|

市场调查报告书

商品编码

1851572

商用机器人:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Commercial Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

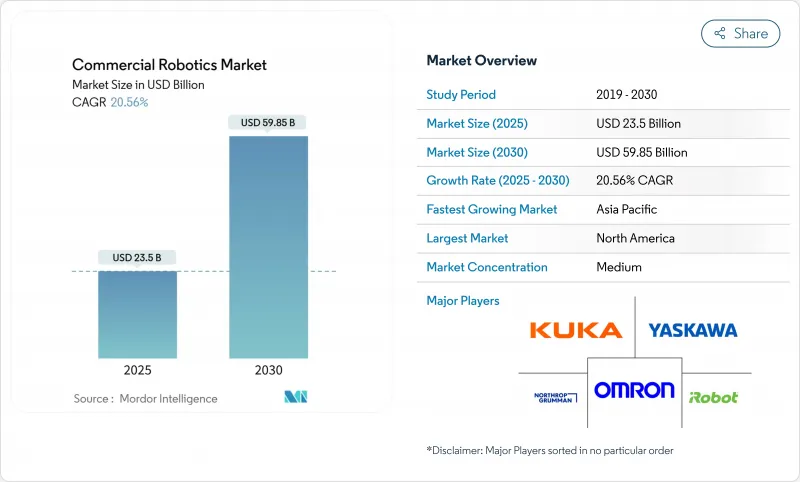

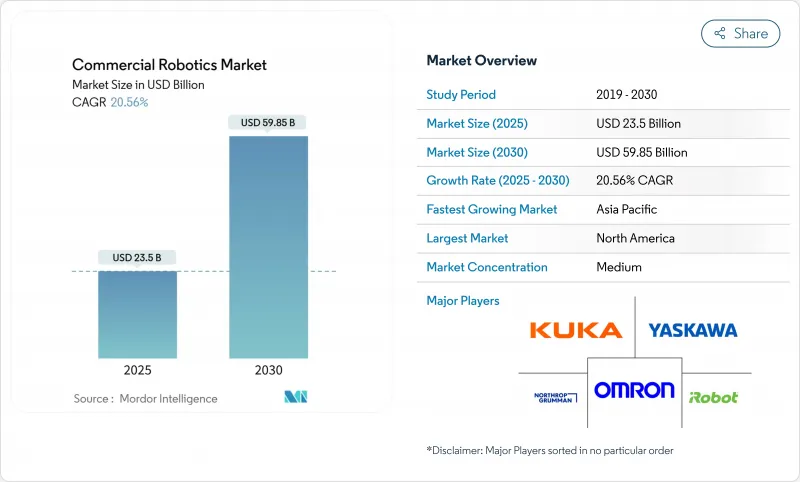

预计到 2025 年,商用机器人市场规模将达到 235 亿美元,到 2030 年将达到 598.5 亿美元,年复合成长率为 20.6%。

随着人工智慧和边缘运算硬体的融合,机器人能够在本地执行感知和操作任务,将延迟降低到个位数毫秒级,市场需求强劲。预计到本十年末,美国将损失850万个工作岗位,製造业和物流业持续面临严重的劳动力短缺,推动自动化预算不断成长。政府采购週期带动了国防和安全平台订单的成长,而大型电商公司正在部署数十万台移动机器人以缩短履约时间。同时,中国1,380亿美元的投资计画也凸显了亚太地区对自主系统日益增长的需求。

全球商用机器人市场趋势与洞察

人工智慧、边缘运算和机器人技术的融合

商用机器人市场受益于设备端人工智慧推理技术,该技术能够弥补云端延迟,实现即时导航选择,并支援生成任务规划。亚马逊经营超过75万台仓库机器人,并透过视觉模型和本地处理的结合,实现了25%的效率提升。约翰迪尔的第二代自主控制系统展示了边缘人工智慧如何实现作物行间厘米级的精准导航,并提升非结构化田地中的运作。随着大规模行为模型的成熟,机器人将从基于规则的行为转向自学习程序,从而将资本设备重塑为可升级的数位资产。这种转变提升了软体的价值,并将商用机器人市场推向平台经济,在平台经济模式下,演算法的维修无需机械改造即可提升现有设备的性能。

劳动力短缺和工资通膨上升

随着人口结构变化导致劳动力萎缩,製造商面临生产线人力短缺的困境。据估计,到2030年,美国工厂将有200万工人失业,而从2021年开始,将有550亿美元的资金投入自动化领域。机器人技术可以减少重复性和危险性的工作,在提高员工留任率的同时,维持生产效率。随着工业机器人硬体价格降至每台10,856美元,中型工厂的投资回收期平均只需一到三年。订阅式融资模式进一步降低了进入门槛。因此,商用机器人市场与企业对人才和生产力的需求相契合,将机器人定位为劳动力增强工具,而非取代威胁。

机器人系统的初始成本高

包括整合和培训在内,实施预算仍超过10万美元,减缓了中小企业采用此技术的速度。机器人即服务(Robot-as-a-Service)合约透过将设备、软体和维护打包成月费,有助于降低资本成本。 Tennant与Brain Corp签订的价值3200万美元的合同,为已投入运作的6500台自主清洁设备提供支持,证明了设施维护领域订阅模式的可行性。模组化设计和标准化介面旨在缩短工程时间,但生态系统工具仍在发展中,尤其是在整合商网路薄弱的新兴国家。

细分市场分析

到2024年,硬体收入将占总收入的66.5%,这清楚地表明了构成每个机器人平台物理核心的致动器、驱动器和感测器等有效载荷的资本密集度。然而,软体收入将实现22.1%的复合年增长率,反映了公司向智慧定义价值的转型。 ABB超过80%的产品组合都整合了人工智慧功能,可实现即时路径规划、动态力控制和基于数位双胞胎的模拟。服务部门目前尚未贡献收入,但随着装置量的成熟,其收入也在成长。

软体利润代表策略转型。随着硬体组件的同质化,演算法堆迭决定了差异化。亚马逊配备触觉感测器的 Vulcan 机器人能够搬运先前由人工拣货员完成的 75% 的库存单位,而如果没有先进的抓取软体,这是不可能实现的。因此,预计在未来十年后半期,软体商用机器人市场规模将超过机械製造成本,从而重塑供应商的权力平衡,并推动订阅模式的获利。

2024年,无人机业务收入占比达38.1%,主要得益于FAA Part 108法规允许的巡检、测绘和最后一公里配送服务。医疗平台成长最快,复合年增长率达21.3%,主要得益于医院为满足微创手术需求而增购达文西手术系统。直觉外科公司(Intuitive Surgical)2025年第一季营收达22.5亿美元,主要得益于其係统用户基数成长15%。

这一类别转变凸显了医疗保健领域对精准化的需求以及老年护理的人口结构变化。同时,田间机器人正在农业和建筑业中迅速普及,而自动导引运输车则在结构化的工业路线中占据主导地位。产品组合的多样性表明,商用机器人市场将更依赖多模态平台的成长,而非任何单一类别的主导地位。

区域分析

到2024年,北美仍将占全球销售额的36.5%,主要得益于国防费用和大规模自动驾驶车辆在电子商务领域的应用。资助的研究项目和创业投资丛集将加速商业化进程,从而实现从试点到全面工厂规模部署的快速过渡。硅谷的技术出口将进一步支持加拿大和墨西哥的平台标准化。

亚太地区将呈现最强劲的成长势头,到2030年复合年增长率将达到21.6%。中国已承诺向工业机器人供应链注入约1,380亿美元,使其国内供应商的份额在2020年至2023年间从30%提升至47%。日本和韩国已总合拨款超过10亿美元用于人形机器人和製造机器人,并促成了官民合作关係的商业化。在东南亚,快速的都市化和不断上涨的工资水准将进一步推动当地製造商采用工业机器人,以提高生产效率。

欧洲是一个成熟且对创新友善的市场,它将成熟的汽车自动化技术与严格的安全标准结合。该地区的「适航55」排放计画鼓励采用能够优化能源和废弃物排放的服务机器人。中东/非洲和南美洲仍处于起步阶段,受限于整合商的缺乏和资金筹措不足。然而,港口自动化计划和矿业机器人正逐步吸引试点订单,预示着长期需求的成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 人工智慧、边缘运算和机器人技术的融合

- 劳动力短缺和工资通膨上升

- 电子商务的兴起推动了仓储机器人的发展

- 政府和国防部门增加对无人系统的投入

- 超老化经济体中的老年护理服务:引入机器人

- 加速关键基础设施检测机器人相关法规的製定

- 市场限制

- 机器人系统的初始成本高

- 联网机器人的网路安全漏洞

- 稀土永磁材料供应链风险

- 熟练的整合商和维护技术人员短缺

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体

- 服务

- 按机器人类型

- 无人机/无人飞行器

- 野外机器人

- 医疗机器人

- 自主机器人

- 其他类型

- 透过使用

- 医疗保健

- 国防与安全

- 农业和林业

- 海洋与近海

- 仓储和物流

- 其他用途

- 透过移动性

- 固定机器人

- 移动地面机器人

- 空中机器人

- 海洋/水下机器人

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd.

- FANUC Corp.

- KUKA AG

- Yaskawa Electric Corp.

- Mitsubishi Electric Corp.

- Northrop Grumman Corp.

- Omron Adept Technologies Inc.

- iRobot Corp.

- Honda Motor Co. Ltd.

- Alphabet Inc.(Intrinsic X)

- Boston Dynamics Inc.

- DJI Technology Co. Ltd.

- Teradyne Inc.(Universal Robots and Mobile Industrial Robots)

- Amazon Robotics(Amazon.com Inc.)

- Intuitive Surgical Inc.

- AgEagle Aerial Systems Inc.

- SANY Heavy Industry Co. Ltd.

- Insitu Inc.(Boeing)

- Baidu Apollo Robotics

- Kraken Robotics Inc.

第七章 市场机会与未来展望

The commercial robotics market size is valued at USD 23.50 billion in 2025 and is projected to register USD 59.85 billion by 2030, advancing at a 20.6% CAGR.

Robust demand stems from the fusion of artificial intelligence with edge-computing hardware that allows robots to execute perception and manipulation tasks locally, trimming latency to single-digit milliseconds. Acute labor shortages continue to tighten across manufacturing and logistics, pushing automation budgets higher as companies look to fill a projected 8.5 million U.S. job gap by decade-end. Government procurement cycles further stimulate orders for defense and security platforms, while large e-commerce players deploy hundreds of thousands of mobile robots to compress fulfillment times. Concurrently, China's state-backed USD 138 billion capital plan underscores Asia-Pacific's accelerating demand for autonomous systems.

Global Commercial Robotics Market Trends and Insights

Technological Convergence of AI, Edge Computing and Robotics

The commercial robotics market benefits from on-device AI inference that offsets cloud latency, enables split-second navigation choices, and supports generative task planning. Amazon operates more than 750,000 warehouse robots that deliver 25% efficiency gains by pairing vision models with local processing. John Deere's second-generation autonomy stack illustrates how edge AI permits centimeter-level steering in crop rows, enhancing uptime in unstructured fields. As large movement models mature, robots switch from rules-based motion to self-learning routines, reframing capital equipment into upgradeable digital assets. This shift elevates software value and propels the commercial robotics market toward platform economics where algorithm improvements lift installed-base capability without mechanical retrofits.

Rising Labor Shortages and Wage Inflation

Manufacturers struggle to staff production lines as demographic shifts shrink labor pools. Vacancies could remove 2 million workers from U.S. factories by 2030, leading to an estimated USD 55 billion redirection of capital toward automation since 2021. Robotics mitigates repetitive and hazardous tasks, improving retention while sustaining throughput. As hardware prices have fallen to USD 10,856 per industrial robot, payback periods for mid-sized plants now average 1-3 years. Subscription financing models further lower entry barriers. Consequently, the commercial robotics market is positioned as a labor-augmentation tool rather than a displacement threat, aligning with corporate mandates to secure talent and productivity simultaneously.

High Up-front Cost of Robotic Systems

Total deployment budgets still top USD 100,000 once integration and training are included, delaying adoption for smaller firms. Robot-as-a-Service contracts help flatten capital curves by bundling equipment, software, and maintenance into monthly fees. Tennant's USD 32 million agreement with Brain Corp underpins 6,500 autonomous cleaning units already in service, proving subscription models in facility care. Modular designs and standardized interfaces aim to trim engineering hours, but ecosystem tooling remains nascent, especially in emerging economies where integrator networks are thin.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of E-commerce Boosting Warehouse Robotics

- Increased Government and Defense Spend on Unmanned Systems

- Cyber-security Vulnerabilities in Connected Robots

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware generated 66.5% of 2024 revenue, underscoring the capital intensity of actuators, drives, and sensor payloads that form each robotic platform's physical backbone. Yet software posted a 22.1% CAGR, reflecting enterprise migration toward intelligence-defined value. Over 80% of ABB's portfolio now bundles AI features that enable real-time path planning, dynamic force control, and digital twin-based simulation. Services contributed residual revenue but are widening as installed bases mature.

Software gains illustrate a strategic pivot. As hardware components commoditize, algorithm stacks dictate differentiation. Amazon's tactile-sensor-equipped Vulcan robot moves 75% of stock-keeping units once reserved for human pickers, a feat impossible without advanced gripping software. Consequently, the commercial robotics market size for software is projected to outpace mechanical build spend by late decade, reshaping supplier power balances and enabling subscription monetization.

Drones accounted for 38.1% of 2024 turnover, buoyed by inspection, mapping, and last-mile delivery services authorized under FAA Part 108 rules that permit beyond-visual-line-of-sight flights. Medical platforms posted the swiftest rise at 21.3% CAGR, with hospitals installing additional da Vinci systems to satisfy minimally invasive procedure demand. Intuitive Surgical recorded USD 2.25 billion Q1 2025 revenue on a 15% system-base expansion.

The category shift underscores healthcare's appetite for precision and demographic-driven eldercare requirements. Meanwhile, field robots demonstrate traction in agriculture and construction, while autonomous guided vehicles dominate structured industrial pathways. Portfolio diversity signals that the commercial robotics market will rely on multi-modal platform growth rather than single-category dominance.

The Commercial Robotics Market Report is Segmented by Component (Hardware, Software, and Services), Type of Robot (Drones/UAVs, Field Robots, Medical Robots, and More), Application (Medical and Healthcare, Defense and Security, Agriculture and Forestry, Marine and Offshore, and More), Mobility (Stationary Robots, Mobile Ground Robots, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.5% revenue leadership in 2024, driven by defense outlays and hyperscale e-commerce deployments that utilize extensive autonomous fleets. Funded research programs and venture capital clusters accelerate commercialization cycles, allowing quick transition from pilot pilots to full plant-scale installations. Technology exports from Silicon Valley further support platform standardization in Canada and Mexico.

Asia-Pacific posts the steepest trajectory at 21.6% CAGR through 2030. China's pledge to inject nearly USD 138 billion backs industrial robot supply chains, raising indigenous supplier share from 30% to 47% between 2020 and 2023. National plans in Japan and South Korea collectively allocate more than USD 1 billion for humanoid and manufacturing-grade robots, channeling public-private partnerships into commercialization. Rapid urbanization and wage escalations across Southeast Asia further cultivate adoption among local manufacturers seeking productivity gains.

Europe remains a mature but innovation-active market, combining established automotive automation with stringent safety standards. The region's fit-for-55 emissions plan favors service robots that optimize energy and waste footprints. Middle East and Africa and South America remain nascent, constrained by integrator scarcity and limited financing. Nonetheless, port automation projects and mining robots are slowly catalyzing pilot orders that foreshadow longer-term demand.

- ABB Ltd.

- FANUC Corp.

- KUKA AG

- Yaskawa Electric Corp.

- Mitsubishi Electric Corp.

- Northrop Grumman Corp.

- Omron Adept Technologies Inc.

- iRobot Corp.

- Honda Motor Co. Ltd.

- Alphabet Inc. (Intrinsic X)

- Boston Dynamics Inc.

- DJI Technology Co. Ltd.

- Teradyne Inc. (Universal Robots and Mobile Industrial Robots)

- Amazon Robotics (Amazon.com Inc.)

- Intuitive Surgical Inc.

- AgEagle Aerial Systems Inc.

- SANY Heavy Industry Co. Ltd.

- Insitu Inc. (Boeing)

- Baidu Apollo Robotics

- Kraken Robotics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological convergence of AI, edge computing and robotics

- 4.2.2 Rising labor shortages and wage inflation

- 4.2.3 Expansion of e-commerce boosting warehouse robotics

- 4.2.4 Increased government and defense spend on unmanned systems

- 4.2.5 Eldercare service-robot adoption in super-aging economies

- 4.2.6 Regulatory fast-tracking of inspection robots for critical infrastructure

- 4.3 Market Restraints

- 4.3.1 High up-front cost of robotic systems

- 4.3.2 Cyber-security vulnerabilities in connected robots

- 4.3.3 Supply-chain risk for rare-earth permanent-magnet materials

- 4.3.4 Shortage of skilled integrators and maintenance technicians

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type of Robot

- 5.2.1 Drones / UAVs

- 5.2.2 Field Robots

- 5.2.3 Medical Robots

- 5.2.4 Autonomous Guided Robots

- 5.2.5 Other Types

- 5.3 By Application

- 5.3.1 Medical and Healthcare

- 5.3.2 Defense and Security

- 5.3.3 Agriculture and Forestry

- 5.3.4 Marine and Offshore

- 5.3.5 Warehousing and Logistics

- 5.3.6 Other Applications

- 5.4 By Mobility

- 5.4.1 Stationary Robots

- 5.4.2 Mobile Ground Robots

- 5.4.3 Aerial Robots

- 5.4.4 Marine / Underwater Robots

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 FANUC Corp.

- 6.4.3 KUKA AG

- 6.4.4 Yaskawa Electric Corp.

- 6.4.5 Mitsubishi Electric Corp.

- 6.4.6 Northrop Grumman Corp.

- 6.4.7 Omron Adept Technologies Inc.

- 6.4.8 iRobot Corp.

- 6.4.9 Honda Motor Co. Ltd.

- 6.4.10 Alphabet Inc. (Intrinsic X)

- 6.4.11 Boston Dynamics Inc.

- 6.4.12 DJI Technology Co. Ltd.

- 6.4.13 Teradyne Inc. (Universal Robots and Mobile Industrial Robots)

- 6.4.14 Amazon Robotics (Amazon.com Inc.)

- 6.4.15 Intuitive Surgical Inc.

- 6.4.16 AgEagle Aerial Systems Inc.

- 6.4.17 SANY Heavy Industry Co. Ltd.

- 6.4.18 Insitu Inc. (Boeing)

- 6.4.19 Baidu Apollo Robotics

- 6.4.20 Kraken Robotics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment