|

市场调查报告书

商品编码

1851528

化妆品包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

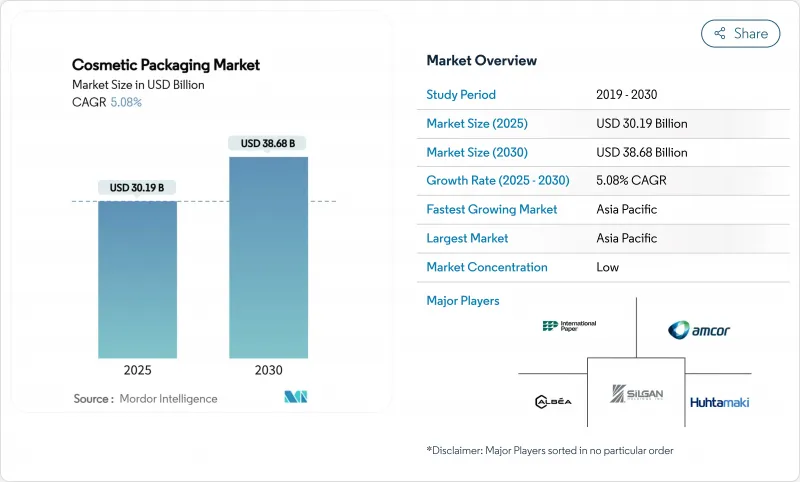

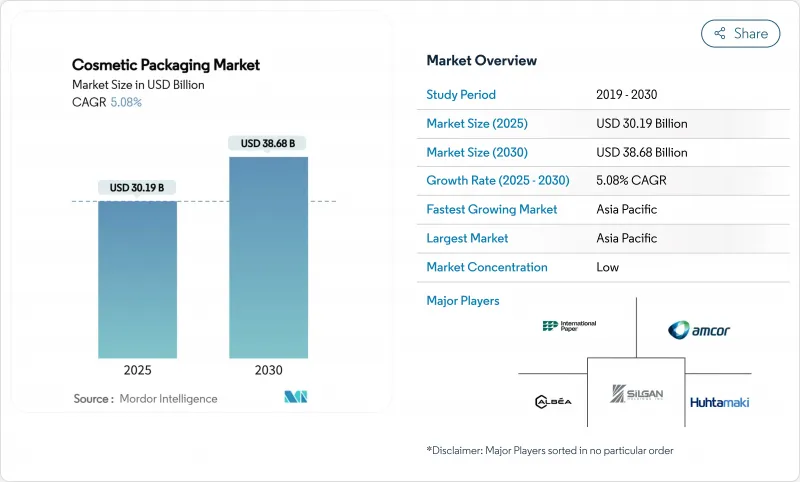

预计到 2025 年,化妆品包装市场规模将达到 301.9 亿美元,到 2030 年将成长至 386.8 亿美元。

这反映了各大品牌对欧盟《包装废弃物法规》的回应。该法规将于2025年2月生效,强制要求包装可回收并遵守生产者延伸责任制。由于地缘政治紧张局势以及中国和欧洲的减产,聚对苯二甲酸乙二醇酯(PET)成本不断上涨,各大品牌正在加速使用再生材料和轻量化设计。亚太地区仍是成长引擎,这得归功于消费者日益成熟的消费习惯和强大的电商物流体系。面膜在中国的成功以及韩国和日本的优质化,都反映了该地区的影响力。虽然塑胶仍保持着成本优势,但玻璃包装凭藉其奢华感、可重复填充性以及循环经济的优势,正在蓬勃发展。同时,诸如安姆科(Amcor)和贝瑞全球(Berry Global)84.3亿美元的合併等整合,正在将规模优势与研发能力相结合,加速永续包装的推广应用。

全球化妆品包装市场趋势与洞察

高端和轻奢美容产品的消费量不断增加

触感丰富的饰面、质感上乘的玻璃和精美的瓶盖塑造了品牌故事,将奢侈品带入主流管道。为迎接2025年世界补充装日,欧莱雅在五年内将其填充用产品种类增加了17倍,同时并未降低其高端定位。雅诗兰黛旗下71%的产品均采用永续包装,显示环保与奢华可以并存。因此,供应商优先考虑能够承受高端配方的高纯度玻璃泵和一体式泵。这项机会也延伸至补充装套件,它们能够确保后续销售并提高净利率。奢侈品牌对环保性能的重视提高了化妆品包装市场所有细分领域的标准。

转向更适合电子商务的轻量级格式

抗破损性以及尺寸和重量上的节省是推动线上销售的关键因素。由于软包装袋可以平放运输,减少空隙填充和运输成本,其复合年增长率高达7.67%。 KISS Cosmetics 在其占地48万平方英尺的工厂中实现了自动化,配备了智慧拣选车和A型架分发器,充分展现了采用统一轻便包装在物流配送方面的履约优势。预计到2032年,包装机器人领域的投资将达到75亿美元,凸显了自动化在优化多SKU产品流转的重要角色。针对宅配网路而非零售货架进行最佳化的品牌,能够确保更快的周转时间和更低的排放,进而增强全球化妆品包装市场抵御物流不稳定的能力。

全球再生树脂价格波动

2024年,由于反倾销法规收紧供应,迫使加工商展开竞标竞价,欧洲PET价格徘徊在每吨1,130欧元至1,170欧元之间。 2025年初,由于原料成本上涨,聚乙烯和聚丙烯的价格分别上涨了每磅5美分和4美分。因此,承诺50%回收率的品牌可以吸收利润衝击,或透过垂直整合(例如自建清洗厂)来对冲风险。由于高品质食品级消费后再生树脂(PCR)价格较高,供应风险可能限制设计自由度,并延缓化妆品包装市场对原生树脂的替代。

细分市场分析

由于成本效益、透明度和生产线速度相容性,塑胶将在2024年占据化妆品包装市场64.58%的份额。聚对苯二甲酸乙二醇酯用于个人护理瓶,聚丙烯用于泵桿和瓶盖,低密度聚乙烯用于软管。然而,玻璃将领先,到2030年将以8.67%的复合年增长率增长,这主要得益于奢侈品牌对玻璃坚固手感、耐刮擦性和无限可回收性的追求。高端消费趋势将推动玻璃化妆品包装实现两位数的收入份额,即使其包装总量低于塑胶。玻璃回收计划,例如雅诗兰黛与Strategic Materials的合作,提高了玻璃屑的品质和熔炉产量比率,从而减轻了环境方面的批评。 [2] 金属化铝和钢仍主要应用于香水和礼品包装领域,其优异的阻隔性能和清爽的触感使其在货架上脱颖而出。纤维板在运输包装和礼品套装中的应用日益广泛,满足了电子商务的缓衝需求,且无需承担塑胶税的额外负担。

第二代材料模糊了不同类别之间的界线。曾经用于软管的多层PET铝塑复合材料正逐渐被单层EVOH阻隔PET取代,后者更易于回收。聚乳酸等生物基树脂正被用于限量版标籤的试验,但其耐热性和填充线摩擦力不足,限制了其规模化应用。那些能够克服这些障碍的供应商所取得的早期成功,反映出永续性表现如今已成为化妆品包装市场供应商选择的重要标准。同时,可回收玻璃瓶项目以及填充用站的出现,显示高端品质和低环境影响的目标正在融合,推动玻璃瓶进入更主流的产品系列。

2024年,瓶装和罐装产品的销售额将成长44.56%,这主要得益于快速填充速度和消费者的熟悉度。宽口罐装产品仍将主导乳霜市场,而窄口宝特瓶在洗髮精和卸妆水中占据主导地位。然而,小袋和立式袋也将实现7.67%的强劲成长,它们不仅减少了每次使用的容量,也降低了宅配运输过程中破损的风险。轻量化技术使品牌能够将每月的包装量从一瓶减少到每信封五袋,从而降低运输排放。管状和棒状产品迎合了防晒油、固态精华和润色膏的需求,符合旅行装容量规定和零洩漏要求。折迭式纸盒是玻璃瓶和精华液管瓶的理想包装选择,其柔软的涂层和烫金工艺营造出高端质感,传递品牌理念。

运输包装盒也将随之演变。瓦楞纸板供应商正在引入演算法製盒技术来减少填充物,并藉助Packsize机器即时切割纸板,使其尺寸与订单一致。消费者的开箱体验将使全通路体验脱颖而出,并鼓励使用印有二维码的插页,从而触发数位会员奖励。软包装上的阻隔涂层将升级为二氧化硅和氧化铝,以确保香气保持并减少氧气透过,同时又不影响可回收性。诸如此类的进步将拓展化妆品软包装市场,并重新定义大众高端包装的美学,使其不再局限于硬质容器。

化妆品包装市场按材料类型(塑胶、玻璃、金属、纸/纸板)、产品类型(瓶/罐、管/棒、折迭式纸盒、瓦楞纸箱、其他)、分配方式(泵、滴管/吸管、喷雾/雾化、其他)、化妆品类型(护髮、彩妆品、护肤、其他)和地区进行细分。市场规模和预测以美元计价。

区域分析

亚太地区预计到2024年将占全球化妆品包装市场收入的42.89%,并在2030年之前以7.45%的复合年增长率增长,这主要得益于可支配收入的增加、韩式美妆的普及以及行动商务的高渗透率。面膜在中国市场的主导地位反映了当地消费者对一次性使用且包装精緻的产品的需求,使该地区成为简约实用型包装袋的热门市场。日本和韩国正在向全球输出气垫粉底和纤细旋转膏等设计理念,这使得该地区的包装加工商拥有先发优势。

由于高端护肤的普及和电子商务的快速发展,北美市场保持着强劲的价值。专业美妆零售商正在试行填充用站,玻璃墨盒供应商也赢得了新的服务合约。自动化解决方案正在推动机器人友善纸板标籤和无底纸标籤的广泛应用。各州层级的塑胶减量立法正在加速向轻量化、单一材料解决方案的转变,并引导投资流向再生PET和纤维替代品。儘管成熟品类已渗透到市场,但这些趋势仍在推动化妆品包装市场蓬勃发展。

欧洲正在建立具有全球影响力的法律规范。在法国,PPWR(包装材料回收条例)的实施和不断上涨的环保费用明确了包装可回收性的阈值,加速了对可拆卸设计的投资。法国和义大利的奢侈香水丛集正在积极推动玻璃创新,例如用于减少刮痕的先进热端涂层。同时,中欧和东欧正在扩大瓶体成型产能,以满足本地品牌和出口生产的需求。世界各地不同的企业正在影响材料策略和技术转移速度,从而推动化妆品包装市场的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 高端和轻奢美容产品的消费量不断增加

- 转向更适合电子商务的轻量级格式

- 高端通路中可填入/可重复使用配送系统的兴起

- 具备认证功能的智慧包装可遏止假冒仿冒品

- 品牌对符合碳标籤标准的包装的需求

- 第三方物流履约中机器人辅助二次包装的快速普及

- 市场限制

- 全球再生树脂价格上涨

- 一次性塑胶製品的监管上限

- 新型生物材料与填充线的不相容性

- 掩埋容量减少导致生产者责任费扩大

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依材料类型

- 塑胶

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丙烯

- 聚乙烯(PE)

- 其他塑料

- 玻璃

- 金属

- 纸和纸板

- 塑胶

- 依产品类型

- 瓶子和罐子

- 管子和棍子

- 折迭式纸盒

- 瓦楞纸箱

- 柔性包装袋

- 其他产品类型

- 透过分配机制

- 泵浦底座

- 滴管/移液器

- 喷雾/雾

- 黏/扭转向上

- 罐子/汤匙

- 依化妆品类型

- 护肤

- 脸部保养

- 身体保养

- 护髮

- 彩妆品

- 香水及香氛

- 其他化妆品类型

- 护肤

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Albea SA

- AptarGroup Inc.

- Amcor Group GmbH

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging LP

- Quadpack Industries SA

- Libo Cosmetics Co. Ltd

- Gerresheimer AG

- Ball Corporation

- Verescence France SA

- SKS Bottle & Packaging Inc.

- Altium Packaging

- Cosmopak Ltd

- Raepak Ltd

- Rieke Corporation

- Essel Propack Ltd

- Huhtamaki Oyj

- Alpla Werke Alwin Lehner GmbH

- RPC M&H Plastics

- HCP Packaging Co. Ltd

第七章 市场机会与未来展望

The cosmetic packaging market size reached USD 30.19 billion in 2025 and is set to climb to USD 38.68 billion by 2030, reflecting a steady 5.08% CAGR.

The advance mirrors brand responses to the European Union's Packaging and Packaging Waste Regulation, effective February 2025, which obliges recyclability and extended producer responsibility compliance. Brands counter rising polyethylene terephthalate costs driven by geopolitical tension and production cuts in China and Europe by accelerating recycled-content usage and lightweight designs. Asia-Pacific remains the growth engine, propelled by sophisticated consumer routines and strong e-commerce logistics; Chinese facial sheet-mask success and premiumization across South Korea and Japan typify the region's influence. Material choice continues to bifurcate: plastics retain cost leadership while glass advances on luxury, refillable, and circular-economy appeal. Meanwhile, corporate consolidation highlighted by Amcor's USD 8.43 billion merger with Berry Global bundles scale and R&D to quicken sustainable-packaging rollouts.

Global Cosmetic Packaging Market Trends and Insights

Growing Consumption of Premium and Masstige Beauty Products

Luxury cues have migrated into mainstream channels as tactile finishes, heavy-wall glass, and ornate closures shape brand storytelling. L'Oreal's 2025 World Refill Day push lifted refillable options seventeen-fold in five years without diluting premium positioning. Estee Lauder already supplies 71% of its portfolio in sustainable formats, confirming that environmental progress and upscale image can co-exist. Suppliers thus prioritise high-clarity glass and mono-material pumps that tolerate prestige formulations. The opportunity extends to refill kits that guarantee adjacency sales and invite higher margins. Luxury's embrace of environmental performance raises the bar for all tiers of the cosmetic packaging market.

Shift Toward E-commerce-Friendly Lightweight Formats

Online sales make damage resistance and dimensional-weight savings decisive. Flexible pouches grow at 7.67% CAGR because they ship flat, cut void fill, and slash freight spend. KISS Cosmetics automated its 480,000 ft2 facility with intelligent cart-picking and A-Frame dispensing, demonstrating fulfilment economics that favour uniform, lighter packs. Packaging-robot investments are projected to reach USD 7.5 billion by 2032, underlining automation's role in smoothing multi-SKU flows. Brands that optimise for courier networks rather than retail shelves secure faster cycle times and lower emissions, fortifying the global cosmetic packaging market against logistics volatility.

Escalating Global Recycled-Resin Price Volatility

European PET hovered at EUR 1,130-1,170 per t in 2024 as anti-dumping rules tightened supply, forcing converters into spot-market bidding wars. Polyethylene and polypropylene followed with five-cent and four-cent per-lb upticks in early 2025 as feedstock costs rose. Brands with 50%-recycled-content pledges thus absorb margin shocks or hedge via vertical integration, such as on-site washing plants. Because high-quality food-grade PCR commands premiums, availability risk constrains design freedom and may slow substitutions away from virgin resin in the cosmetic packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Refillable/Reusable Delivery Systems in Prestige Channels

- Rapid Adoption of Robot-Ready Secondary Packs in 3-PL Fulfilment

- Regulatory Caps on Single-Use Plastic

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics held a 64.58% cosmetic packaging market share in 2024 thanks to cost efficiency, clarity, and line-speed compatibility. Polyethylene terephthalate leads for personal-care bottles, polypropylene secures pump stems and closures, while low-density polyethylene shapes flexible tubes. Yet glass races ahead at 8.67% CAGR to 2030 because prestige brands crave heft, scratch resistance, and infinite recyclability. The premium shift lifts the cosmetic packaging market size for glass to meaningful double-digit revenue slices even as total pack count stays lower than plastic. Glass-recycling initiatives such as Estee Lauder's work with Strategic Materials Inc.improve cullet quality and furnace yields, soothing environmental criticisms[2]. Metallised aluminium and steel remain niche for fragrances and gifting editions where barrier performance and tactile coolness drive shelf impact. Fibre-based board escalates in transit shippers and gift sets, answering e-commerce cushioning needs without raising plastic tax exposure.

Second-generation materials blur lines between categories. Multi-layer PET-aluminium laminates once seen in tubes migrate toward mono-material EVOH-barrier PET that retains recycling stream compatibility. Bio-sourced resins such as polylactic acid win trial runs for limited-edition labels but still battle heat resistance and filling-line friction, limiting scale. Suppliers addressing these hurdles gain early-mover contracts, reflecting how sustainability performance now shapes vendor selection criteria across the cosmetic packaging market. Meanwhile, returnable glass programs aligned with refill stations exemplify how premium credentials fuse with low-impact ambitions to pull glass farther into mainstream assortments.

Bottles and jars delivered 44.56% revenue in 2024, supported by high filling speeds and shopper familiarity. Wide-mouth jars continue to anchor face creams, while narrow-neck PET bottles dominate shampoos and micellar waters. However, sachets and stand-up pouches compound at a brisk 7.67% CAGR, cutting grams per dose and resisting breakage during courier drops. Right-size technology lets brands switch from one bottle-per-month to five flat sachets per envelope, lowering freight-emissions intensity. Tubes and sticks address on-the-go sunscreen, solid serum, and colour-balm trends, meshing with travel-size regulation and zero-leak expectations. Folding cartons remain favoured in luxury presentations, housing glass flacons or booster vials while conveying brand narratives through soft-touch varnish and foil embossing.

Transit boxes evolve too. Corrugated suppliers deploy algorithmic box-making to trim void fill, supported by Packsize machines that cut board in line with real-time order dimensions. Consumer unboxing gains differentiate omnichannel experiences, prompting QR-printed inserts that trigger digital loyalty rewards. Flexible-pack barrier coatings upgrade to silicon oxide or aluminium oxide, securing fragrance retention and reducing oxygen transmission without disqualifying recyclability. Such advances swell the cosmetic packaging market size credited to flexible formats and re-define mass-premium aesthetics away from solely rigid containers.

Cosmetic Packaging Market is Segmented by Material Type (Plastic, Glass, Metal, Paper and Paperboard), Product Type (Bottles and Jars, Tubes and Sticks, Folding Cartons, Corrugated Transit Boxes, and More), Dispensing Mechanism (Pump-Based, Dropper / Pipette, Spray / Mist, and More), Cosmetic Type (Hair Care, Color Cosmetics, Skin Care, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific owned 42.89% of cosmetic packaging market revenue in 2024 and will grow at a 7.45% CAGR to 2030, lifted by rising disposable income, advanced K-beauty regimens, and high mobile-commerce penetration. Sheet-mask dominance in China illustrates local appetite for single-use but sophisticated pack forms, making the region a hotbed for minimalist yet functional pouches. Japan and South Korea export design cues globally, such as airless cushion compacts and slim twist balms, giving regional converters first-mover advantages.

North America holds firm value through premium skincare adoption and rapid e-commerce. Refill station pilots appear in beauty specialty retailers, rewarding glass cartridge suppliers with new service contracts. Automation readiness drives widespread acceptance of robot-friendly corrugate and linerless labels. State-level plastic-reduction bills add urgency to lightweight mono-material shifts, redirecting investment towards recycled-content PET and fibre substitution. These moves keep the cosmetic packaging market buoyant despite mature category penetration.

Europe shapes regulatory frameworks that ripple worldwide. Enforcement of the PPWR and escalating eco-contribution fees in France imposes clear packaging recyclability thresholds, accelerating investment in design for disassembly. Luxury fragrance clusters in France and Italy champion glass innovation, including advanced hot-end coating for scratch reduction. Meanwhile, Central and Eastern Europe attract bottle moulding capacity expansions to serve both local brands and export production. Collectively, global regions influence material strategies and technology transfer rates, interlocking demand drivers for the cosmetic packaging market.

- Albea SA

- AptarGroup Inc.

- Amcor Group GmbH

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging LP

- Quadpack Industries SA

- Libo Cosmetics Co. Ltd

- Gerresheimer AG

- Ball Corporation

- Verescence France SA

- SKS Bottle & Packaging Inc.

- Altium Packaging

- Cosmopak Ltd

- Raepak Ltd

- Rieke Corporation

- Essel Propack Ltd

- Huhtamaki Oyj

- Alpla Werke Alwin Lehner GmbH

- RPC M&H Plastics

- HCP Packaging Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing consumption of premium and masstige beauty products

- 4.2.2 Shift toward e-commerce-friendly lightweight formats

- 4.2.3 Rise of refillable / reusable delivery systems in prestige channels

- 4.2.4 Authentication-enabled smart packaging to curb counterfeits

- 4.2.5 Brand demand for carbon-label-ready packs

- 4.2.6 Rapid adoption of robot-ready secondary packs in 3-PL fulfilment

- 4.3 Market Restraints

- 4.3.1 Escalating global recycled-resin price volatility

- 4.3.2 Regulatory caps on single-use plastics

- 4.3.3 Filling-line incompatibility of novel bio-materials

- 4.3.4 Shrinking landfill capacity driving extended-producer-responsibility fees

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastics

- 5.1.1.1 Polyethylene Terephthalate (PET)

- 5.1.1.2 polypropylene (PP)

- 5.1.1.3 Polyethylene (PE)

- 5.1.1.4 Other Plastics

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.1.1 Plastics

- 5.2 By Product Type

- 5.2.1 Bottles and Jars

- 5.2.2 Tubes and Sticks

- 5.2.3 Folding Cartons

- 5.2.4 Corrugated Transit Boxes

- 5.2.5 Flexible Sachets and Pouches

- 5.2.6 Other Product Type

- 5.3 By Dispensing Mechanism

- 5.3.1 Pump-based

- 5.3.2 Dropper / Pipette

- 5.3.3 Spray / Mist

- 5.3.4 Stick / Twist-up

- 5.3.5 Jar / Scoop

- 5.4 By Cosmetic Type

- 5.4.1 Skin Care

- 5.4.1.1 Facial Care

- 5.4.1.2 Body Care

- 5.4.2 Hair Care

- 5.4.3 Color Cosmetics

- 5.4.4 Perfumes and Fragrances

- 5.4.5 Other Cosmetics Type

- 5.4.1 Skin Care

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacifc

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Kenya

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Albea SA

- 6.4.2 AptarGroup Inc.

- 6.4.3 Amcor Group GmbH

- 6.4.4 Silgan Holdings Inc.

- 6.4.5 DS Smith PLC

- 6.4.6 Graham Packaging LP

- 6.4.7 Quadpack Industries SA

- 6.4.8 Libo Cosmetics Co. Ltd

- 6.4.9 Gerresheimer AG

- 6.4.10 Ball Corporation

- 6.4.11 Verescence France SA

- 6.4.12 SKS Bottle & Packaging Inc.

- 6.4.13 Altium Packaging

- 6.4.14 Cosmopak Ltd

- 6.4.15 Raepak Ltd

- 6.4.16 Rieke Corporation

- 6.4.17 Essel Propack Ltd

- 6.4.18 Huhtamaki Oyj

- 6.4.19 Alpla Werke Alwin Lehner GmbH

- 6.4.20 RPC M&H Plastics

- 6.4.21 HCP Packaging Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment