|

市场调查报告书

商品编码

1851448

乙醇胺:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Ethanolamines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

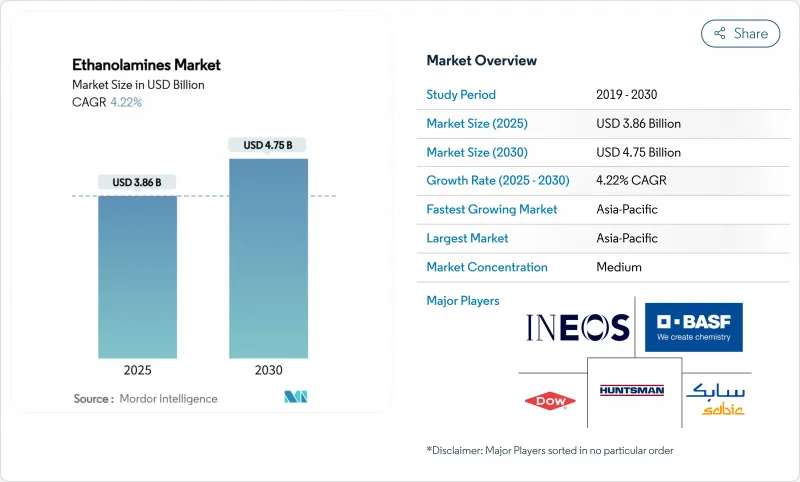

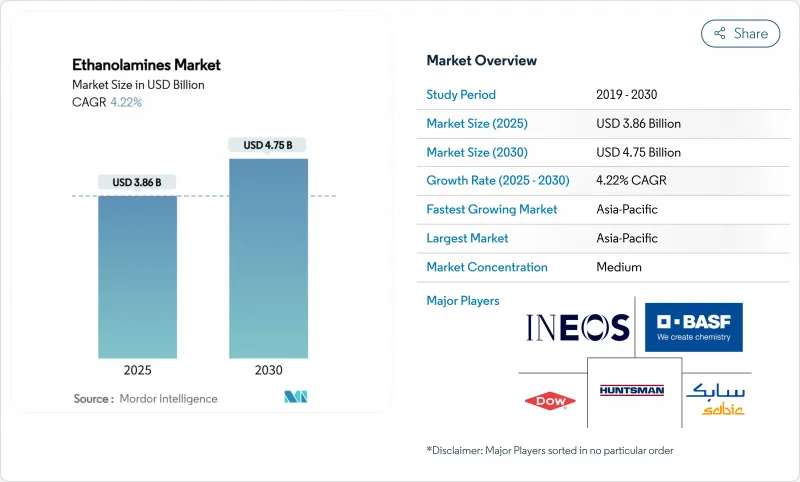

预计到 2025 年乙醇胺市场规模将达到 38.6 亿美元,到 2030 年将达到 47.5 亿美元,年复合成长率为 4.22%。

来自天然气加工、清洁剂、农业化学品和先进製造业的强劲需求,使乙醇胺的销售保持稳定,即便生产商面临日益严格的安全和环境法规。原料的后向整合交易,例如英力士收购利安德巴塞尔的环氧乙烷及其衍生物资产,显示主要供应商如何在确保供应安全的同时获得成本优势。以美国环保署将于2025年8月生效的乙醇胺新用途重要规则为首的监管变革,正在鼓励对生物基路线的投资,同时又不影响传统应用领域的近期消费。同时,BASF在安特卫普和诺力昂在瑞典等老牌企业扩大产能,使乙醇胺市场能够在满足日益增长的永续性需求的同时,维持区域供应安全。

全球乙醇胺市场趋势与洞察

新兴国家的快速工业化

中国、印度、印尼和越南固定资产投资的快速成长刺激了乙醇胺在气体脱硫剂、水泥添加剂和製程化学品领域的新消费。中国针对先进电池原料的一揽子政策将直接增加电解液精炼计划对单乙醇胺的需求。印度不断扩大的生质乙醇产能将增强未来可再生乙醇胺工厂的原料供应,支持其出口导向特种化学品丛集,同时降低进口依赖。东南亚建设计画的扩张将增加对水泥助磨剂用三乙醇胺的需求,同时区域公用事业公司正在部署胺基二氧化碳捕集装置,以实现燃煤和燃气发电厂的脱碳。都市化的加速将提高人均清洁剂和个人保养用品的购买量,从而对錶面活性剂级乙醇胺产生结构性拉动。这些趋势共同推动了乙醇胺市场的中期扩张。

为耐除草剂作物,Glyphosate产量激增

儘管关于杂草抗药性的争论日益激烈,巴西、阿根廷和美国的抗除草剂大豆和玉米种植面积仍在持续扩大,这维持了Glyphosate的大规模合成,而草甘膦的合成依赖于乙醇胺中和步骤。跨国製剂生产商正将生产转移到成本更具竞争力的亚洲,这为乙醇胺市场提供了新的需求管道,但并未改变全球消费量。在开发中国家,农业机械化宣传活动正在增加Glyphosate的使用量。新的双敲除方案将Glyphosate与互补活化剂混合使用,通常会增加每公顷的总胺需求量。虽然欧盟监管机构呼吁减少合成农药的使用,但这些法规通常只是将生产转移到更友善的地区,而不是限制绝对使用。因此,Glyphosate带来的短期成长动能有利于乙醇胺市场的成长。

环氧乙烷原料价格不稳定

环氧乙烷现货价格对石脑油和天然气价格波动高度敏感,在价格突然上涨期间,这会对独立乙醇胺生产商造成压力。 2025年初,由于烯烃利润为负且营运成本过高,韩国多家裂解装置停产,导致亚太地区环氧乙烷供应趋紧。BASF和陶氏等大型综合企业透过将环氧乙烷的流向利润更高的衍生性商品来应对市场波动,凸显了其结构性优势,从而巩固了市场集中度。苏伊士运河和巴拿马运河的货物运输中断进一步增加了原料套利流动的不确定性。小型配方商透过降低开工率或转嫁额外费用来应对,但持续的价格衝击可能会扰乱对价格敏感的应用领域(例如通用清洁剂)的需求。在原料价格趋势恢復正常之前,乙醇胺市场在短期内将被拖累。

细分市场分析

2024年,单乙醇胺的销售额将占总销售额的45.18%,这主要得益于稳定的天然气脱硫剂产量、蓬勃发展的碳捕集试点计画以及在清洁剂领域的广泛应用。预计到2030年,该细分市场将以6.80%的复合年增长率成长,进一步巩固其在乙醇胺市场的核心地位。单乙醇胺的高反应活性使其配方师能够客製广泛的pH频谱,从而保持其在各行业的应用价值。同时,二乙醇胺在金属加工液和除草剂中和剂领域保持着强劲的地位,其优异的缓蚀性能提升了其价值。三乙醇胺在水泥助磨剂领域取得了显着进展,可使水泥抗压强度提高高达5兆帕,从而缩短大型基础设施计划的维护时间。

三大主要等级产品的多元化配置能够帮助供应商抵御下游产业需求波动的影响。炼油厂和钢铁厂碳捕获技术的进步可能会大幅增加单乙醇胺的需求,而个人护理产业的优质化则有助于提升三乙醇胺的利润率。这些因素共同动态,使得乙醇胺市场在产品层面保持了良好的平衡。

传统的环氧乙烷工艺,由于数十年的优化和沈没资本的积累,到2024年将占全球加工产能的92.16%。然而,在可再生能源含量强制性要求和企业净零排放目标的推动下,生质乙醇路线预计将以7.24%的复合年增长率加速发展。泰国和巴西的早期商业化工厂表明,农业废弃物衍生的生物乙烯可以无缝整合到现有的胺化製程中,从而降低下游认证的门槛。欧洲的碳边境调节机制可以透过对隐含排放进行定价来缩小成本差距,引导未来的支出转向低碳路线。

製程强化措施,包括连续反应器系统、膜分离和催化重排等,使传统技术在成本上保持竞争力。然而,愿意为经认证的低碳分子支付溢价的品牌所有者,为生物基供应商提供了极具吸引力的市场立足点。由此形成的双路线框架,既能确保充足的供应,又能促进整个乙醇胺市场的技术升级。

区域分析

亚太地区预计到2024年将占全球收入份额的46.81%,这主要得益于不断扩张的石化联合企业、具有竞争力的劳动力以及下游製造地。中国炼油企业持续推动单乙醇胺生产线的产能提升,以满足国内清洁剂和电子化学品客户的需求;而印度生质乙醇的蓬勃发展,则使印度次大陆成为未来可再生乙醇胺的出口中心。东南亚作物保护製剂生产商,主要集中在泰国和越南,将受益于该地区作物保护支出的成长。

北美拥有强大的生产基地,以德克萨斯州和路易斯安那州的氧化物衍生物产业丛集为核心。英力士斥资7亿美元收购利安德巴塞尔的工厂,确保了与天然气脱硫剂授权商签订的长期供应协议所需的原料供应。亨斯迈在伍德兰兹的E-GRADE扩建项目瞄准半导体精炼市场,并为该地区提供了一种能够抵御大宗商品利润週期波动的增值对冲手段。

欧洲严格的碳政策,例如BASF在安特卫普的14万吨产能升级项目,正在推动低排放装置的投资。诺力昂在斯滕松德获得的ISCC PLUS认证,透过确保可追溯的可再生原料,刺激了个人护理产品的需求。碳边境定价预计将提高高排放气体乙醇胺的进口溢价,间接有利于获得认证的欧洲产品。这些区域动态有助于建立一个平衡的全球网络,从而保障乙醇胺的稳定供应。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 新兴国家的快速工业化

- 为耐除草剂作物,Glyphosate产量激增

- 电动汽车製造业对水基金属加工液的需求不断增长

- 在农药产业中不断扩大应用

- 生物基界面活性剂配方在个人护理领域的成长

- 市场限制

- 环氧乙烷原料价格不稳定

- 杂草抗药性的增强抑制了对Glyphosate的需求。

- 环境友善生物溶剂的出现,对乙醇胺构成挑战

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 单乙醇胺(MEA)

- 二乙醇胺(DEA)

- 三乙醇胺(TEA)

- 透过技术

- 环氧乙烷路线

- 生质乙醇路线

- 透过使用

- 气体处理

- 除草剂(Glyphosate)

- 界面活性剂和清洁剂

- 水泥和混凝土添加剂

- 个人护理配方

- 金属加工油

- 其他用途

- 按最终用户行业划分

- 石油和天然气

- 农业

- 建造

- 个人护理

- 纺织品

- 冶金与金属加工

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Amines & Plasticizers ltd.

- BASF

- Dow

- Huntsman Corporation

- INEOS

- NIPPON SHOKUBAI CO., LTD.

- Nouryon

- OUCC

- SABIC

- Sintez OKA Group

- Thai Ethanolamines Co.

- Tosoh Corp.

第七章 市场机会与未来展望

The ethanolamines market size reached USD 3.86 billion in 2025 and is projected to touch USD 4.75 billion by 2030, advancing at a 4.22% CAGR.

Healthy demand from gas treatment, detergents, agrochemicals and advanced manufacturing keeps volumes stable even as producers confront stricter safety and environmental rules. Feedstock-backward integration deals, such as INEOS's purchase of LyondellBasell's ethylene oxide and derivatives assets, illustrate how leading suppliers secure cost advantages while locking in supply certainty. Regulatory shifts-most notably the United States Environmental Protection Agency's significant-new-use rules for ethanolamines entering force in August 2025-encourage investments in bio-based routes without eroding near-term consumption in conventional applications. Meanwhile, incremental capacity expansions by incumbents like BASF in Antwerp and Nouryon in Sweden position the ethanolamines market to meet rising sustainability requirements while preserving regional supply security.

Global Ethanolamines Market Trends and Insights

Rapid industrialisation in emerging economies

Surging fixed-asset investment across China, India, Indonesia and Vietnam stimulates fresh consumption of ethanolamines for gas sweetening, cement additives and process chemicals. Chinese policy packages that target advanced battery raw materials directly raise monoethanolamine offtake for electrolyte purification projects. India's widening bio-ethanol capacity reinforces future feedstock availability for renewable ethanolamines plants, lowering import dependence while supporting export-oriented specialty chemicals clusters. Expanding construction programs in Southeast Asia lift triethanolamine demand for cement grinding aids, while regional utilities deploy amine-based CO2 capture to decarbonize coal and gas-fired plants. Urbanisation unlocks higher per-capita purchases of detergents and personal-care items, embedding a structural pull for surfactant-grade ethanolamines. Collectively, these trends embed a broad-based, medium-term uplift in the ethanolamines market.

Surging glyphosate production for herbicide-tolerant crops

Even as weed-resistance debates intensify, acreage sown with herbicide-tolerant soybean and maize varieties keeps expanding in Brazil, Argentina and the United States, sustaining large synthesis volumes for glyphosate that rely on ethanolamines neutralisation steps. Multinational formulators are relocating production to cost-competitive Asian hubs, giving the ethanolamines market fresh demand corridors without altering global consumption totals. In developing economies, farm-mechanisation campaigns elevate glyphosate usage because labour-saving herbicides remain cheaper than manual weeding. New double-knock programs that mix glyphosate with complementary actives often boost total amine requirements per hectare. Although regulators in the European Union push for reduced synthetic loads, these restrictions typically shift manufacturing to friendlier jurisdictions rather than curbing absolute tonnage. Consequently, near-term momentum from glyphosate maintains a positive swing factor for ethanolamines market growth.

Volatile ethylene oxide feedstock prices

Spot ethylene-oxide quotes remain highly sensitive to naphtha and natural-gas swings, squeezing standalone ethanolamines producers during sudden upcycles. Several South Korean crackers idled in early 2025 because negative olefin margins rendered operations uneconomic, tightening ethylene-oxide supply in the wider Asia-Pacific basin. Integrated majors such as BASF and Dow weather volatility better by reallocating oxide streams to the highest-margin derivatives, underscoring structural advantages that reinforce market concentration. Freight disruptions through the Suez and Panama canals add further unpredictability to feedstock arbitrage flows. Smaller formulators respond by trimming run rates or passing through surcharges, yet prolonged price shocks risk demand destruction in price-sensitive applications like commodity detergents. Net impact is a near-term drag on the ethanolamines market until feedstock trends normalise.

Other drivers and restraints analyzed in the detailed report include:

- Rising demand for water-based metal-working fluids in EV manufacturing

- Increasing utilization in the agrochemical industry

- Increasing weed resistance to weaken glyphosate demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monoethanolamine held 45.18% of 2024 revenues, supported by steady gas-sweetening runs, burgeoning carbon-capture pilots and broad detergent usage. The segment is forecast to post a 6.80% CAGR to 2030, reinforcing its anchor role in the ethanolamines market. Monoethanolamine's high reactivity allows formulators to tailor a wide pH spectrum, sustaining cross-industry relevance. Meanwhile, diethanolamine retains a solid niche in metal-working fluids and herbicide neutralisation, with coproduct value uplift from improved corrosion-inhibition performance. Triethanolamine advances in cement grinding aids, delivering up to 5 MPa compressive-strength gains that shorten curing times on major infrastructure projects.

Diversification across three primary grades protects suppliers from demand swings in any one downstream sector. Carbon-capture retrofits in refineries and steel mills could sharply raise monoethanolamine call-offs, whereas personal-care premiumisation supports triethanolamine margin resilience. Together, these dynamics keep the ethanolamines market well balanced at the product level.

The legacy ethylene-oxide process represented 92.16% of global throughput in 2024, reflecting decades of optimisation and sunk-capital advantages. Even so, the bio-ethanol pathway is predicted to accelerate at a 7.24% CAGR, propelled by renewable-content mandates and corporate net-zero targets. Early commercial plants in Thailand and Brazil demonstrate that agricultural-residue-derived bio-ethylene can integrate seamlessly into existing amination trains, reducing downstream qualification hurdles. Carbon-border-adjustment schemes in Europe tighten the cost gap by pricing embedded emissions, tilting future expenditures toward low-carbon routes.

Process intensification efforts-continuous reaction systems, membrane-based separations and catalysed rearrangements-keep legacy technology competitive on cash cost. Still, brand owners willing to pay premiums for certified-low-carbon molecules grant bio-based suppliers an attractive foothold. The resulting dual-pathway framework ensures ample supply while catalysing technology upgrades across the wider ethanolamines market.

The Ethanolamines Market Report is Segmented by Product Type (Monoethanolamine, Diethanolamine, and More), Technology (Ethylene Oxide Route and Bio-Ethanol Route), Application (Gas Treatment, Herbicides, and More), End-User Industry (Oil and Gas, Agriculture, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with a 46.81% revenue share in 2024, buoyed by integrated petrochemical complexes, competitive labour and expanding downstream manufacturing hubs. Chinese refiners continually debottleneck mono-ethanolamine lines to serve domestic detergent and electronic-chemicals customers, while India's bio-ethanol surge positions the subcontinent as a future export base for renewable ethanolamines. Southeast Asia's agrochemical formulators, concentrated in Thailand and Vietnam, offer further pull as regional crop-protection spending climbs.

North America retains a robust production backbone anchored by Texas and Louisiana oxide-derivative clusters. INEOS's USD 700 million purchase of LyondellBasell's facility secures feedstock for long-term supply contracts with gas-sweetening licensors. Huntsman's E-GRADE expansion in The Woodlands targets semiconductor-purification niches, giving the region a value-added hedge against commodity margin cycles.

Europe's stringent carbon agenda steers investment toward low-emission units, exemplified by BASF's 140,000-ton upgrade in Antwerp. Nouryon's ISCC PLUS accreditation at Stenungsund spurs personal-care demand by enabling traceable renewable content. Carbon-border-adjustment pricing is expected to elevate import premiums on high-emission ethanolamines, indirectly favouring certified European output. Collectively, these regional dynamics sustain a balanced global network that underpins steady flows in the ethanolamines market.

- Amines & Plasticizers ltd.

- BASF

- Dow

- Huntsman Corporation

- INEOS

- NIPPON SHOKUBAI CO., LTD.

- Nouryon

- OUCC

- SABIC

- Sintez OKA Group

- Thai Ethanolamines Co.

- Tosoh Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid industrialisation in emerging economies

- 4.2.2 Surging glyphosate production for herbicide-tolerant crops

- 4.2.3 Rising demand for water-based metal-working fluids in EV manufacturing

- 4.2.4 Increasing utilization in the agrochemical industry

- 4.2.5 Growth in bio-based surfactant formulation in personal-care

- 4.3 Market Restraints

- 4.3.1 Volatile ethylene oxide feedstock prices

- 4.3.2 Increasing Weed Resistance to Weaken the Demand for Glyphosate

- 4.3.3 Emergence of greener bio-solvents challenging ethanolamines

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Monoethanolamine (MEA)

- 5.1.2 Diethanolamine (DEA)

- 5.1.3 Triethanolamine (TEA)

- 5.2 By Technology

- 5.2.1 Ethylene Oxide Route

- 5.2.2 Bio-ethanol Route

- 5.3 By Application

- 5.3.1 Gas Treatment

- 5.3.2 Herbicides (Glyphosate)

- 5.3.3 Surfactants & Detergents

- 5.3.4 Cement & Concrete Additives

- 5.3.5 Personal-care Formulations

- 5.3.6 Metal-working Fluids

- 5.3.7 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Oil and Gas

- 5.4.2 Agriculture

- 5.4.3 Construction

- 5.4.4 Personal Care

- 5.4.5 Textile

- 5.4.6 Metallurgy and Metalworking

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacifc

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacifc

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Amines & Plasticizers ltd.

- 6.4.2 BASF

- 6.4.3 Dow

- 6.4.4 Huntsman Corporation

- 6.4.5 INEOS

- 6.4.6 NIPPON SHOKUBAI CO., LTD.

- 6.4.7 Nouryon

- 6.4.8 OUCC

- 6.4.9 SABIC

- 6.4.10 Sintez OKA Group

- 6.4.11 Thai Ethanolamines Co.

- 6.4.12 Tosoh Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment