|

市场调查报告书

商品编码

1851354

全像显示器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Holographic Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

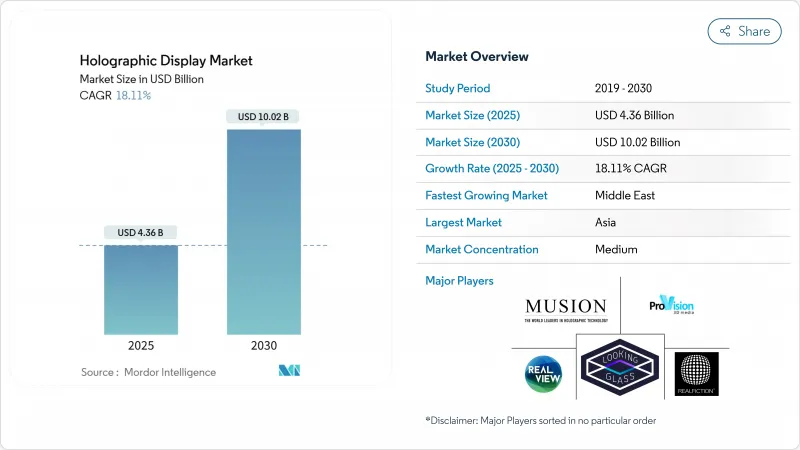

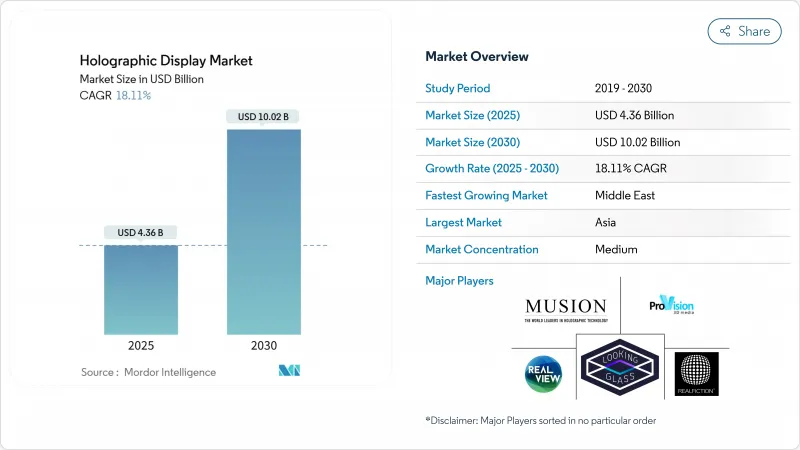

据估计,全像显示市场在 2025 年的价值为 43.6 亿美元,预计到 2030 年将达到 100.2 亿美元,复合年增长率为 18.11%。

强劲的需求主要源自于高阶汽车品牌部署扩增实境抬头显示器、美国领先医院安装立体手术室以及奢侈品零售商采用360度指示牌。这些应用案例标誌着从研究试点到生产部署的决定性转变,因为微型LED波导管的产量比率不断提高,而人工智慧主导的内容引擎降低了生产成本。德国和中国的汽车製造商占据了挡风玻璃应用市场的大部分份额,而美国医疗机构正在加速购买能够缩短手术室规划週期的3D影像。亚洲在生产规模和内容创新方面继续保持领先地位,其中中东零售业实现了最快的区域扩张。光学、竞争和内容创作的整合支撑着一个生态系统,在这个生态系统中,企业可以将身临其境型体验货币化,并创造持久的竞争优势。

全球全像显示市场趋势与洞察

汽车OEM厂商采用扩增实境全像显示器

德国豪华汽车製造商和中国电动车品牌正在将全萤幕全像抬头显示器应用于前挡风玻璃,以区分其高端车型并增强驾驶员的情境察觉。现代摩比斯概念车在2025年国际消费电子展(CES)上展出,该概念车可将导航提示、警报和娱乐内容投射到三个显示区域,并与蔡司合作开发,目标是在2027年实现量产。市场预测显示,到2030年,将有700万辆汽车搭载该技术,届时仪錶板区域将转变为身临其境型(AR)介面。

美国一家领先医院部署三维立体手术规划套件

医院正将真深度全像图应用于肿瘤科、心臟科和整形外科。 RealView Imaging 的 HOLOSCOPE-i 系统使外科医生能够即时导航三维解剖结构,从而缩短手术计划时间并减少手术室中的误差。临床研究表明,全像计画比二维方法更优 61%,尤其适用于非共面放射治疗束。

大规模生产的微型LED波导管的稀缺性推高了物料清单成本。

很少有晶圆厂能够达到高效波导管所需的奈米级公差,这使得其价格比 LCD 和 OLED 替代方案高出 40-60%: SONY吋全高清 OLED 微型显示器的样品价格超过 260 美元(40,000 日元),限制了消费性设备的经济性。

细分市场分析

到2024年,硬体将占全像显示市场收入的75.6%,凸显了支撑全像显示市场的空间灯光调变器、雷射引擎和精密光学元件等关键零件的高资本密集度。虽然投影机、光波导和微型显示引擎仍然是成本驱动因素,但组件价格的下降将导致硬体在全像显示市场中的份额在本十年末略有下降。随着企业寻求承包部署、校准和生命週期支援合同,服务业务的复合年增长率已达22.7%,成为成长最快的领域。整合专家正在将现场安装、云端渲染和培训打包在一起,将一次性设备销售转变为多年合约。医疗网路正在製定服务等级协议,以确保手术规划室的运作,而汽车製造商则将光学系统校准外包给一级供应商。因此,全像显示市场正在从依赖利润率的模式转向依赖辅助服务的模式。

同时,软体堆迭正在添加即时渲染、人工智慧驱动的内容创作和分析功能,从而在实体设备的基础上增加订阅收入。这一趋势与投影和数指示牌产业早期的转变类似,当时内容管理平台变得至关重要。随着体流媒体的日益普及,频宽频宽和安全性修补程式将进一步拓展服务机会。硬体供应商现在正在建立内部专业服务团队或与系统整合商合作,以确保光学元件、韧体和管理内容之间的紧密协调。

预计到2024年,电全像架构的营收成长率将达到40.8%,这主要得益于成熟的液晶硅和反射式空间灯光调变器供应链。稳定的产量比率和成熟的设计工具集使这种格式成为汽车抬头显示器和医疗扫描仪的理想选择,并使其在全像显示市场保持领先地位。同时,触觉空中系统的复合年增长率也达到了24.6%。开发人员正在将相位阵列超音波与体视觉技术相结合,使用户能够「触摸」浮动介面。支援手势控制产品旋转的零售展示台和支援无菌互动的医院显示器就是商业性成功的例子。

雷射/等离子投影解决方案针对户外舞台表演和仪錶板阳光照射等极端亮度场景,而半透明波导管适用于扩增实境智慧眼镜。浦项科技大学推出的超表面光学技术可校正色差,简化色彩管理并缩小设备尺寸。声学和光子捕获领域的研究有望重新定义效率,但目前商业化进程难以预测。总而言之,现有电全像供应商必须在功率、解析度和互动进行创新,以应对全像显示市场中快速涌现的触觉挑战。

区域分析

亚太地区预计2024年将贡献36.9%的收入,这得益于中国电动车的蓬勃发展、日本娱乐科技的崛起以及韩国半导体生态系统的完善。公私合作计画正在奖励微型LED背板和超表面光学技术的发展,从而增强了亚太地区的供应优势。东京、首尔和上海等城市高密度零售业的兴起也促进了亚太地区全像显示市场的规模成长。儘管蔡司和现代等公司之间的合作不断推动创新,但欧洲仍面临亮度限制,这在一定程度上限制了其市场成长。

北美地区正呈现稳定成长势头,这主要得益于美国领先医院升级手术视觉化套件以及国防机构采购立体任务规划桌。加拿大现场活动推广商正在试验全像投影节,以拓展市场。中东地区预计到2030年将以21.5%的复合年增长率成长,成为成长最快的地区。杜拜、利雅德和杜哈的豪华购物中心正大力投资360度全像展示,以增强品牌故事的叙述。阿布达比和新未来城(Neom)的政府智慧倡议计画将推动更多相关实验。

拉丁美洲和非洲仍处于起步阶段,受到进口关税和频宽限制的限制,但圣保罗零售业的先导计画和南非矿业的可见性表明下游市场正在扩张。然而,全球供应链将关键的波导製造环节集中在日本和韩国,这使得所有地区都面临潜在的瓶颈。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 德国和中国高端汽车製造商采用扩增实境全像显示器的情况

- 美国一级医院采用三维立体手术规划系统的比例激增

- 中东奢侈品连锁店利用360度全像指示牌吸引顾客

- 在日本和韩国,实况活动和串流平台(尤其是全息演唱会)的获利模式正在兴起。

- 美国和以色列国防军战场视觉化计画将加速全像沙盘的采购

- 人工智慧生成内容引擎降低了全球3D全像图的製作成本

- 市场限制

- 大规模生产的微型LED波导管短缺导致物料清单成本上升

- 欧盟眼安全和光生物学法规限制雷射/等离子投影输出

- 高运算能力和高功耗限制了行动外形规格。

- 3D内容创作工具链的片段化减缓了生态系的扩展速度。

- 生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 空间灯光调变器(SLM)

- 投影机和雷射引擎

- 光学/镜头模组

- 感应器和摄影机

- 其他的

- 软体

- 服务

- 整合与咨询

- 支援与维护

- 硬体

- 透过技术

- 电全像

- 可触摸/空中触觉

- 雷射/等离子体

- 半透明

- 其他新兴技术(声学、光子陷阱)

- 依产品类型

- 数位电子看板和自助服务终端

- 智慧电视和显示器

- 相机和智慧眼镜

- 医用扫描仪和显微镜

- HUD和挡风玻璃显示器

- 智慧型手机和平板电脑

- 其他的

- 最终用户

- 消费性电子产品

- 零售和展览

- 媒体、娱乐和实况活动

- 医疗保健和医学教育

- 汽车/运输设备

- 军事、国防、航太

- 工业和製造业

- 教育和培训

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 其他南美洲

- 亚太地区

- 中国

- 日本

- 印度

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- HYPERVSN(Kino-mo)

- Looking Glass Factory Inc.

- RealFiction Holding AB

- Holoxica Ltd

- RealView Imaging Ltd

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Konica Minolta Inc.

- Qualcomm Technologies Inc.

- Leia Inc.

- Voxon Photonics

- IKIN Inc.

- Zebra Imaging Inc.

- Burton Inc.

- Light Field Lab, Inc.

- SeeReal Technologies GmbH

- Creal SA

- Jade Bird Display Inc.

- Holitech Technology Co., Ltd.

- Shenzhen SMX Display Technology Co., Ltd.

- MDH Hologram Ltd

- Provision Holding Inc

第七章 市场机会与未来展望

The holographic display market size is estimated posted a current value of USD 4.36 billion in 2025, and it is on track to reach USD 10.02 billion by 2030, supported by an 18.11% CAGR.

Robust demand stems from automotive premium brands rolling out augmented-reality head-up displays, tier-1 U.S. hospitals installing volumetric surgical suites, and luxury retailers adopting 360-degree signage. These use-cases signal a decisive move from research pilots to production roll-outs as micro-LED waveguide yields improve and AI-driven content engines cut creation costs. German and Chinese automakers account for the bulk of windshield deployments, while U.S. health providers accelerate 3D imaging purchases that shorten operating-room planning cycles. Asia continues to lead production scale and content innovation, whereas the Middle East's retail sector delivers the fastest regional expansion. The convergence of optics, computing, and content creation underpins an ecosystem where enterprises can monetize immersive experiences and create durable competitive advantage.

Global Holographic Display Market Trends and Insights

Automotive OEM adoption of augmented-reality holographic HUDs

German luxury marques and Chinese electric-vehicle brands are integrating full-windshield holographic head-up displays to differentiate premium trims and enhance driver situational awareness. Hyundai Mobis' concept shown at CES 2025 projects navigation cues, alerts, and entertainment content across three viewing zones, and joint development with Zeiss targets mass production by 2027. Market forecasts suggest 7 million automotive units will ship by 2030, converting dashboard real estate into immersive AR canvases.

Deployment of volumetric 3D surgical-planning suites in U.S. tier-1 hospitals

Hospitals are turning to true-depth holograms for oncology, cardiology, and orthopedics. RealView Imaging's HOLOSCOPE-i enables surgeons to manipulate 3D anatomy in real time, trimming planning hours and reducing operating-room errors. Clinical studies show 61% preference for holographic plans over 2D methods, especially for non-coplanar radiotherapy beams.

Scarcity of mass-production micro-LED waveguides elevating BOM costs

Few fabs can achieve the nanoscale tolerances required for efficient waveguides, keeping prices 40-60% above LCD or OLED alternatives. Sample quotes for Sony's 0.44-type Full HD OLED microdisplay exceed USD 260 (JPY 40,000), restricting consumer-device economics.

Other drivers and restraints analyzed in the detailed report include:

- Luxury retail chains in Middle-East malls pivoting to 360° holographic signage

- Live-event and streaming platforms monetizing hologram concerts

- Eye-safety and photobiological regulations limiting projection power

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware accounted for 75.6% of 2024 revenue, underscoring the capital intensity of spatial-light modulators, laser engines, and precision optics that underpin the holographic display market. Projectors, optical waveguides, and microdisplay engines remain cost drivers, yet falling component prices will push the hardware share of the holographic display market size down modestly by the decade's close. Services already command the fastest 22.7% CAGR as enterprises look for turnkey deployment, calibration, and lifecycle support agreements. Integration specialists bundle on-premises installation, cloud rendering, and training, converting one-off device sales into multi-year contracts. Healthcare networks specify service-level agreements that guarantee uptime for surgical planning suites, while automakers outsource optical system alignment to tier-1 suppliers. The holographic display market is therefore shifting from hardware margin dependency to attached-service annuities.

In parallel, software stacks add real-time rendering, AI-assisted content creation, and analytics, layering subscription revenue atop physical equipment. The trend mimics earlier transitions in the projection and signage industries, where content-management platforms became indispensable. As volumetric streaming proliferates, bandwidth optimization and security patches will further enlarge the services opportunity. Hardware vendors now incubate internal professional-services groups or ally with systems integrators, ensuring tight coupling between optics, firmware, and managed content-an approach that strengthens ecosystem lock-in across the holographic display industry.

Electro-holographic architectures captured 40.8% revenue in 2024 thanks to mature liquid-crystal-on-silicon and reflective spatial-light-modulator supply chains. Stable yields and established design toolsets make the format the safe choice for automotive HUDs and medical scanners, sustaining its lead in the holographic display market. Meanwhile, haptic mid-air systems clock a 24.6% CAGR as developers combine phased-array ultrasounds with volumetric visuals to let users "touch" floating interfaces. Retail podiums that permit gesture-based product rotation and hospital displays allowing sterile interaction exemplify commercial traction.

Laser/plasma projection solutions target extreme-brightness scenarios such as open-air stage shows and dashboard sunlit conditions, while semi-transparent waveguides serve AR smart-glasses. Metasurface optics unveiled by POSTECH help correct chromatic aberration, simplifying color management and slimming device profiles. Acoustic and photon-trap research lines could redefine efficiency, yet commercialization sits beyond the current forecast horizon. Overall, incumbent electro-holographic vendors must innovate on power, resolution, and interaction to fend off fast-rising haptic challengers in the holographic display market.

The Holographic Display Market Report is Segmented by Component (Hardware, Software, Services), Technology (Electro-Holographic, Touchable/Mid-Air Haptic, and More), Product Type (Digital Signage and Kiosks, Smart TVs and Monitors, and More), End-User (Consumer Electronics, Retail and Exhibition, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific generated 36.9% of 2024 revenue, leveraging China's electric-vehicle boom, Japan's entertainment tech, and South Korea's semiconductor ecosystem. Public-private programs funnel incentives into micro-LED backplanes and metasurface optics, fortifying regional supply dominance. The holographic display market size attributed to Asia Pacific also benefits from dense retail deployments in Tokyo, Seoul, and Shanghai. Europe follows with automotive design wins but faces brightness restrictions that temper growth, although collaborations such as Zeiss-Hyundai sustain innovation pipelines.

North America exhibits steady momentum anchored by U.S. tier-1 hospitals that upgrade surgical visualization suites and defense agencies procuring volumetric mission-planning tables. Canada's live-event promoters experiment with hologram festivals, extending market reach. The Middle East posts the highest 21.5% CAGR through 2030 as luxury malls in Dubai, Riyadh, and Doha invest heavily in 360-degree holographic showcases that elevate brand storytelling. Government smart-city initiatives in Abu Dhabi and Neom foster further experimentation.

Latin America and Africa remain early-stage, constrained by import duties and bandwidth limitations, yet pilot projects in Sao Paulo retail and South African mining visualization hint at downstream expansion. Global supply chains nonetheless route critical waveguide fabrication through Japan and South Korea, exposing all regions to potential bottlenecks, a factor that stakeholders across the holographic display market monitor closely for risk mitigation.

- HYPERVSN (Kino-mo)

- Looking Glass Factory Inc.

- RealFiction Holding AB

- Holoxica Ltd

- RealView Imaging Ltd

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Konica Minolta Inc.

- Qualcomm Technologies Inc.

- Leia Inc.

- Voxon Photonics

- IKIN Inc.

- Zebra Imaging Inc.

- Burton Inc.

- Light Field Lab, Inc.

- SeeReal Technologies GmbH

- Creal SA

- Jade Bird Display Inc.

- Holitech Technology Co., Ltd.

- Shenzhen SMX Display Technology Co., Ltd.

- MDH Hologram Ltd

- Provision Holding Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive OEM Adoption of Augmented-Reality Holographic HUDs in German and Chinese Premium Segments

- 4.2.2 Surging Deployment of Volumetric 3D Surgical Planning Suites in United States Tier-1 Hospitals

- 4.2.3 Retail Luxury Chains in Middle-East Malls Pivoting to 360° Holographic Signage for Foot-Fall Generation

- 4.2.4 Live-Events and Streaming Platforms Monetising Hologram Concerts, Especially in Japan and South Korea

- 4.2.5 Defense Forces' Battlefield Visualization Programs (U.S., Israel) Accelerating Procurement of Holographic Sand-Tables

- 4.2.6 AI-Generated Content Engines Lowering Production Costs for 3D Holograms Globally

- 4.3 Market Restraints

- 4.3.1 Scarcity of Mass-Production Micro-LED Waveguides Elevating BOM Costs

- 4.3.2 Eye-Safety and Photobiological Regulations Limiting Laser/Plasma Projection Power in EU

- 4.3.3 High Compute and Power Foot-print Hindering Mobile Form-Factors

- 4.3.4 Fragmented 3D Content-Creation Toolchain Slowing Ecosystem Scale-up

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Spatial Light Modulators (SLM)

- 5.1.1.2 Projectors and Laser Engines

- 5.1.1.3 Optical/Lens Modules

- 5.1.1.4 Sensors and Cameras

- 5.1.1.5 Others

- 5.1.2 Software

- 5.1.3 Services

- 5.1.3.1 Integration and Consulting

- 5.1.3.2 Support and Maintenance

- 5.1.1 Hardware

- 5.2 By Technology

- 5.2.1 Electro-Holographic

- 5.2.2 Touchable/Mid-Air Haptic

- 5.2.3 Laser/Plasma

- 5.2.4 Semi-Transparent

- 5.2.5 Other Emerging (Acoustic, Photon-Trap)

- 5.3 By Product Type

- 5.3.1 Digital Signage and Kiosks

- 5.3.2 Smart TVs and Monitors

- 5.3.3 Cameras and Smart Glasses

- 5.3.4 Medical Scanners and Microscopes

- 5.3.5 HUDs and Windshield Displays

- 5.3.6 Smartphones and Tablets

- 5.3.7 Others

- 5.4 By End-User

- 5.4.1 Consumer Electronics

- 5.4.2 Retail and Exhibition

- 5.4.3 Media, Entertainment and Live Events

- 5.4.4 Healthcare and Medical Education

- 5.4.5 Automotive and Transportation

- 5.4.6 Military, Defense and Aerospace

- 5.4.7 Industrial and Manufacturing

- 5.4.8 Education and Training

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 HYPERVSN (Kino-mo)

- 6.4.2 Looking Glass Factory Inc.

- 6.4.3 RealFiction Holding AB

- 6.4.4 Holoxica Ltd

- 6.4.5 RealView Imaging Ltd

- 6.4.6 Samsung Electronics Co. Ltd.

- 6.4.7 Sony Corporation

- 6.4.8 Konica Minolta Inc.

- 6.4.9 Qualcomm Technologies Inc.

- 6.4.10 Leia Inc.

- 6.4.11 Voxon Photonics

- 6.4.12 IKIN Inc.

- 6.4.13 Zebra Imaging Inc.

- 6.4.14 Burton Inc.

- 6.4.15 Light Field Lab, Inc.

- 6.4.16 SeeReal Technologies GmbH

- 6.4.17 Creal SA

- 6.4.18 Jade Bird Display Inc.

- 6.4.19 Holitech Technology Co., Ltd.

- 6.4.20 Shenzhen SMX Display Technology Co., Ltd.

- 6.4.21 MDH Hologram Ltd

- 6.4.22 Provision Holding Inc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment