|

市场调查报告书

商品编码

1851600

贴合黏剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Laminating Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

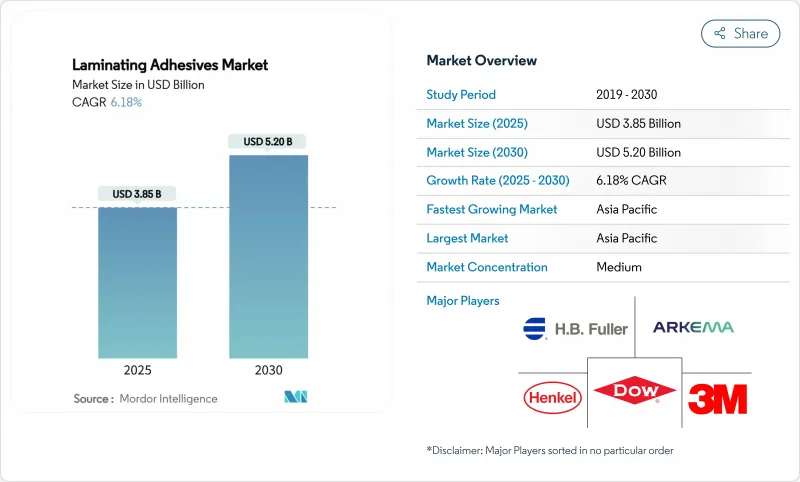

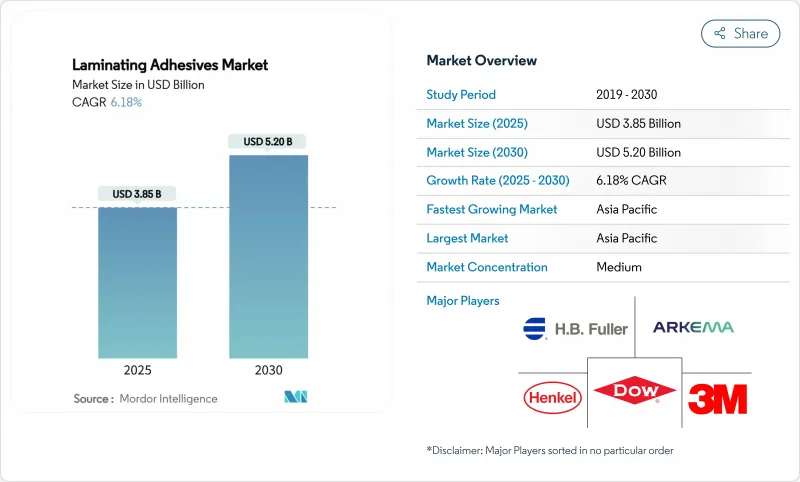

预计到 2025 年,贴合黏剂市场规模将达到 38.5 亿美元,到 2030 年将达到 52 亿美元,在此期间的复合年增长率为 6.18%。

更严格的化学品法规,加上食品、药品和电商小包裹对软包装的持续需求,正推动着这个产业的稳定扩张。品牌所有者现在指定使用无溶剂或水性解决方案来减少挥发性有机化合物 (VOC) 的排放,加速了先进聚氨酯 (PUR) 和丙烯酸类化学品的应用。亚太地区加速的工业化、北美强劲的医疗设备生产以及欧洲严格的循环经济法规,共同塑造产品开发的优先事项。竞争优势取决于垂直整合、合应对力以及扩大生物基原料规模以满足成本和性能目标的能力。

全球贴合黏剂市场趋势与洞察

柔性食品包装市场强劲成长

预计2028年,软质包装规模将达3,416亿美元,年增率达3.2%。这项成长将持续推动市场对符合美国FDA 21 CFR Part 175和中国GB 4806.15-2024食品接触胶合剂国家标准的抗迁移贴合黏剂的需求。加工者对精确热活化曲线的需求,确保了蒸馏过程中密封的完整性,同时防止风味物质在多层结构中迁移。领先的供应商正透过提供低于欧盟二异氰酸酯阈值的低单体PUR等级产品,并缩短合规前置作业时间力。全球食品品牌越来越倾向于要求进行定量迁移测试,并青睐拥有内部分析能力和全球监管文件的供应商。贴合黏剂市场正抓住这一趋势,扩大无溶剂生产线,从而降低能耗并提高职场的安全性。

医用软包装袋和输液袋的层压製程需求激增

流延挤出薄膜为静脉输液袋的目视检查提供了必要的透明度,而吹膜复合材料则增强了药品包装袋的抗穿刺性。 ISO 10993生物相容性测试的高门槛限制了新产品的市场准入,并推高了有效等级产品的溢价。穿戴式医疗设备推动了亲肤型黏合剂的创新,力求在黏合性和无痛释放之间取得平衡。监管机构要求产品在伽马射线、电子束和环氧乙烷灭菌製程中保持灭菌稳定性,促使人们研发能够在灭菌后仍能保持机械强度的化学方法。北美製造商利用符合GMP标准的生产设施和良好的业绩记录,与医院签订长期合约。

对传统溶剂的挥发性有机化合物和全氟烷基物质实施更严格的限制

美国环保署 (EPA) 的《联邦法规》第 59 部分 (40 CFR Part 59) 对工业黏合剂的挥发性有机化合物 (VOC) 含量设定了严格的限制,迫使企业对长期使用的溶剂型产品进行再製造。加州 65 号提案将于 2025 年 12 月生效,届时醋酸乙烯酯将被列为有害物质,这将增加全部区域的标籤检视和再製造成本。同时,欧盟法规将于 2026 年 8 月前将食品包装中全氟烷基和多氟烷基物质 (PFAS) 的总含量限制在 250 ppb 以内,这将推动企业快速过渡到不含 PFAS 的化学物质。遵循成本和重新认证测试正在挤压研发预算,对中小型加工商的影响尤其严重,并加速贴合黏剂市场的整合。

细分市场分析

到2024年,溶剂型产品将占贴合黏剂市场45.65%的份额,这反映了其用途广泛的黏合性和加工商的熟悉程度。该细分市场正稳步成长,但日益严格的VOC法规促使人们重新评估高能耗的干燥隧道。因此,随着加工商采用无需烘箱且能降低高达40%能耗的高速串联生产线,无溶剂型产品预计到2030年将以7.64%的复合年增长率成长。水性分散体占据中间市场,既能降低企业从溶剂型产品过渡到水性产品的学习难度,也具有环保优势。新型紫外光固化和电子束固化系统则针对需要即时强度和低迁移性的特定应用领域。

加工经济效益是推动这项转变的动力。反应型聚氨酯热熔胶兼具热熔胶易于操作和热固性胶的卓越强度,使其成为双层和三层贴合机的理想选择。希伯来大学的研究人员展示了微波触发、光活化黏合剂,这显示了一种可实现按需回收的新一代固化机制。拥有广泛技术贴合机的供应商可以透过支援加工商逐步升级设备,并确保产品在包装、工业和运输等终端应用领域表现的一致性,从而获得战略优势。

区域分析

预计到2024年,亚太地区将占据贴合黏剂市场49.02%的份额,并在2030年之前以7.09%的复合年增长率成长。中国利用丙烷原料在压克力领域投资16亿美元,充分展现了成本创新带来的综效。印度不断壮大的中阶和基础设施建设计划,以及汉高在马哈拉斯特拉邦拉邦的乐泰工厂扩建,都为该地区的产能成长提供了支撑。日本和韩国受益于紧密的供应链和强大的智慧财产权保护,从而能够为电子产品和电动车电池模组提供高精度配方。

北美正利用其先进的研发生态系统和严格的法律规范,加速永续配方领域的突破。该地区在医疗设备和药品製造领域发挥主导作用,推动了对符合美国食品药物管理局 (FDA) 要求的特殊黏合剂的需求。加拿大对多环芳烃 (PAH) 密封剂的监管规定凸显了北美监管对全球供应商的影响。墨西哥具有成本竞争力的工厂为北美自由贸易组织(NAFTA) 的汽车内装和消费品包装供应链提供了支持。

欧洲持续引领全球标准。欧盟日益严格的再生材料含量法规正推动加工商加大对可回收聚氨酯(PUR)和丙烯酸酯的投资。德国的技术基础促进了製程的持续改进,而法国和义大利则拥有庞大的加工产业丛集,这些集群依赖无溶剂升级技术。南美洲以及中东和非洲地区虽然目前规模较小,但随着基础设施和消费市场的扩张,其成长速度高于平均水准。圣戈班以10.25亿美元收购FOSROC的交易凸显了对这些地区建筑和工业领域日益增长的兴趣。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 柔性食品包装市场强劲成长

- 软包装袋和输液袋的层压製程需求激增

- 电子商务小包裹激增需要高性能邮件覆膜材料

- 在高速串联生产线中采用无溶剂聚氨酯系统

- 品牌拥有者推广可回收的单一材料层压板

- 市场限制

- 针对传统溶剂的更严格的VOC和PFAS法规

- 生物基多元醇成本上涨阻碍绿色转型

- 利用隔热薄膜控制您的热预算

- 价值链分析

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 溶剂型

- 水系统

- 无溶剂

- 其他类型(UV/EB固化型)

- 通过树脂化学

- 聚氨酯

- 丙烯酸纤维

- 环氧树脂

- 其他树脂(EVA、聚烯、丁腈)

- 透过使用

- 包裹

- 食物

- 医疗的

- 其他套餐

- 工业层压

- 运输

- 其他用途(纺织品、图形)

- 包裹

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- 3M

- Arkema(Bostik)

- Ashland

- BASF

- Chemline India

- Coim Group

- Covestro

- DIC Corporation

- Dow

- Evonik

- Flint Group

- HB Fuller

- Henkel AG & Co. KGaA

- hubergroup

- INX International Coatings & Adhesives Co.

- LD Davis

- Paramelt

- SAPICI

- Sika AG

- Sun Chemical

- Toyochem

- Toyo-Morton

第七章 市场机会与未来展望

The laminating adhesives market size is valued at USD 3.85 billion in 2025 and is forecast to reach USD 5.20 billion by 2030, advancing at a 6.18% CAGR during the period.

Sustained demand for flexible packaging in food, pharmaceuticals and e-commerce parcels, alongside tightening chemical regulations, underpins this steady expansion. Brand owners now specify solvent-free or water-borne solutions to lower volatile organic compound (VOC) emissions, driving accelerated adoption of advanced polyurethane (PUR) and acrylic chemistries. Accelerating Asia-Pacific industrialization, robust medical device output in North America and stringent circular-economy rules in Europe collectively shape product development priorities. Competitive advantage hinges on vertical integration, regulatory fluency and the ability to scale bio-based raw materials that meet cost and performance targets.

Global Laminating Adhesives Market Trends and Insights

Robust Growth in Flexible Food Packaging

Flexible packaging's 3.2% annual expansion toward a projected USD 341.6 billion by 2028 continues to lift demand for migration-resistant laminating adhesives that comply with FDA 21 CFR Part 175 and China's GB 4806.15-2024 national food-contact adhesive standard. Converter requirements for precise thermal activation profiles ensure seal integrity during high-retort processes while preventing flavor transfer across multilayer structures. Leading suppliers differentiate through low-monomer PUR grades that fall beneath EU diisocyanate thresholds, shortening compliance lead times. Global food brands increasingly mandate quantitative migration testing, favoring vendors with in-house analytics and global regulatory dossiers. The laminating adhesives market capitalizes on this shift by scaling solvent-less lines that cut energy use and elevate workplace safety.

Surge in Medical Flexible Pouches & IV-Bag Laminations

Cast-extruded films deliver crystal clarity vital for IV-bag visual inspection, whereas blown-film laminates boost puncture resistance for pharmaceutical pouches. ISO 10993 biocompatibility testing poses high barriers, restricting new entrants and reinforcing premium pricing for validated grades. Wearable medical devices drive innovation in skin-friendly adhesives that balance adhesion and painless removal. Regulatory bodies demand sterilization stability across gamma, e-beam and ethylene oxide processes, pushing R&D toward chemistries that retain mechanical strength post-sterilization. North American producers leverage GMP facilities and track-record documentation to secure long-term hospital contracts.

VOC & PFAS Regulatory Tightening on Legacy Solvents

The US EPA's 40 CFR Part 59 sets stringent VOC ceilings for industrial adhesives, forcing reformulation of long-standing solvent products. California's listing of vinyl acetate under Proposition 65 effective December 2025 increases labeling and reformulation costs across the region. Concurrently, EU rules cap total PFAS to 250 ppb in food packaging by August 2026, catalyzing rapid migration toward PFAS-free chemistries. Compliance expenditures and re-qualification testing stretch R&D budgets, disproportionately affecting smaller converters and accelerating consolidation within the laminating adhesives market.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce Parcel Boom Demanding High-Performance Mailer Laminates

- Brand-Owner Push for Mono-Material Recycle-Ready Laminates

- Cost-Inflation of Bio-Based Polyols Limiting Green Transition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solvent-borne products retained a 45.65% share of the laminating adhesives market in 2024, reflecting versatile adhesion and entrenched converter familiarity. The segment expands modestly, yet regulatory clampdowns on VOCs spur processors to reassess energy-intensive drying tunnels. Solvent-less grades are therefore registering a vigorous 7.64% CAGR toward 2030 as converters adopt high-speed tandem lines that eliminate ovens and curb energy bills by up to 40%. Water-borne dispersions occupy an intermediary niche, easing the learning curve for firms transitioning away from solvents while offering environmental benefits. Emerging UV- and electron-beam-curable systems target niche applications requiring instant green-strength and low migration.

Processing economics underpin this migration. Reactive PUR hot-melts supply the handling simplicity of hot-melts and the final strength of thermosets, making them prime candidates on duplex and triplex laminators. Microwave-triggered light-activated adhesives demonstrated by Hebrew University researchers hint at next-generation cure mechanisms that could enable on-demand recycling. Suppliers with broad technology portfolios gain strategic leverage by supporting converters through phased equipment upgrades while guaranteeing consistent performance across packaging, industrial and transportation end uses.

The Laminating Adhesives Market Report is Segmented by Type (Solvent-Borne, Water-Borne, and More), Resin Chemistry (Polyurethane, Acrylic, and More), Application (Packaging, Industrial Laminations, and More), and Geography (Asia-Pacific, North America, South America, Europe, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 49.02% of laminating adhesives market share in 2024 and is forecast to grow at a 7.09% CAGR through 2030. China's USD 1.6 billion acrylic acid investment leveraging propane feedstock underlines cost-innovation synergies. India's growing middle class and infrastructure projects, coupled with Henkel's Loctite facility expansion in Maharashtra, anchor regional capacity. Japan and South Korea contribute high-precision formulations for electronics and EV battery modules, benefiting from tight supply chains and robust IP protections.

North America leverages advanced R&D ecosystems and stringent regulatory oversight that accelerate sustainable-formulation breakthroughs. The region's leading role in medical device and pharmaceutical manufacturing drives specialized adhesive demand aligned with FDA requirements. Canada's restriction on polycyclic aromatic hydrocarbon (PAH) sealants highlights the continent's regulatory influence on global suppliers. Mexico's cost-competitive plants support NAFTA supply chains in automotive interiors and consumer packaging.

Europe continues to shape global standards. The EU's escalating recycled-content mandates steer converter investments toward recyclable PUR and acrylic systems. Germany's engineering base fosters continuous process improvements, while France and Italy retain sizable converting clusters that rely on solvent-less upgrades. South America and Middle East & Africa, though smaller today, display above-average growth as infrastructure and consumer markets expand. Saint-Gobain's USD 1.025 billion FOSROC deal underscores rising interest in these regions' construction and industrial segments.

- 3M

- Arkema (Bostik)

- Ashland

- BASF

- Chemline India

- Coim Group

- Covestro

- DIC Corporation

- Dow

- Evonik

- Flint Group

- H.B. Fuller

- Henkel AG & Co. KGaA

- hubergroup

- INX International Coatings & Adhesives Co.

- LD Davis

- Paramelt

- SAPICI

- Sika AG

- Sun Chemical

- Toyochem

- Toyo-Morton

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust growth in flexible food packaging

- 4.2.2 Surge in medical flexible pouches & IV-bag laminations

- 4.2.3 E-commerce parcel boom demanding high-performance mailer laminates

- 4.2.4 Adoption of solvent-free PUR systems in high-speed tandem lines

- 4.2.5 Brand-owner push for mono-material recycle-ready laminates

- 4.3 Market Restraints

- 4.3.1 VOC & PFAS regulatory tightening on legacy solvents

- 4.3.2 Cost-inflation of bio-based polyols limiting green transition

- 4.3.3 Thermal-budget limits with heat-sensitive sustainable films

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Solvent-borne

- 5.1.2 Water-borne

- 5.1.3 Solvent-less

- 5.1.4 Other Types (UV/EB-curable)

- 5.2 By Resin Chemistry

- 5.2.1 Polyurethane

- 5.2.2 Acrylic

- 5.2.3 Epoxy

- 5.2.4 Other Resin Chemistries (EVA, Polyolefin, Nitrile)

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.1.1 Food

- 5.3.1.2 Medical

- 5.3.1.3 Other Packaging

- 5.3.2 Industrial Laminations

- 5.3.3 Transportation

- 5.3.4 Other Applications (Textiles, Graphics)

- 5.3.1 Packaging

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 South America

- 5.4.3.1 Brazil

- 5.4.3.2 Argentina

- 5.4.3.3 Rest of South America

- 5.4.4 Europe

- 5.4.4.1 Germany

- 5.4.4.2 United Kingdom

- 5.4.4.3 Italy

- 5.4.4.4 France

- 5.4.4.5 Rest of Europe

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema (Bostik)

- 6.4.3 Ashland

- 6.4.4 BASF

- 6.4.5 Chemline India

- 6.4.6 Coim Group

- 6.4.7 Covestro

- 6.4.8 DIC Corporation

- 6.4.9 Dow

- 6.4.10 Evonik

- 6.4.11 Flint Group

- 6.4.12 H.B. Fuller

- 6.4.13 Henkel AG & Co. KGaA

- 6.4.14 hubergroup

- 6.4.15 INX International Coatings & Adhesives Co.

- 6.4.16 LD Davis

- 6.4.17 Paramelt

- 6.4.18 SAPICI

- 6.4.19 Sika AG

- 6.4.20 Sun Chemical

- 6.4.21 Toyochem

- 6.4.22 Toyo-Morton

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment