|

市场调查报告书

商品编码

1851515

无线电动汽车充电:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Wireless Electric Vehicle Charging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

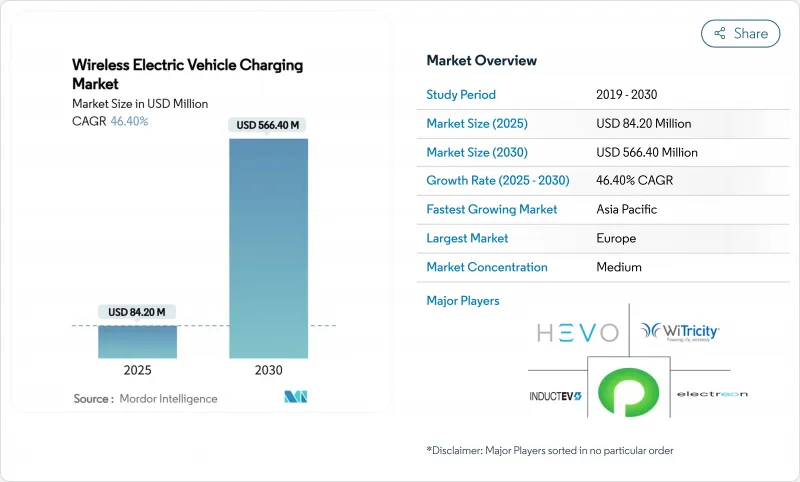

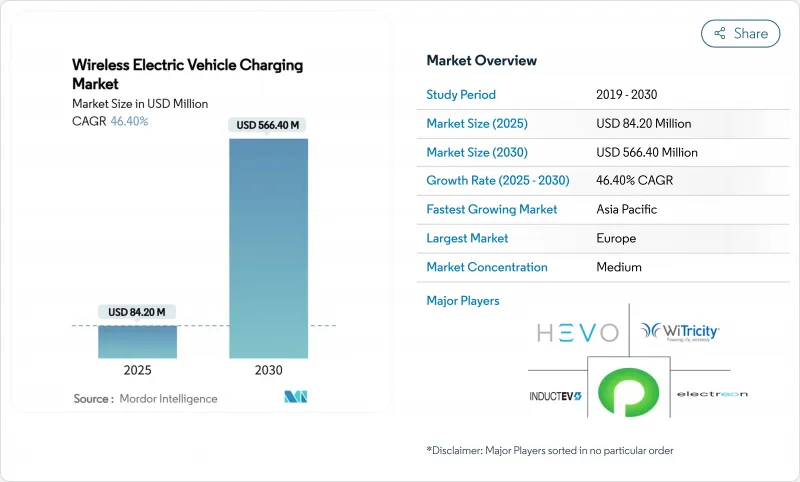

预计到 2025 年,无线电动汽车充电市场规模将达到 8,423 万美元,到 2030 年将达到 5.6646 亿美元,在预测期(2025-2030 年)内,复合年增长率将达到 46.40%。

投资势头强劲,反映出无线充电技术正从实验室试点转向盈利性部署,特斯拉收购Wiferion以及SAE J2954标准于2024年8月发布加速了这一进程。随着主要城市传统插电式充电基础设施接近饱和,汽车製造商现在将无线充电技术视为差异化优势。虽然欧洲目前拥有最强劲的区域需求,但亚太地区是成长最快的地区,这主要得益于中国快速充电桩的部署。在各个地区,车队营运商都强调无线充电可以降低人事费用并提高车辆运转率,从而推动了这项技术的普及,儘管这会增加资本支出。

全球无线电动汽车充电市场趋势与洞察

全球电动车销量正在加速成长

全球电动车销售的强劲势头催生了对差异化充电解决方案前所未有的需求,无线充电技术正逐渐成为一项高端功能,为汽车製造商带来更高的净利率。特斯拉于2024年8月对Wiferion的策略性收购标誌着该技术已超越实验阶段,走向成熟;而WiTricity于2024年5月在日本设立子公司,则预示着双方正携手进行全球扩张。自动驾驶汽车研发与无线充电技术的融合创造了极具吸引力的价值提案,特斯拉于2024年9月提交的四项新的无线充电专利便印证了这一点。这种技术融合表明,随着旅行服务的扩展,无线充电将从一种奢侈的便利功能转变为一种营运必需品。

政府对零排放车辆的强制规定和奖励

零排放车辆强制令日益认识到基础设施限制是推广应用的一大障碍,促使各国政府透过定向补贴和法律规范来奖励无线充电技术的普及。日本在更广泛的关税谈判中考虑为特斯拉充电站提供补贴,这显示无线技术与贸易政策和产业竞争力息息相关。 SAE J3400标准将于2024年9月正式确立为建议标准,这将使政府采购专案能够明确公共车辆的无线充电要求,从而为监管提供清晰的指导。欧洲城市正在考虑禁止在路边停车位使用电缆,尤其是在城市负责人努力消除充电基础设施的视觉干扰并保持其可及性的情况下,这正在推动监管变革,以配合技术发展。

高昂的系统和安装成本

无线充电系统的成本是同等有线解决方案的两到三倍,儘管这项技术的经济性正在不断提高,但高昂的成本仍然是其大规模市场普及的一大障碍。 WiTricity 的 11kW 无线充电器售价 3,500 美元,安装成本在 3,500 美元到 4,000 美元之间。基础设施部署成本更加惊人,动态充电车道需要约 1.67 亿欧元的投资,而同等快速充电站的投资金额仅为 1.05 亿欧元。

细分市场分析

到2024年,静态充电垫片将维持81.90%的市场份额,这反映了其目前的商业性可行性和消费者接受度。同时,随着基础设施投资着眼于长期的出行转型,动态路边充电将在2030年前以62%的复合年增长率加速成长。静态系统受益于成熟的安装通讯协定和久经考验的可靠性,例如WiTricity与多家汽车製造商的合作,以及Electreon在以色列和德国成功部署的客运站。动态充电的应用目前主要集中在试点先导计画和特定路段。然而,密西根州的14th Street和瑞典的Smartroad Gotland等案例表明,动态充电在更大规模的应用场景中具有巨大的商业潜力,因为持续充电可以实现更小的电池配置。

技术成熟週期有利于快速占领市场的静态解决方案,而动态系统则需要协调一致的基础设施投资,远不止于个人购车决策。橡树岭国家实验室实现的270千瓦无线充电技术标誌着静态和动态应用之间的里程碑,因为同一项多相感应耦合技术既支援固定式充电,也支援行动式充电。动态充电的发展轨迹取决于官民合作关係,这种合作能够使基础设施投资与车辆电气化时间表保持一致,并透过提高营运效率来创造网路效应,从而证明高昂的技术成本是合理的。

到2024年,乘用车将占据无线电动汽车充电市场65.20%的份额,而巴士和长途客车将成为成长最快的细分市场,复合年增长率将达到48%。轻型商用车以及中重型卡车代表着新兴应用领域,无线充电技术可实现无需人工干预的自动化充电站营运。插电式混合动力汽车作为一种过渡技术,将保持稳定的需求,但随着纯电动车成本趋于一致以及充电基础设施的扩展,其成长前景将有所下降。

与个人用户部署相比,车队应用具有更优的经济效益,因为集中式充电站可以实现标准化的安装和维护流程,同时最大限度地提高利用率。洛杉矶港为重型卡车部署的500kW无线充电系统表明,商业应用透过提高营运效率和满足排放合规要求,证明了其高价的合理性。巴士和长途远距尤其受益于无线技术与固定线路营运的契合度,可预测的充电方案能够优化电池容量,并降低基础设施的复杂性,相较之下,人工随机充电方式则更为复杂。

区域分析

到2024年,欧洲将占据无线电动汽车充电市场38.20%的份额,这得益于气候法规以及瑞典的电动高速公路和德国的eCharge BASt等早期示范走廊的建设。挪威于2024年8月建成了全球首条城市导向道路,展现了北欧在可再生能源与无线充电融合领域的领先地位。德国豪华汽车製造商正将充电垫片与高端配置车型捆绑销售,以进一步提高本地市场的普及率并增强消费者的认知度。

到2030年,亚太地区的电动车充电桩市场将以43%的复合年增长率快速成长,仅2024年中国就将新增422.2万个充电桩。北京的城市更新计画将在新多用户住宅中配备感应式充电桩,地方政府也将提供补贴,用于在出口走廊上建造动态货车专用车道。日本于2025年4月成立了电动车无线充电委员会,WiTricity也在东京开设了分公司。

北美地区正呈现出一些集中增长点。密西根州第14街的自动扶梯车道和加州耗资2000万美元的加州大学洛杉矶分校道路计划检验了无线充电技术的技术可行性,但由于各州对电磁辐射的规定不尽相同,审批流程可能并不完善。联合秘书处支援SAE J3400标准,该标准旨在规范连接器规格并将无线收费资料纳入联邦资金筹措标准。墨西哥和加拿大仍是新兴市场。跨境货运公司正在倡导走廊互通性,以保护其在配备底盘接收器的卡车上的投资。总而言之,这些区域性发展表明,无线电动汽车充电市场将从各国试点计画的零散模式发展成为覆盖整个大陆的网路。预计到本十年末,成本下降和标准的统一将缩小普及率差距。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球电动车销量正在快速成长。

- 政府对零排放车辆的强制规定和奖励

- 早期 OEM 整合到高阶车型中

- 车队电气化对自主式车库充电的需求

- 都市区电缆限制和路边导垫片

- 新兴的 SAE J2954-2 300kW 以上标准

- 市场限制

- 高昂的系统和安装成本

- 互通性和标准差距

- 人们对人口密集地区电磁波安全性的担忧

- 兆瓦级负载通道的电网谐波约束

- 监管环境

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(2024-2030年)

- 按充电类型

- 静电充电垫片

- 行驶过程中的电源供应

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和大型卡车

- 巴士和长途客车

- 透过输出

- 小于11千瓦

- 11-50 kW

- 51-150 kW

- 150千瓦或以上

- 按安装位置

- 家庭车库

- 职场/商业停车场

- 公共停车场和零售

- 车队及维修站设施

- 高速公路车道

- 透过技术平台

- 电感谐振耦合

- 磁场对准多线圈

- 电容式电源

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- WiTricity Corporation

- InductEV Inc.

- Electreon Wireless Ltd.

- HEVO Inc.

- Plugless Power Inc.(Evatran Group)

- Continental AG

- Robert Bosch GmbH

- Toyota Motor Corporation

- Toshiba Corporation

- Qualcomm Technologies(Halo)

- Siemens AG

- ABB Ltd.

- Wireless Advanced Vehicle Electrification, LLC.(WAVE Charging)

第七章 市场机会与未来展望

The wireless EV charging market stands at USD 84.23 million in 2025 and is projected to reach USD 566.46 million by 2030, advancing at a 46.40% CAGR during the forecast period (2025-2030).

Investment momentum reflects the shift from laboratory pilots to revenue-generating deployments, accelerated by Tesla's purchase of Wiferion and the release of the SAE J2954 standard in August 2024. Automakers now view the technology as a differentiator because conventional plug-in infrastructure in major cities is approaching saturation. Europe commands the largest regional demand today, yet China's rapid build-out of charging points positions Asia-Pacific as the fastest-growing arena. Across all regions, fleet operators underscore that wireless charging lowers labor costs and unlocks high utilization rates, reinforcing technology adoption despite higher capital expenditure.

Global Wireless Electric Vehicle Charging Market Trends and Insights

Rapid Acceleration in Global EV Sales

Global electric vehicle sales momentum creates unprecedented demand for differentiated charging solutions, with wireless technology emerging as a premium feature that commands higher margins for automakers. Tesla's strategic acquisition of Wiferion in August 2024 signals the technology's maturation beyond experimental phases, while WiTricity's establishment of a Japanese subsidiary in May 2024 demonstrates coordinated global expansion efforts. The convergence of autonomous vehicle development with wireless charging capabilities creates a compelling value proposition, as demonstrated by Tesla's four new wireless charging patents filed in September 2024, specifically targeting robotaxi applications where human intervention becomes impractical Not a Tesla App. This technological alignment suggests wireless charging will transition from luxury convenience to operational necessity as mobility services scale.

Extended Government ZEV Mandates & Incentives

Zero-emission vehicle mandates increasingly recognize infrastructure limitations as barriers to adoption, prompting governments to incentivize wireless charging deployment through targeted subsidies and regulatory frameworks. Japan's consideration of subsidies for Tesla's charging stations within broader tariff negotiations illustrates how wireless technology becomes entangled with trade policy and industrial competitiveness. The SAE J3400 standard's establishment as a Recommended Practice in September 2024 provides regulatory clarity that enables government procurement programs to specify wireless charging requirements for public fleets. European cities' exploration of anti-cable regulations for curbside parking creates a regulatory pull that complements a technology push, particularly as urban planners seek to eliminate visual pollution from charging infrastructure while maintaining accessibility.

High System & Installation Costs

Wireless charging systems command 2-3 times the cost of equivalent wired solutions, creating significant barriers to mass market adoption despite improving technology economics. WiTricity's 11 kW wireless charger carries a USD 3,500 price point with installation costs ranging USD 3,500-4,000, compared to traditional Level 2 chargers priced below USD 1,000 installed. Infrastructure deployment costs prove even more challenging, with dynamic charging lanes requiring approximately EUR 167 million investment compared to EUR 105 million for equivalent fast-charging stations, though both scenarios yield similar net present values over extended timeframes.The cost differential becomes particularly acute for public infrastructure deployment, where municipalities must justify premium pricing against limited utilization rates in early adoption phases.

Other drivers and restraints analyzed in the detailed report include:

- Early OEM Integration into Premium Models

- Fleet Electrification Demand for Autonomous Depot Charging

- Interoperability & Standards Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Static pad charging maintains commanding 81.90% of the wireless electric vehicle charging market share in 2024, reflecting current commercial viability and consumer acceptance patterns, while dynamic in-road charging accelerates at 62% CAGR through 2030 as infrastructure investments target long-term mobility transformation. Static systems benefit from established installation protocols and proven reliability, as demonstrated by WiTricity's deployment across multiple automotive partnerships and Electreon's successful bus terminal implementations in Israel and Germany. Dynamic charging applications remain concentrated in pilot projects and specialized corridors. Yet, Michigan's 14th Street deployment and Sweden's Smartroad Gotland demonstrate commercial viability for heavy-duty applications where continuous charging enables smaller battery configurations.

The technology maturation timeline favors static solutions for immediate market development, while dynamic systems require coordinated infrastructure investment beyond individual vehicle purchase decisions. Oak Ridge National Laboratory's achievement of 270 kW wireless power transfer represents a breakthrough that bridges static and dynamic applications, as the same polyphase electromagnetic coupling technology enables both stationary and mobile charging scenarios. Dynamic charging's growth trajectory depends on public-private partnerships that align infrastructure investment with fleet electrification schedules, creating network effects that justify premium technology costs through operational efficiency gains.

Passenger cars command 65.20% of the wireless electric vehicle charging market share in 2024, yet buses and coaches emerge as the fastest-growing segment at 48% CAGR, reflecting commercial operators' willingness to pay technology premiums for operational advantages that reduce total cost of ownership. Light commercial vehicles and medium & heavy trucks represent emerging applications where wireless charging enables autonomous depot operations without human intervention for charging procedures. Plug-in hybrid cars maintain steady demand as transitional technology, though their growth prospects diminish as battery electric vehicles achieve cost parity and charging infrastructure expands.

Fleet applications demonstrate superior economics compared to individual consumer adoption, as centralized depot charging enables standardized installation and maintenance procedures while maximizing utilization rates. The Port of Los Angeles's implementation of 500 kW wireless charging systems for heavy-duty trucks illustrates how commercial applications justify premium pricing through operational efficiency gains and emissions compliance requirements. Buses and coaches particularly benefit from wireless technology's alignment with fixed route operations, where predictable charging schedules enable optimized battery sizing and reduced infrastructure complexity compared to opportunity charging with manual connections.

The Wireless Electric Vehicle Charging Market Report is Segmented by Charging Type (Static Pad Charging, Dynamic In-Road Charging), Vehicle Type (Passenger Cars, and More), Power Output (Up To 11 KW, and More), Installation Site (Home Garages, and More), Technology Platform (Inductive Resonant Coupling, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe controlled 38.20% of the wireless electric vehicle charging market in 2024, anchored by climate regulations and early demonstration corridors such as Sweden's e-motorway and Germany's eCharge BASt. Norway added the world's first inductive urban road in August 2024, showcasing Nordic leadership in blending renewable energy with wireless charging. Germany's premium carmakers further lift regional usage by bundling charging pads within luxury trims, reinforcing consumer familiarity.

Asia-Pacific accelerates at a 43% CAGR through 2030, propelled by China's addition of 4.222 million charging points in 2024 alone. Beijing's urban-renewal plans embed inductive bays within new apartment complexes, while provincial grants fund dynamic truck lanes on export corridors. Japan's formation of the EV Wireless Power Transfer Council in April 2025 and WiTricity's Tokyo branch underscore coordination among utilities, parts suppliers, and policymakers to seed national networks.

North America exhibits concentrated growth pockets. Michigan's induction lane on 14th Street and California's USD 20 million UCLA road project validate technical feasibility, but state-by-state rules on electromagnetic exposure mean patchwork permitting processes. The Joint Office's support for SAE J3400 seeks to unify coupler specifications and integrate wireless billing data into federal funding criteria. Mexico and Canada remain emergent spaces; cross-border freight operators advocate for corridor interoperability to safeguard investment in trucks equipped with underbody receivers. Together, these regional narratives suggest the wireless EV charging market will evolve as a mosaic of national pilots scaling into continental networks. Cost declines and standard harmonization are expected to reduce adoption gaps by the decade's end.

- WiTricity Corporation

- InductEV Inc.

- Electreon Wireless Ltd.

- HEVO Inc.

- Plugless Power Inc. (Evatran Group)

- Continental AG

- Robert Bosch GmbH

- Toyota Motor Corporation

- Toshiba Corporation

- Qualcomm Technologies (Halo)

- Siemens AG

- ABB Ltd.

- Wireless Advanced Vehicle Electrification, LLC. (WAVE Charging)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid acceleration in global EV sales

- 4.2.2 Extended government ZEV mandates & incentives

- 4.2.3 Early OEM integration into premium models

- 4.2.4 Fleet electrification demand for autonomous depot charging

- 4.2.5 Urban anti-cable regulations & curbside inductive pads

- 4.2.6 Emerging SAE J2954-2 more than 300 kW standard

- 4.3 Market Restraints

- 4.3.1 High system & installation costs

- 4.3.2 Interoperability & standards gaps

- 4.3.3 Electro-magnetic safety concerns in dense urban zones

- 4.3.4 Grid harmonics constraints on megawatt in-road lanes

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Charging Type

- 5.1.1 Static Pad Charging

- 5.1.2 Dynamic In-Road Charging

- 5.2 By Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium & Heavy Trucks

- 5.2.4 Buses & Coaches

- 5.3 By Power Output

- 5.3.1 Up to 11 kW

- 5.3.2 11-50 kW

- 5.3.3 51-150 kW

- 5.3.4 Above 150 kW

- 5.4 By Installation Site

- 5.4.1 Home Garages

- 5.4.2 Workplace & Commercial Parking

- 5.4.3 Public Parking Lots & Retail

- 5.4.4 Fleet & Depot Facilities

- 5.4.5 Highway Lanes

- 5.5 By Technology Platform

- 5.5.1 Inductive Resonant Coupling

- 5.5.2 Magnetic Field Alignment Multi-coil

- 5.5.3 Capacitive Power Transfer

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Nigeria

- 5.6.5.6 Egypt

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 WiTricity Corporation

- 6.4.2 InductEV Inc.

- 6.4.3 Electreon Wireless Ltd.

- 6.4.4 HEVO Inc.

- 6.4.5 Plugless Power Inc. (Evatran Group)

- 6.4.6 Continental AG

- 6.4.7 Robert Bosch GmbH

- 6.4.8 Toyota Motor Corporation

- 6.4.9 Toshiba Corporation

- 6.4.10 Qualcomm Technologies (Halo)

- 6.4.11 Siemens AG

- 6.4.12 ABB Ltd.

- 6.4.13 Wireless Advanced Vehicle Electrification, LLC. (WAVE Charging)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment