|

市场调查报告书

商品编码

1851390

环保水泥:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Green Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

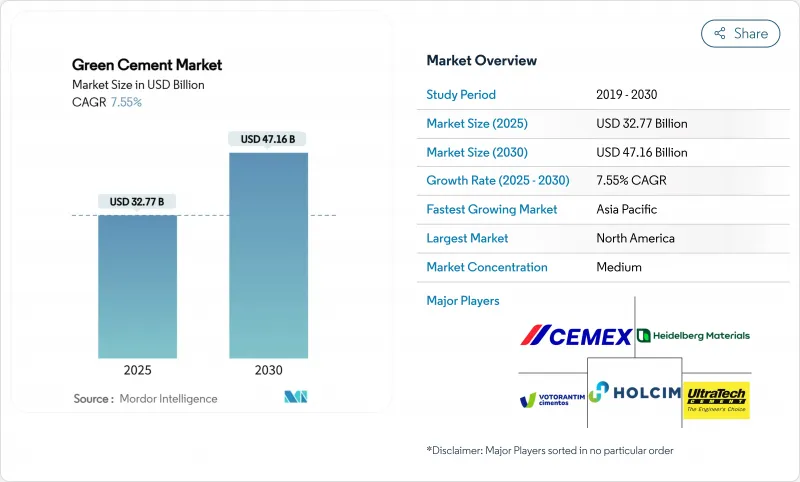

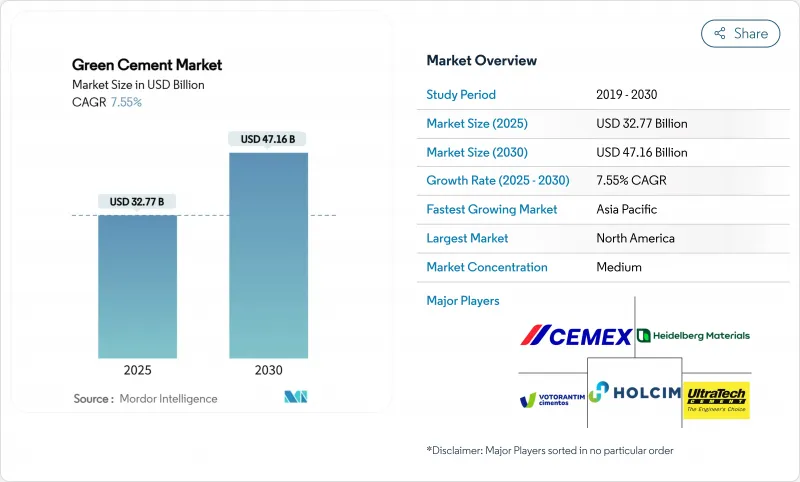

预计到 2025 年,环保水泥市场规模将达到 327.7 亿美元,到 2030 年将达到 471.6 亿美元,预测期(2025-2030 年)复合年增长率为 7.55%。

监管要求、不断上涨的碳价以及有利于低碳材料的采购规则,正推动环保水泥市场从利基市场走向公共和私人计划的主流选择。飞灰基配方占据最大的销售份额,而计划建设支出和与环境、社会及社会责任(ESG)相关的融资正在加速非住宅建筑领域对绿色水泥的采用。亚太地区将迎来最快的成长,而北美地区由于政策实施较早和供应链成熟,将继续保持其销售量主导。随着老牌水泥企业扩大其绿色水泥产品组合,以及专业生产商利用已签订的原材料合同,市场竞争将保持温和态势。

全球环保水泥市场趋势与洞察

全球脱碳指令及注重环境、社会及公司治理(ESG)的建筑规范

强制性低碳采购政策正迅速推动市场需求从普通波特兰水泥转向检验的绿色水泥。加州的目标是到2035年将水泥产业的排放减少40%,并在2045年实现净零排放,美国其他州也在做出类似的努力。欧盟修订后的建筑产品法规将从2024年起要求混凝土产品使用数位护照并揭露二氧化碳排放量,这将使拥有现有生命週期文件的生产商在竞标中占据优先地位。法国、丹麦、爱尔兰和纽约州都已推出渐进式排放上限或清洁采购规则,使合规材料成为预设选项,而非更昂贵的选择。随着各州效仿这些开创性法规,环保水泥市场正获得政策主导的成长底线,而传统生产商只能透过维修窑炉或与专业供应商合作来应对这些成长。

碳价格上涨与排放交易机制

碳成本的增加改变了水泥熟料的经济效益,将二氧化碳排放转化为直接成本。欧盟排放权交易体係正在逐步取消免费的排放配额,促使水泥生产商加快开发低碳替代方案,否则将面临利润空间压缩的风险。中国的国家碳交易平台现已涵盖水泥,加剧了全球最大水泥生产国的成本压力。随着更多地区对碳排放定价,配套的胶凝材料将获得相对竞争力,环保水泥市场相对于传统产品将享有结构性的成本优势。

建筑商和承包商对施工品质的怀疑

由于养护时间延长、寒冷气候下硬化速度减慢以及辅助材料在不同地区供应不稳定,一些建筑商抵制规范变更。标准组织正努力以基于性能的指南取代强制性的混合料配比限制,但知识缺口仍然存在,尤其是在中小企业中。示范计划和有针对性的培训对于规范的广泛应用仍然至关重要。

细分市场分析

预计到2024年,飞灰基配方将占环保水泥市场份额的44.22%,这表明在燃煤残渣丰富的地区,粉煤灰基配方是低碳替代方案。生产商利用其成熟的物流和良好的业绩记录来履行大型基础设施合约和政府竞标。然而,燃煤发电量的下降正在缩小未来的原料供应,迫使企业开采遗留的灰渣池或转向使用石灰石和煅烧粘土混合物。 LC3技术能够减少高达40%的排放,随着实验室测试检验其机械性能与普通硅酸盐水泥相当,该技术正日益受到认可。硅粉基混凝土在高规格应用领域占有一席之地,可提供适用于海洋和化学品密封结构的防渗混凝土。矿渣基替代品正面临即将到来的供应变化,但在综合钢铁厂附近仍具有应用价值。包括无机聚合物混凝土在内的新型接合材料化学技术正在透过先导计画来推进,如果规模经济效益得到改善,则可能使环保水泥市场多样化。

多角化经营可以减少对单一辅助业务的过度依赖,并使生产商免受原材料衝击的影响。伐木灰占美国飞灰回收的10%,提高了供应安全性,但也增加了加工成本。因此,水泥生产商与煤灰回收营业单位之间的战略协议在近期的交易中占据了重要地位。随着企业在技术可行性、排放目标和原料经济性之间寻求平衡,矿渣研磨伙伴关係和黏土烧製合资企业也变得同样重要。

区域分析

2024年,北美将占全球销售额的37.88%,这得益于联邦和州政府的清洁采购法规、早期碳捕获测试以及熟悉混合水泥的承包商。海德堡材料公司的米切尔碳捕获与封存(CCS)计划在30年内地质储存超过5,000万吨二氧化碳,显示其基础设施足以支持长期的产量承诺。供应情况因地区而异:中西部各州可利用其靠近煤灰盆地的优势,而沿海各州则需要进口炉渣和煅烧粘土以满足规格要求。

亚太地区到2030年将以8.22%的复合年增长率成为全球成长最快的地区,这主要得益于印度多年基础建设规划以及东南亚地区逐步收紧的监管政策。中国的整合倡议将促使各大集团升级其工厂,采用低碳轨道以应对房地产行业的逆风,从而维持营运许可。全球三分之二的高铁网路位于该地区,因此需要符合更严格排放标准的混凝土,这将有利于环保水泥市场的发展,因为计划需要补充轨道和车站的混凝土库存。

欧洲兼具强而有力的气候变迁政策和成熟的工业能力。爱尔兰2024年强制所有国家级计划使用低碳水泥,丹麦2025年设定的排放为7.1公斤二氧化碳当量/平方公尺/年,这些都树立了具有影响力的标竿。儘管建筑量有所波动,但碳定价无疑将扩大环保水泥水泥的市场规模,因为二氧化碳成本将促使竞标评估倾向于低熟料混合料。中东和非洲地区也出现了新的需求,特别是海湾国家正在规划建造氢能中心和大型公共。然而,在统一的指导方针出台之前,标准的分散和现场经验的匮乏将阻碍绿色水泥的推广应用。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球脱碳指令与以ESG为中心的建筑规范

- 碳价格上涨与排放交易机制

- 亚太地区的都市化浪潮对低碳材料的需求日益增长。

- 降低储量丰富的辅助胶凝材料原料(飞灰、矿渣)的成本

- 氢燃料窑的商业化

- 市场限制

- 建筑商和承包商对施工品质的怀疑

- 新兴市场标准的片段化

- 由于炼钢工艺转向电弧炉/直接还原铁工艺,炉渣供应量减少。

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 粉煤灰基

- 矿渣基

- 石灰石基底

- 硅灰基

- 其他产品类型

- 按建筑业

- 住宅

- 除了住房之外

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Adani Group

- Buzzi SpA

- CarbonCure Technologies Inc.

- Cemex SAB DE CV

- Cenin

- China National Building Material Group Corporation

- Ecocem

- Heidelberg Materials

- Hoffmann Green Cement Technologies

- Holcim

- JSW Cement

- Kiran Global Chem Limited.

- TAIHEIYO CEMENT CORPORATION

- UltraTech Cement Ltd.

- Votorantim Cimentos

第七章 市场机会与未来展望

The Green Cement Market size is estimated at USD 32.77 billion in 2025, and is expected to reach USD 47.16 billion by 2030, at a CAGR of 7.55% during the forecast period (2025-2030).

Regulatory mandates, rising carbon prices, and procurement rules that favor low-carbon materials move the green cement market from niche status to mainstream selection in public and private projects. Fly-ash-based formulations command the largest revenue share, while infrastructure spending and ESG-linked financing accelerate uptake across non-residential works. Asia-Pacific provides the fastest growth, whereas North America retains volume leadership because of early policy adoption and mature supply chains. Competitive intensity stays moderate as incumbent cement majors scale green portfolios and specialized producers leverage secured feedstock contracts.

Global Green Cement Market Trends and Insights

Global Decarbonization Mandates & ESG-Centric Building Codes

Mandatory low-carbon procurement policies drive immediate demand shifts from ordinary Portland cement to verified green formulations. California targets a 40% emissions cut for its cement sector by 2035 and net-zero by 2045, anchoring similar actions in other U.S. states. The EU's revised Construction Products Regulation obliges digital passports and CO2 disclosure for concrete from 2024, pushing producers already equipped with life-cycle documentation to the front of tender lists. France, Denmark, Ireland, and New York State have each introduced progressive emissions ceilings or Buy Clean rules that make compliant materials the default choice rather than a premium option. As jurisdictions replicate pioneering statutes, the green cement market gains a policy-driven growth floor that traditional producers can meet only by retrofitting kilns or partnering with specialized suppliers.

Rising Carbon Pricing & Emissions-Trading Schemes

Carbon costs alter clinker economics by turning CO2 into a direct expense. The EU Emission Trading System gradually withholds free allowances, prompting cement manufacturers to accelerate low-carbon substitutions or risk margin compression. China's national trading platform now covers cement, expanding cost pressure to the world's largest producer. As more regions price carbon, supplementary cementitious materials gain relative competitiveness, and the green cement market benefits from a structural cost advantage over legacy products.

Performance Scepticism Among Builders & Contractors

Some contractors resist specification changes, citing extended curing, cold-weather set delays, and inconsistent regional availability of supplementary materials. Standards bodies work to replace prescriptive mix limits with performance-based guidelines, yet knowledge gaps persist, especially in small and mid-size firms. Demonstration projects and targeted training remain essential for mainstream adoption.

Other drivers and restraints analyzed in the detailed report include:

- APAC Urbanization Surge Requiring Low-Carbon Materials

- Abundant SCM Feedstocks Lowering Costs

- Fragmented Standards in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fly-ash-based formulations kept a 44.22% green cement market share in 2024, underscoring their status as the default low-carbon substitute where coal-combustion residues remain abundant. Producers leverage mature logistics and well-documented performance to serve large infrastructure contracts and government tenders. However, declining coal generation narrows future feedstock pools, prompting companies to harvest legacy ash ponds or shift toward limestone-calcined clay blends. LC3 technology, able to trim emissions by up to 40%, gains visibility as laboratories validate mechanical parity with ordinary Portland cement. Silica-fume-based variants occupy high-specification niches, delivering impermeable concrete suited to marine and chemical containment structures. Slag-based alternatives struggle with impending supply shifts but retain relevance near integrated steelworks. Novel binder chemistries, including geopolymer concretes, progress through pilot projects that could diversify the green cement market if scale economics improve.

Growing diversification reduces over-reliance on any single supplementary stream and insulates producers from raw-material shocks. With harvested ash constituting 10% of recycled U.S. fly ash, supply security improves, yet processing costs rise. Strategic agreements between cement makers and utility coal-ash reclamation entities therefore feature prominently in recent deal flow. Slag-grinding partnerships and clay-calcination joint ventures become equally critical as companies balance technical feasibility, emissions objectives, and raw-material economics.

The Green Cement Market Report is Segmented by Product Type (Fly-Ash-Based, Slag-Based, Limestone-Based, Silica-Fume-Based, Other Product Types), Construction Sector (Residential, Non-Residential), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.88% of 2024 revenues, anchored by federal and state Buy Clean rules, early carbon-capture pilots, and high contractor familiarity with blended cements. Heidelberg Materials' Mitchell CCS project alone targets geological storage for more than 50 million t of CO2 over 30 years, signaling infrastructure that can underpin long-run volume commitments. Supply availability differs by region: Midwest states leverage proximity to coal-ash basins, while coastal areas import slag or calcined clay to meet specifications.

Asia-Pacific registers the fastest 8.22% CAGR to 2030, fueled by India's multi-year infrastructure pipeline and progressively stricter codes across Southeast Asia. China's consolidation efforts prompt large groups to upgrade plants with low-carbon lines to retain permits amid property-sector headwinds. Two-thirds of global high-speed rail networks reside in the region, requiring concrete that satisfies tightening emissions caps and boon the green cement market as projects replenish track and station stock.

Europe blends robust climate policy with mature industrial capabilities. Ireland's 2024 mandate for low-carbon cement in all state projects and Denmark's 2025 emissions ceiling of 7.1 kg CO2e/m2/year set influential benchmarks. Carbon pricing ensures that the green cement market size expands despite construction-volume volatility, as CO2 costs tilt bid evaluations toward low-clinker mixes. The Middle East and Africa witness emerging demand, especially in Gulf economies planning hydrogen hubs and large-scale public works, yet fragmented standards and limited on-site expertise slow penetration until harmonized guidelines mature.

- Adani Group

- Buzzi S.p.A.

- CarbonCure Technologies Inc.

- Cemex S.A.B DE C.V.

- Cenin

- China National Building Material Group Corporation

- Ecocem

- Heidelberg Materials

- Hoffmann Green Cement Technologies

- Holcim

- JSW Cement

- Kiran Global Chem Limited.

- TAIHEIYO CEMENT CORPORATION

- UltraTech Cement Ltd.

- Votorantim Cimentos

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global decarbonisation mandates and ESG-centric building codes

- 4.2.2 Rising carbon pricing and emissions-trading schemes

- 4.2.3 APAC urbanisation surge requiring low-carbon materials

- 4.2.4 Abundant SCM feedstocks (fly-ash, slag) lowering costs

- 4.2.5 Commercialisation of hydrogen-fuelled kilns

- 4.3 Market Restraints

- 4.3.1 Performance scepticism among builders and contractors

- 4.3.2 Fragmented standards in emerging markets

- 4.3.3 Shrinking slag supply as steel shifts to EAF/DRI

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Fly-Ash-Based

- 5.1.2 Slag-Based

- 5.1.3 Limestone-Based

- 5.1.4 Silica-Fume-Based

- 5.1.5 Other Product Types

- 5.2 By Construction Sector

- 5.2.1 Residential

- 5.2.2 Non-Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adani Group

- 6.4.2 Buzzi S.p.A.

- 6.4.3 CarbonCure Technologies Inc.

- 6.4.4 Cemex S.A.B DE C.V.

- 6.4.5 Cenin

- 6.4.6 China National Building Material Group Corporation

- 6.4.7 Ecocem

- 6.4.8 Heidelberg Materials

- 6.4.9 Hoffmann Green Cement Technologies

- 6.4.10 Holcim

- 6.4.11 JSW Cement

- 6.4.12 Kiran Global Chem Limited.

- 6.4.13 TAIHEIYO CEMENT CORPORATION

- 6.4.14 UltraTech Cement Ltd.

- 6.4.15 Votorantim Cimentos

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment