|

市场调查报告书

商品编码

1851394

高速摄影机:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)High Speed Cameras - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

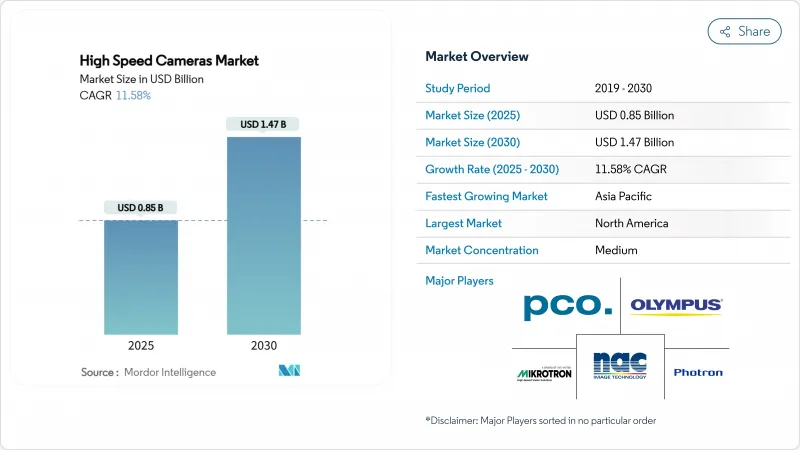

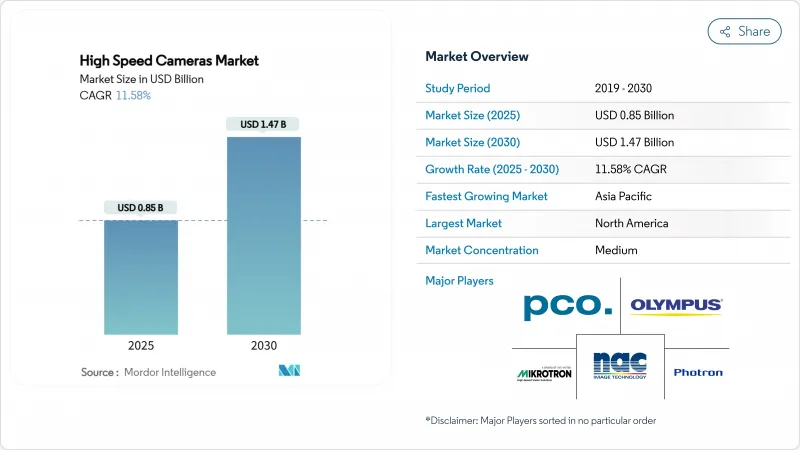

预计到 2025 年,高速摄影机市场规模将成长至 8.5 亿美元,到 2030 年将成长至 14.7 亿美元,复合年增长率为 11.58%。

推动这项技术广泛应用的关键在于超高速影像处理能够揭示以往难以测量的现象,例如碰撞测试中的微小形变以及高超音速衝击波的传播。半导体晶圆侦测、自动驾驶汽车安全检验以及8K体育赛事转播等应用都需要远高于1000帧/秒的影格速率,通常甚至超过10万帧/秒。随着边缘储存成本的下降、人工智慧主导的视觉分析技术的整合以及租赁管道的拓展,基本客群正在进一步扩大。亚太地区的晶圆厂和国防机构正在加大投资,而北美则凭藉国防研发和高端体育赛事製作保持领先地位。

全球高速摄影机市场趋势及洞察

基于人工智慧的视觉分析技术在碰撞测试实验室中迅速普及

如今,碰撞测试专案依赖机器学习演算法,以微秒级的精度分析变形、气囊气流传播以及感测器融合事件。德国和日本的测试设施需要超过 50,000 FPS的影格速率才能提供训练神经网路所需的资料密度,这加速了对即使在极高速度下也能保持低杂讯的旗舰级摄影机的需求。自动驾驶车辆检验需要以精细的时间尺度记录所有合成碰撞场景。高速影像处理和人工智慧的协同发展形成了一个良性循环:更丰富的数据可以改进模型,而模型的改进反过来又会推动更高的影格速率阈值。一级供应商已经开始在其测试车上整合高速模组,以实现直接资料登录。随着监管机构收紧被动安全标准,驾驶者对高速摄影机市场的中期影响将会增强。

短波红外线高速相机在半导体晶圆检测的广泛应用

5nm以下的先进逻辑节点需要超越可见光相机能力的缺陷侦测技术。短波红外线(SWIR)成像仪通常基于InGaAs,能够以每秒数千帧的速度穿透硅层,从而在微影术过程中实现对空洞、图案崩坏和微污染的线上检测。韩国和台湾的工厂正在将这些相机整合到多个製程中,以减少废品并提高生产线产量比率。 SWIR升级的资本效率也影响高端晶圆厂以外的采购标准,中国当地和新加坡的代工厂也正在增加类似的功能。液态金属散热器和专有镜头涂层等温度控管创新技术有助于在更高的速度下保持量子效率。这些因素将在短期内影响市场驱动因素。

CoaXPress组件的进口关税推高了物料清单成本。

针对CoaXPress专用晶片组和线缆不断上涨的贸易关税,推高了美国以乙太网路为基础正在逐步推进,但延迟和确定性问题仍然存在。整合商正在增加库存以对冲关税波动风险,这加剧了其营运资金紧张的局面。儘管这些政策可能会取消,但高速摄影机市场短期内受到的拖累显而易见。

细分市场分析

到2024年,影像感测器将占销售额的34%,在高速摄影机市场规模的讨论中占据关键地位。然而,由于10万帧/秒突发拍摄对缓衝需求的爆炸性增长,储存子系统将以13.8%的复合年增长率增长。製造商正在将堆迭式DRAM整合到更靠近感测器的位置,从而缩短走线长度并降低延迟。并行NVMe阵列能够无遗失帧地记录UHD输出,而FPGA则可执行即时压缩。散热板和减震底盘也在不断发展,以散发多余的热量并抑制暗电流。

边缘储存价格的日益亲民使得东协地区的中小型企业能够将高速影像处理引入以往只能依靠人工质检的生产线。电源模组也紧接着,锂硫电池组的出现延长了井下探针的无线运作时间。同时,镜头製造商正在改进用于短波红外线(SWIR)传输的低色散光学元件,以满足半导体检测需求的激增。总而言之,正是组件创新使企业在高速相机市场中脱颖而出。

2-5MP 级感测器占据了 42% 的市场份额,其兼具足够的空间细节和可持续的数据速率,因此在当前高速相机市场中占据最大份额。然而,随着像素架构量子效率和读出速度的提升,5MP 以上的感测器正以 14.8% 的复合年增长率快速增长。 12MP 以上的相机目前已可用于半导体晶圆成像,使 AI 缺陷分类器能够在不停机的情况下侦测亚微米级缺陷。

新兴的全域百叶窗CMOS技术支援透过CoaXPress-12连结以71帧/秒的速度拍摄6500万像素的影片。体育分析也从中受益:8K慢动作影片能够展现以往难以察觉的动态细节。随着主机PC采用PCIe 5.0,像素上限将会提高,进而推动高速摄影机市场向上发展。

高速摄影机市场报告按组件(影像感测器、处理器、底盘及其他)、分辨率(低于2MP、2-5MP及其他)、影格速率(250-1K、1-5K、5-20K及其他)、频谱(可见光、红外线、X射线及其他)、应用(全新、租赁、二手)、市场预测以美元计价。

区域分析

北美地区预计到2024年将维持33%的收入份额,主要得益于高超音速研发、8K体育赛事转播管道以及完善的租赁生态系统。美国国防实验室正在运作超过10万帧/秒的摄影机研究等离子体激元引起的衝击波,而加拿大航太设施则在评估结冰对复合材料机翼的影响。墨西哥的汽车产业走廊提供了稳定的撞击测试需求。区域供应商透过双重采购CoaXPress板材来规避关税风险,从而维持供应链的韧性。

亚太地区复合年增长率最高,达13%。韩国和台湾的晶圆厂正全力投入5奈米以下製程的竞赛,在微影术工艺流程中部署短波红外线高速阵列。中国正将国防预算转向超高速光学技术,以减少对进口感测器的依赖。日本正在将机器人和成像技术整合到需要毫秒级回馈的组装中,而印度则透过其产品生命週期资讯(PLI)计划来提升国内电子产品检测能力。

儘管资料网路发展缓慢,欧洲仍保持稳定成长。德国的原始设备製造商(OEM)凭藉着结合机器视觉和数数位双胞胎的AI增强型防撞机车,引领着产业发展。英国正在推进航太涡轮扇发动机的研究,而法国则将高速影像处理应用于铁路受电弓监控。在中东,坚固耐用的电池供电摄影机在150摄氏度的高温下潜入油井,用于诊断堵塞物,证明了即使在恶劣环境下高速成像的可行性。非洲和南美洲仍在发展中,但矿井爆炸分析和大学研究计画正在兴起,这预示着高速摄影机的应用正在日益广泛。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在汽车碰撞测试实验室(德国、日本),基于人工智慧、需要超高影格速率影像处理的视觉分析技术正日益普及。

- SWIR高速相机在半导体晶圆检测的广泛应用(韩国、台湾)

- 美国和中国国防预算优先考虑高超音速武器试验,推动了对10万帧/秒武器的需求。

- 8K体育赛事转播加速租赁市场扩张(北美和欧盟)

- 用于井下诊断的耐用型电池供电摄影机(中东)

- 中小企业(东协)采用板载边缘储存驱动器的价格下降

- 市场限制

- CoaXPress组件的进口关税推高了物料清单成本(美国)

- 超过 50k FPS 时,热噪音和散热需求限制了可携式设备的性能。

- 训练有素的高速影像技术人员短缺(新兴市场)

- 欧洲传统工厂网路导致资料流瓶颈(超过 10Gbps)

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 影像感测器

- 处理器和控制器

- 镜片

- 记忆体系统(板载和外置)

- 车身和底盘

- 冷却系统

- 电池和电源模组

- 其他(线缆、配件、软体)

- 通过决议

- 小于200万像素

- 2-5 MP

- 5 MP-12 MP

- 1200万像素或以上

- 按影格速率

- 250-1,000 fps

- 1,001-5,000 fps

- 5,001-20,000 fps

- 20,001-100,000 fps

- 超过 100,000 FPS

- 按频谱类型

- 可见光(RGB)

- 红外线(近红外线和中波红外线)

- 短波红外线 (SWIR)

- X射线

- 紫外线 (UV)

- 依用途类型

- 新相机

- 出租相机

- 二手/翻新相机

- 透过使用

- 汽车和运输设备碰撞测试

- 航太与国防(风洞、弹道学)

- 工业製造-电子和半导体

- 工业製造 - 通用机械

- 研究与设计—大学与研究机构

- 媒体与娱乐製作

- 体育分析与广播

- 医疗保健和医学诊断

- 家用电子电器测试

- 其他(能源、采矿)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Vision Research Inc.

- Photron Ltd.

- Olympus Corporation

- nac Image Technology Inc.

- Mikrotron GmbH

- PCO AG

- Optronis GmbH

- Weisscam GmbH

- Fastec Imaging Corp.

- AOS Technologies AG

- Del Imaging Systems LLC

- IX Cameras Inc.

- Motion Capture Technologies LLC

- Teledyne DALSA Inc.

- Sony Group Corp.

- Grass Valley USA LLC

- Chronos Imaging Inc.

- High-Speed Vision GmbH

- Ametek Inc.(Phantom Brand)

- Red Digital Cinema LLC

第七章 市场机会与未来展望

The high-speed camera market size is valued at USD 0.85 billion in 2025 and is projected to advance to USD 1.47 billion by 2030, translating to an 11.58% CAGR.

Strong uptake stems from the ability of ultra-fast imaging to unravel phenomena that once escaped measurement-ranging from crash-test micro-deformations to hypersonic shock-wave propagation. Semiconductor wafer inspection, autonomous-vehicle safety validation, and live 8K sports broadcasting each demand frame rates well above 1,000 FPS, and often beyond 100,000 FPS. Edge storage cost declines, integration of AI-driven vision analytics, and widening rental access further broaden the customer base. Regional dynamics are shifting as Asia-Pacific fabs and defense agencies scale investment, while North America preserves leadership through defense R&D and premium sports production.

Global High Speed Cameras Market Trends and Insights

Surge in AI-Based Vision Analytics for Crash-Test Labs

Crash-test programs now rely on machine-learning algorithms that dissect micro-second deformation, airbag plume propagation, and sensor fusion events. German and Japanese facilities require frame rates beyond 50,000 FPS to deliver the data density that feeds neural-network training, accelerating demand for flagship cameras able to maintain low noise at extreme speeds. Autonomous-vehicle validation compounds the need as every synthetic crash scenario must be documented in granular temporal layers. The co-evolution of high-speed imaging and AI creates a virtuous cycle: richer data improves models, which in turn push frame-rate thresholds higher. Tier-1 suppliers are already embedding high-speed modules inside sleds to ensure direct datalogging. As regulatory bodies tighten passive-safety standards, the driver's medium-term impact on the high-speed camera market strengthens.

Proliferation of SWIR High-Speed Cameras for Semiconductor Wafer Inspection

Advanced logic nodes below 5 nm demand defect detection that visible-light cameras cannot deliver. SWIR imagers, often based on InGaAs, penetrate silicon layers while operating at thousands of frames per second, allowing inline detection of voids, pattern collapse, and micro-contamination during lithography. South Korean and Taiwanese fabs have integrated these cameras across multiple process steps, reducing scrap and elevating line yield. The capital efficiency of SWIR upgrades has influenced procurement standards beyond premium fabs, with foundries in mainland China and Singapore adding similar capability. Thermal-management innovations-liquid-metal heat spreaders and proprietary lens coatings-are helping maintain quantum efficiency at high speeds. These factors underpin the driver's immediate, short-term weight on market growth.

Import Tariffs on CoaXPress Components Raising BOM Costs

Escalating trade duties on specialized CoaXPress chipsets and cables inflate system costs for U.S. assemblers. CoaXPress remains unrivaled for carrying 25 Gbps over coaxial links, so substitution is limited. Vendors absorb part of the surcharge, yet full systems still list 8-12% higher. Incremental redesign toward Ethernet-based alternatives inches forward, but latency and determinism concerns persist. Integrators queue additional stock to hedge tariff swings, straining working capital. While policy could unwind, its short-term drag on the high-speed camera market is tangible.

Other drivers and restraints analyzed in the detailed report include:

- Defense Budgets Prioritizing Hypersonic Weapon Testing

- Live 8K Sports Broadcast Accelerating Rental Uptake

- Thermal Noise & Cooling Needs Above 50 k FPS Limiting Portables

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Image sensors captured 34% of 2024 revenue, underscoring their centrality to any high-speed camera market size discussion. Yet memory subsystems are the flashpoint for future gains, climbing at a 13.8% CAGR as buffering demand explodes during 100,000 FPS bursts. Manufacturers integrate stacked DRAM closer to the sensor, shortening trace lengths and lowering latency. Parallel NVMe arrays now log UHD output without dropped frames, while FPGAs conduct on-the-fly compression. Cooling plates and vibration-damped chassis evolve to dissipate the extra thermal load, keeping dark current in check.

Edge storage affordability lets SMEs in ASEAN deploy high-speed imaging on factory lines previously limited to manual QC. Power modules follow suit; lithium-sulfur packs yield longer untethered runtime for down-hole probes. Meanwhile, lens manufacturers refine low-dispersion optics coated for SWIR transmission, complementing the surge in semiconductor inspection. Overall, component innovation sustains competitive differentiation inside the high-speed camera market.

The 2-5 MP tier held 42% share, pairing adequate spatial detail with maintainable data rates, giving it the largest slice of current high-speed camera market share. However, sensors above 5 MP are rising at a 14.8% CAGR as pixel architectures gain quantum efficiency and read-out speeds. Cameras exceeding 12 MP now film semiconductor wafers, enabling AI defect classifiers to spot sub-micron anomalies without halting the line.

Emergent global-shutter CMOS tech supports 65 MP at 71 FPS, routed over CoaXPress-12 links. Sports analytics similarly benefits: 8K slow-motion clips reveal biomechanical subtleties once invisible. As host PCs adopt PCIe 5.0, the ceiling on megapixels will climb, reinforcing upward migration within the high-speed camera market.

The High-Speed Camera Report is Segmented by Component (Image Sensors, Processors, Body and Chassis, and More), Resolution (Less Than 2 MP, 2-5 MP, and More), Frame Rate (250-1K, 1-5K, 5-20K, and More), Spectrum (Visible, Infrared, X-Ray, and More), Usage (New, Rental, Used), Application (Automotive and Transportation, Industrial, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 33% of 2024 revenue, driven by hypersonic R&D, 8K sports broadcast pipelines, and an entrenched rental ecosystem. U.S. defense laboratories run cameras beyond 100,000 FPS to study plasma-induced shock, while Canadian aerospace facilities evaluate icing impacts on composite wings. Mexico's automotive corridor brings steady crash-test demand. Regional suppliers hedge tariff risk by dual-sourcing CoaXPress boards, keeping supply chains resilient.

Asia-Pacific presents the steepest trajectory at a 13% CAGR. South Korean and Taiwanese fabs, locked in sub-5 nm competition, deploy SWIR high-speed arrays across lithography tracks. China channels defense budgets into ultra-fast optics, shrinking reliance on imported sensors. Japan fuses robotics and imaging for assembly lines requiring millisecond-level feedback, while India's PLI schemes incentivize domestic electronics inspection capacity.

Europe grows steadily despite data-network inertia. German OEMs lead AI-enhanced crash loci, combining machine vision with digital twins. The United Kingdom advances aerospace turbofan research, and France integrates high-speed imaging into rail pantograph monitoring. In the Middle East, rugged, battery-powered cameras descend oil wells at 150 °C to diagnose obstructions, proving high-speed viability in harsh zones. Africa and South America remain embryonic but show upticks in mining blast analysis and university research programs, foreshadowing broader penetration of the high-speed camera market.

- Vision Research Inc.

- Photron Ltd.

- Olympus Corporation

- nac Image Technology Inc.

- Mikrotron GmbH

- PCO AG

- Optronis GmbH

- Weisscam GmbH

- Fastec Imaging Corp.

- AOS Technologies AG

- Del Imaging Systems LLC

- IX Cameras Inc.

- Motion Capture Technologies LLC

- Teledyne DALSA Inc.

- Sony Group Corp.

- Grass Valley USA LLC

- Chronos Imaging Inc.

- High-Speed Vision GmbH

- Ametek Inc. (Phantom Brand)

- Red Digital Cinema LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in AI-based Vision Analytics Requiring Ultra-High Frame-Rate Imaging in Automotive Crash Test Labs (Germany and Japan)

- 4.2.2 Proliferation of SWIR High-speed Cameras for Semiconductor Wafer Inspection (South Korea and Taiwan)

- 4.2.3 Defense Budgets Prioritizing Hypersonic Weapon Testing Boosting 100 k FPS Demand (U.S. and China)

- 4.2.4 Live 8K Sports Broadcast Accelerating Rental Uptake (North America and EU)

- 4.2.5 Rugged Battery-Powered Cameras for Down-hole Diagnostics (Middle East)

- 4.2.6 On-board Edge Storage Price Declines Enabling SME Adoption (ASEAN)

- 4.3 Market Restraints

- 4.3.1 Import Tariffs on CoaXPress Components Raising BOM Costs (U.S.)

- 4.3.2 Thermal Noise and Cooling Needs Above 50 k FPS Limiting Portables

- 4.3.3 Shortage of Trained High-speed Imaging Technicians (Emerging Markets)

- 4.3.4 Data-Stream Bottlenecks (greater than 10 Gbps) with Legacy Factory Networks (Europe)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Image Sensors

- 5.1.2 Processors and Controllers

- 5.1.3 Lens

- 5.1.4 Memory Systems (On-board and External)

- 5.1.5 Body and Chassis

- 5.1.6 Cooling Systems

- 5.1.7 Battery and Power Modules

- 5.1.8 Others (Cables, Accessories, Software)

- 5.2 By Resolution

- 5.2.1 Less than 2 MP

- 5.2.2 2 - 5 MP

- 5.2.3 5 MP - 12 MP

- 5.2.4 Greater than 12 MP

- 5.3 By Frame Rate

- 5.3.1 250 - 1,000 FPS

- 5.3.2 1,001 - 5,000 FPS

- 5.3.3 5,001 - 20,000 FPS

- 5.3.4 20,001 - 100,000 FPS

- 5.3.5 Greater than 100,000 FPS

- 5.4 By Spectrum Type

- 5.4.1 Visible (RGB)

- 5.4.2 Infrared (NIR and MWIR)

- 5.4.3 Short-Wave Infrared (SWIR)

- 5.4.4 X-ray

- 5.4.5 Ultraviolet (UV)

- 5.5 By Usage Type

- 5.5.1 New Cameras

- 5.5.2 Rental Cameras

- 5.5.3 Used / Refurbished Cameras

- 5.6 By Application

- 5.6.1 Automotive and Transportation Crash Testing

- 5.6.2 Aerospace and Defense (Wind-Tunnel, Ballistics)

- 5.6.3 Industrial Manufacturing - Electronics and Semiconductor

- 5.6.4 Industrial Manufacturing - General Machinery

- 5.6.5 Research and Design - Universities and Labs

- 5.6.6 Media and Entertainment Production

- 5.6.7 Sports Analytics and Broadcast

- 5.6.8 Healthcare and Medical Diagnostics

- 5.6.9 Consumer Electronics Testing

- 5.6.10 Others (Energy, Mining)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 Middle East

- 5.7.4.1 Israel

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 United Arab Emirates

- 5.7.4.4 Turkey

- 5.7.4.5 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Vision Research Inc.

- 6.4.2 Photron Ltd.

- 6.4.3 Olympus Corporation

- 6.4.4 nac Image Technology Inc.

- 6.4.5 Mikrotron GmbH

- 6.4.6 PCO AG

- 6.4.7 Optronis GmbH

- 6.4.8 Weisscam GmbH

- 6.4.9 Fastec Imaging Corp.

- 6.4.10 AOS Technologies AG

- 6.4.11 Del Imaging Systems LLC

- 6.4.12 IX Cameras Inc.

- 6.4.13 Motion Capture Technologies LLC

- 6.4.14 Teledyne DALSA Inc.

- 6.4.15 Sony Group Corp.

- 6.4.16 Grass Valley USA LLC

- 6.4.17 Chronos Imaging Inc.

- 6.4.18 High-Speed Vision GmbH

- 6.4.19 Ametek Inc. (Phantom Brand)

- 6.4.20 Red Digital Cinema LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment