|

市场调查报告书

商品编码

1851421

北美碳纤维:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)North America Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

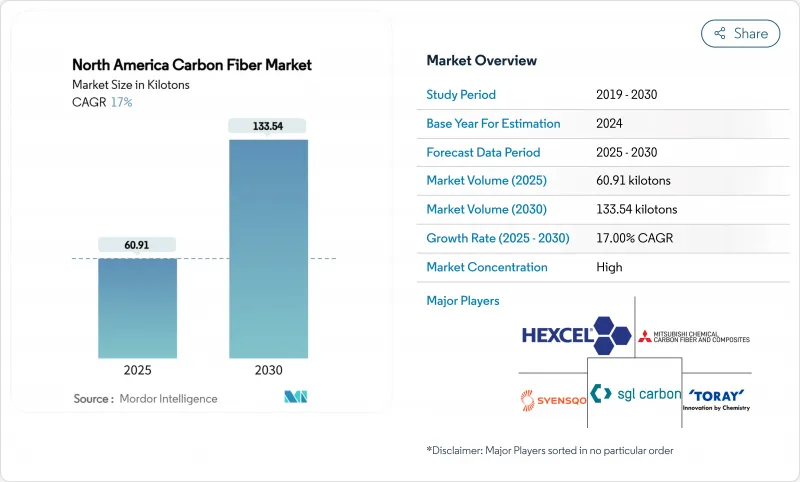

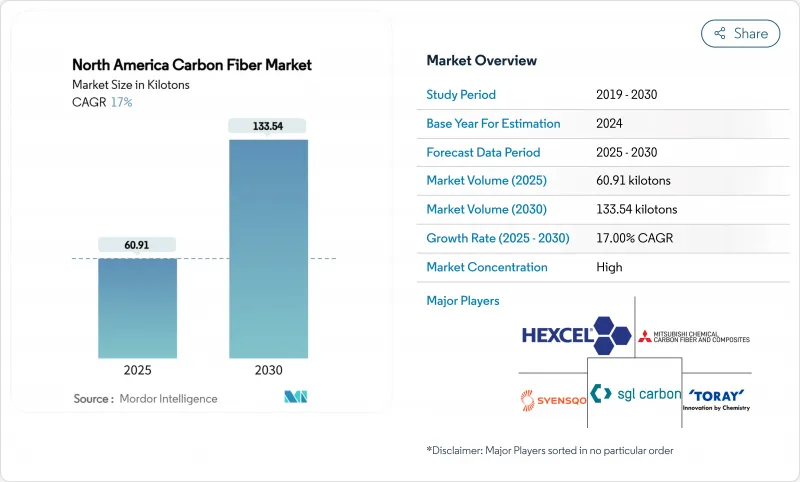

预计北美碳纤维市场规模将在 2025 年达到 60.91 千吨,在 2030 年达到 133.54 千吨,在预测期(2025-2030 年)内达到 17% 的复合年增长率。

随着航太生产的復苏、电动车製造商减轻车身重量以及可再生能源公司生产更长的风力涡轮机叶片,需求将会增加。儘管聚丙烯腈 (PAN) 仍然是原料供应的主导,但石油沥青替代品的快速成长表明价格主导的替代趋势。随着汽车製造商和风力发电机原始设备製造商 (OEM) 寻求减少生命週期排放,再生纤维正日益受到关注。在美国,Hexcel 和 Toray 已扩大产能并提高了本地供给能力,但前体采购和资本密集度仍然是风险因素。为了成功竞争,企业需要多元化的终端用途组合、灵活的生产线以及与客户的紧密合作,而不是依赖传统的航太生产规模。

北美碳纤维市场趋势与洞察

轻型车辆需求不断成长

汽车电气化使北美碳纤维市场成为新型轻量化策略的核心。正如通用汽车(GM)的初步试验所示,汽车製造商正在使用自动化纤维铺放线将结构部件整合到关键车型中。美国能源局提供的联邦研发资金正在加速用于电池组外壳的延展性碳纤维复合材料的开发。燃油经济法规和消费者对续航里程的预期,支撑着大规模生产平台的持续多年需求。

加速在航太和国防领域的应用

航太继续引领北美碳纤维市场,因为下一代飞机和高超音速防御系统需要高模量纤维。东丽公司向美国太空总署的HiCAM专案供应热固性和热塑性预浸料,以加速复合材料机翼的製造速度。柯林斯太空公司投资2亿美元,扩大其位于斯波坎的碳碳煞车片产能;通用电气太空公司承诺在美国复合材料零件生产领域累计约10亿美元,从而增强其长期需求前景。

监理主导的原物料供应风险

美国白宫和加拿大政府的关键资料审查表明,对聚丙烯腈(PAN)前驱体进口的审查力度正在加大。政策变化,例如出口管制清单和更严格的环境授权,可能会加剧北美碳纤维市场的供应紧张,并增加合规成本。

细分市场分析

到2024年,PAN将占据北美碳纤维市场91.83%的份额。该细分市场受益于其成熟的强度重量比和完善的供应链。同时,由于汽车和建筑业的买家将成本置于极限抗拉强度之上,石油沥青和人造丝预计将以18.91%的复合年增长率成长。 Advanced Carbon Products LLC公司已开发出中间相沥青碳纤维前驱体,与传统的PAN基製造方法相比,可大幅降低成本。

需求的变化有利于那些提供多元化前驱体选择的供应商。沥青的产量比率超过70%,而聚丙烯腈(PAN)的产率仅为55%,因此在相同的炉内能耗下,沥青的每公斤成本更低。对于压力容器和民用基础设施等大众市场应用而言,这些经济优势使得替代前驱体成为越来越可靠的选择。

由于航太和国防领域对可追溯性有着极高的要求,预计到2024年,原生纤维将占据北美碳纤维市场76.21%的份额。然而,再生纤维预计将以19.05%的复合年增长率成长。 Vartega公司已成功研发出机械性质与原生纤维相当,但成本仅为原生纤维一半,且二氧化碳排放降低96-99%的再生纤维。

原始设备製造商 (OEM) 对再生中间体的接受度正在提高。波音公司使用 KyronTEX 侧壁板表明,使用再生纤维可以满足严格的客舱内装要求。使用再生纤维的汽车射出成型化合物可将成品零件成本降低高达 30%,从而促进其大规模应用。

北美碳纤维市场报告按原材料(聚丙烯腈 (PAN)、石油沥青、人造丝)、类型(原生碳纤维 (VCF)、再生碳纤维 (RCF))、应用(复合材料、纤维、其他)、终端用户产业(航太与国防、替代能源、其他)和地区(美国、加拿大、其他)进行细分。市场预测以吨为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 轻型车辆需求不断成长

- 在航太和国防领域加速应用

- 在风力发电领域不断扩大应用

- 高性能运动用品的扩张

- 大型移动车辆氢气储存槽的采用情况

- 市场限制

- 高额研发和资本支出

- 监理主导的原物料供应风险

- 回收基础设施有限,品质参差不齐。

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按原料

- 聚丙烯腈(PAN)

- 石油沥青和人造丝

- 按类型

- 原生碳纤维(VCF)

- 再生碳纤维(RCF)

- 透过使用

- 复合材料

- 纺织品

- 微电极

- 催化剂

- 按最终用户行业划分

- 航太/国防

- 替代能源

- 车

- 建筑和基础设施

- 体育用品

- 其他终端用户产业(海事和航运)

- 按地区

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- A&P Technology, Inc.

- ACP Composites Inc.

- DowAksa

- Gurit Services AG

- Hexcel Corporation

- HS HYOSUNG USA

- Jiangsu Hengshen Co., Ltd.

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Present Advanced Composites Inc.

- SGL Carbon

- Syensqo

- TEIJIN LIMITED

- Toray Industries Inc.

- Vartega Inc.

第七章 市场机会与未来展望

The North America Carbon Fiber Market size is estimated at 60.91 kilotons in 2025, and is expected to reach 133.54 kilotons by 2030, at a CAGR of 17% during the forecast period (2025-2030).

Demand rises as aerospace production recovers, electric-vehicle makers cut curb weight and renewable-energy firms build longer wind blades. Polyacrylonitrile (PAN) continues to lead raw-material supply, yet fast-growing petroleum-pitch alternatives signal price-driven substitution. Recycled fibers gain traction because automakers and wind-turbine OEMs seek lower life-cycle emissions. United States output expansions by Hexcel and Toray improve local availability, but precursor sourcing and capital intensity still pose risk. Competitive success now depends on diversified end-use portfolios, agile production lines and close customer integration, rather than reliance on legacy aerospace volumes.

North America Carbon Fiber Market Trends and Insights

Rising Demand from Lightweight Vehicles

Automotive electrification positions the North America carbon fiber market at the center of new lightweight strategies. Automakers use automated-fiber-placement lines to integrate structural parts in mainstream models, as shown by General Motors' pilot trials. Federal R&D funding from the U.S. Department of Energy accelerates ductile carbon-fiber composite development for battery-pack housings. Regulations on fuel economy and consumer range expectations underpin sustained multi-year demand across volume platforms.

Accelerating Usage in Aerospace and Defense

Aerospace keeps its lead within the North America carbon fiber market because next-generation aircraft and hypersonic defense systems require high-modulus fiber. Toray supplies thermoset and thermoplastic prepregs for NASA's HiCAM program to improve fast-build composite wings. Collins Aerospace invested USD 200 million to enlarge Spokane carbon-carbon brake capacity, while GE Aerospace earmarked almost USD 1 billion for U.S. composite part production, reinforcing long-cycle demand visibility.

Regulatory-Driven Supply Risk for Raw Materials

Critical-material reviews by the White House and the Canadian government signal heightened scrutiny of PAN precursor imports. Policy shifts, such as export-control lists or stricter environmental permits, could pinch supply and raise compliance costs for the North America carbon fiber market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Utilization from Wind Energy Sector

- Expansion of High-Performance Sporting Goods

- Limited Recycling Infrastructure and Quality Variance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PAN commanded 91.83% of the North America carbon fiber market in 2024. The segment benefits from proven strength-to-weight ratios and well-understood supply chains. Petroleum-pitch and rayon, in contrast, are set to grow at an 18.91% CAGR because auto and construction buyers prioritize lower cost over ultimate tensile strength. Advanced Carbon Products LLC has developed a mesophase pitch carbon fiber precursor, offering a significant cost-saving opportunity compared to the conventional PAN-based production method.

Demand shifts favor suppliers that diversify precursor choice. Higher yield rates that exceed 70% for pitch versus 55% for PAN can cut per-kilogram costs when furnace energy remains constant. For mass-market uses such as pressure vessels or civil infrastructure, these economics make alternative precursors increasingly credible options.

Virgin fiber retained 76.21% share of the North America carbon fiber market size in 2024 because aerospace and defense require full traceability. Recycled fiber, however, is projected to post a 19.05% CAGR. Vartega reached mechanical properties comparable to virgin fiber but at half the cost and 96-99% lower CO2 footprint.

OEM acceptance of recycled intermediates is rising. Boeing's use of KyronTEX sidewall panels shows that strict cabin-interior requirements can be met with reclaimed content. Automotive injection-molding compounds with recycled strands now cut finished-part cost by up to 30%, spurring volume adoption.

The North America Carbon Fiber Market Report is Segmented by Raw Material (Polyacrylonitrile (PAN), Petroleum Pitch and Rayon), Type (Virgin Carbon Fiber (VCF), Recycled Carbon Fiber (RCF)), Application (Composite Materials, Textiles, and More), End-User Industry (Aerospace and Defense, Alternative Energy, and More), and Geography (United States, Canada, and More). The Market Forecasts are Provided in Terms of Volume (tons).

List of Companies Covered in this Report:

- A&P Technology, Inc.

- ACP Composites Inc.

- DowAksa

- Gurit Services AG

- Hexcel Corporation

- HS HYOSUNG USA

- Jiangsu Hengshen Co., Ltd.

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Present Advanced Composites Inc.

- SGL Carbon

- Syensqo

- TEIJIN LIMITED

- Toray Industries Inc.

- Vartega Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from Lightweight Vehicles

- 4.2.2 Accelerating Usage in Aerospace and Defense

- 4.2.3 Growing Utilization from Wind Energy Sector

- 4.2.4 Expansion of High-Performance Sporting Goods

- 4.2.5 Adoption in Hydrogen Storage Tanks for Heavy-Duty Mobility

- 4.3 Market Restraints

- 4.3.1 High Research and Development, and Capital Expenditure

- 4.3.2 Regulatory-Driven Supply Risk for Raw Materials

- 4.3.3 Limited Recycling Infrastructure and quality variance

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Raw Material

- 5.1.1 Polyacrylonitrile (PAN)

- 5.1.2 Peroleum Pitch and Rayon

- 5.2 By Type

- 5.2.1 Virgin Carbon Fiber (VCF)

- 5.2.2 Recycled Carbon Fiber (RCF)

- 5.3 By Application

- 5.3.1 Composite Materials

- 5.3.2 Textiles

- 5.3.3 Micro-electrodes

- 5.3.4 Catalysis

- 5.4 By End-user Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Alternative Energy

- 5.4.3 Automotive

- 5.4.4 Construction and Infrastructure

- 5.4.5 Sporting Goods

- 5.4.6 Other End-user Industries (Marine and Maritime)

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 A&P Technology, Inc.

- 6.4.2 ACP Composites Inc.

- 6.4.3 DowAksa

- 6.4.4 Gurit Services AG

- 6.4.5 Hexcel Corporation

- 6.4.6 HS HYOSUNG USA

- 6.4.7 Jiangsu Hengshen Co., Ltd.

- 6.4.8 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.9 Present Advanced Composites Inc.

- 6.4.10 SGL Carbon

- 6.4.11 Syensqo

- 6.4.12 TEIJIN LIMITED

- 6.4.13 Toray Industries Inc.

- 6.4.14 Vartega Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment