|

市场调查报告书

商品编码

1851535

自动化储存和搜寻系统(ASRS):市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automated Storage And Retrieval System (ASRS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

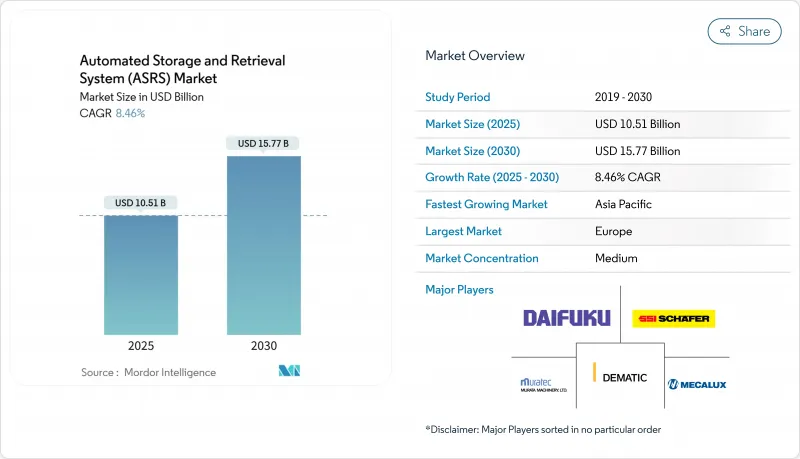

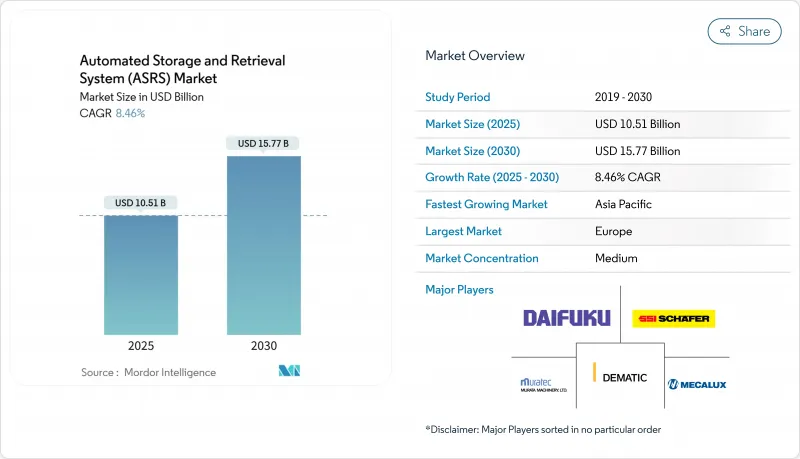

预计到 2025 年,自动化储存和搜寻系统市场价值将达到 105.1 亿美元,到 2030 年将达到 157.7 亿美元。

这反映了强劲的复合年增长率,凸显了智慧自动化从仓库营运商的可选升级转变为策略必需品的转变。

电子商务交易量激增、劳动力长期短缺以及房地产成本不断上涨,共同促成了自动化储存和搜寻系统市场的一个转折点,使得部署这些系统能够显着提升吞吐量、准确性和空间利用率。面对物流营运中每年 5-7% 的薪资成长,企业正将资本密集的自动化计划视为应对营运成本上涨的保障,而节能的立方体和穿梭车解决方案也符合企业永续性的要求。多种技术的融合正在重塑解决方案的设计。现代平台整合了机器人技术、人工智慧路径规划演算法和预测性维护分析,可将非计划性停机时间减少高达 30%。早期采用者报告称,高混合订单的周期时间缩短了 40%,这使得自动化储存和搜寻系统投资成为全通路履约策略的基础。

全球自动化储存与搜寻系统(ASRS)市场趋势与洞察

履约压力

到2025年中期,亚马逊部署一百万台机器人的计画已充分证明,人工拣货无法应付每小时接近300行的订单处理量。其他零售商迅速做出回应,加快推进其「立方体穿梭车」(Cube Shuttle)计划,将订单处理週期从数小时缩短至数分钟,从而加速了自动化储存和搜寻系统市场的发展。服装和电子产品退货率的上升使得准确性变得至关重要。人工智慧增强型机械手的商品识别准确率现已超过99%,有效减少了成本高昂的重新出货。履约业者也发现,机器人技术能够减少堆高机作业次数和照明需求,进而降低每笔订单8%的能源成本。

人事费用上升和安全义务

2024年,堆高机事故占仓库死亡事故的大多数,每週造成美国8,400万美元的工伤赔偿。 2025年发布的新版美国职业安全与健康管理局(OSHA)指南转移了雇主的责任,并加速了向「物料到人」单元的转变,这种模式将人员从人流密集的通道中移除。预计到2028年,汽车修理厂将面临20%的技工缺口,因此它们采用了小型装载系统,将稀缺的劳动力从搜寻岗位转移到诊断岗位。总而言之,这些动态共同推动了自动化储存和搜寻系统市场在中期内成长,增幅超过两个百分点。

前期资本支出高,投资回收期长

儘管承包计划已被证实具有显着的成本节约潜力,但其金额从7万美元到300万美元不等,对许多小型经销商而言仍然是一大障碍。总拥有成本 (TCO) 模式通常会在基础价格的基础上增加40%的软体、试运行和培训费用,这意味着在宏观经济不确定时期,投资回报期将超出财务长的负担范围。基于订阅的「按次付费」模式旨在降低领先成本,但目前仅适用于部分大批量使用情境。

细分市场分析

到2024年,固定巷道起重机系统仍将占全球销售额的38.2%,这主要得益于汽车和大众消费品工厂的需求,这些工厂可预测的物流流程使得高性能货架成为必要。这些工厂历来是自动化储存和搜寻系统市场的设计模板,限制了使用者对特定巷道宽度和吞吐量上限的依赖。基于立方体的网格系统和机器人储存线透过将储存密度提高60%并将搜寻时间缩短至70秒以内而迅速发展,预计到本十年末将实现12.1%的复合年增长率,从而改变了综合收益。像AutoStore和DSV这样的知名第三方物流公司已在九个国家/地区扩展了立方体系统的部署,凸显了其多功能性和适应性。穿梭车系统则介于两者之间。模组化的穿梭车通道使企业能够在不进行大规模建筑维修的情况下逐步扩展。这种灵活性对那些希望根据年度需求波动调整其自动化储存和搜寻系统投资的快速成长型零售商极具吸引力。

儘管垂直升降模组 (VLM) 和旋转货架解决方案仍属于小众市场,收入占不到 10%,但在占地面积有限且零件完整性至关重要的场所,它们却能创造显着价值。例如,医疗设备组装使用 VLM 来保护微机械零件免受污染,同时实现超过 99.9% 的拣选精度。混合型仓库越来越多地采用起重机、穿梭车和立方体货架的组合。这种架构表明,自动化储存和搜寻系统市场已从单一技术转向客製化生态系统。 Kardex 与 Berkshire Grey 的合作将 AI 视觉拣选单元整合到其 VLM 产品线中,实现了 99.99% 的准确率,进一步强化了塑造现代仓库设计的跨领域融合趋势。

到2024年,单元货载托盘系统将占总收入的42.5%,这主要得益于汽车零件组装、饮料托盘化以及其他以同质商品为主要储存物件的散装物流领域的成长。然而,电子商务中SKU的爆炸性成长导致周转箱层级的搜寻速度大幅提升,而单元货载起重机无法以经济高效的方式满足这一需求,因此对小型装载系统的需求正以11.3%的复合年增长率增长。预计在全通路生鲜领域,小型装载週转箱解决方案的自动化储存和搜寻市场规模将成长得更快,因为该领域平均每个购物篮包含35个线上订单。单一小型装载通道每小时可处理多达1200个週转箱循环,从而在有限的空间内实现门市补货和线上订购线下取货的履约履行。

托盘穿梭车子系统弥合了高吞吐量托盘储存和选择性存取需求之间的差距,可配置深度,从而平衡储存密度和速度。中型负载应用可处理小批量物品以及电子产品和汽车售后零件中较为笨重的中型组件。随着仓库管理系统 (WMS) 基于实时单次移动成本而非僵化的孤立区域来指导拣货,运营商越来越多地在统一的软体平台上混合使用不同类型的货物,这标誌着自动化存储和搜寻系统市场正悄然走向成熟。

ASRS 市场报告按产品类型(固定巷道起重机系统、穿梭车系统、垂直升降模组 (VLM) 等)、负载类型(单元货载、托盘负载穿梭车、小型负载、中型负载、週转箱/纸箱等)、应用(存储和缓衝、货到人拣货、套件组装和地区排序等)、最终用户行业(製造业、非製造业)和地区对行业排序。

区域分析

欧洲仍将是最大的区域贡献者,预计2024年将占全球销售额的33.8%。每小时超过28美元的高昂人事费用以及严格的工人安全法规使得自动化在经济上极具吸引力,而欧盟的永续性法规也认可高密度立方体网格是降低建筑能耗的有效途径。德国的《2025年高科技战略》累计3.692亿美元用于机器人研发,并加强了有利于解决方案提供者的商业生态系统。一家斯堪地那维亚零售商将六个传统仓库合併为一个自动化仓库,使每笔订单的二氧化碳排放量减少了35%。

亚太地区成长最快,复合年增长率达11.9%。中国耗资万亿元人民币的大型企划标誌着国家对工厂自动化的坚定承诺;日本提案连接大阪和东京的500公里输送机网络,从而催生了对高吞吐量分类节点的需求。韩国的政策诱因为智慧工厂部署提供了1.28亿美元的补贴;大福公司在DAIFUKU CO. LTD.的工厂于2025年投产后,印度也成为了其生产基地,缩短了区域客户的前置作业时间。因此,亚太地区的自动化储存和搜寻系统市场正受益于国内需求和在地化生产能力的双重推动。

北美仍然是创新中心,拥有许多超大规模电子商务试验场,为全球树立了标竿。亚马逊部署了以人工智慧为基础的模式来重新规划其机器人车队的路线,在提高每小时拣货量的同时,也提升了能源效率。 AutoStore位于新罕布夏州的新总部设有一所培训学院,旨在解决技能缺口问题,并支持该公司关于在2026年底在该地区安装车辆数量将超过300辆的预测。沙乌地阿拉伯的一家药品分销商将于2024年试行半自动化履约,而巴西的一家第三方物流公司将受惠于资本财税收优惠,这将使这两个地区在未来五年内成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 履约压力

- 人事费用上升和职场安全法规要求

- 转型为微型履约与都市配送中心(悄无声息地)

- 低温运输自动化(鲜为人知的领域)

- 低调的预测性维护分析可提高投资报酬率

- 亚太地区和欧洲产业政策奖励

- 市场限制

- 初始投资额高,投资回收期长

- ASRS技术熟练人员短缺

- 与传统仓库管理系统整合的复杂性

- 互联自动化储存与检索系统 (ASRS) 中的网路安全漏洞(鲜为人知)

- 关键法规结构评估

- 价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 关键相关人员影响评估

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 依产品类型

- 固定巷道起重机系统

- 太空梭系统

- 垂直升降模组(VLM)

- 轮播模组(垂直、水平)

- 立方体型/机器人型立方体存储

- 按载荷类型

- 单元货载

- 托盘公路穿梭车

- 迷你公路

- 中载

- 手提袋/纸箱等

- 透过使用

- 储存和缓衝

- 现场拣货

- 试剂盒和定序

- 组装/生产支持

- 冷藏和冷冻处理

- 按最终用户行业划分

- 製造业

- 车

- 饮食

- 製药和生命科学

- 电子和半导体

- 金属和机械

- 非製造业

- 电子商务与零售

- 第三方物流(3PL)和仓储业

- 机场和行李处理

- 国防和政府商店

- 製造业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- ASEAN

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Daifuku Co., Ltd.

- Schaefer Systems International GmbH(SSI SCHAEFER)

- Dematic Corp.(KION Group AG)

- Murata Machinery, Ltd.

- Mecalux, SA

- Honeywell Intelligrated, Inc.

- KUKA AG

- KNAPP AG

- Kardex Holding AG

- Toyota Industries Corporation

- Viastore Systems GmbH

- AutoStore Holdings Ltd.

- Swisslog Holding AG

- Vanderlande Industries BV

- Bastian Solutions LLC

- System Logistics SpA

- Hanel Storage Systems

- Modula SpA

- TGW Logistics Group GmbH

- BEUMER Group GmbH & Co. KG

- Stocklin Logistik AG

- Godrej Korber Supply Chain Ltd.

- Westfalia Technologies, Inc.

- Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- Unitechnik Systems GmbH

第七章 市场机会与未来展望

The automated storage and retrieval system market size was valued at USD 10.51billion in 2025 and is forecast to reach USD 15.77 billion by 2030, reflecting a robust 8.46% CAGR that underscores how intelligent automation has shifted from optional upgrade to strategic necessity for warehouse operators.

Growing e-commerce volumes, chronic labor shortages, and escalating real-estate costs have combined to create a tipping point at which automated storage and retrieval system market deployments deliver measurable gains in throughput, accuracy, and space utilization. Companies facing 5%-7% annual wage inflation in logistics roles have treated capital-intensive automation projects as a hedge against rising operating expenses, while energy-efficient cube and shuttle solutions align with corporate sustainability mandates. Technology convergence is reshaping solution design; modern platforms integrate robotics, AI routing algorithms, and predictive maintenance analytics that cut unplanned downtime by up to 30%. Early adopters report cycle-time reductions of 40% for high-mix order profiles, positioning automated storage and retrieval system market investments as a foundation for omnichannel fulfillment strategies.

Global Automated Storage And Retrieval System (ASRS) Market Trends and Insights

E-commerce fulfillment pressure

By mid-2025, Amazon's deployment of 1 million robots served as visible proof that manual picking cannot sustain order profiles approaching 300 lines per hour. Peer retailers responded by fast-tracking cube and shuttle projects that shrink order cycle times from hours to minutes, driving accelerated bookings for the automated storage and retrieval system market. Higher return rates in apparel and electronics sharpened the focus on accuracy; AI-enhanced grippers now achieve item recognition accuracy above 99%, cutting costly reships. Fulfillment operators also discovered that robotics lowered energy cost per order by 8% by limiting forklift movements and lighting requirements.

Rising labor costs and safety mandates

Forklift incidents accounted for most fatal warehouse accidents in 2024, costing USD 84 million in weekly injury claims across the United States. New OSHA guidelines issued in 2025 shifted employer liability, prompting accelerated conversion to goods-to-person cells that remove humans from high-traffic aisles. Automotive maintenance depots suffering a projected 20% technician shortfall by 2028 adopted mini-load systems to reassign scarce labor from retrieval to diagnostic roles. Collectively, these dynamics add more than two percentage points to automated storage and retrieval system market growth over the mid-term.

High initial CAPEX and extended payback periods

Turnkey projects ranging from USD 70,000 to USD 3 million deterred many small distributors despite demonstrable cost-out potential. TCO models reveal software, commissioning, and training often add another 40% to sticker price, stretching payback beyond CFO comfort zones during periods of macro uncertainty. Subscription-based "pay-per-pick" models started to mitigate upfront expense, though current availability is limited to select high-volume use cases.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward micro-fulfillment centers

- Deep-freeze warehouse automation

- Cyber-security vulnerabilities threaten connected ASRS operations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fixed-aisle crane installations still delivered 38.2% of global revenue in 2024, anchored in automotive and bulk consumer-goods plants where predictable flows justify tall rack structures. These installations historically set the design template for the automated storage and retrieval system market, yet they lock users into specific aisle widths and throughput ceilings. Cube-based grids and robotic storage lines gained momentum by raising storage density 60% and slashing retrieval times to under 70 seconds, driving a 12.1% CAGR that will shift the revenue mix before decade-end. AutoStore and populous 3PLs such as DSV scaled cube deployments across nine countries, underscoring multipurpose adaptability. Shuttle-based systems occupy a middle ground; modular shuttle lanes allow firms to expand incrementally without major building retrofits. That flexibility appeals to fast-growing retailers who want automated storage and retrieval system market investments aligned with year-to-year demand swings.

Vertical lift modules (VLMs) and carousel solutions remain niche at under 10% revenue share, yet they add critical value where floor area is scarce and parts integrity is paramount. Medical-device assemblers, for example, use VLMs to protect micro-mechanical parts from contamination while achieving pick accuracies above 99.9%. Hybrid facilities increasingly mix cranes, shuttles, and cubes, an architecture that exemplifies how the automated storage and retrieval system market evolved toward tailored ecosystems rather than single-technology bets. Kardex's collaboration with Berkshire Grey incorporated AI vision pick cells into VLM lines, attaining 99.99% accuracy and reinforcing the cross-pollination trend shaping modern warehouse design.

Unit-load pallet systems captured 42.5% of 2024 revenue, powered by automotive subassemblies, beverage palletizing, and other bulk flows where each storage location houses homogenous items. Yet the SKU explosion in e-commerce drove tote-level retrieval rates that unit-load cranes cannot satisfy cost-effectively, opening demand for mini-load systems advancing at 11.3% CAGR. The automated storage and retrieval system market size for mini-load tote solutions is projected to expand even faster in omnichannel grocery, where online order lines per basket average 35. A single mini-load aisle can process up to 1,200 tote cycles per hour, enabling store replenishment and click-and-collect fulfillment from one footprint.

Pallet shuttle subsystems bridge high-throughput pallet storage with selective access demands, permitting configurable depth that balances density and speed. Mid-load applications, though smaller in headline numbers, handle awkward medium-sized components in electronics and aftermarket auto parts, functions often overlooked in project scoping yet critical to end-to-end flow. Operators increasingly blend load types inside unified software platforms so that WMS directs picks based on real-time cost per move, rather than rigid siloed zones, signaling a nuanced maturity within the automated storage and retrieval system market.

The ASRS Market Report Segments the Industry Into by Product Type (Fixed-Aisle Crane Systems, Shuttle-Based Systems, Vertical Lift Modules (VLM), and More), Load Type (Unit Load, Pallet Load Shuttle, Mini Load, Mid Load, and Tote / Carton and Others), Application (Storage and Buffering, Goods-To-Person Order Picking, Kitting and Sequencing, and More), End-User Industry (Manufacturing, and Non-Manufacturing), and Geography.

Geography Analysis

Europe retained the largest regional contribution at 33.8% of 2024 global revenue. High labor costs exceeding USD 28 per hour and stringent worker-safety legislation made automation financially compelling, while EU sustainability rules recognized high-density cube grids as a path to lower building energy footprint. Germany's High-Tech Strategy 2025 earmarked USD 369.2 million for robotics R&D, reinforcing commercial ecosystems that nurture solution providers. Scandinavian retailers compressed six conventional warehouses into a single automated facility and cut CO2 per shipped order by 35%.

Asia-Pacific delivered the fastest growth at 11.9% CAGR. China's trillion-yuan robotics megaproject signaled state-level commitment to factory automation, while Japan proposed a 500-kilometer conveyor belt network linking Osaka and Tokyo, creating demand for high-throughput sortation nodes. Korean policy incentives added USD 128 million in grants for smart-factory deployments, and India became a production hub following Daifuku's 2025 plant opening that lowers lead times for regional customers. The automated storage and retrieval system market in Asia-Pacific therefore benefits from both domestic demand and localized manufacturing capacity.

North America remains innovation center, with hyperscale e-commerce proving grounds that set global benchmarks. Amazon introduced AI foundation models to re-route swarm robots, improving energy efficiency while increasing picks per hour, which directly influences design specifications adopted by peers. AutoStore's new headquarters in New Hampshire houses an academy that trains technicians, addressing the skill-gap restraint and underscoring the company's forecast to surpass 300 regional installations by late-2026. Latin America and Middle East and Africa are emerging corridors; Saudi pharmaceutical distributors piloted semi-automated fulfillment in 2024, and Brazilian 3PLs benefitted from tax breaks on capital goods, positioning both regions as growth white space over the next five years.

- Daifuku Co., Ltd.

- Schaefer Systems International GmbH (SSI SCHAEFER)

- Dematic Corp. (KION Group AG)

- Murata Machinery, Ltd.

- Mecalux, S.A.

- Honeywell Intelligrated, Inc.

- KUKA AG

- KNAPP AG

- Kardex Holding AG

- Toyota Industries Corporation

- Viastore Systems GmbH

- AutoStore Holdings Ltd.

- Swisslog Holding AG

- Vanderlande Industries B.V.

- Bastian Solutions LLC

- System Logistics S.p.A.

- Hanel Storage Systems

- Modula S.p.A.

- TGW Logistics Group GmbH

- BEUMER Group GmbH & Co. KG

- Stocklin Logistik AG

- Godrej Korber Supply Chain Ltd.

- Westfalia Technologies, Inc.

- Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- Unitechnik Systems GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce fulfillment pressure

- 4.2.2 Rising labor-cost and workplace-safety mandates

- 4.2.3 Shift toward micro-fulfillment / urban DCs (under-the-radar)

- 4.2.4 Deep-freeze warehouse automation for cold-chain (under-the-radar)

- 4.2.5 Predictive-maintenance analytics boosting ROI (under-the-radar)

- 4.2.6 Industrial-policy incentives in APAC and Europe

- 4.3 Market Restraints

- 4.3.1 High initial CAPEX and long pay-back

- 4.3.2 Scarcity of ASRS-skilled technicians

- 4.3.3 Integration complexity with legacy WMS

- 4.3.4 Cyber-security vulnerabilities in connected ASRS (under-the-radar)

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Fixed-Aisle Crane Systems

- 5.1.2 Shuttle-Based Systems

- 5.1.3 Vertical Lift Modules (VLM)

- 5.1.4 Carousel Modules (Vertical and Horizontal)

- 5.1.5 Cube-Based / Robotic Cube Storage

- 5.2 By Load Type

- 5.2.1 Unit Load

- 5.2.2 Pallet Load Shuttle

- 5.2.3 Mini Load

- 5.2.4 Mid Load

- 5.2.5 Tote / Carton and Others

- 5.3 By Application

- 5.3.1 Storage and Buffering

- 5.3.2 Goods-to-Person Order Picking

- 5.3.3 Kitting and Sequencing

- 5.3.4 Assembly / Production Support

- 5.3.5 Cold-Storage and Deep-Freeze Handling

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.1.1 Automotive

- 5.4.1.2 Food and Beverages

- 5.4.1.3 Pharmaceuticals and Life Sciences

- 5.4.1.4 Electronics and Semiconductor

- 5.4.1.5 Metals and Machinery

- 5.4.2 Non-manufacturing

- 5.4.2.1 E-commerce and Retail

- 5.4.2.2 Third-Party Logistics (3PL) and Warehousing

- 5.4.2.3 Airports and Baggage Handling

- 5.4.2.4 Defense and Government Stores

- 5.4.1 Manufacturing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Daifuku Co., Ltd.

- 6.4.2 Schaefer Systems International GmbH (SSI SCHAEFER)

- 6.4.3 Dematic Corp. (KION Group AG)

- 6.4.4 Murata Machinery, Ltd.

- 6.4.5 Mecalux, S.A.

- 6.4.6 Honeywell Intelligrated, Inc.

- 6.4.7 KUKA AG

- 6.4.8 KNAPP AG

- 6.4.9 Kardex Holding AG

- 6.4.10 Toyota Industries Corporation

- 6.4.11 Viastore Systems GmbH

- 6.4.12 AutoStore Holdings Ltd.

- 6.4.13 Swisslog Holding AG

- 6.4.14 Vanderlande Industries B.V.

- 6.4.15 Bastian Solutions LLC

- 6.4.16 System Logistics S.p.A.

- 6.4.17 Hanel Storage Systems

- 6.4.18 Modula S.p.A.

- 6.4.19 TGW Logistics Group GmbH

- 6.4.20 BEUMER Group GmbH & Co. KG

- 6.4.21 Stocklin Logistik AG

- 6.4.22 Godrej Korber Supply Chain Ltd.

- 6.4.23 Westfalia Technologies, Inc.

- 6.4.24 Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- 6.4.25 Unitechnik Systems GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment