|

市场调查报告书

商品编码

1851402

云端储存:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Cloud Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

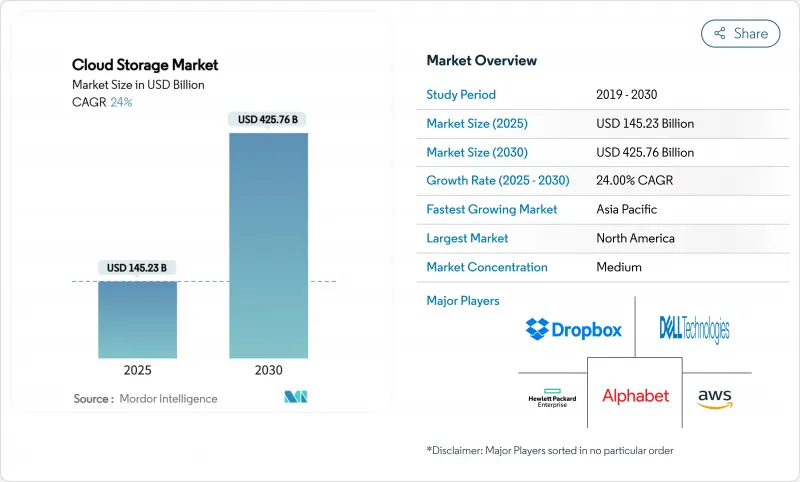

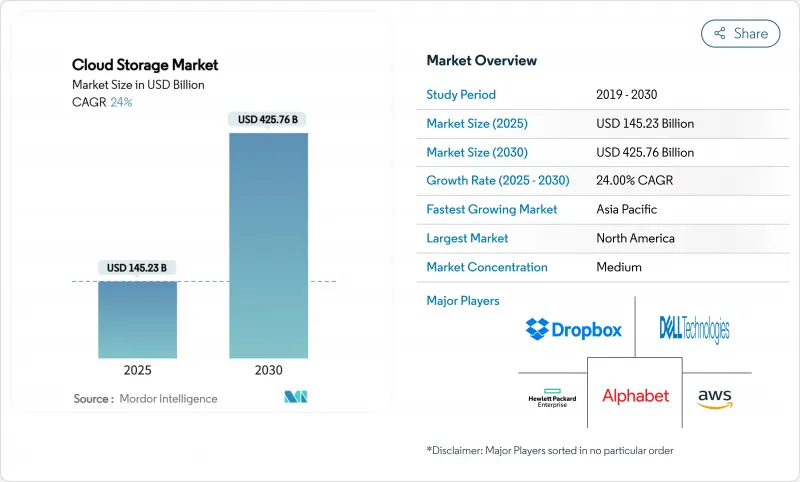

预计到 2025 年,云端储存市场规模将达到 1,452.3 亿美元,到 2030 年将达到 4,257.6 亿美元,复合年增长率为 24.0%。

生成式人工智慧的普及、资料主权要求以及对现代化、节能基础设施的需求,正在加速企业迁移,并重塑全球储存架构。超大规模资料中心投资的活性化、亚太地区主权云端支出的增加以及中小企业的稳定采用,正在扩大全球潜在用户群,而与通膨挂钩的建设成本则推动了低功耗技术的创新。物件储存主导人工智慧工作负载,混合部署成长最快,亚太地区引领着区域扩张。寻求人工智慧优化容量、主权云端区域和碳感知服务的供应商之间的竞争仍然激烈。

全球云端储存市场趋势与洞察

知识工作者应用中由生成式人工智慧主导的资料爆炸(2025 年及以后)

生成式人工智慧工作负载正推动企业资料量呈现数量级成长。由于机械硬碟难以满足延迟目标,人工智慧训练环境对固态硬碟的需求正以每年 35% 的速度成长。单次训练运行的储存占用量将从 2025 年的 30TB 成长到 2030 年的 100TB,而随着新产品整合人工智慧功能,推理节点的成长速度将更快。成本模型显示,资料处理成本超过了模型开发成本,迫使供应商优化分层和压缩策略。超大规模资料中心正在重新设计其储存层,采用高吞吐量的非挥发性记忆体丛集和针对并行存取最佳化的物件储存桶。

加速媒体和游戏产业的边缘到云端工作流程

媒体和游戏工作室正在采用云端优先的流程。随着串流媒体和即时渲染的扩展,97% 的工作室计划在 2025 年增加储存预算。云端游戏以 44% 的复合年增长率成长,需要分散式快取来维持跨区域的延迟低于 50 毫秒。然而,这些公司将 51% 的储存预算用于 API 呼叫和外部流量,这促使他们采用多重云端部署以避免额外费用。预计到 2024 年,边缘运算投资将达到 2,320 亿美元,服务供应商正在整合本地网关和超大规模归檔,以实现无缝的资产流。

数据主权问题持续复杂化

从美国的《云端法案》到中国的跨境资料流动规则,各种不同的法规迫使企业采用分散的储存布局,并复製资料集以符合当地法律法规。法律的不确定性增加了遵循成本,并减缓了企业在全球扩张的步伐,因为企业需要应对重迭的司法管辖权主张。

细分市场分析

2024年,公共云端将以59.0%的营收成长引领该领域,但随着资料居住法规的日益严格,混合架构到2030年将以26.01%的复合年增长率成长。企业正在将本地节点与公有云的可扩展性相结合,以满足延迟和合规性目标。政府主权框架进一步推动了混合云的需求,而边缘投资则将微区域纳入整合的资源池。目前,混合环境管理着82%的企业工作负载,显示企业正从完全依赖公有云的策略转向混合云。

第二个成长动力来自人工智慧训练集群,这类集群需要本地GPU相邻以实现高吞吐量,但可以透过云端爆发来应对峰值需求。企业采用控制平面软体来编配跨站点的策略,从而降低厂商锁定风险并优化成本。供应商透过整合可观测性、自动化资料分层和市场生态系统来脱颖而出。随着预算重新分配的持续进行,云端储存市场可能会出现部署模式的整合,最终形成一个涵盖核心区、边缘区和主权区的灵活、策略主导的架构。

随着非结构化资料的爆炸性成长,物件储存库的营收将在2024年成长51.2%,并在2030年之前维持在25.0%的成长率。物件平台云端储存市场规模受益于其固有的可扩展性、丰富的元资料以及纠删码的经济性,这些优势与生成式人工智慧语料库的需求相契合。文件层和区块层将继续用于传统工作负载和联机事务处理(OLTP)工作负载,并将部分份额让给物件层,后者经过强化,可支援Petabyte级并行存取。

创新主要围绕着多租户命名空间隔离、内联加密以及无需预处理即可直接向训练节点提供资料的GPU直连流水线。美光部署32TB NVMe SSD,凸显了该公司向基于快闪记忆体的物件丛集转型的决心。专利申请揭示了纠删码快取和分散式杂凑索引的进步,从而提升了效能和持久性。随着人工智慧应用的不断扩展,物件储存很可能成为云端储存市场中内容、模型查核点和向量资料库的基础。

云端储存市场报告按部署模式(私有云端、公共云端、其他)、储存类型(文件储存、物件储存、其他)、公司规模(中小企业、大型企业)、应用程式(备份和復原、应用管理、其他)、最终用户垂直行业(银行、金融服务和保险、製造业、零售业、电子商务、其他)和地区进行细分。

区域分析

受超大规模资料中心总部需求和人工智慧早期应用的推动,北美地区将占2024年总营收的38.0%。资料中心电力需求预计到2028年将以每年16%的速度成长,但输电瓶颈和授权延误正在影响成长速度。拟议的法规,例如云端客户身份验证(KYC),可能会扰乱跨境工作流程,并促使企业转向多区域架构。硬体短缺会不时限制产能,但持续的投资将使其在创新和支出方面保持领先地位。

亚太地区是成长引擎,在政府数位化计画、主权云端政策以及人工智慧应用日益普及的推动下,年复合成长率高达24.98%。预计到2025年,中国在云端领域的支出将达到460亿美元,主要得益于本土供应商和政策支援。印度的服务市场规模将在2024年上半年达到52亿美元,并争取2028年达到255亿美元。澳洲和日本正在推动区域性框架建设,同时建构居住合规区,区域资料中心容量的年复合成长率将达到13.3%。

在GDPR的推动下,欧洲正稳步发展,各行各业都在积极采用加密和资料最小化技术。巴西、墨西哥和智利正在吸引超大规模资料中心营运商的投资,而拉丁美洲的託管资料中心专案规模到2029年预计将达到100亿美元。非洲的需求正以每年25%至30%的速度成长,但在全球收入中所占比例不到1%。本地服务供应商正透过价格和货币弹性来提升自身竞争力。这些动态共同建构了一个多极化的市场,在这个市场中,区域生态系统与全球互联互通并存。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 宏观经济影响评估

- 市场驱动因素

- 提高各组织机构的云端采用率

- 对低成本、高速储存存取的需求日益增长

- 加速媒体和游戏产业的边缘到云端工作流程

- 人工智慧时代将主导知识工作者应用程式的数据爆炸性成长(2025年及以后)。

- 政府对主权云框架的奖励策略

- ESG主导的储存优化和碳感知工作负载

- 市场限制

- 数据主权问题的复杂性依然存在

- 民众对出境费的抗拒情绪日益高涨,以及供应商锁定风险。

- 多重云端资料蔓延造成安全漏洞

- 边远市场的最后一公里频宽限制

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 产业间竞争

- 投资分析

第五章 市场规模与成长预测

- 透过部署模式

- 私有云端

- 公有云

- 混合云

- 依储存类型

- 文件储存

- 物件储存

- 区块储存

- 按公司规模

- 小型企业

- 大公司

- 透过使用

- 备份和復原

- 资料管理与归檔

- 应用程式管理

- 协作与内容服务

- 按最终用户行业划分

- BFSI

- 医疗保健与生命科学

- 政府和公共机构

- 製造业

- 零售与电子商务

- 资讯科技和电讯

- 媒体与娱乐

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 土耳其

- 非洲

- 南非

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC(Alphabet)

- Alibaba Cloud(Alibaba Group)

- IBM Corporation

- Oracle Corporation

- Dell Technologies Inc.

- Hewlett Packard Enterprise

- NetApp Inc.

- Dropbox Inc.

- Box Inc.

- Wasabi Technologies

- Backblaze Inc.

- Tencent Cloud

- OVHcloud

- Rackspace Technology

- Hitachi Vantara

- Fujitsu Limited

- pCloud AG

- Tresorit AG

- Iron Mountain

第七章 市场机会与未来展望

The cloud storage market size reached USD 145.23 billion in 2025 and is forecast to reach USD 425.76 billion by 2030 at a 24.0% CAGR.

Generative-AI adoption, data-sovereignty mandates, and the need for modern, energy-efficient infrastructure are accelerating enterprise migration and reshaping storage architectures worldwide. Intensifying hyperscaler investment, rising sovereign-cloud spend across Asia Pacific, and steady SME adoption are widening the global addressable base while inflation-linked construction costs spur innovation in low-power technologies. Object storage dominates AI workloads, hybrid deployment grows fastest, and Asia Pacific leads regional expansion. Competitive rivalry remains high as providers pursue AI-optimized capacity, sovereign-cloud zones, and carbon-aware services.

Global Cloud Storage Market Trends and Insights

Gen-AI-led data explosion in knowledge-worker apps (2025+)

Generative-AI workloads are multiplying enterprise data volumes by an order of magnitude. Solid-state drive demand for AI training environments is climbing 35% per year as spinning disks struggle to meet latency targets. Storage footprints for single training runs are set to scale from 30 TB in 2025 to 100 TB by 2030, while inference nodes grow even faster as new products embed AI features. Cost models now reveal that data-handling charges eclipse model-development expenses, pushing vendors to optimize tiering and compression. Hyperscalers are redesigning storage layers to favor high-throughput NVM-based clusters and object storage buckets tuned for parallel access.

Edge-to-cloud workflow acceleration in media and gaming

Media and gaming studios are embracing cloud-first pipelines; 97% plan to raise storage budgets in 2025 as streaming and real-time rendering expand. Cloud gaming's 44% CAGR requires distributed caches that maintain <50 ms latency across regions. Yet, these firms spend 51% of storage budgets on API calls and egress traffic, catalyzing multi-cloud placement to avoid fees. Edge-compute spend is forecast at USD 232 billion in 2024, pushing providers to integrate on-premise gateways with hyperscale archives for seamless asset flows.

Persistent data-sovereignty complexity

Divergent regulations-from the U.S. CLOUD Act to China's cross-border flow rules-force organizations to operate fragmented storage footprints and duplicate datasets to meet local statutes. Legal uncertainty raises compliance spend and slows global rollouts as firms navigate overlapping jurisdictional claims.

Other drivers and restraints analyzed in the detailed report include:

- Government stimulus for sovereign cloud frameworks

- ESG-driven storage optimization and carbon-aware workloads

- Escalating egress-fee backlash and vendor lock-in risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment's revenue in 2024 reflected a 59.0% public-cloud lead, yet hybrid architectures are on track for a 26.01% CAGR to 2030 as data residency laws tighten. Enterprises blend on-premise nodes with public scalability to meet latency and compliance goals. Governments' sovereign frameworks further propel hybrid demand, while edge investments embed micro-regions into unified pools. Hybrid environments now manage 82% of enterprise workloads, validating the shift away from all-public strategies.

A second growth vector lies in AI training clusters that require local GPU adjacency for throughput yet still need cloud bursts for spikes. Organizations adopt control-plane software to orchestrate policies across sites, mitigating lock-in and optimizing cost. Vendors differentiate via integrated observability, automated data-tiering, and marketplace ecosystems. As budgets reallocate, the cloud storage market will see deployment models converge into fluid, policy-driven fabrics spanning core, edge, and sovereign zones.

Object repositories generated 51.2% revenue in 2024 and will compound at 25.0% through 2030 as unstructured data explodes. The cloud storage market size for object platforms benefits from intrinsic scalability, rich metadata, and erasure-coding economics that align with generative-AI corpus needs. File and block tiers persist for legacy and OLTP workloads but cede share to object layers hardened for petabyte-scale parallel access.

Innovation centers on multi-tenant namespace isolation, in-line encryption, and GPU-direct pipelines that feed training nodes without staging. Micron's roll-out of 32 TB NVMe SSDs underscores the migration toward flash-based object clusters. Patent filings reveal advances in erasure-coded caching and distributed-hash indexing, amplifying performance and durability. As AI adoption broadens, object storage will underpin content, model checkpoints, and vector databases within the cloud storage market.

The Cloud Storage Market Report is Segmented by Deployment Mode (Private Cloud, Public Cloud, and More), Storage Type (File Storage, Object Storage, and More), Enterprise Size (SMEs and Large Enterprises), Application (Backup and Recovery, Application Management, and More), End-User Industry (BFSI, Manufacturing, Retail and E-Commerce, and More), and Geography.

Geography Analysis

North America held 38.0% revenue in 2024 as hyperscaler headquarters and early AI adoption drove demand. Data-center power needs are on a 16% annual trajectory to 2028, though transmission bottlenecks and permitting delays pressure timelines. Regulatory proposals such as cloud know-your-customer (KYC) checks may fragment cross-border workflows, nudging enterprises toward multi-region architectures. Hardware shortages intermittently constrain capacity, but continuous investment sustains leadership in innovation and spend.

Asia Pacific is the growth engine, charting a 24.98% CAGR courtesy of government digitization programs, sovereign-cloud mandates, and rising AI adoption. China's spending will hit USD 46 billion in 2025, buoyed by local vendors and policy support. India's services market reached USD 5.2 billion in H1 2024 and targets USD 25.5 billion by 2028. Australia and Japan advance localized frameworks, while a 13.3% CAGR in regional data-center capacity underscores the build-out of residency-compliant zones.

Europe grows steadily under GDPR, with sectoral codes pushing encryption and data-minimization features. Latin America's colocation pipeline could reach USD 10 billion by 2029 as Brazil, Mexico, and Chile court hyperscaler investment. Africa's demand rises 25-30% annually, yet represents <1% global revenue; local providers differentiate on price and currency flexibility. These dynamics confirm a multipolar cloud storage market where regional ecosystems coexist with global connectivity.

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC (Alphabet)

- Alibaba Cloud (Alibaba Group)

- IBM Corporation

- Oracle Corporation

- Dell Technologies Inc.

- Hewlett Packard Enterprise

- NetApp Inc.

- Dropbox Inc.

- Box Inc.

- Wasabi Technologies

- Backblaze Inc.

- Tencent Cloud

- OVHcloud

- Rackspace Technology

- Hitachi Vantara

- Fujitsu Limited

- pCloud AG

- Tresorit AG

- Iron Mountain

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Macroeconomic Impact Assessment

- 4.3 Market Drivers

- 4.3.1 Increase in cloud adoption across organizations

- 4.3.2 Rising demand for low-cost, high-speed storage access

- 4.3.3 Edge-to-cloud workflow acceleration in media and gaming

- 4.3.4 Gen-AI-led data explosion in knowledge-worker apps (2025+)

- 4.3.5 Government stimulus for sovereign cloud frameworks

- 4.3.6 ESG-driven storage optimization and carbon-aware workloads

- 4.4 Market Restraints

- 4.4.1 Persistent data-sovereignty complexity

- 4.4.2 Escalating egress-fee backlash and vendor lock-in risk

- 4.4.3 Multi-cloud data-sprawl security gaps

- 4.4.4 Limited last-mile bandwidth in frontier markets

- 4.5 Value Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Industry Rivalry

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Mode

- 5.1.1 Private Cloud

- 5.1.2 Public Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Storage Type

- 5.2.1 File Storage

- 5.2.2 Object Storage

- 5.2.3 Block Storage

- 5.3 By Enterprise Size

- 5.3.1 SMEs

- 5.3.2 Large Enterprises

- 5.4 By Application

- 5.4.1 Backup and Recovery

- 5.4.2 Data Management and Archiving

- 5.4.3 Application Management

- 5.4.4 Collaboration and Content Services

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 Healthcare and Life Sciences

- 5.5.3 Government and Public Sector

- 5.5.4 Manufacturing

- 5.5.5 Retail and E-commerce

- 5.5.6 IT and Telecom

- 5.5.7 Media and Entertainment

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 Turkey

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC (Alphabet)

- 6.4.4 Alibaba Cloud (Alibaba Group)

- 6.4.5 IBM Corporation

- 6.4.6 Oracle Corporation

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Hewlett Packard Enterprise

- 6.4.9 NetApp Inc.

- 6.4.10 Dropbox Inc.

- 6.4.11 Box Inc.

- 6.4.12 Wasabi Technologies

- 6.4.13 Backblaze Inc.

- 6.4.14 Tencent Cloud

- 6.4.15 OVHcloud

- 6.4.16 Rackspace Technology

- 6.4.17 Hitachi Vantara

- 6.4.18 Fujitsu Limited

- 6.4.19 pCloud AG

- 6.4.20 Tresorit AG

- 6.4.21 Iron Mountain

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment