|

市场调查报告书

商品编码

1851453

药品包装:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

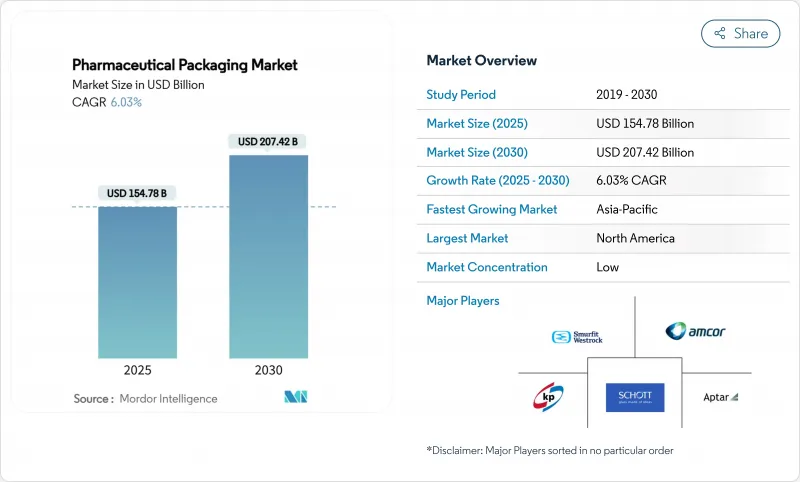

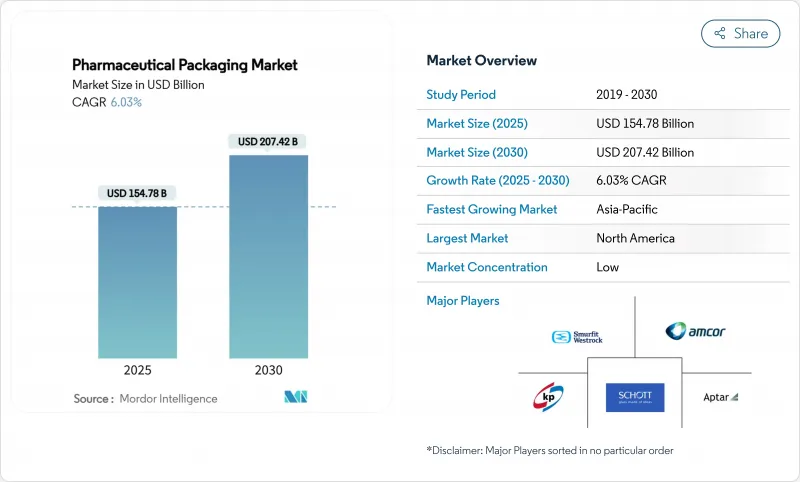

预计到 2025 年,药品包装市场规模将达到 1,547.8 亿美元,到 2030 年将达到 2,074.2 亿美元,年复合成长率为 6.03%。

未来五年,生技药品产量不断增长、全球可追溯性法规日益严格以及永续性推进,将继续推动资本流入新的灌装生产线、高阻隔材料和循环经济型设计领域。随着基因和细胞疗法达到商业性规模,对能够满足更小批量、个人化治疗需求的灵活包装产能的需求也将随之增长。亚太地区8.96%的复合年增长率反映了国内药品产量的成长和医疗覆盖范围的扩大。材料策略正处于不断变化之中,塑胶仍占据市场主导地位,但随着欧盟和美国PFAS法规即将实施,生物基聚合物、无铝泡壳和消费后回收薄膜正迅速从试点生产转向量产。同时,聚乙烯、聚丙烯和PET价格的波动正在收窄利润净利率,促使大型加工商签订长期供应商合约并进行垂直整合。

全球医药包装市场趋势与洞察

人口老化和慢性病流行

人口平均年龄的成长将推动长期用药需求的增加,从而支撑对日历式泡壳、大尺寸标籤和单手开启管瓶的稳定需求,这些包装有助于提高行动不便患者的用药依从性。德国2024年的疫苗接种计画调整,肺炎链球菌疫苗接种量增加23%,B族脑膜炎双球菌疫苗接种量增加52%,显示老年人对预防保健的接受度正在提高。包装供应商正在积极回应,推出可记录开启事件并将依从性资料传输给医疗团队的智慧包装。随着支付方将报销与实际疗效挂钩,智慧封口和支援NFC功能的纸匣的需求将进一步成长。

扩大生技药品和注射产品线

预填充式注射器对于新生物製药的上市至关重要,因为它们简化了患者自行给药流程,最大限度地降低了污染风险,并减少了灌装结束时的废弃物。 BD 的 iDFill™ 注射器整合了 RFID 技术,可即时识别;而 Neopak™ XtraFlow™ 设计可容纳以往只能管瓶包装的黏稠製剂。 GMP 附录 1 的修订正在加速市场对即用型玻璃管和聚合物容器的需求,这些容器无需清洗和除热原步骤,有助于 CDMO 在无需新建无尘室的情况下扩大产能。

石油衍生树脂的价格波动

供应中断和不可抗力事件导致PET价格在2024年6月上涨1.1%,进一步挤压了加工业者本已微薄的利润空间。医药接触材料的规格限制了快速更换等级的能力,迫使许多加工商要么承担更高的成本,要么重新谈判长期合约。瓦楞纸板供应商也面临纤维成本上涨的困境,并宣布将于2025年1月将价格上调70美元/吨。

细分市场分析

到2024年,塑胶将占药品包装市场45.64%的份额,其中以高密度聚乙烯(HDPE)瓶、聚丙烯(PP)瓶盖和聚对苯二甲酸乙二醇酯(PET)泡壳包装为主,这些产品在成本和阻隔性能之间取得了良好的平衡。然而,随着品牌所有者推行循环经济目标,该领域的成长速度将会放缓。在塑胶领域,由于抗碎裂环烯烃材料的出现,聚丙烯(PP)注射器的市场规模正在稳定成长。玻璃仍然是光敏性和湿敏性生技药品包装的必备材料,而i型硼硅酸管瓶儘管重量较重且存在破碎风险,但正逐渐成为细胞毒性填充剂的主流包装。金属则在气雾剂和植入式医疗器材领域发挥独特的作用。

生物基树脂、再生PET中阻隔膜以及纸质药瓶(例如阿勒格尼健康网络的TallyTube试点计画)正蓬勃发展。研发供应商在产品大规模上市前会考虑保质期保证、萃取物特性以及生产线切换成本,而早期采用这些产品的医院则会在供应商审核中加入永续性评分,以赢得采购竞标。

区域分析

到2024年,北美将占全球药品包装市场35.32%的份额,其中1,600亿美元的投资将用于提升生技药品产能和增强国内供应韧性。 《药品供应链安全法案》(DSCSA)的序列化法规将促进编码设备的升级,而全氟烷基和多氟烷基物质(PFAS)的早期淘汰将推动聚合物再製造。德国2024年的药品产量将下降1.5%,但mRNA、基因和放射性药物研发投入的持续成长将推动高阻隔包装的需求。随着生产者责任费的扩大,可回收包装形式将获得奖励,预计全部区域的包装收入将从2024年的1530亿欧元增加到2029年的1860亿欧元。

亚太地区将达到最高的复合年增长率,达到8.96%。中国和印度将扩大原料药生产,吸引合约研发生产机构(CDMO)的投资,这些机构需要在更严格的供应链安全法规下采购本地包装。日本药品医疗器材管理局(PMDA)的严格标准与欧盟的无菌升级标准相呼应,将迫使企业儘早采用符合附件一标准的隔离器。地缘政治变化带来风险:中国的反间谍法可能会使与包装序列化合作伙伴的技术转移和资料共用变得复杂。在全部区域,医疗保健的扩张和分散式临床模式正在推动可邮寄、温控运输包装的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 人口老化和慢性病流行

- 扩大生技药品和注射产品线

- 永续性主导的材料替代

- 强制性数位可追溯性(例如,DSCSA、欧盟FMD)

- 人工智慧赋能的自适应灌装生产线(报道不足)

- 居家/分散式临床试验数量增加,需要即用型试剂盒(未充分报告)

- 市场限制

- 石油衍生树脂价格波动

- 资本密集的无菌和验证要求

- 欧盟和美国即将推出 PFAS/氟聚合物法规(通报不足)

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 材料

- 塑胶

- 高密度聚苯乙烯

- 低密度聚乙烯和线性低密度聚乙烯

- PET

- 其他塑料

- 玻璃

- I型硼硅酸

- II 型处理钠石灰

- 第三型钠石灰

- 金属

- 纸和纸板

- 生物聚合物和其他材料

- 塑胶

- 按包装级别

- 初级包装

- 瓶子

- 预填充式注射器

- 管瓶和安瓿

- 泡壳包装

- 二级包装

- 纸箱和纸套

- 标籤和插页

- 三级包装

- 纸板运输箱

- 托盘和防护系统

- 初级包装

- 依产品类型

- 瓶子

- 预填充式注射器

- 管瓶和安瓿

- 泡壳包装

- 盖子与封口装置

- 管状和袋状

- 其他产品类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor plc

- Gerresheimer AG

- Schott AG

- West Pharmaceutical Services Inc.

- AptarGroup Inc.

- Smurfit WestRock

- Becton, Dickinson & Company

- Catalent Inc.

- CCL Industries Inc.

- Klockner Pentaplast Group

- Nipro Corporation

- Vetter Pharma International GmbH

- McKesson Corporation

- FlexiTuff International Ltd.

- WL Gore & Associates Inc.

- Stevanato Group

- Corning Incorporated

- Owen-Illinois Inc.

- SGD Pharma

第七章 市场机会与未来展望

The pharmaceutical packaging market size reached USD 154.78 billion in 2025 and is forecast to rise to USD 207.42 billion by 2030, advancing at a 6.03% CAGR.

Over the next five years, escalating biologics output, stricter global traceability rules, and widespread sustainability targets will keep capital flowing into new fill-finish lines, high-barrier materials, and circular-ready designs. Demand for flexible pack volumes that match smaller, personalized therapy batches will expand as gene and cell therapies reach commercial scale. North America remains the largest regional contributor, supported by DSCSA-driven serialisation, while Asia-Pacific's sizeable 8.96% CAGR reflects rising domestic drug production and broadening health coverage.Material strategies are in flux: plastics still dominate yet bio-based polymers, aluminium-free blisters, and post-consumer-recycled films move quickly from pilot to production as EU and US PFAS curbs near enforcement. Meanwhile, price swings in polyethylene, polypropylene, and PET keep margins tight, encouraging longer supplier contracts and vertical integration by larger converters.

Global Pharmaceutical Packaging Market Trends and Insights

Aging population and chronic disease prevalence

Rising median ages push long-term therapy volumes higher, underpinning consistent demand for calendar blisters, large-print labels, and one-hand-open vials that aid adherence among patients with reduced dexterity. Germany's 2024 vaccination shifts, with pneumococcal doses up 23% and meningococcal B up 52%, illustrate broader preventive-care uptake in seniors . Packaging suppliers respond with connected packs that log opening events and forward adherence data to care teams. Growth in smart closures and NFC-enabled cartons will intensify as payers link reimbursement to real-world outcomes.

Biologics and injectable pipeline expansion

Prefilled syringes sit at the core of new biologic launches because they simplify self-administration, minimise contamination risks, and reduce waste during fill-finish. BD's iDFill(TM) syringe embeds RFID for instant verification, while its Neopak(TM) XtraFlow(TM) design handles viscous formulations that were once vial-only. GMP Annex 1 revisions accelerate demand for ready-to-use glass tubing and polymer containers that bypass washing and depyrogenation steps, helping CDMOs scale capacity without constructing new cleanrooms.

Petro-derivative resin price volatility

Supply disruptions and force majeure events lifted PET prices by 1.1% in June 2024, shrinking already tight converter margins. Pharmaceutical contact material specs restrict rapid grade switches, forcing many converters to absorb cost spikes or renegotiate long contracts. Corrugated shippers also face higher fibre costs, with a USD 70 per-ton increase announced for January 2025.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability-driven material substitution

- Digital traceability mandates (DSCSA, EU-FMD)

- Capital-intensive sterility and validation requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics retained 45.64% of pharmaceutical packaging market share in 2024, anchored by HDPE bottles, PP closures, and PET blisters that balance cost and barrier needs. Yet the segment's growth moderates as brand owners court circularity objectives. Within plastics, the pharmaceutical packaging market size for PP-based syringes is rising steadily thanks to break-resistant cyclic olefin options. Glass remains indispensable for light- and moisture-sensitive biologics; Type I borosilicate vials dominate cytotoxic fills despite higher weight and shatter risk. Metals hold niche aerosol and implantable device roles.

Momentum gathers around bio-attributed resins, recycled PET mid-barrier webs, and paper-based pill bottles such as Allegheny Health Network's Tully Tube pilot. Developers weigh shelf-life assurance, extractables profiles, and line changeover costs before wide release, yet early adopters win procurement tenders from hospitals adding sustainability scoring to vendor audits.

The Pharmaceutical Plastic Packaging Market Report is Segmented by Raw Material (Polypropylene, and More), Product Type (Bottles and Solid Containers, Vials and Ampoules, and More), Packaging Format (Rigid, Flexible), Route of Drug Delivery (Oral, Parenteral/Injectable, and More), End-User (Pharma Manufacturers, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 35.32% of pharmaceutical packaging market share in 2024 as investments worth USD 160 billion target biologics capacity and domestic supply resilience. DSCSA serialisation stipulations stimulate coding machinery upgrades, and early PFAS phase-outs drive polymer reformulation. Europe balances stringent green-deal rules with high-cost energy inputs; Germany saw 1.5% output decline in 2024 yet sustained R&D outlays in mRNA, gene, and radiopharma therapies demanding high-barrier packs. Region-wide packaging revenue is expected to rise from EUR 153 billion in 2024 to EUR 186 billion by 2029 as extended-producer-responsibility fees reward recyclable formats.

Asia-Pacific records the strongest 8.96% CAGR. China and India expand API output and attract CDMO investments that need local pack sourcing under tighter supply-security rules. Japan's stringent PMDA standards enforce early adoption of Annex 1 aligned isolators, mirroring EU sterility upgrades. Geopolitical shifts introduce risk: China's anti-espionage laws potentially complicate tech transfer and data sharing for pack serialisation partners. Across the region, national healthcare expansions and decentralised clinical models spur demand for mail-ready temperature-controlled shippers.

- Amcor plc

- Gerresheimer AG

- Schott AG

- West Pharmaceutical Services Inc.

- AptarGroup Inc.

- Smurfit WestRock

- Becton, Dickinson & Company

- Catalent Inc.

- CCL Industries Inc.

- Klockner Pentaplast Group

- Nipro Corporation

- Vetter Pharma International GmbH

- McKesson Corporation

- FlexiTuff International Ltd.

- W. L. Gore & Associates Inc.

- Stevanato Group

- Corning Incorporated

- Owen-Illinois Inc.

- SGD Pharma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing population and chronic disease prevalence

- 4.2.2 Biologics and injectable pipeline expansion

- 4.2.3 Sustainability-driven material substitution

- 4.2.4 Digital traceability mandates (e.g., DSCSA, EU-FMD)

- 4.2.5 AI-enabled adaptive fill-finish lines (under-reported)

- 4.2.6 Rise of at-home/?decentralised trials needing mail-ready packs (under-reported)

- 4.3 Market Restraints

- 4.3.1 Petro-derivative resin price volatility

- 4.3.2 Capital-intensive sterility and validation requirements

- 4.3.3 Looming PFAS/fluoropolymer restrictions in EU and US (under-reported)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.1.1 HDPE

- 5.1.1.2 LDPE and LLDPE

- 5.1.1.3 PET

- 5.1.1.4 Other Plastics

- 5.1.2 Glass

- 5.1.2.1 Type I Borosilicate

- 5.1.2.2 Type II Treated Soda-lime

- 5.1.2.3 Type III Soda-lime

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.1.5 Biopolymers and Other Materials

- 5.1.1 Plastics

- 5.2 By Packaging Level

- 5.2.1 Primary Packaging

- 5.2.1.1 Bottles

- 5.2.1.2 Prefilled Syringes

- 5.2.1.3 Vials and Ampoules

- 5.2.1.4 Blister Packs

- 5.2.2 Secondary Packaging

- 5.2.2.1 Cartons and Sleeves

- 5.2.2.2 Labels and Inserts

- 5.2.3 Tertiary Packaging

- 5.2.3.1 Corrugated Shippers

- 5.2.3.2 Pallets and Protective Systems

- 5.2.1 Primary Packaging

- 5.3 By Product Type

- 5.3.1 Bottles

- 5.3.2 Prefilled Syringes

- 5.3.3 Vials and Ampoules

- 5.3.4 Blister Packs

- 5.3.5 Caps and Closures

- 5.3.6 Tubes and Pouches

- 5.3.7 Other Product Types

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia and New Zealand

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Middle East

- 5.4.4.1.1 United Arab Emirates

- 5.4.4.1.2 Saudi Arabia

- 5.4.4.1.3 Turkey

- 5.4.4.1.4 Rest of Middle East

- 5.4.4.2 Africa

- 5.4.4.2.1 South Africa

- 5.4.4.2.2 Nigeria

- 5.4.4.2.3 Egypt

- 5.4.4.2.4 Rest of Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Gerresheimer AG

- 6.4.3 Schott AG

- 6.4.4 West Pharmaceutical Services Inc.

- 6.4.5 AptarGroup Inc.

- 6.4.6 Smurfit WestRock

- 6.4.7 Becton, Dickinson & Company

- 6.4.8 Catalent Inc.

- 6.4.9 CCL Industries Inc.

- 6.4.10 Klockner Pentaplast Group

- 6.4.11 Nipro Corporation

- 6.4.12 Vetter Pharma International GmbH

- 6.4.13 McKesson Corporation

- 6.4.14 FlexiTuff International Ltd.

- 6.4.15 W. L. Gore & Associates Inc.

- 6.4.16 Stevanato Group

- 6.4.17 Corning Incorporated

- 6.4.18 Owen-Illinois Inc.

- 6.4.19 SGD Pharma

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment