|

市场调查报告书

商品编码

1851459

电磁阀:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Solenoid Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

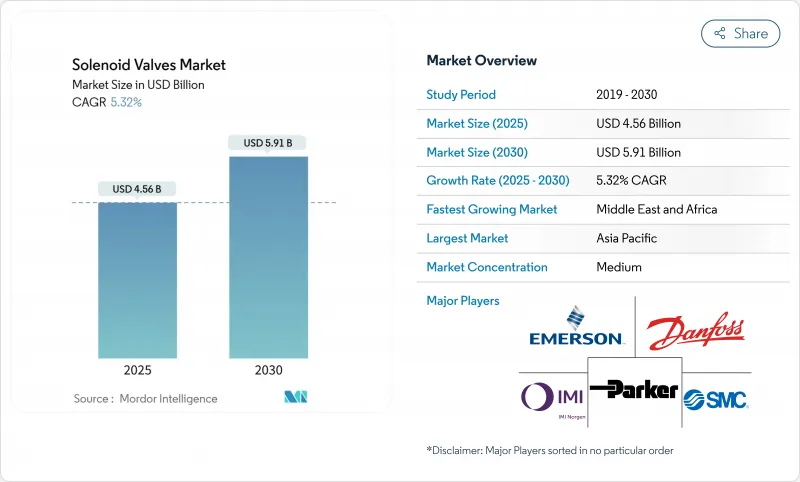

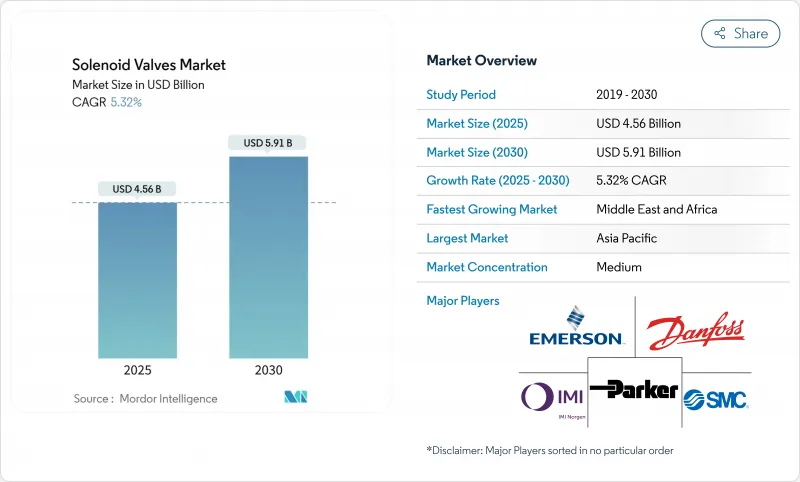

预计到 2025 年,电磁阀市场规模将达到 45.6 亿美元,到 2030 年将达到 59.1 亿美元,在此期间的复合年增长率为 5.32%。

需求将主要来自水资源再利用、页岩气井口、氢气电解槽和轻型电动车(EV)热感自动化计划。亚太地区仍维持销售主导,而中东和非洲地区由于经济多元化计划,成长速度最快。技术差异化正转向零排放驱动、支援IO-Link的诊断以及轻质工程塑料,以满足车辆续航里程目标。儘管面临来自亚洲低成本製造商日益激烈的价格竞争以及合金成本的波动,原始设备製造商(OEM)仍然优先考虑智慧、易于维护的电磁阀架构,以减少停机时间并实现预测性维护。

全球电磁阀市场趋势与洞察

欧盟和海湾合作委员会工业污水再利用计画的扩展

欧盟的《循环经济指令》和波湾合作理事会的《水资源短缺指令》正在推动对先进处理厂的投资,这些处理厂需要自动化学药剂注入、反冲洗控制和级间切换。电磁阀能够提供手动装置无法比拟的精确、低洩漏驱动,尤其是在处理配方随进水水质波动而变化的情况下。中东地区采用零液体排放装置的石油生产商倾向于选择不銹钢或双层壁阀体以及数位位置反馈装置,以满足环境审核的要求。

小型电动车温度控管迴路的普及化需要微型螺线管

新一代电动车电池冷却系统、电力电子冷却器和车厢空调系统整合了多迴路电路,这些电路依赖快速、节能的微型电磁阀。像三华汽车这样的供应商正在将冷媒型电磁阀商业化,这些电磁阀能够在容量有限的电池组中循环运行数百万次。轻量化的PEEK阀体和低功耗线圈可以提高续航里程,使这一领域成为电磁阀市场的核心成长引擎。

在高于 120 度C 的应用中,高开关循环疲劳

在蒸气管路和高温反应器中,电磁线圈容易发生加速介电击穿。虽然市面上已有优质耐高温铜线圈和全氟橡胶密封件,但高昂的材料成本限制了它们在价格敏感型计划中的应用。而那些面临维修週期延长的公用事业公司则必须选择更换为更高密度的线圈,这进一步减缓了电磁阀市场的成长。

细分市场分析

直动式电磁阀将在2024年占据42%的市场份额,预计2025年市场收入将达到19亿美元。其结构简单、压力降小、循环速度快,使其非常适合用于公用供水管和OEM机械。然而,以6.9%的复合年增长率快速发展的先导式电磁阀正日益应用于井口、动力锅炉和大型化学反应器等需要大于25毫米介面和超过100巴压力的应用领域。艾默生页岩气解决方案正是这一转变的体现,该方案将活塞隔膜与微型电磁先导相结合,能够提供每小时数千立方公尺的标准压力。升级到预测性维护平台的产业也非常青睐先导式电磁阀的低涌入电流和更安静的关闭特性。

线圈必须能够承受上游压力的波动,隔膜需要采用耐磨弹性体材料,而外壳通常整合一个螺纹感测器,用于向PLC提供资料。亚洲製造商目前正在大规模复製经典的先导式结构,这加剧了价格竞争,但也提高了新兴经济体的供应量,扩大了电磁阀市场。

双向截止阀仍是市场主导产品,占2024年销售额的55%,约占电磁阀市场23亿美元的份额。它们广泛应用于灌溉、压缩空气和基础製程隔离领域。然而,随着食品饮料和生物技术产业对快速产品切换的需求,三通切换阀预计将以每年6.4%的速度成长。这些阀门无需手动更换阀芯即可在生产、CIP清洗和灭菌流程之间切换,满足卫生製造的要求。一些製药设备将20个或更多三通阀整合到一个数位歧管中,从而减少30%的占地面积并加快安装速度。

製造商透过采用无空腔内结构和符合FDA标准的密封件来应对这项挑战,从而消除了污染物可能积聚的死角。控制软体将每个连接埠映射到一个PLC标籤,实现了基于配方的流路控制。多端口创新也已应用于半导体湿式製程台,在这些製程台上,化学品必须在几毫秒内流经多个清洗槽和蚀刻槽,这进一步推动了三通电磁阀在市场上的应用。

区域分析

亚太地区预计到2024年将占全球销售额的34%,这主要得益于中国庞大的电子产品生产能力、日本的精密机器人技术以及印度不断增长的药品出口。政府对国内半导体和电池工厂的支持正在推动相关技术的广泛应用,而日本和韩国的氢气试点计画则需要能够承受700巴气体压力的高可靠性阀门。此外,中国沿海地区的水资源再利用政策也带动了市政部门的新需求。

预计中东和非洲地区将以7.50%的复合年增长率成长,受益于沙乌地阿拉伯的「2030愿景」多元化计划和阿联酋的石化超级基地。阿曼和沙乌地阿拉伯NEOM的氢气和氨出口计画需要用于低温和高压工况的专用先导式阀门。非洲的需求成长虽然不大,但成长方向多元化,这主要得益于南非矿业脱水业务的成长和埃及食品工业的扩张。

北美页岩气、液化天然气和製药业正推动售后市场销售稳定成长。科罗拉多和德克萨斯州正在快速部署零排放井口阀,并透过监管主导的资本投资更新现有设备。在加拿大,一座碳捕集示范工厂正在寻找耐腐蚀电磁阀来处理混合二氧化碳流。欧洲作为一个成熟且创新主导的地区,正在向绿色氢能数位化製造转型。儘管整体成长放缓,但这项转型确保了智慧IO-Link阀门的价值,并巩固了电磁阀市场的高端价格分布。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟和海湾合作委员会工业污水再利用计画的扩展

- 小型电动车温度控管迴路的普及化需要微型螺线管

- 在东协地区快速维修传统饮料生产线,使其符合卫生标准。

- 美国和阿根廷页岩盆地的天然气井自动化

- 欧洲和日本氢电解槽的建设趋势

- 製药业4.0时代提升了对智慧IO-Link阀门的偏好

- 市场限制

- 在高于 120°C 的应用中,高开关循环疲劳

- 特殊合金(例如双相不銹钢)的价格波动

- 拉丁美洲现场性能验证技术纯熟劳工短缺

- 医疗器材原始设备製造商对压电微阀的竞争日益激烈

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析(如适用)

- 行业标准和法规

- 技术概览

- 电磁阀的发展演变及其在电动车/自动驾驶汽车中的新应用

- 关键设计和技术考虑因素

第五章 市场规模与成长预测

- 运行原理

- 直接作用型

- 飞行员驾驶

- 按连接埠/串流配置

- 双向

- 三人行

- 超过四边

- 按阀体材质

- 黄铜

- 防锈的

- 铝

- 工程塑胶和复合材料

- 按尺寸

- 超小型(小于5毫米)

- 超小型(5-10毫米)

- 微型(10-25毫米)

- 小光圈(25-50毫米)

- 大光圈(50毫米或以上)

- 按最终用户行业划分

- 饮食

- 过滤系统

- 灌装/注射生产线

- 车

- 气压悬吊

- 燃油喷射和废气排放

- 安全保障系统

- 变速箱和传动系统

- 其他(暖通空调、门)

- 化工/石油化工

- 储存方向控制

- 隔离阀

- 发电

- 蒸气控制和给水器

- 升降机和水泵

- 洪水系统

- 石油和天然气

- 挖掘

- 矿业

- 下游供应

- 医疗保健和製药

- 按行业(农业技术、航太、纺织、其他)

- 饮食

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、合资、智慧财产权)

- 市占率分析

- 公司简介

- Emerson Electric Co.(ASCO)

- Danfoss A/S

- Parker-Hannifin Corp.

- SMC Corp.

- IMI plc

- Burkert GmbH and Co. KG

- Curtiss-Wright Corp.

- AirTAC International Group

- Kendrion NV

- The Lee Co.

- CEME SpA

- PeterPaul Electronics Co.

- CKD Corp.

- Anshan Solenoid Valve Co.

- KANKEO SANGYO Co.

- Rotex Automation

- Festo SE and Co. KG

- ODE Srl

- GEMU Group

- Genebre SA

第七章 市场机会与未来展望

The solenoid valves market size is valued at USD 4.56 billion in 2025 and is forecast to reach USD 5.91 billion by 2030, reflecting a 5.32% CAGR over the period.

Demand stems from automation projects in water reuse, shale-gas wellheads, hydrogen electrolyzers, and compact electric-vehicle (EV) thermal loops. Asia-Pacific retains volume leadership, while the Middle East and Africa exhibits the fastest expansion because of economic diversification programs. Technology differentiation is shifting toward zero-emissions actuation, IO-Link-enabled diagnostics, and lightweight engineering plastics that satisfy automotive range targets. Despite growing price competition from low-cost Asian producers and alloy cost swings, OEMs continue to prioritize smart, service-friendly solenoid architectures that limit downtime and enable predictive maintenance.

Global Solenoid Valves Market Trends and Insights

Expansion of Industrial Waste-water Re-use Schemes in EU & GCC

Circular-economy directives in the European Union and water-scarcity mandates in the Gulf Cooperation Council are accelerating investments in advanced treatment plants that need automated chemical dosing, back-flush control, and stage switching. Solenoid valves enable precise, low-leak actuation that manual devices cannot match, especially when treatment recipes shift with feed-water variability. Oil producers adopting zero-liquid-discharge plants in the Middle East prefer stainless-steel or duplex bodies coupled with digital position feedback to meet environmental audits.

Surge in Compact EV Thermal-Management Loops Requiring Micro-Solenoids

Battery cooling, power-electronics chillers, and cabin HVAC in next-generation EVs integrate multi-loop circuits that depend on fast, energy-efficient micro-solenoids. Suppliers such as Sanhua Automotive have commercialized refrigerant versions able to cycle millions of times while operating inside constrained battery packs. Lightweight PEEK bodies and low-power coils extend driving range, making the segment a core growth engine for the solenoid valves market.

High Switching-Cycle Fatigue in >120 °C Applications

Steam lines and high-temperature reactors expose solenoid coils to accelerated insulation breakdown. Premium high-temp copper windings and perfluoro-elastomer seals are available but raise bill-of-material cost, curbing adoption in price-sensitive projects. Utilities facing extended maintenance intervals perceive risk in swapping to higher-density windings, moderating growth for the solenoid valves market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Retrofit of Legacy Beverage Lines in ASEAN for Hygienic Design

- Gas Well-Head Automation in Shale Basins of US & Argentina

- Price Volatility of Specialty Alloys (e.g., Duplex Stainless)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Direct-acting valves led the solenoid valves market with 42% share in 2024, translating to an estimated USD 1.9 billion of 2025 revenue. Their simple architecture, minimal pressure drop, and fast cycling suit utilities water lines and OEM machinery. Yet pilot-operated mechanisms, advancing at 6.9% CAGR, increasingly service wellheads, power boilers, and large chemical reactors that require ports above 25 mm and pressures exceeding 100 bar. Emerson's shale-gas solution highlights the shift, pairing a minute electromagnetic pilot with a piston diaphragm able to pass thousands of standard cubic meters per hour. Industries upgrading to predictive maintenance platforms value the lower inrush current and quieter closing profile typical of pilot-operated units.

The move alters supply-chain needs: coils must tolerate fluctuating upstream pressures, diaphragms demand abrasion-resistant elastomers, and housings often integrate threaded sensors that feed PLCs. Asian fabricators now replicate classic pilot-operated geometries at scale, intensifying price pressure but also expanding availability across emerging economies, thereby broadening the solenoid valves market.

Two-way shut-off valves remain the workhorse, holding 55% revenue in 2024, roughly USD 2.3 billion of solenoid valves market size. They dominate irrigation, compressed-air, and basic process isolation. However, as food, beverage, and biotech adopters demand rapid SKU changeovers, three-way diverter designs grow 6.4% annually. These valves alternate between production, CIP, and sterilization streams without manual spool changes, aligning with hygienic directives. Certain pharmaceutical skids now bundle twenty or more three-way units on a single digital manifold, trimming footprint by 30% and slashing install time.

Manufacturers respond with cavity-free internals and FDA-approved seals that eliminate dead legs where contaminants accumulate. Control software maps each port to PLC tags, enabling recipe-driven flow paths. Multi-port innovations bleed into semiconductor wet benches, where chemistries must route through multiple rinse and etch tanks in milliseconds, reinforcing three-way adoption across the solenoid valves market.

The Solenoid Valves Market Report is Segmented by Operating Principle (Direct-Acting, Pilot-Operated), Port Configuration (Two-Way, Three-Way, and Four-Way), Material (Brass, Steel, Aluminum, and Plastics), Size (Micro, Sub, Mini, Small, and Large), End-User (Food, Automotive, Chemical, Oil and Gas, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific, home to 34% of 2024 revenue, leverages China's vast electronics output, Japan's precision robotics, and India's expanding pharma exports. Governments supporting domestic semiconductor fabs and battery plants fuel manifold adoption, while hydrogen pilot corridors in Japan and Korea demand high-integrity valves able to tolerate 700 bar gaseous service. Additionally, rising water-reuse mandates in coastal Chinese provinces add fresh municipal demand.

The Middle East and Africa, posting a projected 7.50% CAGR, benefits from Vision 2030 diversification projects in Saudi Arabia and petrochemical mega-sites in the UAE. Hydrogen-ammonia export plans from Oman and Saudi NEOM require specialized pilot-operated valves compatible with cryogenic and high-pressure duty. African growth centers on South African mining dewatering and Egyptian food-processing expansion, driving moderate yet diverse uptake.

North America contributes steady aftermarket turnover in shale gas, LNG, and pharma. The rapid rollout of zero-emissions wellhead valves across Colorado and Texas showcases regulatory-driven capex that refreshes installed bases. In Canada, carbon-capture demonstration plants call for corrosion-proof solenoids handling CO2 mixed streams. Europe, a mature yet innovation-led region, pivots to green hydrogen and digitalized manufacturing. That pivot secures value for smart IO-Link-ready valves despite slower headline growth, anchoring premium price bands within the solenoid valves market.

- Emerson Electric Co. (ASCO)

- Danfoss A/S

- Parker-Hannifin Corp.

- SMC Corp.

- IMI plc

- Burkert GmbH and Co. KG

- Curtiss-Wright Corp.

- AirTAC International Group

- Kendrion N.V.

- The Lee Co.

- CEME S.p.A

- PeterPaul Electronics Co.

- CKD Corp.

- Anshan Solenoid Valve Co.

- KANKEO SANGYO Co.

- Rotex Automation

- Festo SE and Co. KG

- ODE S.r.l.

- GEMU Group

- Genebre S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Industrial Waste-water Re-use Schemes in EU and GCC

- 4.2.2 Surge in Compact EV Thermal-Management Loops Requiring Micro-Solenoids

- 4.2.3 Rapid Retrofit of Legacy Beverage Lines in ASEAN for Hygienic Design

- 4.2.4 Gas Well-Head Automation in Shale Basins of US and Argentina

- 4.2.5 Hydrogen Electrolyzer Build-Out in Europe and Japan

- 4.2.6 Growing Preference for Smart, IO-Link-Enabled Valves in Pharma 4.0

- 4.3 Market Restraints

- 4.3.1 High Switching-Cycle Fatigue in greater than 120 degree C Applications

- 4.3.2 Price Volatility of Specialty Alloys (e.g., Duplex SS)

- 4.3.3 Skilled Labor Shortage for Field Retro-Commissioning in LATAM

- 4.3.4 Rising Competition from Piezo-Electric Micro-Valves in Medical OEMs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing Analysis (if applicable)

- 4.8 Industry Standards and Regulations

- 4.9 Technology Snapshot

- 4.9.1 Evolution of Solenoid Valves and Emerging EV / AV Uses

- 4.9.2 Major Design and Technical Considerations

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Operating Principle

- 5.1.1 Direct-Acting

- 5.1.2 Pilot-Operated

- 5.2 By Port/Flow Configuration

- 5.2.1 Two-Way

- 5.2.2 Three-Way

- 5.2.3 Four-Way and Above

- 5.3 By Valve Body Material

- 5.3.1 Brass

- 5.3.2 Stainless Steel

- 5.3.3 Aluminum

- 5.3.4 Engineering Plastics and Composites

- 5.4 By Size

- 5.4.1 Micro-Miniature (less than 5 mm)

- 5.4.2 Sub-Miniature (5-10 mm)

- 5.4.3 Miniature (10-25 mm)

- 5.4.4 Small Diaphragm (25-50 mm)

- 5.4.5 Large Diaphragm (greater than 50 mm)

- 5.5 By End-user Industry

- 5.5.1 Food and Beverage

- 5.5.1.1 Filtration Systems

- 5.5.1.2 Filling / Dosing Lines

- 5.5.2 Automotive

- 5.5.2.1 Air-Suspension

- 5.5.2.2 Fuel Injection and Emission

- 5.5.2.3 Safety and Security Systems

- 5.5.2.4 Transmission and Driveline

- 5.5.2.5 Others (HVAC, Doors)

- 5.5.3 Chemical and Petrochemical

- 5.5.3.1 Direction Control for Storage

- 5.5.3.2 Isolation Valves

- 5.5.4 Power Generation

- 5.5.4.1 Steam Control and Feeders

- 5.5.4.2 Lifts and Pumping

- 5.5.4.3 Deluge Systems

- 5.5.5 Oil and Gas

- 5.5.5.1 Drilling

- 5.5.5.2 Extraction

- 5.5.5.3 Downstream Supply

- 5.5.6 Healthcare and Pharmaceutical

- 5.5.7 Other Verticals (Agri-Tech, Aerospace, Textile, etc.)

- 5.5.1 Food and Beverage

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, IP)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Emerson Electric Co. (ASCO)

- 6.4.2 Danfoss A/S

- 6.4.3 Parker-Hannifin Corp.

- 6.4.4 SMC Corp.

- 6.4.5 IMI plc

- 6.4.6 Burkert GmbH and Co. KG

- 6.4.7 Curtiss-Wright Corp.

- 6.4.8 AirTAC International Group

- 6.4.9 Kendrion N.V.

- 6.4.10 The Lee Co.

- 6.4.11 CEME S.p.A

- 6.4.12 PeterPaul Electronics Co.

- 6.4.13 CKD Corp.

- 6.4.14 Anshan Solenoid Valve Co.

- 6.4.15 KANKEO SANGYO Co.

- 6.4.16 Rotex Automation

- 6.4.17 Festo SE and Co. KG

- 6.4.18 ODE S.r.l.

- 6.4.19 GEMU Group

- 6.4.20 Genebre S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment