|

市场调查报告书

商品编码

1851525

酰胺纤维:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Aramid Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

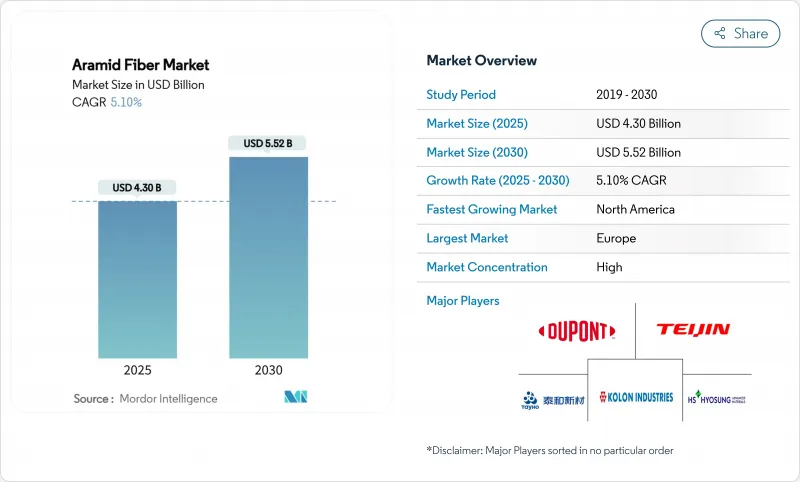

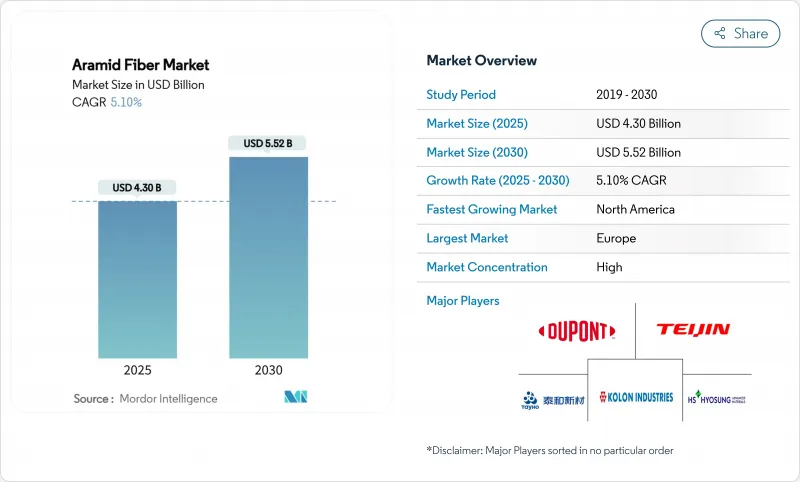

预计到 2025 年,酰胺纤维市场规模将达到 43 亿美元,到 2030 年将达到 55.2 亿美元,预测期内(2025-2030 年)复合年增长率为 5.10%。

该纤维在汽车、航太、电讯和先进个人防护设备等领域的广泛应用推动了市场需求,而其优异的强度重量比和热稳定性也确保了其长期应用前景。电动车、5G网路建设以及高超音速和太空专案投资的增加,都对轻量化材料提出了更高的要求,这也持续推动市场机会。同时,原材料价格(主要是MPD和PPD)的波动挤压了净利率,并促使领先製造商进行垂直整合。智慧财产权限制进一步影响竞争动态,巩固了那些能够投入研发资金并利用交叉授权机制的现有企业的地位。

全球酰胺纤维市场趋势与洞察

亚洲製造地加强个人防护装备安全强制措施

中国、印度和东南亚新兴经济体工业安全法规的实施,推动了芳香聚酰胺增强手套、头盔和耐热工作服订单的成长。芳香聚酰胺材料製成的工业头盔比ABS材质的头盔抗衝击性高出37%,加速了其在工厂的普及。对位芳香聚酰胺製成的防切割手套在重量减轻30%的情况下,防护等级达到5级,且更适合长时间配戴。间位芳香聚酰胺製成的阻燃工作服在425°C高温下仍能保持结构完整性,并符合更严格的铸造和石化安全标准。因此,供该地区的製造商正在增加芳香聚酰胺纱线和织物的配额,从而巩固了酰胺纤维市场的成长势头。

芳香聚酰胺增强型轻量化电动车轮胎推动欧盟绿色新政

欧洲汽车製造商正在加速轮胎重新设计项目,以减轻车辆重量,从而延长电动车的续航里程。芳香聚酰胺增强轮胎汽车胎体可达到高达25%的减重,直接辅助实现「绿色交易」的交通运输脱碳目标。每减轻1公斤重量,就能增加0.7公里的续航里程,这促使汽车製造商使用芳香聚酰胺代替聚酯或钢丝。橡胶混炼商正在将芳香聚酰胺增强橡胶混合物商业化,这种混合物在降低滚动阻力的同时,还能保持耐久性,从而增强了欧洲乃至北美对酰胺纤维的需求。

MPD和PPD原物料价格波动

原油价格高企和区域供应中断推高了MPD和PPD的成本,挤压了生产商的利润空间,并使长期合约面临风险。美国商务部已将芳香族二胺列为生产高度集中、具有重要化学价值的原料之一,加剧了供应安全风险。儘管製造商正透过探索生物基中间体和芳香聚酰胺废料的闭合迴路回收来应对,但短期波动仍持续抑制酰胺纤维市场的成长动能。

细分市场分析

到2024年,对位芳香聚酰胺将占据酰胺纤维市场65%的份额,这主要得益于弹道防护、航太和摩擦材料领域的需求成长。对位芳香聚酰胺纱线的抗拉强度接近3.8 GPa,使其在防护衣和航空蜂窝材料领域保持领先地位。美国不断增长的国防预算以及对轻质汽车复合材料的重新关注,为对位芳香聚酰胺在酰胺纤维市场提供了稳定的销售来源。东丽公司在韩国工厂扩建3,000吨产能等重大投资,凸显了对该类纤维的巨额资本投入。

儘管间位芳香聚酰胺的市占率目前较小,但其成长速度惊人,预计到2030年将以5.42%的复合年增长率成长。先进的湿式纺丝长丝目前的拉伸强度可达1255兆帕,并且在长时间紫外线照射后仍能保持90%以上的强度,这为电力线护套等户外应用开闢了新的前景。间位芳香聚酰胺也可用于阻燃织物、绝缘纸和过滤袋,满足电子、工业安全和环境保护领域对热稳定性的需求。由于亚洲半导体产能的扩张以及欧盟绿色转型计划的推进,间位酰胺纤维市场预计将稳步增长,这将形成一种竞争动态,在这种格局下,材料性能而非价格将成为决定客户转换率的关键因素。

到2024年,湿式纺丝将占据酰胺纤维市场60%的份额,并继续以5.87%的复合年增长率超越主要市场。此製程可实现均匀的聚合物凝固,以产生密度均匀、介电稳定性高的纤维,这是製造电工纸和过滤介质的先决条件。升级后的溶剂回收模组可降低排放和成本,并正被注重永续性的终端用户所采用。随着电气化程度的提高和对滤材需求的成长,湿式纺丝酰胺纤维的市场规模预计将持续扩大。

对于对位芳纶芳香聚酰胺,干喷湿纺製程仍然至关重要,因为链取向决定了其极高的拉伸性能。对聚酰亚胺类似物的实验表明,其拉伸强度可达 2.72 GPa,模量超过 114 GPa,这为未来对位芳香聚酰胺增强材料的发展指明了方向。儘管该工艺目前市场份额较小,但它为高端弹道纱线的供应提供了保障,满足了国防部门和奢侈运动品牌的需求。持续的生产线升级,旨在提高生产效率和改进溶剂捕集技术,将有助于巩固其在酰胺纤维市场中的这一独特地位。

区域分析

到2024年,欧洲将占酰胺纤维市场35%的份额。严格的工人安全法规、符合ISO标准的阻燃标准以及欧盟的绿色新政正在推动芳纶纤维在汽车和工业领域的高价值应用。德国凭藉其出口导向的汽车产业基础,将引领该地区的销售成长,而法国和荷兰则专注于先进的过滤和航太层压材料。政府对电动车电池工厂的激励措施将进一步促进聚合物复合材料的应用。

从2025年到2030年,北美将以5.34%的复合年增长率实现最快成长。联邦国防预算将持续推动对位芳香聚酰胺弹道飞弹材料的需求,而美国国家航空暨太空总署(美国国家航空暨太空总署)和商业发射服务供应商则将投资转向间位芳香聚酰胺隔热罩。美国通讯业者正在升级飓风易发走廊的航空光纤骨干网,并指定使用芳香聚酰胺强度的组件以减轻风暴造成的损失。加拿大也呈现类似的趋势,其重点在于公共,尤其是在采矿和能源基础设施领域。

亚太地区将成为酰胺纤维市场的下一个前线。中国正在扩大国内生产规模,以减少对进口的依赖,并力争在本世纪中期实现对对位芳香聚酰胺的自给自足。智慧工厂、电动车电池厂和可再生能源基础设施的大规模建设将增加对轻质耐热材料的需求。日本和韩国正在加速推进半导体和5G硬体的高科技部署,这需要芳香聚酰胺所具备的介电稳定性和机械韧性。印度的「印度製造」国防计画和更新后的职业安全规范将促进该地区个人防护装备和防护用品的消费,从而进一步推动区域成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲製造地加强个人防护装备安全强制措施

- 芳香聚酰胺增强型轻量化电动车轮胎是欧盟绿色交易的基础。

- 5G部署激增推动了对芳香聚酰胺增强光纤电缆的需求

- 各国增加国防支出

- 高超音速和太空防御领域的投资推动了间位芳香聚酰胺隔热罩的消耗。

- 市场限制

- MPD和PPD原料的价格波动

- 对位芳香聚酰胺:专利交叉许可壁垒阻碍新进入者

- 高昂的生产成本

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 产业间竞争

第五章 市场规模与成长预测

- 依产品类型

- 对位芳香聚酰胺

- 间位芳香聚酰胺

- 透过纺丝工艺

- 湿纺

- 干喷湿纺

- 透过使用

- 安全防护设备

- 摩擦和煞车材料

- 光纤电缆

- 航太零件

- 汽车复合材料

- 电气绝缘

- 其他(工业过滤、橡胶和轮胎加固)

- 按最终用户行业划分

- 安全防护装置

- 航太

- 车

- 电子与通讯

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Aramid Hpm, LLC.

- China National Bluestar(Group)Co. Ltd.

- DuPont

- HS HYOSUNG ADVANCED MATERIALS

- Huvis Corp.

- Kolon Industries, Inc.

- Sinochem Internation Corporation

- SINOPEC YIZHENG CHEMICAL FIBRE LIMITED

- SRO Aramid

- Suzhou Zhaoda Specially Fiber Technical Co.,Ltd.

- TAEKWANG INDUSTRIAL CO., LTD.

- Teijin Limited

- Toray Industries Inc.

- TOYOBO MC Corporation

- Wuxi City Shengte Carbon Fiber Products Co.,Ltd

- X-FIPER NEW MATERIAL CO.,LTD

- Yantai Tayho Advanced Materials Co.,Ltd.

第七章 市场机会与未来展望

The Aramid Fiber Market size is estimated at USD 4.30 billion in 2025, and is expected to reach USD 5.52 billion by 2030, at a CAGR of 5.10% during the forecast period (2025-2030).

Increasing penetration in automotive, aerospace, telecom, and advanced personal protective equipment elevates demand, while the fiber's strength-to-weight ratio and thermal stability anchor long-term relevance. Material-lightweighting targets in electric mobility, the build-out of 5G networks, and rising investment in hypersonic and space programs continuously widen commercial opportunities. At the same time, feedstock price swings, mainly for MPD and PPD, keep margins under pressure, prompting vertical-integration moves by large producers. Intellectual-property constraints further shape competitive dynamics, cementing the position of incumbents that can finance R&D and navigate cross-licensing frameworks.

Global Aramid Fiber Market Trends and Insights

Escalating PPE Safety Mandates Across Asian Manufacturing Hubs

Growing enforcement of industrial-safety rules in China, India, and emerging Southeast Asian economies is lifting orders for aramid-reinforced gloves, helmets, and heat-resistant workwear. Industrial helmets made with aramid composites show 37% higher impact resistance than ABS counterparts, a performance gap that accelerates factory adoption. Cut-resistant gloves incorporating para-aramid deliver Level 5 protection with 30% less weight, improving comfort for continuous wear. Fire-retardant workwear formulated with meta-aramid maintains structural integrity at 425 °C, aligning with stricter foundry and petrochemical safety codes. Manufacturers supplying this region therefore raise allocation for aramid yarns and fabrics, strengthening the growth profile of the aramid fiber market.

EU Green-Deal Push for Lightweight EV Tires Reinforced with Aramid

European automakers accelerate tire redesign programs that shave vehicle mass to extend electric-car range. Aramid-reinforced tire carcasses cut weight by up to 25%, a saving directly linked to the Green Deal's transport decarbonization targets . Every kilogram trimmed offers a 0.7 km range gain, motivating OEMs to substitute polyester or steel cords with aramid. Compounders are commercializing aramid-filled rubber mixes that lower rolling resistance yet keep durability, reinforcing demand for the aramid fiber market in Europe and soon North America.

MPD & PPD Feedstock Price Volatility

Surging crude-oil swings and regional supply disruptions elevate MPD and PPD cost curves, compressing producer margins and unsettling long-term contracts. The U.S. Department of Commerce lists aromatic diamines among chemically critical inputs subject to geopolitically concentrated production, heightening supply-security risks . Manufacturers counter by exploring bio-based intermediates and closed-loop recovery of aramid scrap, yet near-term volatility still shaves growth momentum within the aramid fiber market.

Other drivers and restraints analyzed in the detailed report include:

- 5G Roll-out Surge Elevating Demand for Aramid-Reinforced Optical-Fiber Cables

- Hypersonic & Space Defense Investments Raising Meta-Aramid Thermal-Shield Consumption

- Patent Cross-Licensing Barriers Deterring New Para-Aramid Entrants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The para-aramid segment held a commanding 65% aramid fiber market share in 2024, supported by ballistic protection, aerospace, and friction-material demand. Para-aramid yarns deliver tensile strength near 3.8 GPa, sustaining their position in body armor and aviation honeycombs. Defense-budget uplifts in the United States and renewed interest in lightweight automotive composites ensure stable volume pipelines for para-aramid within the aramid fiber market. Significant investments, such as a 3,000-ton capacity addition at Toray's South Korea site, underscore the scale of capital allocation toward this fiber class.

Meta-aramid, while smaller in base, stages the fastest trajectory at a 5.42% CAGR through 2030. Advanced wet-spun filaments now reach 1,255 MPa tensile strength and retain over 90% strength after prolonged UV exposure, unlocking outdoor applications like transmission-line covers. Embedded in fire-retardant fabrics, insulation papers, and filtration bags, meta-aramid addresses thermal stability demands in electronics, industrial safety, and environmental protection. The aramid fiber market size for meta-aramid is forecast to expand steadily because of expanding semiconductor capacity across Asia and EU green-transition projects, setting a competitive dynamic where material attributes, not only price, decide customer conversion.

Wet spinning captured 60% of aramid fiber market share in 2024 and continues to out-pace the headline market with a 5.87% CAGR. The process offers homogeneous polymer coagulation, producing uniformly dense fibers that achieve high dielectric stability, a prerequisite for electrical papers and filtration media. Upgraded solvent-recycling modules reduce emissions and cost, supporting adoption even among sustainability-minded end-users. The aramid fiber market size for wet-spun output is projected to widen in line with electrification and filter-media demand growth.

Dry-jet wet spinning remains indispensable for para-aramid where chain orientation drives extreme tensile metrics. Lab runs of polyimide analogues display tensile strength up to 2.72 GPa and modulus above 114 GPa, confirming pathway headroom for future para-aramid enhancement. Although overall share is smaller, the process anchors high-end ballistic yarn supply, aligning with the needs of defense ministries and premium sports-equipment brands. Continuous line upgrades aimed at throughput efficiency and solvent-capture technology will safeguard its niche contribution to the aramid fiber market.

The Aramid Fiber Market Report Segments the Industry by Product Type (Para-Aramid, Meta-Aramid), Spinning Process (Wet Spinning, Dry Wet Spinning), Application (Security and Protection Equipment, Frictional and Brake Materials, and More), End-User Industry (Safety and Protection Equipment, Aerospace, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe anchors the global aramid fiber market with 35% revenue in 2024. Stringent worker-safety laws, ISO-aligned flame standards, and the European Union's Green Deal propel high-value adoption in automotive and industrial settings. Germany, with its export-oriented automotive base, leads regional volume expansion, while France and the Netherlands specialize in advanced filtration and aerospace laminates. Government incentives for electric-vehicle battery plants further stimulate polymer-composite uptake.

North America posts the fastest CAGR at 5.34% for 2025-2030. Federal defense appropriations feed continuous demand for para-aramid ballistic materials, whereas NASA and private launch providers channel investments into meta-aramid thermal shields. U.S. telecom carriers renew aerial fiber backbones across hurricane-prone corridors, specifying aramid strength members to mitigate storm damage. Canada follows similar trends with a public-safety focus, particularly in mining and energy infrastructure.

Asia-Pacific represents the next frontier of scale for the aramid fiber market. China escalates domestic output to cut reliance on imports and targets self-sufficiency in para-aramid by mid-decade. Massive construction of smart factories, EV battery plants, and renewable infrastructure multiplies demand for lightweight, heat-resistant materials. Japan and South Korea refine high-tech deployment in semiconductors and 5G hardware, requiring dielectric stability and mechanical resilience that aramid delivers. India's Make-in-India defense program and updated occupational-safety codes build local PPE and armor consumption, adding depth to regional growth.

- Aramid Hpm, LLC.

- China National Bluestar (Group) Co. Ltd.

- DuPont

- HS HYOSUNG ADVANCED MATERIALS

- Huvis Corp.

- Kolon Industries, Inc.

- Sinochem Internation Corporation

- SINOPEC YIZHENG CHEMICAL FIBRE LIMITED

- SRO Aramid

- Suzhou Zhaoda Specially Fiber Technical Co.,Ltd.

- TAEKWANG INDUSTRIAL CO., LTD.

- Teijin Limited

- Toray Industries Inc.

- TOYOBO MC Corporation

- Wuxi City Shengte Carbon Fiber Products Co.,Ltd

- X-FIPER NEW MATERIAL CO.,LTD

- Yantai Tayho Advanced Materials Co.,Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating PPE Safety Mandates Across Asian Manufacturing Hubs

- 4.2.2 EU Green Deal Push for Lightweight EV Tires Reinforced with Aramid

- 4.2.3 5G Rollout Surge Elevating Demand for Aramid-Reinforced Optical-Fiber Cables

- 4.2.4 Increase in Defense Spending by Many Countries

- 4.2.5 Hypersonic and Space Defense Investments Raising Meta Aramid Thermal Shield Consumption

- 4.3 Market Restraints

- 4.3.1 MPD and PPD Feedstock Price Volatility

- 4.3.2 Patent Cross Licensing Barriers Deterring New Para-Aramid Entrants

- 4.3.3 High Production Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Para Aramid

- 5.1.2 Meta Aramid

- 5.2 By Spinning Process

- 5.2.1 Wet Spinning

- 5.2.2 Dry Jet Wet Spinning

- 5.3 By Application

- 5.3.1 Security and Protection Equipment

- 5.3.2 Frictional and Brake Materials

- 5.3.3 Optical Fiber Cables

- 5.3.4 Aerospace Components

- 5.3.5 Automotive Composites

- 5.3.6 Electrical Insulation

- 5.3.7 Others (industrial filtration, rubber and tire reinforcement)

- 5.4 By End User Industry

- 5.4.1 Safety and Protection Equipment

- 5.4.2 Aerospace

- 5.4.3 Automotive

- 5.4.4 Electronics and Telecommunication

- 5.4.5 Other End User Industries

- 5.5 Geography

- 5.5.1 Asia Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Aramid Hpm, LLC.

- 6.4.2 China National Bluestar (Group) Co. Ltd.

- 6.4.3 DuPont

- 6.4.4 HS HYOSUNG ADVANCED MATERIALS

- 6.4.5 Huvis Corp.

- 6.4.6 Kolon Industries, Inc.

- 6.4.7 Sinochem Internation Corporation

- 6.4.8 SINOPEC YIZHENG CHEMICAL FIBRE LIMITED

- 6.4.9 SRO Aramid

- 6.4.10 Suzhou Zhaoda Specially Fiber Technical Co.,Ltd.

- 6.4.11 TAEKWANG INDUSTRIAL CO., LTD.

- 6.4.12 Teijin Limited

- 6.4.13 Toray Industries Inc.

- 6.4.14 TOYOBO MC Corporation

- 6.4.15 Wuxi City Shengte Carbon Fiber Products Co.,Ltd

- 6.4.16 X-FIPER NEW MATERIAL CO.,LTD

- 6.4.17 Yantai Tayho Advanced Materials Co.,Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Market Expansion of Unmanned Aerial Vehicles (UAV)