|

市场调查报告书

商品编码

1851447

汽车开关:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Switch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

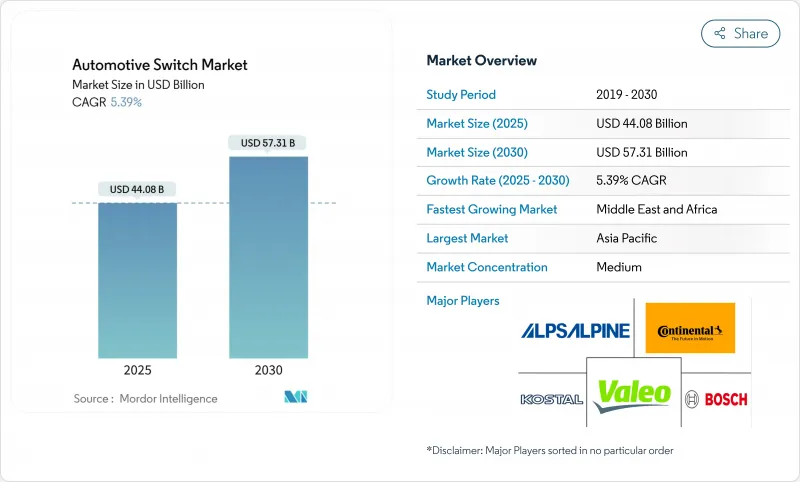

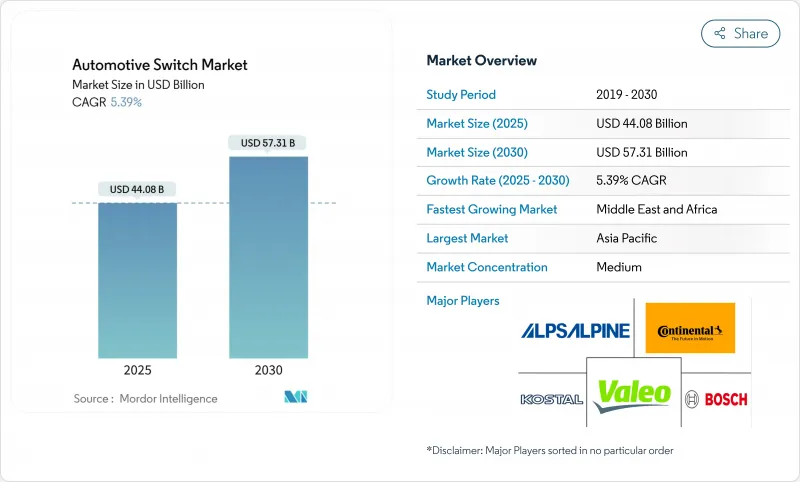

预计到 2025 年汽车开关市场规模将达到 440.8 亿美元,到 2030 年将达到 573.1 亿美元,年复合成长率为 5.39%。

这种成长反映了汽车产业向软体定义型汽车的更广泛转变,在这种模式下,开关作为人机互动的第一道防线,连接着机械感知和电子智慧。与燃油车相比,纯电动车需要更多的铜和高压电路。资讯娱乐系统和高级驾驶辅助系统(ADAS)功能的扩展、对豪华照明座舱的追求以及更严格的ISO 26262安全法规,都提高了人们对所有开关功能的要求。随着触觉和电容式技术挑战机械技术的现状,竞争日益激烈;同时,铜和稀土供应链的衝击迫使製造商重新思考采购、成本规避和地域生产布局。

全球汽车开关市场趋势与洞察

汽车电气化的兴起

电动动力传动系统有着独特的控制需求,包括电池管理、能量回收煞车和热优化,这需要能够承受高电压并保持触觉反应的专用开关。Panasonic汽车的集中式ECU架构展示了移除发热硬体后电子元件含量如何大幅成长。预计到2024年,巴西插电式汽车的销量将激增90%,达到177,360辆,凸显了需求模式的快速变化。中国计划在2026年推出100%国产晶片的汽车,将进一步重塑零件采购格局。这些因素将透过扩大开关的产量和功能多样性来推动汽车开关市场的发展。

高级资讯娱乐和ADAS功能的成长

基于高通骁龙平台的云端互联驾驶座需要通讯与外部感测器、语音助理和空中升级后端通讯的多功能控制器。大陆集团的可程式触觉旋钮只需一个旋钮即可模拟多种按键手感,满足下一代仪表板的空间和设计需求。安全至关重要的ADAS(高级驾驶辅助系统)层需要通过ISO 26262认证的开关,以确保车道维持等功能的冗余执行。 ADAS改装后市场规模已接近10亿美元,扩大了老旧车辆寻求新增安全功能的潜在需求。

铜和稀土价格波动

自2024年2月以来,铜价已上涨近20%,预计到2025年将超过每吨15,000美元,这将推高所有使用高纯度触点的机械开关的材料成本。同时,中国对稀土出口的限制已迫使铃木和福特等汽车製造商短期停产。为了保障汽车开关市场的利润,开关製造商正在采取措施对冲材料成本风险、重新设计接点布局,并评估低品质合金。

细分市场分析

机械式开关设计预计在2024年仍将占据93.82%的市场份额,其可靠性已得到验证,能够抵御极端温度、灰尘和振动。按钮用于处理高频用户操作,摇桿单元控制二进位功能,拨片则用于管理方向盘上的指令。即使显示器不断发展,机械式开关的汽车开关市场也预计将稳定成长。

触控开关目前市场规模较小,但随着豪华车和大众高端车型逐渐采用嵌入式背光面板,预计到2030年将以8.17%的复合年增长率成长。大陆集团的静电回授旋钮无需齿轮即可模拟机械定位感,而Snaptron的可焊接触觉圆顶则可使年产能增加一倍。混合模组将电容式感测整合在薄塑胶盖下,同时仍能提供触觉回馈,这不仅赋予了OEM厂商设计上的自由,也保留了汽车开关市场所期望的传统触感。

由于各司法管辖区对方向灯、危险警告灯和警示灯等功能都有严格的号誌要求,指示器控制产品在2024年占总收入的25.11%。即使在全数数位化驾驶座中,指示器应用的汽车开关市场规模仍然保持稳定,因为即使萤幕故障,外部照明指令也必须正常运作。

得益于电动车中里程感应式热感逻辑技术的应用,HVAC(空调)介面正以5.57%的复合年增长率快速成长。东海理化(Tokai Rika)的套模喷涂工艺已被丰田Hiace)采用,该工艺在降低生产能耗的同时,还能实现耐刮擦的外壳。触控萤幕的普及并不会完全取代空调控制系统,使用者仍需要透过触觉方式即时控制除湿和除霜,这支撑了整个汽车开关市场的需求。

区域分析

亚太地区在汽车开关市场占有领先地位,目前是全球最大的汽车开关市场,预计2024年销售量将占全球总销售量的49.88%。凭藉中国、日本、韩国和印度强大的供应链丛集,以及充足的电动车奖励,随着全球汽车製造商扩大在地化生产,亚太地区始终处于领先地位。泰国首个电动皮卡计画和印尼富含镍的电池走廊进一步巩固了亚太地区的领先地位。

儘管中东和非洲地区面积较小,但到2030年,其复合年增长率将达到7.58%,成为成长最快的地区。沙乌地阿拉伯价值29亿美元的汽车计划储备,包括Seah投资13亿美元的电动车综合体,以及计画在2025年建成的5万个公共充电桩,正在推动海湾地区各国对电动车的需求。杜拜到2030年实现4.2万辆电动车的目标,进一步拉大了成长差距。

北美和欧洲市场保持强劲势头,将高端品牌与高配置的ADAS(高级驾驶辅助系统)和资讯娱乐系统结合。南美市场正在崛起,巴西斥资300亿雷亚尔(约60亿美元)的Stellantis计画确保了区域製造能力的提升。生产能力靠近最终组装地点的供应商更有能力应对不断变化的贸易和合规压力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 汽车电气化进程

- 高级资讯娱乐和ADAS功能的成长

- 新兴国家汽车产量增加

- 高端室内设计对照明和电容式开关的需求

- 采用触觉/压力触摸开关技术

- 功能安全(ISO 26262)冗余开关设计的需求

- 市场限制

- 铜和稀土原料价格波动;

- 朝向基于显示器的触控介面转变

- 触觉穹顶子组件供应瓶颈

- 更严格的电磁相容性法规会增加检验成本。

- 价值链分析

- 技术展望

- 监管环境

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按开关类型

- 机械开关

- 旋钮

- 按钮

- 置物柜

- 拨动开关/拨片

- 触控开关

- 电容式垫片

- 触觉回馈

- 多功能/组合模组

- 机械开关

- 透过使用

- 指示器系统开关

- 暖通空调控制

- 电动车窗/车门锁开关

- 方向盘控制开关

- 座椅和内装舒适性开关

- 灯光和雨刷开关

- 发动机管理系统(EMS)开关

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型/大型商用车辆

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Alps Alpine Co. Ltd

- Robert Bosch GmbH

- Continental AG

- HELLA GmbH & Co KGaA

- Omron Corporation

- Panasonic Holdings Corp

- Tokai Rika Co. Ltd

- Minda Corporation Ltd

- ZF Friedrichshafen AG

- Leopold Kostal GmbH & Co. KG

- Valeo SA

- Toyodenso Co Ltd

- TE Connectivity Ltd

- LS Automotive

- Denso Corporation

- Nidec Mobility

- Joyson Electronics

第七章 市场机会与未来展望

The automotive switch market size stands at USD 44.08 billion in 2025 and is forecast to reach USD 57.31 billion by 2030, advancing at a 5.39% CAGR.

The upswing reflects a wider transition to software-defined vehicles where switches act as frontline human-machine interfaces that connect mechanical feel with electronic intelligence. Electrification now shapes material demand and cost structures, as each battery-electric vehicle needs far more copper and high-voltage circuitry than its combustion counterpart. Greater infotainment and ADAS content, the push for luxurious illuminated cabins, and stricter ISO 26262 safety rules all raise the functional expectations placed on every switch. Competitive rivalry intensifies as haptic and capacitive technologies challenge the mechanical status quo, while supply-chain shocks surrounding copper and rare-earths force manufacturers to rethink sourcing, cost hedging, and regional production footprints.

Global Automotive Switch Market Trends and Insights

Rise in Vehicle Electrification

Electric powertrains introduce unique control needs-battery management, regenerative braking, and thermal optimization all require purpose-built switches that tolerate higher voltage while preserving tactile response. Panasonic Automotive's centralized ECU architecture shows how electronics content balloons once combustion hardware is removed. Brazil's plug-in sales jumped 90% in 2024 to 177,360 units, underscoring how quickly demand patterns shift. China's plan to launch cars using 100% domestically sourced chips by 2026 will further reshape component procurement paths . These forces collectively lift the automotive switch market by broadening both unit volumes and the variety of switch functions.

Growth of Advanced Infotainment & ADAS Features

Cloud-linked cockpits built on Qualcomm's Snapdragon platforms require multifunction controllers able to talk to exterior sensors, voice assistants, and over-the-air update back-ends. Continental's programmable haptic knob enables a single dial to mimic many different detents, satisfying space and styling goals in next-generation dashboards . Safety-critical ADAS layers demand switches certified to ISO 26262, ensuring redundant actuation for features such as lane-keeping. The retrofit ADAS aftermarket, approaching USD 1 billion, expands addressable demand among older vehicles seeking new safety functions.

Volatile Prices of Copper & Rare-Earth Inputs

Copper prices climbed nearly 20% after February 2024 and are on track to top USD 15,000 per ton in 2025, inflating the bill-of-materials for every mechanical switch that uses high-purity contacts. Parallel restrictions on Chinese rare-earth exports have already forced short production pauses at OEMs, including Suzuki and Ford. Switch makers are hedging material costs, redesigning contact layouts, and evaluating lower-mass alloys to protect margins inside the automotive switch market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Vehicle Output in Emerging Economies

- Premium-Interior Demand for Illuminated & Capacitive Switches

- Shift Toward Display-Based Touch Interfaces

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mechanical designs retained 93.82% of 2024 revenue, proving their reliability in temperature, dust, and vibration extremes. Buttons handle high-frequency user tasks, rocker units govern binary functions, and paddles manage steering-mounted commands. The automotive switch market size for mechanical variants is projected to expand steadily even as displays grow, because safety codes continue to demand tactile backup controls.

Touch-based switches hold modest volume today but carry an 8.17% CAGR to 2030 as luxury and mass-premium trims migrate to flush lit panels. Continental's electrostatic feedback knob reproduces mechanical detents without gears, and Snaptron's solderable tactile domes can double annual output capacity. This convergence blurs the line: hybrid modules bundle capacitive sensing beneath a thin plastic cap yet still generate a click, giving OEMs styling freedom while maintaining the legacy feel expected in the automotive switch market.

Indicator controls owned 25.11% of 2024 revenue because every jurisdiction mandates robust signaling for turn, hazard, and warning functions. The automotive switch market size for indicator applications remains secure even in fully digital cockpits, as external lighting commands must work when screens fail.

HVAC interfaces earn the fastest 5.57% CAGR thanks to range-sensitive thermal logic in electric cars. Tokai Rika's in-mold-painting process, already used on Toyota's Hiace, slashes energy use during manufacturing while delivering scratch-resistant fascias. Climate controls cannot disappear into touchscreens entirely; users need immediate tactile access to demist or defrost, sustaining demand across the automotive switch market.

The Automotive Switch Market Report is Segmented by Switch Type (Mechanical Switches, Touch-Based Switches, and More), Application (Indicator System Switches, HVAC Controls, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific spearheads the automotive switch market with 49.88% revenue in 2024, making it the largest market today. Entrenched supply clusters in China, Japan, South Korea, and India, plus robust EV incentives, keep the region in front as global OEMs scale local production. Thailand's first electric pickup program and Indonesia's nickel-rich battery corridor reinforce APAC's leadership.

The Middle East & Africa, while smaller, posts the fastest 7.58% CAGR through 2030. Saudi Arabia's USD 2.9 billion pipeline of automotive projects, including Ceer's USD 1.3 billion EV complex, alongside 50,000 public chargers planned by 2025, accelerates switch demand across Gulf economies. Dubai's target of 42,000 EVs by 2030 further widens the growth gap.

North America and Europe retain strong positions by marrying premium nameplates with high-content ADAS and infotainment systems. South America gains steady ground as Brazil's R$30 billion (USD 6.0 billion) Stellantis program secures regional manufacturing. Suppliers able to locate production close to final assembly sites remain best placed to navigate evolving trade and compliance pressures.

- Alps Alpine Co. Ltd

- Robert Bosch GmbH

- Continental AG

- HELLA GmbH & Co KGaA

- Omron Corporation

- Panasonic Holdings Corp

- Tokai Rika Co. Ltd

- Minda Corporation Ltd

- ZF Friedrichshafen AG

- Leopold Kostal GmbH & Co. KG

- Valeo SA

- Toyodenso Co Ltd

- TE Connectivity Ltd

- LS Automotive

- Denso Corporation

- Nidec Mobility

- Joyson Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in vehicle electrification

- 4.2.2 Growth of advanced infotainment & ADAS features

- 4.2.3 Rising vehicle output in emerging economies

- 4.2.4 Premium-interior demand for illuminated & capacitive switches

- 4.2.5 Adoption of haptic/force-touch switch technology

- 4.2.6 Functional-safety (ISO 26262) need for redundant switch designs

- 4.3 Market Restraints

- 4.3.1 Volatile prices of copper & rare-earth inputs

- 4.3.2 Shift toward display-based touch interfaces

- 4.3.3 Supply bottlenecks in tactile-dome sub-components

- 4.3.4 Tighter EMC limits raising validation costs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Switch Type

- 5.1.1 Mechanical Switches

- 5.1.1.1 Knob

- 5.1.1.2 Button

- 5.1.1.3 Rocker

- 5.1.1.4 Toggle/Paddle

- 5.1.2 Touch-based Switches

- 5.1.2.1 Capacitive Touchpad

- 5.1.2.2 Haptic-feedback Surface

- 5.1.3 Multifunction / Combination Modules

- 5.1.1 Mechanical Switches

- 5.2 By Application

- 5.2.1 Indicator System Switches

- 5.2.2 HVAC Controls

- 5.2.3 Power Window and Door-Lock Switches

- 5.2.4 Steering-Wheel Control Switches

- 5.2.5 Seat and Interior Comfort Switches

- 5.2.6 Lighting and Wiper Switches

- 5.2.7 Engine-Management (EMS) Switches

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Egypt

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Alps Alpine Co. Ltd

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Continental AG

- 6.4.4 HELLA GmbH & Co KGaA

- 6.4.5 Omron Corporation

- 6.4.6 Panasonic Holdings Corp

- 6.4.7 Tokai Rika Co. Ltd

- 6.4.8 Minda Corporation Ltd

- 6.4.9 ZF Friedrichshafen AG

- 6.4.10 Leopold Kostal GmbH & Co. KG

- 6.4.11 Valeo SA

- 6.4.12 Toyodenso Co Ltd

- 6.4.13 TE Connectivity Ltd

- 6.4.14 LS Automotive

- 6.4.15 Denso Corporation

- 6.4.16 Nidec Mobility

- 6.4.17 Joyson Electronics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment