|

市场调查报告书

商品编码

1939599

热塑性聚氨酯(TPU):市场份额分析、产业趋势与统计、成长预测(2026-2031)Thermoplastic Polyurethane (TPU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

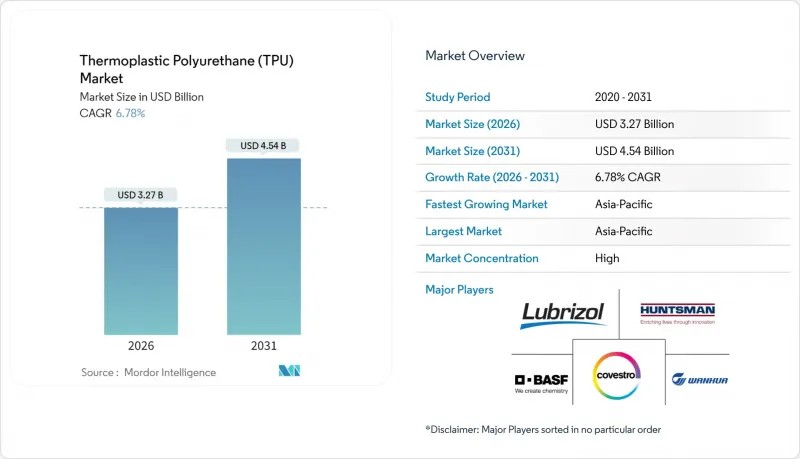

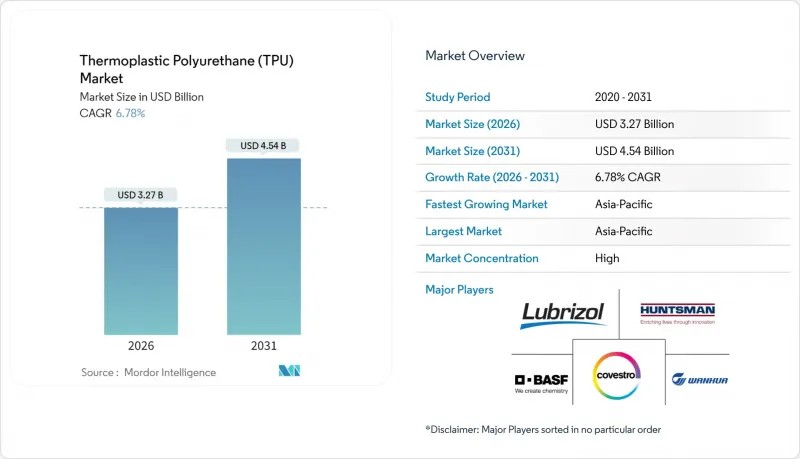

热塑性聚氨酯市场预计将从 2025 年的 30.6 亿美元成长到 2026 年的 32.7 亿美元,预计到 2031 年将达到 45.4 亿美元,2026 年至 2031 年的复合年增长率为 6.78%。

这一成长主要得益于鞋类、汽车、医疗设备和积层製造(3D列印)等行业需求的不断增长。加工商正在寻找兼具弹性、耐磨性和易加工性的材料。聚酯类材料因其优异的机械性能和成本平衡而占据主导地位。同时,生物基原料和闭合迴路设计的运用正帮助品牌满足永续性的要求。轻量化电动车的日益普及、穿戴式健康监测设备的广泛应用以及柔性太阳能组件中TPU膜的日益普及,进一步扩大了热塑性聚氨酯市场的潜在基本客群。从区域来看,亚太地区凭藉其一体化的供应链和大规模的下游生产能力,成为最具竞争力的地区,而北美製造商则在法规遵循和特殊应用创新方面处于主导。

全球热塑性聚氨酯(TPU)市场趋势与洞察

穿戴式医疗设备

连续血糖监测仪、智慧型心臟贴片和新一代导管的快速普及推动了医用级TPU的需求。这些设备需要触感柔软、具有长期皮肤相容性和耐弯曲性。为了满足亚洲医疗技术製造商的在地化供应需求,Avient公司在其通过ISO 13485认证的苏州工厂将NEUSoft TPU的产能提高了三倍。随后,Lubrizol和Polyhose公司在泰米尔纳德邦建立了一家管材製造厂,将神经血管产品的产能提高了五倍。此类垂直整合的投资透过缩短前置作业时间和确保材料等级通过严格的生物相容性测试,进一步加速了热塑性聚氨酯市场的发展。

3D列印耗材和粉末

积层製造技术正在革新原型製作流程,使功能性零件能够模拟最终用途的性能。BASF的 Ultrasint TPU01运作粉末层熔融平台,实现了 80% 的粉末回收率和 88-90 的邵氏 A 硬度。这赋予了材料优异的能量回弹性能,使其适用于晶格中底和汽车吸震管道。製程稳定性降低了废弃物,而回收粉末的使用降低了单一部件的成本,从而鼓励一级供应商将 TPU 整合到大规模生产线中。这提高了设计自由度,加速了迭代开发,并促进了热塑性聚氨酯市场的广泛应用。

1,4-BDO原物料价格波动

聚酯和聚醚型热塑性聚氨酯(TPU)的软段化学结构中均含有1,4-丁二醇。供应中断和对两用物项监管的日益严格审查推高了交易价格,并使库存计划变得复杂。化学品经销商报告称,与受限物质相关的文书工作会延误清关,并在需求激增期间延长前置作业时间。儘管生产商透过多种筹资策略和期货合约来对冲风险,但他们仍然面临利润率压缩,这限制了热塑性聚氨酯市场的产能扩张计划。

细分市场分析

预计到2025年,聚酯基TPU将占总销售额的39.35%,复合年增长率达7.73%,成为热塑性聚氨酯市场中规模最大且成长最快的细分市场。其优异的耐油耐脂性能使其在液压软管、电线涂层和汽车动力带等领域具有显着优势。BASF的Elastollan B CF系列产品可将成型週期缩短25%,并将硬度范围从邵氏A25扩展至邵氏D70。这使得生产兼具透明度和低温衝击强度的零件成为可能,从而提高了二次加工商的生产效率和经济效益。

聚醚基热塑性聚氨酯(TPU)在对耐水解性要求极高的应用领域,例如气动管道和户外电缆,仍然保持着良好的市场需求。聚己内酯基TPU在生物可吸收支架领域取得了一些进展。静电纺丝奈米纤维透过模拟细胞外基质并支持药物控释,正在拓展临床研究的管道。化学结构的多样性确保热塑性聚氨酯市场能满足各行业广泛的性能要求。

区域分析

预计到2025年,亚太地区将占全球收入的57.40%,并在2031年之前维持7.55%的年均成长率。中国垂直整合的供应链集中了原料采购、配製和加工环节,降低了服务交付成本。 Avient在苏州的投资实现了导管级TPU的本地化生产,有助于缩短区域医疗设备製造商的前置作业时间。同时,路博润在印度的导管製造计划将使其区域产能扩大五倍,进而增强心血管器械OEM厂商的供应保障。

北美位居第二,这主要得益于高性能运动用品、医疗抛弃式产品和特殊薄膜领域的高应用率。对二异氰酸酯监管的日益严格提高了市场准入门槛,同时也推动了低游离异氰酸酯预聚物和生物基碳材料的创新。此外,对积层製造的投资也促进了该地区材料的差异化发展,从而支持热塑性聚氨酯市场细分领域的成长。

欧洲正充分利用主导地位。各大品牌优先考虑可再生碳原料和透明的废弃物处理方案,加速了对生物质平衡型TPU的需求。德国和法国的汽车零件製造商正在整合TPU密封件以满足欧盟的排放气体目标,而义大利时尚品牌则在高端配件领域采用无溶剂TPU合成皮革。

儘管南美洲和中东及非洲地区仍在发展中,但它们具有重要的战略意义。巴西的製鞋丛集正在增加对可再生TPU颗粒的需求,而阿联酋的建筑商则指定使用能够抵御沙漠紫外线的TPU屋顶防水卷材。由于当地产能有限,跨国製造商正在建立分销中心和技术服务中心,以打入新兴的热塑性聚氨酯市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 穿戴式医疗设备推动了对医用级TPU的需求。

- 3D列印耗材和粉末加速原型製作技术的普及

- 生物基鞋类计画推动消费

- 柔软性太阳能和建筑膜材料从PVC到TPU的过渡

- 在工业应用的使用日益增多

- 市场限制

- 1,4-丁二醇原料价格的波动推高了聚酯/醚基TPU的价格。

- 加强对异氰酸酯暴露的监管

- 汽车应用中耐热TPEE/TPV替代的风险

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 聚酯TPU

- 聚醚基热塑性聚氨酯(TPU)

- 聚己内酯基热塑性聚氨酯(TPU)

- 透过使用

- 挤出成型产品

- 射出成型产品

- 黏合剂

- 其他用途

- 按最终用途行业划分

- 鞋类

- 车

- 医疗保健

- 电气和电子设备

- 建造

- 重工业

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 策略趋势

- 市占率分析

- 公司简介

- BASF

- Avient Corporation

- Coim Group

- Covestro AG

- Dongsung

- Epaflex Polyurethanes SpA

- Hexpol AB

- Huntsman International LLC

- Miracll Chemicals Co. Ltd

- Mitsui Chemicals Inc.

- Novotex Italiana SpA

- Sumei Chemical Co. Ltd

- Suzhou Austen New Mstar Technology Ltd

- Taiwan PU Corporation

- The Lubrizol Corporation

- Tosoh Corporation

- Trinseo

- Wanhua Chemical Group Co. Ltd

第七章 市场机会与未来展望

The Thermoplastic Polyurethane market is expected to grow from USD 3.06 billion in 2025 to USD 3.27 billion in 2026 and is forecast to reach USD 4.54 billion by 2031 at 6.78% CAGR over 2026-2031.

Expanding demand across footwear, automotive, medical devices, and additive manufacturing anchors this growth as converters seek materials that combine elasticity, abrasion resistance, and ease of processing. Polyester grades hold sway because they balance mechanical performance with cost, while bio-based content and closed-loop designs help brands meet sustainability mandates. Rising lightweighting in electric vehicles, strong adoption in wearable health monitors, and increased use of TPU membranes in flexible solar modules further widen the addressable base of the thermoplastic polyurethane market. Regional competitive intensity is highest in Asia-Pacific due to integrated supply chains and sizable downstream capacity, yet North American producers set the pace on regulatory compliance and specialty innovation.

Global Thermoplastic Polyurethane (TPU) Market Trends and Insights

Wearable medical devices

Surging adoption of continuous glucose monitors, smart cardiac patches and next-generation catheters is intensifying the pull for medical-grade TPU. These devices require soft touch, long-term skin compatibility and kink resistance. Avient tripled capacity for its NEUSoft TPU in Suzhou under ISO 13485 certification to localize supply for Asian health-tech manufacturers . Lubrizol and Polyhose followed with a Tamil Nadu tubing plant that scales neurovascular products five-fold . Such vertical investments shorten lead times and lock in material grades that can pass stringent biocompatibility testing, adding momentum to the thermoplastic polyurethane market.

3D-printing filaments & powders

Additive manufacturing reshapes prototype cycles by enabling functional parts that mimic end-use performance. BASF's Ultrasint TPU01 runs on powder-bed fusion platforms with 80% powder recyclability and 88-90 Shore A hardness, delivering energy return suited to lattice midsoles and impact-absorbing automotive ducts. Process stability lowers scrap while recycled powder cuts cost per part, encouraging tier-1 suppliers to integrate TPU into serial production. The resulting design freedom accelerates iteration and supports broader adoption across the thermoplastic polyurethane market.

1,4-BDO feedstock volatility

Polyester and polyether TPU rely on 1,4-butanediol for soft-segment chemistry. Supply disruptions and dual-use regulatory scrutiny raise transaction prices and complicate inventory planning. Chemical distributors report that controlled-substance documentation slows customs clearance, extending lead times during demand spikes. Producers hedge with multi-sourcing strategies and forward contracts but still face margin compression that restrains capacity expansion plans in the thermoplastic polyurethane market.

Other drivers and restraints analyzed in the detailed report include:

- Bio-based mono-material footwear

- PVC-to-TPU shift in membranes

- Tightening isocyanate regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyester TPU generated 39.35% of 2025 revenue and is projected to grow at 7.73% CAGR, establishing it as both the largest and fastest segment within the thermoplastic polyurethane market. Robust oil and grease resistance underpins its dominance in hydraulic hoses, wire coatings and dynamic automotive belts. BASF's Elastollan B CF series trims cycle times by 25% and widens hardness coverage from 25 Shore A to 70 Shore D, enabling parts that combine clarity with low-temperature impact strength. The resulting productivity gains improve economic viability for secondary converters.

Polyether TPU sustains demand where hydrolysis resistance is paramount, such as pneumatic tubes and outdoor cables. Polycaprolactone TPU, though smaller, advances in bio-resorbable scaffolds. Electrospun nanofibers mimic extracellular matrices and support controlled drug release, expanding clinical research pipelines. Diversified chemistry assures that the thermoplastic polyurethane market can address divergent performance specifications across industries.

The Thermoplastic Polyurethane Market Report Segments the Industry by Product Type (Polyester TPU, Polyether TPU, Polycaprolactone TPU), Application (Extruded Products, Injection Molded Products, and More), End-User Industry (Footwear, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 57.40% of global revenue in 2025 and is set to compound at 7.55% annually to 2031. China's vertically integrated supply chain secures raw materials, compounding and conversion under one roof, thereby compressing cost to serve. Avient's Suzhou investment localises catheter-grade TPU production, cutting lead times for regional device makers. Concurrently, Lubrizol's Indian tubing project lifts regional capacity five-fold and enhances supply resilience for cardiovascular OEMs.

North America ranks second owing to high adoption in performance sports, medical disposables and specialty films. Regulatory tightening on diisocyanates elevates barriers to entry yet spurs innovation in low-free-isocyanate prepolymers and bio-based carbon routes. Investments in additive manufacturing also advance regional material differentiation, supporting niche growth inside the thermoplastic polyurethane market.

Europe leverages its leadership in circular economy frameworks. Brands favour renewable carbon feedstocks and transparent end-of-life schemes, accelerating demand for biomass-balanced TPU grades. Automotive suppliers in Germany and France integrate TPU seal profiles to meet EU fleet emission targets, while Italian fashion houses adopt solvent-free TPU synthetic leather for luxury accessories.

South America and the Middle East & Africa remain nascent but strategic. Brazilian footwear clusters consume increasing volumes of recyclable TPU pellets, while United Arab Emirates contractors specify TPU roofing membranes to withstand desert UV exposure. Local production remains limited, encouraging multinational producers to establish distribution hubs and technical service centers to penetrate these emerging nodes of the thermoplastic polyurethane market.

- BASF

- Avient Corporation

- Coim Group

- Covestro AG

- Dongsung

- Epaflex Polyurethanes SpA

- Hexpol AB

- Huntsman International LLC

- Miracll Chemicals Co. Ltd

- Mitsui Chemicals Inc.

- Novotex Italiana SpA

- Sumei Chemical Co. Ltd

- Suzhou Austen New Mstar Technology Ltd

- Taiwan PU Corporation

- The Lubrizol Corporation

- Tosoh Corporation

- Trinseo

- Wanhua Chemical Group Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Wearable Medical Devices Driving Medical-Grade TPU Demand

- 4.2.2 3D-Printing Filaments & Powders Accelerating Prototyping Adoption

- 4.2.3 Bio-Based Mono-Material Footwear Programs Boosting Consumption

- 4.2.4 PVC-to-TPU Shift in Flexible Solar & Architectural Membranes

- 4.2.5 Rising Usage in Industrial Applications

- 4.3 Market Restraints

- 4.3.1 1,4-BDO Feedstock Volatility Inflating Polyester/Ether TPU Prices

- 4.3.2 Tightening Isocyanate-Exposure Regulations

- 4.3.3 Displacement Risk from High-Heat TPEE & TPV in Automotive Application

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Polyester TPU

- 5.1.2 Polyether TPU

- 5.1.3 Polycaprolactone TPU

- 5.2 By Application

- 5.2.1 Extruded Products

- 5.2.2 Injection Molded Products

- 5.2.3 Adhesives

- 5.2.4 Other Applications

- 5.3 By End-Use Industry

- 5.3.1 Footwear

- 5.3.2 Automotive

- 5.3.3 Medical

- 5.3.4 Electrical & Electronics

- 5.3.5 Construction

- 5.3.6 Heavy Engineering

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global & Market Overview, Core Segments, Financials, Strategy, Rank/Share, Products, Recent Developments)

- 6.3.1 BASF

- 6.3.2 Avient Corporation

- 6.3.3 Coim Group

- 6.3.4 Covestro AG

- 6.3.5 Dongsung

- 6.3.6 Epaflex Polyurethanes SpA

- 6.3.7 Hexpol AB

- 6.3.8 Huntsman International LLC

- 6.3.9 Miracll Chemicals Co. Ltd

- 6.3.10 Mitsui Chemicals Inc.

- 6.3.11 Novotex Italiana SpA

- 6.3.12 Sumei Chemical Co. Ltd

- 6.3.13 Suzhou Austen New Mstar Technology Ltd

- 6.3.14 Taiwan PU Corporation

- 6.3.15 The Lubrizol Corporation

- 6.3.16 Tosoh Corporation

- 6.3.17 Trinseo

- 6.3.18 Wanhua Chemical Group Co. Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment

- 7.2 Shifting Focus Toward the Development of Bio-based Products