|

市场调查报告书

商品编码

1851613

聚氨酯泡沫涂料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Spray Polyurethane Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

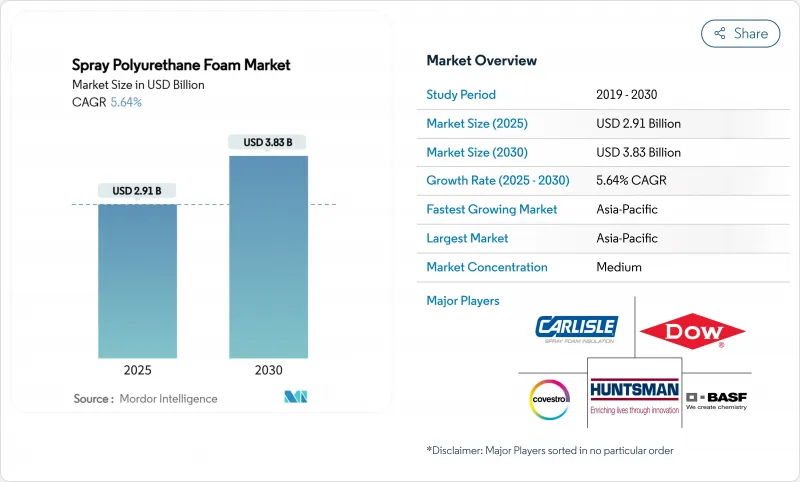

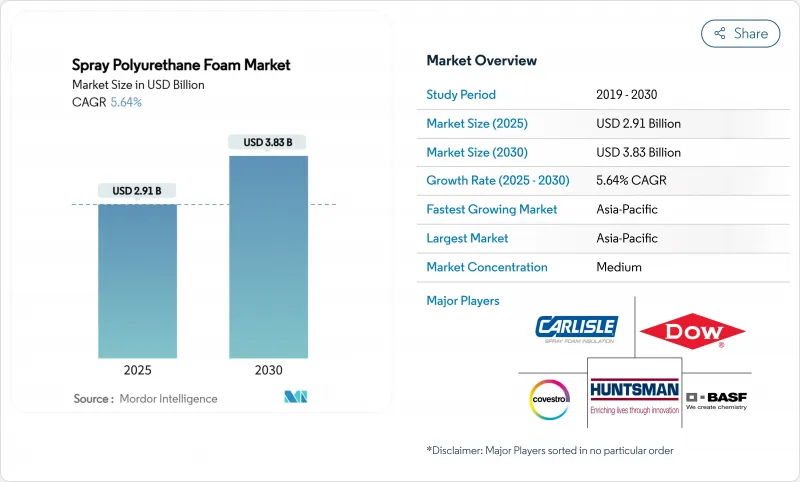

预计到 2025 年,聚氨酯泡沫涂料市场规模将达到 29.1 亿美元,到 2030 年将达到 38.3 亿美元,在预测期(2025-2030 年)内复合年增长率为 5.64%。

随着建筑节能法规的日益严格和低全球暖化潜势(GWP)强制规定的实施,低温运输投资加速,对高价值隔热材料的需求也随之增长。製造商正在以氢氟烯烃和其他新一代发泡取代高GWP的氢氟碳化合物(HFC),以符合美国环保署(EPA)于2025年1月1日生效的《技术过渡限制规则》(epa.gov)。安装商的整合、维修活动的活性化以及与环境、社会和治理(ESG)相关的资金筹措进一步推动了住宅、商业和工业计划的发展势头,而二氧化碳基多元醇的技术创新则为供应商带来了长期的永续性收益。

全球聚氨酯泡沫涂料市场趋势及洞察

严格的建筑节能规范与强制性维修

2024 年国际节能规范将封闭式喷涂泡棉指定为首选的空气屏障解决方案,迫使建筑师指定更高的 R 值和防潮性能。加州 2023 年规范和佛罗里达州 2026 年规范更新均简化了维修许可流程,降低了拆除成本,并加速了市场需求,尤其是在低坡度商业屋顶方面。这些规则的改变扩大了维修范围,鼓励使用混合隔热材料组件,并促使承包商加强培训和资本投入,以采用双组分系统。

人们越来越关注温室气体排放

企业净零排放目标正与建筑业主成本目标相融合,凸显了喷涂泡沫材料能够根据美国环保署能源之星计划,将供暖和製冷能耗降低高达10%的能力。 Installed Building Products公司报告称,自2020年以来,喷涂泡沫材料的二氧化碳排放减少了55%,同时产量也大幅增长,这表明该技术实现了增长与排放的脱钩。像Johns Manville这样的製造商,即使节能产品的产量增加,其绝对排放也实现了两位数的下降,这凸显了永续性和盈利的一致性。

玻璃纤维与纤维素之间的竞争

注重成本的房屋建筑商仍然倾向于选择玻璃纤维棉毡,这得益于其长期稳定的供应商网路和较低的设备要求。根据家庭创新研究实验室(Home Innovation Research Labs)的数据,随着多用户住宅的成长和材料成本的降低,喷涂泡棉的市场份额已从11%下降至8%,凸显了其对价格的敏感度。玻璃纤维製造商正透过提供更高密度的产品来缩小性能差距,而纤维素则利用其再生材料的品牌影响力来吸引具有环保意识的消费者。因此,喷涂泡棉供应商必须加强其在生命週期节能方面的价值通讯,以弥补较高的前期投资成本。

细分市场分析

到2024年,双组分高压喷涂系统将占据37.62%的市场份额,这主要得益于其现场混合的稳定性、卓越的R值以及在商业建筑领域获得监管部门的认可。BASF在湛江新建的异氰酸酯和TPU生产线增强了当地的供应能力,并巩固了该领域在亚太地区的领先地位。随着基础设施计划对抗震和温度变化性能的需求日益增长,半刚性喷涂泡沫正以7.19%的复合年增长率快速扩张。单组分罐装产品为小型计划提供了便利,而低压喷涂套件适用于对散热要求极高的敏感基材。

整合品牌策略的推广体现了一种竞争策略:Holcim 的 Enverge® 品牌整合了其 Gaco™ 和 SES™ 产品组合,为承包商提供屋顶、墙面和特殊泡棉材料的单一规范路径。产品多元化带来了交叉销售机会,包括适用于太阳能屋顶和桥面的半刚性创新产品,以及旨在满足防火法规要求的喷砂灌注系统。拥有丰富产品目录和区域技术中心的供应商仍然最有优势赢得规格订单。

聚氨酯泡沫涂料市场报告按产品类型(双组分高压喷涂泡沫、双组分低压喷涂泡沫、其他)、应用(隔热、防水、石棉封装、密封剂、其他)、最终用途行业(住宅、商业建筑、工业、其他)和地区(亚太地区、北美、欧洲、南美、中东和非洲)进行细分。

区域分析

预计到2024年,亚太地区将占据聚氨酯泡沫涂料市场48.19%的份额,年复合成长率达7.66%,主要得益于快速的都市化、工厂扩张以及节能规范的实施。同时,预计到2030年,印度的暖通空调(HVAC)产业规模将达到300亿美元,年复合成长率达15.8%,这将推动建筑外墙升级改造的需求。日本和韩国在地震带对建筑外墙有着严格的要求,因此更倾向于使用轻盈、高黏结性的隔热材料,例如喷涂泡沫。东南亚国协正在扩大水产品和疫苗的低温运输储存能力,从而提振了区域需求。BASF在亚太地区多年期195亿美元的投资计划,体现了供应商对该地区市场吸收能力的信心。

北美市场成熟且稳定,联邦政府逐步淘汰氢氟碳化合物(HFC)的政策统一了合规标准,并降低了规范的复杂性。加拿大寒冷的气候有利于厚层阁楼喷涂泡沫的使用,而墨西哥则凭藉近岸外包和汽车製造业的成长,已成为全球第四大聚氨酯消费国。建筑商之间的整合使得全美各地的建筑商能够在美国和加拿大实现外墙解决方案的标准化,而TopBuild不断扩展的网路也为此提供了支持。

儘管宏观经济环境疲软,但欧洲的净零排放目标和一波翻新将刺激需求。二异氰酸酯培训法规虽然会带来一些摩擦,但最终将有利于资金雄厚且拥有完善环境、健康与安全 (EHS) 体系的製造商。科思创的 DreamResource计划推出了以 20% 二氧化碳为原料的硬质泡沫,展现了欧洲在循环化学领域的领先地位。列日大学开发了一种不含异氰酸酯、以 70-90% 生物基原料製成的泡沫,凸显了区域产学合作的重要性。巴西、沙乌地阿拉伯和阿联酋率先将喷涂泡沫应用于大型商业计划,预示着未来市场规模将持续成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 严格的建筑节能法规和维修义务

- 人们越来越关注温室气体排放

- 低温运输和冷藏物流的成长

- ESG挂钩绿色债券融资辅助SPF升级

- 对适用于太阳能屋顶的高升力泡沫材料的需求

- 市场限制

- 玻璃纤维与纤维素之间的竞争

- 二异氰酸酯法规和限制

- HFO发泡剂供应波动

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 双组分高压喷涂泡沫

- 双组分低压喷涂泡沫

- 单组件形式 (OCF)

- 半硬质喷涂泡沫

- 透过使用

- 隔热材料

- 防水的

- 石棉封装

- 密封剂

- 其他应用(混凝土提升、填充空隙等)

- 按最终用途行业划分

- 住宅大楼

- 商业建筑

- 工业和基础设施

- 农业和特殊产业

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- BASF

- Accella Polyurethane Systems

- Carlisle Spray Foam Insulation

- Covestro AG

- Dow

- FOAM-LOK(Firestone)

- GACO

- Huntsman Corporation LLC

- ISOTHANE LTD

- Johns Manville

- NCFI Polyurethanes

- Rhino Linings

- SOPREMA Canada.

- SWD Urethane

第七章 市场机会与未来展望

The Spray Polyurethane Foam Market size is estimated at USD 2.91 billion in 2025, and is expected to reach USD 3.83 billion by 2030, at a CAGR of 5.64% during the forecast period (2025-2030).

This expansion occurs as building-energy codes tighten, low-GWP regulations take effect, and cold-chain investment accelerates, driving higher-value insulation demand. Manufacturers are swapping high-GWP HFCs for hydrofluoroolefin and other next-generation blowing agents to comply with the EPA's Technology Transitions Restrictions rule that began on 1 January 2025 epa.gov. Consolidation among installers, growing retrofit activity, and ESG-linked financing further reinforce momentum across residential, commercial, and industrial projects, while innovation in CO2-based polyols positions suppliers for long-term sustainability gains.

Global Spray Polyurethane Foam Market Trends and Insights

Strict Building-Energy Codes and Retrofit Mandates

The 2024 International Energy Conservation Code elevates closed-cell spray foam as a preferred air-barrier solution, compelling architects to specify higher R-values and moisture control measures. California's 2023 standards and Florida's 2026 code update both streamline retrofit approvals, lowering removal costs and accelerating demand, particularly for low-slope commercial roofs These rule changes widen the retrofit addressable base, encourage hybrid insulation assemblies, and push contractors toward more training and equipment investment that favors two-component systems.

Rising Concerns Over GHG Emissions

Corporate net-zero goals merge with building-owner cost targets, highlighting spray foam's ability to cut heating-and-cooling energy by up to 10% according to the EPA's Energy Star program. Installed Building Products reported a 55% CO2 reduction from spray foam use since 2020 while materially increasing output, showing the technology's decoupling of growth from emissions. Manufacturers such as Johns Manville logged double-digit drops in absolute emissions even as energy-saving product volumes rose, underscoring alignment between sustainability and profitability.

Competition from Fiberglass and Cellulose

Cost-focused residential builders still default to fiberglass batts, supported by long-standing installer networks and low equipment requirements. Home Innovation Research Labs data showed an 11% to 8% pullback in spray foam share amid multifamily growth and material cost saving, highlighting price sensitivity. Fiberglass makers are narrowing performance gaps with higher-density offerings, while cellulose leverages recycled content branding to appeal to eco-minded consumers. Spray foam suppliers must therefore sharpen value messaging around lifecycle energy savings to overcome higher upfront spend.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Cold-Chain and Refrigerated Logistics

- ESG-Linked Green-Bond Financing for SPF Upgrades

- Regulations and Restrictions on Di-Isocyanates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment anchored by two-component high-pressure systems held a 37.62% spray polyurethane foam market share in 2024, reflecting consistent on-site mixing, superior R-values, and code acceptance in commercial construction. BASF's new isocyanate and TPU lines in Zhanjiang strengthen local supply chains, reinforcing the segment's dominance in Asia-Pacific. Semi-rigid spray foam is expanding at a 7.19% CAGR as infrastructure projects need flexibility for vibration and temperature swings. One-component cans address small-project convenience, while low-pressure kits cover sensitive substrates where reduced exothermic heat is critical.

A push for integrated brands illustrates competitive strategy: Holcim's Enverge(R) label merges Gaco(TM) and SES(TM) portfolios, giving installers a single specification path for roof, wall, and specialty foams. Product diversification frames cross-selling opportunities, with semi-rigid innovations aimed at solar-ready roofs and bridge decks, and intumescent-infused systems targeting fire-resistance regulations. Suppliers that maintain broad catalogs and regional technical centers remain best positioned to seize specification wins.

The Spray Polyurethane Foam Market Report is Segmented by Product Type (Two-Component High-Pressure Spray Foam, Two-Component Low-Pressure Spray Foam, and More), Application (Insulation, Waterproofing, Asbestos Encapsulation, Sealant, Other Application), End-Use Industry (Residential Buildings, Commercial Buildings, Industrial and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific captured 48.19% of spray polyurethane foam market share in 2024 and is forecast to climb at 7.66% CAGR, driven by rapid urbanization, factory expansions, and energy-code adoption. China's real-estate slowdown redirects stimulus toward urban renewal, boosting retrofit insulation spend, while India's HVAC sector is set to hit USD 30 billion by 2030 on a 15.8% CAGR pathway, raising demand for building envelope upgrades. Japan and South Korea enforce stringent envelope requirements in seismic zones, favoring lightweight, high-adhesion insulation such as spray foam. ASEAN nations expand cold-chain capacity for seafood and vaccine storage, pulling regional demand upward. BASF's multi-year USD 19.5 billion Asia-Pacific investment plan exemplifies supplier confidence in the region's absorption capacity.

North America remains a mature but stable arena where federal HFC phase-outs harmonize compliance and keep specification complexity low. Canada's cold climates sustain thick-layer attic spray foam usage, while Mexico emerges as the world's fourth-largest polyurethane consumer on near-shoring momentum and automotive manufacturing growth. Consolidation among contractors enables national builders to standardize envelope solutions across the US and Canada, reinforced by TopBuild's network expansion.

Europe's net-zero directives and renovation wave stimulate demand despite tepid macro-economics. Di-isocyanate training rules introduce friction but ultimately favor well-capitalized manufacturers with robust EHS programs. Covestro's DreamResource project introduces rigid foam containing 20% CO2 as feedstock, demonstrating European leadership in circular chemistry. University of Liege advances isocyanate-free foams with 70-90% biobased content, underscoring regional academic-industry collaboration. In South America and the Middle East and Africa, energy-efficiency codes are tightening gradually; early movers in Brazil, Saudi Arabia, and the UAE adopt spray foam in commercial megaprojects, signaling future volume uplift.

- BASF

- Accella Polyurethane Systems

- Carlisle Spray Foam Insulation

- Covestro AG

- Dow

- FOAM-LOK (Firestone)

- GACO

- Huntsman Corporation LLC

- ISOTHANE LTD

- Johns Manville

- NCFI Polyurethanes

- Rhino Linings

- SOPREMA Canada.

- SWD Urethane

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strict Building-Energy Codes and Retrofit Mandates

- 4.2.2 Rising Concerns over GHG Emissions

- 4.2.3 Growth in Cold-Chain and Refrigerated Logistics

- 4.2.4 ESG-linked green bond financing for SPF upgrades

- 4.2.5 High-lift Foam Demand for Solar-Ready Roofs

- 4.3 Market Restraints

- 4.3.1 Competition from Fiberglass and Cellulose

- 4.3.2 Regulations and Restrictions on Di-isocyanates

- 4.3.3 HFO Blowing-agent Supply Volatility

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Two-Component High-Pressure Spray Foam

- 5.1.2 Two-Component Low-Pressure Spray Foam

- 5.1.3 One-Component Foam (OCF)

- 5.1.4 Semi-Rigid Spray Foam

- 5.2 By Application

- 5.2.1 Insulation

- 5.2.2 Waterproofing

- 5.2.3 Asbestos Encapsulation

- 5.2.4 Sealant

- 5.2.5 Other Application (Concrete Lifting / Void Filling, etc.)

- 5.3 By End-use Industry

- 5.3.1 Residential Buildings

- 5.3.2 Commercial Buildings

- 5.3.3 Industrial and Infrastructure

- 5.3.4 Agriculture and Specialty

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Accella Polyurethane Systems

- 6.4.3 Carlisle Spray Foam Insulation

- 6.4.4 Covestro AG

- 6.4.5 Dow

- 6.4.6 FOAM-LOK (Firestone)

- 6.4.7 GACO

- 6.4.8 Huntsman Corporation LLC

- 6.4.9 ISOTHANE LTD

- 6.4.10 Johns Manville

- 6.4.11 NCFI Polyurethanes

- 6.4.12 Rhino Linings

- 6.4.13 SOPREMA Canada.

- 6.4.14 SWD Urethane

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment