|

市场调查报告书

商品编码

1939575

生物分解性塑胶包装:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Biodegradable Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

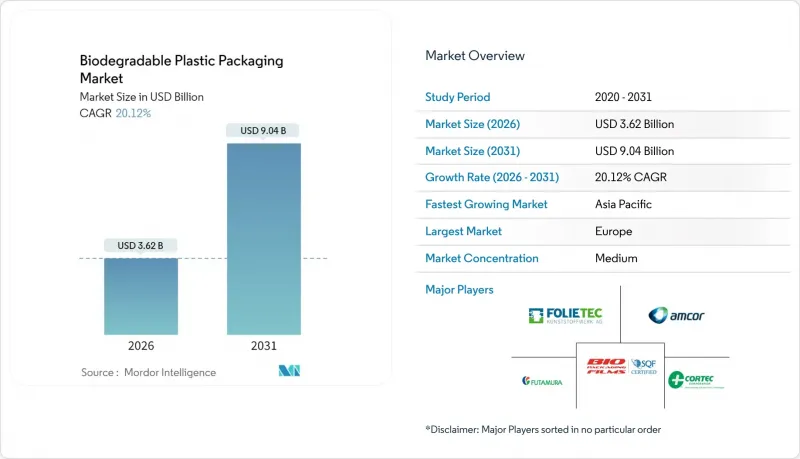

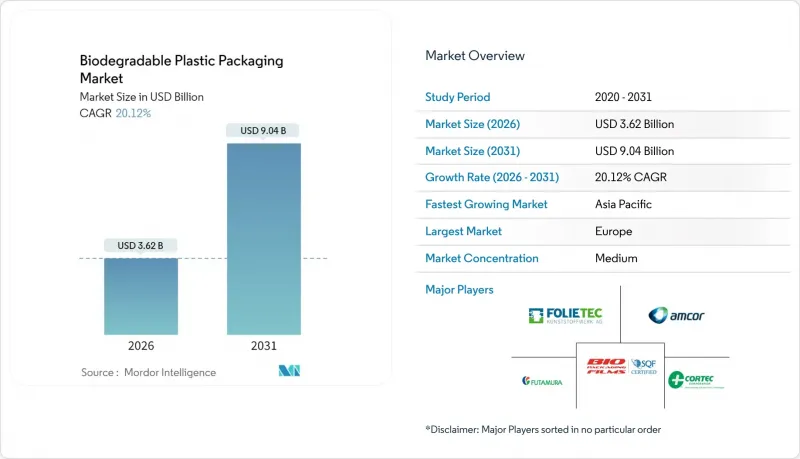

预计到 2026 年,生物分解性塑胶包装市场价值将达到 36.2 亿美元。

这意味着从 2025 年的 30.1 亿美元成长到 2031 年的 90.4 亿美元,2026 年至 2031 年的复合年增长率为 20.12%。

这一强劲的成长势头反映了监管要求的不断加强、企业碳定价政策的推行以及生物基树脂加工技术的快速发展,这些因素共同推动了可堆肥包装形式的经济可行性。品牌所有者现在优先考虑全球而非区域性的包装规范,这使得订单量更大,单位成本更低。材料创新不断缩小与传统聚合物的性能差距,海洋可降解的PHA和耐热的PBAT等产品如今已满足严格的阻隔性和耐热性要求。同时,市政垃圾减量目标正在推动食品配送和零售业采用经认证的可堆肥解决方案,从而为树脂供应商创造了可预测的需求。因此,生物分解性塑胶包装市场拥有清晰的需求前景,足以抵销农业原料价格的波动。

全球生物分解性塑胶包装市场趋势及洞察

欧盟和印度加速禁止使用一次性石油基塑胶包装

欧盟2024年一次性塑胶指令立即刺激了对经认证的可堆肥食品接触包装的需求,以刀叉餐具和翻盖式容器等难以回收的产品。印度各邦的禁令将鼓励超过18亿消费者做出同样的转变,迫使跨国公司协调全球规范,并为树脂工厂释放规模经济效益。超过生物基溢价的罚款进一步推动了其普及。澳洲2024年的禁令将加强政策的连锁效应,从而为生产者维持需求的可见度。

北美食品配送应用程式的兴起,对可堆肥包装形式提出了更高的要求。

在主要都会区,大型聚合平台要求餐厅使用可堆肥的碗、杯子和刀叉餐具,以符合市政废弃物分流目标和2024年消费者偏好趋势。由于外送收费系统掩盖了不断上涨的材料成本,业者正着力提升品牌形象并降低掩埋成本。连锁餐厅的试点计画已将垃圾处理成本降低了15-20%,并有助于遵守城市法规。这项要求也正在扩展到云端厨房网络,从而推动了对酱料和配菜软包装的需求。

西欧以外缺乏工业堆肥基础设施

亚太和拉丁美洲地区生物基树脂的采用速度近期超过了能够完全分解生物基树脂的高温堆肥厂的发展速度,这给掩埋转移和甲烷排放带来了风险,可能损害其环保主张。市政资金限制和审批障碍减缓了相关设施的运作,而私人业者仍在等待关于接收混合食品和包装废弃物标准的明确规定。在产能扩大之前,缺乏足够处理方案的地区的销售将受到限制,从而限制生物分解性塑胶包装市场的快速普及。

细分市场分析

按材料类型划分,生物分解性塑胶包装市场规模仍将以聚乳酸(PLA)为主导,到2025年,PLA的市场份额将达到65.92%。然而,聚羟基烷酯(PHA)预计将以24.62%的复合年增长率(CAGR)实现最高成长。 PHA在海洋环境中已被证实具有良好的生物降解性,并且能够满足更严格的沿海废弃物法规,使其成为岛屿和港口城市吸管、刀叉餐具和阻隔性包装袋的理想选择。製造商正在利用PHA宽广的熔融范围来生产PLA难以成型的厚型管瓶和化妆品容器。此外,美国和泰国宣布的利用农业残渣而非食品级糖的新产能,使其免受原材料价格波动的影响。

在工业堆肥普及的地区,PLA 仍保持着成本竞争力,这为西欧的烘焙薄膜和热成型沙拉容器提供了支持。持续的研发促成了耐热 Ingeo 等级产品的开发,其能够承受高达 105°C 的填充温度,从而缩小了性能差距。 PBAT 和 PBS 则服务于耐热和化学接触等细分市场,而淀粉基复合复合材料则在价格竞争激烈的购物袋领域占据主导地位。整体材料市场格局正从第一代产品的成本优势转向第二代产品的性能优势,这将有助于生物分解性塑胶包装市场的长期多元化发展。

截至2025年,软包装在生物分解性塑胶包装市场中占据58.12%的份额,这主要得益于轻便的包装袋、包装膜和邮寄袋,它们能够最大限度地降低电子商务和食材自煮包配送的运输成本。以改良生产线加工的薄膜能够达到适用于生鲜食品的氧气透过率,因此无需二次包装即可延长食品的保质期。高端零食品牌优先选择透明的PLA窗口来展现产品品质,而增加了PBAT的复合材料则能提供更佳的抗穿刺性能。

硬质包装正以22.45%的复合年增长率成长,主要得益于咖啡胶囊、保温杯内衬和微波炉托盘的推动。 NatureWorks与咖啡机製造商IMA联合推出了承包胶囊系统,该系统可在90天内完成生物降解,从而开拓了散装饮料市场。连锁餐厅正从聚苯乙烯翻盖式容器转向工业级可生物降解的PHA内衬纤维碗,从而兼顾了性能和品牌价值。硬质包装市场的快速成长表明,功能性的提升正在削弱传统技术的优势,并扩大生物分解性塑胶包装市场的收入潜力。

生物分解性塑胶包装市场,分析维度包括材料类型(淀粉基复合复合材料、聚乳酸(PLA)等)、包装类型(软包装与硬包装)、终端用户行业(食品、饮料、餐饮服务等)、可堆肥性(家庭可堆肥、工业可堆肥)以及地区(北美、欧洲、亚太、中东和非洲、南美)。市场预测以美元计价。

区域分析

欧洲成熟的堆肥基础设施和完善的法规环境使其有望在2025年占据生物分解性塑胶包装市场35.21%的份额。区域树脂生产商受益于统一的EN标准和生产者延伸责任制(EPR)费用带来的可预测需求,而加工商则受益于巴黎、柏林和马德里等城市蓬勃发展的食品配送平台的接近性。政府对有机废弃物收集的补贴也进一步推动了包装的普及,巩固了欧洲在短期内的领先地位。

亚太地区正以24.02%的复合年增长率(CAGR)保持领先地位,这主要得益于印度、中国和泰国分阶段实施难以回收包装的禁令。在中国,到2027年,主要城市的「不可降解」塑胶法规将从购物袋扩展到外带餐盒,从而鼓励建立以木薯和稻壳为原料的社区工厂。儘管印度的法规仍存在累积,但人口覆盖率的不断提高正促使跨国快餐连锁企业采用标准化的可生物降解涂层技术。澳洲和纽西兰也已全面禁止一次性塑胶製品,这即时刺激了整个大洋洲对替代品的需求。

在北美,食品配送强制规定和财富500强企业内部碳定价正在推动工业堆肥的普及,但各地区工业堆肥的普及程度仍不均衡。拉丁美洲的特大城市,例如圣保罗和墨西哥城,已经建立了试点堆肥中心,为更广泛的成长奠定了基础。在中东和非洲,掩埋短缺和旅游业主导的塑胶禁令正在创造利基市场,尤其是在波湾合作理事会(GCC)的酒店业。总体而言,不同地区的政策步伐和基础设施投资模式解释了生物分解性塑胶包装市场区域成长差异的原因。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟和印度加速禁止使用一次性石油基塑胶包装

- 随着外带应用在北美越来越受欢迎,对可堆肥包装的需求也在增加。

- 由于零售商宣布自己「塑胶中和」(例如沃尔玛、家乐福),需求不断增加。

- 现有吹膜生产线维修,以适应生物基树脂(资本投资:约 15%)

- 品牌转型,包装上采用透明碳标籤

- 在企业层级引入内部碳定价机制(高于70美元/吨)会使生物能源方案更具吸引力。

- 市场限制

- 西欧以外缺乏工业堆肥基础设施

- PLA原料(玉米、甘蔗)价格波动

- 消费者对「可堆肥」和「可生物降解」标籤的困惑

- 美国和日本对机械回收过程污染的处罚

- 供应链分析

- 监理与技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业生态系分析

- 生物降解和生物基塑胶包装的创新

- 比较分析—石油基塑胶与生物降解包装

- 生质塑胶-生产状况

- 生质塑胶生产统计数据

- 按树脂类型分割的产量

- 按地区分類的产量

- 餐饮服务/饭店餐饮业的演变趋势

- 新兴产业趋势

第五章 市场规模与成长预测

- 依材料类型

- 淀粉混合物

- 聚乳酸(PLA)

- 聚己二酸丁二醇酯-对苯二甲酸丁二醇酯(PBAT)

- 聚丁二酸丁二醇酯(PBS)

- 聚羟基烷酯(PHAs)

- 其他材料类型

- 按包装类型

- 软包装

- 袋子和小袋

- 薄膜和包装

- 标籤和封套

- 硬包装

- 餐具

- 托盘和碗

- 食品容器

- 咖啡杯和咖啡胶囊

- 其他硬质包装

- 软包装

- 按最终用途行业划分

- 食物

- 饮料

- 对于餐饮服务业

- 个人及居家护理

- 製药

- 其他终端用户产业

- 它可堆肥吗?

- 可家庭堆肥

- 工业可堆肥

- 按地区

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor plc

- BASF SE

- NatureWorks LLC

- Tetra Pak International SA

- Sealed Air Corporation

- Kuraray Co., Ltd.

- Taghleef Industries

- FKuR Kunststoff GmbH

- good natured Products Inc.

- Pactiv Evergreen Inc.

- ALPLA Werke Alwin Lehner GmbH

- Transcontinental Inc.

- Plascon Industries

- Futamura Group

- Cortec Corporation

- BioBag International AS

- Biome Bioplastics

- Bio Packaging Films

- Bio Futura

- Groupe Barbier

- VektoPack

- Singular Solutions Inc.

- Biogreen Biotech

- Plabottles.eu(Global Solutions BV)

第七章 市场机会与未来展望

Biodegradable Plastic Packaging market size in 2026 is estimated at USD 3.62 billion, growing from 2025 value of USD 3.01 billion with 2031 projections showing USD 9.04 billion, growing at 20.12% CAGR over 2026-2031.

The strong trajectory reflects simultaneous regulatory mandates, corporate carbon-pricing policies, and rapid advances in bio-resin processing that together improve economic viability for compostable formats. Brand owners now prefer global rather than regional packaging specifications, allowing large volume contracts that lower per-unit costs. Material innovation continues to cut performance gaps with conventional polymers; marine-degradable PHA and heat-resistant PBAT variants now satisfy demanding barrier and temperature requirements. In parallel, municipal waste-diversion targets push food-delivery and retail sectors to adopt certified compost-ready solutions, creating predictable offtake for resin suppliers. The biodegradable plastic packaging market therefore enjoys clear line-of-sight demand that compensates for still-volatile agricultural feedstock pricing.

Global Biodegradable Plastic Packaging Market Trends and Insights

Accelerated bans on single-use petro-plastic packaging across EU and India

The European Union's 2024 Single-Use Plastic Directive immediately raised demand for certified compostable food-contact packs, replacing difficult-to-recycle items such as cutlery and clamshells. India's statewide prohibitions expose more than 1.8 billion consumers to the same shift, forcing multinationals to harmonize global specifications and unlocking scale economies for resin plants. Penalties that exceed the premium on bio-materials further accelerate adoption. Australia's 2024 bans reinforce a cascading policy effect that sustains volume visibility for producers.

Food-delivery app proliferation requiring compost-ready formats in North America

Leading aggregators mandate that restaurants use compostable bowls, cups, and cutlery in top metropolitan areas, aligning with municipal diversion goals and consumer preference tracking recorded in 2024. Delivery fee structures hide the material premium, so operators focus on brand perception and landfill fee savings. Chain pilots report 15-20% lower disposal costs and smoother compliance with city ordinances. The requirement has spilled into cloud kitchen networks, amplifying flexible-pack demand for sauces and sides.

Tight industrial-composting infrastructure outside Western Europe

Adoption in Asia-Pacific and Latin America recently outpaced the build-out of high-temperature composting plants capable of fully degrading bio-resins, risking landfill diversion and methane release that undermine environmental claims . Municipal funding limitations and permitting hurdles delay facility commissioning, while private operators await clearer acceptance rules for mixed food and packaging waste. Until capacity expands, sales into regions without adequate end-of-life options are capped, tempering the otherwise rapid uptake of the biodegradable plastic packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Retailer "plastic-neutral" pledges boosting demand

- Re-tooling of existing film-blowing lines to run bio-resins

- Feedstock price volatility for PLA

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The biodegradable plastic packaging market size for material types remained skewed toward Polylactic Acid, which held 65.92% share in 2025, yet Polyhydroxyalkanoates posted the strongest 24.62% CAGR outlook. PHA's ability to biodegrade in marine settings satisfies growing coastal-waste legislation, making it the preferred option for straws, cutlery, and high-barrier pouches targeting island and port cities. Manufacturers exploit its broad melt-flow window to mold thicker pharmaceutical vials and personal-care jars that PLA struggles to handle. The segment also benefits from fresh capacity announcements in the United States and Thailand that leverage agricultural residues instead of food-grade sugar sources, insulating it from feedstock swings.

PLA remains cost-competitive where industrial composting exists, supporting bakery films and thermoformed salad tubs in Western Europe. Continuous R&D produced higher-heat Ingeo grades that withstand 105 °C filling temperatures, narrowing earlier performance gaps. PBAT and PBS serve niche heat-resistant or chemical-contact applications, while starch blends dominate ultra-price-sensitive grocery bag programs. The overall material landscape shows a transition from first-generation cost leadership to second-generation performance leadership, reinforcing the long-term diversification of the biodegradable plastic packaging market.

Flexible formats commanded 58.12% of the biodegradable plastic packaging market share in 2025, underpinned by light-weighted pouches, wraps, and mailers that minimize freight costs for e-commerce and meal-kit delivery. Films processed on retrofitted lines achieve oxygen transmission rates suitable for fresh produce, extending shelf life without secondary wraps. Premium snack brands emphasize transparent windows made from clarified PLA to showcase product integrity, while laminates incorporating PBAT improve puncture resistance.

Rigid formats accelerate at 22.45% CAGR on the back of coffee pods, hot-cup linings, and microwave-ready trays. NatureWorks and machine supplier IMA released a turnkey pod system that meets Keurig and Nespresso specifications and composts in 90 days, opening high-volume beverage channels. Foodservice chains shift from polystyrene clamshells to PHA-lined fiber bowls compatible with industrial composters, satisfying performance and brand-equity goals. The fast-growing rigid segment illustrates how functionality gains erode legacy dominance and broaden total addressable revenue for the biodegradable plastic packaging market.

The Biodegradable Plastic Packaging Market Report is Segmented by Material Type (Starch Blends, Polylactic Acid (PLA), and More), Packaging Type (Flexible Packaging and Rigid Packaging), End-Use Industry (Food, Beverage, Foodservice, and More), Compostability (Home-Compostable and Industrial-Compostable), and Geography (North America, Europe, Asia-Pacific, MEA, South America). Market Forecasts are Provided in Value (USD).

Geography Analysis

Europe's mature composting infrastructure and comprehensive regulatory backdrop secured 35.21% biodegradable plastic packaging market share in 2025. Regional resin producers benefit from cohesive EN standards and predictable demand created by extended-producer-responsibility fees, while converters profit from proximity to high-growth food delivery platforms now ubiquitous in Paris, Berlin, and Madrid. Government subsidies for separate organic waste collection further aid pack adoption, cementing Europe's near-term leadership.

Asia-Pacific generates the strongest 24.02% CAGR as India, China, and Thailand enforce phased bans on difficult-to-recycle packaging formats. Chinese directives targeting "non-degradable" plastics in tier-one cities escalate from carrier bags to takeaway containers by 2027, spawning localized plants using cassava and rice-husk feedstocks. India's state regulations remain fragmented, yet cumulative population coverage draws multinational quick-service restaurants to standardize compostable coating technologies. Australia and New Zealand also adopted comprehensive single-use plastic prohibitions, driving immediate substitution demand throughout Oceania.

North America leverages food-delivery mandates and internal carbon-pricing at Fortune 500 corporations to propel adoption, although regional coverage of industrial composting remains uneven. Latin American megacities such as Sao Paulo and Mexico City deploy pilot composting hubs, setting the stage for broader growth. In the Middle East and Africa, landfill scarcity and tourism-driven plastic bans create niche opportunities, especially in Gulf Cooperation Council hospitality sectors. Overall, jurisdictional policy cadence and infrastructure investment patterns explain divergent regional growth in the biodegradable plastic packaging market.

- Amcor plc

- BASF SE

- NatureWorks LLC

- Tetra Pak International S.A.

- Sealed Air Corporation

- Kuraray Co., Ltd.

- Taghleef Industries

- FKuR Kunststoff GmbH

- good natured Products Inc.

- Pactiv Evergreen Inc.

- ALPLA Werke Alwin Lehner GmbH

- Transcontinental Inc.

- Plascon Industries

- Futamura Group

- Cortec Corporation

- BioBag International AS

- Biome Bioplastics

- Bio Packaging Films

- Bio Futura

- Groupe Barbier

- VektoPack

- Singular Solutions Inc.

- Biogreen Biotech

- Plabottles.eu (Global Solutions BV)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated bans on single-use petro-plastic packaging across EU and India

- 4.2.2 Food-delivery app proliferation requiring compost-ready formats in North America

- 4.2.3 Retailer "plastic-neutral" pledges (e.g., Walmart, Carrefour) boosting demand

- 4.2.4 Re-tooling of existing film-blowing lines to run bio-resins (CAPEX ? 15 %)

- 4.2.5 Brand shift to transparent carbon-labelling on packs

- 4.2.6 Corporate-level internal carbon-price adoption (>US $70/t) favouring bio-options

- 4.3 Market Restraints

- 4.3.1 Tight industrial-composting infrastructure outside Western Europe

- 4.3.2 Feed-stock price volatility for PLA (corn, sugarcane)

- 4.3.3 Consumer confusion around "compostable" vs "biodegradable" claims

- 4.3.4 Mechanical-recycling stream contamination penalties in US and Japan

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Industry Ecosystem Analysis

- 4.8 Innovations in Biodegradable and Bio-based Plastic Packaging

- 4.9 Comparative Analysis - Petro-plastic vs Biodegradable Packaging

- 4.10 Bioplastics - Production Landscape

- 4.10.1 Production Statistics for Bioplastics

- 4.10.2 Production by Resin Type

- 4.10.3 Production by Region

- 4.11 Evolving Trends in the Foodservice/HoReCa Sector

- 4.12 Emerging Industry Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Starch Blends

- 5.1.2 Polylactic Acid (PLA)

- 5.1.3 Poly(Butylene Adipate-co-Terephthalate) (PBAT)

- 5.1.4 Polybutylene Succinate (PBS)

- 5.1.5 Polyhydroxyalkanoates (PHA)

- 5.1.6 Other Material Types

- 5.2 By Packaging Type

- 5.2.1 Flexible Packaging

- 5.2.1.1 Bags and Pouches

- 5.2.1.2 Films and Wraps

- 5.2.1.3 Labels and Sleeves

- 5.2.2 Rigid Packaging

- 5.2.2.1 Tableware

- 5.2.2.2 Trays and Bowls

- 5.2.2.3 Food Containers

- 5.2.2.4 Coffee Cups and Pods

- 5.2.2.5 Other Rigid Packaging

- 5.2.1 Flexible Packaging

- 5.3 By End-use Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Foodservice

- 5.3.4 Personal Care and Home Care

- 5.3.5 Pharmaceutical

- 5.3.6 Other End - Use Industry

- 5.4 By Compostability

- 5.4.1 Home-Compostable

- 5.4.2 Industrial-Compostable

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Amcor plc

- 6.4.2 BASF SE

- 6.4.3 NatureWorks LLC

- 6.4.4 Tetra Pak International S.A.

- 6.4.5 Sealed Air Corporation

- 6.4.6 Kuraray Co., Ltd.

- 6.4.7 Taghleef Industries

- 6.4.8 FKuR Kunststoff GmbH

- 6.4.9 good natured Products Inc.

- 6.4.10 Pactiv Evergreen Inc.

- 6.4.11 ALPLA Werke Alwin Lehner GmbH

- 6.4.12 Transcontinental Inc.

- 6.4.13 Plascon Industries

- 6.4.14 Futamura Group

- 6.4.15 Cortec Corporation

- 6.4.16 BioBag International AS

- 6.4.17 Biome Bioplastics

- 6.4.18 Bio Packaging Films

- 6.4.19 Bio Futura

- 6.4.20 Groupe Barbier

- 6.4.21 VektoPack

- 6.4.22 Singular Solutions Inc.

- 6.4.23 Biogreen Biotech

- 6.4.24 Plabottles.eu (Global Solutions BV)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment