|

市场调查报告书

商品编码

1851565

输送机:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Conveyors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

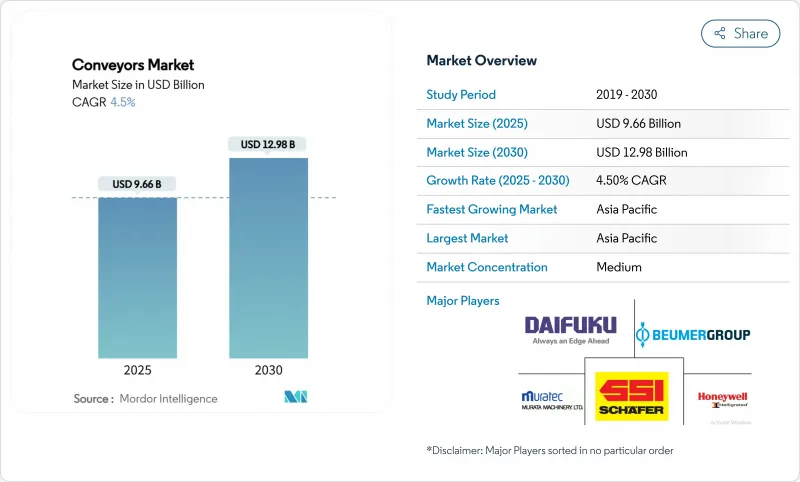

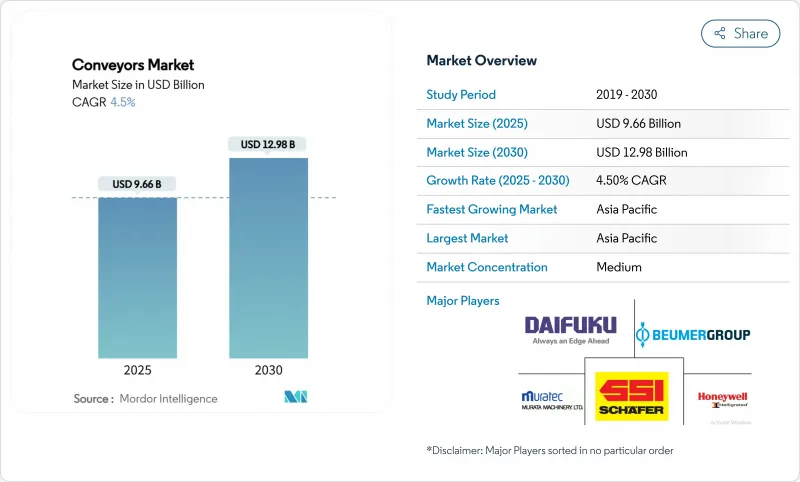

预计到 2025 年,输送机市场规模将达到 96.6 亿美元,到 2030 年将达到 129.8 亿美元,预测期(2025-2030 年)复合年增长率为 4.5%。

这一前景受到电子商务快速成长、工业4.0投资以及对能源效率追求的推动,这些因素共同促成了再生驱动技术的应用,该技术在下坡工况下可降低37%至39%的能耗。亚太地区的需求领先,而中东地区则运作大型物流园区的投产而实现了最快的成长。儘管传送带技术仍保持较高的装机量,但随着工厂寻求减少占地面积,架空式设计正以最快的速度扩张。软体主导的预测性维护已成为成长最强劲的组件领域,可将非计划性停机时间减少高达30%,并延长资产寿命。同时,中小企业不愿在资本支出上投入资金,导致高端升级的步伐放缓,而AGV/AMR的替代也给传统的固网带来了额外的压力。

全球输送机市场趋势与洞察

电子商务履约中心快速成长

都市区微型履约中心需要能够在最小占地面积内,以每小时处理超过7,200个包裹的输送机平台。亚马逊位于泰国的Cafe Amazon配送中心展示了模组化的Interroll系统如何能够每天在4000家门市处理2万个包裹。高吞吐量的交叉传送带分类机能够兑现当日送达的承诺,而垂直布局则最大限度地提高了空间受限的亚洲大都市的立方吞吐量。开发商指定使用即插即用的传送模组,以便在无需土木工程的情况下重新配置设施。这些要求维持了设备的更新週期,并巩固了传送系统市场作为最后一公里物流支柱的地位。

食品饮料工厂对自动化处理的需求日益增长

加工商不仅满足卫生合规要求,更致力于优化端到端的生产效率。 Balaji Wafers 透过采用主动式滚筒传送带生产线,实现了零计划外停机,该生产线能够轻柔地处理产品。配备视觉功能的输送机可即时检测缺陷,进而减少人工检查。 Diversified Foods 的 DirectDrive 螺旋输送机如今可在高产量零嘴零食包装生产线上每天 48 小时连续运作,彻底杜绝了以往的机械故障。模组化塑胶传送带延长了使用寿命,而新兴的植物来源产品线则需要能够处理不同湿度易碎物品的灵活布局。

前期投资额高,投资报酬期长

即使内部报酬率达到15%,能量回收驱动装置也需要六年才能收回成本,这对资金紧张的公司来说是一个不小的挑战。钢材价格在每吨870美元至950美元之间波动,也让预算编制变得更加复杂。虽然租赁模式已经存在,但在信贷市场紧张的地区,其普及速度仍然缓慢。这种成本压力限制了高阶设备在输送机系统市场的渗透率。

细分市场分析

到2024年,皮带输送机将维持39%的市场份额,成为采矿、食品和一般製造业生产线的关键组成部分。德克萨斯州的Dune Express公司透过皮带输送机,每年输送1300万吨货物,全程42英里,减少了2.5万次卡车运输,充分证明了皮带输送机的优势。随着工厂腾出占地面积并提高工人安全,架空式输送机的市占率将以8.1%的复合年增长率成长。滚筒输送系统受惠于适用于可重构组装的模组化框架,而托盘输送线则可满足汽车产业的精密作业需求。在各个领域,智慧感测器将使预测性维护的准确率提升至95%以上。

随着永续采矿和散装物流计划的推进,皮带输送机系统市场规模预计将持续扩大。节能型振动设计仅需传统驱动功率的20%,体现了各领域的技术创新。板条式和炼式输送机仍应用于重型车辆生产,但由于市场对更灵活替代方案的需求不断增长,其发展受到抑制。

到2024年,单元物料搬运的需求将占总需求的64.3%,这主要得益于电子商务和离散製造工作流程的发展,这些流程强调宽鬆的产品控制和零压力堆积。配备视觉辅助缺陷检测系统的分类系统目前已能胜任分类任务,同时提高了安全性。散装搬运虽然规模较小,但其年复合成长率将超过单元物料搬运,达到8.7%,这主要得益于快速消费品产业的成长和农业现代化。混合型设备的出现模糊了不同物料搬运方式之间的界限,因为工厂需要能够在托盘和颗粒饲料之间切换的基础设施。

在采矿业,TAKRAF 的 Collahuasi计划体现了对大容量输送能力的需求。製药无尘室依靠真空输送机以每小时超过 11,100 公升的速度输送物料,同时保持无菌环境。这两个领域为输送机系统市场提供了多元化的收入来源。

区域分析

到2024年,亚太地区将占据输送机系统市场38%的份额,这主要得益于中国、印度和东南亚製造群的扩张。DAIFUKU CO. LTD.在印度新建的工厂印证了汽车和电子产业日益增长的本地需求。中国持续在矿业和港口基础设施中安装大型散装输送带,而印度将利用SAMARTH Udyog的设施加速智慧工厂的升级改造。半导体产业的投资将带动无尘室输送机需求的成长,而日本310英里长的货运铁路计画则凸显了其雄心勃勃的计划工程维修目标。

中东地区物流业将以8.9%的复合年增长率成长,并受惠于物流多元化。沙乌地阿拉伯的「2030愿景」计画将投资1,066亿美元用于建造奥克萨贡等货运走廊,这将推动对高容量分拣和港口的需求。阿联酋的物流市场预计到2025年将达到200.3亿美元,将带动仓储自动化领域的投资,预计到2025年,该领域的投资将达到16亿美元。

北美和欧洲在能源部能源效率津贴和欧盟碳排放法规的推动下,持续推动老旧设备的现代化改造。翻新硬碟的驱动装置正在迅速普及,尤其是在欧洲,绿色环保政策提高了投资报酬率。南美和非洲的采矿和港口计划推动了这一增长,但资金限制减缓了以分析为中心的系统的普及。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务履约中心快速成长

- 食品饮料工厂对自动化处理的需求日益增长

- 机场客流量增加促进了行李搬运输送带的使用

- 政府对工业4.0现代化的奖励

- 城市微型履约需要紧凑型模组化输送机

- 能量再生输送机驱动装置支援ESG目标

- 市场限制

- 初始投资额高,投资回收期长

- 改装整合可能导致生产停机

- 自主移动机器人(AMR)和自动导引车(AGV)作为替代技术正在兴起。

- 输送机控製网路中的OT-IT网路安全漏洞

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 腰带

- 滚筒

- 调色盘

- 开卖

- 板条/链条

- 螺丝和气压

- 按载荷类型

- 单位处理量

- 散装搬运

- 按最终用户行业划分

- 飞机场

- 零售与电子商务

- 车

- 饮食

- 製药

- 采矿和采石

- 製造业(离散型和流程型)

- 其他的

- 透过系统配置

- 固定/线性

- 模组化/灵活

- 按组件

- 运输设备

- 驱动与控制

- 软体与分析

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 法国

- 义大利

- 英国

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Daifuku Co., Ltd.

- SSI Schaefer AG

- Murata Machinery Ltd.

- Mecalux SA

- BEUMER Group GmbH & Co. KG

- KNAPP AG

- Swisslog AG(KUKA)

- Honeywell Intelligrated

- Flexco

- Vanderlande Industries

- Dematic(KION Group)

- Interroll Holding AG

- Fives Group

- TGW Logistics Group

- Hytrol Conveyor Company

- Bastian Solutions Inc.

- Siemens Logistics

- Martin Engineering

- Dorner Manufacturing

- Intralox LLC

第七章 市场机会与未来展望

The Conveyors Market size is estimated at USD 9.66 billion in 2025, and is expected to reach USD 12.98 billion by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

The outlook is shaped by rapid e-commerce fulfillment growth, Industry 4.0 investment, and the search for energy efficiency that pushes regenerative-drive adoption capable of 37-39% power savings in downhill duty cycles. Asia-Pacific leads demand, while the Middle East records the fastest expansion as large logistics parks come online. Belt technology retains a plurality of installations, but overhead designs are scaling fastest because factories want floor-space relief. Software-driven predictive maintenance is emerging as the strongest component growth area, cutting unplanned downtime by up to 30% and extending asset life. At the same time, capital-spending hesitancy among smaller enterprises tempers the pace of high-end upgrades, and AGV/AMR substitution places added pressure on traditional fixed lines.

Global Conveyors Market Trends and Insights

Rapid growth of e-commerce fulfillment centres

Urban micro-fulfillment nodes now need conveyor platforms that sort more than 7,200 boxes per hour while occupying minimal floor area. Cafe Amazon's Thailand hub shows the model, handling 20,000 boxes a day across 4,000 outlets via a modular Interroll system. High-throughput crossbelt sorters keep same-day delivery promises, and vertical layouts maximize cubic throughput in space-restricted Asian megacities. Developers specify plug-and-play conveyor modules so that facilities can be re-arranged without civil works. These requirements sustain robust equipment replacement cycles and reinforce the conveyor systems market as a backbone of last-mile logistics.

Increasing demand for automated handling in food and beverage plants

Processors move beyond hygiene compliance toward end-to-end throughput optimization. Balaji Wafers reached zero unplanned downtime by shifting to Activated Roller Belt lines that maintain gentle product handling. Vision-equipped conveyors conduct real-time defect checks, shrinking manual inspection. In high-volume snack packaging, DirectDrive spirals now run for 48 hours straight at Diversified Foods, eliminating historic mechanical failures. Modular plastic belting extends service life, and emerging plant-based product lines require adaptable layouts able to process fragile items with varying moisture profiles.

High upfront CAPEX and long ROI periods

Even with 15% internal rates of return, energy-regenerative drives need six years to recoup capital, a hurdle for cash-constrained firms. Steel price swings between USD 870-950 per ton complicate budgeting. Leasing models exist, yet adoption lags in regions with tight credit markets. This cost tension restrains premium equipment penetration within the conveyor systems market.

Other drivers and restraints analyzed in the detailed report include:

- Rising airport passenger volumes boosting baggage-handling conveyors

- Government incentives for Industry 4.0 modernisation

- AMRs and AGVs emerging as substitute technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Belt conveyors retained 39% share in 2024, a cornerstone of mining, food and general manufacturing lines. The Dune Express in Texas proves belt scale, moving 13 million tons annually across 42 miles and removing 25,000 truck trips. Overhead variants lift at an 8.1% CAGR as factories open floor space and improve worker safety. Roller systems benefit from modular frames suited to reconfigurable assembly, while pallet lines serve precision automotive tasks. Across categories, smart sensors push predictive maintenance accuracy above 95%.

The conveyor systems market size for belt solutions is projected to expand alongside sustainable mining and bulk logistics projects, whereas overhead designs capture incremental share by maximizing cubic utilization. Energy-efficient vibratory designs need only 20% of traditional drive force, reflecting cross-segment innovation. Slat and chain lines remain embedded in heavy vehicle production, yet their growth is tempered by rising demand for flexible alternatives.

Unit handling represented 64.3% of 2024 demand, driven by e-commerce and discrete manufacturing workflows that value gentle product control and zero-pressure accumulation. Systems with vision-assisted defect detection now handle classification tasks while improving safety. Bulk handling, though smaller, will outpace unit growth at 8.7% CAGR, keyed to commodities growth and agriculture modernisation. Hybrid installations blur boundaries as plants seek infrastructure able to switch between pallets and granular feed.

In mining, TAKRAF's Collahuasi project underlines heavy-duty bulk capacity requirements. Pharmaceutical cleanrooms depend on vacuum conveyors transferring more than 11,100 liters per hour while preserving sterility. These dual paths sustain diversified revenue streams within the conveyor systems market.

Conveyor Systems Market Report is Segmented by Product Type (Belt, Roller, Pallet, Overhead, Slat/Chain and More), Load Type (Unit Handling, Bulk Handling), End-User Industry (Airport, Retail & E-Commerce, Automotive and More), System Configuration (Fixed/Linear, Modular/Flexible), Component (Conveying Equipment, Drives & Controls, Software & Analytics), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 38% of the conveyor systems market in 2024, anchored by expanding manufacturing clusters in China, India, and Southeast Asia. Daifuku's new Indian factory underscores rising local demand from automotive and electronics verticals. China continues to install heavy-duty bulk belts in mining and port infrastructure, while India leverages SAMARTH Udyog facilities to accelerate smart-factory retrofits. Cleanroom conveyor demand rises with semiconductor investment, and Japan's 310-mile freight line spotlights megaproject ambition.

The Middle East, growing at an 8.9% CAGR, benefits from logistics diversification agendas. Saudi Vision 2030 dedicates USD 106.6 billion to freight corridors such as Oxagon, driving need for high-capacity sortation and port conveyors. The UAE logistics market, valued at USD 20.03 billion in 2025, underpins warehouse automation outlays forecast at USD 1.6 billion by 2025.

North America and Europe continue to modernize legacy installations, spurred by DOE energy-efficiency grants and EU carbon regulations. Regenerative drives see early uptake, especially in Europe where green mandates elevate ROI calculations. South America and Africa show pockets of growth tied to mining and port projects, yet capital constraints slow adoption of analytics-heavy systems.

- Daifuku Co., Ltd.

- SSI Schaefer AG

- Murata Machinery Ltd.

- Mecalux S.A.

- BEUMER Group GmbH & Co. KG

- KNAPP AG

- Swisslog AG (KUKA)

- Honeywell Intelligrated

- Flexco

- Vanderlande Industries

- Dematic (KION Group)

- Interroll Holding AG

- Fives Group

- TGW Logistics Group

- Hytrol Conveyor Company

- Bastian Solutions Inc.

- Siemens Logistics

- Martin Engineering

- Dorner Manufacturing

- Intralox L.L.C.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth of e-commerce fulfilment centres

- 4.2.2 Increasing demand for automated handling in food and beverage plants

- 4.2.3 Rising airport passenger volumes boosting baggage-handling conveyors

- 4.2.4 Government incentives for Industry 4.0 modernisation

- 4.2.5 Urban micro-fulfilment requires compact modular conveyors

- 4.2.6 Energy-regenerative conveyor drives support ESG targets

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX and long ROI periods

- 4.3.2 Retrofit integration risk causing production downtime

- 4.3.3 AMRs and AGVs emerging as substitute technologies

- 4.3.4 OT-IT cyber-vulnerabilities in conveyor control networks

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Belt

- 5.1.2 Roller

- 5.1.3 Pallet

- 5.1.4 Overhead

- 5.1.5 Slat / Chain

- 5.1.6 Screw and Pneumatic

- 5.2 By Load Type

- 5.2.1 Unit Handling

- 5.2.2 Bulk Handling

- 5.3 By End-User Industry

- 5.3.1 Airport

- 5.3.2 Retail and E-commerce

- 5.3.3 Automotive

- 5.3.4 Food and Beverage

- 5.3.5 Pharmaceuticals

- 5.3.6 Mining and Quarrying

- 5.3.7 Manufacturing (Discrete and Process)

- 5.3.8 Others

- 5.4 By System Configuration

- 5.4.1 Fixed / Linear

- 5.4.2 Modular / Flexible

- 5.5 By Component

- 5.5.1 Conveying Equipment

- 5.5.2 Drives and Controls

- 5.5.3 Software and Analytics

- 5.6 By Region

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 Italy

- 5.6.3.4 United Kingdom

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Israel

- 5.6.5.5 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Daifuku Co., Ltd.

- 6.4.2 SSI Schaefer AG

- 6.4.3 Murata Machinery Ltd.

- 6.4.4 Mecalux S.A.

- 6.4.5 BEUMER Group GmbH & Co. KG

- 6.4.6 KNAPP AG

- 6.4.7 Swisslog AG (KUKA)

- 6.4.8 Honeywell Intelligrated

- 6.4.9 Flexco

- 6.4.10 Vanderlande Industries

- 6.4.11 Dematic (KION Group)

- 6.4.12 Interroll Holding AG

- 6.4.13 Fives Group

- 6.4.14 TGW Logistics Group

- 6.4.15 Hytrol Conveyor Company

- 6.4.16 Bastian Solutions Inc.

- 6.4.17 Siemens Logistics

- 6.4.18 Martin Engineering

- 6.4.19 Dorner Manufacturing

- 6.4.20 Intralox L.L.C.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment