|

市场调查报告书

商品编码

1851400

振动监测:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Vibration Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

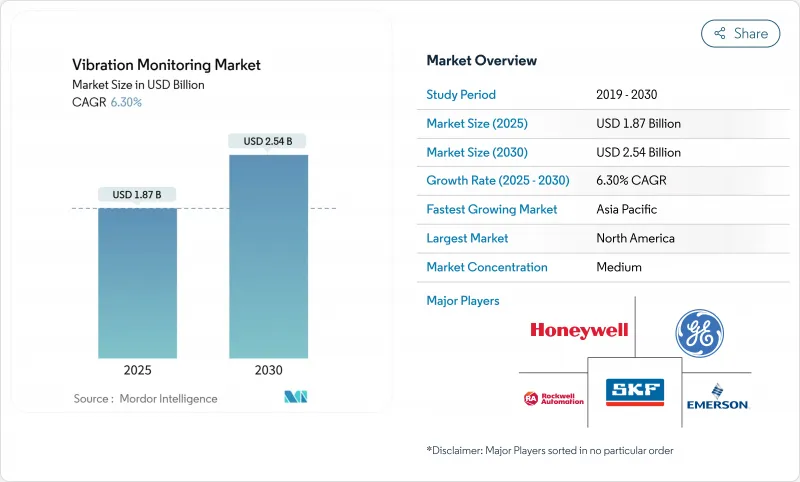

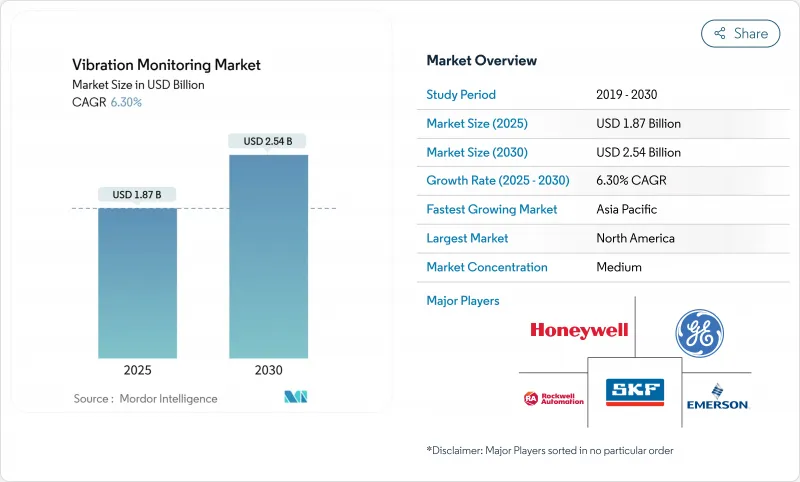

预计到 2025 年,振动监测市场规模将达到 18.7 亿美元,到 2030 年将达到 25.4 亿美元,预测期内复合年增长率为 6.3%。

人们日益意识到计划外机械故障的高成本,这正促使维护策略从被动应对转向预测性维护,从而推动石油天然气、发电和离散製造等行业对基于状态的监控技术进行持续投资。无线工业物联网感测器、边缘分析和云端平台正在融合,以降低资料撷取成本,扩大对难以触及资产的覆盖范围,并提供指导性洞察以延长资产寿命。危险产业监管压力的不断增加、老旧燃煤发电厂的退役延期以及亚洲政府支持的智慧製造计划,都将进一步刺激市场需求。随着自动化领域的领导者将振动分析融入更广泛的数位双胞胎生态系统,竞争日益激烈,这提高了独立感测器供应商的准入门槛,并增强了振动监测市场的长期成长前景。

全球振动监测市场趋势与洞察

危险区域无线工业物联网感测器的应用日益普及

在炼油厂、化工厂和海上钻机,无线本质安全型振动感测器正逐步取代有线解决方案,营运商希望最大限度地减少人员暴露风险和维护成本。艾默生的AMS无线振动监测器采用WirelessHART协议,电池寿命长达三至五年。这款最新设备将三轴加速器与内建的预测分析功能相结合,可实现对泵浦、压缩机和祛水器的远端监测。沙特阿美在其法迪利天然气厂部署了454个无线振动节点,充分展现了这些解决方案在大规模危险环境中的可扩展性。不断改进的通讯协定安全性和边缘处理能力持续降低整体拥有成本,推动了振动监测产品在市场的广泛应用。

从週期性在线监测过渡到连续性在线监测

电力公司正逐渐抛弃传统的路线巡检方式,转而采用永久安装的感测器,将高解析度资料传输到由旋转设备专家组成的远端中心。 GE Vernova 的远端监控与诊断服务将数千个蒸气涡轮和燃气涡轮机资料点连接到云端分析平台,可在故障发生前一到两个月检测到异常情况,从而实现最佳停机计划。复合迴圈电厂将从中受益最大,因为突发的负载波动会产生振动模式,而传统的季度巡检往往无法检测到这些模式。随着原始设备製造商将效能保固与持续监控合规性捆绑在一起,振动监控市场对运作系统的需求可能会持续成长。

ISO 18436-2认证振动分析师短缺

现代系统会产生庞大而复杂的资料集,需要专家解读才能确认机械故障。培训分析人员达到 ISO 18436-2 等级需要两到三年时间,而人才供应无法满足工业需求,尤其是在快速成长的经济体。虽然许多公司已透过外包诊断或部署自动化分析来应对这项挑战,但复杂的涡轮机械故障通常需要人工判断,这限制了某些振动监测市场的扩张。

细分市场分析

到2024年,硬体将占振动监测市场收入的62%,其中加速计、速度感测器和接近探头在每个设施中都扮演着核心角色。加速计凭藉其宽广的频率范围和易于安装在泵浦、马达和齿轮箱上的优势占据主导地位。随着MEMS和光学感测器应用范围的扩大和节点成本的降低,硬体的市场份额预计将会放缓。另一方面,到2030年,随着用户转向包含数据分析、诊断和维护建议的基于结果的合同,服务将以7.8%的复合年增长率实现最高增长。软体也将同步发展,从本地频谱检视器转向应用机器学习数位双胞胎关联的云端平台,从而使供应商能够获得持续收入。 TDK的Tronics AXO 315(数位力平衡MEMS加速计)展示了韧体丰富的感测器如何模糊硬体和软体服务之间的界限。

对预测性洞察的日益重视,正将服务提供者定位为策略伙伴而非交易型供应商。按监控资产或避免停机时间收费的託管服务协议,协调了奖励,并提升了对分析订阅的需求。大型自动化公司利用其全球服务网路来获取这一价值,而专注于复杂故障模式的诊断公司则专注于此。日益严重的劳动力短缺有利于自动化诊断,并强化了振动监测市场以服务主导的成长模式。

到2024年,线上连续监测将占总收入的55%,只要涡轮机、压缩机和挤出机等关键设备需要全天候监测,这一比例就会保持在高位。连续资料流能够及早识别路径测量无法捕捉到的频谱特征趋势和瞬态事件。虽然可携式系统目前仍主要用于一些不太重要的设备,但无线感测成本的降低正促使预算转向将振动和温度通道整合到单一设备中的永久安装节点。

无线远端监测预计将以9.2%的复合年增长率成长。目前,电池供电节点的使用寿命超过三年,而工业级网状通讯协定可提供适用于保护逻辑的确定性延迟。艾默生报告称,每个站点部署了数千个无线振动监测点,证明即使在大型建筑群中,无线监测也能实现可行的规模化应用。边缘驻留分析透过仅传输预过滤指标,进一步降低了频宽需求。这些优势使得振动监测市场越来越倾向于在待开发区和改装计划中采用无线架构。

区域分析

北美地区引领市场,预计2024年将占全球收入的37%,这主要得益于海上油气监管法规强制要求进行线上状态监测,以及美国电力产业的大规模维修。公用事业公共产业延长燃煤机组和复合迴圈电厂的使用寿命将持续推动对感测器的需求,而加拿大油砂作业则需要能够承受极寒和粉尘环境的坚固耐用的设备。政府对职场安全的重视也推动了投资,巩固了该地区在振动监测市场的主导地位。

欧洲凭藉其製造业基础和能源效率法规,保持着较大的市场份额。德国正大力推进工业4.0,将振动数据与製造执行系统(MES)和企业资源计划(ERP)系统集成,以实现对资产的全面了解。英国北海油气业者正大力投资无线网状感测技术,以降低危险区域的布线成本。同时,欧盟严格的机械指令将状态监控纳入风险评估架构。这些因素共同构成了持续的、合规主导的需求,这将支撑整个欧洲大陆的振动监测市场。

亚太地区将以8.6%的复合年增长率成为成长最快的地区,中国、日本和印度的智慧製造奖励将推动感测器应用。半导体产业强调MEMS本地化生产的策略将进一步降低装置成本。东南亚各国政府推动中小企业快速工业化数位化的措施将扩大潜在市场。无线通讯协定和云端分析技术在新工厂中迅速普及,摆脱了旧有系统的束缚,使该地区成为振动监测市场的重要成长引擎。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在全球范围内,无线工业物联网感测器在危险区域的应用日益广泛。

- 发电涡轮机监测方式从週期性监测转向连续性线上监测(北美和欧洲)

- 中东地区石油和天然气业者将强制要求根据资产关键性进行预测性维护。

- 政府资助的智慧製造计画提振了对MEMS加速计的需求(亚洲)

- 利用振动监测技术对老旧燃煤发电厂维修,以延长其使用寿命(南美洲)

- 市场限制

- 获得 ISO 18436-2 认证的振动分析师非常少见。

- 云端连线监控网关的网路安全加固成本

- 一般认为低运转时间批量食品加工生产线的投资报酬率较低

- 无线标准碎片化造成互通性挑战

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 加速计

- 速度感测器

- 位移/接近探头

- 其他硬体(MEMS、压电、光学)

- 软体

- 服务

- 硬体

- 透过监控过程

- 线上/持续

- 可携式/基于Root的

- 无线远端(边缘和云端)

- 透过部署模式

- 本地部署

- 云/SaaS

- 透过网路技术

- 有线(4-20 mA、Modbus、乙太网路)

- 无线(BLE、ISA100、6LoWPAN)

- 透过使用

- 马达和水泵

- 涡轮机和压缩机

- 变速箱和轴承

- 风扇和鼓风机

- 按最终用户行业划分

- 石油和天然气

- 能源与电力

- 汽车与运输

- 化工/石油化工

- 采矿和金属

- 饮食

- 航太/国防

- 纸浆和造纸

- 海洋

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SKF

- Emerson Electric Co.

- General Electric(Baker Hughes)

- Honeywell International Inc.

- Rockwell Automation Inc.

- National Instruments Corp.

- Analog Devices Inc.

- Siemens AG

- ABB Ltd.

- Fluke Corporation

- Bruel and Kjar Vibro

- Meggitt PLC

- SPM Instrument AB

- Schaeffler AG

- STMicroelectronics

- PCB Piezotronics Inc.

- Banner Engineering Corp.

- Parker Hannifin(Kinetics)

- Azima DLI Corporation

- Baker Hughes Condition Monitoring

第七章 市场机会与未来展望

The vibration monitoring market is valued at USD 1.87 billion in 2025 and is projected to reach USD 2.54 billion by 2030, advancing at a 6.3% CAGR through the forecast period.

Increasing recognition of the high cost of unplanned machinery failures is shifting maintenance strategies from reactive to predictive approaches, driving steady investment in condition-based monitoring across oil and gas, power generation, and discrete manufacturing. Wireless IIoT sensors, edge analytics, and cloud platforms are converging to reduce data-collection costs, extend coverage to hard-to-reach assets, and enable prescriptive insights that lengthen asset life. Heightened regulatory pressure in hazardous industries, the retirement deferment of aging coal-fired plants, and government-backed smart-manufacturing schemes in Asia further accelerate demand. Competitive intensity is rising as established automation majors fold vibration analytics into broader digital-twin ecosystems, raising entry barriers for stand-alone sensor suppliers and strengthening the long-term growth outlook for the vibration monitoring market.

Global Vibration Monitoring Market Trends and Insights

Rising Adoption of Wireless IIoT-Enabled Sensors in Hazardous Zones

Wireless, intrinsically safe vibration sensors are replacing cabled solutions in refineries, chemical plants, and offshore rigs as operators seek to minimize human exposure and maintenance overheads. Emerson's AMS Wireless Vibration Monitor, which operates on WirelessHART and provides a three-to-five-year battery life, illustrates how modern devices now combine triaxial accelerometry with embedded prescriptive analytics, enabling remote coverage of pumps, compressors, and steam traps. Aramco's roll-out of 454 wireless vibration nodes at the Fadhili Gas Plant shows the scalability of these solutions in large-scale hazardous. Improved protocol security and edge processing continue to lower total cost of ownership, underpinning broader acceptance across the vibration monitoring market.

Shift from Periodic to Online Continuous Monitoring in Power-Generation Turbines

Power utilities are abandoning route-based checks in favor of permanent sensors that stream high-resolution data to remote centers staffed by rotating-equipment specialists. GE Vernova's Remote Monitoring & Diagnostics service connects thousands of steam- and gas-turbine data points to cloud analytics that spot anomalies one to two months before failure, allowing optimized shutdown scheduling. Combined-cycle plants benefit most, because rapid load changes introduce vibration patterns that legacy quarterly checks overlook. With original-equipment manufacturers now bundling performance guarantees to continuous-monitoring adherence, demand for always-on systems in the vibration monitoring market is set to climb steadily.

Scarcity of Vibration Analysts with ISO 18436-2 Certification

Modern systems generate large, complex data sets that still need expert interpretation to confirm machine faults. Training an analyst to ISO 18436-2 level takes two to three years, and supply lags industrial demand, especially in fast-growing economies. Many firms respond by outsourcing diagnostics or deploying automated analytics, yet intricate turbomachinery failures often require human judgement, tempering expansion in parts of the vibration monitoring market.

Other drivers and restraints analyzed in the detailed report include:

- Asset-Criticality-Based Predictive-Maintenance Mandates by Offshore Oil & Gas Operators

- Government-Funded Smart-Manufacturing Programs Boosting MEMS Accelerometer Demand

- Cyber-Hardening Costs for Cloud-Connected Monitoring Gateways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware led the vibration monitoring market with 62% revenue in 2024, underscoring the central role of accelerometers, velocity pickups, and proximity probes in every installation. Accelerometers dominate because they span wide frequency ranges and mount easily on pumps, motors, and gearboxes, while displacement transducers remain mandatory on high-speed turbines. The hardware share is expected to moderate as MEMS and optical sensors widen application scope and reduce node cost. Services, however, post the strongest 7.8% CAGR through 2030 as users shift toward outcome-based contracts that bundle data analytics, diagnostics, and maintenance recommendations. Software evolves in parallel, migrating from on-premise spectrum viewers to cloud platforms that apply machine learning and digital-twin correlation, enabling vendors to lock in recurring revenue. TDK's Tronics AXO 315, a digital, force-rebalance MEMS accelerometer, exemplifies how firmware-rich sensors blur the line between hardware and software services.

The growing emphasis on predictive insights positions service providers as strategic partners rather than transactional suppliers. Managed-service contracts that charge per monitored asset or per avoided downtime align incentives and amplify demand for analytics subscriptions. Large automation houses leverage global service networks to capture this value, while niche diagnostic firms specialize in complex failure modes. As labor shortages tighten, automated diagnostics gain favor, reinforcing service-led growth across the vibration monitoring market.

Online continuous monitoring captured 55% of 2024 revenue, a position it will hold as long as critical equipment such as turbines, compressors, and extruders require around-the-clock oversight. Continuous data streams allow trending of spectral signatures and early identification of transient events that route-based measurements miss. Portable systems still serve lower-criticality assets, yet cost reductions in wireless sensing are tilting budgets toward permanent nodes that combine vibration and temperature channels on a single device.

Wireless remote monitoring is forecast to rise at a 9.2% CAGR. Battery-powered nodes now sustain three-plus years of life, and industrial-grade mesh protocols provide deterministic latency suitable for protection logic. Emerson reports deployments of thousands of wireless vibration points per site, proving viable scale for large complexes. Edge-resident analytics further lower bandwidth needs by transmitting only pre-filtered indicators. As these advantages compound, the vibration monitoring market increasingly favors wireless architectures for both greenfield and retrofit projects.

The Vibration Monitoring Market Report is Segmented by Component (Hardware, Software, Services), Monitoring Process (Online/Continuous, Portable, Wireless Remote), Deployment Mode (On-Premises, Cloud), Network Technology (Wired, Wireless), Application (Motors and Pumps, Turbines, and More), End-User Industry (Oil and Gas, Energy, Automotive, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 37% of 2024 revenue, propelled by offshore oil and gas regulations that mandate online condition monitoring, plus large-scale retrofits in the United States power sector. Utilities extending the life of coal-fired units and combined-cycle plants underpin continual sensor demand, while Canada's oil sands operations require robust devices that withstand extreme cold and dust. Government emphasis on workplace safety also promotes investment, cementing the region's dominance in the vibration monitoring market.

Europe maintains a sizeable share on the strength of its manufacturing base and energy-efficiency legislation. Germany champions Industry 4.0 roll-outs that couple vibration data with MES and ERP systems for holistic asset views. The United Kingdom's North Sea operators invest heavily in wireless mesh sensing to overcome hazardous-area cabling costs, while the EU's stringent machinery directives embed condition monitoring within risk-assessment frameworks. These factors create stable, compliance-driven demand that supports the vibration monitoring market across the continent.

Asia-Pacific posts the fastest 8.6% CAGR, buoyed by Chinese, Japanese, and Indian smart-manufacturing incentives that subsidize sensor adoption. Semiconductor strategies emphasizing local MEMS production further reduce device cost. Rapid industrialization across Southeast Asia and government efforts to digitalize SMEs expand the addressable base. Adoption of wireless protocols and cloud analytics is swift in new plants unencumbered by legacy systems, positioning the region as a key growth engine for the vibration monitoring market.

- SKF

- Emerson Electric Co.

- General Electric (Baker Hughes)

- Honeywell International Inc.

- Rockwell Automation Inc.

- National Instruments Corp.

- Analog Devices Inc.

- Siemens AG

- ABB Ltd.

- Fluke Corporation

- Bruel and Kjar Vibro

- Meggitt PLC

- SPM Instrument AB

- Schaeffler AG

- STMicroelectronics

- PCB Piezotronics Inc.

- Banner Engineering Corp.

- Parker Hannifin (Kinetics)

- Azima DLI Corporation

- Baker Hughes Condition Monitoring

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Wireless IIoT-Enabled Sensors in Hazardous Zones (Global)

- 4.2.2 Shift from Periodic to Online Continuous Monitoring in Power Generation Turbines (North America and Europe)

- 4.2.3 Asset-criticality-based Predictive Maintenance Mandates by Offshore Oil and Gas Operators (Middle East)

- 4.2.4 Government-funded Smart Manufacturing Programs Boosting MEMS Accelerometer Demand (Asia)

- 4.2.5 Aging Coal-Fired Plants Retrofitting Vibration Monitoring for Life-Extension (South America)

- 4.3 Market Restraints

- 4.3.1 Scarcity of Vibration Analysts with ISO 18436-2 Certification

- 4.3.2 Cyber-hardening Costs for Cloud-connected Monitoring Gateways

- 4.3.3 Low ROI Perception in Low-runtime Batch Food Processing Lines

- 4.3.4 Fragmented Wireless Standards Causing Interoperability Issues

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Accelerometers

- 5.1.1.2 Velocity Sensors

- 5.1.1.3 Displacement/Proximity Probes

- 5.1.1.4 Other Hardware (MEMS, Piezo, Optical)

- 5.1.2 Software

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By Monitoring Process

- 5.2.1 Online/Continuous

- 5.2.2 Portable/Route-based

- 5.2.3 Wireless Remote (Edge and Cloud)

- 5.3 By Deployment Mode

- 5.3.1 On-premises

- 5.3.2 Cloud / SaaS

- 5.4 By Network Technology

- 5.4.1 Wired (4-20 mA, Modbus, Ethernet)

- 5.4.2 Wireless (BLE, ISA100, 6LoWPAN)

- 5.5 By Application

- 5.5.1 Motors and Pumps

- 5.5.2 Turbines and Compressors

- 5.5.3 Gearboxes and Bearings

- 5.5.4 Fans and Blowers

- 5.6 By End-user Industry

- 5.6.1 Oil and Gas

- 5.6.2 Energy and Power

- 5.6.3 Automotive and Transportation

- 5.6.4 Chemicals and Petrochemicals

- 5.6.5 Mining and Metals

- 5.6.6 Food and Beverage

- 5.6.7 Aerospace and Defense

- 5.6.8 Pulp and Paper

- 5.6.9 Marine

- 5.6.10 Other Industries

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 Middle East

- 5.7.4.1 Israel

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 United Arab Emirates

- 5.7.4.4 Turkey

- 5.7.4.5 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SKF

- 6.4.2 Emerson Electric Co.

- 6.4.3 General Electric (Baker Hughes)

- 6.4.4 Honeywell International Inc.

- 6.4.5 Rockwell Automation Inc.

- 6.4.6 National Instruments Corp.

- 6.4.7 Analog Devices Inc.

- 6.4.8 Siemens AG

- 6.4.9 ABB Ltd.

- 6.4.10 Fluke Corporation

- 6.4.11 Bruel and Kjar Vibro

- 6.4.12 Meggitt PLC

- 6.4.13 SPM Instrument AB

- 6.4.14 Schaeffler AG

- 6.4.15 STMicroelectronics

- 6.4.16 PCB Piezotronics Inc.

- 6.4.17 Banner Engineering Corp.

- 6.4.18 Parker Hannifin (Kinetics)

- 6.4.19 Azima DLI Corporation

- 6.4.20 Baker Hughes Condition Monitoring

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment