|

市场调查报告书

商品编码

1851544

医疗保健领域的印刷电子技术:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Printed Electronics In Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

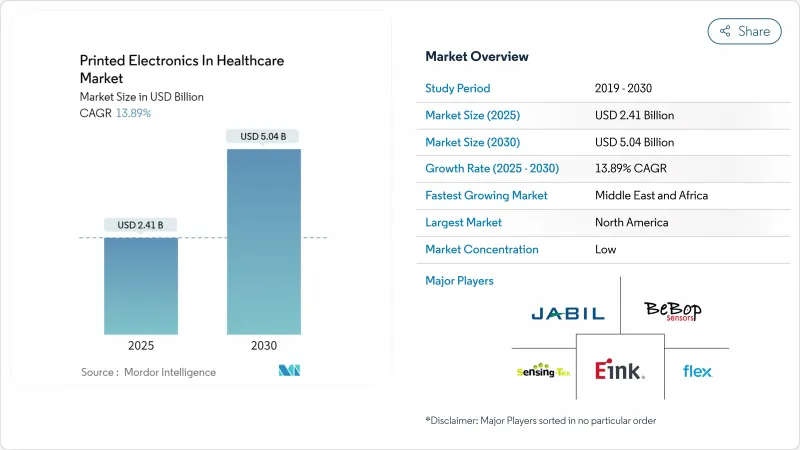

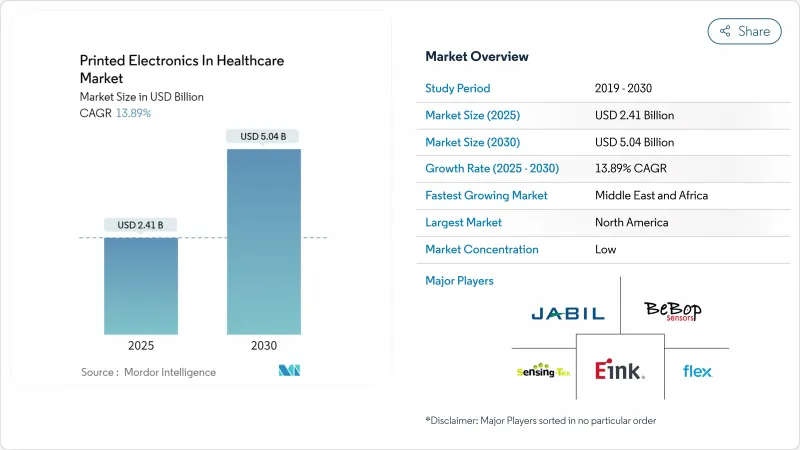

目前医疗保健领域印刷电子产品的市场规模为 24.1 亿美元,预计到 2030 年将达到 50.4 亿美元,复合年增长率为 13.89%。

这项强劲成长得益于该技术能够以传统硅製造製程无法比拟的单位成本,提供柔性、轻巧且一次性使用的医疗设备。对用于远端患者监护的可穿戴设备的强劲需求、智慧药品包装的增长以及生物相容性导电油墨的快速创新,都为近期增长提供了支撑。北美地区监管政策的早期明确和美国国立卫生研究院 (NIH) 的慷慨津贴将加速商业化进程,而亚太地区对照护现场的推动将扩大基本客群。同时,随着临床应用障碍的克服,自修復导体和可拉伸基板的突破有望带来新的收入来源。

全球医疗保健印刷电子市场趋势与洞察

美国居家医疗领域迅速采用穿戴贴片进行远端患者监护

远端医疗)扩大了远距医疗的报销范围,美国食品药物管理局(FDA)批准了亲肤型血糖贴片和心臟贴片,这些措施正推动印刷感测器在居家医疗领域的广泛应用。混合微流控贴片现在可以收集多参数生命体征,为医疗团队提供详细的纵向数据,无需患者前往诊所。美国医疗系统报告称,再入院率降低,病患满意度提高,证实了实质的成本节约。在此环境下,设备製造商的规模化生产为欧盟和亚太地区的医疗系统在评估报销框架时树立了令人信服的先例。

欧盟打击假药指令推动采用印刷式射频辨识技术的智慧药品包装。

欧盟《反假药指令》的全面序列化要求迫使製药公司在每个零售包装中加入防伪功能。采用高速柔版印刷生产线生产的印刷式RFID和NFC标籤,如今既满足了可追溯性要求,又具备防篡改功能,且单位成本达到非专利和品牌药生产商可接受的水平。采用符合欧盟标准的包装的全球製药公司,也正将同样的解决方案推广到亚太地区的物流中心,从而对适用于纸张和箔材的导电油墨的需求产生了倍增效应。

FDA和EMA的检验週期延缓了商业推广。

实际的510(k)审查通常远超预期,耗时六至七个月,因为审查人员会要求提供新基材的额外实验室和临床数据。此外,欧洲新的医疗器材法规(MDR)增加了临床性能测试,迫使企业提交双轨申请。网路安全和人工智慧文件要求的提高以及测试成本的增加,导致一些中型企业推迟在美国上市,转而选择在中东和南美进行试点部署。

细分市场分析

到2024年,印刷生物感测器将占印刷电子市场41.8%的份额。血糖试纸和连续血糖监测仪将占据市场主导地位,这得益于美国市场核准的通过,使得常规血糖监测不再那么令人诟病。感染疾病检测将继续成为亚太地区公共卫生竞标的主要成长引擎,而新兴的pH贴片和伤口监测贴片也正在获得临床应用。

可拉伸柔性混合电子产品将成为同类产品中成长最快的,复合年增长率将达到16.3%。自修復导电网能够承受反覆的应变循环而不发生分层,从而实现长达一週的心臟和神经系统监测。用于药品包装的印刷型RFID标籤将成为第二大需求支柱,尤其是在全球序列化要求日益成熟的背景下。

由于网版印刷技术具有成熟的生产效率和一次性电极的低单位成本,预计到2024年,它将占据印刷电子市场52.9%的份额。成熟的製程控制有助于通过FDA认证,使其成为大规模生产生物感测器的首选製程。

气溶胶喷射和3D列印技术正以14.7%的复合年增长率成长。在微流体通道内沉积导电线的能力,已将原型製作时间从数天缩短至数分钟。瑞士和新加坡的早期采用者已在试点规模上实现了亚100微米通道的精度,从而能够快速迭代实验室晶片诊断设计。

区域分析

2024年,北美将占全球销售额的40.8%,这得益于FDA早期推出的数位健康框架和NIH的资助计划,这些计划降低了材料研发的风险。梅奥诊所和克利夫兰诊所进行的多中心试验检验了远端监测终点,并简化了区域医院网路的采购核准。位于安大略省的加拿大研究丛集在特种基板累积了丰富的专业知识,进一步巩固了我们在北美的领先地位。

欧洲仍是重要的战略要地。欧洲的大型製药公司必须遵守《反假药指令》,这持续催生了对序列化智慧标籤的需求。德国的精密机械製造传统为大批量印刷机提供了支持,而英国则将风险投资投入创业投资资金灵活的新兴企业新创公司。法国和北欧国家的公共卫生部门将透过远端感测器的预防性医疗报销来鼓励其广泛应用。

预计中东和非洲地区的复合年增长率将达到15.4%,位居全球之首。沙乌地阿拉伯和阿联酋的国家卫生推广计画已为连网诊断技术拨出预算,将印刷电子技术视为无需庞大基础设施即可快速覆盖农村地区的途径。南非监管机构正将医疗器材代码与美国食品药物管理局(FDA)的分类标准接轨,加速进口核准。这一势头标誌着该地区在医疗技术自主化方面又向前迈进了一步。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 美国居家医疗领域对穿戴式远距病人监护贴片的快速采用

- 欧盟假药指令推广采用印有RFID技术的智慧药品包装。

- 用于感染疾病检测的照护现场检测一次性生物感测器在亚洲迅速普及。

- 慢性疾病负担推动了心臟病学领域对柔性印刷电极的需求。

- 为保障低温运输完整性,疫苗领域亟需采用印刷式温度感测器。

- 由美国国立卫生研究院和欧盟地平线津贴资助的生物相容性导电油墨研发

- 市场限制

- FDA和EMA的检验週期延缓了商业推广。

- 聚合物基材的灭菌和生物相容性挑战

- 湿度劣化会降低印刷生物感测器的使用寿命。

- 新兴市场穿戴诊断报销的不确定性

- 生态系分析

- 监理与技术展望

- 印刷技术概览

- 网版印刷

- 喷墨列印

- 凹版印刷及柔版印刷

- 气溶胶喷射和其他新兴技术

- 印刷技术概览

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 印刷生物感测器

- 葡萄糖感测器

- 感染疾病检测条

- 其他生物感测器

- 印刷式生理感测器

- 心电图/脑电图电极

- 温度/pH贴片

- 印刷型RFID/NFC标籤

- 伸缩性柔性混合电子装置

- 印刷微射流

- 其他列印零件(天线、加热器)

- 印刷生物感测器

- 透过印刷技术

- 网版印刷

- 喷墨列印

- 凹版/柔版

- 气溶胶喷射和3D列印

- 透过使用

- 病患监测和穿戴式设备

- 诊断检测和照护现场

- 药物传输和智慧型贴片

- 药品包装和仿冒品

- 医疗影像和治疗设备

- 其他的

- 最终用户

- 医院和诊所

- 家庭医疗保健提供者

- 製药和生物技术公司

- 诊断实验室

- 学术研究机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 南美洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- DuPont de Nemours, Inc.

- Henkel AG and Co. KGaA

- Nissha Co., Ltd.(Nissha Medical)

- Flex Ltd.(Health Solutions)

- Molex LLC(Sensable)

- GE Healthcare

- Abbott Laboratories(FreeStyle Libre Sensors)

- Medtronic plc(Printed Electrodes)

- Jabil Inc.(Blue Sky Center)

- Zimmer Biomet(Smart Implants)

- NovaCentrix Corp.

- PragmatIC Semiconductor Ltd.

- Thinfilm Electronics ASA

- Toppan Printing Co., Ltd.(Healthcare Labels)

- PolyIC GmbH and Co. KG

- GSI Technologies LLC

- PV Nano Cell Ltd.

- Coatema Coating Machinery GmbH

- Bebop Sensors Inc.

- Sensing Tex SL

第七章 市场机会与未来展望

The printed electronics market size in healthcare is currently valued at USD 2.41 billion and is forecast to achieve USD 5.04 billion by 2030, reflecting a 13.89% CAGR.

This vigorous expansion stems from the technology's ability to deliver flexible, lightweight, and disposable medical devices at unit costs traditional silicon manufacturing cannot match. Strong demand for remote patient-monitoring wearables, growth in smart pharmaceutical packaging, and rapid innovation in biocompatible conductive inks anchor near-term growth. North America's early regulatory clarity and generous NIH grants accelerate commercialization pipelines, while Asia-Pacific's push for point-of-care diagnostics widens the customer base. Meanwhile, breakthroughs in self-healing conductors and stretchable substrates promise fresh revenue streams as clinical adoption hurdles are cleared.

Global Printed Electronics In Healthcare Market Trends and Insights

Rapid Uptake of Remote Patient-Monitoring Wearable Patches in United States Homecare

Medicare's broader reimbursement for telehealth, coupled with FDA clearance of skin-friendly glucose and cardiac patches, fuels wide deployment of printed sensors in the home-care channel. Hybrid microfluidic-regulated patches now capture multi-parameter vitals, handing care teams granular longitudinal data without clinic visits. U.S. systems report fewer readmissions and higher patient satisfaction, confirming tangible cost savings. Device makers scaling in this environment set a compelling precedent for EU and APAC health systems as they evaluate reimbursement frameworks.

EU Falsified Medicines Directive Catalyzing Smart Pharma-Packaging with Printed RFID

Full serialization under the EU Falsified Medicines Directive forces pharmaceutical producers to embed authentication features on every retail pack. Printed RFID and NFC tags, fabricated on high-speed flexographic lines, now satisfy both traceability and tamper evidence at unit cost levels acceptable to generic and branded manufacturers. Global drug firms adopting EU-compliant packaging extend the same solutions to APAC logistics hubs, creating a multiplier effect on demand for conductive inks optimized for paper and foil substrates.

FDA and EMA Validation Cycles Delaying Commercial Roll-outs

Actual 510(k) reviews often stretch to 6-7 months, well beyond nominal timelines, as examiners request extra bench and clinical data on novel substrates. De novo classifications lengthen approvals further, and the new European MDR imposes additional clinical performance studies, forcing dual submission tracks. Rising cybersecurity and AI documentation requirements add layers of testing cost, prompting some mid-cap firms to defer U.S. launches in favor of pilot deployments in MEA or South America.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Point-of-Care Disposable Biosensors for Infectious Disease Detection in Asia

- Cold-Chain Integrity Needs Boosting Printed Temperature Sensors for Vaccines

- Sterilization and Biocompatibility Challenges of Polymer Substrates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Printed biosensors held 41.8% of the printed electronics market in 2024. Glucose strips and continuous glucose monitors dominate the installed base, buoyed by over-the-counter U.S. approvals that destigmatize routine monitoring. Infectious disease assays remain a growth engine in APAC public-health tenders, while emerging pH and wound-monitor patches broaden clinical reach.

Stretchable and flexible hybrid electronics is projected to post a 16.3% CAGR, the fastest among types. Self-healing conductive meshes now survive repeated strain cycles without delamination, allowing week-long cardiac or neuro monitoring. Printed RFID labels for pharma packs add a second demand pillar, especially as global serialization mandates mature

Screen printing captured 52.9% of the printed electronics market in 2024 thanks to proven throughput and low per-unit costs for disposable electrodes. Mature process controls ease FDA filing, making it the default for high-volume biosensors.

Aerosol jet and 3D methods are growing at a 14.7% CAGR. Their ability to deposit conductive tracks inside 3D microfluidic channels has cut prototyping times from days to minutes. Early adopters in Switzerland and Singapore have demonstrated sub-100 µm channel fidelity at pilot scale, enabling rapid design iteration for lab-on-chip diagnostics.

The Printed Electronics in Healthcare Market Report is Segmented by Type (Printed Biosensors, Printed Physiological Sensors, Printed RFID/NFC Labels, and More), Printing Technology (Screen Printing, Inkjet Printing, and More), Application (Patient Monitoring, Diagnostic Testing, Drug Delivery, and More), End-User (Hospitals, Home Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America posted 40.8% of global revenue in 2024, benefiting from FDA's early digital-health frameworks and NIH funding streams that de-risk material R&D. Multicenter trials at Mayo Clinic and Cleveland Clinic validate remote monitoring endpoints, smoothing procurement approvals for regional hospital networks. Canadian research clusters in Ontario add specialized substrate expertise, further bolstering continental leadership.

Europe remains a strategic stronghold. The region's pharmaceutical giants must comply with the Falsified Medicines Directive, locking in sustained demand for serialized smart tags. Germany's precision-machinery heritage supports high-volume printing presses, while the United Kingdom channels venture funding into flexible IC startups. Public health authorities in France and Nordic nations augment uptake through preventive-care reimbursement for remote sensors.

The Middle East and Africa is forecast to deliver a 15.4% CAGR, the fastest worldwide. National health expansions in Saudi Arabia and the United Arab Emirates allocate budget lines for connected diagnostics, seeing printed electronics as a quick path to rural coverage without heavy infrastructure. South Africa's regulatory agency aligns its device code to FDA classification, accelerating import approvals. This momentum signals a step-change in the region's medical technology self-sufficiency.

- DuPont de Nemours, Inc.

- Henkel AG and Co. KGaA

- Nissha Co., Ltd. (Nissha Medical)

- Flex Ltd. (Health Solutions)

- Molex LLC (Sensable)

- GE Healthcare

- Abbott Laboratories (FreeStyle Libre Sensors)

- Medtronic plc (Printed Electrodes)

- Jabil Inc. (Blue Sky Center)

- Zimmer Biomet (Smart Implants)

- NovaCentrix Corp.

- PragmatIC Semiconductor Ltd.

- Thinfilm Electronics ASA

- Toppan Printing Co., Ltd. (Healthcare Labels)

- PolyIC GmbH and Co. KG

- GSI Technologies LLC

- PV Nano Cell Ltd.

- Coatema Coating Machinery GmbH

- Bebop Sensors Inc.

- Sensing Tex S.L.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Uptake of Remote Patient-Monitoring Wearable Patches in United States Homecare

- 4.2.2 EU Falsified Medicines Directive Catalyzing Smart Pharma-Packaging with Printed RFID

- 4.2.3 Surge in Point-of-Care Disposable Biosensors for Infectious Disease Detection in Asia

- 4.2.4 Chronic-Disease Burden Driving Demand for Flexible Printed Electrodes in Cardiology

- 4.2.5 Cold-Chain Integrity Needs Boosting Printed Temperature Sensors for Vaccines

- 4.2.6 NIH and EU Horizon Grants Funding Bio-Compatible Conductive-Ink R&D

- 4.3 Market Restraints

- 4.3.1 FDA and EMA Validation Cycles Delaying Commercial Roll-outs

- 4.3.2 Sterilization and Biocompatibility Challenges of Polymer Substrates

- 4.3.3 Humidity-Driven Degradation Limiting Shelf-Life of Printed Biosensors

- 4.3.4 Reimbursement Ambiguity for Wearable Diagnostics in Emerging Markets

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Printing Technology Snapshot

- 4.5.1.1 Screen Printing

- 4.5.1.2 Inkjet Printing

- 4.5.1.3 Gravure and Flexography

- 4.5.1.4 Aerosol Jet and Other Emerging Techniques

- 4.5.1 Printing Technology Snapshot

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Printed Biosensors

- 5.1.1.1 Glucose Sensors

- 5.1.1.2 Infectious-Disease Test Strips

- 5.1.1.3 Other Biosensors

- 5.1.2 Printed Physiological Sensors

- 5.1.2.1 ECG/EEG Electrodes

- 5.1.2.2 Temperature/pH Patches

- 5.1.3 Printed RFID/NFC Labels

- 5.1.4 Stretchable and Flexible Hybrid Electronics

- 5.1.5 Printed Microfluidics

- 5.1.6 Other Printed Components (Antennas, Heaters)

- 5.1.1 Printed Biosensors

- 5.2 By Printing Technology

- 5.2.1 Screen Printing

- 5.2.2 Inkjet Printing

- 5.2.3 Gravure/Flexography

- 5.2.4 Aerosol Jet and 3D Printing

- 5.3 By Application

- 5.3.1 Patient Monitoring and Wearables

- 5.3.2 Diagnostic Testing and Point-of-Care

- 5.3.3 Drug Delivery and Smart Patches

- 5.3.4 Pharmaceutical Packaging and Anti-Counterfeit

- 5.3.5 Medical Imaging and Therapeutic Devices

- 5.3.6 Others

- 5.4 By End-user

- 5.4.1 Hospitals and Clinics

- 5.4.2 Home Healthcare Providers

- 5.4.3 Pharmaceutical and Biotech Companies

- 5.4.4 Diagnostic Laboratories

- 5.4.5 Academic and Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 DuPont de Nemours, Inc.

- 6.4.2 Henkel AG and Co. KGaA

- 6.4.3 Nissha Co., Ltd. (Nissha Medical)

- 6.4.4 Flex Ltd. (Health Solutions)

- 6.4.5 Molex LLC (Sensable)

- 6.4.6 GE Healthcare

- 6.4.7 Abbott Laboratories (FreeStyle Libre Sensors)

- 6.4.8 Medtronic plc (Printed Electrodes)

- 6.4.9 Jabil Inc. (Blue Sky Center)

- 6.4.10 Zimmer Biomet (Smart Implants)

- 6.4.11 NovaCentrix Corp.

- 6.4.12 PragmatIC Semiconductor Ltd.

- 6.4.13 Thinfilm Electronics ASA

- 6.4.14 Toppan Printing Co., Ltd. (Healthcare Labels)

- 6.4.15 PolyIC GmbH and Co. KG

- 6.4.16 GSI Technologies LLC

- 6.4.17 PV Nano Cell Ltd.

- 6.4.18 Coatema Coating Machinery GmbH

- 6.4.19 Bebop Sensors Inc.

- 6.4.20 Sensing Tex S.L.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment