|

市场调查报告书

商品编码

1851492

计划管理软体:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Project Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

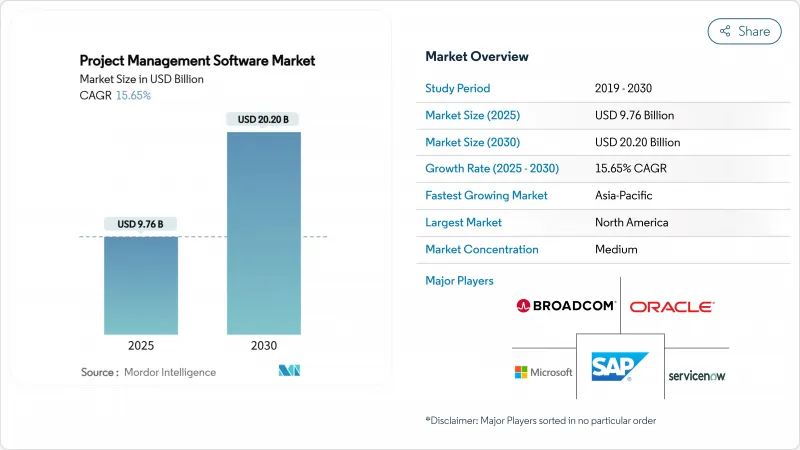

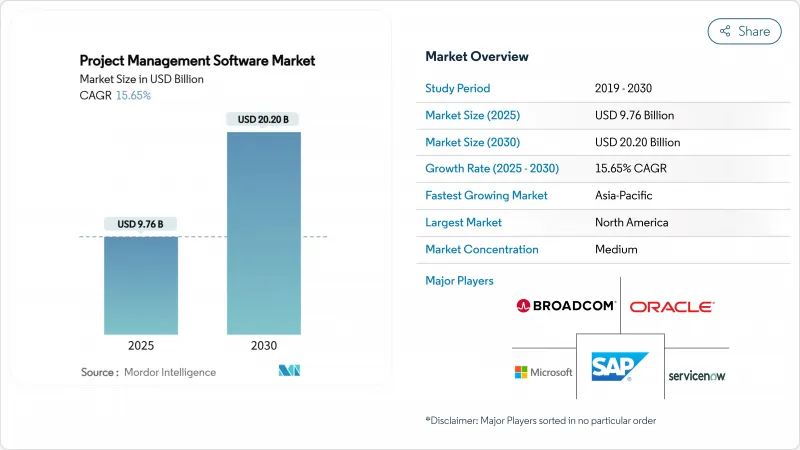

计划管理软体市场预计到 2025 年将达到 97.6 亿美元,到 2030 年将成长到 202 亿美元,复合年增长率为 15.65%。

云端配置、低程式码可配置性和预测分析等技术,将计划监控从任务追踪升级到策略编配,持续推动市场扩张。随着分散式团队需要即时协作,以及企业将专案资料与财务、人力资源和客户系统整合以实现统一的可视性,市场需求不断增长。混合部署在受监管行业中成长最快,因为本地资料管理仍然不可或缺。中小企业正在透过绕过传统的采用障碍来加速采用,而人工智慧原生功能则增强了风险管理和成本预测。随着供应商整合特定产业的工作流程和开放的API生态系统,竞争日益激烈。

全球计划管理软体市场趋势与洞察

远端和混合企划团队的云端优先采用

据报道,从桌面工具迁移到云端原生平台可将任务完成速度提升 54%。计划管理软体市场正蓬勃发展,即时同步功能使跨时区的分散式团队能够保持工作进度。 IT 部门更青睐云端的可扩展性,因为它减轻了容量规划的负担。随着受监管行业在可访问性和数据控制之间寻求平衡,混合模式正以 18.4% 的复合年增长率成长。供应商正积极回应,提供满足资料主权要求并消除协作摩擦的资料驻留选项。

将您的专案管理平台与企业级 SaaS 堆迭集成

企业平均运行 976 个应用程序,但只有 28% 实现了有效集成,这减缓了计划资料的流动。现代平台将自身定位为与财务、客户关係管理 (CRM) 和人力资源 (HR) 系统整合的枢纽,从而提升了计划管理软体市场在企业架构中的重要性。预计到 2025 年,SaaS 整合市场规模将超过 150 亿美元,而实施全面整合策略的公司则报告生产力提高了 30%。云端原生供应商透过提供开放的 API 和预先建置连接器来减少昂贵的客製化编码,从而获得了竞争优势。

旧系统迁移和定製成本高昂

由于资料映射、检验和使用者培训需要投入大量精力,企业面临的实施成本可能高达许可费的三倍。迁移成本平均超支 30%,每Terabyte存檔资料的成本最高可达 15,000 美元。这项障碍会减缓更新週期,并阻碍拥有高度客製化工作流程的现有企业在计划管理软体市场的渗透。

细分市场分析

到2024年,云端部署将占总营收的75%,但混合配置的复合年增长率将达到18.4%,展现出计划管理软体市场最强劲的成长动能。混合解决方案可将本机储存库与云端工作空间同步。本地部署在政府和国防领域仍然占据主导地位,但随着云端区域安全认证要求日益严格,其市场份额正在萎缩。

混合模式的兴起反映了用于管理无缝离线同步、加密隧道和选择性储存的工具的出现。建设公司将图纸储存在本地伺服器上,同时透过云端控制面板共用工地现场更新。供应商透过提供精细化的租户管理以及围绕合规性建立提升销售路径来脱颖而出。

2024年,大型企业将占专案管理软体支出的61.1%,而中小企业将以17.2%的复合年增长率成长,这将重塑计划管理软体市场规模的格局。成长将主要集中在亚太地区,地方政府正在提供津贴以提升企业的数位技能。日本中小企业正在采用基于人工智慧的排班系统来弥补人手不足。收费系统正在取消最低用户数量限制,从而降低市场进入门槛。

在市场饱和的地区,随着企业成长趋于平缓,供应商推出中小企业的精简版产品和社群活动。但跨国企业仍依赖复杂的整合和高阶分析套件来推动营收成长。这种双重需求迫使产品团队在维持产品可扩充性的同时,避免使用者上手过程过于复杂。

计划管理软体市场报告按配置(云端部署、本地部署)、组织规模(大型企业、中小企业)、最终用户行业(IT 和电信、医疗保健、建筑和基础设施、银行、金融服务和保险、其他)、订阅类型(月度订阅、年度订阅、一次性许可)和地区对行业进行分类。

区域分析

2024年,北美占据了计划管理软体市场36.5%的份额。该地区的企业凭藉着强大的基础设施和充足的IT预算,部署了端到端的计划生态系统。微软在Microsoft 365整合计划管理功能的支援下,2024年营收成长16%,达到2,450亿美元。创新中心持续引领人工智慧模组的开发,但应用已接近饱和,导致区域成长放缓。

亚太地区到2030年将以15.3%的复合年增长率成长,成为所有地区中成长最快的地区。随着跨国公司采用整合的Salesforce和Azure技术堆迭来管理跨境倡议,中国的SaaS市场将以每年近30%的速度成长。在云端运算普及和新兴企业企业蓬勃发展的推动下,印度的SaaS收入预计将从2023年的71.8亿美元成长到2032年的629.3亿美元。东南亚的中小型企业将采用符合区域合规规范的在地化专案管理套件。

随着GDPR强制要求在地化能力,欧洲将迎来强劲成长,这将使提供欧盟资料中心和高级加密技术的供应商受益。在南美洲以及中东和非洲,宽频和支付管道的改善推动了云端服务的普及,此前基础设施的不足阻碍了云端服务的使用。随着连接成本的进一步下降,供应商预计云端服务将实现两位数成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 远端和混合企划团队的云端优先采用

- 将您的专案管理平台与企业级 SaaS 堆迭集成

- 低程式码/无程式码配置方式正被中小企业广泛采用。

- 人工智慧主导的进度和成本偏差预测分析

- 行业专用专案管理套件(建筑、医疗保健等)

- 嵌入计划工作流程的 ESG 合规报告

- 市场限制

- 迁移和定製到原有系统需要高昂的成本

- 多租户云端中的资料主权和隐私问题

- 功能商品化会增加供应商锁定风险。

- 变更管理疲劳抑制了大规模部署

- 关键法规结构评估

- 价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 关键相关人员影响评估

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 透过部署

- 云

- 本地部署

- 按组织规模

- 大公司

- 小型企业

- 按最终用户行业划分

- 资讯科技和电讯

- 卫生保健

- 建筑和基础设施

- BFSI

- 政府/公共部门

- 製造业

- 其他的

- 按订阅类型

- 月度订阅

- 年度订阅

- 一次许可证

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 澳洲

- 纽西兰

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Adobe Inc.(Workfront)

- AEC Software Inc.

- Asana Inc.

- Atlassian Corporation PLC

- Basecamp LLC

- Broadcom Inc.(Clarity PPM)

- ClickUp(Mango Technologies, Inc.)

- Microsoft Corporation

- Monday.com Ltd.

- Oracle Corporation

- Planview Inc.

- Procore Technologies Inc.

- SAP SE

- ServiceNow Inc.

- Smartsheet Inc.

- Teamwork.com Ltd.

- Trello Enterprise(Atlassian)

- Unit4 NV

- Wrike Inc.(Citrix Systems)

- Zoho Corporation Pvt Ltd.

第七章 市场机会与未来展望

The project management software market stands at USD 9.76 billion in 2025 and is advancing at a 15.65% CAGR toward USD 20.20 billion by 2030.

Expansion remains anchored in cloud-first deployment, low-code configurability, and predictive analytics that collectively upgrade project oversight from task tracking to strategic orchestration. Demand intensifies as distributed teams require real-time collaboration, and enterprises integrate project data with finance, HR, and customer systems for unified visibility. Hybrid deployment registers the fastest growth because regulated industries still need local data control. Small and medium enterprises (SMEs) accelerate adoption by bypassing traditional implementation hurdles, while AI-native features strengthen risk management and cost forecasting. Competitive intensity increases as vendors embed industry-specific workflows and open API ecosystems.

Global Project Management Software Market Trends and Insights

Cloud-First Adoption for Remote and Hybrid Project Teams

Organizations report 54% faster task completion when shifting from desktop tools to cloud-native platforms. The project management software market gains traction because real-time synchronization enables distributed teams to sustain momentum across time zones. IT departments prefer cloud scalability that removes capacity planning burdens. Hybrid models grow at 18.4% CAGR because regulated sectors balance accessibility with data control. Vendors respond by offering data-residency options that satisfy sovereignty mandates while keeping collaboration friction-free.

Integration of PM Platforms with Enterprise SaaS Stacks

Enterprises run an average of 976 applications, yet only 28% are meaningfully integrated, stalling project data flow. Modern platforms position themselves as integration hubs tied to finance, CRM, and HR systems, raising the project management software market relevancy in enterprise architecture. The SaaS integration segment is projected to exceed USD 15 billion by 2025, and firms that deploy comprehensive integration strategies report 30% productivity lifts. Cloud-native vendors gain an advantage through open APIs and pre-built connectors that curb expensive custom coding.

High Migration and Customization Costs for Legacy Estates

Enterprises face implementation bills that triple license fees because data mapping, validation, and user training are labor intensive. Migration overruns average 30% and can reach USD 15,000 per terabyte of archives. The hurdle delays refresh cycles and slows the project management software market uptake among incumbents with heavily customized workflows.

Other drivers and restraints analyzed in the detailed report include:

- SME Uptake Boosted by Low-Code / No-Code Configurability

- AI-Driven Predictive Analytics for Schedule and Cost Variance

- Data-Sovereignty and Privacy Concerns in Multi-Tenant Clouds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployment held 75% of revenue in 2024, but hybrid configurations grow at 18.4% CAGR, signalling the strongest momentum inside the project management software market. Hybrid solutions synchronize local repositories with cloud workspaces; this duality attracts firms bound by data residency statutes. On-premise persists in government and defense, yet its share shrinks as security certifications for cloud zones tighten.

The hybrid rise reflects tools that now manage seamless offline sync, encrypted tunnels, and selective storage. Construction companies keep drawings on local servers yet share field updates through cloud dashboards. Vendors differentiate by offering granular tenancy controls, creating upsell paths around compliance.

Large enterprises controlled 61.1% of 2024 spend, but SMEs chart a 17.2% CAGR that reshapes the project management software market size trajectory. Growth centers on Asia-Pacific, where local governments fund digital upskilling grants. Japanese SMEs adopt AI-assisted scheduling to offset labor shortages. Pricing tiers remove user minimums, reducing the barrier to entry.

Enterprise growth plateaus in saturated regions, so vendors launch light editions and community events geared to smaller firms. Yet, multi-national corporations still anchor revenue with complex integrations and premium analytics bundles. Dual focus forces product teams to maintain scalability without complicating onboarding.

The Project Management Software Market Report Segments the Industry Into Deployment (Cloud, and On-Premise), Organization Size (Large Enterprises, and Small and Medium Enterprises), End-User Industry (IT and Telecom, Healthcare, Construction and Infrastructure, BFSI, and More), Subscription Type (Monthly Subscription, Annual Subscription, and One-Time License), and Geography.

Geography Analysis

North America held 36.5% of the project management software market in 2024. Enterprises there leverage robust infrastructure and sizable IT budgets to roll out end-to-end project ecosystems. Microsoft recorded 16% revenue growth to USD 245 billion in 2024, supported by integrated project functions within Microsoft 365. Innovation hubs continue to pioneer AI modules, yet regional growth moderates as penetration nears saturation.

Asia-Pacific grows at 15.3% CAGR through 2030, the fastest across regions. China's SaaS segment expands near 30% annually, with multinationals installing integrated Salesforce and Azure stacks to manage cross-border initiatives. India's SaaS revenue is forecast to increase from USD 7.18 billion in 2023 to USD 62.93 billion by 2032, driven by cloud adoption and startup momentum. SMEs across Southeast Asia adopt local-language PM suites that embed regional compliance norms.

Europe posts steady gains as GDPR compels localization features, rewarding vendors offering EU data centers and advanced encryption. South America, and Middle East, and Africa now improve broadband and payment rails, nurturing cloud subscriptions previously held back by infrastructure gaps. Vendors anticipate double-digit uptake once connectivity costs fall further.

- Adobe Inc. (Workfront)

- AEC Software Inc.

- Asana Inc.

- Atlassian Corporation PLC

- Basecamp LLC

- Broadcom Inc. (Clarity PPM)

- ClickUp (Mango Technologies, Inc.)

- Microsoft Corporation

- Monday.com Ltd.

- Oracle Corporation

- Planview Inc.

- Procore Technologies Inc.

- SAP SE

- ServiceNow Inc.

- Smartsheet Inc.

- Teamwork.com Ltd.

- Trello Enterprise (Atlassian)

- Unit4 N.V.

- Wrike Inc. (Citrix Systems)

- Zoho Corporation Pvt Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first adoption for remote and hybrid project teams

- 4.2.2 Integration of PM platforms with enterprise SaaS stacks

- 4.2.3 SME uptake boosted by low-code / no-code configurability

- 4.2.4 AI-driven predictive analytics for schedule and cost variance

- 4.2.5 Vertical-specific PM suites (e.g., construction, healthcare)

- 4.2.6 ESG compliance reporting embedded in project workflows

- 4.3 Market Restraints

- 4.3.1 High migration and customization costs for legacy estates

- 4.3.2 Data-sovereignty and privacy concerns in multi-tenant clouds

- 4.3.3 Feature commoditization heightening vendor-lock-in risk

- 4.3.4 Change-management fatigue curbing large-scale roll-outs

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises

- 5.3 By End-user Industry

- 5.3.1 IT and Telecom

- 5.3.2 Healthcare

- 5.3.3 Construction and Infrastructure

- 5.3.4 BFSI

- 5.3.5 Government and Public Sector

- 5.3.6 Manufacturing

- 5.3.7 Others

- 5.4 By Subscription Type

- 5.4.1 Monthly Subscription

- 5.4.2 Annual Subscription

- 5.4.3 One-time License

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 ASEAN

- 5.5.5.6 Australia

- 5.5.5.7 New Zealand

- 5.5.5.8 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adobe Inc. (Workfront)

- 6.4.2 AEC Software Inc.

- 6.4.3 Asana Inc.

- 6.4.4 Atlassian Corporation PLC

- 6.4.5 Basecamp LLC

- 6.4.6 Broadcom Inc. (Clarity PPM)

- 6.4.7 ClickUp (Mango Technologies, Inc.)

- 6.4.8 Microsoft Corporation

- 6.4.9 Monday.com Ltd.

- 6.4.10 Oracle Corporation

- 6.4.11 Planview Inc.

- 6.4.12 Procore Technologies Inc.

- 6.4.13 SAP SE

- 6.4.14 ServiceNow Inc.

- 6.4.15 Smartsheet Inc.

- 6.4.16 Teamwork.com Ltd.

- 6.4.17 Trello Enterprise (Atlassian)

- 6.4.18 Unit4 N.V.

- 6.4.19 Wrike Inc. (Citrix Systems)

- 6.4.20 Zoho Corporation Pvt Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment