|

市场调查报告书

商品编码

1851538

活性碳:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Activated Carbon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

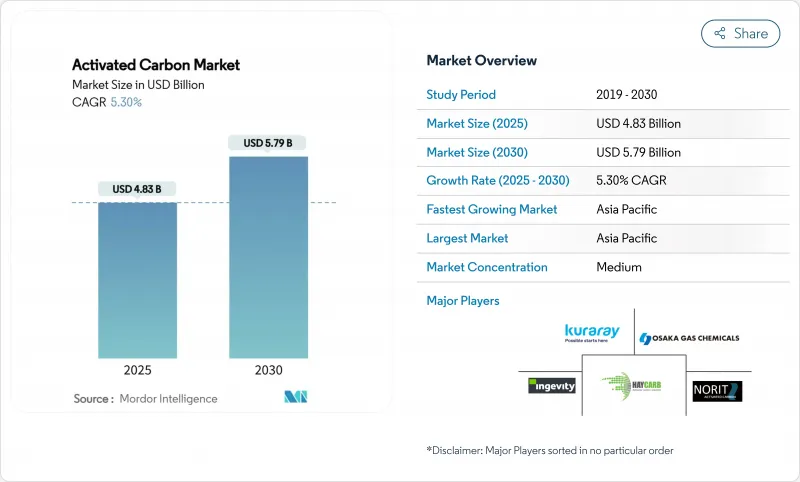

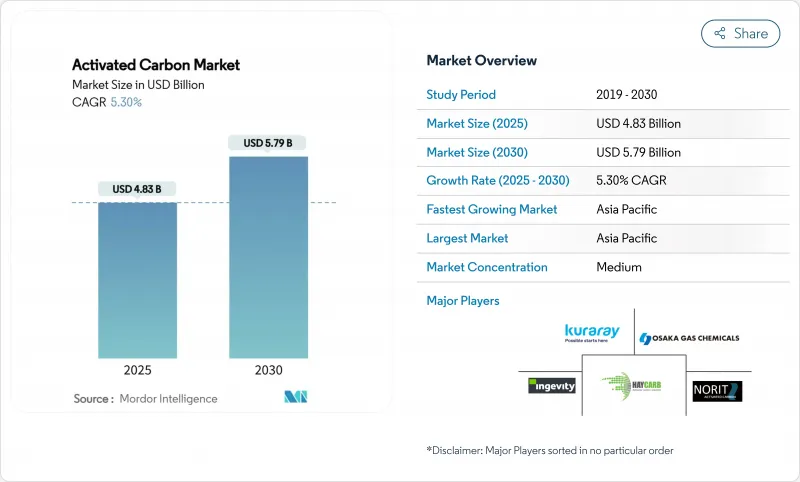

活性碳市场规模预计到 2025 年将达到 48.3 亿美元,预计到 2030 年将达到 57.9 亿美元,在预测期(2025-2030 年)内复合年增长率为 5.30%。

严格的水质法规、亚太地区的快速工业化以及製药、采矿和先进空气过滤製程对特种活性碳日益增长的需求,正在推动市场成长。棕榈壳仍然是高性能活性碳的优质原料,但供应紧张和煤炭价格波动促使企业进行垂直整合,并寻求替代原料。特别是,美国环保署 (EPA) 2024 年发布的 PFAS 饮用水标准将颗粒活性碳 (GAC) 指定为最佳可用技术。同时,粉末状活性碳 (PAC) 对于减少燃煤电厂的汞排放至关重要,而木质活性碳则因永续生产方面的突破而吸引投资。能够确保原材料供应稳定、投资于重新运作能力并提供数位监测服务的製造商,将更有利于赢得未来的合约。

全球活性碳市场趋势与洞察

饮用水中 PFAS法令遵循

美国环保署 (EPA) 于 2024 年 4 月发布的《国家饮用水主要法规》对六种 PFAS 化合物设定了限值,正式将颗粒活性碳 (GAC) 列为最佳可用技术,并强制要求美国所有公共供水系统从 2027 年开始监测,并在 2029 年前全面达标。该法规要求 PFOA 和 PFOS 的去除效率超过 99%,预计这将为活性碳系统创造 15.5 亿美元的年市场价值。欧洲的公用事业公司为了应对 PFAS 和微量污染物阈值的收紧,已开始效仿这些规范,这为美国和日本的供应商创造了出口机会。系统维修通常会采用 GAC 滤料、不銹钢接触器以及包含多年固定更换量的现场重新运作服务合约。拥有快速重新运作窑和数位化床层寿命分析技术的供应商在竞标评估中可以获得竞争优势。

防止燃煤电厂造成空气污染

目前,北美超过135座电厂(总装置容量超过55吉瓦)采用粉末活性碳喷射系统,汞捕集率可达90%或更高。美国环保署(EPA)将于2024年5月进行技术审查,届时将进一步收紧汞和颗粒物排放限值,使粉末活性碳喷射系统成为不愿投资湿式洗涤器升级改造的业主成本最低的维修。中国监管机构也正在调整排放法规,加速小型锅炉吸附式解决方案的推广。适用于高喷射温度和严格失火阈值的粉末配方供不应求,使得美国产椰壳粉末活性碳(抗孔隙堵塞)价格居高不下。

椰壳原料供应中断

热带国家供应全球80%以上的椰壳炭,但菲律宾受飓风影响导致的收成损失将使原料供应在2024年之前持续减少。像Carbon Activated Corporation这样的生产商正在加速垂直整合,在斯里兰卡开设第二家炭厂,同时与中国一家椰壳炭出口商签署了溢流供应协议。虽然硬木片和棕榈仁壳也被考虑作为紧急方案,但这些替代品通常孔隙分布较宽,会降低其去除PFAS和贵金属离子的效率。

细分市场分析

预计到2024年,棕榈壳产品将占活性碳市场36.5%的份额,这反映了其优异的孔隙分布,有利于PFAS的吸附和金的负载。其超过99%的硬度可最大限度地减少反冲洗过程中的碎片化,从而延长市政过滤器的床层寿命。然而,亚太地区工厂的扩张导致椰壳炭的竞争异常激烈,而2024年不利的天气状况也凸显了单一来源供应的脆弱性。

受永续森林认证体系和高碘值热解製程的推动,煤基材料市场正以5.8%的复合年增长率成长。在孔隙率要求不高的烟气和溶剂回收应用中,煤基材料仍具有成本效益。儘管前景可观,但目前关于污泥和锯末衍生炭的学术研究仍处于中试阶段,而主流生产商仍依赖传统原料。

预计到2024年,颗粒状活性碳产品将占据50%的市场份额,并在2030年之前以6.33%的最高复合年增长率增长,这主要得益于其重新运作能力和在填充床中稳定的压降性能。挤压/造粒活性碳适用于对低压降和高抗压强度要求极高的应用,例如溶剂蒸气吸附、压缩空气干燥和汽车碳罐。创新的气相颗粒活性碳装置整合了变温吸附技术,该技术利用电暖器对床层进行原位再生。

粉状活性碳虽然可重复使用性较差,但在需要快速释放、高比表面积产品的市场中,例如可在数小时内处理浑浊水源的救灾水包,其市场份额正在不断增长。颗粒状活性碳目前正转向沼气净化领域,欧洲的垃圾掩埋沼气处理商正在采购添加了硫浸渍添加剂的颗粒,用于去除硫化氢。从长远来看,环境处置法规和碳足迹核算可能会进一步推动可再生颗粒活性碳系统的经济效益,从而显着促进活性碳市场的成长。

区域分析

亚太地区处于活性碳市场扩张的前沿,2024年占据全球63%的收入份额,预计到2030年将以6.11%的复合年增长率成长。中国透过垂直整合的工厂支援区域生产,这些工厂将棕榈壳、煤炭和锯末转化为各种活性炭,供应国内自来水公司和出口市场。印度的「饮用水生命线计画」(Jal Jeevan Mission)旨在实现农村地区的全民用水,该计画已发布竞标文件,指定使用颗粒活性碳(GAC)过滤器去除水中的砷和氟化物。

北美市场受益于监管的确定性和较高的人均消费量。光是2024年美国环保署(EPA)的PFAS法规一项,就可能在本十年末将活性碳(GAC)的需求增加一倍。欧洲市场规模较小,但技术较为先进。剑桥大学的研究开发出一种带电活性碳海绵,能够以低能耗直接吸收空气中的二氧化碳,预示着未来该技术可望拓展至气候减缓领域。

南美洲和中东正迅速采用碳材料进行采矿和天然气加工,智利金矿商指定椰壳碳用于其 CIL 迴路,卡达液化天然气生产商采用颗粒状碳来满足低温分离前严格的汞污染限制。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 符合美国水处理应用的严格环境法规

- 更重视空气污染防治(特别是汞去除)

- 对水质净化的需求不断增长

- 黄金开采和金属回收

- 农业和农药需求量大

- 市场限制

- 棕榈壳供应链中断

- 煅烧煤价格上涨挤压了煤基PAC生产商的净利率

- 运作工厂的高资本密集度限制了循环经营模式。

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按原料

- 煤基

- 椰壳

- 低音提琴

- 其他原料(泥炭、褐煤等)

- 按形式

- 粉末活性碳(PAC)

- 颗粒活性碳(GAC)

- 挤压/造粒活性碳(EAC)

- 透过使用

- 漂白处理

- 糖的生产

- 浓缩治疗

- 溶剂回收

- PFAS吸附处理

- 饮用水处理

- 其他用途

- 按最终用户行业划分

- 水处理

- 工业加工

- 卫生保健

- 饮食

- 车

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Albemarle Corporation

- Arq, Inc.

- Carbon Activated Corporation

- CarboTech

- CPL

- Donau Carbon GmbH

- HAYCARB PLC

- Ingevity

- KALPAKA CHEMICALS

- KURARAY CO., LTD.

- MICBAC INDIA

- Nanping Yuanli Active Carbon Company

- Norit

- Osaka Gas Chemicals Co., Ltd

- Rotocarb

- Silcarbon Aktivkohle GmbH

- Suneeta Carbons

第七章 市场机会与未来展望

The Activated Carbon Market size is estimated at USD 4.83 billion in 2025, and is expected to reach USD 5.79 billion by 2030, at a CAGR of 5.30% during the forecast period (2025-2030).

Stringent water-quality rules, rapid industrialization in Asia-Pacific, and rising demand for specialty grades in pharmaceutical, mining, and advanced air-filtration processes propel growth. Coconut-shell feedstock remains the premium raw material for high-performance grades, yet tightening supply and volatile coal prices are spurring vertical integration and exploration of alternative precursors. Regulatory momentum anchors long-term demand for granular products, most notably the U.S. EPA's 2024 PFAS drinking-water standard naming granular activated carbon (GAC) as Best Available Technology. Simultaneously, powdered activated carbon (PAC) is pivotal in mercury-emission control for coal-fired utilities, while wood-based carbons attract investment through sustainable production breakthroughs. Manufacturers able to secure raw-material certainty, invest in reactivation capacity, and bundle digital monitoring services are best positioned to capture upcoming contracts.

Global Activated Carbon Market Trends and Insights

PFAS-Compliance Regulations for Drinking Water

The U.S. EPA's April 2024 National Primary Drinking Water Regulation capped six PFAS compounds and formally lists GAC as Best Available Technology, compelling all U.S. public water systems to start monitoring in 2027 and fully comply by 2029. The mandate next brings a projected USD 1.55 billion annual market for activated carbon systems, supported by validated removal efficiencies surpassing 99% for PFOA and PFOS. European utilities preparing for tighter PFAS and micro-pollutant thresholds have begun replicating these specifications, creating an export window for U.S. and Japanese suppliers. System retrofits frequently integrate GAC media, stainless-steel contactors, and on-site reactivation service contracts, locking in multi-year replacement volumes. Suppliers with rapid-turnaround reactivation kilns and digital bed-life analytics gain competitive headroom during bid evaluations.

Air-Pollution Control for Coal-Fired Utilities

More than 135 North American plants, representing over 55 GW of capacity, currently deploy powdered-carbon injection systems that achieve more than 90% mercury capture. The EPA's May 2024 technology review further narrows allowable mercury and particulate limits, making PAC the lowest-cost retrofit for owners unwilling to invest in wet-scrubber upgrades. Chinese regulators are also reshaping flue-gas norms, accelerating adsorption-based solutions for smaller boilers. Powder formulations tailored for elevated injection temperatures and strict loss-on-ignition thresholds are in short supply, enabling premium pricing for U.S. coconut-shell PAC grades that resist pore blocking.

Feedstock Supply Disruption for Coconut Shells

Tropical nations supply more than 80% of global coconut-shell char, and harvest setbacks caused by cyclones in the Philippines cut feedstock availability during 2024. Producers such as Carbon Activated Corporation accelerated vertical integration, opening a second char plant in Sri Lanka while lining up overflow supply agreements with Chinese shell-char exporters. Contingency plans involve qualifying hardwood chips and palm-kernel shells, yet such alternatives often produce broader pore distributions that reduce removal efficiency for PFAS and precious-metal ions.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Water-Purification Demand in Emerging Economies

- Gold Mining and Metal-Recovery Requirements

- Volatile Kiln-grade Coal Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coconut-shell products captured 36.5% of the activated carbon market in 2024, reflecting superior micropore distributions that excel at PFAS adsorption and gold-loading tasks. Hardness values exceeding 99% minimize fragmentation during backwashing, extending bed life in municipal filters. Asia-Pacific mill expansions, however, compete fiercely for shell char, and 2024 weather disruptions spotlighted the vulnerability of single-source procurement.

Wood-based carbons are the fastest-advancing alternative, rising at a 5.8% CAGR on the back of certified sustainable forestry programs and pyrolysis improvements that yield high iodine numbers. Coal-based variants remain cost-effective for flue-gas and solvent-recovery duties where tight micropore volume is less critical. Although promising, academic work on sludge- and sawdust-derived carbons is still at pilot scale, leaving mainstream producers dependent on legacy precursors.

Granular products held a commanding 50% share in 2024 and are forecast to record the highest 6.33% CAGR through 2030, thanks to their reactivation capability and consistent head-loss performance in packed beds. Extruded/pelletized carbons address applications such as solvent vapor adsorption, compressed-air drying, and automotive canisters where low pressure drop and high crush strength are paramount. GAC design considerations focus on uniform particle size to reduce channeling, while innovative vapor-phase GAC units integrate temperature swing adsorption that regenerates beds in situ with electric heaters.

Powdered grades, although less reusable, capture share in markets requiring high surface-area products delivered rapidly, illustrated by disaster-relief water packs capable of treating turbid sources within hours. Pelletized offerings are now pivoting toward biogas purification, with European landfill-gas operators procuring pellets infused with sulfur-impregnated additives for hydrogen-sulfide removal. Long-term, environmental disposal rules and carbon-footprint accounting may tilt economics further toward regenerable GAC systems, strengthening their outsized contribution to activated carbon market growth.

The Activated Carbon Market Report Segments the Industry by Raw Material (Coal-Based, Coconut-Shell-Based, and More), Form (Powdered Activated Carbon (PAC), Granular Activated Carbon (GAC), and Extruded/Pelletised Activated Carbon (EAC)), Application (Decolorization Treatment, Sugar Production, and More), End-User Industry (Water Treatment, Industrial Processing, and More), and Geography (Asia-Pacific, North America, and More).

Geography Analysis

Asia-Pacific held a dominant 63% revenue share in 2024 and is forecast to grow at a leading 6.11% CAGR to 2030, reinforcing its centrality to activated carbon market expansion. China anchors regional production with vertically integrated plants that convert coconut shells, coal, and sawdust into a broad portfolio of carbons tailored for domestic water utilities and export markets. India's Jal Jeevan mission, targeting universal rural-water access, is issuing tender documents that stipulate GAC filters for arsenic and fluoride removal, thereby opening procurement to both local mills and Japanese-owned subsidiaries.

North America is buoyed by regulatory certainty and high per-capita consumption. The 2024 EPA PFAS rule alone could double GAC demand by the end of the decade. Europe commands a smaller yet technologically sophisticated market. Research at the University of Cambridge yielded an electrified charcoal sponge that adsorbs CO2 directly from air with reduced energy input, hinting at future diversification into climate-mitigation applications.

South America and the Middle East, though accounting for modest volume, record rapid adoption of carbons for mining and gas-processing duties. Chilean gold miners specify coconut-shell carbons for CIL circuits, while Qatari LNG producers deploy pelletized carbons to meet stringent mercury spec contamination limits prior to cryogenic separation.

- Albemarle Corporation

- Arq, Inc.

- Carbon Activated Corporation

- CarboTech

- CPL

- Donau Carbon GmbH

- HAYCARB PLC

- Ingevity

- KALPAKA CHEMICALS

- KURARAY CO., LTD.

- MICBAC INDIA

- Nanping Yuanli Active Carbon Company

- Norit

- Osaka Gas Chemicals Co., Ltd

- Rotocarb

- Silcarbon Aktivkohle GmbH

- Suneeta Carbons

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Conformance to Stringent Environmental Regulations in Water Treatment Applications in the United States

- 4.2.2 Augmenting Prominence for Air Pollution Control (Especially Mercury Removal)

- 4.2.3 Growing Water Purification Demand

- 4.2.4 Gold Mining and Metal Recovery

- 4.2.5 High demand from Agriculture and Agrochemicals

- 4.3 Market Restraints

- 4.3.1 Supply-chain disruption of coconut shell feedstock

- 4.3.2 Escalating kiln-grade coal prices narrowing margins for coal-based PAC makers

- 4.3.3 High capital intensity of reactivation plants limiting circular business models

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Raw Material

- 5.1.1 Coal-Based

- 5.1.2 Coconut-Shell-Based

- 5.1.3 Wood-Based

- 5.1.4 Other Raw Materials (Peat, Lignite, etc.)

- 5.2 By Form

- 5.2.1 Powdered Activated Carbon (PAC)

- 5.2.2 Granular Activated Carbon (GAC)

- 5.2.3 Extruded / Pelletised Activated Carbon (EAC)

- 5.3 By Application

- 5.3.1 Decolorization Treatment

- 5.3.2 Sugar Production

- 5.3.3 Concentration Treatment

- 5.3.4 Solvent Recovery

- 5.3.5 PFAS Adsorption Treatment

- 5.3.6 Drinking Water Treatment

- 5.3.7 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Water Treatment

- 5.4.2 Industrial Processing

- 5.4.3 Healthcare

- 5.4.4 Food and Beverage

- 5.4.5 Automotive

- 5.4.6 Other End-user Industry

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Albemarle Corporation

- 6.4.2 Arq, Inc.

- 6.4.3 Carbon Activated Corporation

- 6.4.4 CarboTech

- 6.4.5 CPL

- 6.4.6 Donau Carbon GmbH

- 6.4.7 HAYCARB PLC

- 6.4.8 Ingevity

- 6.4.9 KALPAKA CHEMICALS

- 6.4.10 KURARAY CO., LTD.

- 6.4.11 MICBAC INDIA

- 6.4.12 Nanping Yuanli Active Carbon Company

- 6.4.13 Norit

- 6.4.14 Osaka Gas Chemicals Co., Ltd

- 6.4.15 Rotocarb

- 6.4.16 Silcarbon Aktivkohle GmbH

- 6.4.17 Suneeta Carbons

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Rising Research Activities Research to Develop Bio-based Plastics