|

市场调查报告书

商品编码

1851593

植绒黏合剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Flock Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

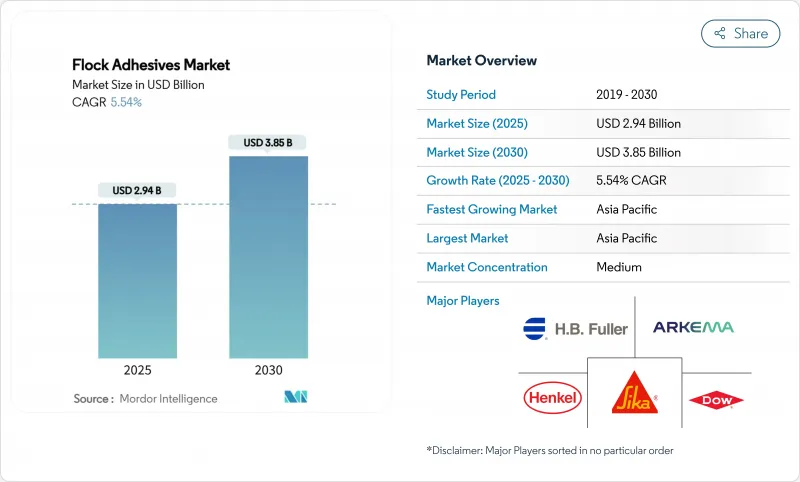

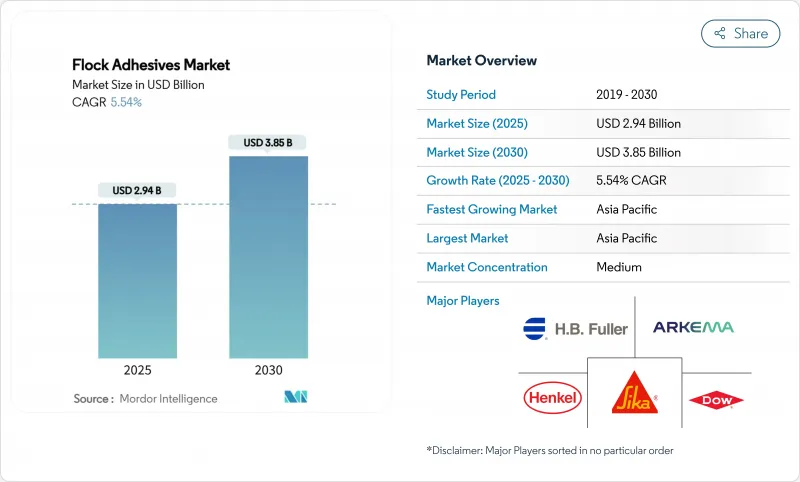

预计到 2025 年,植绒黏合剂市场规模将达到 29.4 亿美元,到 2030 年将达到 38.5 亿美元,在预测期(2025-2030 年)内,复合年增长率将达到 5.54%。

成长将主要受汽车内装需求的推动,而汽车内装需求的增加又得益于电动车 (EV) 产量的成长,同时,注重触感舒适性和隔热性能的高端包装需求也将促进市场成长。监管政策向水性及无挥发性有机化合物 (VOC) 化学品的转变正在推动产品快速改进,尤其是在欧盟限制二异氰酸酯的使用以及中国收紧车内排放法规的情况下。到 2024 年,汽车应用将占据植绒胶黏剂市场 42.56% 的最大份额,并将以 6.42% 的复合年增长率 (CAGR) 实现最快成长。亚太地区将继续保持其地理领先地位,到 2024 年将占据 51.84% 的市场份额,并预计到 2030 年将以 6.19% 的复合年增长率增长。同时,聚氨酯树脂体系占据主导地位,市场份额为 38.19%,而「其他」化学品将以 6.65% 的复合年增长率实现最高增长。

全球植绒胶黏剂市场趋势及洞察

对涂层织物和高檔成品的需求激增

汽车和奢侈品製造商正加大植绒材料的使用力度,以彰显卓越品质。车内零件,例如仪錶板、立柱和收纳托盘,都能透过植绒工艺营造奢华触感,提升握持感并消除异响。奢侈品包装製造商也采用相同的技术,确保珠宝盒和手机壳从第一触感就散发出高端质感。这种触感上的提升有助于提高零售价格,并增强品牌差异化。这些因素共同造就了植绒黏合剂更广泛、更稳定的需求基础。

轻量化、低碳的汽车内装零件推动了其普及应用

汽车製造商正用黏合复合材料面板替代笨重的紧固件,从而为每款车型减重。植绒黏合剂能够牢固地固定薄塑胶和织物层压板,并通过碰撞、振动和耐久性测试。重量减轻直接转化为更长的电动车续航里程,这是消费者和监管机构密切关注的指标。组装也从中受益,因为更少的卡扣和螺丝缩短了生产週期,并简化了回收流程。随着电气化日益普及,轻量化概念正不断推动群体解决方案成为工程领域的有力竞争者。

挥发性异氰酸酯/丙烯酸酯原料价格

黏合剂生产商依赖石油化学衍生物,其成本随油价和供应链波动而波动。近期甲基丙烯酸供应过剩导致价格下跌12%,但几週后树脂生产商大幅涨价。与汽车原始设备製造商签订的长期固定价格合约限制了他们转嫁额外费用的能力。规模较小的配方商尤其面临风险,因为它们缺乏规模或多元化的产品组合来进行对冲。利润率的不确定性抑制了企业在动盪时期进行积极资本投资的意愿。

细分市场分析

聚氨酯在2024年占据植绒胶黏剂市场38.19%的份额,主要得益于其与汽车基材的广泛相容性和高耐热性。然而,异氰酸酯的监管审查正在改变市场需求,其他树脂类型的预期复合年增长率将达到6.65%。随着非异氰酸酯植绒胶黏剂作为丙烯酸树脂和环氧树脂的替代品(其VOC含量更低且更易于操作)日益普及,预计其市场规模将超过传统树脂。汉高的生物基聚氨酯产品,其可再生成分含量高达71%,与标准配方相比,二氧化碳排放量减少了60%,显示永续发展概念可以影响采购决策。

监管机构对二异氰酸酯产品提出了更严格的工人培训和标籤要求,而原始设备製造商 (OEM) 则要求提供符合规定的替代品。为了应对这些要求,混炼商正在扩展其丙烯酸分散体和非异氰酸酯聚氨酯 (NIPU) 的化学配方,以满足黏合性、柔韧性和耐热循环性能方面的需求,同时确保二异氰酸酯含量不超过 0.1% 的阈值。能够平衡合规性、性能和成本的供应商,随着传统产品面临日益严格的限制,很可能会要求更高的利润率。

区域分析

亚太地区预计到2024年将占据全球植绒胶黏剂市场51.84%的份额,并在2030年之前以6.19%的复合年增长率成长。中国是该地区需求的核心,国内品牌和出口型组装纷纷采用植绒内部装潢建材,以提升产品感知品质并满足低VOC排放法规的要求。西卡在辽宁和新加坡新建的工厂体现了其在本地产能方面的投资,旨在缩短前置作业时间并满足新兴的电池散热需求。日本和韩国正在扩大其用于电子和汽车应用的低甲醛环氧基体系,并在材料科学领域保持领先地位,从而提升了产能。

北美市场紧随其后,其消费市场成熟但对技术要求更高。原始设备製造商 (OEM) 正在实施严格的采购标准,以确保永续性和供应链透明度,从而推动水性分散液和生物基材料的快速普及。公共基础设施和军事采购管道为铁路内饰和航太舱室配件等小众植绒应用领域提供了支持,即使汽车产量低迷,也能维持基准需求。

欧洲兼具严格的监管和创新领先地位。欧洲的循环经济行动计画规定,到2027年,所有设备必须配备可拆卸电池,这为新型可剥离黏合剂创造了市场空间,这类黏合剂的绒毛在报废后必须能够彻底分离。例如,Power Adhesives公司最近推出了一种经认证的可生物降解热熔胶系统,其生物基含量高达44%。南美洲和中东/非洲地区的市场规模总体上不大,但随着供应链多元化,其重要性日益凸显。巴西正在扩大其汽车组装能,而这依赖于在地采购的植绒装饰材料;海湾地区的石化产业整合也提供了具有竞争力的树脂原料。儘管非洲市场仍处于起步阶段,但其毗邻高成长城市的消费性电子包装製造商正积极投资非洲市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对涂层织物和高檔成品的需求激增

- 汽车内装零件重量更轻、碳排放量更低,正在推动其应用。

- 监管方向转向水性/无挥发性有机化合物化学品

- 电动车电池组中的温度控管衬里

- 消费性电子产品包装中的高级开箱美学

- 市场限制

- 挥发性异氰酸酯和丙烯酸酯原料价格

- 加强对溶剂排放的监管

- 来自雷射纹理和替代表面处理的竞争

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依树脂类型

- 丙烯酸纤维

- 聚氨酯

- 环氧树脂

- 其他树脂种类(醇酸树脂、氰基丙烯酸酯树脂等)

- 透过使用

- 车

- 纺织品

- 纸张/包装

- 其他用途(印刷、图形等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3M

- Argent International

- Arkema

- Dow

- HB Fuller Company

- Henkel AG and Co. KGaA

- International Coatings

- Kissel+Wolf GmbH

- Nyatex

- Parker Hannifin

- Sika AG

- Stahl Holdings BV

- SwissFlock AG

- Toyochem Co. Ltd.

第七章 市场机会与未来展望

The Flock Adhesives Market size is estimated at USD 2.94 billion in 2025, and is expected to reach USD 3.85 billion by 2030, at a CAGR of 5.54% during the forecast period (2025-2030).

Growth is anchored in automotive interior demand, accelerated by rising electric-vehicle (EV) production, and reinforced by premium packaging requirements that emphasize soft-touch aesthetics and thermal functionality. Regulatory shifts toward water-based and VOC-free chemistries are prompting rapid product reformulation, especially as the European Union restricts diisocyanates and China tightens interior-emission limits. Automotive applications command the largest slice of the flock adhesives market at 42.56% in 2024 and also expand the fastest at 6.42% CAGR, underscoring the segment's dual role as volume base and innovation engine. Asia-Pacific retains geographic leadership with 51.84% share in 2024 and a 6.19% CAGR outlook through 2030, benefiting from concentrated automotive manufacturing footprints and expanding EV battery capacity. Meanwhile, polyurethane resin systems dominate with 38.19% share, yet "other" chemistries display the strongest 6.65% CAGR as formulators pivot toward acrylic, epoxy and non-isocyanate alternatives to stay ahead of incoming regulation.

Global Flock Adhesives Market Trends and Insights

Surging Demand for Coated Fabrics and Luxury Finish Products

Automotive and luxury-goods producers are stepping up use of flocked materials to signal elevated quality. Cabin parts such as dashboards, pillars and storage trays gain a plush feel that improves grip and cuts rattling noise. Premium packaging makers adopt the same technology so that jewelry boxes or smartphone cases feel exclusive from first touch. The tactile upgrade supports higher retail prices and strengthens brand differentiation. Together these factors translate into a wider, more stable demand base for flock adhesives.

Lightweight, Low-Carbon Vehicle Interior Parts Push Adoption

Car makers are substituting heavy fasteners with adhesive-bonded composite panels to shave grams from every model. Flock adhesives secure thin plastics and fabric laminates while meeting crash, vibration and durability tests. Mass reductions directly extend EV driving range, a metric closely watched by consumers and regulators. Assembly lines also benefit because fewer clips and screws cut cycle times and simplify recycling. As electrification spreads, the weight-saving argument keeps flock solutions on engineering shortlists.

Volatile Isocyanate and Acrylate Feedstock Prices

Adhesive makers rely on petrochemical derivatives whose costs whipsaw with oil and supply-chain shocks. Recent methacrylic-acid oversupply drove a 12% price drop, only for resin producers to impose sharp increases weeks later. Long fixed-price contracts with automotive OEMs limit the ability to pass surcharges through. Smaller formulators are especially exposed because they lack hedging scale and diversified portfolios. Margin uncertainty discourages bold capacity investments during turbulent periods.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Shift Toward Water-Based / VOC-Free Chemistries

- Flocked Thermal-Management Liners in Electric Vehicles Battery Packs

- Tightening Solvent-Emission Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyurethane captured 38.19% of flock adhesives market share in 2024, buoyed by broad compatibility with automotive substrates and strong thermal resilience. Yet regulatory scrutiny of isocyanates is shifting demand, evidenced by the 6.65% CAGR projected for "other" resin types. The flock adhesives market size for non-isocyanate chemistries is expected to outpace incumbents as acrylic and epoxy alternatives gain traction, driven by inherently lower VOCs and simplified handling. Henkel's bio-based polyurethane containing 71% renewable content demonstrates a 60% CO2 reduction versus standard formulas, signaling how sustainability narratives translate into purchasing criteria.

Regulators require worker training and stricter labelling for diisocyanate products, prompting OEMs to request compliant substitutes. Formulators respond by scaling acrylic dispersions and non-isocyanate polyurethane (NIPU) chemistries that meet adhesion, flexibility and heat-cycling needs without surpassing 0.1% diisocyanate thresholds. Suppliers able to balance compliance, performance and cost will command premium margins as legacy options face phased restriction.

The Flock Adhesives Market Report is Segmented by Resin Type (Acrylic, Polyurethane, Epoxy, Other Resin Types), Application (Automotive, Textiles, Paper and Packaging, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 51.84% flock adhesives market share in 2024 and is set to grow at 6.19% CAGR through 2030. China anchors regional demand as domestic brands and export-oriented assemblers adopt flocked interiors to elevate perceived quality and meet low-VOC mandates. Sika's new Liaoning and Singapore plants illustrate local capacity investments aimed at shortening lead times and tailoring chemistries for emerging battery-thermal needs. Japan and South Korea complement volume with materials science leadership, scaling epoxy-based and low-formal-emission systems for electronics as well as autos.

North America follows with mature but technologically demanding consumption. OEMs enforce strict sourcing criteria on sustainability and supply-chain transparency, incentivizing rapid adoption of water dispersions and bio-based content. Public infrastructure and military procurement channels support niche flocked applications in rail interiors and aerospace cabin fittings, keeping baseline demand intact despite plateaued vehicle output.

Europe blends tight regulation with innovation leadership. The continent's Circular Economy Action Plan requires removable batteries in devices by 2027, spawning new debondable-adhesive niches where flock must cleanly separate at end-of-life. Companies like Power Adhesives recently introduced certified biodegradable hot-melt systems containing 44% bio-based content, a template likely to spread into flock formulations. South America, the Middle East and Africa collectively represent modest volumes but rising importance as supply chains diversify. Brazil expands automotive assembly capacity that relies on locally sourced flocked trims, while petrochemical integration in the Gulf provides competitive resin feedstock. African markets remain early-stage yet draw investment from consumer-electronics packagers seeking proximity to high-growth urban centers.

- 3M

- Argent International

- Arkema

- Dow

- H.B. Fuller Company

- Henkel AG and Co. KGaA

- International Coatings

- Kissel + Wolf GmbH

- Nyatex

- Parker Hannifin

- Sika AG

- Stahl Holdings B.V.

- SwissFlock AG

- Toyochem Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for coated fabrics and luxury finish products

- 4.2.2 Lightweight, low-carbon vehicle interior parts push adoption

- 4.2.3 Regulatory shift toward water-based / VOC-free chemistries

- 4.2.4 Flocked thermal-management liners in electric vehicles battery packs

- 4.2.5 Premium unboxing aesthetics in consumer-electronics packaging

- 4.3 Market Restraints

- 4.3.1 Volatile isocyanate and acrylate feedstock prices

- 4.3.2 Tightening solvent-emission regulations

- 4.3.3 Competition from laser-texturing and alternative finishes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Polyurethane

- 5.1.3 Epoxy

- 5.1.4 Other Resin Types (Alkyd, Cyanoacrylate, etc.)

- 5.2 By Application

- 5.2.1 Automotive

- 5.2.2 Textiles

- 5.2.3 Paper and Packaging

- 5.2.4 Other Applications (Printing and Graphics, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Argent International

- 6.4.3 Arkema

- 6.4.4 Dow

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG and Co. KGaA

- 6.4.7 International Coatings

- 6.4.8 Kissel + Wolf GmbH

- 6.4.9 Nyatex

- 6.4.10 Parker Hannifin

- 6.4.11 Sika AG

- 6.4.12 Stahl Holdings B.V.

- 6.4.13 SwissFlock AG

- 6.4.14 Toyochem Co. Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment