|

市场调查报告书

商品编码

1851488

印度风力发电:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)India Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

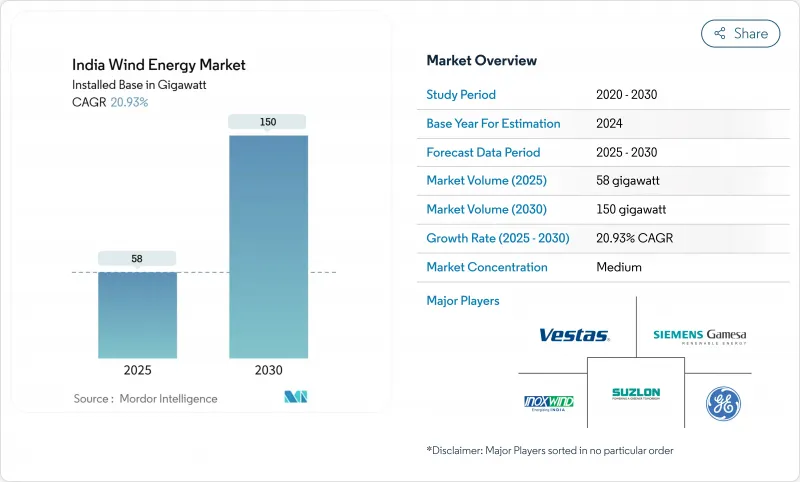

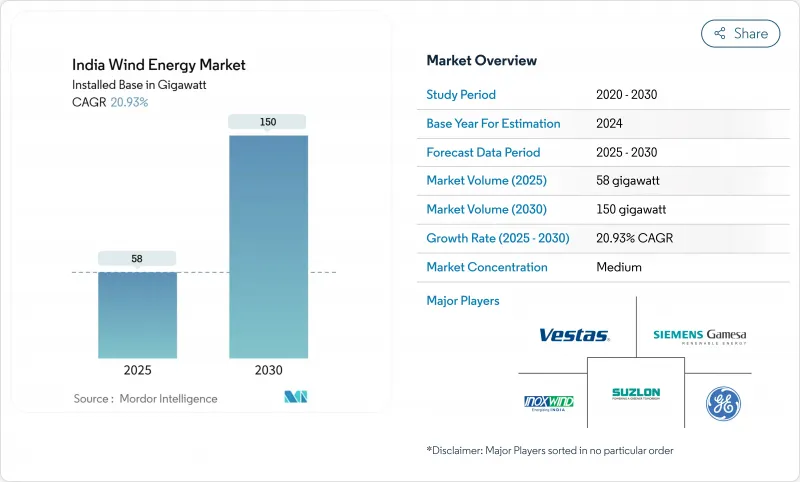

印度风力发电市场规模预计将从 2025 年的 58 吉瓦成长到 2030 年的 150 吉瓦,预测期(2025-2030 年)的复合年增长率为 20.93%。

这一发展势头得益于以500吉瓦非化石燃料目标为基础的政策支持、企业购电协议的增加以及风能和太阳能混合发电项目的竞标。资料中心营运商增加电网级采购、老旧风力涡轮机改造的復苏以及首笔离岸风电可行性缺口资金筹措进一步巩固了成长前景。 2025年6月州际输电豁免到期以及各州土地资源限制带来的成本阻力构成了短期挑战,但鑑于国内製造业的深度和对绿氢的需求,长期前景不应受到影响。

印度风力发电市场趋势与洞察

加速泰米尔纳德邦和古吉拉突邦风能和太阳能可再生发电捆绑式电力竞标,以提高发电容量利用率

至2024年,混合能源竞标将占可再生能源总竞标的43%,高于2020年的16%。在古吉拉突邦和泰米尔纳德邦,每千瓦时2.58-2.67印度卢比的定价展现了其成本竞争力。到2025年,混合能源运作中装置容量将达到7.7兆瓦,另有300兆瓦正在筹建中。这种模式透过匹配互补的发电特性来增强电网稳定性,确保印度风力发电市场在波动较大的负载曲线下保持强劲的需求。

为古吉拉突邦首轮4GW离岸风力发电计画提供可行性缺口资金,将促进供应链投资

印度联邦内阁提出的7,453亿卢比一揽子计划,其中包括600亿卢比的港口建设资金,将缩小计划和离岸风电计划之间的电价差距。古吉拉突邦的坎贝湾和泰米尔纳德邦沿海地区合计拥有70吉瓦的技术潜力,使离岸风力发电成为印度长期多元化发展的支柱。港口升级和专用输电走廊的建设将加速单桩基础、过渡段和高压直流输电线路等供应链的本地化。因此,印度的风力发电市场将拥有大量高容量係数的资产,以补充白天太阳能发电的不足。

卡纳塔克邦和马哈拉斯特拉邦的土地分配冻结导致陆上管道建设延误

卡纳塔克邦计划在2024年新增1135兆瓦发电装置容量,但邦级土地储备的枯竭限制了计划实施进度。儘管有关开放准入的监管改革改善了下游电力需求,但土地用途变更的多部门审批流程仍然漫长。太阳能竞标竞标进一步缩小了可用地块的范围。在新的土地租赁框架最终确定之前,这些瓶颈可能会减缓印度风力发电市场的建设步伐。

细分市场分析

到2024年,陆域风电将占印度风力发电市场份额的100%,这得益于印度国内每年18吉瓦的涡轮机製造产能以及每千瓦时2.68-3.6印度卢比的极具竞争力的价格。离岸风电目前仍处于起步阶段,但预计将以35%的复合年增长率成长,这得益于74.53兆印度卢比的资金筹措计画以及超过40%的优异运转率。因此,到2030年,印度离岸风力发电计划的市场规模预计将从目前的小规模成长到两位数吉瓦的水平。

较高的资本密集度和专业化的物流将使离岸风电的平准化成本在不计补贴的情况下维持在9-12印度卢比/千瓦时左右。拟议的64%本土化率规则将增强陆上风电的经济效益,同时促进海上基础设施和阵列的本地供应链发展。随着时间的推移,规模经济和以港口主导的製造群将缩小成本差距,预计未来十年印度风力发电市场将向陆上-陆下平衡的格局转型。

印度风力发电市场报告按行业(陆上和海上)进行细分。市场规模和预测以装置容量(吉瓦)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速风能和太阳能混合可再生能源竞标;提高泰米尔纳德邦和古吉拉突邦的发电容量利用率

- 古吉拉特邦首轮4GW离岸风力发电专案可行性缺口资金筹措古吉拉突邦供应链投资

- 改造计画将释放5-15吉瓦老旧风电场的容量,用于安装更大容量的风力涡轮机。

- 绿氢能政策推动工业丛集对高负载率风电的需求

- ISTS费用豁免提升了资源丰富的西部各州风电计划的内部收益率

- 资料中心营运商寻求风能和太阳能的即时控制组合,企业购电协议(PPA)需求激增,这带动了企业购电协议的激增。

- 市场限制

- 卡纳塔克邦和马哈拉斯特拉邦的土地分配冻结导致陆上管道建设延误

- 坎贝湾离岸风力发电电网疏散通道延误

- 涡轮机零件消费税的上涨加剧了与太阳能发电的成本竞争

- 各邦电力公司(DISCOM)的银行限制措施(能源供应低于30%)增加了经济萎缩的风险。

- 供应链分析

- 监理展望

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- PESTEL 分析

第五章 市场规模与成长预测

- 按行业

- 陆上

- 按涡轮机容量

- 小于2兆瓦

- 2~3.5 MW

- 3.5兆瓦或以上

- 透过使用

- 实用规模

- 工业专属式

- 商业设施

- 离岸

- 按安装类型

- 固定底部

- 浮体式

- 按深度

- 浅水区(水深小于30公尺)

- 过渡段(30-60公尺)

- 深海(超过60公尺)

- 陆上

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名/份额)

- 公司简介

- Inox Wind Limited

- Suzlon Energy Limited

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- General Electric Company

- Envision Energy

- Wind World(India)Ltd

- Tata Power Renewable Energy Ltd

- Enercon GmbH

- Senvion India

- ReNew Power(ReNew Energy Global PLC)

- Adani Green Energy Ltd

- JSW Energy-Mytrah Cluster

- Amp Energy India Pvt Ltd

- Greenko Group

- Siemens Energy AG

- Mingyang Smart Energy

- Nordex SE

- Leitwind Shriram Manufacturing Ltd

- GE T&D India Ltd

- SKF India

- Hitachi Energy India Ltd

- Bharat Heavy Electricals Ltd

- LM Wind Power(India)

第七章 市场机会与未来展望

The India Wind Energy Market size in terms of installed base is expected to grow from 58 gigawatt in 2025 to 150 gigawatt by 2030, at a CAGR of 20.93% during the forecast period (2025-2030).

Policy support under the 500 GW non-fossil target, rising corporate power-purchase agreements, and hybrid wind-solar auctions underpin this momentum. Increased grid-scale procurement by data-centre operators, resurgence in repowering of aging turbines, and the first offshore viability-gap funding tranche further strengthen growth prospects. Cost headwinds from the June 2025 expiry of interstate-transmission waivers and state-level land constraints pose near-term challenges but do not derail the long-term outlook, as domestic manufacturing depth and green-hydrogen demand create structural upside.

India Wind Energy Market Trends and Insights

Accelerated Hybrid Renewable Auctions Bundling Wind with Solar Enhancing Capacity Utilisation in Tamil Nadu & Gujarat

Hybrid tenders accounted for 43% of all renewable auctions in 2024, up from 16% in 2020. Tariffs of INR 2.58-2.67 / kWh in Gujarat and Tamil Nadu demonstrate cost competitiveness, while capacity-utilisation factors above 60% meet round-the-clock requirements for commercial consumers. Operational hybrid capacity stood at 7.7 GW in 2025 with a 30 GW pipeline, and NTPC's recent 1.2 GW award signals strong institutional backing. The approach enhances grid stability by matching complementary generation profiles, ensuring that the India wind energy market maintains robust demand across volatile load curves.

Viability-Gap Funding for Initial 4 GW Offshore Wind Round in Gujarat Catalyst for Supply-Chain Investments

The Union Cabinet's INR 74.53 billion package, including INR 6 billion for ports, narrows the tariff gap between onshore and offshore projects. Gujarat's Gulf of Khambhat and Tamil Nadu's coast jointly offer 70 GW technical potential, positioning offshore wind as a long-term diversification pillar. Port upgrades and dedicated evacuation corridors accelerate supply-chain localisation for monopiles, transition pieces, and HVDC export lines. As a result, the India wind energy market secures a foundation for high-capacity-factor assets that complement solar-heavy daytime generation.

Land Allotment Freeze in Karnataka & Maharashtra Slowing Onshore Pipeline

State-level land-bank depletion constrains project execution timelines despite Karnataka adding 1,135 MW in 2024. Regulatory reforms around open access improve downstream offtake, yet multi-agency clearances for land conversion remain protracted. Competing solar bids further tighten suitable parcels. These bottlenecks could slow the build rate for the India wind energy market until additional land-leasing frameworks are finalised.

Other drivers and restraints analyzed in the detailed report include:

- Repowering Scheme Opening 5-15 GW of Ageing Wind Farms for High-Capacity Turbines

- Green Hydrogen Policy Driving Demand for High-Load-Factor Wind Power in Industrial Clusters

- Delayed Grid Evacuation Corridors for Offshore Wind at Gulf of Khambhat

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Onshore capacity accounted for 100% India's wind energy market share in 2024, supported by 18 GW of annual domestic turbine manufacturing capacity and competitive tariffs between INR 2.68-3.6/kWh. Offshore wind, although at a nascent stage, is forecast to expand at a 35% CAGR, underpinned by the INR 74.53 billion funding scheme and superior capacity factors exceeding 40%. As a result, the India wind energy market size for offshore projects could rise from a negligible base to a double-digit gigawatt level by 2030.

Higher capital intensity and specialised logistics keep offshore levelised costs near INR 9-12/kWh without subsidies. The draft 64% domestic-content rule strengthens onshore economics while seeding local supply chains for offshore foundations and arrays. Over time, scale economies and port-led manufacturing clusters are expected to narrow cost gaps, allowing the India wind energy market to transition toward a balanced onshore-offshore mix in the next decade.

India Wind Energy Market Report is Segmented by Sector (Onshore and Offshore). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Inox Wind Limited

- Suzlon Energy Limited

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- General Electric Company

- Envision Energy

- Wind World (India) Ltd

- Tata Power Renewable Energy Ltd

- Enercon GmbH

- Senvion India

- ReNew Power (ReNew Energy Global PLC)

- Adani Green Energy Ltd

- JSW Energy - Mytrah Cluster

- Amp Energy India Pvt Ltd

- Greenko Group

- Siemens Energy AG

- Mingyang Smart Energy

- Nordex SE

- Leitwind Shriram Manufacturing Ltd

- GE T&D India Ltd

- SKF India

- Hitachi Energy India Ltd

- Bharat Heavy Electricals Ltd

- LM Wind Power (India)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Hybrid Renewable Auctions Bundling Wind with Solar Enhancing Capacity Utilisation in Tamil Nadu & Gujarat

- 4.2.2 Viability-Gap Funding for Initial 4 GW Offshore Wind Round in Gujarat Catalyst for Supply-Chain Investments

- 4.2.3 Repowering Scheme Opening 5-15 GW of Ageing Wind Farms for High-Capacity Turbines

- 4.2.4 Green Hydrogen Policy Driving Demand for High-Load-Factor Wind Power in Industrial Clusters

- 4.2.5 ISTS Charge Waivers Boosting Wind Project IRRs in Resource-Rich Western States

- 4.2.6 Corporate PPAs Surge from Data-centre Operators Seeking RTC Wind-Solar Mix

- 4.3 Market Restraints

- 4.3.1 Land Allotment Freeze in Karnataka & Maharashtra Slowing Onshore Pipeline

- 4.3.2 Delayed Grid Evacuation Corridors for Offshore Wind at Gulf of Khambhat

- 4.3.3 Rising GST on Turbine Components Eroding Cost Competitiveness vs Solar

- 4.3.4 Banking Restrictions (<30% Energy) by State DISCOMs Increasing Curtailment Risk

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Sector

- 5.1.1 Onshore

- 5.1.1.1 By Turbine Capacity

- 5.1.1.1.1 Up to 2 MW

- 5.1.1.1.2 2 to 3.5 MW

- 5.1.1.1.3 Above 3.5 MW

- 5.1.1.2 By Application

- 5.1.1.2.1 Utility-scale

- 5.1.1.2.2 Captive Industrial

- 5.1.1.2.3 Commercial and Institutional

- 5.1.2 Offshore

- 5.1.2.1 By Installation Type

- 5.1.2.1.1 Fixed-Bottom

- 5.1.2.1.2 Floating

- 5.1.2.2 By Water Depth

- 5.1.2.2.1 Shallow (Below 30 m)

- 5.1.2.2.2 Transitional (30 to 60 m)

- 5.1.2.2.3 Deepwater (Above 60 m)

- 5.1.1 Onshore

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Inox Wind Limited

- 6.4.2 Suzlon Energy Limited

- 6.4.3 Siemens Gamesa Renewable Energy SA

- 6.4.4 Vestas Wind Systems A/S

- 6.4.5 General Electric Company

- 6.4.6 Envision Energy

- 6.4.7 Wind World (India) Ltd

- 6.4.8 Tata Power Renewable Energy Ltd

- 6.4.9 Enercon GmbH

- 6.4.10 Senvion India

- 6.4.11 ReNew Power (ReNew Energy Global PLC)

- 6.4.12 Adani Green Energy Ltd

- 6.4.13 JSW Energy - Mytrah Cluster

- 6.4.14 Amp Energy India Pvt Ltd

- 6.4.15 Greenko Group

- 6.4.16 Siemens Energy AG

- 6.4.17 Mingyang Smart Energy

- 6.4.18 Nordex SE

- 6.4.19 Leitwind Shriram Manufacturing Ltd

- 6.4.20 GE T&D India Ltd

- 6.4.21 SKF India

- 6.4.22 Hitachi Energy India Ltd

- 6.4.23 Bharat Heavy Electricals Ltd

- 6.4.24 LM Wind Power (India)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment