|

市场调查报告书

商品编码

1851603

电动马达:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Electric Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

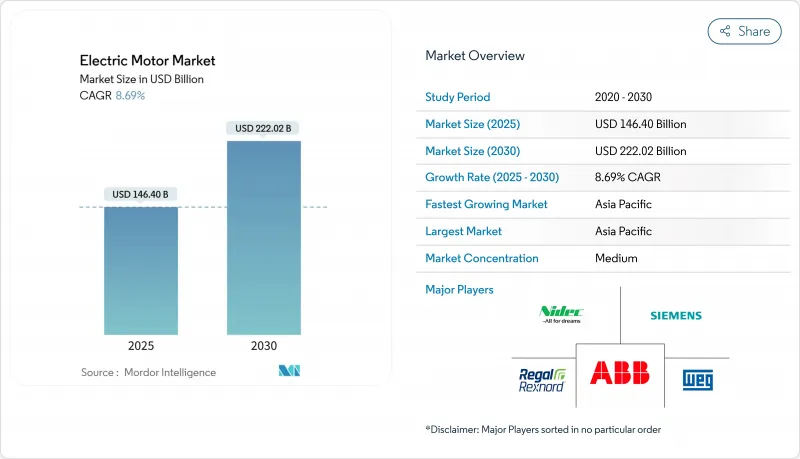

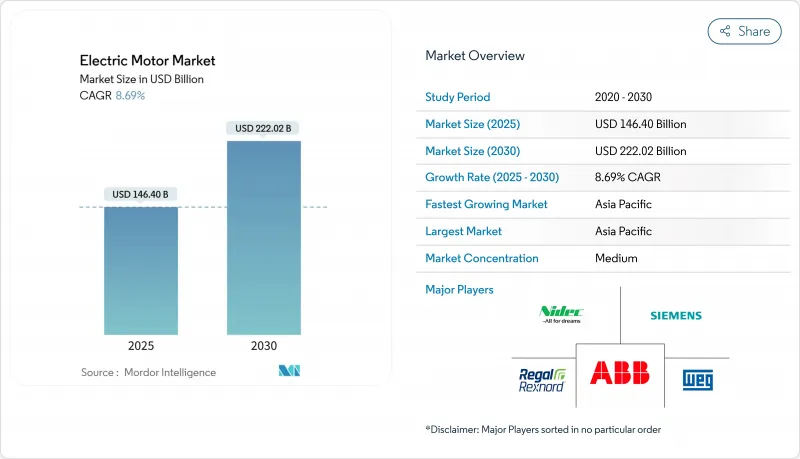

预计到 2025 年,全球马达市场规模将达到 1,464 亿美元,到 2030 年将达到 2,220.2 亿美元,预测期(2025-2030 年)复合年增长率为 8.69%。

全球电气化进程、日益严格的最低能源效率法规以及电动车、暖通空调升级和可再生能源计划需求的成长,共同推动了马达产业的成长。 IEC能源效率等级的强化,加上欧盟生态设计指令以及北美和亚洲的同等法规,正在加速传统马达的更换销售。同时,中国、印度和东南亚製造业的持续扩张增加了工业机械的数量,而物联网赋能的预测性维护平台则缩短了更换週期。这导致市场转向IE4和IE5能源效率等级、永磁架构和整合驱动,同时也加剧了研发竞争和供应商整合。

全球马达市场趋势与洞察

亚洲离散製造业製造业自动化快速电气化

到2024年,中国工厂的机器人密度将达到每万名员工322台机器人,每台机器人配备6至12个伺服马达。越南和印度正在复製这一自动化发展趋势,推动供应链多元化,并刺激对具有更严格速度-扭矩范围的精密马达的迫切需求。终端用户现在更注重全生命週期效率而非前期成本,这促使亚洲二线工业对高效节能型马达的需求不断增长。伺服驱动单元的数位双胞胎可以缩短试运行时间,并为电机OEM厂商创造新的业务收益来源。随着自动化向小批量生产转移,马达驱动的可配置性和快速调谐能力正成为马达市场中至关重要的采购因素。

联邦能源标准推动美国家庭维修中暖通空调系统的加速普及

最新的能源效率比(SEER)标准将导致数百万套传统暖通空调系统不符合标准,从而在2027年之前每年形成15%的更换管道。变速马达可将居民用电量降低高达40%,而适用于寒冷气候的热泵将于2024年底开始推广,使其覆盖范围扩大到北部各州。公用事业公司正透过分时电价来改善经济效益,这种电价有利于变频压缩机,从而进一步推动了IE4级风扇和鼓风机马达的稳步普及。承包商现在将可即时报告负载曲线的连网控制系统捆绑销售,并将资料传输到分析平台,以便为未来的维修优化设备尺寸。这些监管变化将使北美马达市场稳步走上成长轨道。

钕的价格不稳定给永磁马达的经济效益带来了压力。

钕现货价格在经历了早期的飙升后,过去12个月下跌了42%,这使得牵引马达马达项目的物料清单预测变得更加复杂。电动车平台需要多达5公斤的磁性材料,因此价格波动会影响整个车系。原始设备製造商(OEM)透过双重采购和试验减少磁铁数量的拓扑结构(例如铁氧体辅助同步马达)来规避风险。对同步磁阻设计的研究虽然可以提供无磁铁扭力图,但需要严格的空气间隙处理流程。不确定性促使采购团队倾向于签署长期承购协议,但持续的波动仍可能抑制马达市场的成长。

细分市场分析

到2024年,交流马达将占全球销量的73.34%,其9.4%的复合成长率将使其在2030年之前继续主导马达市场。感应马达在输送机、水泵和风扇领域仍占据主导地位,而同步马达在对速度精度要求极高的应用中也越来越受欢迎。如今,数位驱动器能够自动调节转子磁通,从而提高千瓦时效率,并使IE4感应马达系统能够直接取代IE2传统马达系统。在直流马达方面,无刷马达设计正在延长无人机和电动自行车的维护週期,在不威胁交流马达整体市场份额的前提下,开闢出一片属于自己的独特市场。

儘管AC马达凭藉着成熟的模具、充足的备件和简化的安装方式,在棕地改装中仍占据主导地位,但轴向拓扑结构的出现带来了新的竞争。伺服级马达为先进机器人提供动力,将回馈编码器与边缘运算结合,实现毫秒的运动控制。在此背景下,电机市场将继续青睐那些能够将规模经济与平台化模组化相结合的供应商。

受智慧家电、暖通空调风扇和手持设备等产品兴起的推动,到2024年,小功率马达将占总出货量的52%。严格的绝缘封装限制推动了小型化,而无卤绝缘薄膜和粉末冶金齿轮的出现则缓解了热限制。相较之下,500匹马力以上的马达年复合成长率将达到8%,虽然销量不高,但对营收的影响却十分显着。大型永磁马达目前驱动14兆瓦的离岸风电机舱,而矿用输送机则需要坚固耐用的全封闭式风冷式(TEFC)外壳来应对沙漠气候。

功率范围为1-500马力的整体式马达仍是生产线的核心,得益于变频驱动器,可实现20-30%的节能。随着OEM厂商不断扩展其IE4产品目录,该细分市场正逐渐模糊跨界融合的界限,将小型马达紧凑的定子结构与高功率马达的冷却策略相结合。不同功率等级的成长动态差异,使得整个马达市场的成长机会变得更加复杂。

电动马达市场报告按马达类型(DC马达、AC马达、其他)、输出功率等级(分数马力、其他)、电压(低压、中压、高压)、应用(工业机械、暖通空调和冷冻、其他)、最终用户产业(住宅、商业、工业)和地区(北美、欧洲、亚太、南美、中东和非洲)进行细分。

区域分析

亚太地区预计到2024年将占全球销售额的42.6%,到2030年将以10.7%的复合年增长率成长。广东省的电机产业丛集整合了铸造、绕线和驱动电子等端到端前置作业时间。越南的工业吸引了契约製造将马达再进口给区域供应商,拓宽了供应链。政府对高效设备的激励措施正在推动纺织厂和半导体厂快速采用IE4级马达。

北美拥有第二大市场份额,这主要得益于联邦暖通空调能源效率法规和蓬勃发展的自动化生态系统。中西部地区的汽车工厂透过预测性维护维修,将停机时间减少了高达 45%,推动了持续的续约订单。美国电池工厂的建设正将牵引马达研发资金投入一个合作实验室,用于测试转子迭片在高速负载循环下的性能。加拿大陆上风电改造计画正在将采购重点转向更轻的直驱电机,从而推动了电机市场的发展。

欧洲持续成长得益于离岸风电和严格的生态设计法规这两大支柱。北海港口正在扩建机舱,以管理配备直驱式永磁发电机的15兆瓦风力发电机组。製造商将服务中心集中在波兰和西班牙,以履行五年一次的大修合约。欧盟能源价格的波动促使工业用户优先考虑IE4维修,进而缩短投资回收期。

中东和非洲虽然绝对规模较小,但海水淡化厂和瓦斯增压站的成长速度却高于预期。阿联酋的EPC合约指定使用IECEx认证的防爆电机,从而催生了高利润率的需求。在南美洲,巴西和智利的工业运作带动了中压泵驱动装置和糖厂压榨机订单的回升。在所有地区,能源效率法规的趋同都维持了马达市场的需求动能。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 最新进展

- 市场驱动因素

- 亚洲离散製造业製造业自动化快速电气化

- 联邦能源标准推动美国家庭维修中暖通空调系统的加速普及

- 欧洲离岸风力发电机安装量激增,需要高功率永磁马达。

- 中国电池电动车动力传动系统的扩张正在推动对高效牵引马达的需求。

- 工业IoT驱动的预测性维护加速了北美老旧马达的更换

- 政府对最低排放标准的强制规定推动了IE4和IE5马达的全球销售。

- 市场限制

- 钕的价格不稳定给永磁马达的经济效益带来了压力。

- IGBT模组的供应限制限制了高压马达的生产。

- 中东石油和天然气产业防爆马达认证週期长

- 整合伺服驱动器的兴起降低了独立马达的商机。

- 供应链分析

- 监理展望

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依马达类型

- AC马达(感应式(非同步)、同步式)

- DC马达(有刷和无刷直流马达)

- 其他(密封马达、步进马达)

- 按额定输出

- 分数马力(1 马力或以下)

- 整数马力(1-500 马力)

- 高功率(超过500马力)

- 透过电压

- 低电压(低于1千伏特)

- 中压(1至6千伏特)

- 高压(6千伏特或更高)

- 透过使用

- 工业机械

- 暖通空调和製冷

- 汽车与运输

- 电器产品

- 公共产业和能源

- 其他(农业、石油和天然气、采矿)

- 按最终用途行业划分

- 住房

- 商业

- 产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名/份额)

- 公司简介

- ABB Ltd.

- Siemens AG

- Nidec Corporation

- Regal Rexnord Corporation

- WEG SA

- Toshiba Corporation

- Hitachi Ltd.

- Rockwell Automation, Inc.

- AMETEK, Inc.

- Johnson Electric Holdings Ltd.

- TECO Electric & Machinery Co., Ltd.

- Mitsubishi Electric Corporation

- Baldor Electric Company

- Brook Crompton Holdings Ltd.

- Anhui Wannan Electric Machine Co., Ltd.

- Kirloskar Electric Company Ltd.

- Hyosung Heavy Industries

- Danaher Motion(Kollmorgen)

- Yaskawa Electric Corporation

- Fuji Electric Co., Ltd.

- Robert Bosch GmbH

- Schneider Electric SE

- SEW-Eurodrive GmbH & Co. KG

- Emerson Electric Co.

第七章 市场机会与未来展望

The Electric Motor Market size is estimated at USD 146.40 billion in 2025, and is expected to reach USD 222.02 billion by 2030, at a CAGR of 8.69% during the forecast period (2025-2030).

Growth is anchored in the worldwide push for electrification, stricter minimum-efficiency regulations, and rising demand from electric vehicles, HVAC upgrades, and renewable-energy projects. Tighter IEC efficiency classes, combined with the EU Ecodesign Directive and comparable rules in North America and Asia, are accelerating replacement sales of legacy motors. Simultaneously, sustained expansion of manufacturing in China, India, and Southeast Asia is raising unit volumes in industrial machinery, while IoT-enabled predictive-maintenance platforms shorten replacement cycles. The resulting shift toward IE4 and IE5 designs, permanent-magnet architectures, and integrated drives is heightening R&D competition and driving consolidation among suppliers.

Global Electric Motor Market Trends and Insights

Rapid Electrification of Manufacturing Automation in Asia's Discrete Industries

Robot density in Chinese factories reached 322 units per 10,000 workers in 2024, each robot integrating 6-12 servo motors. Vietnam and India are replicating this automation curve to attract supply-chain diversification, spurring localized demand for precision motors with tighter speed-torque envelopes. End users now make procurement choices on lifetime efficiency rather than upfront cost, lifting premium-efficiency unit penetration rates across tier-2 Asian industrial parks. Digital twins for servo-driven cells cut commissioning time and signal an emerging service revenue pool for motor OEMs. As automation migrates to small-batch production, configurability and rapid motor-drive tuning have become decisive buying factors in the electric motor market.

Accelerating HVAC Adoption in US Residential Retrofits Driven by Federal Energy Standards

The latest SEER mandates rendered millions of legacy HVAC systems non-compliant, opening a 15% annual replacement channel through 2027. Variable-speed motors trim residential electricity demand by up to 40%, and cold-climate heat-pump launches in late 2024 expanded viability into northern states. Utilities sweeten the economics with time-of-use tariffs that reward inverter-driven compressors, reinforcing a steady pull for IE4-grade fan and blower motors. Contractors now bundle connected controls that report real-time load profiles, feeding analytics platforms that refine sizing for future retrofits. This regulatory-enabled shift keeps North America firmly on the growth path of the electric motor market.

Volatile Neodymium Prices Pressuring Permanent-Magnet Motor Economics

Neodymium spot prices slid 42% in the past 12 months after earlier spikes, complicating BOM forecasts for traction-motor programs. EV platforms require up to 5 kg of magnet material, so price swings ripple through entire model portfolios. OEMs hedge by dual-sourcing and experimenting with magnet-reduced topologies such as ferrite-assisted synchronous motors. Parallel research on synchronous-reluctance designs offers magnet-free torque maps but demands tight air-gap machining. The uncertainty nudges procurement teams toward long-term offtake contracts, yet sustained volatility could still shave growth from the electric motor market.

Other drivers and restraints analyzed in the detailed report include:

- Surging Offshore Wind Turbine Installations Requiring High-Power Permanent-Magnet Motors in Europe

- Battery Electric Vehicle Powertrain Ramp-Up in China Catalyzing High-Efficiency Traction Motors Demand

- Supply Constraints of IGBT Modules Limiting High-Voltage Motor Production

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AC units generated 73.34% of global revenue in 2024, and their 9.4% compound growth will keep them central to the electric motor market size narrative through 2030. Induction models remain the default for conveyors, pumps, and fans, while synchronous variants proliferate where speed precision matters. Digital drives now auto-tune rotor flux to squeeze extra kilowatt-hours, making IE4 induction systems a drop-in swap for IE2 legacy fleets. On the DC side, brushless designs extend service intervals in drones and e-bikes, carving defensible niches without threatening overall AC share.

Mature tooling, abundant spare parts, and simplified installation secure AC motors' hold on brownfield retrofits, yet emerging axial-flux topologies hint at fresh competitive stakes. Servo grades feed advanced robotics, fusing feedback encoders with edge computing for millisecond-level motion control. Against this backdrop, the electric motor market continues to reward suppliers that blend scale economics with platform-ready modularity.

Fractional-horsepower units cornered 52% of 2024 shipments as smart appliances, HVAC blowers, and handheld devices multiplied. Tight packaging constraints spur emphasis on miniaturization, with halogen-free insulation films and powder-metal gears lifting thermal limits. In contrast, >500 HP machines will post an 8% CAGR, creating an outsized revenue impact despite modest volumes. Large-frame permanent-magnet motors now propel 14-MW offshore wind nacelles, while mining conveyors demand rugged TEFC housings rated for desert climates.

Integral-horsepower brackets (1-500 HP) remain the backbone of process lines, benefitting from variable-frequency drives that unlock 20-30% energy savings. As OEMs broaden their IE4 catalogs, segment crossover formats blur, blending compact stator geometries of small motors with the cooling strategies of their high-power cousins. All told, divergent growth dynamics within power classes reinforce the complexity of sizing opportunities across the electric motor market.

The Electric Motor Market Report is Segmented by Motor Type (DC Motor, AC Motor, and Others), Output Power Rating (Fractional Horsepower, and Others), Voltage (Low Voltage, Medium Voltage, and High Voltage), Application (Industrial Machinery, HVAC and Refrigeration, and Others), End-Use Industry (Residential, Commercial, and Industrial), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific led with 42.6% of 2024 revenue and will clock a 10.7% CAGR to 2030 as China maintains volume leadership and India accelerates Make-in-India initiatives. Guangdong-based motor clusters integrate end-to-end casting, winding, and drive electronics, compressing lead times for domestic EV customers. Vietnam's industrial parks lure contract manufacturers that back-source motors to regional suppliers, widening supply webs. Government incentives on high-efficiency equipment encourage swift adoption of IE4 grades across textile and semiconductor fabs.

North America holds the second-largest stake, energized by federal HVAC efficiency laws and a vibrant automation ecosystem. Predictive-maintenance retrofits in Midwest auto plants cut downtime by up to 45%, nudging continuous replacement orders. The US battery-plant build-out funnels traction-motor R&D spend into joint labs that test rotor laminations under high-speed duty cycles. Canada's on-shore wind repowering schemes shift procurement toward lighter direct-drive units, enriching the electric motor market.

Europe sustains growth on dual pillars of offshore wind and stringent Ecodesign rules. Ports on the North Sea expand nacelle staging capacity to manage 15-MW turbines outfitted with direct-drive PM generators. Manufacturers centralize service hubs in Poland and Spain to satisfy 5-year overhaul contracts. EU energy-price volatility pushes industrial users to prioritise IE4 retrofits, shortening payback horizons.

The Middle East and Africa, though smaller in absolute terms, post above-trend growth from water-desalination plants and gas booster stations. UAE EPC contracts specify explosion-proof motors with IECEx certification, creating pockets of high-margin demand. South America's industrial restarts in Brazil and Chile reignite orders for medium-voltage pump drives and sugar-mill crushers. Across all regions, regulatory convergence on efficiency keeps demand momentum intact for the electric motor market.

- ABB Ltd.

- Siemens AG

- Nidec Corporation

- Regal Rexnord Corporation

- WEG S.A.

- Toshiba Corporation

- Hitachi Ltd.

- Rockwell Automation, Inc.

- AMETEK, Inc.

- Johnson Electric Holdings Ltd.

- TECO Electric & Machinery Co., Ltd.

- Mitsubishi Electric Corporation

- Baldor Electric Company

- Brook Crompton Holdings Ltd.

- Anhui Wannan Electric Machine Co., Ltd.

- Kirloskar Electric Company Ltd.

- Hyosung Heavy Industries

- Danaher Motion (Kollmorgen)

- Yaskawa Electric Corporation

- Fuji Electric Co., Ltd.

- Robert Bosch GmbH

- Schneider Electric SE

- SEW-Eurodrive GmbH & Co. KG

- Emerson Electric Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Recent Trends & Developments

- 4.3 Market Drivers

- 4.3.1 Rapid Electrification of Manufacturing Automation in Asia?s Discrete Industries

- 4.3.2 Accelerating HVAC Adoption in US Residential Retrofits Driven by Federal Energy Standards

- 4.3.3 Surging Offshore Wind Turbine Installations Requiring High-Power Permanent-Magnet Motors in Europe

- 4.3.4 Battery Electric Vehicle Powertrain Ramp-Up in China Catalyzing High-Efficiency Traction Motors Demand

- 4.3.5 Industrial IoT-Enabled Predictive Maintenance Boosting Replacement of Aging Motors in North America

- 4.3.6 Government Mandates on MEPS Propelling IE4 & IE5 Motor Sales Globally

- 4.4 Market Restraints

- 4.4.1 Volatile Neodymium Prices Pressuring Permanent-Magnet Motor Economics

- 4.4.2 Supply Constraints of IGBT Modules Limiting High-Voltage Motor Production

- 4.4.3 Lengthy Certification Cycles for Explosion-Proof Motors in Middle-East Oil & Gas

- 4.4.4 Growing Adoption of Integrated Servo Drives Reducing Stand-Alone Motor Revenue Opportunities

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Motor Type

- 5.1.1 AC Motor (Induction (Asynchronous), Synchronous)

- 5.1.2 DC Motor (Brushed, Brushless (BLDC))

- 5.1.3 Others (Hermetic Motor, Stepper Motor)

- 5.2 By Output Power Rating

- 5.2.1 Fractional Horsepower (Below 1 HP)

- 5.2.2 Integral Horsepower (1 to 500 HP)

- 5.2.3 High-Power (Above 500 HP)

- 5.3 By Voltage

- 5.3.1 Low Voltage (Below 1 kV)

- 5.3.2 Medium Voltage (1 to 6 kV)

- 5.3.3 High Voltage (Above 6 kV)

- 5.4 By Application

- 5.4.1 Industrial Machinery

- 5.4.2 HVAC and Refrigeration

- 5.4.3 Automotive and Transportation

- 5.4.4 Residential Appliances

- 5.4.5 Utilities and Energy

- 5.4.6 Others (Agriculture, Oil and Gas, Mining)

- 5.5 By End-Use Industry

- 5.5.1 Residential

- 5.5.2 Commercial

- 5.5.3 Industrial

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Nordic Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Malaysia

- 5.6.3.6 Thailand

- 5.6.3.7 Indonesia

- 5.6.3.8 Vietnam

- 5.6.3.9 Australia

- 5.6.3.10 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Siemens AG

- 6.4.3 Nidec Corporation

- 6.4.4 Regal Rexnord Corporation

- 6.4.5 WEG S.A.

- 6.4.6 Toshiba Corporation

- 6.4.7 Hitachi Ltd.

- 6.4.8 Rockwell Automation, Inc.

- 6.4.9 AMETEK, Inc.

- 6.4.10 Johnson Electric Holdings Ltd.

- 6.4.11 TECO Electric & Machinery Co., Ltd.

- 6.4.12 Mitsubishi Electric Corporation

- 6.4.13 Baldor Electric Company

- 6.4.14 Brook Crompton Holdings Ltd.

- 6.4.15 Anhui Wannan Electric Machine Co., Ltd.

- 6.4.16 Kirloskar Electric Company Ltd.

- 6.4.17 Hyosung Heavy Industries

- 6.4.18 Danaher Motion (Kollmorgen)

- 6.4.19 Yaskawa Electric Corporation

- 6.4.20 Fuji Electric Co., Ltd.

- 6.4.21 Robert Bosch GmbH

- 6.4.22 Schneider Electric SE

- 6.4.23 SEW-Eurodrive GmbH & Co. KG

- 6.4.24 Emerson Electric Co.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment