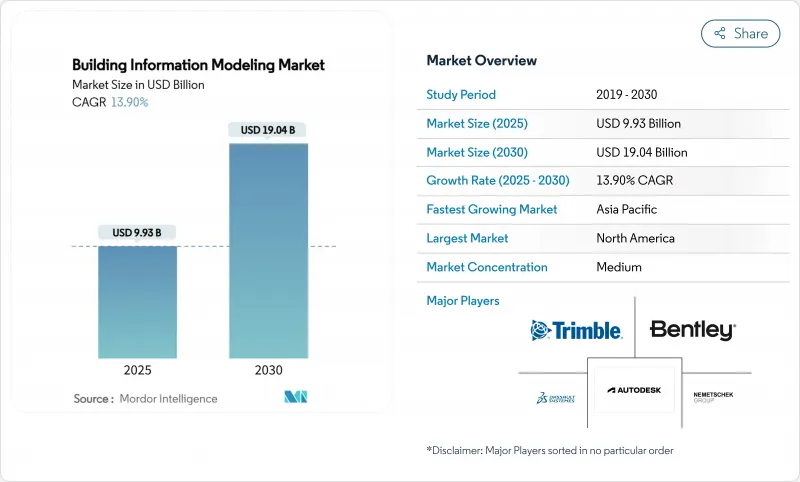

建筑资讯模型 (BIM) 市场预计到 2025 年将达到 99.3 亿美元,到 2030 年将达到 190.4 亿美元,复合年增长率为 13.9%。

建筑、工程、施工和营运领域的快速数位转型正推动BIM从视觉化工具发展成为云端协作平台。政府日益严格的政策、人工智慧和数数位双胞胎的整合,以及SaaS模式的广泛应用(降低了中小企业的初期成本),都为BIM的成长提供了动力。供应商也将4D进度安排、5D成本估算和永续性分析等功能作为预设配置,从而提高了用户切换系统的门槛。激烈的市场竞争促使BIM不断升级,提升互通性和工作流程自动化水平,也加深了使用者在整个计划生命週期中对订阅生态系统的依赖。

全球建筑资讯模型(BIM)市场趋势与洞察

电子指令与 ISO 19650 的协调一致加速了全球 BIM 的普及应用。

在成熟的建筑经济体中,公共计划强制使用BIM正在使数位化交付工作流程走向规范化。英国计画到2025年,对超过500万英镑的公共计划强制实施3级BIM,鼓励结构化资料交换,进而降低采购风险。超过60%的欧洲公共机构已发布正式的BIM策略,鼓励私人开发商遵循相同的标准。美国多个州和加拿大省份的类似政策也产生了同样的连锁反应。围绕ISO 19650的标准化简化了跨国合作,减少了合约歧义,并缩短了新相关人员的上手时间,从而直接提高了建筑资讯模型(BIM)市场的采用率。

数位双胞胎赋能的资产生命週期管理的兴起

业主们正越来越多地将BIM模型与物联网感测器连接起来,创建即时数位双胞胎模型,从而优化维护并减少停机时间。配备感测器孪生模型的建筑报告称,每年营运成本可节省5%,维护回应时间缩短了35%。在占有成本80%的阶段,这种可量化的节省潜力正促使设施营运商将传统模型升级为资料丰富的孪生模型,从而推动建筑资讯模型(BIM)市场在营运阶段的软体和服务收入成长。

中小型承包商面临高昂的许可证和培训成本

初始席位授权费用可能超过1万美元,而年度续约和硬体升级会增加整体拥有成本,这阻碍了许多中小企业采用该软体。虽然像新加坡的生产力解决方案补助金(Productivity Solutions Grant)这样的资助计划可以报销高达50%的软体费用,从而部分减轻了负担,但成本敏感性在短期内仍将阻碍建筑资讯模型(BIM)市场的发展。

细分市场分析

软体收入占比达 68%(67.5 亿美元)。 Revit 和 Archicad 等建模套件仍然是模型创建的入门级产品,集成的 4D 和 5D 功能如今已成为标配,而非高级附加元件。持续更新并融入人工智慧驱动的碰撞检测功能,正在降低客户流失,并推动建筑资讯模型 (BIM) 市场的发展。

随着业主和承包商将模型开发、协调和分析外包,服务收入正以15.8%的复合年增长率成长。外包使公司能够在无需支付固定薪酬的情况下获得稀缺人才。在欧洲和亚洲,复杂的公共运输项目普遍采用专业的BIM顾问,这扩大了建筑资讯模型(BIM)服务市场的潜在规模。

到2025年,本地部署方案的市场规模将达到71.5亿美元,占总营收的72%。大型设计公司更倾向于使用符合严格资料主权法规的本地伺服器。 FedRAMP和ISO 27001等安全认证正逐步缓解这些担忧,但根深蒂固的工作流程却减缓了这一转变的步伐。

云采用率正以18.5%的复合年增长率成长。订阅授权模式可降低资本支出,提供即时扩展能力,并使分散式企划团队能够即时协作处理模式。疫情证明远距办公的可行性后,许多公司开始采用SaaS模式来建构未来的营运模式,建筑资讯模型(BIM)市场的重心也正稳步转向託管解决方案。

区域分析

北美地区预计到2025年将创造37.7亿美元的收入,占全球收入的38%。联邦政府的基础设施支出以及数位化交付需求将推动交通运输和公共工程领域广泛采用建筑资讯模型(BIM)。美国建筑资讯模型市场规模的扩大得益于标准化物件库的普及,这些物件库简化了采购和生命週期管理。

欧洲则位居第二,这主要得益于英国和德国的强制规定。欧洲大陆预计在2024年达到30.9亿美元的收入,并在2032年翻倍。像Nemetschek这样的区域软体领导企业,利用其与学术研究的紧密联繫,保持强大的技能人才储备,并在市场中保持竞争力。

亚太地区是成长最快的地区,复合年增长率达15%。中国的智慧城市计画、日本为解决劳动力短缺问题而大力推动自动化以及印度不断扩展的交通走廊,都显着推动了市场成长。新加坡已成为该地区政策主导发展的标桿,政府激励措施涵盖部分软体支出,进一步扩大了建筑资讯模型(BIM)市场。

中东和非洲的规模虽然仍然较小,但海湾国家的发展势头强劲。沙乌地阿拉伯的NEOM等大型企划正在采用全面的数位双胞胎策略,为该地区树立了新的标竿。目前正在进行能力建设项目,以提升本地人才的技能,逐步减少对进口技术的依赖。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 协调电子指令和 ISO 19650 标准,加速全球 BIM 采用

- 数位双胞胎赋能的资产生命週期管理的兴起

- 绿建筑和净零排放合规性推动

- 模组化/异地建造需要无缝预製。

- 云端采用和SaaS定价降低了进入门槛

- 人工智慧驱动的生成式设计和预测分析可提高生产力

- 市场限制

- 中小型承包商面临高昂的许可证和培训成本

- 编写工具与开放标准之间的互通性

- 云端工作流程中的网路安全和智慧财产权保护问题

- 传统企业对流程重组有文化抵触情绪

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按解决方案类型

- 软体

- 方面

- 3D

- 4D

- 5D

- 6D

- 7D以上

- 服务

- 咨询顾问

- 实施与集成

- 培训和支持

- 託管服务

- 软体

- 透过部署模式

- 本地部署

- 云

- 依计划生命週期阶段

- 施工前期(规划与设计)

- 施工(现场施工)

- 施工后(运作和维护)

- 透过使用

- 商业建筑

- 住房部门

- 工业和製造设施

- 基础建设(公路、铁路、机场、港口、桥樑)

- 设施(医疗保健、教育、政府)

- 其他用途

- 最终用户

- 建筑师和设计师

- 工程师(结构、机电)

- 承包商和建筑商

- 业主和开发人员

- 设施和资产管理人员

- 顾问和计划经理

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧国家

- 其他欧洲地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、资金筹措、伙伴关係)

- 市占率分析

- 公司简介

- Autodesk Inc.

- Nemetschek SE

- Bentley Systems Inc.

- Trimble Inc.

- Dassault Systemes SE

- Hexagon AB

- AVEVA Group PLC

- Asite Solutions Ltd

- RIB Software GmbH

- Graphisoft SE

- Allplan GmbH

- Topcon Positioning Systems Inc.

- Procore Technologies Inc.

- ACCA Software SPA

- Revizto SA

- CMiC Inc.

- Beck Technology Ltd

- Vectorworks Inc.

- Tekla Corporation(Trimble)

- Bimeye Inc.

第七章 市场机会与未来展望

The building information modeling market is valued at USD 9.93 billion in 2025 and is forecast to reach USD 19.04 billion by 2030, advancing at a 13.9% CAGR.

Rapid digital transformation across architecture, engineering, construction and operations is expanding BIM from a visualization tool into a cloud-enabled collaboration platform. Growth is reinforced by tighter government mandates, integration with artificial intelligence and digital twins, and wider SaaS availability that lowers up-front costs for smaller firms. Vendors are also embedding 4D scheduling, 5D cost estimation and sustainability analytics as default capabilities, which keeps switching barriers high. Intense competition is prompting continuous upgrades that improve interoperability and workflow automation, deepening user reliance on subscription ecosystems throughout the project lifecycle.

Global Building Information Modeling Market Trends and Insights

E-mandates and ISO 19650 alignment accelerating global BIM uptake

Mandated BIM use on public projects is normalizing digital delivery workflows across mature construction economies. The United Kingdom's requirement for Level 3 BIM on public projects above GBP 5 million by 2025 encourages structured data exchanges that lower procurement risk. More than 60% of European public agencies now publish formal BIM strategies, which pushes private developers to follow the same standards. Comparable policies in several US states and provinces in Canada have the same cascading effect. Standardization around ISO 19650 simplifies cross-border collaboration, reduces contractual ambiguity and shortens onboarding time for new stakeholders, directly lifting adoption rates for the building information modeling market.

Rise of digital-twin-enabled asset lifecycle management

Owners increasingly connect BIM models with IoT sensors to generate live digital twins that optimize maintenance and reduce downtime. Buildings equipped with sensor-linked twins have reported 5% annual operating cost cuts and 35% faster maintenance response times. The promise of quantified savings during the 80% cost-of-ownership phase is compelling facility operators to upgrade legacy models into data-rich twins, which lifts software and service revenues throughout the operational stage of building information modeling market adoption.

High Licensing & Training Costs for SME Contractors

Initial seat licenses can exceed USD 10,000 while annual renewals and hardware upgrades increase total cost of ownership, causing many small firms to defer adoption. Funding programs such as Singapore's Productivity Solutions Grant that reimburses up to 50% of software expenses partially mitigate the burden, yet cost sensitivity remains a near-term drag on the building information modeling market.

Other drivers and restraints analyzed in the detailed report include:

- Green-building and net-zero compliance pressures

- Modular or off-site construction demanding seamless prefab coordination

- Interoperability & open-standards gaps across authoring tools

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software holds a 68% revenue share worth USD 6.75 billion. Authoring suites such as Revit and Archicad remain the entry point for model creation, with integrated 4D and 5D functions now interpreted as table stakes rather than premium add-ons. Continuous updates that incorporate AI-driven clash detection keep customer churn low, anchoring the building information modeling market.

Service revenue is rising at a 15.8% CAGR as owners and contractors outsource model development, coordination and analytics. Outsourcing gives firms access to scarce talent without fixed payroll commitments. Complex public-transportation schemes in Europe and Asia commonly appoint specialist BIM consultancies, expanding the addressable building information modeling market size for services.

On-premises installations represent USD 7.15 billion and 72% of 2025 revenue. Large design houses favor local servers that align with strict data-sovereignty rules. Security certifications such as FedRAMP and ISO 27001 are gradually easing those concerns, yet entrenched workflows slow migration.

Cloud deployments are growing at 18.5% CAGR. Subscription licensing lowers capital expenditure and delivers instant scalability, letting dispersed project teams co-author models in real time. After pandemic-driven remote work proved viable, many firms adopted SaaS to future-proof operations, steadily shifting the center of gravity of the building information modeling market toward hosted solutions.

The Building Information Modeling Market Report is Segmented by Solution (Software, Services), Deployment Mode (On-Premises, Cloud), Project Lifecycle Stage (Pre-Construction, Construction, Post-Construction), Application (Commercial Buildings, Residential Buildings, and More), End User (Architects and Designers, Engineers, and More), and Geography). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated USD 3.77 billion and 38% of global revenue in 2025. Federal infrastructure spending tied to digital-delivery requirements fuels broad adoption across transportation and utilities. The building information modeling market size in the United States benefits from standardized object libraries that simplify procurement and lifecycle management.

Europe ranks second, anchored by mandates in the United Kingdom and Germany. The continent's 2024 revenue reached USD 3.09 billion and is on course to double by 2032. Regional software champions such as Nemetschek leverage close ties to academic research, which sustains a robust skills pipeline and keeps the building information modeling market competitive.

Asia-Pacific is the fastest-growing region at 15% CAGR. China's smart-city initiatives, Japan's automation push to counter labor shortages, and India's expanding transport corridors create substantial volume. Government incentives in Singapore that cover a portion of software expenditure make it the region's benchmark for policy-led progress, further enlarging the building information modeling market.

The Middle East and Africa remain smaller but exhibit strong momentum in Gulf states. Mega-projects like NEOM in Saudi Arabia adopt full digital-twin strategies, setting new regional standards. Capacity-building programs are underway to upskill local talent, gradually reducing reliance on imported expertise.

- Autodesk Inc.

- Nemetschek SE

- Bentley Systems Inc.

- Trimble Inc.

- Dassault Systemes SE

- Hexagon AB

- AVEVA Group PLC

- Asite Solutions Ltd

- RIB Software GmbH

- Graphisoft SE

- Allplan GmbH

- Topcon Positioning Systems Inc.

- Procore Technologies Inc.

- ACCA Software SPA

- Revizto SA

- CMiC Inc.

- Beck Technology Ltd

- Vectorworks Inc.

- Tekla Corporation (Trimble)

- Bimeye Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-mandates and ISO 19650 Alignment Accelerating Global BIM Uptake

- 4.2.2 Rise of Digital-Twin-enabled Asset Lifecycle Management

- 4.2.3 Green-Building and Net-Zero Compliance Pressures

- 4.2.4 Modular / Off-site Construction Demanding Seamless Prefab Coordination

- 4.2.5 Cloud adoption and SaaS pricing lowering entry barriers

- 4.2.6 AI-driven generative design and predictive analytics boosting productivity

- 4.3 Market Restraints

- 4.3.1 High Licensing and Training Costs for SME Contractors

- 4.3.2 Interoperability and Open-Standards Gaps Across Authoring Tools

- 4.3.3 Cyber-security and IP Protection Concerns in Cloud Workflows

- 4.3.4 Cultural Resistance to Process Re-engineering in Legacy Firms

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Software

- 5.1.1.1 Dimension

- 5.1.1.1.1 3D

- 5.1.1.1.2 4D

- 5.1.1.1.3 5D

- 5.1.1.1.4 6D

- 5.1.1.1.5 7D and Beyond

- 5.1.2 Services

- 5.1.2.1 Consulting and Advisory

- 5.1.2.2 Implementation and Integration

- 5.1.2.3 Training and Support

- 5.1.2.4 Managed Services

- 5.1.1 Software

- 5.2 By Deployment Mode

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.3 By Project Lifecycle Stage

- 5.3.1 Pre-construction (Planning and Design)

- 5.3.2 Construction (Site Execution)

- 5.3.3 Post-construction (Operations and Maintenance)

- 5.4 By Application

- 5.4.1 Commercial Buildings

- 5.4.2 Residential Buildings

- 5.4.3 Industrial and Manufacturing Facilities

- 5.4.4 Infrastructure (Roads, Rail, Airports, Ports, Bridges)

- 5.4.5 Institutional (Healthcare, Education, Government)

- 5.4.6 Other Applications

- 5.5 By End User

- 5.5.1 Architects and Designers

- 5.5.2 Engineers (Structural, MEP)

- 5.5.3 Contractors and Builders

- 5.5.4 Owners and Developers

- 5.5.5 Facilities and Asset Managers

- 5.5.6 Consultants and Project Managers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Nordics

- 5.6.3.6 Rest of Europe

- 5.6.4 Middle East

- 5.6.4.1 United Arab Emirates

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 Turkey

- 5.6.4.4 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Rest of Africa

- 5.6.6 Asia-Pacific

- 5.6.6.1 China

- 5.6.6.2 Japan

- 5.6.6.3 India

- 5.6.6.4 South Korea

- 5.6.6.5 Southeast Asia

- 5.6.6.6 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Autodesk Inc.

- 6.4.2 Nemetschek SE

- 6.4.3 Bentley Systems Inc.

- 6.4.4 Trimble Inc.

- 6.4.5 Dassault Systemes SE

- 6.4.6 Hexagon AB

- 6.4.7 AVEVA Group PLC

- 6.4.8 Asite Solutions Ltd

- 6.4.9 RIB Software GmbH

- 6.4.10 Graphisoft SE

- 6.4.11 Allplan GmbH

- 6.4.12 Topcon Positioning Systems Inc.

- 6.4.13 Procore Technologies Inc.

- 6.4.14 ACCA Software SPA

- 6.4.15 Revizto SA

- 6.4.16 CMiC Inc.

- 6.4.17 Beck Technology Ltd

- 6.4.18 Vectorworks Inc.

- 6.4.19 Tekla Corporation (Trimble)

- 6.4.20 Bimeye Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment