|

市场调查报告书

商品编码

1851445

木器涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Wood Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

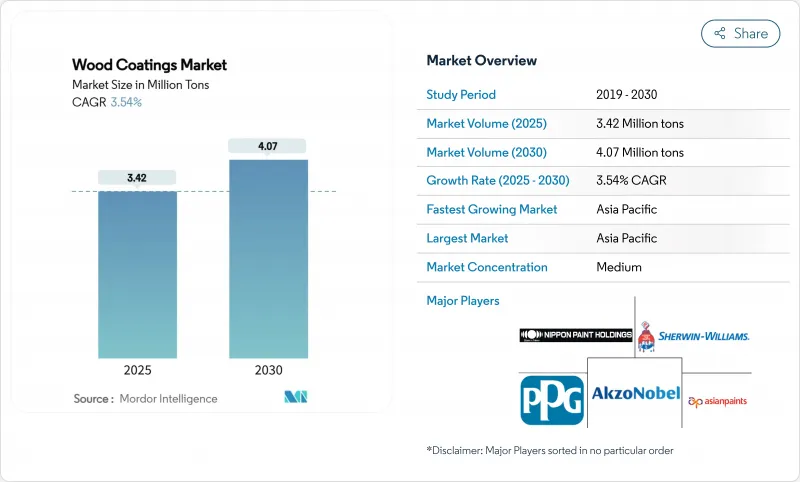

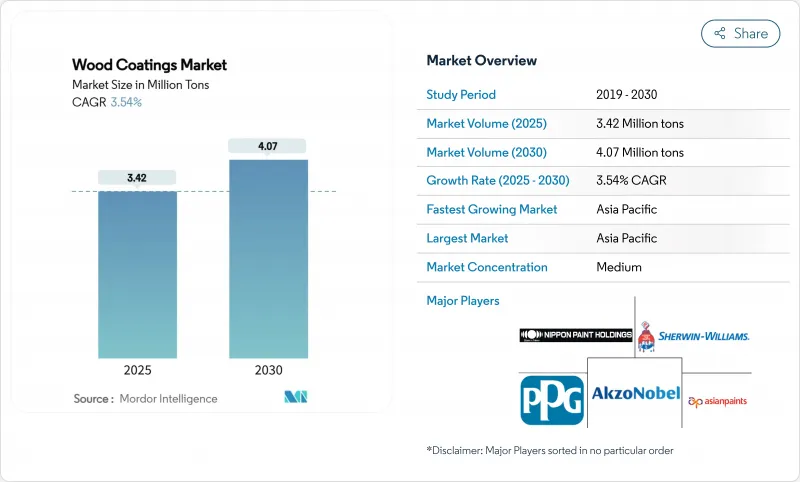

预计到 2025 年,木材涂料市场规模将达到 342 万吨,到 2030 年将达到 407 万吨,预测期(2025-2030 年)复合年增长率为 3.54%。

这一稳步扩张得益于亚太地区的製造业基础、水性化学品加速普及以及全球家具产业的持续需求。儘管聚氨酯因其耐久性仍是领先的树脂平台,但环保法规正推动低挥发性有机化合物(VOC)替代品的快速普及。製造商也透过投资配方灵活性和在地采购来应对原材料价格(尤其是二氧化钛)的波动。顶级供应商之间的整合,加上中端企业在生物基添加剂领域不断创新,加剧了市场竞争,同时也提高了小型企业必须达到的基准值。

全球木器涂料市场趋势与洞察

亚太地区模组化与RTA家具的蓬勃发展

快速的都市化和日益缩小的公寓面积正在推动中国、印度和印尼等国模组化和组装家具的普及。这些大量生产的家具需要耐刮擦、快干的涂料,这迫使配方师优化涂料在人造基材(如中密度纤维板)上的渗透性。光是印尼的工厂到2024年10月就将生产100.4万吨涂料,其中木器涂料占7%。快干型聚氨酯-丙烯酸混合涂料的供应商正在赢得新契约,亚太地区在木器涂料市场中扮演核心角色。

欧盟主导转向低VOC水性配方转变

欧盟日益严格的VOC法规正加速从溶剂型系统朝向水性系统的转型。现代水性聚氨酯分散体的耐久性如今已与溶剂型系统相媲美,消除了以往的性能差距。欧洲配方商将这些符合法规的产品出口到北美和亚洲,透过使用单一配方运作全球生产线,实现了成本协同效应,并在其他地区推行类似法规之际,享受先发优势。这种合作是木器涂料市场的关键结构性驱动力,促进了以生物基共黏合剂为重点的研发,从而进一步减少排放。

树脂和溶剂价格波动

自2025年1月起,欧盟对中国产二氧化钛征收11.4%至32.3%的反倾销税,导致原物料成本飙升。木器涂料市场的小型生产商面临利润空间压缩,部分企业不得不采用减少颜料用量或使用替代填料的方式进行再生产,而跨国公司则透过签订长期供应协议来规避风险。

细分市场分析

预计到2024年,聚氨酯将占据木器涂料市场60%的份额,并在2030年之前以3.79%的复合年增长率成长。聚氨酯的交联密度使其具备家具出口商所需的耐化学性,能够通过严格的耐久性测试。到2024年,聚氨酯将成为树脂木器涂料市场最大的组成部分,随着生物多元醇等级的推出,其领先优势将继续扩大。生物多元醇等级在降低化石成分的同时,也能保持硬度。丙烯酸树脂因其紫外线稳定性,仍是户外树脂的主流;而硝化纤维素在安全法规较宽鬆的地区仍用于传统家具。与Solus相容的生物基体係正引导买家选择更安全的即用型涂料。聚酯在钢琴和精品橱柜的高光泽饰面领域占据着独特的地位,展现了其独特的市场定位。新兴的木质素基黏合剂有望在永续性主导的试点计划中占有一席之地,但目前仅占总需求的不到1%。因此,聚氨酯的强势地位为木器涂料市场所有主要製造商的竞争性配方蓝图提供了支持。

湿固化脂肪族聚氨酯技术的进步使得VOC含量低于50克/公升,在不牺牲开放时间的前提下,超越了以往的规范。越南和波兰的领先家具OEM厂商正在使用平板喷涂机和真空涂装机检验这些系统,这表明聚氨酯将继续代表高端性能。 </p><h3><u>地理分析</u></h3><p>到2024年,亚太地区将以57%的市占率主导木器涂料市场,并实现3.9%的最快区域复合年增长率。中国仍然是关键,这得益于国内消费和出口导向家具产业丛集的推动;而印度新兴的中产阶级正在推动当地高端市场的发展。随着各国政府收紧排放法规并加速水性产品的采用,亚太地区已成为规模主导创新的关键区域。 </p>

北美在木器涂料市场占据重要份额,并在技术升级方面处于领先地位。 DIY 的普及和高端装饰风格的兴起正在改变消费者的购买习惯,大型零售商的自有品牌项目也要求产品获得第三方永续性认证。 HIRI 预测,到 2025 年,住宅投资将復苏 3.9%,从而增强短期需求的韧性。此外,气候变迁正在推动对具有柔性膜的外墙涂料的需求,这种涂料能够适应墙板基材上的湿度变化,进一步丰富了该地区木器涂料市场的 SKU 种类。

在欧洲,严格的法规与建筑中木材的广泛应用相辅相成。欧盟的「绿色新政」激励措施鼓励使用低碳建筑材料,并推动了对高性能涂料的需求,这些涂料能够保护多用户住宅中的CLT构件。随着甲醛和VOC阈值的实施,从2022年起,该地区近一半的家具涂装生产线将转向水性或UV固化涂料,溶剂型涂料的淘汰速度超过其他任何地区。这些动态使得欧洲既成为监管标桿,也成为发展中国家配方技术的出口中心。

其他好处

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区模组化与RTA家具的蓬勃发展

- 欧盟主导转向低VOC水性配方转变

- 北美高端室内装潢趋势

- DIY家居装修中心的扩张

- 欧洲的木造多户住宅

- 市场限制

- 树脂和溶剂价格波动

- 加强甲醛/挥发性有机化合物法规

- 家具中层压板和塑胶的替代

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依树脂类型

- 聚氨酯

- 丙烯酸纤维

- 硝化纤维素

- 聚酯纤维

- 其他的

- 透过技术

- 水系统

- 溶剂型

- 紫外线固化型

- 粉末涂装

- 透过使用

- 家具及设备

- 门窗

- 内阁

- 其他用途(包括地板、露台和装饰线条)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems

- Benjamin Moore & Co.

- Ceramic Industrial Coatings

- Hempel A/S

- Jotun

- Kansai Nerolac Paints Limited

- KAPCI Coating

- MAS Paints

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- Ritver

- RPM International Inc.

- Teknos Group

- The Sherwin-Williams Company

第七章 市场机会与未来展望

The Wood Coatings Market size is estimated at 3.42 Million tons in 2025, and is expected to reach 4.07 Million tons by 2030, at a CAGR of 3.54% during the forecast period (2025-2030).

This steady expansion is supported by the Asia-Pacific manufacturing base, accelerating shifts toward water-borne chemistries, and sustained demand from the global furniture sector. Polyurethane's durability keeps it the leading resin platform, while environmental regulations are fast-tracking adoption of low-VOC alternatives. Manufacturers are also navigating raw-material price swings-especially titanium dioxide-by investing in formulation flexibility and localized sourcing. Consolidation among top suppliers, paired with growing mid-tier innovation in bio-based additives, is strengthening competition while raising the performance baseline that smaller firms must match.

Global Wood Coatings Market Trends and Insights

Modular & RTA Furniture Boom in Asia-Pacific

Rapid urbanization and shrinking apartment sizes have spurred a surge in modular and ready-to-assemble furniture across China, India, and Indonesia. These high-volume furniture lines require scratch-resistant finishes that cure quickly, pushing formulators to optimize penetration on engineered substrates such as MDF. Indonesian factories alone produced 1.004 million tons of coatings by October 2024, with wood coatings representing 7%, highlighting the scale of regional demand. Suppliers responding with fast-drying polyurethane-acrylic hybrids are capturing new contracts, reinforcing Asia-Pacific's central role in the wood coatings market.

EU-Led Shift to Low-VOC Waterborne Formulations

The European Union's tightening VOC caps have accelerated migration away from solvent-borne systems. Recent aqueous polyurethane dispersions now match solvent-borne durability, closing the historical performance gap. European formulators exporting these compliant chemistries to North America and Asia achieve cost synergies by running global production lines on a single recipe, gaining first-mover advantages as other regions move toward similar rules. This alignment is a leading structural driver for the wood coatings market, stimulating R&D focused on bio-based co-binders that further cut emissions.

Resin & Solvent Price Volatility

Anti-dumping duties of 11.4%-32.3% on Chinese titanium dioxide entering the EU, effective January 2025, have pushed raw-material costs sharply higher. Smaller manufacturers in the wood coatings market face margin compression, leading some to reformulate with lower pigment volumes or alternative extenders, while multinationals hedge exposure through long-term supply contracts.

Other drivers and restraints analyzed in the detailed report include:

- Premium Interior Decor Trend in North America

- Timber-Rich Multi-Family Housing in Europe

- Stricter Formaldehyde / VOC Caps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyurethane dominated the wood coatings market with a 60% share in 2024 and is set to grow at 3.79% CAGR through 2030. Its cross-linking density delivers chemical resistance that furniture exporters demand to meet stringent durability tests. In 2024 polyurethane already represented the largest slice of wood coatings market size for resins and continues widening its lead with introductions of bio-polyol grades that cut fossil content without sacrificing hardness. Acrylic resins remain the exterior workhorse thanks to UV stability, while nitrocellulose still services classic furniture in regions with lenient safety codes. Solus-enabled biobased systems are nudging buyers toward safer drop-in options. Polyester's niche in high-build gloss finishes for pianos and boutique cabinetry signals its specialty positioning. Emerging lignin-based binders are poised to capture sustainability-driven pilot projects but remain under 1% of total demand today. Polyurethane's entrenched position therefore anchors competitive formulation roadmaps across every major producer participating in the wood coatings market.

Advancements in moisture-curing aliphatic polyurethanes now offer <50 g/L VOC content, surpassing legacy specifications without sacrificing open time. Major OEM furniture lines in Vietnam and Poland have validated these systems for flat-line spray and vacuum coaters, demonstrating that polyurethane will continue shaping premium performance tiers. As environmental scrutiny tightens, suppliers integrating recycled PET polyols further extend the resin's lifecycle credentials, keeping this chemistry at the center of investment decisions across the global wood coatings industry.

The Wood Coatings Market Report Segments the Industry by Resin Type (Polyurethane, Acrylic, Nitrocellulose, and More), Technology (Water-Borne, Solvent-Borne, UV-Cured, and More), Application (Furniture and Fixtures, Doors and Windows, Cabinets, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific dominated the wood coatings market with 57% share in 2024 and posted the quickest regional CAGR at 3.9%. China remains the cornerstone, supported by domestic consumption and export-oriented furniture clusters, while India's rising middle class powers local premium segments. Water-borne adoption is accelerating as regional governments tighten emission ceilings, making Asia-Pacific the pivotal arena for scale-driven innovation.

North America holds significant share in the wood coatings market and leads in technology upgrades. DIY participation and premium decor formats shape buying patterns, and big-box retailers' private-label programs now demand third-party sustainability certifications. HIRI forecasts a 3.9% rebound in 2025 home-improvement expenditures, reinforcing short-cycle demand resilience. Climatic events have also heightened demand for exterior stains with flexible membranes that tolerate moisture swings across siding substrates, further diversifying SKU count in the region's wood coatings market.

Europe combines stringent regulations with architectural timber adoption. The EU's Green Deal incentives favor low-carbon building materials, propelling demand for high-performance coatings that shield CLT elements in multi-family structures. Enforcement of formaldehyde and VOC thresholds has shifted nearly half of regional furniture finishing lines to water-borne or UV-cure chemistries since 2022, compressing the solvent-borne base faster than in any other geography. These dynamics position Europe as both a regulatory benchmark and an export hub for formulation technology destined for developing markets.

- Akzo Nobel N.V.

- Asian Paints

- Axalta Coating Systems

- Benjamin Moore & Co.

- Ceramic Industrial Coatings

- Hempel A/S

- Jotun

- Kansai Nerolac Paints Limited

- KAPCI Coating

- MAS Paints

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- Ritver

- RPM International Inc.

- Teknos Group

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Modular and RTA Furniture Boom in Asia-Pacific

- 4.2.2 EU-Led Shift to Low-VOC Waterborne Formulations

- 4.2.3 Premium Interior Decor Trend in North America

- 4.2.4 Expansion of DIY Home-Improvement Retail

- 4.2.5 Timber-Rich Multi-Family Housing in Europe

- 4.3 Market Restraints

- 4.3.1 Resin and Solvent Price Volatility

- 4.3.2 Stricter Formaldehyde / VOC Caps

- 4.3.3 Substitution by Laminates and Plastics in Furniture

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Resin Type

- 5.1.1 Polyurethane

- 5.1.2 Acrylic

- 5.1.3 Nitrocellulose

- 5.1.4 Polyester

- 5.1.5 Others

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 UV-Cured

- 5.2.4 Powder Coatings

- 5.3 By Application

- 5.3.1 Furniture and Fixtures

- 5.3.2 Doors and Windows

- 5.3.3 Cabinets

- 5.3.4 Other Applications (including Floors, Decks, and Molding Products)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Russia

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems

- 6.4.4 Benjamin Moore & Co.

- 6.4.5 Ceramic Industrial Coatings

- 6.4.6 Hempel A/S

- 6.4.7 Jotun

- 6.4.8 Kansai Nerolac Paints Limited

- 6.4.9 KAPCI Coating

- 6.4.10 MAS Paints

- 6.4.11 National Paints Factories Co. Ltd.

- 6.4.12 Nippon Paint Holdings Co., Ltd.

- 6.4.13 PPG Industries Inc.

- 6.4.14 Ritver

- 6.4.15 RPM International Inc.

- 6.4.16 Teknos Group

- 6.4.17 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Demand for UV-cured Coatings