|

市场调查报告书

商品编码

1851575

电脑数值控制(CNC):市场占有率分析、产业趋势、统计数据、成长预测 (2025-2030)Computer Numerical Controls (CNC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

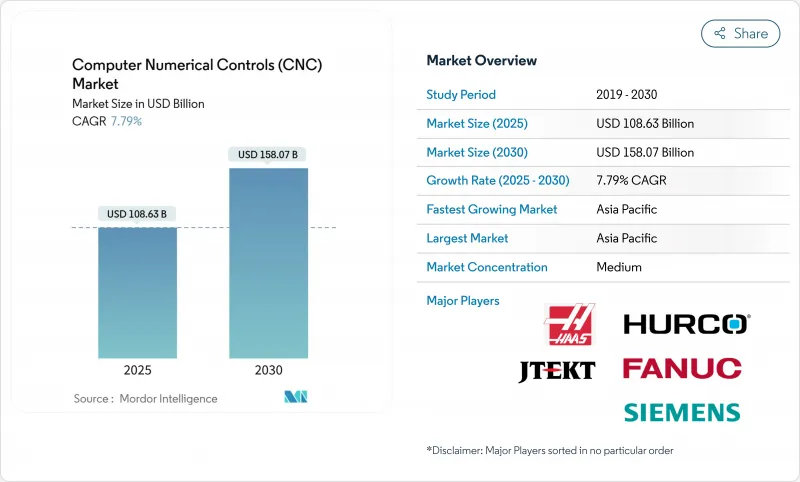

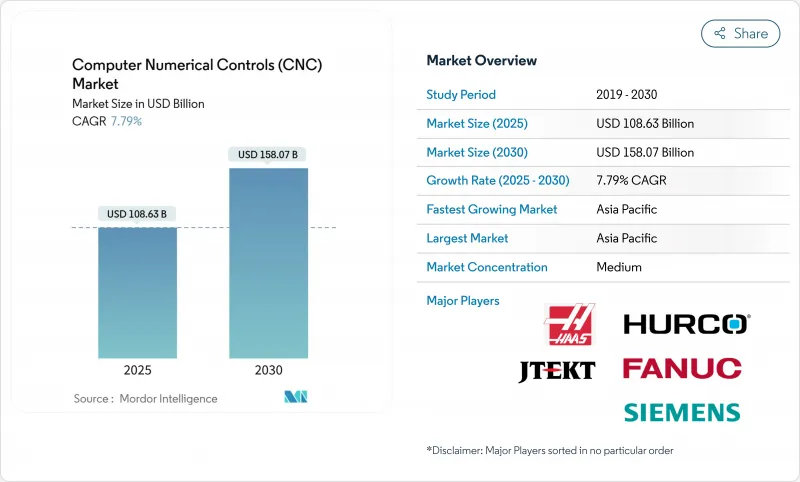

全球CNC工具机市场预计到 2025 年将达到 1,086.3 亿美元,到 2030 年将达到 1,580.7 亿美元,复合年增长率为 7.79%。

持续紧张的劳动力市场、生产近岸外包以及工业4.0自动化推进等因素,正促使製造商加速投资多轴和数位化连网设备。美国和欧洲的帐单调整正将资金从低成本地区转移到支援小批量生产的灵活加工设备。网路安全风险与互联互通同步上升,促使供应商将安全设计功能整合到新型控制器中。与此同时,钢铁和铝价持续飙升,推动了对能够最大限度减少废料的精密加工的需求。这些因素共同支撑着CNC工具机市场的强劲成长势头,但零件短缺造成的供应摩擦构成了一项迫在眉睫的挑战。

全球电脑数值控制(CNC) 市场趋势与洞察

北美和欧洲因製造业回流主导

2023年,美国从中国进口的成品将下降13%,而得益于优惠的基础设施和半导体政策,国内工厂投资将大幅成长。进口的加工零件价格波动较大,因此买家更倾向于选择能够处理各种零件的适应性强的五轴工具机和模组化机器人单元。靠近市场的生产模式降低了运输风险,并提高了交货速度,从而为更高的交货支出提供了合理性。能够提供快速换模和数位化设定能力的供应商将获得竞争优势。这种生产回流趋势将数十年的外包模式转化为本地产能的提升,直接扩大了CNC工具机市场。

工业4.0推动了数位双胞胎相容型CNC控制器的应用。

数位双胞胎使程式设计人员能够虚拟检验刀具路径,从而在西门子Sinumerik 828D硬体上将实体设定时间缩短20%。研究表明,与虚拟对应物进行闭合迴路协作的机器可以将生产率提高14.53%,并将能耗降低13.9%。航太和汽车产业的应用最为迅速,因为这两个产业需要即时补偿热漂移和刀具磨损。控制器供应商正在整合云端连接和人工智慧分析技术,将数控工具机市场转变为以软体为中心的产业。随着授权收入的成长,机器製造商正将重心从一次性硬体利润转向经常性收入。

半导体运动控制晶片短缺限制了供应。

精密伺服驱动器依赖专用ASIC晶片,而这些晶片供不应求,高阶机型的前置作业时间甚至超过九个月。一些製造商正在尝试利用现有晶片进行重新设计,但这需要成本高昂的重新认证。抢占配额的OEM厂商正在扩大市场份额,而后来者则错失了订单。儘管订单量强劲,但瓶颈问题仍阻碍CNC工具机市场的短期发展。

细分市场分析

到2024年,CNC车床将占据CNC工具机市场23.4%的份额,仍是加工轴和轮毂等圆形零件的关键设备。随着电动车动力传动系统总成的发展不断提高公差要求,许多加工厂正在对传统车削中心进行改造,使其配备动力刀具和Y轴功能。铣床能够加工航太和医疗植入所需的复杂模腔,是CNC工具机市场中第二大细分市场。随着电池机壳钣金设计需求的增加,雷射电浆切割机的市场份额将有所增长,而电火花加工机床则适用于加工高硬度工具钢。由于单次装夹功能可缩短夹具製作时间并消除重复进给误差,预计五轴平台数控工具机的市场规模将以10.8%的复合年增长率成长。研磨和焊接机床将进一步拓展其市场定位。摩擦搅拌焊接无需填充金属即可连接电池外壳,而研磨机床则可以对涡轮盘进行镜面抛光。

5轴及以上工具机类别表明,价值正从主轴功率转向灵活性。整合式刀库使数百把刀具能够在一次加工循环中处理铝、钛和复合材料。探测程序可即时检验几何形状,从而在材料成本更高的情况下减少废品。早期采用者报告称,一旦操作员掌握了轴联动指令,生产效率即可提高18%。因此,零件供应商将多轴工具机视为应对劳动力风险的策略性对冲手段,推动数控工具机市场朝向更复杂的层面发展,而这与车间规模无关。

三轴机床仍以 46% 的市占率占据市场主导地位,其在简单加工方面具有极具吸引力的性价比。然而,包含底切和螺旋槽等零件加工需求促使加工车间增加旋转工作台或投资购买全功能五轴工具机。随着工具机融合铣削和车削功能,无需重新装夹即可进行任意方向的加工,五轴及以上工具机市场预计将以 10.8% 的复合年增长率增长。改进的 CAM 软体和培训补贴使得这项技术更容易被中端市场买家所接受,从而扩大了高轴数数控工具机的市场规模。

四轴系统中的旋转倾斜工作台填补了这一空白,使定位加工成为一种经济实惠的入门选择。然而,航太领域对同步运动能力的需求日益增长,而这只有真正的五轴系统才能提供。 FANUC 的FANUC-A 控制器拥有 2.7 倍的 CPU 处理能力,并针对复杂的刀具路径优化了轴插补。随着 OEM 厂商检验更短的加工週期和更高的表面光洁度,即使是较保守的加工车间也在重新思考其设备升级蓝图。这种动态变化确保了CNC工具机市场的稳定转型,使其超越了传统模式。

区域分析

亚太地区以52%的市占率领先CNC工具机市场,这得益于中国庞大的供应商生态系统和日本领先的多轴技术。北京的「双循环」政策鼓励本土化生产,刺激了对国产主轴和回馈编码器的需求。东京投资镁合金加工技术,用于航太发射,进一步巩固了其在轻量化材料领域的领先地位。韩国国家资助的驱动系统研发计画降低了对进口伺服的依赖,凸显了该地区追求自主自给自足的策略。东南亚国协受益于供应链多元化,吸引了待开发区工厂,这些工厂需要入门级但可升级的设备。

北美地区正凭藉《基础设施投资与就业法案》和《晶片製造与生产法案》(CHIPS Act)推动的回流计划激增,发展势头强劲。西门子已累计超过100亿美元用于扩建美国的电气化硬体生产线,新增900个技术岗位。FANUC在密西根州投资1.1亿美元的园区每年培训数千名工程师,缓解了劳动力短缺问题。加拿大魁北克的航太丛集正在采用高速钛合金刀具,而墨西哥的汽车产业中心则在投资柔性加工技术,以满足即将到来的电动车组装需求。因此,CNC工具机市场正受惠于政策与私人投资的协同作用。

在永续性指令和电动出行推动下,欧洲经济呈现稳定成长态势。法国航太补贴加速了混合积层製造设备的试验,提升了本土原始设备製造商(OEM)的竞争力。一家德国中型企业正在对一台老旧铣床维修,加装闭合迴路驱动系统,以降低能耗,符合欧盟绿色交易的目标。发那科( FANUC)在伊比利亚半岛的办公室扩张表明,西班牙和葡萄牙对机器人加工单元的需求正在增长。东欧国家正在承接西方工厂的产能溢出,推动了中型三轴加工中心的订单成长。儘管面临宏观经济逆风,欧洲仍是塑造未来CNC工具机市场规格的技术试验场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美和欧洲因製造业回流主导

- 工业4.0推动了数位双胞胎相容型CNC控制器的普及应用。

- 电动车动力传动系统日益复杂,推动亚洲多轴CNC工具机订单订单。

- 政府对航太精密加工的补助(日本、法国)

- 数控自动化单元有助于解决全球技术工人短缺问题。

- 来自高成长医疗设备领域的微型CNC工具机需求

- 市场限制

- 半导体运动控制晶片短缺限制了供应。

- 五轴加工中心和混合积层製造设备需要高资本投资。

- 网路化数控系统中的网路安全问题

- 钢铁和铝价波动会影响中小企业的投资报酬率。

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资趋势与资本投资分析

第五章 市场规模与成长预测

- 按模型

- CNC车床

- CNC铣床

- 数控雷射切割机

- 数控等电浆切割机

- CNC电火花加工工具机

- CNC研磨

- CNC绕线机

- 数控焊接机

- 其他机器类型

- 按轴类型

- 三轴

- 第四轴

- 5个或更多轴

- 按组件

- CNC控制器

- 伺服马达驱动

- 感测器和回馈

- 其他的

- 透过控制系统

- 开放回路

- 封闭式

- 透过部署

- 独立式CNC工具机

- 整合製造单元(CNC+机器人)

- 最终用户

- 汽车(包括电动车)

- 航太/国防

- 电力和能源

- 工业机械

- 医疗设备

- 电子和半导体

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 中东和非洲

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Fanuc Corporation

- Siemens AG

- DMG Mori Seiki Co., Ltd.

- Haas Automation, Inc.

- Mitsubishi Electric Corporation

- Okuma Corporation

- Yamazaki Mazak Corporation

- Hurco Companies, Inc.

- JTEKT Corporation

- Dr. Johannes Heidenhain GmbH

- Trumpf Group

- Bosch Rexroth AG

- GSK CNC Equipment Co., Ltd.

- Dalian Machine Tool Group

- Makino Milling Machine Co., Ltd.

- Hyundai Wia Corporation

- Fagor Automation

- Brother Industries, Ltd.

- Amera-Seiki, Inc.

- Fair Friend Group(FFG)

- Doosan Machine Tools Co., Ltd.

- Hardinge Inc.

- TAKISAWA Machine Tool Co., Ltd.

- Protomatic Inc.

- Metal Craft AMS

- Micromedical LLC

第七章 市场机会与未来展望

The global CNC machine market stands at USD 108.63 billion in 2025 and is forecast to reach USD 158.07 billion by 2030, reflecting a 7.79% CAGR.

Persistently tight labor markets, near-shoring of production, and the push for Industry 4.0 automation are converging, so manufacturers are accelerating investments in multi-axis and digitally connected equipment. Reshoring legislation in the United States and Europe is shifting capital away from low-cost regions toward flexible machining assets that support short lead-time production. Cybersecurity risk is rising in parallel with connectivity, motivating vendors to embed security-by-design features in new controllers. At the same time, sustained high steel and aluminum prices are driving demand for precision processes that minimize scrap. Together these forces keep the CNC machine market on a solid growth trajectory even as component shortages create near-term supply friction.

Global Computer Numerical Controls (CNC) Market Trends and Insights

Reshoring-led Demand for Flexible CNC Equipment in North America and Europe

U.S. imports of finished goods from China fell 13% in 2023 while domestic factory investment rose sharply after infrastructure and semiconductor incentives. Incoming work is highly variable, so buyers prefer adaptable 5-axis machines and modular robot cells that handle diverse part families. Near-market production justifies higher capital outlays because freight risks fall and delivery speed improves. Vendors that offer rapid re-tooling and digital setup features gain a competitive edge. This reshoring vector directly enlarges the CNC machine market by converting decades of outsourced volumes into local capacity growth.

Industry 4.0-Driven Adoption of Digital-Twin-Enabled CNC Controllers

Digital twins let programmers validate tool paths virtually, cutting physical setup time by 20% with Siemens Sinumerik 828D hardware. Studies show 14.53% productivity gains and 13.9% lower energy use when machines run in closed-loop coordination with their virtual counterparts. Adoption is strongest in aerospace and automotive sectors that need real-time compensation for thermal drift and tool wear. Controller suppliers embed cloud connectivity and AI analytics, turning the CNC machine market into a software-centric arena. As license revenues grow, machine builders look to recurring income rather than one-time hardware margin.

Semiconductor Motion-Control Chip Shortages Constraining Supply

Precision servo drives rely on specialty ASICs that remain in short supply, stretching lead times for premium machines beyond nine months. Some builders redesign around available chips, but that demands costly re-qualification. OEMs with secured allocations win share while latecomers lose backlog. The bottleneck suppresses the near-term CNC machine market volume despite solid order books.

Other drivers and restraints analyzed in the detailed report include:

- EV Power-train Complexity Boosting Multi-Axis CNC Orders in Asia

- Government Incentives for Aerospace Precision Machining (Japan, France)

- High CAPEX of 5-Axis and Hybrid Additive-Subtractive Machines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CNC lathes held 23.4% of CNC machine market share in 2024 and remain indispensable for round parts such as shafts and hubs. Continuing EV power-train development raises tolerance demands, so many shops retrofit live tooling and Y-axis capability to conventional turning centers. Milling machines form the next largest slice of the CNC machine market, serving complex mold cavities for aerospace and medical implants. Laser and plasma cutters grow as sheet-metal designs multiply in battery enclosures, and EDM stays relevant for hardened tool steels. The CNC machine market size for 5-axis platforms is poised to grow 10.8% CAGR because single-setup capability slashes fixture time and eliminates reposting errors. Grinding and welding machines add niche depth: friction-stir welding joins battery shells without filler metal, while grinding delivers mirror finishes on turbine discs.

The 5-axis and above category illustrates why value is shifting toward flexibility rather than raw spindle horsepower. Integrated tool changers allow several hundred cutters that handle aluminum, titanium, and composites in one cycle. Probing routines verify geometry in situ, reducing scrap despite high material costs. Early adopters report 18% throughput gains once operators master simultaneous axis commands. Component suppliers therefore treat multi-axis as a strategic hedge against labor risk, pushing the CNC machine market toward higher complexity tiers regardless of plant size.

Three-axis units still anchor the installed base with a 46% share and attractive price-performance ratios for simple work. Yet part programs with undercuts and helical flutes drive shops to add rotary tables or invest in full five-axis machines. The 5-axis and above segment posts a 10.8% CAGR because it merges milling and turning, enabling machining from all directions without reclamping. Improved CAM software plus training subsidies make the technology accessible to mid-market buyers, widening the CNC machine market size for advanced axis counts.

Rotary-tilt tables on 4-axis systems bridge the gap and allow affordable entry into positional machining. However, aerospace primes increasingly require simultaneous motion capability that only true 5-axis delivers. FANUC's 500i-A controller, with 2.7 times CPU power, optimizes axis interpolation for complex tool paths. As OEMs validate shorter cycle times and better surface finishes, even conservative job shops reconsider equipment roadmaps. This dynamic ensures a steady migration that enlarges the CNC machine market beyond conventional formats.

CNC Market Report is Segmented by Machine Type (CNC Lathe Machines, CNC Milling Machines, and More), Axis Type (3-Axis, and More), Component (CNC Controller, Servo Motor Drive, and More), Control System (Open-Loop, Closed-Loop), Deployment (Stand-Alone CNC Machines, Integrated Production Cells), End User (Automotive, Aerospace and Defense, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the CNC machine market with a 52% revenue share, anchored by China's vast supplier ecosystem and Japan's trail-blazing multi-axis technology. Beijing's dual-circulation policy encourages local content, spurring demand for domestic spindle makers and feedback encoders. Tokyo's investment in magnesium alloy machining for space launch widens its leadership in lightweight materials. South Korea's state-funded drive system advances cut reliance on imported servos, underlining a regional strategy toward self-sufficiency. ASEAN countries benefit from supply-chain diversification, attracting greenfield plants that require entry-level yet upgradeable equipment.

North America gains momentum as reshoring projects proliferate under the Infrastructure Investment and Jobs Act and the CHIPS Act. Siemens earmarked over USD 10 billion to expand U.S. production lines for electrification hardware, adding 900 skilled roles. FANUC's USD 110 million campus in Michigan trains thousands of technicians annually, alleviating talent shortages. Canadian aerospace clusters in Quebec adopt high rpm titanium cutters, while Mexican automotive hubs invest in flexible machining to service near-term EV assembly demand. The CNC machine market thus benefits from synchronized policy and private investment.

Europe shows steady growth amid sustainability mandates and push for electric mobility. French aerospace subsidies accelerate hybrid additive-subtractive machine trials, boosting local OEM competitiveness. Germany's Mittelstand firms retrofit legacy mills with closed-loop drives to cut energy use, aligning with EU Green Deal goals. FANUC's Iberia office expansion signals rising demand in Spain and Portugal for robotized machining cells. Eastern European countries capture overflow work from Western plants, driving orders for mid-range 3-axis centers. Despite macro headwinds, Europe remains a technology testbed that shapes future CNC machine market specifications.

- Fanuc Corporation

- Siemens AG

- DMG Mori Seiki Co., Ltd.

- Haas Automation, Inc.

- Mitsubishi Electric Corporation

- Okuma Corporation

- Yamazaki Mazak Corporation

- Hurco Companies, Inc.

- JTEKT Corporation

- Dr. Johannes Heidenhain GmbH

- Trumpf Group

- Bosch Rexroth AG

- GSK CNC Equipment Co., Ltd.

- Dalian Machine Tool Group

- Makino Milling Machine Co., Ltd.

- Hyundai Wia Corporation

- Fagor Automation

- Brother Industries, Ltd.

- Amera-Seiki, Inc.

- Fair Friend Group (FFG)

- Doosan Machine Tools Co., Ltd.

- Hardinge Inc.

- TAKISAWA Machine Tool Co., Ltd.

- Protomatic Inc.

- Metal Craft AMS

- Micromedical LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Reshoring-led Demand for Flexible CNC Equipment in North America and Europe

- 4.2.2 Industry 4.0-Driven Adoption of Digital-Twin-Enabled CNC Controllers

- 4.2.3 EV Power-train Complexity Boosting Multi-Axis CNC Orders in Asia

- 4.2.4 Government Incentives for Aerospace Precision Machining (Japan, France)

- 4.2.5 Automated CNC Cells Addressing Global Skilled-Labor Shortages

- 4.2.6 Micro-CNC Demand from High-Growth Medical Device Segment

- 4.3 Market Restraints

- 4.3.1 Semiconductor Motion-Control Chip Shortages Constraining Supply

- 4.3.2 High CAPEX of 5-Axis and Hybrid Additive-Subtractive Machines

- 4.3.3 Cyber-Security Concerns with Networked CNC Systems

- 4.3.4 Volatile Steel and Aluminum Prices Impacting SME ROI

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Trends and Capital Expenditure Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Machine Type

- 5.1.1 CNC Lathe Machines

- 5.1.2 CNC Milling Machines

- 5.1.3 CNC Laser Cutting Machines

- 5.1.4 CNC Plasma Cutting Machines

- 5.1.5 CNC Electric Discharge Machines (EDM)

- 5.1.6 CNC Grinding Machines

- 5.1.7 CNC Winding Machines

- 5.1.8 CNC Welding Machines

- 5.1.9 Other Machine Types

- 5.2 By Axis Type

- 5.2.1 3-Axis

- 5.2.2 4-Axis

- 5.2.3 5-Axis and Above

- 5.3 By Component

- 5.3.1 CNC Controller

- 5.3.2 Servo Motor Drive

- 5.3.3 Sensors and Feedback

- 5.3.4 Others

- 5.4 By Control System

- 5.4.1 Open-loop

- 5.4.2 Closed-loop

- 5.5 By Deployment

- 5.5.1 Stand-alone CNC Machines

- 5.5.2 Integrated Production Cells (CNC + Robotics)

- 5.6 By End User

- 5.6.1 Automotive (incl. EV)

- 5.6.2 Aerospace and Defense

- 5.6.3 Power and Energy

- 5.6.4 Industrial Machinery

- 5.6.5 Medical Devices

- 5.6.6 Electronics and Semiconductor

- 5.6.7 Other End Users

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.2 Latin America

- 5.7.2.1 Mexico

- 5.7.2.2 Brazil

- 5.7.2.3 Argentina

- 5.7.2.4 Rest of Latin America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Middle East and Africa

- 5.7.5 Asia-Pacific

- 5.7.5.1 China

- 5.7.5.2 Japan

- 5.7.5.3 South Korea

- 5.7.5.4 India

- 5.7.5.5 Australia

- 5.7.5.6 Rest of Asia-Pacific

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global?level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Fanuc Corporation

- 6.4.2 Siemens AG

- 6.4.3 DMG Mori Seiki Co., Ltd.

- 6.4.4 Haas Automation, Inc.

- 6.4.5 Mitsubishi Electric Corporation

- 6.4.6 Okuma Corporation

- 6.4.7 Yamazaki Mazak Corporation

- 6.4.8 Hurco Companies, Inc.

- 6.4.9 JTEKT Corporation

- 6.4.10 Dr. Johannes Heidenhain GmbH

- 6.4.11 Trumpf Group

- 6.4.12 Bosch Rexroth AG

- 6.4.13 GSK CNC Equipment Co., Ltd.

- 6.4.14 Dalian Machine Tool Group

- 6.4.15 Makino Milling Machine Co., Ltd.

- 6.4.16 Hyundai Wia Corporation

- 6.4.17 Fagor Automation

- 6.4.18 Brother Industries, Ltd.

- 6.4.19 Amera-Seiki, Inc.

- 6.4.20 Fair Friend Group (FFG)

- 6.4.21 Doosan Machine Tools Co., Ltd.

- 6.4.22 Hardinge Inc.

- 6.4.23 TAKISAWA Machine Tool Co., Ltd.

- 6.4.24 Protomatic Inc.

- 6.4.25 Metal Craft AMS

- 6.4.26 Micromedical LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment