|

市场调查报告书

商品编码

1851368

超级电容:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Supercapacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

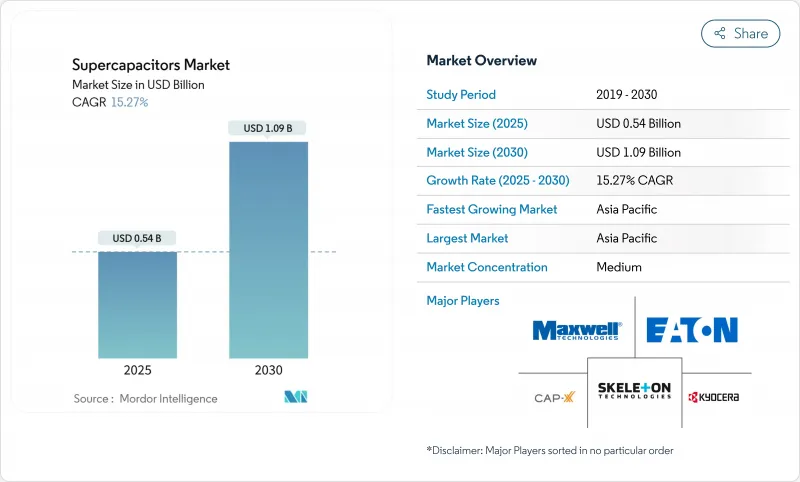

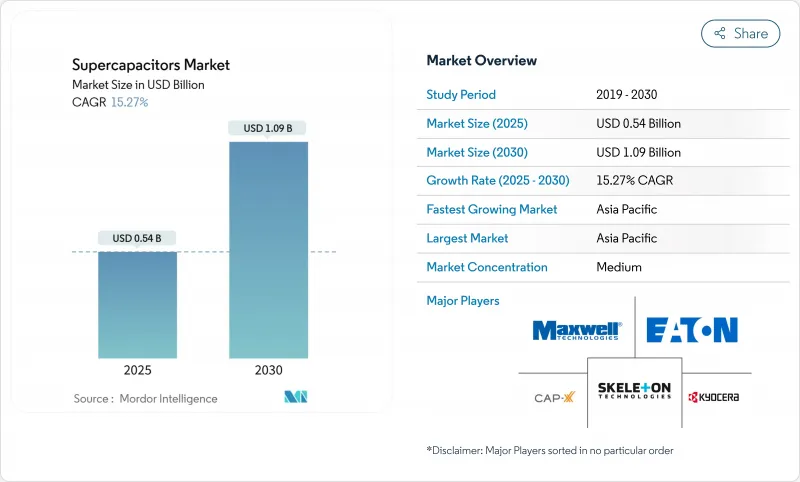

全球超级电容市场预计到 2025 年将达到 5.4 亿美元,到 2030 年将达到 10.9 亿美元,年复合成长率为 15.27%。

推动成长的因素包括:欧盟48V轻混动力系统强制令等电气化法规、人工智慧(AI)突波期间资料中心对不断电系统的需求,以及将电池和超级电容相结合以实现快速频率响应的电网现代化计划。中国仍然是生产和研发的核心,随着锂离子电池市场份额的下降,韩国製造商正将重心转向储能係统。产品创新主要集中在将能量密度提升至电池水平的混合动力设计以及可实现超薄穿戴装置的石墨烯电极。活性碳价格和离子液体电解质等供应链风险将在短期内压缩净利率,但会促进区域多元化发展。

全球超级电容市场趋势与洞察

电子公车队快速采用超级电容模组进行再生製动

城市交通越来越多地采用再生煞车系统,该系统结合了电池和超级电容,与纯电池系统相比,可回收高达 85% 的动能。梅赛德斯-奔驰的 Intouro 混合动力公车采用 48 伏特超级电容器组,可承受数百万次的充电循环而不会劣化,从而降低了 5% 的燃油消耗。中国城市走在前列,目前已将混合动力公车场站接入电网,用于车辆充电和电网稳定服务。系统供应商正在整合演算法,根据路线地形在超级电容和电池之间自动切换功率,从而降低整体拥有成本。随着电动公车采购量的成长,这项技术增强了超级电容在公共运输电气化领域的竞争力。

电网级电池和超级电容器混合储能

电力公司公共产业超级电容的即时频率调节能力。示范测试表明,与独立锂离子电池组相比,超级电容器可将频率下降降低17.43%,与纯电池方案相比,其经济效益是后者的3.2倍。美国能源局预测,随着自动化电池生产的扩展,到2030年,储能的平准化成本将达到每度电0.337美元。此外,超级电容还具有环境优势,因为它们不使用钴或镍。这些因素使得超级电容市场成为高可再生能源场景下,与长寿命电池互补的重要电网组成部分。

认证差距(IEC 62391)限制了住宅部署

IEC 62391 测试程序延长了认证週期并增加了成本,尤其对中小企业而言更是如此。对比研究表明,该标准比 Maxwell 和 QC/T 741-2014通讯协定耗时更长,导致产品上市延迟长达 12 个月。其对高电流测试的重视与典型家庭的用电需求不符。这一行政障碍导致了市场分割,并减缓了住宅储能领域的准入,而简化合规流程本可以释放该领域的新需求。

细分市场分析

由于其成熟的生产线和在工业功率缓衝领域久经考验的耐用性,电双层电容器预计在2024年将维持55.2%的超级电容市场份额。混合型超级电容融合了类似电池的储能特性和传统电容器的功率输出特性,预计到2030年将以18.1%的复合年增长率成长。这种混合型方案满足了原始设备製造商(OEM)对能够承受数秒电压骤降并保持更长放电週期的设备的需求。

包括锂离子电容器在内的多种新型锂离子电容器的研发进展,正在缩小能量密度差距并提高动作温度。在汽车逆变器和併网系统中的先导计画已证明其循环寿命超过一百万次。这些特性意味着混合型超级电容器将成为超级电容行业的下一个性能标竿。

2024年,模组化组件将占据超级电容市场57.8%的份额,这主要得益于整合的平衡电路以及与公车、起重机和风力发电机的即插即用相容性。同时,随着电网营运商和电动车製造商选择800V以上的高压电池组,电池组预计将以每年17.4%的速度成长。到2030年,随着公用事业公司部署超级电容电容器的市场规模可能会翻倍。

电池产品在穿戴式装置和工业控制器领域仍然至关重要,因为在这些领域,板级整合和成本敏感度仍然是关键因素。供应商目前提供的模组化架构允许客户以 50 伏特为增量扩展能量,从而缩短计划设计週期。先进的温度控管功能也进一步推动了电池产品在严苛环境下的应用。

区域分析

中国拥有庞大的活性碳加工规模和深厚的研究基础,发表了65.4%的高影响力论文,预计到2024年将占全球收入的28.2%。国内电动车製造商和国家支持的电网计划推动了市场需求的成长,也支撑了销售量的成长。国家优先发展本地储能技术的政策进一步强化了超级电容市场的供应链生态系统。

到2030年,韩国及整个亚洲地区的复合年增长率将达到16.3%,将推动LG能源解决方案、三星SDI和SK安等公司投资超过200亿美元用于新增产能。韩国企业将凭藉其电极涂层技术,为北美公用事业公司的储能係统提供组件级解决方案。日本将贡献高精度、高可靠性的汽车模组製造,东南亚国家将吸引寻求多元化供应链的组装厂。

美国正利用《通膨降低法案》的激励措施,在超大型资料中心实现超级电容UPS设备的在地化生产和部署。欧洲仍然以监管为主导,欧VII排放标准刺激了汽车需求,电网现代化资金则支持混合储能试点计画。拉丁美洲和中东等新兴地区正在测试超级电容组,以确保微电网的稳定性,这表明超级电容市场具有长期成长潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动公车队快速采用再生煞车超级电容模组

- 电网级电池和超级电容器混合储能

- 用于超薄穿戴装置的石墨烯电极取得突破性进展

- 欧盟的48V轻混动力系统强制令将加速12-48V模组的需求

- 资料中心超大规模资料中心业者部署基于超级电容的UPS以满足ESG目标

- 市场限制

- 活性碳前驱物价格波动会影响物料清单成本。

- 认证差距(IEC 62391)限制了住宅应用

- 能量密度平台期(最高10Wh/kg)限制了远距电动车的普及。

- 离子液体电解质供应链瓶颈导致前置作业时间延长

- 监管与技术视角(电极材料、亚太地区额定值、电解、电压范围)

- 宏观经济因素和贸易价格的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资与资金筹措分析

第五章 市场规模与成长预测

- 依成分(类型)

- 双电层电容器(EDLC)

- 赝电容器

- 混合型超级电容

- 按外形规格

- 细胞

- 模组

- 盒

- 依安装类型(分立元件)

- 表面黏着技术

- 径向引线

- 卡扣式

- 螺丝终端

- 按最终用户行业划分

- 消费性电子产品

- 穿戴式装置

- 智慧型手机和平板电脑

- SSD 和记忆体备份

- 能源与公共产业

- 电网频率调节

- 可再生能源併网(风能、太阳能)

- 微电网和UPS

- 工业设备

- 机器人与自动化

- 电动工具

- 重型机械和起重机

- 汽车与运输

- 搭乘用车

- 48V轻混

- 启停式微混合动力

- 商用车辆

- 公车

- 追踪

- 铁路和路面电车

- 航空航太

- 资料中心和电信

- 国防与航太

- 其他(医疗设备、农业无人机)

- 消费性电子产品

- 按地区

- 美国

- 欧洲

- 中国

- 日本

- 韩国及其他亚太地区

- 世界其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Maxwell Technologies Inc.(Tesla)

- Skeleton Technologies SA

- CAP-XX Ltd.

- Eaton Corporation plc

- Panasonic Holdings Corp.

- LS Mtron Ltd.

- Kyocera Corp.

- Nippon Chemi-Con Corp.

- Supreme Power Solutions Co.

- Shanghai Aowei Technology Development Co.

- Samwha capacitor Group

- Nanoramic Laboratories(FastCAP)

- Nawa Technologies SAS

- Cornell Dubilier Electronics Inc.

- Toyo capacitor Co.

- Shenzhen Topmay Electronic Co.

- Liaoning Brother Electronics Technology Co.

- Chengdu ZT-Energy Tech Co.

- Loxus Inc.

- Nantong Jianghai capacitor Co. Ltd

- Beijing HCC Energy

- Jinzhou Kaimei Power Co. Ltd(KAM)

- Shanghai Green Tech Co. Ltd(GTCAP)

- Shenzhen Topmay Electronic Co. Ltd

- SEMG(Seattle Electronics Manufacturing Group(HK)Co. Ltd)

- Shanghai Pluspark Electronics Co. Ltd

第七章 市场机会与未来展望

The global supercapacitors market stood at USD 0.54 billion in 2025 and is forecast to reach USD 1.09 billion by 2030, advancing at a 15.27% CAGR.

Growth is supported by electrification rules such as the European Union's 48-volt mild-hybrid mandate, datacenter demand for uninterruptible power during artificial-intelligence (AI) surges, and grid-modernization projects that blend batteries with supercapacitors for rapid frequency response. China continues to anchor production and research, while Korean manufacturers pivot toward energy-storage systems as their lithium-ion share slips. Product innovation centres on hybrid designs that lift energy density toward battery-like levels and graphene electrodes that enable ultra-thin wearables. Supply-chain risks around activated-carbon prices and ionic-liquid electrolytes temper near-term margins but also encourage regional diversification.

Global Supercapacitors Market Trends and Insights

Rapid adoption of regenerative-braking supercapacitor modules in e-bus fleets

Urban transit agencies are scaling regenerative-braking systems that pair batteries with supercapacitors, recovering up to 85% more kinetic energy than battery-only setups. Mercedes-Benz's Intouro hybrid bus cut fuel use by 5% using a 48-volt supercapacitor pack that endures millions of charge cycles without degradation. Chinese cities were first movers and now link hybrid depots to the grid for both vehicle charging and grid-stability services. System suppliers integrate algorithms that shift power between supercapacitors and batteries to match route topography, which lowers total cost of ownership. As electric-bus procurements rise, this capability strengthens the competitive position of the supercapacitors market in mass-transit electrification.

Grid-scale battery-supercapacitor hybrid storage

Utilities value supercapacitors for instant frequency regulation. Demonstrations showed a 17.43% reduction in frequency-drop rates versus standalone lithium-ion arrays, delivering economic benefits 3.2-times greater than battery-only solutions. The U.S. Department of Energy projects levelized storage costs of USD 0.337 per kWh by 2030 as automated cell production scales. Operators also cite environmental advantages because supercapacitors avoid cobalt and nickel. These factors position the supercapacitors market as an essential grid-forming resource that complements long-duration batteries under high-renewable penetration scenarios.

Certification gaps (IEC 62391) limiting residential adoption

IEC 62391 testing procedures prolong qualification timelines and raise costs, especially for smaller firms. Comparative studies show the standard takes longer than Maxwell and QC/T 741-2014 protocols, stretching product launches by up to 12 months. The heavy focus on high-current testing is mismatched with typical household power profiles. This administrative hurdle slows the supercapacitors market from penetrating residential energy-storage segments where simplified compliance would unlock new demand.

Other drivers and restraints analyzed in the detailed report include:

- Graphene-based electrode breakthroughs enabling ultra-thin wearables

- EU 48 V mild-hybrid mandate accelerating demand for 12-48 V modules

- Energy-density plateau (~10 Wh/kg) restricting long-range EV penetration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electric Double-Layer Capacitors maintained a 55.2% share of the supercapacitors market in 2024, reflecting established production lines and proven durability in industrial power buffering. Hybrid Supercapacitors are on track for an 18.1% CAGR to 2030 as they merge battery-like energy storage with classic capacitor power delivery. The hybrid approach answers OEM calls for devices that can ride through seconds-long voltage dips and also sustain longer discharge profiles.

Rapid R&D advances, including lithium-ion capacitor variants, narrow the energy-density gap and extend operating temperatures. Pilot projects in automotive inverters and grid-forming systems showcase cycle lifetimes beyond one million cycles. These traits position hybrids as the next performance benchmark within the supercapacitors industry.

Module assemblies captured 57.8% of the supercapacitors market in 2024 thanks to integrated balancing circuitry and drop-in compatibility for buses, cranes, and wind turbines. Pack configurations, however, are projected to grow 17.4% annually as grid operators and EV makers opt for higher-voltage stacks that exceed 800 V. The supercapacitors market size for pack-level products could double by 2030 as utilities deploy them for sub-second frequency response.

Cell products retain relevance in wearables and industrial controllers where board-level integration and cost sensitivity remain critical. Vendors now offer modular architectures that let customers scale energy in 50-volt increments, shortening project design cycles. Advanced thermal-management features further widen adoption across harsh-duty environments.

The Supercapacitors Market Report is Segmented by Configuration (Type) (Electric Double-Layer Capacitors (EDLC), Pseudo Capacitors, and Hybrid Supercapacitors), Form Factor (Cell, Module, and Pack), Mounting Type (Discrete Components) (Surface-Mount, Radial Leaded, Snap-In, and More), End-User Industry (Consumer Electronics, Energy and Utilities, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

China controlled 28.2% of global revenue in 2024 due to scale in activated-carbon processing and a deep research base that publishes 65.4% of high-impact papers. Domestic demand from electric-vehicle makers and state-backed grid projects underpins volume growth. State policies that prioritise local energy-storage content further entrench supply-chain ecosystems for the supercapacitors market.

Korea and the broader Asia region are set for a 16.3% CAGR through 2030, propelled by LG Energy Solution, Samsung SDI, and SK On investments that exceed USD 20 billion in new capacity. Korean firms channel expertise in electrode coatings toward pack-level storage systems aimed at North American utilities. Japan contributes precision manufacturing for high-reliability automotive modules, while Southeast Asian nations attract assembly plants seeking diversified supply bases.

The United States leverages Inflation Reduction Act incentives to localise production and deploy supercapacitor-based UPS units in hyperscale datacenters. Europe remains regulation-driven, with the Euro 7 framework spurring automotive demand and grid-modernization funds supporting hybrid storage pilot plants. Emerging regions in Latin America and the Middle East trial supercapacitor packs for microgrid stability, signalling long-term addressable growth for the supercapacitors market.

List of Companies Covered in this Report:

- Maxwell Technologies Inc. (Tesla)

- Skeleton Technologies SA

- CAP-XX Ltd.

- Eaton Corporation plc

- Panasonic Holdings Corp.

- LS Mtron Ltd.

- Kyocera Corp.

- Nippon Chemi-Con Corp.

- Supreme Power Solutions Co.

- Shanghai Aowei Technology Development Co.

- Samwha capacitor Group

- Nanoramic Laboratories (FastCAP)

- Nawa Technologies SAS

- Cornell Dubilier Electronics Inc.

- Toyo capacitor Co.

- Shenzhen Topmay Electronic Co.

- Liaoning Brother Electronics Technology Co.

- Chengdu ZT-Energy Tech Co.

- Loxus Inc.

- Nantong Jianghai capacitor Co. Ltd

- Beijing HCC Energy

- Jinzhou Kaimei Power Co. Ltd (KAM)

- Shanghai Green Tech Co. Ltd (GTCAP)

- Shenzhen Topmay Electronic Co. Ltd

- SEMG (Seattle Electronics Manufacturing Group (HK) Co. Ltd)

- Shanghai Pluspark Electronics Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of regenerative-braking supercapacitor modules in e-bus fleets

- 4.2.2 Grid-scale battery-supercapacitor hybrid storage

- 4.2.3 Graphene-based electrode breakthroughs enabling ultra-thin wearables

- 4.2.4 EU 48 V mild-hybrid mandate accelerating demand for 12-48 V modules

- 4.2.5 Supercapacitor-based UPS deployment by Datacenter hyperscalers to meet ESG targets

- 4.3 Market Restraints

- 4.3.1 Activated-carbon precursor price volatility inflating BOM costs

- 4.3.2 Certification gaps (IEC 62391) limiting the residential adoption

- 4.3.3 Energy-density plateau (~10 Wh/kg) restricting long-range EV penetration

- 4.3.4 Ionic-liquid electrolyte supply-chain bottlenecks elongating lead-times

- 4.4 Regulatory and Technological Outlook (Electrode Material, CAsia-Pacificitance Ratings, Electrolyte, Voltage Range)

- 4.5 Impact of Macroeconomic Factors and Trade Tarrifs

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Configuration (Type)

- 5.1.1 Electric Double-Layer Capacitors (EDLC)

- 5.1.2 Pseudocapacitors

- 5.1.3 Hybrid Supercapacitors

- 5.2 By Form Factor

- 5.2.1 Cell

- 5.2.2 Module

- 5.2.3 Pack

- 5.3 By Mounting Type (Discrete Components)

- 5.3.1 Surface-Mount

- 5.3.2 Radial Leaded

- 5.3.3 Snap-in

- 5.3.4 Screw Terminal

- 5.4 By End-User Industry

- 5.4.1 Consumer Electronics

- 5.4.1.1 Wearables

- 5.4.1.2 Smartphones and Tablets

- 5.4.1.3 SSD and Memory Backup

- 5.4.2 Energy and Utilities

- 5.4.2.1 Grid Frequency Regulation

- 5.4.2.2 Renewable Integration (Wind, Solar)

- 5.4.2.3 Microgrid and UPS

- 5.4.3 Industrial Equipment

- 5.4.3.1 Robotics and Automation

- 5.4.3.2 Power Tools

- 5.4.3.3 Heavy Machinery and Cranes

- 5.4.4 Automotive and Transportation

- 5.4.4.1 Passenger Cars

- 5.4.4.1.1 48 V Mild Hybrid

- 5.4.4.1.2 Start-Stop Micro Hybrid

- 5.4.4.2 Commercial Vehicles

- 5.4.4.2.1 Buses

- 5.4.4.2.2 Trucks

- 5.4.4.3 Rail and Tram

- 5.4.4.4 Aviation and Aerospace

- 5.4.5 Data Centers and Telecom

- 5.4.6 Defense and Space

- 5.4.7 Others (Medical Devices, Agri-drones)

- 5.4.1 Consumer Electronics

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Europe

- 5.5.3 China

- 5.5.4 Japan

- 5.5.5 Korea and Rest of Asia-Pacific

- 5.5.6 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Maxwell Technologies Inc. (Tesla)

- 6.4.2 Skeleton Technologies SA

- 6.4.3 CAP-XX Ltd.

- 6.4.4 Eaton Corporation plc

- 6.4.5 Panasonic Holdings Corp.

- 6.4.6 LS Mtron Ltd.

- 6.4.7 Kyocera Corp.

- 6.4.8 Nippon Chemi-Con Corp.

- 6.4.9 Supreme Power Solutions Co.

- 6.4.10 Shanghai Aowei Technology Development Co.

- 6.4.11 Samwha capacitor Group

- 6.4.12 Nanoramic Laboratories (FastCAP)

- 6.4.13 Nawa Technologies SAS

- 6.4.14 Cornell Dubilier Electronics Inc.

- 6.4.15 Toyo capacitor Co.

- 6.4.16 Shenzhen Topmay Electronic Co.

- 6.4.17 Liaoning Brother Electronics Technology Co.

- 6.4.18 Chengdu ZT-Energy Tech Co.

- 6.4.19 Loxus Inc.

- 6.4.20 Nantong Jianghai capacitor Co. Ltd

- 6.4.21 Beijing HCC Energy

- 6.4.22 Jinzhou Kaimei Power Co. Ltd (KAM)

- 6.4.23 Shanghai Green Tech Co. Ltd (GTCAP)

- 6.4.24 Shenzhen Topmay Electronic Co. Ltd

- 6.4.25 SEMG (Seattle Electronics Manufacturing Group (HK) Co. Ltd)

- 6.4.26 Shanghai Pluspark Electronics Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment