|

市场调查报告书

商品编码

1851360

热电偶温度感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Thermocouple Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

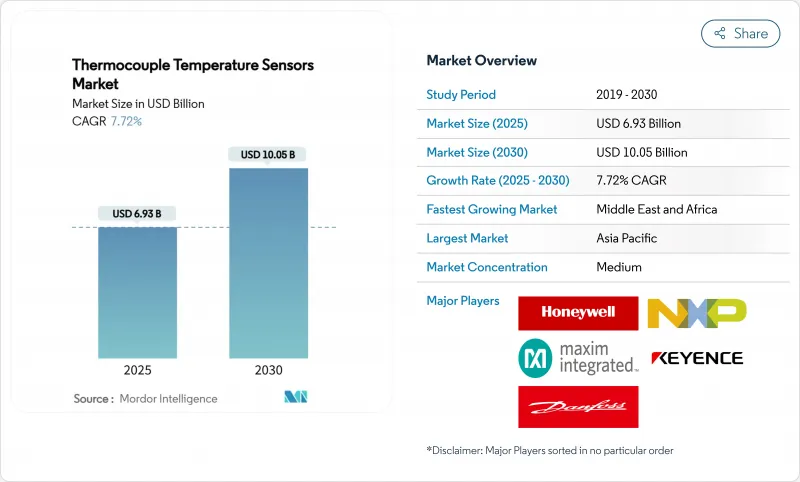

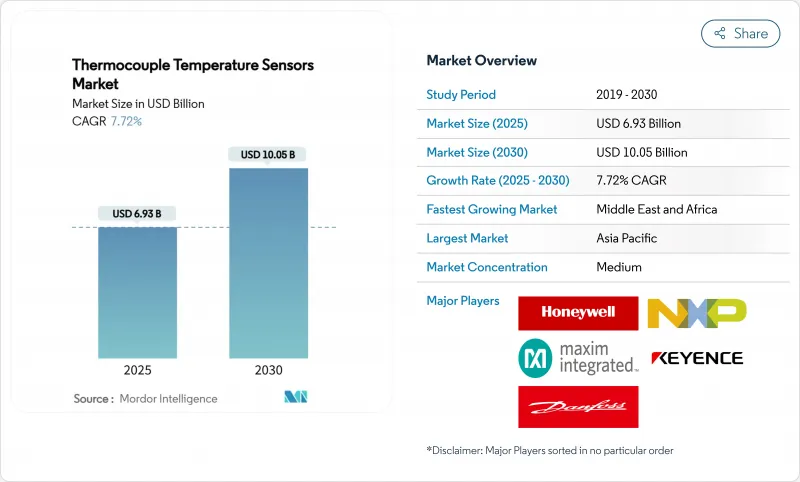

热电偶温度感测器市场预计到 2025 年将达到 69.3 亿美元,到 2030 年将达到 100.5 亿美元,年复合成长率为 7.72%。

即时热数据能够提升效率、安全性和产量比率,这推动了相关产业的需求成长。工业4.0改装、绿色氢电解槽、液化天然气基础设施和电动车电池超级工厂的扩张,都促进了K型、N型和T型探头的应用场景日益丰富。同时,诸如EtherNet/IP协定等数位网路标准正在将传统感测器转变为智慧节点,为预测性维护平台提供资料支援。来自亚洲低成本进口产品和光纤替代方案的竞争日益激烈,而更严格的电机效率测试和强制性嵌入式监控等新的监管要求,也在推动这一趋势。

全球热电偶温度感测器市场趋势与洞察

预测性维护推动多点热电偶的应用

拥抱工业4.0标准的工厂营运商正在用多点热电偶阵列取代单单点感测器感测器,从而产生详细的温度图。结合机器学习演算法,这些阵列可在故障发生前数週侦测到漂移和热点,将非计划性停机时间减少高达30%。欧洲工厂引领改装浪潮,北美汽车製造商和化学加工商也纷纷效仿,因为CEN研讨会协议18038为数据驱动型维护制定了蓝图。计算成本的下降以及ODVA的即插即用EtherNet/IP协定缩短了整合时间,推动了该技术的广泛应用。随着越来越多的工厂采用热感分析标准,能够将感测器与分析服务捆绑销售的供应商将获得更高的利润。

绿氢能推动对高温监测的需求

固体氧化物电解槽规模的扩大已将动作温度范围推至 800°C 以上,在此阈值下,N 型和升级版 K 型探头的性能优于其他金属基感测器。连续温度曲线分析可保护电堆免受缩短寿命的热循环影响,而加州能源委员会的津贴也激发了全球对温度控制通讯协定的兴趣。亚洲电解槽供应商正在指定使用可承受氢气暴露的焊接矿物绝缘 (MI) 组件,从而在热电偶温度感测器市场打造了一个高端产品层级。随着欧洲气候政策资金涌入绿色氢能产业丛集,对超稳定探头的整体需求正在将潜在销售市场远远扩展到试点工厂之外。

价格下跌对欧美製造商来说是一个挑战。

自2023年以来,来自中国和印度的低成本K型和J型探针的激增,已使平均售价下降了15%至20%,挤压了占总产量一半以上的标准组装的利润空间。亚洲供应商也以30%至40%的折扣出售MI电缆,迫使传统品牌专注于专业设计和服务密集合约。美国分销商报告称,由于终端用户预期价格会进一步下降而推迟更换,存货周转速度正在放缓。镍和铬的短期通膨加剧了欧洲公司的成本控制难题,而买家不愿承担额外费用,这进一步限制了收入成长。

细分市场分析

K型热电偶温度感测器凭藉其-200°C至+1350°C的通用量程,预计到2024年将保持35%的市场份额。此量程涵盖了主要的製造业、食品工业和暖通空调迴路,即使商品化导致净利率下降,K型热电偶仍然非常适合大批量订单。同时,N型热电偶凭藉其抗氧化性能,在航太测试台和氢反应器领域赢得了订单,预计到2030年将以8.9%的复合年增长率增长。原始设备製造商(OEM)预计,延长校准週期将带来生命週期成本节约,使采购部门能够抵消较高的初始成本。新兴的R、S和B合金目前仍主要面向高端超高温应用,但铂丝纯度正在逐步提高,因此在半导体外延生产线中得到了应用,因为在1200°C下控制漂移是重中之重。

材料科学的最新进展正在扩大其应用范围。薄膜沉淀如今可将微米级热电偶网格嵌入陶瓷基板中,从而实现晶圆温度的即时测量。供应商正转向使用氧化铝隔热材料和Fibro Platinum热电偶丝,这些材料能够承受1600°C的连续高温,使玻璃、耐火材料和增材製造窑炉能够取代传统的光学高温计。 T型热电偶在-200 度C液化天然气(LNG)商用的微型细分市场中蓬勃发展,在该领域,精度比成本更为重要。总而言之,这些发展增强了高端热电偶市场对批量价格压缩的抵御能力。

接地型产品仍占据OEM厂商产品目录的主导地位,可达到毫秒级的反应时间。然而,伺服驱动器和变频马达系统对电气隔离的需求日益增长,促使采购转向非接地型产品。非接地型产品可将接地迴路杂讯降低90%,而反应速度仅损失20%。半导体製造商指定使用此类产品来保护敏感的测量电子元件免受杂讯电流的影响。裸露的结仍然用于实验室玻璃器皿和非加压试验钻机,但其脆弱性限制了其市场份额。随着工厂为预测性维护而重新布线,控制工程师更倾向于采用混合设计,例如部分隔离的微型结,以平衡电磁相容性和动态响应。

雷射焊接尖端结构的进步提高了疲劳寿命,使非接地磁阻式探头能够承受高振动涡轮级。供应商正在添加微型连接器和环氧树脂灌封盐,以提高密封完整性,同时不影响热滞后。一些电池製造商正在采用具有陶瓷珠接头的夹式皮肤感测器来监测电池外壳温度,将接头创新引入家用电子电器领域。儘管受到硅基晶片的衝击,这种跨行业的学习仍然使热电偶温度感测器市场保持活力。

热电偶温度感测器市场按热电偶类型、接点类型(接地接点、非接地接点、其他)、温度范围(低于0°C、0°C至350°C、其他)、探头配置(珠状导线、矿物绝缘(MI)电缆、其他)、终端用户产业(石油天然气、发电、其他)和地区进行细分。市场预测以美元计价。

区域分析

由于製造业基地密集,亚太其他地区占据了热电偶温度感测器市场42%的份额。高精度探头被应用于中国的电池窑炉和日本的晶片工厂,而铂合金探头则被韩国指定用于OLED玻璃熔融区。印度的石化企业正在订购更多标准的K型和J型探头,同时对在地采购的需求也在成长,这促使了合资企业的出现。该地区的低成本工厂正在生产商品化探头,这些探头随后被输送到全球供应链,对其他地区的价格造成了不利影响。

中东将成为成长最快的地区,到2030年复合年增长率将达到9.5%。沙乌地阿美公司在达曼的一家工厂获得许可,可就地生产MI探头和热电偶套管。投资项目涵盖石化中心、太阳热能发电发电厂和海水淡化装置等,这些项目都需要能够承受从低温到1000°C高温的耐用感测器。本地组装缩短了前置作业时间,使供应商能够更好地满足国内市场的需求,并重塑热电偶温度感测器市场的分销管道。

北美在航太、液化天然气和先进製造业领域占有重要份额。墨西哥湾沿岸一家新建的液化工厂正在订购用于-162 度C低温环境的T型管,而喷射发动机原始设备製造商(OEM)正在对用于1200 度C燃烧室的贵金属探针进行认证。欧盟汽车法规2019/1781强制要求对效率声明进行热电偶整合检验,德国一家氢气试验厂则要求对固体氧化物电解池(SOEC)的电堆进行900°C的测量。南美洲和非洲虽然仍处于起步阶段,但与采矿、纸浆和造纸以及化肥厂寻求製程升级相关的需求正在成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场驱动因素

- 工业4.0向预测性维护的转变促使欧洲工厂采用多点热电偶

- 在亚太地区扩大绿色氢电解槽(监测温度高于 800°C)的建设

- 北美液化天然气再气化终端的建设正在推进,需要T型低温探针。

- 中国电动车电池超级工厂窑炉安装需要高精度K型感测器

- 欧盟法规 2019/1781 加强了马达效率测试,并强制要求内建热电偶。

- 市场限制

- 由于来自低成本亚洲供应链的商品化钾肥和钾肥进口,价格走低

- 高电磁干扰航太引擎中光纤感测器被取代的威胁

- 超过1200°C的校准漂移限制了其在半导体外延线的应用。

- 镍和铬供应波动扰乱了欧洲MI电缆探头的生产。

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- PESTEL 分析

第五章 市场规模与成长预测

- 热电偶型

- J型

- T型

- N型

- E型

- R 型和 S 型

- B型

- 其他的

- 按连线类型

- 接地连接

- 未接地接线盒

- 裸露的接线盒

- 按温度范围

- 零度以下

- 0度至350度

- 350度至700度

- 超过700度

- 透过探针配置

- 串珠线

- 矿物绝缘(MI)电缆

- 热电偶套管和保护管

- 表面和渗透

- 灵活/客製化线束

- 按最终用户行业划分

- 石油和天然气

- 发电业务

- 化工和石油化工

- 金属和采矿

- 饮食

- 汽车/电动车电池

- 航太/国防

- 半导体和电子学

- 医疗保健和生命科学

- 暖通空调和楼宇自动化

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 策略趋势

- 市占率分析

- 公司简介

- Omega Engineering(Spectris plc)

- Emerson Electric Co.

- Endress+Hauser Group

- Honeywell International Inc.

- ABB Ltd

- Yokogawa Electric Corp.

- WIKA Alexander Wiegand SE

- TE Connectivity Ltd.

- Watlow Electric Manufacturing Co.

- Fluke Corporation

- Siemens AG

- JUMO GmbH and Co. KG

- Tempsens Instruments

- Pyromation Inc.

- Durex Industries

- Thermo Fisher Scientific Inc.

- GHM Group(Greisinger)

- TC Ltd(UK)

- Thermo Electric Instrumentation

- Tip TEMP

第七章 市场机会与未来展望

The thermocouple temperature sensors market size is valued at USD 6.93 billion in 2025 and is forecast to reach USD 10.05 billion by 2030, reflecting a 7.72% CAGR.

Demand stems from industries where real-time thermal data underpins efficiency, safety and yield-especially at temperatures where RTDs and thermistors fall short. Expansion in Industry 4.0 retrofits, green-hydrogen electrolysers, LNG infrastructure and EV battery gigafactories is elevating use cases that favour Type K, N and T probes. At the same time, digital networking standards such as EtherNet/IP profiles are turning legacy sensors into smart nodes that feed predictive-maintenance platforms. Intensifying competition comes from low-cost Asian imports and fiber-optic alternatives, yet regulatory mandates for tighter motor-efficiency tests and embedded monitoring add fresh tailwinds.

Global Thermocouple Temperature Sensors Market Trends and Insights

Predictive maintenance driving multi-point thermocouple adoption

Factory operators adopting Industry 4.0 standards are replacing single-point sensors with multi-point thermocouple strings that create detailed thermal maps. When paired with machine-learning algorithms, these arrays detect drift or hotspots weeks ahead of a fault, reducing unplanned downtime by up to 30%. European plants pioneered the retrofit wave, yet North American automakers and chemical processors are following as CEN Workshop Agreement 18038 offers a blueprint for data-driven maintenance. Broader adoption is fuelled by falling computing costs and ODVA's plug-and-play EtherNet/IP profiles that shrink integration time. As more plants normalize thermal profiling, suppliers able to bundle sensors with analytics services capture higher margins.

Green hydrogen driving high-temperature monitoring demand

Scaling of solid-oxide electrolyser cells pushes operating zones beyond 800 °C, a threshold where Type N and upgraded Type K probes outclass other metal-based sensors. Continuous profiling guards against thermal cycling that shortens stack life, and California Energy Commission grants have sharpened global attention on temperature-control protocols. Asian electrolyser vendors now specify pre-welded mineral-insulated (MI) assemblies rated for hydrogen exposure, creating a premium tier within the thermocouple temperature sensors market. As European climate-policy funds funnel into green-hydrogen clusters, collective demand for ultra-stable probes widens the addressable sales pool well past pilot plants.

Price erosion challenging Western manufacturers

A surge of low-cost K and J probes from China and India has cut average selling prices by 15-20% since 2023, squeezing margins on standard assemblies that make up over half of unit volumes. Asian vendors also ship MI cables at 30-40% discounts, forcing legacy brands to pivot toward specialized designs or service-heavy contracts. Distributors in the United States report inventory turns slowing as end users defer replacements in anticipation of further price drops. Short-cycle inflationary spikes in nickel and chromium amplify cost control woes for European firms, yet buyers remain reluctant to shoulder surcharges, deepening the restraint on revenue growth.

Other drivers and restraints analyzed in the detailed report include:

- LNG infrastructure expansion boosts cryogenic sensor demand

- EV battery manufacturing driving precision temperature control

- Fiber-optic sensors threatening high-EMI applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Type K maintained a 35% hold on the thermocouple temperature sensors market share in 2024 on versatility across -200 °C to +1350 °C. That span covers mainstream manufacturing, food processing and HVAC loops, positioning the variant for volume contracts even as commoditization trims margins. Type N, however, is capturing orders in aerospace test stands and hydrogen reactors at an 8.9% CAGR through 2030, aided by immunity to green-rot oxidation. OEMs see life-cycle savings from longer calibration intervals, swinging purchasing departments toward higher upfront costs. Emerging R, S and B alloys remain priced for boutique ultra-high-temperature work, but incremental breakthroughs in platinum wire purity are nudging them into semiconductor epitaxy lines where 1200 °C drift control is paramount.

Recent material science gains widen adoption envelopes. Thin-film deposition now embeds micron-scale thermocouple grids on ceramic substrates, serving real-time wafer temperature measurement. Suppliers highlight alumina insulation and Fibro Platinum wire for 1600 °C continuous service, enabling glass, refractory and additive-manufacturing kilns to retire legacy optical pyrometers. Type T retains a thriving micro-niche at -200 °C LNG duties where accuracy trumps cost. Collectively, these moves reinforce the premium segments' resilience against bulk price compression.

Grounded junction models still dominate OEM catalogues because they achieve millisecond response times. Yet the push for electrical isolation in servo drives and variable-frequency motor systems moves procurement toward ungrounded versions that damp ground-loop noise by 90% while sacrificing only 20% response speed. Semiconductor fabricators specify these variants to shield sensitive measurement electronics from stray currents. Exposed junctions continue in lab glassware and non-pressurized pilot rigs but carry limited share due to fragility. As factories re-wire for predictive maintenance, control engineers balance electromagnetic compatibility against dynamic response, favouring hybrid designs such as partially insulated mini junctions.

Advances in laser-welded tip construction lift fatigue life, letting ungrounded MI probes survive high-vibration turbine stages. Vendors add miniature connectors and epoxy potting salts that improve seal integrity without hampering thermal lag. Some battery producers adopt clip-on skin sensors-essentially exposed junctions set in ceramic beads-to audit cell casing temperatures, pulling junction innovation into consumer-electronics territory. These cross-industry learnings keep the thermocouple temperature sensors market vibrant despite encroachment from silicon-based chips.

Thermocouple Temperature Sensors Market Segmented by Thermocouple Type, Junction Type (Grounded Junction, Ungrounded Junction and More), Temperature Range (Below 0 °C, 0 °C - 350 °C and More), Probe Configuration (Beaded-Wire, Mineral-Insulated (MI) Cable and More) End-User Industry (Oil and Gas, Power Generation and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's 42% command of the thermocouple temperature sensors market rests on its dense manufacturing base. China's battery kilns and Japan's chip fabs consume high-accuracy probes, while South Korea specifies platinum alloys for OLED glass melt zones. India's petrochemical expansion adds orders for standard K and J variants yet increasingly demands local content, spurring joint ventures. Low-cost plants across the region manufacture commoditized probes that flow into global supply chains, creating price headwinds elsewhere.

The Middle East posts the quickest regional climb at 9.5% CAGR through 2030. Saudi Aramco-approved facilities in Dammam now produce MI probes and thermowells domestically. Investment flows span petrochemical hubs, solar-thermal farms and desalination units, all requiring rugged sensors from cryogenic to 1000 °C zones. Local assembly shortens lead times and helps suppliers meet in-country value mandates, reshaping distribution networks in the thermocouple temperature sensors market.

North America maintains substantial share via aerospace, LNG and advanced manufacturing. New liquefaction trains along the Gulf Coast order Type T strings for -162 °C service, whereas jet-engine OEMs qualify noble-metal probes for 1200 °C combustors. Europe's uptake hinges on regulatory stimuli; EU Motor Regulation 2019/1781 obliges embedded thermocouple verification for efficiency labelling, and hydrogen pilot plants in Germany necessitate 900 °C measurement of SOEC stacks. South America and Africa remain nascent but show upticks tied to mining, pulp-and-paper and fertilizer plants seeking process upgrades.

- Omega Engineering (Spectris plc)

- Emerson Electric Co.

- Endress+Hauser Group

- Honeywell International Inc.

- ABB Ltd

- Yokogawa Electric Corp.

- WIKA Alexander Wiegand SE

- TE Connectivity Ltd.

- Watlow Electric Manufacturing Co.

- Fluke Corporation

- Siemens AG

- JUMO GmbH and Co. KG

- Tempsens Instruments

- Pyromation Inc.

- Durex Industries

- Thermo Fisher Scientific Inc.

- GHM Group (Greisinger)

- TC Ltd (UK)

- Thermo Electric Instrumentation

- Tip TEMP

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Shift toward predictive maintenance in Industry 4.0 boosting multi-point thermocouple retrofits across European factories

- 4.1.2 Expansion of green-hydrogen electrolyzes build-outs (>800 C monitoring) in Asia Pacific

- 4.1.3 LNG regasification terminal build-outs requiring cryogenic Type-T probes in North America

- 4.1.4 EV battery gigafactory kiln installations in China demanding high-accuracy Type-K sensors

- 4.1.5 EU Regulation 2019/1781 mandating tighter motor-efficiency tests and embedded thermocouples

- 4.2 Market Restraints

- 4.2.1 Price erosion from commoditized K and J imports out of low-cost Asian supply chains

- 4.2.2 Substitution threat from fiber-optic sensors in high-EMI aerospace engines

- 4.2.3 Calibration drift >1 200 C limiting use in semiconductor epitaxy lines

- 4.2.4 Nickel and chromium supply volatility disrupting MI-cable probe output in Europe

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Thermocouple Type

- 5.1.1 Type J

- 5.1.2 Type T

- 5.1.3 Type N

- 5.1.4 Type E

- 5.1.5 Type R and S

- 5.1.6 Type B

- 5.1.7 Others

- 5.2 By Junction Type

- 5.2.1 Grounded Junction

- 5.2.2 Ungrounded Junction

- 5.2.3 Exposed Junction

- 5.3 By Temperature Range

- 5.3.1 Below 0 C

- 5.3.2 0 C 350 C

- 5.3.3 350 C 700 C

- 5.3.4 Above 700 C

- 5.4 By Probe Configuration

- 5.4.1 Beaded-Wire

- 5.4.2 Mineral-Insulated (MI) Cable

- 5.4.3 Thermowell and Protection Tube

- 5.4.4 Surface and Penetration

- 5.4.5 Flexible / Custom Harness

- 5.5 By End-User Industry

- 5.5.1 Oil and Gas

- 5.5.2 Power Generation

- 5.5.3 Chemicals and Petrochemicals

- 5.5.4 Metals and Mining

- 5.5.5 Food and Beverage

- 5.5.6 Automotive and EV Battery

- 5.5.7 Aerospace and Defense

- 5.5.8 Semiconductor and Electronics

- 5.5.9 Healthcare and Life Sciences

- 5.5.10 HVAC and Building Automation

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Nigeria

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Omega Engineering (Spectris plc)

- 6.3.2 Emerson Electric Co.

- 6.3.3 Endress+Hauser Group

- 6.3.4 Honeywell International Inc.

- 6.3.5 ABB Ltd

- 6.3.6 Yokogawa Electric Corp.

- 6.3.7 WIKA Alexander Wiegand SE

- 6.3.8 TE Connectivity Ltd.

- 6.3.9 Watlow Electric Manufacturing Co.

- 6.3.10 Fluke Corporation

- 6.3.11 Siemens AG

- 6.3.12 JUMO GmbH and Co. KG

- 6.3.13 Tempsens Instruments

- 6.3.14 Pyromation Inc.

- 6.3.15 Durex Industries

- 6.3.16 Thermo Fisher Scientific Inc.

- 6.3.17 GHM Group (Greisinger)

- 6.3.18 TC Ltd (UK)

- 6.3.19 Thermo Electric Instrumentation

- 6.3.20 Tip TEMP

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis