|

市场调查报告书

商品编码

1851623

中国电动车市场:市场份额分析、行业趋势、统计数据和成长预测(2025-2030)China Electric Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

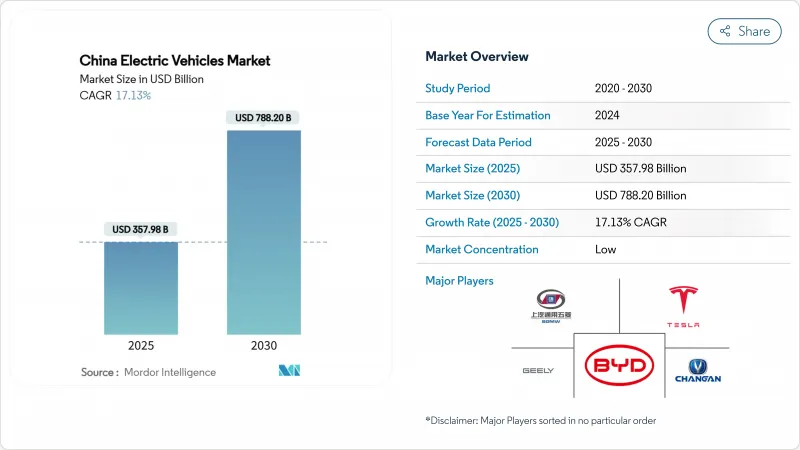

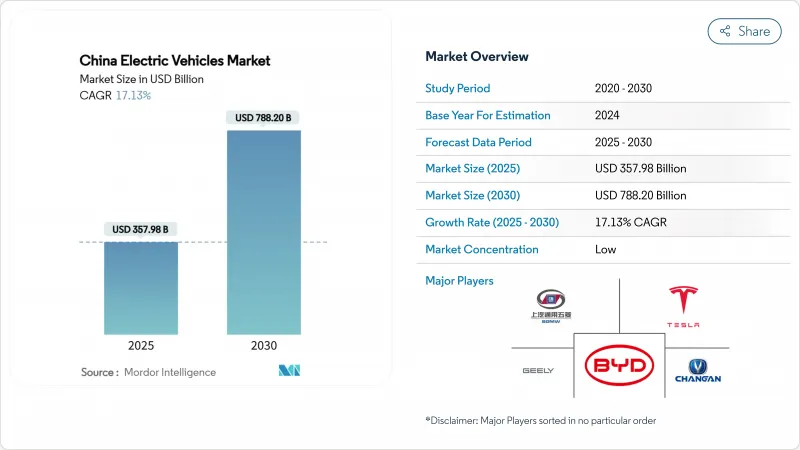

预计到 2025 年,中国电动车市场规模将达到 3,579.8 亿美元,到 2030 年将达到 7,882 亿美元,在预测期(2025-2030 年)内,复合年增长率将达到 17.13%。

电池成本趋于稳定、充电和换电服务在全国普及,以及插电式混合动力汽车在二、三线城市的强劲成长势头,将推动销售成长。汽车製造商也在加速垂直整合和电池化学技术创新,以在价格竞争日益激烈的环境下确保利润空间。基础设施投资和具有成本竞争力的磷酸铁锂电池将帮助中国电动车市场进一步渗透对价格敏感的农村市场。

中国电动车市场趋势与洞察

新能源车购置免税政策延长至2027年

每辆车1,390美元至4,175美元的税收减免政策,有助于缓解后补贴时代的过渡期压力,并维持入门车型的价格竞争力。二、三线客户对这些优惠政策反应热烈,预计2024年新能源汽车销售的三分之一将受惠于税收减免和以旧换新奖励。政策的可预测性使汽车製造商能够更好地规划产能扩张和中期改款,尤其是对于中型跨界车而言,这类车型是中国电动车销售的主要驱动力。

兴建全国快速充电和换电走廊

宁德时代和中石化正在兴建500座换电站,换电站换电时间仅需两分钟。目前高速公路已覆盖60%的服务区域,但57%的充电桩集中在15个城市,这意味着西部省份仍有发展空间。这种双轨制的基础设施策略既满足了通勤者的需求,也保障了车辆的执行时间,从而增强了人们对中国电动车市场的信心。

中央补贴逐步取消延缓了升级週期

2022年12月补贴政策的结束导致购车优惠减少了1,670-2,780元人民币,让中阶轿车的价格更加敏感。汽车製造商采取了返利和区域性以旧换新计划等应对措施,但这仍然导致更换週期延长。随着电池投入成本的下降,对直接补贴的依赖将会降低,预计中国电动车市场的自然更换节奏将逐渐恢復正常。

细分市场分析

到2024年,电池式电动车将引领中国电动车市场,占当年出货量的58.36%。然而,插电式混合动力汽车预计到2030年将以21.47%的复合年增长率成长,随着内陆地区基础设施的日益完善,两者之间的差距将逐渐缩小。双燃料的灵活性使得插电式混合动力汽车成为充电设施稀少地区车主的首选过渡方案。

纯电动车成本的持续下降将使全电动车型在小型车和出租车车队中保持吸引力,而插电式混合动力汽车在家用SUV和农村轿车中的增长将使动力传动系统组合多样化,促使製造商在不同的架构之间进行对冲,而固态电池计划则瞄准了2030年以后高端纯电动汽车的浪潮。

到2024年,乘用车将占中国电动车市场份额的88.25%,而轻型商用车的复合年增长率为18.71%。市政零排放配额、枢纽辐射式物流以及电池更换的经济效益,使得电动轻型商用车成为可靠的车队资产。

SUV市场将以15.21%的复合年增长率成长,这主要得益于消费者对宽敞内部空间的需求,以及公车业者在区域低排放气体法规的推动下更新其柴油车队。商业性应用的普及将进一步推高电池需求,并扩大中国电动车市场规模,使其不再局限于个人出行领域。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场驱动因素

- 新能源车购置免税期延长至2027年

- 全国快速充电与电池更换走廊建设计画

- 插电式混合动力车在二、三线城市销量激增,凸显其燃油经济性

- 市政电子货运配额提振了对电动轻型商用车的需求

- V2G 试收费系统可实现车网互动收入流

- 与采用磷酸铁锂电池主导的小型内燃机汽车成本持平

- 市场限制

- 中央补贴逐步取消延缓了升级週期

- 碳酸锂价格波动和出口限制

- 各州对低使用率公共充电桩的数量设定上限

- 新能源汽车品质问题日益增多(JD Power IQS 调查)正在削弱消费者忠诚度。

- 价值/供应链分析

- 监管环境

- 技术展望

- 电池化学发展趋势

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按传动系统类型

- 电池电动车

- 插电式混合动力电动车

- 燃料电池电动车

- 按车辆类型

- 搭乘用车

- 掀背车

- 轿车

- SUV

- MPV

- 商用车辆

- 轻型商用车

- 公车和长途客车

- 中型和大型卡车

- 搭乘用车

- 电池化学

- LFP

- NCM/NMC

- NCA

- 其他的

- 按价格分布

- 不到1万美元

- 10,000 美元至 20,000 美元

- 20,000美元至30,000美元

- 30,000 美元至 50,000 美元

- 超过5万美元

第六章 竞争情势

- 策略趋势

- 市占率分析

- 公司简介

- BYD Company Ltd

- SAIC-GM-Wuling

- Tesla Inc.

- Geely Auto Group

- Changan Automobile

- Great Wall Motors

- BAIC Motor Corp.

- SAIC Motor Corp. Ltd.

- Dongfeng Motor Corp.

- FAW Group

- GAC Aion

- NIO Inc.

- Xpeng Motors

- Li Auto

- Leapmotor

- Hozon Auto(Neta)

- Zeekr Intelligent Tech.

- Seres Group

- Jiangling Motors Corp.

- JAC Motors

- Chery Automobile

第七章 市场机会与未来展望

The China Electric Vehicles Market size is estimated at USD 357.98 billion in 2025, and is expected to reach USD 788.20 billion by 2030, at a CAGR of 17.13% during the forecast period (2025-2030).

Battery cost parity, a nationwide charging and battery-swap build-out, and tier-2/3 city PHEV momentum reinforce volume expansion. Automakers are also accelerating vertical integration and battery chemistry innovation to secure falling margins amid price wars. Infrastructure investment and cost-competitive LFP batteries position the Chinese electric vehicle market for further penetration into price-sensitive rural segments.

China Electric Vehicles Market Trends and Insights

Extended NEV Purchase-Tax Exemptions to 2027

Tax-free status worth USD 1,390-4,175 per vehicle cushions the post-subsidy transition and keeps entry-level pricing competitive. Tier-2/3 customers react strongly to this saving, and one-third of 2024 NEV sales leveraged the exemption plus trade-in incentives. Predictable policy horizons let automakers schedule capacity ramps and mid-cycle refreshes, particularly for mid-market crossovers driving the volume of China's electric vehicles.

Nationwide Fast-Charging & Battery-Swap Corridor Build-Out

Public charging points rose drastically over the past few years, while CATL and Sinopec are placing 500 battery-swap stations capable of two-minute exchanges. Highway coverage now spans 60% of service areas, and 57% of chargers remain clustered within 15 cities, signalling headroom in western provinces. The twin-track infrastructure strategy addresses commuter top-up needs and fleet uptime demands, underpinning confidence in the Chinese electric vehicle market.

Phase-Out of Central Subsidies Slowing Upgrade Cycles

The December 2022 subsidy sunset trimmed purchase incentives by RMB 1,670-2,780, elevating price sensitivity in mid-market sedans. Automakers countered with rebates and regional trade-in schemes, yet replacement intervals lengthened. As battery input costs drop, reliance on direct subsidies is expected to fade, restoring natural replacement rhythms within the Chinese electric vehicle market.

Other drivers and restraints analyzed in the detailed report include:

- PHEV Surge in Tier-2/3 Cities on Fuel-Savings Appeal

- Municipal E-Freight Quotas Boosting Electric LCV Demand

- Lithium-Carbonate Price & Export-Control Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery electric vehicles led 2024 deliveries with a 58.36% share, anchoring the China electric vehicle market size for that year. Plug-in hybrids, however, are forecast to post a 21.47% CAGR to 2030, narrowing the gap as infrastructure diffuses inland. Dual-fuel flexibility makes PHEVs the preferred bridge tech for drivers facing sparse chargers.

Continued BEV cost erosion keeps fully electric models appealing in subcompacts and taxi fleets, yet PHEV growth in family SUVs and rural sedans diversifies the powertrain mix. Manufacturers, therefore, hedge across architectures, while solid-state programs target the post-2030 premium BEV wave.

Passenger cars captured 88.25% of China's electric vehicle market share in 2024, but light commercial vans are rising on an 18.71% CAGR trajectory. Municipal zero-emission quotas, hub-and-spoke logistics, and battery-swap economics make electric LCVs a reliable fleet asset.

SUVs show 15.21% CAGR as consumers trade up for cabin space, and bus operators refresh diesel fleets under local low-emission mandates. Commercial adoption reinforces battery demand curves and broadens China's electric vehicle market size beyond private mobility.

The China Electric Vehicle Market Report is Segmented by Drivetrain Type (Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, and More), Vehicle Type (Passenger Cars [Hatchback and More] and Commercial Vehicles [Light Commercial Vehicles and More]), Battery Chemistry (LFP, NCM/NMC, and More), and Price Band (Less Than USD 10, 000 and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- BYD Company Ltd

- SAIC-GM-Wuling

- Tesla Inc.

- Geely Auto Group

- Changan Automobile

- Great Wall Motors

- BAIC Motor Corp.

- SAIC Motor Corp. Ltd.

- Dongfeng Motor Corp.

- FAW Group

- GAC Aion

- NIO Inc.

- Xpeng Motors

- Li Auto

- Leapmotor

- Hozon Auto (Neta)

- Zeekr Intelligent Tech.

- Seres Group

- Jiangling Motors Corp.

- JAC Motors

- Chery Automobile

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Extended NEV Purchase-Tax Exemptions to 2027

- 4.1.2 Nationwide Fast-Charging & Battery-Swap Corridor Build-Out

- 4.1.3 PHEV Surge in Tier-2/3 Cities on Fuel-Savings Appeal

- 4.1.4 Municipal E-Freight Quotas Boosting Electric LCV Demand

- 4.1.5 V2G Pilot Tariffs Enabling Vehicle-Grid Revenue Streams

- 4.1.6 LFP-Driven Cost Parity With Sub-Compact ICE Cars

- 4.2 Market Restraints

- 4.2.1 Phase-Out of Central Subsidies Slowing Upgrade Cycles

- 4.2.2 Lithium-Carbonate Price & Export-Control Volatility

- 4.2.3 Provincial Caps on Low-Utilisation Public Chargers

- 4.2.4 Rising NEV Quality Issues (JD Power IQS) Denting Loyalty

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Battery-Chemistry Trends

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Drivetrain Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Plug-in Hybrid Electric Vehicles

- 5.1.3 Fuel-cell Electric Vehicles

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.1.1 Hatchback

- 5.2.1.2 Sedan

- 5.2.1.3 SUV

- 5.2.1.4 MPV

- 5.2.2 Commercial Vehicles

- 5.2.2.1 Light Commercial Vehicles

- 5.2.2.2 Buses & Coaches

- 5.2.2.3 Medium & Heavy Trucks

- 5.2.1 Passenger Cars

- 5.3 By Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCM/NMC

- 5.3.3 NCA

- 5.3.4 Others

- 5.4 By Price Band

- 5.4.1 Less than USD 10,000

- 5.4.2 USD 10,000 - 20,000

- 5.4.3 USD 20,000 - 30,000

- 5.4.4 USD 30,000 - 50,000

- 5.4.5 Over USD 50,000

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 BYD Company Ltd

- 6.3.2 SAIC-GM-Wuling

- 6.3.3 Tesla Inc.

- 6.3.4 Geely Auto Group

- 6.3.5 Changan Automobile

- 6.3.6 Great Wall Motors

- 6.3.7 BAIC Motor Corp.

- 6.3.8 SAIC Motor Corp. Ltd.

- 6.3.9 Dongfeng Motor Corp.

- 6.3.10 FAW Group

- 6.3.11 GAC Aion

- 6.3.12 NIO Inc.

- 6.3.13 Xpeng Motors

- 6.3.14 Li Auto

- 6.3.15 Leapmotor

- 6.3.16 Hozon Auto (Neta)

- 6.3.17 Zeekr Intelligent Tech.

- 6.3.18 Seres Group

- 6.3.19 Jiangling Motors Corp.

- 6.3.20 JAC Motors

- 6.3.21 Chery Automobile

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment