|

市场调查报告书

商品编码

1906980

欧洲自动导引车(AGV)市场占有率分析、产业趋势与统计、成长预测(2026-2031)Europe Automated Guided Vehicle (AGV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

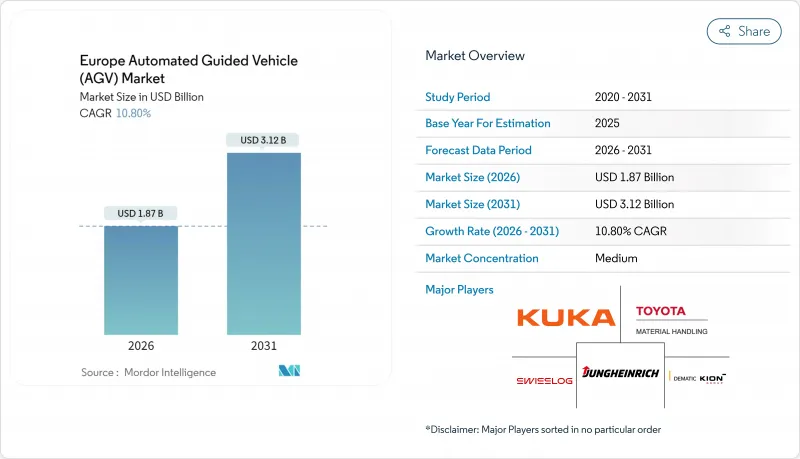

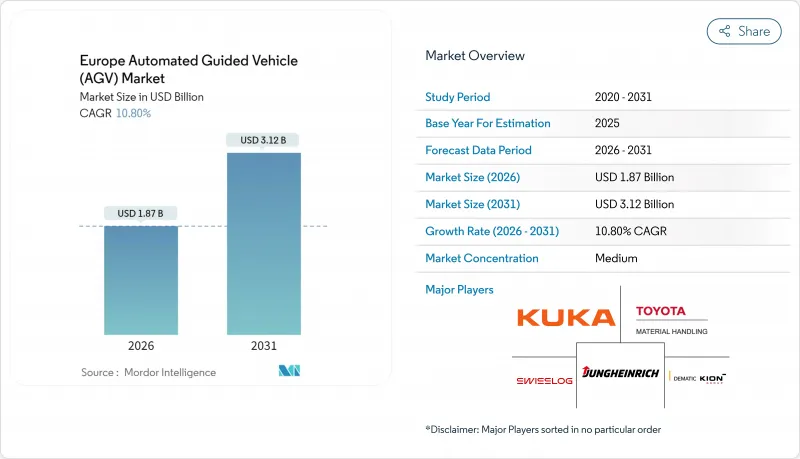

欧洲自动导引车 (AGV) 市场预计到 2026 年将达到 18.7 亿美元,高于 2025 年的 16.9 亿美元,预计到 2031 年将达到 31.2 亿美元,2026 年至 2031 年的年复合成长率(CAGR)为 10.8%。

汽车产业的弹性製造倡议、大规模港口自动化专案以及电子商务的持续扩张是推动成长的关键因素,而电子商务的扩张需要高吞吐量的物流。锂离子驱动系统、5G赋能的车队协调以及基于人工智慧的交通管理平台正在融合,以提高整体设施生产力,同时满足欧盟的脱碳目标。德国在自动化领域的领先地位、荷兰的港口计划以及英国应对严重劳动力短缺的倡议,都是推动技术应用的重要因素,而射频频谱碎片化和高昂的整合成本仍然是限制技术普及率的因素。

欧洲自动导引车(AGV)市场趋势与洞察

欧洲都市区履约中心数量快速成长

都市区履约中心的快速成长正在重新定义AGV的设计重点,使其更加面积,并实现全天候运作。 REWE集团位于马德堡、耗资2.5亿欧元的物流中心实现了50%的内部物流自动化,每天处理28.6万个包裹,充分展现了以AGV为中心的布局所带来的规模经济效益。专业零售商也纷纷效仿,例如Dr. Max在义大利新建的仓库就利用行动机器人来支援线上销售额55%的成长。随着物流地产空置率趋于稳定,零售商们正在积极洽谈,以获得具备自动化功能的仓储空间,从而支持AGV快速充电基础设施的建设。

德国汽车工厂的柔性生产线符合工业4.0标准

德国汽车製造商正逐步抛弃固定式输送机,转而采用配备AGV车队的矩阵式生产模式。在梅赛德斯-宾士的素车製造流程中,约100辆库卡AGV能够即时自主地调整零件流转。在BMW工厂,人工智慧集群控制软体能够根据车型组合的变化自动调整运输路线,实现零停机。像杜尔的EcoProFleet这样的专用于喷漆车间的AGV,将这一理念延伸至涂装线,使多种车型能够共用资源运作。

中小企业初始系统整合和定製成本较高

许多中小企业仅两台自动导引车 (AGV) 的整合报价就高达 49,000 欧元以上,这限制了其市场渗透率。虽然优化后的布局可以将投资回收期缩短至八个月以内,但由于缺乏内部专业知识和对补贴计划了解有限,采用率仍然参差不齐。经合组织的一项调查显示,72% 的欧洲中小企业了解数位化带来的好处,但由于技能和资金方面的差距,只有 18% 的企业正在积极采用先进的自动化技术。

细分市场分析

截至2025年,自动堆高机在欧洲AGV市占率中占比37.60%,这主要得益于其与现有托盘工作流程的兼容性以及成熟的安全认证。牵引车和拖车是大型製造园区的主力设备,而组装平台则履约汽车产业的准时生产。受电子商务物流需求的推动,单元货载具预计到2031年将以12.6%的复合年增长率成长,从而进一步扩大其在欧洲AGV市场规模中的占比。

技术进步正在模糊传统的产品类别界线。凯傲的KAnIS计划展示了一款支援5G连接的室外堆高机,它能够与室内车队协同工作,将自动化延伸至场地区域。丰田与吉迪恩的合作则将堆高机的传统技术与人工智慧驱动的自主移动机器人(AMR)结合,标誌着这家供应商正在转型为一个高度适应性强、用途广泛的平台。

由于雷射导引在结构化路径中展现出卓越的精度,预计到2025年,其市场份额将达到41.40%。视觉引导车辆将以13.9%的复合年增长率成长,利用SLAM和感测器融合技术自主绘製复杂环境地图,并减少基础设施维修。磁力路径和引导路径将继续应用于低温运输隧道等关键路径追踪场景。弗劳恩霍夫IPA研究所的自由导航研究表明,混合视觉-雷射方法无需固定反射器即可保持毫米级精度。 Inoc Robotics公司正利用光达和运动追踪器融合技术,将此模型扩展到崎岖的户外环境。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧洲都市区履约中心数量快速成长

- 德国汽车工厂的柔性生产线符合工业4.0标准

- 西欧物流人事费用上升和人口短缺

- 欧盟绿色交易为低排放量物流设备提供奖励措施

- 鹿特丹和安特卫普的港口自动化计划推动了船舶自动导引车(AGV)的普及应用。

- 欧盟「地平线」计画资助下一代众包导航演算法

- 市场限制

- 中小企业系统整合和客製化的初始成本较高

- 欧洲射频频谱碎片化导致高密度仓库网路延迟。

- CE标誌和ISO 3691-4安全认证的前置作业时间较长

- 熟练的AGV系统整合商数量有限

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章 市场规模与成长预测

- 按车辆类型

- 自动堆高机

- 牵引车辆/拖拉机/拖船

- 单元货载机

- 组装车辆

- 特殊应用/客製化规格

- 透过导航技术

- 雷射导

- 磁感应法/感应法

- 视觉引导

- 自然地形辨识/SLAM

- 依电池类型

- 铅酸电池

- 锂离子

- 镍氢电池

- 超级电容/快速充电

- 按操作模式

- 手动操作

- 混合/双模式

- 完全自主

- 透过使用

- 运输/配送

- 储存和检索

- 组装/套件组装

- 包装和托盘堆垛

- 按最终用户行业划分

- 车

- 食品/饮料

- 零售与电子商务

- 电学

- 一般製造业

- 製药

- 航太/国防

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Swisslog Holding AG

- KUKA AG

- Jungheinrich AG

- Toyota Material Handling Europe AB

- Dematic(KION Group)

- SSI Schaefer AG

- Murata Machinery Ltd

- ABB Ltd

- Seegrid Corporation

- AGILOX Services GmbH

- Balyo SA

- Elettric 80 SpA

- Linde Material Handling GmbH

- STILL GmbH

- Mobile Industrial Robots(MiR)

- Fives Intralogistics SAS

- Euroimpianti SpA

- Oceaneering International(AGV Systems)

- Transbotics Corporation

- Amerden Inc.

第七章 市场机会与未来展望

European AGV market size in 2026 is estimated at USD 1.87 billion, growing from 2025 value of USD 1.69 billion with 2031 projections showing USD 3.12 billion, growing at 10.8% CAGR over 2026-2031.

Growth is driven by flexible manufacturing initiatives in the automotive sector, large-scale port automation programs, and sustained e-commerce expansion that demands high-throughput intralogistics. Lithium-ion powertrains, 5G-enabled fleet orchestration, and AI-based traffic management platforms are converging to raise overall equipment productivity while meeting EU decarbonization targets. Germany's automation leadership, the Netherlands' port projects, and the United Kingdom's response to acute labor shortages serve as powerful adoption catalysts, whereas fragmented RF spectrum and high integration costs still moderate deployment velocity.

Europe Automated Guided Vehicle (AGV) Market Trends and Insights

E-commerce fulfilment centres' surge across urban Europe

Rapid growth in urban fulfilment hubs is resetting AGV design priorities toward compact footprints and 24/7 availability. REWE Group's EUR 250 million logistics hub in Magdeburg automates 50% of intralogistics and handles 286,000 packages per day, proving the scale advantages of AGV-centric layouts. Specialty retailers follow suit; Dr. Max's new Italian warehouse uses mobile robots to sustain 55% online-sales growth. Combined with stabilizing logistics-real-estate vacancies, retailers now negotiate for automation-ready space that supports rapid AGV charging infrastructure.

Industry 4.0-enabled flexible manufacturing lines in German automotive plants

German automakers are dismantling rigid conveyor lines in favor of matrix production orchestrated by AGV fleets. Mercedes-Benz's body-in-white operations run nearly 100 KUKA vehicles that autonomously synchronize component flows in real time. BMW's factory implementations rely on AI fleet control software to adapt transport routes to model-mix changes without downtime. Purpose-built paint-shop AGVs such as Durr's EcoProFleet expand the concept to finishing lines, allowing multiple vehicle types to run on shared resources.

High up-front system integration & customisation costs for SMEs

Many SMEs confront integration quotations exceeding EUR 49,000 for a modest two-AGV installation, stalling broader market penetration. Although payback can arrive within eight months in optimized layouts, limited in-house expertise and low awareness of subsidy programs leave uptake uneven. OECD surveys show 72% of European SMEs understand digital benefits, yet only 18% actively deploy advanced automation due to skills and funding gaps.

Other drivers and restraints analyzed in the detailed report include:

- Labour-cost inflation & demographic shortages in Western Europe's logistics workforce

- EU Green Deal incentives for low-emission intralogistics equipment

- Fragmented European RF spectrum causing network latency in dense warehouses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automated forklifts captured 37.60% of the European AGV market share in 2025, underpinned by drop-in compatibility with existing pallet workflows and mature safety certifications. Tow tractors and tug vehicles remain staples in large manufacturing campuses, whereas assembly line platforms support just-in-time automotive sequencing. Unit-load carriers, propelled by e-commerce fulfilment needs, are forecast to grow at a 12.6% CAGR, increasing their contribution to the European AGV market size through 2031.

Technical evolution blurs legacy categories: KION's KAnIS project demonstrates 5G-linked outdoor forklifts that coordinate with indoor fleets, extending automated coverage to yard areas. Toyota's alliance with Gideon blends forklift heritage with AI-driven AMRs, revealing how suppliers reposition toward adaptable multi-purpose platforms.

Laser guidance commanded 41.40% share in 2025 thanks to proven precision in structured aisles. Vision-guided vehicles, growing at 13.9% CAGR, leverage SLAM and sensor fusion to self-map unpredictable environments, reducing infrastructure retrofits. Magnetic and inductive paths persist in critical path-following use cases such as cold-chain tunnels. Free-navigation research at Fraunhofer IPA shows how hybrid vision-laser stacks eliminate fixed reflectors while preserving millimetric accuracy. Innok Robotics extends this model outdoors with LiDAR plus motion-tracker fusion for rough terrain.

The European AGV Market Report is Segmented by Vehicle Type (Automated Forklift, Unit-Load Carrier, and More), Navigation Technology (Laser Guided, Magnetic/Inductive Guided, and More), Battery Type (Lead-Acid, Lithium-Ion, Nickel-Metal Hydride, and More), Mode of Operation (Manual Override, Hybrid/Dual-Mode, and More), Application, End-User Industry, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Swisslog Holding AG

- KUKA AG

- Jungheinrich AG

- Toyota Material Handling Europe AB

- Dematic (KION Group)

- SSI Schaefer AG

- Murata Machinery Ltd

- ABB Ltd

- Seegrid Corporation

- AGILOX Services GmbH

- Balyo SA

- Elettric 80 SpA

- Linde Material Handling GmbH

- STILL GmbH

- Mobile Industrial Robots (MiR)

- Fives Intralogistics SAS

- Euroimpianti SpA

- Oceaneering International (AGV Systems)

- Transbotics Corporation

- Amerden Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce Fulfilment Centres Surge Across Urban Europe

- 4.2.2 Industry 4.0 Enabled Flexible Manufacturing Lines in German Automotive Plants

- 4.2.3 Labour-Cost Inflation and Demographic Shortages in Western Europes Logistics Workforce

- 4.2.4 EU Green Deal Incentives for Low-Emission Intralogistics Equipment

- 4.2.5 Port Automation Projects in Rotterdam and Antwerp Boosting Maritime AGV Adoption

- 4.2.6 Horizon Europe Funding for Next-Gen Swarm Navigation Algorithms

- 4.3 Market Restraints

- 4.3.1 High Up-front System Integration and Customisation Costs for SMEs

- 4.3.2 Fragmented European RF Spectrum Causing Network Latency in Dense Warehouses

- 4.3.3 Lengthy CE-Mark and ISO 3691-4 Safety Certification Lead-Times

- 4.3.4 Limited Availability of Skilled AGV Systems Integrators

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value-Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Vehicle Type

- 5.1.1 Automated Forklift

- 5.1.2 Tow / Tractor / Tug

- 5.1.3 Unit-Load Carrier

- 5.1.4 Assembly Line Vehicle

- 5.1.5 Special-Purpose / Custom

- 5.2 By Navigation Technology

- 5.2.1 Laser Guided

- 5.2.2 Magnetic / Inductive Guided

- 5.2.3 Vision Guided

- 5.2.4 Natural Feature / SLAM

- 5.3 By Battery Type

- 5.3.1 Lead-acid

- 5.3.2 Lithium-ion

- 5.3.3 Nickel-Metal Hydride

- 5.3.4 Super-capacitor / Fast-Charge

- 5.4 By Mode of Operation

- 5.4.1 Manual Override

- 5.4.2 Hybrid / Dual-Mode

- 5.4.3 Fully Autonomous

- 5.5 By Application

- 5.5.1 Transportation and Distribution

- 5.5.2 Storage and Retrieval

- 5.5.3 Assembly and Kitting

- 5.5.4 Packaging and Palletising

- 5.6 By End-User Industry

- 5.6.1 Automotive

- 5.6.2 Food and Beverage

- 5.6.3 Retail and E-commerce

- 5.6.4 Electronics and Electrical

- 5.6.5 General Manufacturing

- 5.6.6 Pharmaceuticals

- 5.6.7 Aerospace and Defence

- 5.7 By Country

- 5.7.1 Germany

- 5.7.2 United Kingdom

- 5.7.3 France

- 5.7.4 Italy

- 5.7.5 Spain

- 5.7.6 Netherlands

- 5.7.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Swisslog Holding AG

- 6.4.2 KUKA AG

- 6.4.3 Jungheinrich AG

- 6.4.4 Toyota Material Handling Europe AB

- 6.4.5 Dematic (KION Group)

- 6.4.6 SSI Schaefer AG

- 6.4.7 Murata Machinery Ltd

- 6.4.8 ABB Ltd

- 6.4.9 Seegrid Corporation

- 6.4.10 AGILOX Services GmbH

- 6.4.11 Balyo SA

- 6.4.12 Elettric 80 SpA

- 6.4.13 Linde Material Handling GmbH

- 6.4.14 STILL GmbH

- 6.4.15 Mobile Industrial Robots (MiR)

- 6.4.16 Fives Intralogistics SAS

- 6.4.17 Euroimpianti SpA

- 6.4.18 Oceaneering International (AGV Systems)

- 6.4.19 Transbotics Corporation

- 6.4.20 Amerden Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment