|

市场调查报告书

商品编码

1851437

多因素身份验证 (MFA):市场份额分析、行业趋势、统计数据和成长预测 (2025-2030)Multifactor Authentication (MFA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

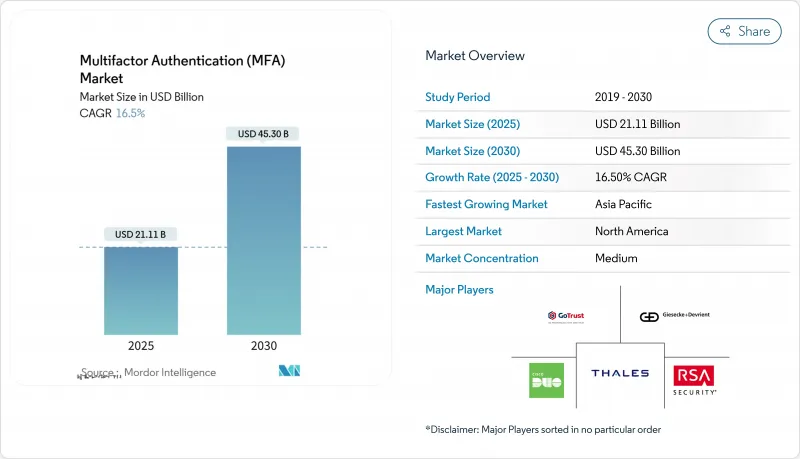

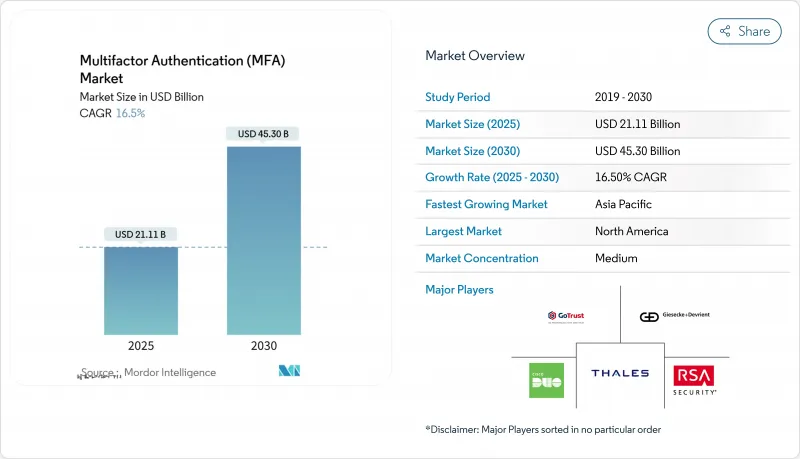

2025年全球多因子身分验证市场规模目前为211.1亿美元,预计2030年将达453亿美元。

推动这一成长趋势的因素包括:零信任理念的普及、资料保护法规的强化以及勒索软体的兴起,这些因素促使人们迫切需要投资于更强大的身份验证技术。诸如美国2025年《健康保险流通与责任法案》(HIPAA)安全规则和欧洲数位身分钱包法规等,正促使采购方向从基本的一次性密码(OTP)工具转向防钓鱼的金钥和硬体符记,这印证了多因素身分验证市场正向高信任解决方案转型。同时,安全晶片供应链的衝击以及不断上涨的A2P简讯费用,也促使买家转向基于软体或装置嵌入式的身份验证元件。北美在零信任领域的领先地位、亚太地区的行动身分识别倡议以及欧洲的钱包法规,正在形成一个全球性的飞轮效应,这将使多因素身分验证产业在2030年之前保持两位数的成长。

全球多因素身份验证 (MFA) 市场趋势与洞察

受监管产业快速转向零信任安全架构

零信任架构要求对每个会话进行持续身份验证,将多因素身份硬体符记(MFA) 从附加元件提升为核心控制措施。根据加拿大金融机构监理办公室 (OSFI) B-13 的规定,加拿大银行必须逐步淘汰简讯验证码 (SMS OTP),并在日常营运中采用硬体代币和生物辨识因素。包括 Capital One 在内的美国大型金融机构已承诺在 2025 年底前取消员工密码,并以基于装置凭证的金钥取而代之,从而降低撞库攻击的风险。供应商正积极回应,建构统一员工、人员编制和机器身分的平台架构,从而拓展多因素身分验证市场生态系统。

勒索软体即服务(RaaS)的激增正在推高保险费。

网路保险公司现在将防钓鱼的多因素身份验证 (MFA) 视为一项基本的安全措施。如果仅使用电子邮件或简讯验证码 (SMS-OTP) 进行身份验证,保险公司可能会拒绝承保或提高保费,因此投资 MFA 可以直接对冲保险成本。随着中间人攻击套件的普及,企业董事会正在将资金从边界防火墙转向身份验证,这推动了历来转型缓慢的中型企业对多因素身份验证的需求。

传统 SCADA/ICS 环境中的多因素身份验证 (MFA)互通性有限

工业网路依赖于确定性的延迟和持续的执行时间。增加一个登入步骤会带来停机风险,因此工厂营运商选择将营运技术 (OT) 与资讯技术 (IT) 分离,而不是改造现有系统以全面实施多因素身份验证 (MFA),这限制了重工业领域多因素身份验证市场的收入潜力。

细分市场分析

到2024年,软体解决方案将贡献48.3%的收入,占据多因素身份验证市场最大的份额。订阅许可、API套件和云端主机简化了混合办公模式的部署。随着企业从边界管理过渡到整合合规性彙报和自适应风险指标的身份架构,该细分市场的价值提案将进一步提升。以WebAuthn工具链和SDK为代表的无密码平台正经历着19.2%的复合年增长率,这反映出买家倾向于选择能够清除凭证资料库并从源头上抵御网路钓鱼的身份验证方式。虽然硬体对于需要隔离储存安全元件的受监管工作负载仍然至关重要,但晶片短缺正在推高代币成本,并促使预算转向软体。

对实施专业知识的需求正使託管服务成为一个极具吸引力的细分市场。服务合作伙伴透过设计使用者宣传活动、维修旧版应用程式以及监控多因素身份验证 (MFA) 控制面板,将一次性产品引入转化为持续的咨询收入。因此,大型整合商正将产品部署与更广泛的零信任计划捆绑在一起,从而提高了平均合约价值,并强化了多因素身份验证市场向以平台为中心的采购模式转变的趋势。

到2024年,双重登入仍将贡献46.4%的收入,主要得益于身分验证器应用程式和简讯验证码提供的快速风险缓解功能。然而,随着浏览器和行动作业系统厂商将FIDO2整合到原生工作流程中,防钓鱼金钥正以18.4%的复合年增长率快速成长。微软决定预设将新用户帐户设为无密码帐户,这提供了一个强而有力的参考模型。虽然在某些政府和金融领域,要求三个或更多因素的多因素身份验证框架仍然是强制性的,但更广泛的商业性目标正转向基于风险的动态增强验证强度的编配。

多因素身份验证市场按产品类型(硬体、软体、服务)、身份验证模型(双重因素、多因素、其他)、部署模式(本地部署、云端、混合部署)、企业规模(中小企业、大型企业)、存取管道(VPN、远端登入、其他)、最终用户产业(银行、金融机构、其他小型企业、大型企业)、存取管道(VPN、远端登入、其他)、最终用户产业(银行、金融机构、其他小型企业、大型企业)、存取管道(VPN、远端登入、其他)、最终用户产业(银行、金融机构、其他小型企业、大型企业)、存取管道(VPN、远端登入、其他)、最终用户产业(银行、金融机构、其他小型企业、大型企业)、存取管道(VPN、远端登入、其他)、最终用户产业(银行、金融机构、其他小型企业、大型企业)和地区进行细分。市场预测以美元计价。

区域分析

预计北美地区2024年的营收成长率将维持在37.8%,到2030年将以14.2%的复合年增长率持续成长。美国关于关键基础设施网路安全的行政命令和加拿大的OSFI B-13法规已将多因素身份验证(MFA)制度化,推动了该地区身份SaaS供应商生态系统的创新週期。因此,随着零信任采购进入维护阶段,供应商提升销售自我调整分析功能,北美多因素身份验证市场规模正在稳步扩大。

由于政府识别项目的推动,亚太地区可望实现16.5%的复合年增长率。日本的「我的号码」(My Number)智慧型手机凭证目前已为超过650家企业提供登入服务;新加坡的银行正在用FIDO令牌取代简讯验证码,从而扩大其主流应用。澳洲的数位身分框架正在向联邦政府服务部门推广使用密码卡,这促使私营部门纷纷效仿。东南亚和印度等新兴经济体正透过以行动生物辨识技术取代传统密码来拓展市场。

在欧洲,27 个国家的 2024/1183 号法规实现了钱包登录的标准化,实现了两位数的增长率;公共部门确保了供应商的规模,而私营在线服务提供商必须实现互操作,否则将面临客户流失的风险;中东和非洲的部署量随着云迁移和网络弹性竞标的增加而增加,为全球多因素身份验证市场带来了全球多因素身份验证市场的来源。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 受监管产业快速转向零信任安全架构

- 勒索软体即服务(RaaS)的激增正在推高保险费。

- 欧盟电子政府网站必须采用基于FIDO的强认证

- 推播通知钓鱼套件推动了对反钓鱼多因素身份验证 (MFA) 的需求。

- 基于人工智慧的深度造假攻击正迫使生物识别变得更加精准。

- 曼达洛人式公私威胁情报共用模式(美国与五眼联盟)

- 市场限制

- 在传统的SCADA/ICS环境中,MFA互通性受到限制。

- A2P 价格上涨导致 OTP 简讯费用上升

- 行动身份验证系统使用者体验的分散化阻碍了员工的采用。

- 硬体符记晶片短缺和安全元件供应风险

- 供应链分析

- 监理与技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 硬体

- 令牌(USB、智慧卡、智慧钥匙)

- 生物辨识设备(指纹、手掌、脸部)

- 其他装置(穿戴式装置、智慧卡 - NFC)

- 软体

- 身份验证解决方案(TOTP、推送、U2F)

- 行动应用(原生应用程式、SDK)

- 服务

- 管理及专业服务

- 硬体

- 通过认证模型

- 双重认证(2FA)

- 多元素(3F 和 4F)

- 自适应/基于风险的多因素分析

- 无密码(WebAuthn、Passkeys)

- 透过部署模式

- 本地部署

- 云

- 公共

- 私人的

- 杂交种

- 按公司规模

- 中小企业

- 大公司

- 透过接入通道

- VPN和远端登入

- Web 和 SaaS 应用

- 移动劳动力

- 按最终用户行业划分

- 银行和金融机构

- 加密货币和Web3交易所

- 技术(SaaS、IT 服务、DevOps)

- 政府(联邦政府、州政府、地方政府、系统整合商)

- 医疗保健和製药

- 零售与电子商务

- 能源、公共产业和製造业

- 教育、移民和公共服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(资金筹措、伙伴关係)

- 市占率分析

- 公司简介

- Giesecke+Devrient GmbH

- Thetis

- GoTrustID Inc.

- Thales Group

- Duo Security(Cisco Systems Inc.)

- RSA Security LLC

- Okta Inc.

- Google LLC(Alphabet Inc.)

- Ping Identity Corp.

- ManageEngine(Zoho Corp.)

- Microsoft Corp.

- TeleSign Corp.(Proximus Group)

- HID Global Corp.

- OneSpan Inc.

- CyberArk Software Ltd.

- ForgeRock Inc.

- Entrust Corp.

- SecureAuth Corp.

- Symantec Corp.(Broadcom Inc.)

- Keyless Technologies

- Secret Double Octopus

- Trusona Inc.

第七章 市场机会与未来展望

The global multifactor authentication market size currently stands at USD 21.11 billion in 2025 and is projected to reach USD 45.30 billion by 2030, reflecting a strong 16.50% CAGR.

This growth trajectory is underpinned by zero-trust adoption, tightening data-protection directives, and escalating ransomware premiums that drive urgent investment in stronger authentication. Regulatory mandates such as the 2025 HIPAA Security Rule in the United States and the European Digital Identity Wallet regulation are shifting procurement from basic OTP tools to phishing-resistant passkeys and hardware tokens, confirming the multifactor authentication market's transition toward high-assurance solutions. At the same time, supply-chain shocks to secure-element chips and escalating A2P SMS fees are pushing buyers to favor software-based or device-embedded factors. North America's zero-trust leadership, Asia-Pacific's mobile-identity initiatives, and Europe's wallet regulation together create a global flywheel that sustains double-digit expansion for the multifactor authentication industry through 2030.

Global Multifactor Authentication (MFA) Market Trends and Insights

Rapid Migration to Zero-Trust Security Architectures Across Regulated Industries

Zero-trust blueprints now require continuous identity checks on every session, elevating MFA from an optional add-on to core control. Canadian banks must abandon SMS OTP under OSFI B-13, pushing hardware tokens and biometric factors into routine operations. U.S. financial majors, including Capital One have pledged to remove employee passwords by end-2025, substituting device-certificate-anchored passkeys that cut credential-stuffing risk. Vendors respond by building platform fabrics that unify authentication across workforce, customer, and machine identities, strengthening the multifactor authentication market's ecosystem breadth.

Surge in Ransomware-as-a-Service Driving Insurance Premium Hikes

Cyber insurers now treat phishing-resistant MFA as baseline hygiene. Policies are refused or repriced upward where email-only or SMS-OTP remains in place, making MFA investment a direct insurance-cost hedge. As adversary-in-the-middle kits commoditize, boards shift funding from perimeter firewalls to identity assurance, propelling multifactor authentication market demand among mid-size enterprises previously slow to modernize.

Legacy SCADA/ICS Environments' Limited MFA Interoperability

Industrial networks depend on deterministic latency and continuous uptime. Injecting extra login steps risks downtime, so plant operators isolate OT from IT rather than retrofit full MFA, capping reachable multifactor authentication market revenue in heavy industry.

Other drivers and restraints analyzed in the detailed report include:

- Mandated FIDO-Based Strong Authentication for EU e-Government Portals

- Push-Notification Phishing Kits Raising Demand for Phishing-Resistant MFA

- Rising OTP SMS Costs Amid A2P Fee Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software solutions generated 48.3% of 2024 revenue and anchor the largest slice of the multifactor authentication market. Subscription licensing, API toolkits, and cloud consoles streamline rollouts across hybrid workforces. The segment's value proposition scales further as enterprises migrate perimeter controls into identity fabrics that integrate compliance reporting and adaptive risk metrics. Passwordless platforms-led by WebAuthn toolchains and SDKs-are clocking 19.2% CAGR, reflecting buyer preference for factors that erase credential databases and defeat phishing at the root. Hardware remains indispensable for regulated workloads that stipulate isolated secure-element storage, yet chip shortages inflate token costs and nudge budgets toward software.

Demand for implementation expertise turns managed services into an attractive niche. Service partners design enrollment campaigns, retrofit legacy apps, and monitor MFA dashboards, turning one-off product placement into recurring advisory revenue. As a result, large integrators bundle rollouts with broader zero-trust projects, lifting average contract values and reinforcing the multifactor authentication market's shift to platform-centric procurement.

Two-factor login still underpins 46.4% of 2024 revenue, primarily through authenticator apps and SMS codes that deliver quick risk reduction. However, phishing-resistant passkeys are expanding at 18.4% CAGR as browser and mobile-OS vendors bake FIDO2 into native workflows. Microsoft's decision to make new consumer accounts passwordless by default supplies a powerful reference model. Multifactor frameworks requiring three or more factors remain compulsory in select government and financial segments, but the broader commercial appetite pivots toward risk-based orchestration that elevates factor strength dynamically.

Multifactor Authentication Market is Segmented by Offering Type (Hardware, Software, Services), Authentication Model (Two-Factor, Multifactor, and More), Deployment Mode (On-Premises, Cloud, Hybrid), Enterprise Size (SMEs, Large Enterprises), Access Channel (VPN and Remote Login, and More), End-User Industry (Banking and Financial Institutions, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.8% revenue in 2024 and should log 14.2% CAGR to 2030. U.S. executive orders on critical-infrastructure cybersecurity and Canadian OSFI B-13 collectively institutionalize MFA, while the ecosystem of identity SaaS vendors headquartered in the region keeps innovation cycles brisk. The multifactor authentication market size for North America thus scales steadily as zero-trust procurement enters the maintenance phase and vendors upsell adaptive analytics.

Asia-Pacific is on a 16.5% CAGR trajectory thanks to government identity programs. Japan's My Number smartphone credential now underpins login for over 650 firms, and Singapore's banks have replaced SMS with FIDO tokens, broadening mainstream adoption. Australia's Digital ID framework rolls out passkeys for federal services, spurring private-sector copycats. Emerging economies across Southeast Asia and India extend market runway by leapfrogging legacy passwords straight into mobile biometrics.

Europe advances at solid double digits as Regulation 2024/1183 standardizes wallet login across 27 nations. Public-sector volume guarantees vendor scale, and private online-service providers must interoperate or risk customer churn. The Middle East and Africa, though starting from a smaller base, record increasing deployments aligned with cloud migration and cyber-resilience bids, adding diversified revenue streams to the global multifactor authentication market.

- Giesecke+Devrient GmbH

- Thetis

- GoTrustID Inc.

- Thales Group

- Duo Security (Cisco Systems Inc.)

- RSA Security LLC

- Okta Inc.

- Google LLC (Alphabet Inc.)

- Ping Identity Corp.

- ManageEngine (Zoho Corp.)

- Microsoft Corp.

- TeleSign Corp. (Proximus Group)

- HID Global Corp.

- OneSpan Inc.

- CyberArk Software Ltd.

- ForgeRock Inc.

- Entrust Corp.

- SecureAuth Corp.

- Symantec Corp. (Broadcom Inc.)

- Keyless Technologies

- Secret Double Octopus

- Trusona Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid migration to Zero-Trust security architectures across regulated industries

- 4.2.2 Surge in ransomware-as-a-service driving insurance premium hikes

- 4.2.3 Mandated FIDO-based strong authentication for e-Government portals in EU

- 4.2.4 Push-notification phishing kits raising demand for phishing-resistant MFA

- 4.2.5 AI-powered deep-fake attacks forcing higher-factor biometrics

- 4.2.6 Mandalorian Class Public-Private threat-intel sharing models (US and Five-Eyes)

- 4.3 Market Restraints

- 4.3.1 Legacy SCADA/ICS environments limited MFA interoperability

- 4.3.2 Rising OTP SMS costs amid A2P fee inflation

- 4.3.3 Fragmented mobile authenticator UX hurting workforce adoption

- 4.3.4 Hardware token chip shortages and secure-element supply risk

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering Type

- 5.1.1 Hardware

- 5.1.1.1 Tokens (USB, Smart-card, Smartkey)

- 5.1.1.2 Biometric Devices (Fingerprint, Palm-vein, Facial)

- 5.1.1.3 Other Devices (Wearables, Smartcards-NFC)

- 5.1.2 Software

- 5.1.2.1 Authenticator Solutions (TOTP, Push, U2F)

- 5.1.2.2 Mobile Apps (Native, SDK)

- 5.1.3 Services

- 5.1.3.1 Managed and Professional Services

- 5.1.1 Hardware

- 5.2 By Authentication Model

- 5.2.1 Two-Factor (2FA)

- 5.2.2 Multifactor (3F and 4F)

- 5.2.3 Adaptive / Risk-Based MFA

- 5.2.4 Password-less (WebAuthn, Passkeys)

- 5.3 By Deployment Mode

- 5.3.1 On-premises

- 5.3.2 Cloud

- 5.3.2.1 Public

- 5.3.2.2 Private

- 5.3.3 Hybrid

- 5.4 By Enterprise Size

- 5.4.1 Small and Medium-sized Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By Access Channel

- 5.5.1 VPN and Remote Login

- 5.5.2 Web and SaaS Applications

- 5.5.3 Mobile Workforce

- 5.6 By End-user Industry

- 5.6.1 Banking and Financial Institutions

- 5.6.2 Cryptocurrency and Web3 Exchanges

- 5.6.3 Technology (SaaS, IT Services, DevOps)

- 5.6.4 Government (Federal, State, Local, Integrators)

- 5.6.5 Healthcare and Pharmaceutical

- 5.6.6 Retail and E-commerce

- 5.6.7 Energy, Utilities and Manufacturing

- 5.6.8 Education, Immigration and Public Services

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 GCC

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Israel

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Egypt

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Giesecke+Devrient GmbH

- 6.4.2 Thetis

- 6.4.3 GoTrustID Inc.

- 6.4.4 Thales Group

- 6.4.5 Duo Security (Cisco Systems Inc.)

- 6.4.6 RSA Security LLC

- 6.4.7 Okta Inc.

- 6.4.8 Google LLC (Alphabet Inc.)

- 6.4.9 Ping Identity Corp.

- 6.4.10 ManageEngine (Zoho Corp.)

- 6.4.11 Microsoft Corp.

- 6.4.12 TeleSign Corp. (Proximus Group)

- 6.4.13 HID Global Corp.

- 6.4.14 OneSpan Inc.

- 6.4.15 CyberArk Software Ltd.

- 6.4.16 ForgeRock Inc.

- 6.4.17 Entrust Corp.

- 6.4.18 SecureAuth Corp.

- 6.4.19 Symantec Corp. (Broadcom Inc.)

- 6.4.20 Keyless Technologies

- 6.4.21 Secret Double Octopus

- 6.4.22 Trusona Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment