|

市场调查报告书

商品编码

1851441

车队管理解决方案:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Fleet Management Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

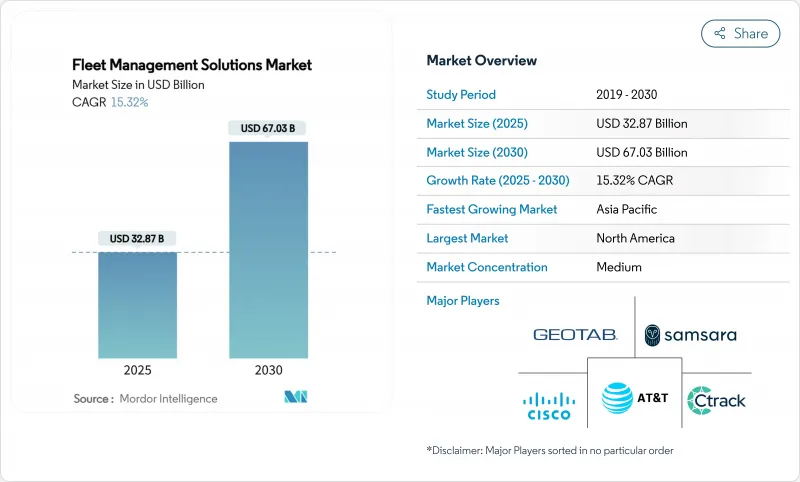

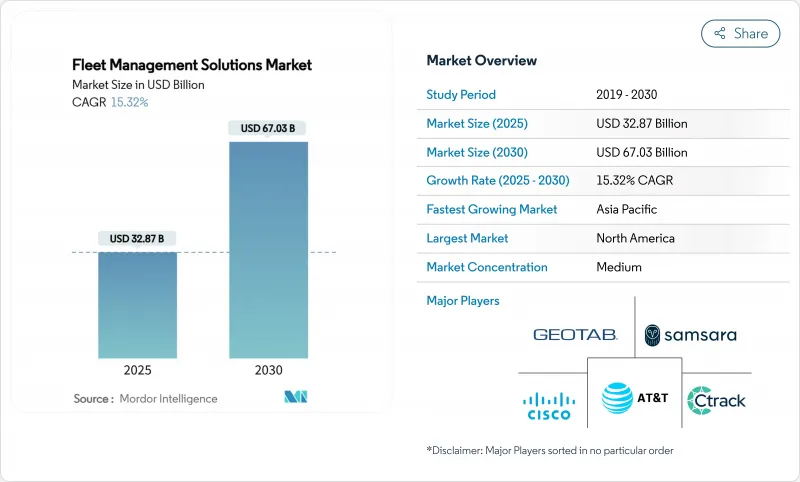

预计到 2025 年,车队管理解决方案市场将创造 328.7 亿美元的收入,到 2030 年将达到 670.3 亿美元,复合年增长率高达 15.32%。

这项业绩反映了日益严格的二氧化碳排放和电子日誌记录强制规定、OEM嵌入式远端资讯处理技术的普及以及5G的到来——5G支援低于10毫秒的即时调整延迟。随着车队优化路线、燃油消耗和预防性保养以提高利润率,对互联平台的投资已成为董事会层面的优先事项。将边缘人工智慧与安全云端服务结合的供应商正在扩大差距,从而在不损害资料主权的前提下实现预测分析。车队管理解决方案市场也受益于基于使用量的保险伙伴关係,这种合作将更安全的驾驶与更低的保费挂钩,形成自我强化的良性循环。半导体短缺和不断变化的隐私法规抑制了成长前景,主要使缺乏多元化供应链和合规专业知识的新参与企业处于不利地位。

全球车队管理解决方案市场趋势与洞察

OEM嵌入式资讯系统的激增

到2023年,超过四分之三的新型轻型车辆将具备原生互联功能,使用户能够直接存取引擎诊断、电池健康状况以及进行无线软体更新。但整合多个OEM厂商的资料馈送需要强大的标准化引擎和开放的API介面。已与超过150家製造商完成整合的供应商,透过帮助客户节省售后硬体成本并解锁更丰富的预测性维护模型,正在赢得市场份额。

5G 和 NB-IoT 部署可降低延迟

毫秒级以下的连结使负责人能够在拥塞显现之前更新密集都市区道路的路线,从而减少15-20%的燃油消耗。车辆上的边缘运算模组现在可以执行人工智慧视觉功能,在本地标记急煞车和偏离车道事件,并将异常情况发送到云端。使用5G技术的智慧电錶可以即时中继故障数据,加快停电后的恢復速度。

联网车队面临的网路勒索软体风险

2017年至2022年间,针对交通运输网路的攻击将增加四倍,导致即时资产位置暴露,车辆被锁定直至支付赎金。中型运输公司通常使用过时的维护软体,且缺乏多因素身份验证,这扩大了其面临的威胁面。产业组织目前建议在所有远端资讯处理网关上采用零信任架构和端点检测。

细分市场分析

混合架构正以 20.4% 的复合年增长率成长,这主要得益于其能够在高峰期利用弹性云分析的同时,将敏感的营运资料保留在本地。到 2024 年,基于云端的车队管理解决方案将占据 63% 的市场份额,但出于合规性考虑的买家(例如国防机构)仍然需要本地伺服器。供应商正在捆绑边缘网关,这些网关仅同步异常事件,从而降低漫游费用并支援低频宽区域的运作。案例研究证实,混合架构在满足资料保留法规的同时,降低了紧急应变期间的延迟。

这种发展势头源于纯云端部署中汲取的经验教训,在纯云端部署中,网路连线中断会导致电子日誌记录 (ELD) 日誌出现缺失。现在,供应商正在将关键规则集预先载入到边缘装置上,即使网路连线降至 2G,也能确保驾驶员保持合规。网路连线恢復后,快取的记录会自动同步。这种模式正在重新定义架构:云端成为分析核心,边缘成为合规卫士,而本地设备则确保系统主权。

车辆追踪仍然是收入支柱,占比高达 27.5%,但市场需求正转向分析和彙报,该领域正以每年 18.1% 的速度成长。如今,仪表板会根据安全评分对驾驶员进行排名,并利用机器学习技术预测煞车皮寿命。车队管理解决方案市场透过自动化指导、燃油税调整和基于人工智慧的货物监控等附加元件模组获得高利润。将这些洞察与开放 API 打包的供应商正在将单次销售转化为多年平台合约。

专业化趋势日益明显。一家供应商专注于都市区货运的低矮桥樑避障技术,而另一家则专注于为欧洲营运商提供煞车性能监测。这种垂直细分正在取代通用的「地图上的点」式平台。一份报告指出,自从引入连网驾驶员培训以来,安全事故减少了35%,该培训将远端资讯处理数据转化为微学习影片。

车队管理解决方案市场报告按部署类型(本地部署、云端部署、其他)、解决方案类型(资产/车辆追踪、驾驶员管理和安全、其他)、车辆类型(重型卡车(超过 3.5 吨)、巴士和长途客车、其他)、车队规模(少于 50 辆车、50-199公共产业、其他)、最终用户产业

区域分析

北美地区在车队管理解决方案市场占据36%的份额,主要得益于强制性电子日誌和成熟的行动电话网路。随着货运公司因违反营运时间规定而面临越来越高的处罚,远端资讯处理已成为必不可少的环节。美国、加拿大和墨西哥之间的跨境营运推动了对统一合规仪表板的需求。此外,该地区还面临日益严重的勒索软体威胁,促使企业加强对终端安全模组的投资。

亚太地区以15.4%的复合年增长率呈现最高增速。中国的智慧城市试点计画正在将远端资讯处理数据整合到交通指挥中心,从而实现优先通行电动货车的绿灯讯号。在印度,电商企业正在部署路线优化器,以缓解交通拥堵并缩短配送时间。澳洲和纽西兰现已要求重型车辆使用通讯记录仪,预计2028年,总安装量将达到270万台。东南亚部分地区的网路覆盖分散,促使人们采用混合边缘云端-云模式,在4G网路不可用时进行资料缓衝。

欧洲在欧盟2040年二氧化碳减量目标的后期阶段维持了稳定的能源需求。与排放等级挂钩的基于里程的收费方式迫使车队即时测量和报告燃油强度,使数据分析成为调度的核心。 GDPR强化了隐私设计架构,并奖励传输过程中采用加密技术的供应商。一家英国物流公司利用人工智慧将远端资讯处理行程数据与载重係数结合,减少了5万吨二氧化碳排放。东欧高昂的行动电话费用给实施带来了挑战,但共用服务模式正在兴起。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- OEM嵌入式资讯系统的激增

- 5G 和 NB-IoT 部署可降低延迟

- 基于使用量的保险伙伴关係

- 更严格的当地二氧化碳/排放控制规定

- 边缘人工智慧助力预测性维护

- 商用无人机机队创造邻近性

- 市场限制

- 联网车队面临的网路勒索软体风险

- 监管资料共用规则碎片化

- 反对个人资讯保护

- 碳化硅功率电子元件供电瓶颈

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 半导体短缺的影响

第五章 市场规模与成长预测

- 按部署模式

- 本地部署

- 云(SaaS)

- 杂交种

- 按解决方案类型

- 资产/车辆跟踪

- 驾驶员管理与安全

- 营运与调度

- 燃油和路线优化

- 合规与风险

- 分析与报告

- 按车辆类型

- 轻型商用车(小于3.5吨)

- 大型卡车(超过3.5吨)

- 公车和长途客车

- 拖车/拖车

- 非公路及施工机械

- 按车队规模

- 少于50个单位

- 50-199个单位

- 200-999个单元

- 超过1000台

- 按最终用户行业划分

- 运输与物流

- 能源与公共产业

- 建筑和采矿

- 製造和零售分销

- 政府/公共

- 其他(租赁、废弃物管理)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 非洲

- 南非

- 奈及利亚

- 埃及

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(合资企业/合资企业)

- 市占率分析

- 公司简介

- AT&T Inc.

- Cisco Systems Inc.

- Geotab Inc.

- Verizon Communications Inc.(Verizon Connect)

- Trimble Inc.

- Omnitracs LLC

- Samsara Inc.

- MiX Telematics

- TomTom NV

- Ctrack(Inseego)

- KeepTruckin(Motive)

- Fleet Complete

- Donlen(Hertz)

- Azuga Inc.

- Chevin Fleet Solutions

- Octo Telematics

- Tenna LLC

- Odoo SA

- Rarestep Inc.(Fleetio)

- One Step GPS

- Advance Tracking Technologies

- Astrata Group

- Switchboard Inc.

- Transflo

- Go Fleet

- Wheels Inc.

- ID Systems(PowerFleet)

- Others(white-listed)

第七章 市场机会与未来展望

The fleet management solutions market generated USD 32.87 billion in 2025 and is forecast to climb to USD 67.03 billion by 2030, advancing at a robust 15.32% CAGR.

This performance reflects tightening CO2 and electronic logging mandates, the spread of OEM-embedded telematics, and the arrival of 5G that supports sub-10 millisecond latency for real-time coordination. Margins improve when fleets optimize routes, fuel consumption, and preventive maintenance, so investment in connected platforms has become a board-level priority. Vendors that combine edge AI with secure cloud services are widening the gap because they permit predictive analytics without compromising data sovereignty. The fleet management solutions market also benefits from usage-based insurance partnerships that translate safer driving into premium reductions, creating a self-reinforcing adoption cycle. Semiconductor shortages and evolving privacy rules temper the growth outlook but primarily disadvantage newcomers that lack diversified supply chains and compliance expertise.

Global Fleet Management Solutions Market Trends and Insights

Rapid rise in OEM-embedded telematics

More than three-quarters of new light vehicles shipped with native connectivity in 2023, giving operators direct access to engine diagnostics, battery health, and over-the-air software updates. Blending multiple OEM data feeds, however, demands powerful normalization engines and open APIs. Providers that already integrate across 150-plus makes are gaining wallet share because they spare customers the cost of aftermarket hardware while unlocking richer predictive maintenance models.

5G and NB-IoT rollout lowering latency

Sub-10 millisecond links allow dispatchers to update routes in dense urban corridors before congestion materializes, trimming fuel use by 15-20%. Edge computing modules on the vehicle now run AI vision that flags hard-braking or lane-departure events locally, sending only exceptions to the cloud, which lowers bandwidth charges and speeds driver coaching. Utility fleets illustrate the benefit: smart meters using 5G relay fault data in real time, accelerating outage restoration.

Cyber-ransomware risk on connected fleets

Attacks against transport networks quadrupled between 2017 and 2022, exposing real-time asset locations and immobilizing vehicles until ransoms are paid. Mid-sized carriers often run outdated maintenance software that lacks multifactor authentication, widening the threat surface. Industry associations now recommend zero-trust architectures and endpoint detection on every telematics gateway.

Other drivers and restraints analyzed in the detailed report include:

- Usage-based insurance partnerships

- Stricter CO2 / ELD mandates

- Fragmented regulatory data-sharing rules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid architectures are rising at 20.4% CAGR because they keep sensitive operations data on-premises while tapping elastic cloud analytics during peak demand. The fleet management solutions market size for cloud deployments reached 63% share in 2024, but compliance-driven buyers such as defense agencies still require on-site servers. Suppliers bundle edge gateways that sync only exception events, cutting roaming charges and supporting operations in low-bandwidth geographies. Case studies in government electric vehicle programs confirm that hybrid stacks reduce latency for emergency response while meeting data residency statutes.

Adoption momentum stems from lessons learned in pure-cloud rollouts where connection drops led to gaps in ELD logs. Vendors now pre-load critical rulesets on edge devices, letting drivers stay compliant even if coverage falls to 2G. Once connectivity resumes, cached records synchronize automatically. This pattern is redefining architectures: cloud stays the analytics brain, edge becomes the compliance guard, and on-prem appliances assure sovereignty.

Vehicle tracking remains the revenue anchor at 27.5% share, but demand is shifting toward analytics and reporting that grow 18.1% a year. Dashboards now rank drivers by safety score and project brake-pad life using machine learning. The fleet management solutions market generates higher margins from add-on modules such as automated coaching, fuel tax reconciliation, and AI-based cargo monitoring. Providers that package these insights with open APIs convert single-product sales into multi-year platform contracts.

Specialization is intensifying. Some vendors focus on low-bridge avoidance for urban freight, others on brake-performance monitoring for European operators. This vertical depth is displacing generic "dots-on-a-map" platforms. Early adopters report 35% cuts in safety incidents after rolling out connected driver training that translates telematics data into micro-learning videos.

The Fleet Management Solutions Market Report is Segmented by Deployment Type (On-Premises, Cloud, and More), Solution Type (Asset / Vehicle Tracking, Driver Management and Safety, and More), Vehicle Type (Heavy Trucks (above 3. 5 T), Buses and Coaches, and More), Fleet Size (less Than 50 Vehicles, 50-199 Vehicles, and More), End-User Industry (Transportation and Logistics, Energy and Utilities, and More), and Geography.

Geography Analysis

North America retains 36% share of the fleet management solutions market, bolstered by enforced electronic logs and mature cellular networks. Carriers face stiffer penalties for hours-of-service violations, so telematics is non-negotiable. Insurers reward safe-driving records captured via video AI, and cross-border operations between the United States, Canada, and Mexico elevate demand for unified compliance dashboards. The region also sees higher ransomware exposure, motivating investments in endpoint security modules.

Asia Pacific exhibits the highest growth at 15.4% CAGR. China's smart-city pilots embed telematics feeds into traffic command centers, enabling green-wave signals that favor electric delivery vans. In India, e-commerce boomers deploy route optimizers to tame congestion and shrink delivery windows. Australia and New Zealand now require electronic work diaries for heavy vehicles, lifting total installed units to an expected 2.7 million by 2028. Fragmented telecom coverage in parts of Southeast Asia pushes hybrid edge-cloud models that buffer data when 4G is unavailable.

Europe records steady demand behind the EU's 2040 CO2 targets. Distance-based tolling tied to emission classes forces fleets to measure and report real-time fuel intensity, putting analytics at the heart of dispatch. GDPR elevates privacy-by-design architectures, rewarding vendors that encrypt at rest and in transit. A UK logistics firm trimmed 50,000 tonnes of CO2 by using AI to blend telematics trip data with load factors, underscoring how sustainability mandates intersect with profitability. Adoption challenges persist in Eastern Europe where cellular tariffs remain high, but shared-services models are emerging.

- AT&T Inc.

- Cisco Systems Inc.

- Geotab Inc.

- Verizon Communications Inc. (Verizon Connect)

- Trimble Inc.

- Omnitracs LLC

- Samsara Inc.

- MiX Telematics

- TomTom N.V.

- Ctrack (Inseego)

- KeepTruckin (Motive)

- Fleet Complete

- Donlen (Hertz)

- Azuga Inc.

- Chevin Fleet Solutions

- Octo Telematics

- Tenna LLC

- Odoo SA

- Rarestep Inc. (Fleetio)

- One Step GPS

- Advance Tracking Technologies

- Astrata Group

- Switchboard Inc.

- Transflo

- Go Fleet

- Wheels Inc.

- I.D. Systems (PowerFleet)

- Others (white-listed)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid rise in OEM-embedded telematics

- 4.2.2 5G and NB-IoT rollout lowering latency

- 4.2.3 Usage-based insurance partnerships

- 4.2.4 Stricter regional CO? / ELD mandates

- 4.2.5 Edge-AI enabling predictive maintenance

- 4.2.6 Commercial drone fleets creating adjacency

- 4.3 Market Restraints

- 4.3.1 Cyber-ransomware risk on connected fleets

- 4.3.2 Fragmented regulatory data-sharing rules

- 4.3.3 Driver privacy backlash (under-reported)

- 4.3.4 Silicon carbide power electronics supply bottlenecks

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Semiconductor Shortage

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 On-Premise

- 5.1.2 Cloud (SaaS)

- 5.1.3 Hybrid

- 5.2 By Solution Type

- 5.2.1 Asset / Vehicle Tracking

- 5.2.2 Driver Management and Safety

- 5.2.3 Operations and Dispatch

- 5.2.4 Fuel and Route Optimization

- 5.2.5 Compliance and Risk

- 5.2.6 Analytics and Reporting

- 5.3 By Vehicle Type

- 5.3.1 Light Commercial Vehicles (less than 3.5 t)

- 5.3.2 Heavy Trucks (above 3.5 t)

- 5.3.3 Buses and Coaches

- 5.3.4 Trailers / Semi-trailers

- 5.3.5 Off-highway and Construction Equipment

- 5.4 By Fleet Size

- 5.4.1 less than 50 Vehicles

- 5.4.2 50-199 Vehicles

- 5.4.3 200-999 Vehicles

- 5.4.4 above or equal to 1,000 Vehicles

- 5.5 By End-User Industry

- 5.5.1 Transportation and Logistics

- 5.5.2 Energy and Utilities

- 5.5.3 Construction and Mining

- 5.5.4 Manufacturing and Retail Distribution

- 5.5.5 Government and Public Safety

- 5.5.6 Others (Rental, Waste Mgmt.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 Russia

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA / JVs)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AT&T Inc.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Geotab Inc.

- 6.4.4 Verizon Communications Inc. (Verizon Connect)

- 6.4.5 Trimble Inc.

- 6.4.6 Omnitracs LLC

- 6.4.7 Samsara Inc.

- 6.4.8 MiX Telematics

- 6.4.9 TomTom N.V.

- 6.4.10 Ctrack (Inseego)

- 6.4.11 KeepTruckin (Motive)

- 6.4.12 Fleet Complete

- 6.4.13 Donlen (Hertz)

- 6.4.14 Azuga Inc.

- 6.4.15 Chevin Fleet Solutions

- 6.4.16 Octo Telematics

- 6.4.17 Tenna LLC

- 6.4.18 Odoo SA

- 6.4.19 Rarestep Inc. (Fleetio)

- 6.4.20 One Step GPS

- 6.4.21 Advance Tracking Technologies

- 6.4.22 Astrata Group

- 6.4.23 Switchboard Inc.

- 6.4.24 Transflo

- 6.4.25 Go Fleet

- 6.4.26 Wheels Inc.

- 6.4.27 I.D. Systems (PowerFleet)

- 6.4.28 Others (white-listed)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment