|

市场调查报告书

商品编码

1851597

金属涂层:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Metal Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

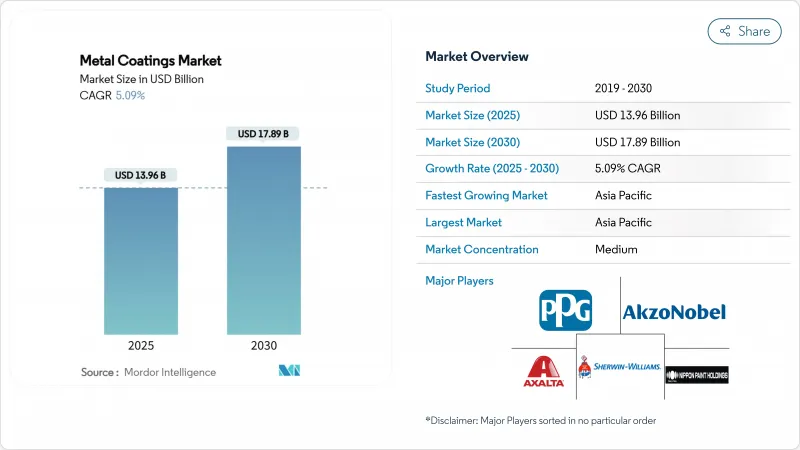

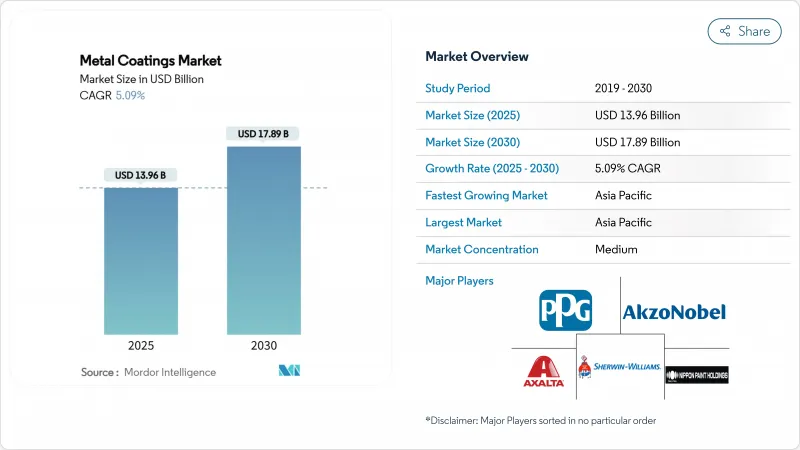

预计到 2025 年,金属涂层市场规模将达到 139.6 亿美元,到 2030 年将达到 178.9 亿美元,预测期(2025-2030 年)复合年增长率为 5.09%。

儘管空气品质法规日益严格、原料价格波动剧烈、客户需求不断变化,但这项发展轨迹凸显了该产业的韧性。北美、欧洲和亚太地区的监管机构正在强制降低挥发性有机化合物 (VOC) 的阈值,这不仅鼓励快速再製造,也为水性固化和能量固化系统创造了机会。随着已开发经济体基础设施的更新、交通运输车队的电气化以及离岸风力发电的普及,市场需求将同步成长。技术供应商正透过混合固化化学、自修復黏合剂和数位化製程控制来满足这些需求,从而有望提高产品性能和永续性。

全球金属涂层市场趋势与洞察

严格的挥发性有机化合物(VOC)法规推动水性技术发展

新的空气品质标准正在加速从溶剂型系统转向水性系统的结构性转变。美国环保署于2025年1月修订了气雾剂涂料的挥发性有机化合物(VOC)排放标准,将合规期限延长至2027年1月,同时维持更严格的限值。加州南海岸空气品质管理区将于2025年5月收紧其针对汽车修补漆的1151号规则限值,业内相关人员预计类似的限值将逐步推广至其他相关领域。加拿大将于2025年1月对130个产品类型实施VOC浓度限值,显示这一趋势正在被广泛接受。这些法规对拥有成熟的水性平台和可扩展生产能力的供应商有利。目前,水性系统在许多室内和轻工业应用中的性能与溶剂型系统相当,但仍需要精细的表面处理和更严格的施工湿度控制。

已开发国家基础建设更新力道加大

在北美和欧洲,桥樑、港口和能源基础设施的大规模维修正在推动对高性能防护涂料的需求。美国离岸风力发电开发平臺在2025年初超过52吉瓦,各州政策的目标是到2030年达到112吉瓦,这将推动25-30年防腐蚀涂层系统的广泛应用。一种干膜厚度为660微米的环氧-聚氨酯三涂层系统可提供超过15年的现场服务,并已成为钢製单桩和过渡段的实际标准规范。基础设施业主越来越倾向于使用预测性维护工具,能够发出劣化讯号的智慧涂层也正在试验中。

原物料价格不稳定

由于绿色能源需求和地缘政治紧张局势导致铝、铜和锌的价格居高不下,金属涂料製造商正面临利润率压缩的困境。世界银行预测,到2025年,基底金属的平均价格将维持在2019-2021年水准之上。二氧化钛是许多配方中成本最高的成分,预计到2025年,中国的二氧化钛产能将增加至700万吨,这将对颜料利润率构成下行压力,并引发买家对品质稳定性的担忧。欧洲高密集型冶炼厂在2024年削减了产量,增加了供应风险,迫使加工商调整库存策略。

细分市场分析

预计到2024年,环氧树脂将占据最大的收入份额,达到39.17%,这主要得益于其在海洋和重工业应用中无与伦比的黏合性和耐化学性。该领域持续受益于技术创新,例如用于改善阻隔性能的奈米级填充材和用于提高紫外线稳定性的量子点光光引发剂。同时,由丙烯酸树脂、氟聚合物和硅氧烷杂化物组成的特殊「其他树脂」是成长最快的类别,复合年增长率达6.85%,因为建筑商、汽车製造商和可再生能源营运商正在寻求客製化功能,例如自清洁、疏冰和散热。源自植物油和藻类生物质的生物基树脂化学物质也正在建筑面漆和家用电器涂料中进行中试应用。这些趋势巩固了环氧树脂的核心地位,同时也为寻求在不牺牲永续性的前提下实现特定性能的终端用户提供了更多选择。

随着聚氨酯树脂在汽车塑胶领域占据主导地位,而聚酯树脂在建筑建筑幕墙保持成本领先优势,树脂市场的竞争格局正在趋于多元化。先进的固化剂供应商正在推广近红外线光活化的硫醇-环氧树脂网络,在厚度超过2.5公分的薄膜中实现了90%以上的转化率,为重型精炼製程打开了大门。同时,聚天门冬胺酸体係正在促进桥樑和停车场等建筑结构的树脂再利用。这些市场发展趋势使得树脂品类能够透过传统的大宗市场和高端细分市场解决方案来获取附加价值,从而支撑整个金属涂料市场实现均衡成长。

金属涂料市场报告按树脂类型(环氧树脂、聚酯树脂、聚氨酯树脂及其他树脂类型)、技术(水性、溶剂型、粉末涂料及其他)、应用领域(建筑、汽车、船舶、防护、一般工业及其他应用)和地区(亚太地区、北美、欧洲、南美、中东和非洲)进行细分。市场预测以美元计价。

区域分析

预计亚太地区将继续保持领先地位,2024年营收成长率将达到46.92%,并在2030年前维持6.36%的复合年增长率。中国决定在2023年将钢铁出口量提高36.2%,这将在国内需求波动的情况下维持转化涂层和线圈涂布的国内消费。印度蓝图在2047年将其钢铁产能提高三倍,达到5亿吨,这将为下游业务带来巨大的商机。印度已将碳排放强度目标设定为每吨粗钢2.25吨二氧化碳,奖励采用高固态和水溶配方。区域二氧化钛产能接近700万吨,不仅促进了中日製造商之间的垂直整合,也加剧了品质竞争。由于逐步淘汰铅和实施挥发性有机化合物(VOC)法规,预计到2030年,印尼的涂料产值将达到42.4亿美元。

北美在基础设施和交通运输领域拥有强劲的需求基础。美国计划在2030年安装112吉瓦的离岸风力发电,这将推动对玻璃鳞片环氧树脂和先进底漆的需求,这些产品能够在喷水环境中保证25年的使用寿命。联邦和州政府对国内电动车生产的激励措施正在推动数十亿美元的资本项目,并带动低温烘烤阴极电解涂料和电池组绝缘涂料的订单。墨西哥作为近岸外包中心的崛起促使阿克苏诺贝尔计划在2024年将其位于新莱昂州的捲材生产线扩建35%,这表明该公司预期汽车产量将持续增长。

欧洲正努力在高昂的能源成本和严格的永续性要求之间寻求平衡。BASF正在对其价值68亿美元的涂料部门进行策略评估,这显示能源波动将如何影响其投资组合决策。同时,汉高2024年21.85亿欧元的销售额凸显了其凭藉高端船舶和防护技术所展现的韧性。北海离岸风力发电是超耐久涂料系统的主要来源,三层环氧聚氨酯涂料已成为业界黄金标准。航太底漆和麵漆正在向无铬替代品过渡,以满足欧洲航空安全局的要求。循环经济政策正在推动生物基树脂和可回收包装的研发,从而巩固欧洲作为未来涂料科学熔炉的地位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 严格的挥发性有机化合物 (VOC) 法规推动水性技术发展

- 已开发国家基础建设更新的增加

- 汽车产量不断扩大

- 用于电动汽车电池外壳的线圈涂布铝材市场快速成长

- 离岸风力发电设施需要高性能的防腐蚀系统

- 市场限制

- 原物料价格不稳定

- 新兴国家遵守溶剂型挥发性有机化合物(VOC)法规的成本

- 严峻的营运环境所带来的挑战

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依树脂类型

- 环氧树脂

- 聚酯纤维

- 聚氨酯

- 其他树脂类型(丙烯酸树脂、氟树脂等)

- 透过技术

- 水溶液

- 溶剂型

- 粉末

- 紫外线 (UV) 固化型

- 发光二极体(LED)固化

- 透过使用

- 建筑学

- 车

- 海洋

- 保护

- 一般工业

- 其他用途(可再生能源等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 泰国

- 马来西亚

- 菲律宾

- 越南

- 新加坡

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 土耳其

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 埃及

- 卡达

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- AkzoNobel NV

- Axalta Coating Systems LLC

- BASF

- Beckers Group

- Chugoku Marine Paints, Ltd.

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- Shalimar Paints Ltd

- Socomore

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

第七章 市场机会与未来展望

The Metal Coatings Market size is estimated at USD 13.96 billion in 2025, and is expected to reach USD 17.89 billion by 2030, at a CAGR of 5.09% during the forecast period (2025-2030).

This trajectory highlights the sector's resilience despite tighter air-quality rules, volatile feedstock prices, and shifting customer requirements. Regulatory bodies in North America, Europe, and Asia-Pacific are enforcing lower volatile-organic-compound (VOC) thresholds, prompting rapid reformulation but also opening opportunities for water-borne and energy-curable systems. Demand expands in tandem with infrastructure renewal in developed economies, electrification of transport fleets, and a surge in offshore wind power installations. Technology suppliers are meeting these needs with hybrid curing chemistries, self-healing binders, and digital process controls that promise both performance and sustainability gains.

Global Metal Coatings Market Trends and Insights

Stringent Volatile Organic Compound (VOC) Regulations Boosting Water-Borne Technologies

New air-quality standards are accelerating a structural shift from solvent-borne to water-borne formulations. The United States Environmental Protection Agency amended National Volatile Organic Compound (VOC) Emission Standards for aerosol coatings in January 2025 and retained stricter limits while extending compliance to January 2027, giving producers a finite window to transition . California's South Coast Air Quality Management District tightened Rule 1151 limits for automotive refinishes in May 2025, and industry observers expect similar caps to cascade into adjacent segments. Canada enforced Volatile Organic Compound (VOC) concentration limits across 130 product categories in January 2025, illustrating the breadth of the trend. These mandates reward suppliers that possess mature water-borne platforms and scalable production assets. Although water-borne systems now rival solvent-borne performance in many indoor and light-industrial uses, they still require meticulous surface preparation and more stringent humidity control during application.

Rising Infrastructure Renewal in Developed Economies

Large-scale refurbishment of bridges, ports, and energy infrastructure sustains demand for high-performance protective coatings across North America and Europe. The United States offshore-wind development pipeline surpassed 52 GW in early 2025, and state policies target 112 GW by 2030, driving uptake of 25-30 year anti-corrosion paint systems. Three-coat epoxy-polyurethane schemes with 660 µm dry-film thickness have delivered 15+ year field service, becoming de-facto specifications for steel monopiles and transition pieces. Infrastructure owners increasingly favor predictive-maintenance tools, and smart coatings able to signal degradation are entering pilot deployment.

Volatile Feedstock Prices

Metal-coating producers face margin compression as aluminum, copper, and zinc prices remain elevated due to green-energy demand and geopolitical tensions. The World Bank projects base-metal average prices to stay above the 2019-2021 levels through 2025 . Titanium dioxide, the largest single cost item in many formulations, saw Chinese capacity climb toward 7 million tons in 2025, exerting downward pressure on pigment margins while introducing quality-consistency concerns for buyers. Energy-intensive smelters in Europe curtailed output during 2024, adding supply risk and forcing converters to adjust inventory policies.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Automotive Production Volume

- Offshore Wind Installations Demanding High-Performance Anti-Corrosion Systems

- Compliance Cost of Solvent-Borne Volatile Organic Compound (VOC) Limits in Emerging Nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy resins generated the largest share of 2024 revenue at 39.17% on the strength of unmatched adhesion and chemical resistance in marine and heavy-industrial service. The segment continues to benefit from innovations such as nanoscale fillers that improve barrier properties, while quantum-dot photoinitiators extend ultraviolet stability. At the same time, specialty "other resins" comprising acrylic, fluoropolymer, and siloxane hybrids are the fastest-growing category at 6.85% CAGR as builders, automakers, and renewable-energy operators demand tailored features such as self-cleaning, ice-phobic, and heat-dissipation attributes. Bio-based resin chemistries derived from plant oils and algal biomass are also gaining pilot-scale adoption in architectural topcoats and appliance finishes. Combined, these trends reinforce epoxy's central role while widening the choice set for end users seeking targeted performance without sacrificing sustainability.

The competitive landscape for resins is diversifying as polyurethane chemistries carve out space in automotive plastics and polyester maintains cost leadership in building facades. Suppliers of advanced curing agents promote thiol-epoxy networks activated by near-infrared light, achieving over 90% conversion in films thicker than 2.5 cm and opening doors for heavy-equipment refinish. In parallel, polyaspartic systems allow accelerated return-to-service for bridges and parking structures. These developments position the resin category to capture incremental value through both traditional bulk volumes and premium niche solutions, underpinning a balanced growth outlook for the overall metal coatings market.

The Metal Coatings Market Report is Segmented Into by Resin Type (Epoxy, Polyester, Polyurethane, Other Resin Types), Technology (Water-Borne, Solvent-Borne, Powder, and More), Application (Architectural, Automotive, Marine, Protective, General Industrial, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained leadership with 46.92% revenue in 2024 and is projected to advance at 6.36% CAGR through 2030. China's decision to raise steel exports by 36.2% during 2023 sustains local consumption of conversion and coil coatings even as domestic demand levels fluctuate. India's roadmap to triple steel-making capacity to 500 million tons by 2047 underpins vast downstream opportunities; the country already targets a reduction of carbon-intensity to 2.25 tons CO2 per ton of crude steel, incentivizing adoption of high-solid and water-borne formulations. Regional titanium-dioxide capacity nears 7 million tons, supporting vertical integration for Chinese and Japanese producers but also sharpening quality competition. Indonesia illustrates the broader arc: its coatings value is set to reach USD 4.24 billion by 2030 as legislation phases out lead and institutes VOC fees.

North America maintains a solid demand base across infrastructure and transportation. The United States aims for 112 GW of installed offshore wind by 2030, driving procurement of glass-flake epoxies and advanced primers that guarantee 25-year lifetimes in splash-zone environments. Federal and state incentives for domestic EV production have unlocked multi-billion-dollar capital programs, translating to orders for low-bake cathodic electrocoats and insulating battery-pack coatings. Mexico's emergence as a near-shoring hub spurred AkzoNobel to expand coil lines in Nuevo Leon by 35% capacity in 2024, signaling expectations of sustained automotive output growth.

Europe balances high energy costs with stringent sustainability mandates. BASF's ongoing strategic review of its USD 6.8 billion coatings division shows how energy volatility influences portfolio decisions. Meanwhile, Hempel's EUR 2,185 million revenues in 2024 underscore the resilience afforded by premium marine and protective technologies. Offshore wind in the North Sea remains a powerhouse for ultra-durable systems, with three-coat epoxy-polyurethane specifications serving as the gold standard. Aerospace primes and topcoats migrate to chrome-free alternatives to satisfy European Aviation Safety Agency requirements. Circular-economy policies drive R&D on bio-derived resins and recyclable packaging, reinforcing Europe's role as a crucible for future coating science.

- AkzoNobel N.V.

- Axalta Coating Systems LLC

- BASF

- Beckers Group

- Chugoku Marine Paints, Ltd.

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- Shalimar Paints Ltd

- Socomore

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Volatile Organic Compound (VOC) Regulations Boosting Water-Borne Technologies

- 4.2.2 Rising Infrastructure Renewal in Developed Economies

- 4.2.3 Expanding Automotive Production Volume

- 4.2.4 Surge in Coil-Coated Aluminium for Electronic Vehicle Battery Enclosures

- 4.2.5 Offshore Wind Installations Demanding High-Performance Anti-Corrosion Systems

- 4.3 Market Restraints

- 4.3.1 Volatile Feedstock Prices

- 4.3.2 Compliance Cost of Solvent-Borne Volatile Organic Compound (VOC) Limits in Emerging Nations

- 4.3.3 Challenges Associated with Harsh Operational Environment

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Polyurethane

- 5.1.4 Other Resin Types (Acrylic, Fluoropolymer, etc.)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder

- 5.2.4 Ultraviolet (UV)-Cured

- 5.2.5 Light Emitting Diode (LED) Curing

- 5.3 By Application

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Marine

- 5.3.4 Protective

- 5.3.5 General Industrial

- 5.3.6 Other Applications (Renewable Energy, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Malaysia

- 5.4.1.7 Philippines

- 5.4.1.8 Vietnam

- 5.4.1.9 Singapore

- 5.4.1.10 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Turkey

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 Nigeria

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AkzoNobel N.V.

- 6.4.2 Axalta Coating Systems LLC

- 6.4.3 BASF

- 6.4.4 Beckers Group

- 6.4.5 Chugoku Marine Paints, Ltd.

- 6.4.6 Hempel A/S

- 6.4.7 Jotun

- 6.4.8 Kansai Paint Co.,Ltd.

- 6.4.9 Nippon Paint Holdings Co. Ltd

- 6.4.10 PPG Industries Inc.

- 6.4.11 Shalimar Paints Ltd

- 6.4.12 Socomore

- 6.4.13 Teknos Group

- 6.4.14 The Sherwin-Williams Company

- 6.4.15 TIGER Coatings GmbH & Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Biodegradable Metal Coatings