|

市场调查报告书

商品编码

1851601

离型纸:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Release Liners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

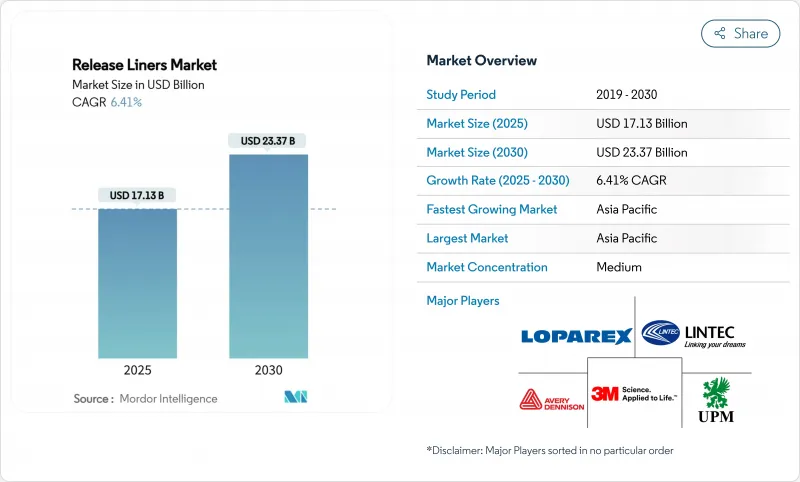

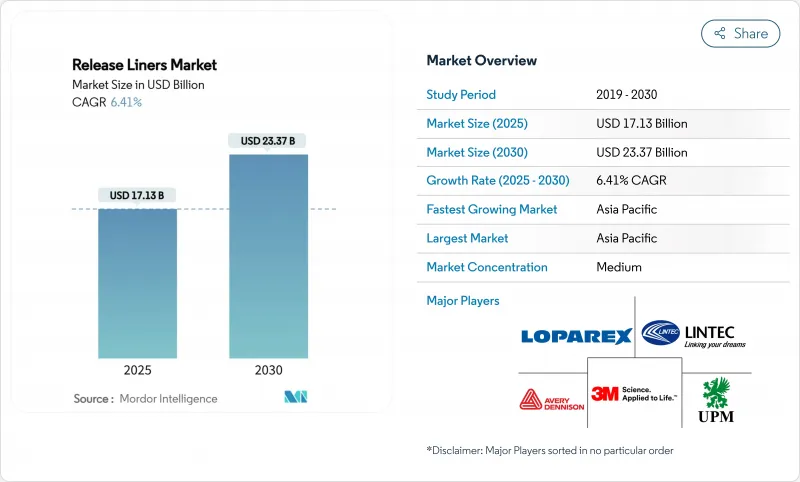

据估计,离型纸市场规模将在 2025 年达到 171.3 亿美元,到 2030 年达到 233.7 亿美元,在预测期(2025-2030 年)内复合年增长率为 6.41%。

对稳定性能和尺寸精度要求高的应用领域,例如电商物流、高端食品包装和先进工业胶带,正推动强劲的需求。标籤仍是核心应用领域,但医疗设备、预浸复合材料和电池胶带的应用成长更为迅速,产品结构正向利润率更高、技术密集结构转变。亚太地区在销售和成长率方面均领先主导,巩固了其规模优势,同时也使西方品牌所有者面临供应链集中带来的风险。材料创新正在加速。虽然玻璃纸仍占据主导地位,但薄膜和聚合物涂层替代品正在蓬勃发展,因为加工商正在寻求既能防潮、耐热、耐化学腐蚀又不牺牲可回收性的产品。

全球离型纸市场趋势与洞察

食品饮料产业对洁净标示包装的需求日益增长

食品饮料品牌商正以未漂白的玻璃纸、水溶性硅酮和符合直接食品接触法规的可堆肥化学品,取代漂白基材和溶剂型涂料。 Lintec的天然色调玻璃纸标誌着一种趋势,即转向加工最少的纸张,这种纸张无需使用萤光增白剂,并能实现凹版印刷的保真度。其功能性能如今也扩展到阻隔油污和水分,从而在不发生黏合剂迁移的情况下保持成分透明。能够提供可追溯性证明的加工商,随着零售商加强其永续性评估,正获得更高的溢价。对不含 PFAS 系统的需求正从欧盟蔓延至北美,迫使供应商开发即使在高速涂覆下也能清洁释放的无氟替代品。预计到 2024 年,食品饮料市场份额将达到 29.26%,材料升级将迅速波及全球市场,并提高供应商的认证门槛。

电子商务的蓬勃发展推动了对标籤的需求。

随着线上订购线下取货、订阅服务和当日送达模式的兴起,小包裹量持续成长。离型纸必须能够支援超过150公尺/分钟的自动化列印生产线、可变资料条码以及-20°C至40°C的低温运输。稳定的剥离力和纸幅平整度能够最大限度地减少停机时间和误贴,从而直接影响每个包裹的履约成本。高端开箱体验的趋势如今已扩展到全通路食品杂货和个人护理用品的配送领域,这推动了对带有纹理清漆和金属装饰的多层标籤的需求。这些标籤采用精密涂层的离型纸製成,以保护油墨的完整性直至使用。因此,离型纸市场正在经历销售成长,价值重心也转向了针对机器人和影像检查设备优化的高规格纸张和薄膜背衬。

离型纸废弃物处理难题

由于硅油残留阻碍了常规回收利用,废旧衬纸大多被掩埋。 FINAT 的 CELAB-Europe 联盟的目标是到 2025 年实现 75% 的回收率,但进展取决于回收物流和终端市场对再生纤维的需求。西密西根大学研发的水溶性隔离层能够在製浆过程中去除硅油,但由于製程维修和打包运输成本,商业性应用仍然有限。 Sustana 集团位于威斯康辛州的工厂已证明其技术可行性,但其业务范围有限。随着生产者延伸责任製浆计画的日益普及,加工商面临着不断上涨的费用,这削弱了无衬纸和可重复使用纸浆的价格竞争力。

细分市场分析

预计到2024年,玻璃纸仍将占据离型纸市场37.18%的份额,凭藉其成本效益、表面光滑度和FDA食品接触认证,将继续为大批量标籤和胶带项目提供支援。然而,由于品牌商为了减少运输排放而指定使用低克重离型纸,导致儘管平方公尺需求增加,但吨位却有所下降,因此玻璃纸的增长将较为温和。聚乙烯涂层牛皮纸因其优于无涂布牛皮纸的防潮性能,在冷藏食品和户外标籤领域的需求不断增长。由BO-PET和BOPP製成的薄膜离型纸在电子、航太和汽车层压材料领域迅速扩张,这些材料的固化温度高于纤维素纸的玻璃化转变温度。

双向拉伸聚酰胺、聚四氟乙烯涂层玻璃布和微纤化纤维素复合材料具有多种功能特性,包括抗静电性、260°C以上的热稳定性以及防水性。儘管处理过程仍处于小众市场,但随着加工商采用多道涂层生产线或线上等离子处理来固定脱模剂,平均售价正在上涨。玻璃纸供应商正透过推出阻隔性增强型产品来回应洁净标示包装的需求,这些产品包括未漂白、金属化和碳酸钙填充型。这些迭代式的改进使玻璃纸保持了其市场地位,即使其成长最快的市场份额已被工程薄膜所取代。

到2024年,硅酮体系将占据离型纸市场81.22%的份额,这主要得益于其多样化的固化化学特性、低表面能以及丰富的硅氧烷原料供应。铂催化紫外光固化硅酮透过缩短固化视窗并实现1000公尺/分钟的高速涂覆,从而保持了价格竞争力。含氟聚合物离型纸市场虽然规模较小,但以7.64%的复合年增长率成长。这是因为全氟化链赋予了离型纸化学惰性和超低剥离强度,这对于高温复合材料模具和强力胶带至关重要。

对 PFAS 化学品的监管压力正在加剧市场分化:航太领域对传统氟硅油的需求依然旺盛,而包装和卫生用品领域则转向丙烯酸和聚烯脱模清漆。像 Hightower Products 这样的供应商现在提供不含 PFAS 的配方,这些配方可根据黏度和固色树脂进行定制,以平衡清洁脱模和可回收性。硅油製造商正在推出迁移控制等级的产品,以最大限度地减少硅氧烷迁移到光学薄膜和半导体晶圆。竞争优势取决于能够检验亚 ppm 级迁移并加快客户认证的分析能力。

区域分析

预计到2024年,亚太地区将占据全球42.74%的市场份额,并在2030年之前以7.56%的复合年增长率增长,这主要得益于该地区垂直整合的从纸浆到涂料的供应链以及不断增长的中阶消费。随着包装加工商将产能扩展到更靠近电商履约中心的地方,中国将占据吨位成长的大部分份额;而日本和韩国则专注于为半导体工厂和电池组装提供高精度衬垫。政府对可再生能源的激励措施也推动了风力涡轮机叶片製造领域对预浸衬垫的需求。

北美在航太、医疗设备和快餐店包装领域拥有庞大的安装基础。美国受惠于以明尼苏达州、麻萨诸塞州和加州为中心的丛集,是FDA核准的医用胶带的研发中心。加拿大利用其丰富的森林资源推广FSC认证的玻璃纸和黏土涂层牛皮纸,满足零售商的永续性要求。墨西哥的近岸外包热潮正促使跨国公司将RFID、标籤和薄膜涂层工厂设在汽车和消费性电子工厂附近。艾利丹尼森公司1亿美元的投资正是这发展动能的有力证明。

欧洲在监管方面始终处于领先地位,并积极推动循环经济目标,奖励那些能够证明其消费后衬纸回收率的供应商。德国在与汽车轻量化相关的工业胶带创新方面处于领先地位,而义大利和法国则在高端包装领域占据优势,小批量生产和高品质标籤对高端衬纸的需求日益增长。北欧国家透过强制逐步淘汰 PFAS 并推广生物基替代品,正在影响全球材料标准。东欧是为欧盟单一市场供应原料的成本效益型生产走廊,但地缘政治紧张局势可能会扰乱原物料物流。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 食品饮料产业对洁净标示包装的需求日益增长

- 电子商务的蓬勃发展推动了对标籤的需求。

- 推广优质卫生和医用胶带

- 航太和风能预浸料需要特殊衬里

- 电动车电池电极胶带的应用现状

- 市场限制

- 离型纸废弃物处理难题

- 纸浆和硅胶原料价格波动

- 转向无底纸标籤系统

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按基础材料

- 玻璃纸/超压光纸

- 聚乙烯涂布纸

- 薄膜衬垫

- 黏土涂层牛皮纸

- 其他(例如,聚涂层双向拉伸聚对苯二甲酸乙二醇酯(BO-PET)薄膜等)

- 透过释放剂

- 硅酮

- 氟树脂

- 非硅酮(丙烯酸等)

- 透过使用

- 标籤

- 形象的

- 磁带

- 医疗的

- 工业的

- 其他用途(卫生用品等)

- 按最终用途行业划分

- 饮食

- 医疗保健和製药

- 个人护理和化妆品

- 汽车与运输

- 电子学

- 建筑/施工

- 其他终端用户产业(例如农业)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3M

- Ahlstrom

- Avery Dennison Corporation

- Dow

- Eastman Chemical Company

- Elkem ASA

- Felix Schoeller

- Gascogne Group

- Laufenberg GmbH

- LINTEC Corporation

- Loparex

- Mativ Holdings, Inc.

- Mitsubishi Chemical Group Corporation.

- Mondi

- Polyplex

- Sappi Ltd

- SJA Film Technologies Ltd.

- Techlan

- The Griff Network

- UPM

第七章 市场机会与未来展望

The Release Liners Market size is estimated at USD 17.13 billion in 2025, and is expected to reach USD 23.37 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Steady demand stems from e-commerce logistics, premium food packaging, and advanced industrial tapes, all of which require consistent release performance and tight dimensional tolerances. Labels remain the anchor application, yet medical devices, prepreg composites, and battery cell tapes are expanding faster and reshaping the product mix toward higher-margin, technology-intensive constructions. Asia-Pacific's dual leadership in volume and growth reinforces production scale advantages while exposing Western brand owners to supply-chain concentration risks. Material innovation is accelerating: glassine paper still dominates, but filmic and poly-coated alternatives are growing quickly as converters seek moisture, heat, and chemical resistance without sacrificing recyclability.

Global Release Liners Market Trends and Insights

Growing Demand for Clean-Label Packaging in Food and Beverage

Food and beverage brand owners are replacing bleached substrates and solvent-based coatings with unbleached glassine, water-borne silicones, and compostable chemistries that meet direct-food-contact rules. LINTEC's natural-tone glassine illustrates the pivot toward minimally processed papers that enable gravure print fidelity while eliminating optical brighteners . Functional performance now extends to barrier protection against grease and moisture, permitting clear ingredient transparency without adhesive migration. Converters able to document traceability capture price premiums as retailers tighten sustainability scorecards. Demand for PFAS-free systems is spreading from the EU to North America, pushing suppliers to scale fluorine-free alternatives that still release cleanly at high application speeds. With food and beverage holding 29.26% share in 2024, iterative material upgrades ripple quickly across global volumes and reinforce supplier qualification hurdles.

E-commerce Boom Accelerating Label Demand

Parcel volumes continue rising with click-and-collect, subscription, and same-day delivery models. Release liners must perform across automated print-apply lines that exceed 150 m/min, handle variable-data barcoding, and endure cold-chain swings from -20 °C to 40 °C. Consistent release force and web flatness minimize downtime and misapplies, directly influencing fulfillment cost per package. Premium unboxing trends now extend to omnichannel grocery and personal-care shipments, boosting demand for multi-layer labels with tactile varnishes and metallic accents. These constructions rely on precision-coated liners to protect ink integrity until point-of-use. The release liner market, therefore, sees volume gains plus a value shift toward high-spec paper and film backings optimized for robotics and vision inspection equipment.

Release-Liner Waste Disposal Challenges

Used liner is largely landfilled because silicone residues impede standard recycling. FINAT's CELAB-Europe consortium aims for 75% recycling by 2025, but progress hinges on collection logistics and end-market demand for recovered fibers. Western Michigan University's water-soluble barrier layer enables silicone removal during pulping, yet commercial adoption remains limited by process retrofits and bale transport costs. Sustana Group's Wisconsin plant shows technical feasibility, but its geographic reach is narrow. As Extended Producer Responsibility schemes spread, converters face escalating fees that erode price competitiveness versus linerless or reusable formats.

Other drivers and restraints analyzed in the detailed report include:

- Uptake of Premium Hygiene and Medical Tapes

- Aerospace and Wind Prepregs Needing Specialty Liners

- Volatile Pulp and Silicone Raw-Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glassine retained 37.18% share of release liner market size in 2024 and continues to anchor high-volume label and tape programs thanks to cost efficiency, surface smoothness, and FDA food-contact clearances. Yet growth moderates as brand owners specify lower-grammage liners to cut freight emissions, eroding tonnage even where square-meter demand rises. Polyethylene-coated kraft papers are gaining in chilled-food and outdoor labeling where moisture resistance outperforms uncoated grades. Filmic liners made from BO-PET and BOPP are expanding quickly in electronics, aerospace, and automotive laminates that cure at temperatures beyond the glass-transition point of cellulosic papers.

Alternative substrates inside the "Others" category are setting the pace: bi-axially oriented polyamide, PTFE-coated glass cloth, and micro-fibrillated cellulose composites deliver multi-functional properties such as anti-static release, thermal stability above 260 °C, and repulpability. Adoption remains niche yet lifts average selling price because converters implement multi-pass coating lines and inline plasma treatments to anchor release agents. Glassine suppliers are responding with barrier-enhanced variations-unbleached, metallized, or calcium-carbonate-filled-aimed at clean-label packaging. These iterative shifts ensure glassine stays relevant while ceding the fastest growth slices to engineered films.

Silicone systems controlled 81.22% of the 2024 release liner market, supported by versatile cure chemistries, low surface energy, and abundant supply of base siloxanes. Platinum-catalyzed UV silicones shorten cure windows, enabling high-speed 1,000 m/min coating that sustains price competitiveness. The release liner market size for fluoropolymer-based agents is smaller yet advancing at 7.64% CAGR because perfluorinated chains deliver chemical inertness and ultra-low release force vital in high-temperature composite molds and aggressive adhesive tapes.

Regulatory pressure on PFAS chemicals is fostering a split: legacy fluoro-silicones for aerospace retain demand, while packaging and hygiene sectors shift toward acrylic or polyolefin release varnishes. Suppliers such as Hightower Products now market PFAS-free formulations customized by viscosity and anchorage resins, balancing clean release with recyclability. Silicone producers answer with controlled-migration grades that minimize siloxane transfer onto optical films and semiconductor wafers. Competitive advantage hinges on analytical capability to verify sub-ppm migration and accelerate customer qualification.

The Release Liner Market Report is Segmented by Substrate (Clay-Coated Kraft Paper, Filmic Liners, and, More), Release Agent (Silicone, Fluoropolymer, and More), Application (Labels, Graphics, and More), End-Use Industry (Food and Beverage, Healthcare and Pharmaceuticals, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 42.74% market share in 2024 and is projected to grow at a 7.56% CAGR through 2030, underpinned by the region's vertically integrated pulp-to-coating supply chain and expanding middle-class consumption. China accounts for the bulk of incremental tonnage as packaging converters ramp capacity near e-commerce fulfilment hubs, while Japan and South Korea specialize in high-precision liners for semiconductor fabs and battery cell assembly. Government incentives for renewable energy also lift demand for prepreg liners in wind-blade production.

North America preserves a sizeable installed base in aerospace, medical device, and quick-service restaurant packaging. The United States is the hub for FDA-cleared medical tape development, benefiting from clusters around Minnesota, Massachusetts, and California. Canada leverages abundant forest resources to promote FSC-certified glassine and clay-coated kraft, aligning with retailer sustainability mandates. Mexico's near-shoring boom encourages multinationals to co-locate RFID, label, and filmic coating facilities close to automotive and consumer-electronics plants; Avery Dennison's USD 100 million investment testifies to this momentum.

Europe remains the regulatory vanguard, driving circularity targets that reward suppliers able to certify post-consumer liner recycling rates. Germany spearheads industrial tape innovation linked to automotive lightweighting, whereas Italy and France capitalize on luxury packaging where small-batch, high-finish labels command premium liners. Nordic countries influence global material standards by mandating PFAS phase-outs and promoting bio-based alternatives. Eastern Europe serves as a cost-effective production corridor supplying the EU single market, though geopolitical tensions occasionally disrupt feedstock logistics.

- 3M

- Ahlstrom

- Avery Dennison Corporation

- Dow

- Eastman Chemical Company

- Elkem ASA

- Felix Schoeller

- Gascogne Group

- Laufenberg GmbH

- LINTEC Corporation

- Loparex

- Mativ Holdings, Inc.

- Mitsubishi Chemical Group Corporation.

- Mondi

- Polyplex

- Sappi Ltd

- SJA Film Technologies Ltd.

- Techlan

- The Griff Network

- UPM

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Clean-label Packaging in Food and Beverage

- 4.2.2 E-commerce Boom Accelerating Label Demand

- 4.2.3 Uptake of Premium Hygiene and Medical Tapes

- 4.2.4 Aerospace and Wind Prepregs Needing Specialty Liners

- 4.2.5 Electric Vehicles Battery Cell Electrode Tapes Adoption

- 4.3 Market Restraints

- 4.3.1 Release-liner Waste Disposal Challenges

- 4.3.2 Volatile Pulp and Silicone Raw-material Prices

- 4.3.3 Shift Toward Liner-less Labelling Systems

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Substrate

- 5.1.1 Glassine / Super-calendered Paper

- 5.1.2 Polyethylene-coated Paper

- 5.1.3 Filmic Liners

- 5.1.4 Clay-coated Kraft Paper

- 5.1.5 Others (Poly-coated Biaxially Oriented Polyethylene Terephthalate (BO-PET) film, etc.)

- 5.2 By Release Agent

- 5.2.1 Silicone

- 5.2.2 Fluoropolymer

- 5.2.3 Non-silicone (Acrylic, Others)

- 5.3 By Application

- 5.3.1 Labels

- 5.3.2 Graphics

- 5.3.3 Tapes

- 5.3.4 Medical

- 5.3.5 Industrial

- 5.3.6 Other Applications (Hydiene Products, etc.)

- 5.4 By End-use Industry

- 5.4.1 Food and Beverage

- 5.4.2 Healthcare and Pharmaceuticals

- 5.4.3 Personal Care and Cosmetics

- 5.4.4 Automotive and Transportation

- 5.4.5 Electronics

- 5.4.6 Building and Construction

- 5.4.7 Other End-user Industries (Agriculture, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Ahlstrom

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Dow

- 6.4.5 Eastman Chemical Company

- 6.4.6 Elkem ASA

- 6.4.7 Felix Schoeller

- 6.4.8 Gascogne Group

- 6.4.9 Laufenberg GmbH

- 6.4.10 LINTEC Corporation

- 6.4.11 Loparex

- 6.4.12 Mativ Holdings, Inc.

- 6.4.13 Mitsubishi Chemical Group Corporation.

- 6.4.14 Mondi

- 6.4.15 Polyplex

- 6.4.16 Sappi Ltd

- 6.4.17 SJA Film Technologies Ltd.

- 6.4.18 Techlan

- 6.4.19 The Griff Network

- 6.4.20 UPM

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Incorporation of Nano-coatings into Release Liners for Enhanced Release Properties