|

市场调查报告书

商品编码

1851367

汽车自动紧急煞车系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Autonomous Emergency Braking System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

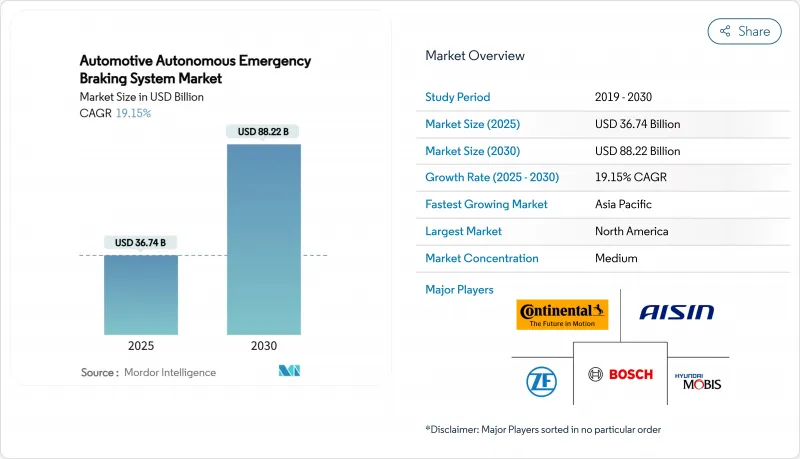

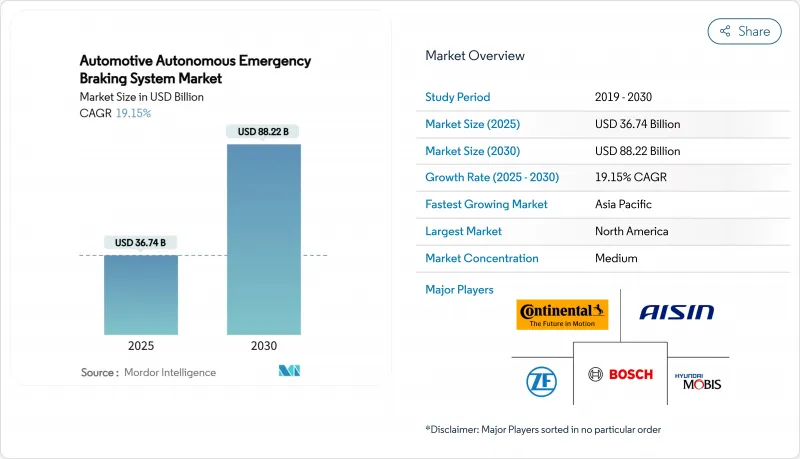

预计到 2025 年,自动紧急煞车市场规模将达到 367.4 亿美元,到 2030 年将扩大到 882.2 亿美元,复合年增长率为 19.15%。

这一成长趋势得益于美国、欧盟和中国法规中规定的强制性设备规则。这些规则取消了选配配置週期,并促进了所有价格区间的全系列系统整合。更严格的强制性能标准,例如高速碰撞避免、夜间行人侦测和路口安全,迫使汽车製造商采用多感测器融合架构。低于50美元的雷达模组、不断下降的光达成本以及片上人工智慧处理进一步压缩了系统材料清单,使大众市场车辆能够缩小与高端车型的技术差距。同时,保险公司为配备自动紧急煞车系统(AEB)的车辆提供基于使用量的折扣,刺激了商用运输领域的改装需求,并推动了自动紧急煞车市场的发展。不同地区的合规期限错开收入来源,并奖励那些能够快速适应地区通讯协定的可扩展平台供应商。

全球汽车自动紧急煞车系统市场趋势与洞察

关于安装自动紧急煞车装置的强制规定

政府强制实施的自动紧急煞车(AEB)要求,推动了市场不可逆转的扩张,超越了传统的汽车普及週期。美国国家公路交通安全管理局(NHTSA)的最终规则规定,AEB系统必须能够在时速高达90英里(约145公里)的情况下自动煞车。行人侦测必须在黑暗中有效运行,并要求所有车辆在2029年9月前全面达标。这种基于性能而非特定技术的监管方式,允许製造商在满足严格的有效性阈值的同时,选择最佳的感测器组合。初步测试表明,只有2023款丰田Corolla符合这项综合标准,这表明整个产业都需要进行重大的技术改进。该法律规范透过设定最低性能标准,从根本上改变了竞争动态,有利于那些能够提供整合感测器融合解决方案的技术先进的供应商。预计每辆车82美元的实施成本与预计52.4亿美元至65.2亿美元的生命週期净收益相比,只是很小的门槛,这为加速推广应用提供了强有力的经济理由。

消费者对NCAP五星安全评级的需求日益增长

消费者安全意识的提升正推动着他们做出超出监管标准的购买决策,从而为安全评级最高的车辆创造了市场溢价。欧洲新车安全评鑑协会(Euro NCAP)2026年的通讯协定更新包括增强型自动紧急煞车(AEB)测试场景,例如路口碰撞规避和单车侦测,製造商也要求整合先进的感测器才能获得最高评级。美国公路安全保险美国(IIHS)呼吁制定更严格的AEB法规,反映出消费者意识到现有系统在黑暗环境下的性能显着不足,这为采用热成像和先进感测器融合技术的製造商创造了差异化优势。这种由消费者主导的需求在高阶汽车领域尤其显着,因为安全技术是该领域的关键差异化因素,例如Volvo等製造商正利用其城市安全系统(City Safety)来展示其在降低碰撞风险方面可衡量的优势。 NCAP蓝图将持续到2033年,确保技术的持续发展,防止市场停滞,并奖励持续的创新投资。 Liberty Mutual 的 TechSafety 计划为配备先进安全功能的沃尔沃车主提供折扣,这表明保险业对 AEB 有效性的看法与消费者需求是如何交织在一起的。

用于高级自动紧急煞车系统的雷射雷达和多感测器堆迭高成本。

儘管雷射雷达(LiDAR)拥有卓越的探测能力,但其高昂的整合成本阻碍了其广泛应用,导致高端和大众市场车辆市场分化。虽然像和赛这样的公司计划在2025年将光达的价格降低50%,但目前的成本仍然远高于雷达和摄影机的组合,限制了其在豪华车领域的应用。根据奥纬咨询(Oliver Wyman)的分析,雷射雷达在紧急煞车等安全关键应用中具有更高的精度,但面临来自雷达分辨率和成本效益提升的竞争压力。由于系统复杂性、整合成本和检验要求的增加,将光达、雷达和摄影机结合以实现冗余和性能提升的多感测器融合架构正变得越来越具有挑战性。 Aeva Technologies被选为量产车的一级光达供应商,显示市场对调频连续波(FMCW)技术的信心。然而,过渡期将持续到2010年代中期,这反映出该技术在工程和成本优化方面需要投入大量资源。这种成本限制尤其影响商用车的普及,并且可能会减缓基于雷射雷达的自动紧急煞车系统在大众市场领域的应用,因为车队营运商优先考虑的是总拥有成本,而不是高级安全功能。

细分市场分析

乘用车占自动紧急煞车系统(AEB)市场最大的份额,高达73.68%,这得益于消费者日益增长的安全期望以及相关法规的推动。重型商用车在2024年仅占6%的市场份额,但其复合年增长率(CAGR)将达到14.20%,是成长最快的市场,这主要得益于美国联邦汽车运输安全管理局(FMCSA)针对总重超过10,001磅(约4.5吨)的卡车出台的法规。这一高增长基数使车队成为战略要地,改装套件起价仅为1,500美元,可减少碰撞造成的停机时间,并可透过保险退款获得补贴。轻型商用车维持20%的市场份额,主要得益于电子商务物流了配送哩程的增加。预计到2025年至2030年,重型商用车自动紧急煞车系统市场规模将成长两倍以上,因为车队采购週期将因合规期限的临近而缩短。

车队也在影响技术的发展方向。采埃孚的线控刹车或拖车车头,从而最大限度地减少停机时间并实现维修零件的标准化。这种跨领域的技术流动正推动着自动紧急煞车产业保持规模化和创新化的良性循环。

到2024年,雷达将占据自动紧急煞车市场46.32%的份额,这主要得益于其全天候的可靠性和持续下降的成本。纯摄影机系统将占22%,而雷达与摄影机融合系统因在低照度条件下性能欠佳,将仅占20%。雷射雷达(LiDAR)虽然仍处于发展初期,但正以31.70%的复合年增长率快速增长,这主要得益于垂直共振腔面射型雷射)和调频连续波(FMCW)架构降低了物料成本,并实现了小于10厘米的距离精度。超音波单元仍占4%,主要用于低速机动应用。预计到2030年,以雷射雷达为中心的自动紧急煞车系统市场份额将接近15%,这主要得益于全球OEM厂商超过60亿美元的固态感测器订单。

融合的潜力正在不断增长。混合模组整合了窄视场雷射雷达(用于高解析度、中距离测绘)和广视场雷达(用于在恶劣天气条件下保持可靠性),从而实现了成本平衡的覆盖范围。将雷达数位讯号处理(DSP)、人工智慧加速器和雷射雷达控制集成到单一晶粒上的半导体蓝图预示着进一步的集成,这将加剧自动紧急煞车行业的竞争。

区域分析

2024年,北美将占全球自动紧急煞车系统(AEB)销售的34.23%,这主要得益于严格的联邦安全标准和持续不断的诉讼推动了该技术的快速普及。该地区较高的车辆平均车龄也促进了强劲的改装需求,因为车队为了获得保险优惠而加快合规进程。预计到2030年,随着FMVSS 127标准的逐步实施,北美自动紧急煞车系统市场规模将达到280亿美元。

欧洲占了30%的市场份额,这主要得益于《通用安全法规II》(General Safety Regulation II)。该法规统一了27个成员国的安全要求,并将自动紧急煞车(AEB)纳入了高阶驾驶辅助系统(ADAS)的范畴。以欧洲为中心的汽车製造商倾向于采用集中式电子电气架构,将AEB、车道维持和自我调整巡航等功能整合在共用的感测器阵列上,从而提高供应商的规模经济效益,并使自动紧急煞车市场更具盈利。

亚太地区将在2024年占据28%的市场份额,并有望实现12.50%的最高复合年增长率,这主要得益于比亚迪等中国汽车製造商为其售价低于1.5万美元的低成本电动车配备自动紧急煞车系统(AEB)。国产晶片组和垂直整合的感测器供应链将降低成本,从而推动AEB的大规模普及,其产量将超过欧洲。澳洲将从2025年2月起强制所有新乘用车配备AEB,进一步扩大该地区的监管覆盖范围,以维持该地区的发展动能。如果目前的成长动能持续下去,到2030年,亚太地区自动紧急煞车系统的市场规模可望超过北美。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 关于强制安装AEB的监理义务

- 消费者对NCAP五星安全评级的需求日益增长

- 可扩展的4D融合技术降低了雷达和摄影机感测器的成本

- 人工智慧增强型成像雷达能够以低成本实现高解析度感知。

- 配备自动紧急煞车系统的车辆可享有基于使用量的保险折扣

- 中国和美国夜间行人自动紧急煞车要求

- 市场限制

- 用于高级自动紧急煞车系统的雷射雷达和多感测器堆迭高成本。

- 恶劣天气下感测器性能受限,容易出现误报

- 77GHz雷达晶片组半导体短缺

- 毫米波雷达演算法相关的智慧财产权诉讼愈演愈烈

- 价值/供应链分析

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和重型商用车辆

- 透过组件技术

- 基于雷达的自动紧急制动

- 基于摄影机的自动曝光

- 基于光达的自动紧急制动

- 感知器融合自动紧急煞车(雷达+摄影机)

- 基于超音波的AEB

- 按运转速度等级

- 低速自动紧急煞车(低于 40 公里/小时)

- 高速自动紧急煞车(超过 40 公里/小时)

- 行人自动紧急制动

- 交叉路口或交会处 AEB

- 按销售管道

- OEM安装

- 售后市场

- 车队改装服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Autoliv Inc.

- Hyundai Mobis Co. Ltd.

- WABCO Holdings Inc.

- Valeo SA

- Aisin Corporation

- Aptiv PLC

- Mobileye NV

- Magna International Inc.

第七章 市场机会与未来展望

The autonomous emergency braking market reached USD 36.74 billion in 2025 and is forecast to expand to USD 88.22 billion by 2030, reflecting a 19.15% CAGR.

The growth trajectory is anchored in compulsory fitment rules now embedded in the United States, European Union, and China regulations. These regulations eliminate optional-equipment cycles and drive full-range system integration across every price segment. Mandatory performance thresholds tighten around high-speed collision avoidance, night-time pedestrian detection, and junction safety, forcing automakers to standardize multi-sensor fusion architectures. Sub-USD 50 radar modules, falling LiDAR costs, and on-chip AI processing further compress system bills of material, allowing mass-market vehicles to close the technology gap with premium models. Insurance carriers, meanwhile, offer usage-based discounts on AEB-equipped fleets, catalyzing retrofit demand in commercial transport and reinforcing the autonomous emergency braking market's momentum. Divergent regional compliance deadlines create staggered revenue waves that reward suppliers with scalable platforms capable of rapidly calibrating local protocols.

Global Automotive Autonomous Emergency Braking System Market Trends and Insights

Regulatory Mandates for Mandatory AEB Installation

Government-imposed AEB requirements create non-negotiable market expansion that transcends traditional automotive adoption cycles. NHTSA's final rule mandates that AEB systems be capable of automatic braking at speeds up to 90 mph. That pedestrian detection functionality should operate effectively in darkness, with full compliance required by September 2029.The regulation's performance-based approach, rather than technology-specific requirements, enables manufacturers to choose optimal sensor combinations while meeting stringent effectiveness thresholds. Preliminary testing reveals that only the 2023 Toyota Corolla meets these comprehensive standards, indicating substantial technology upgrades required across the industry. This regulatory framework fundamentally alters competitive dynamics by establishing minimum performance baselines that favor technologically sophisticated suppliers capable of delivering integrated sensor fusion solutions. The estimated USD 82 per vehicle implementation cost represents a minimal barrier relative to the projected USD 5.24 to USD 6.52 billion lifetime net benefits, creating compelling economic justification for accelerated adoption.

Rising Consumer Demand for NCAP 5-Star Safety Ratings

Consumer safety consciousness drives purchasing decisions beyond regulatory minimums, creating market premiums for vehicles achieving top-tier safety ratings. Euro NCAP's updated 2026 protocols introduce enhanced AEB testing scenarios, including junction collision avoidance and cyclist detection capabilities, with manufacturers requiring advanced sensor integration to achieve maximum ratings. The Insurance Institute for Highway Safety's advocacy for stringent AEB regulations reflects consumer awareness that current systems significantly underperform in darkness, creating differentiation opportunities for manufacturers deploying infrared cameras and advanced sensor fusion. This consumer-driven demand particularly influences premium vehicle segments where safety technology is a key differentiator, with manufacturers like Volvo leveraging City Safety technology to demonstrate measurable crash reduction benefits. The NCAP roadmap extending through 2033 ensures continuous technology evolution requirements, preventing market stagnation and rewarding ongoing innovation investments. Liberty Mutual's TechSafety program, offering discounts to Volvo owners with advanced safety features, demonstrates how consumer demand intersects with the insurance industry's recognition of AEB effectiveness.

High Cost of LiDAR & Multi-Sensor Stacks for Premium AEB

LiDAR integration costs constrain widespread adoption despite superior detection capabilities, creating market segmentation between premium and volume vehicle categories. While companies like Hesai plan to reduce LiDAR prices by 50% in 2025, current costs still exceed radar-camera combinations by substantial margins, limiting deployment to higher-end vehicle segments. Oliver Wyman's analysis indicates that LiDAR provides superior accuracy for safety-critical applications like emergency braking but faces competitive pressure due to improved radar resolution and cost-effectiveness. The challenge intensifies multi-sensor fusion architectures that combine LiDAR, radar, and cameras to achieve redundancy and enhanced performance, as system complexity increases, integration costs, and validation requirements. Aeva Technologies' selection as a Tier 1 LiDAR supplier for series production vehicles demonstrates market confidence in FMCW technology. However, the transition timeline extending to mid-decade reflects the substantial engineering and cost optimization required. This cost constraint particularly affects commercial vehicle adoption, where fleet operators prioritize total cost of ownership over premium safety features, potentially delaying LiDAR-based AEB penetration in high-volume segments.

Other drivers and restraints analyzed in the detailed report include:

- Declining Radar & Camera Sensor Cost with Scalable 4D Fusion

- AI-Enhanced Imaging Radar Unlocking Low-Cost High-Resolution Perception

- Sensor Performance Limits in Adverse Weather & False Positives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars hold the largest autonomous emergency braking market share at 73.68%, benefiting from rising consumer safety expectations that align with regulation. Heavy commercial vehicles represented only 6% of the market share in 2024, yet are climbing at the highest CAGR of 14.20% on the back of FMCSA rules covering trucks above 10,001 lb GVW. This high-growth base positions fleets as a strategic beachhead, with retrofit kits priced from USD 1,500 achieving payback through collision-related downtime reduction and insurance rebates. Light commercial vans retain a 20% share as e-commerce logistics multiply delivery miles. The heavy commercial vehicles' autonomous emergency braking market size is projected to more than triple between 2025 and 2030 as fleet purchasing cycles compress around compliance deadlines.

Fleets are also influencing technology paths. ZF's brake-by-wire program covering 5 million units demonstrates commercial platforms' power to set scale economies that later cascade into passenger segments. Tier 1 suppliers now design modular sensor suites that clip onto tractor cabs or trailer noses, minimizing downtime and standardizing service parts. This cross-segment technology flow ensures the autonomous emergency braking industry retains a virtuous cycle of volume and innovation.

Radar dominated the autonomous emergency braking market with a 46.32% share in 2024, prized for all-weather robustness and steadily falling cost curves. Camera-only systems cover 22% but struggle in lowlight, driving uptake of radar-camera fusion that occupies a 20% share. LiDAR, though nascent, is surging at 31.70% CAGR as vertical cavity surface-emitting lasers and FMCW architectures slash BOM and deliver sub-10 cm range accuracy. Ultrasonic units remain parked at 4% for low-speed maneuvers. The autonomous emergency braking market share of LiDAR-centric systems is expected to approach 15% by 2030, supported by global OEM order books exceeding USD 6 billion for solid-state sensors.

Convergence is increasingly likely. Hybrid modules integrate a narrow-field LiDAR for high-resolution mid-range mapping with wide-field radar to secure adverse-weather reliability, yielding cost-balanced coverage. Semiconductor roadmaps embedding radar DSP, AI accelerators, and LiDAR control on a single die promise further consolidation, amplifying competitive tension inside the autonomous emergency braking industry.

The Automotive Autonomous Emergency Braking System Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Component Technology (Radar-Based, Camera-Based, LiDAR-Based AEB, and More), Operating Speed Class (Low-Speed, High-Speed, Pedestrian AEB, and More), and Sales Channel (OEM-Installed, Aftermarket Retrofit, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 34.23% of 2024 revenue, a position underpinned by rigorous federal safety standards and a familiar litigation landscape that encourages proactive adoption. The region's high-average-vehicle age also underwrites robust retrofit demand as fleets accelerate compliance to capture insurance benefits. The autonomous emergency braking market size in North America is set to reach USD 28 billion by 2030, paralleling the staged FMVSS 127 compliance window.

Europe followed with 30% market share, supported by the General Safety Regulation II that synchronizes safety requirements across 27 member states and embeds AEB within a wider umbrella of Advanced Driver Assistance Systems. Euro-centric OEMs favour centralized E/E architectures that host AEB, lane-keep and adaptive cruise on a shared sensor array, improving scale effects for suppliers and boosting profitability within the autonomous emergency braking market.

Asia-Pacific posted 28% share in 2024 yet registers the highest 12.50% CAGR as Chinese OEMs like BYD inject AEB into budget EVs retailing below USD 15,000. Domestic chipsets and vertically integrated sensor supply chains compress cost structures, unlocking mass-volume deployments that dwarf European build counts. Australia's mandate for AEB on all new passenger cars from February 2025 widens regulatory coverage in the region, sustaining regional momentum. The autonomous emergency braking market size in Asia-Pacific could surpass North America before 2030 if current trajectories hold.

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Autoliv Inc.

- Hyundai Mobis Co. Ltd.

- WABCO Holdings Inc.

- Valeo SA

- Aisin Corporation

- Aptiv PLC

- Mobileye N.V.

- Magna International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Mandates for Mandatory AEB Installation

- 4.2.2 Rising Consumer Demand for NCAP 5-Star Safety Ratings

- 4.2.3 Declining Radar & Camera Sensor Cost With Scalable 4D Fusion

- 4.2.4 AI-Enhanced Imaging Radar Unlocking Low-Cost High-Resolution Perception

- 4.2.5 Usage-Based Insurance Discounts Tied to AEB-Equipped Vehicles

- 4.2.6 Night-Time Pedestrian AEB Requirements in China & US

- 4.3 Market Restraints

- 4.3.1 High Cost of LiDAR & Multi-Sensor Stacks for Premium AEB

- 4.3.2 Sensor Performance Limits in Adverse Weather & False Positives

- 4.3.3 Semiconductor Shortages for 77 GHz Radar Chipsets

- 4.3.4 Intensifying IP Litigation Around mmWave Radar Algorithms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium and Heavy Commercial Vehicles

- 5.2 By Component Technology

- 5.2.1 Radar-based AEB

- 5.2.2 Camera-based AEB

- 5.2.3 LiDAR-based AEB

- 5.2.4 Sensor-Fusion AEB (Radar + Camera)

- 5.2.5 Ultrasonic-based AEB

- 5.3 By Operating Speed Class

- 5.3.1 Low-Speed AEB (Less Than 40 Kmph)

- 5.3.2 High-Speed AEB (More Than 40 Kmph)

- 5.3.3 Pedestrian AEB

- 5.3.4 Junction or Intersection AEB

- 5.4 By Sales Channel

- 5.4.1 OEM-Installed

- 5.4.2 Aftermarket Retrofit

- 5.4.3 Fleet Retrofit Service

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Denso Corporation

- 6.4.5 Autoliv Inc.

- 6.4.6 Hyundai Mobis Co. Ltd.

- 6.4.7 WABCO Holdings Inc.

- 6.4.8 Valeo SA

- 6.4.9 Aisin Corporation

- 6.4.10 Aptiv PLC

- 6.4.11 Mobileye N.V.

- 6.4.12 Magna International Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment