|

市场调查报告书

商品编码

1851628

防弹复合材料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Ballistic Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

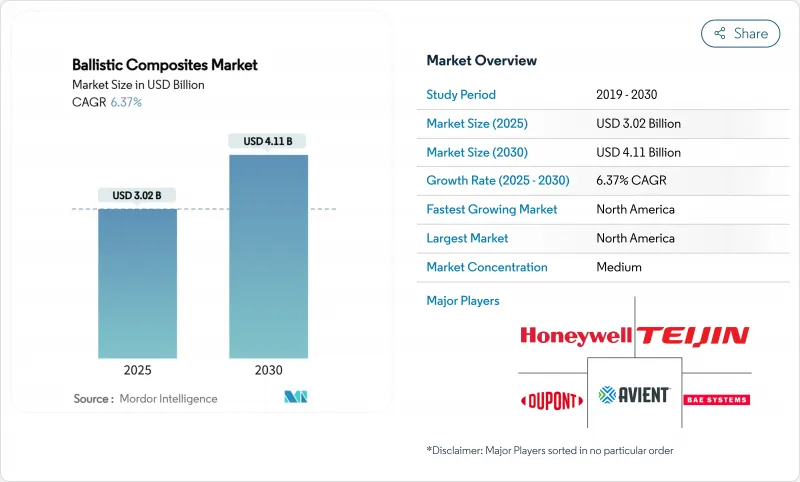

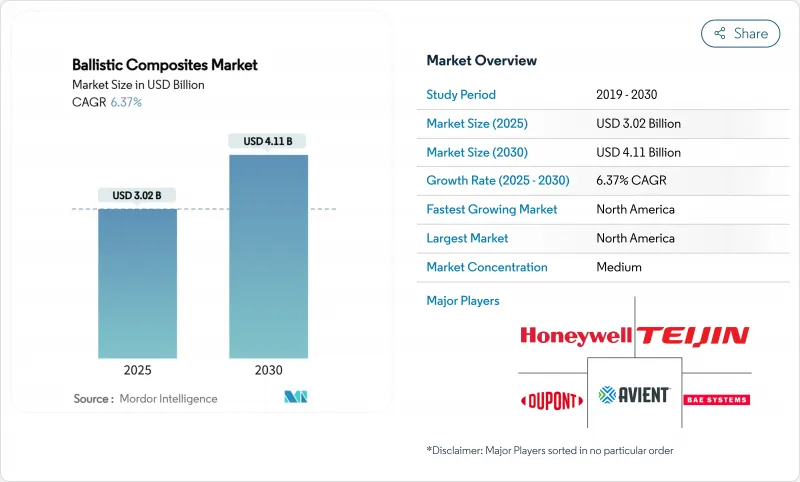

预计到 2025 年,弹道复合材料市场规模将达到 30.2 亿美元,到 2030 年将达到 41.1 亿美元,预测期(2025-2030 年)的复合年增长率为 6.37%。

国防现代化、自动驾驶车辆防护以及航太领域在不牺牲机组人员安全的前提下持续降低机身重量的努力,将推动市场稳定成长。需求成长将主要集中在轻质高强度层压结构、混合纤维积层法的广泛应用以及先进复合材料模具从航太供应链向装甲生产线的转移。酰胺纤维是目前大多数装甲解决方案的增强材料,而聚合物基体则使製造商能够在多次打击性能和加工灵活性之间取得平衡。北美凭藉美国高预算的士兵现代化计划以及依赖精密装甲结构的下一代汽车平臺,保持领先地位。同时,随着大规模步兵部队个人防护工具采购的加速,亚太地区也日益受到重视。杜邦公司推出的克维拉EXO等新技术,其抗拉强度比标准芳香聚酰胺高出30%,展现了弹道复合材料市场创新步伐的加快。

全球弹道复合材料市场趋势与洞察

增加全球国防费用

主要国家不断增长的国防支出正从根本上改变防弹复合材料的需求模式,采购重点转向防护重量比更高的先进材料。美国的地面X车辆技术专案便是这一趋势的典型例证,该专案旨在透过创新的复合装甲系统而非传统的钢板,在保持生存能力的同时,将重量减轻50%。这项战略转变反映出军事规划者认识到,未来的作战效能将取决于机动性和灵活性,而非被动装甲的厚度。在亚洲国防市场,类似的现代化进程也在进行中,例如印度等国正在将先进的防弹头盔纳入标准步兵装备,MKU有限公司已于2025年向印度陆军交付了Kavro Doma 360头盔。采购转向复合材料将带来持续的需求成长,超越了传统的周期性国防费用模式。

推动航太和国防平台减重

航太和国防製造商正积极推行轻量化策略,将抗弹复合材料定位为提升下一代平台性能的关键因素。碳纤维复合材料在飞弹应用中已展现出比铝合金轻40-50%的减重效果,从而延长了射程并负载容量,直接转化为战术性优势。这一趋势也延伸至低温高超音速系统。 2025年, 座舱罩 Aerospace公司赢得了美国一份价值280万美元的合同,为其提供可重复使用的隔热瓦,以承受再入大气层时的弹道衝击。隔热和弹道性能要求的交叉融合为抗弹复合材料市场开闢了新的成长点。

高昂的加工和认证成本

防弹复合材料产业面临许多挑战,复杂的加工要求和繁琐的认证通讯协定显着增加了製造成本和市场进入门槛。将于2024年生效的NIJ 0101.07标准引入了更严格的防弹衣测试方法,要求製造商投资先进的测试设备并延长认证週期。诸如STANAG 4569之类的军用标准进一步增加了复杂性,其多角度、多速度的射击测试方法只有少数实验室能够提供。对可控气氛热压、纤维张力钻机和电脑控制的铺展成型生产线的投资推高了准入门槛,使防弹复合材料市场的现有企业占据优势。

细分市场分析

预计到2024年,酰胺纤维将占弹道复合材料市场43.69%的份额,复合年增长率达6.40%。最新的克维拉EXO纤维在保持阻燃性的同时,抗拉强度提高了30%,从而能够製造更薄的装甲板,并提升士兵的机动性。超高分子量聚乙烯(UHMWPE)正在缩小与芳纶纤维的差距,吸引那些优先考虑轻量化和防潮性能的客户。对于经常暴露在高温环境下的车辆装甲而言,S玻璃纤维仍然占据主导地位。随着研究机构展现出动态强度超过14 GPa的奈米碳管纱线,市场竞争日益激烈。

芳香聚酰胺供应商正透过改进表面处理技术来增强基体黏合力,并与织物製造商合作,以实现多轴积层法,从而应对多重衝击场景,以此巩固自身市场地位。超高分子量聚乙烯(UHMWPE)製造商正在亚洲扩大产能,以稳定前置作业时间和降低成本。混合酰胺纤维、UHMWPE和碳纤维的复合材料层压板兼具拉伸强度、抗分层性和耐热性。生物基纤维倡议虽然仍处于小众市场,但正吸引着注重永续性目标的国防机构,并为弹道复合材料市场的长期多元化发展指明了方向。

区域分析

北美将在2024年以43.16%的市占率引领弹道复合材料市场,预计到2030年将以6.51%的复合年增长率成长。未来远程突击飞机专案正在为贝尔V-280「英勇」飞机配备Entegris复合材料装甲,这清楚地表明了市场对该产品持续的需求。强大的联邦国防预算、稳健的供应链以及大学支持的测试基础设施,都为该地区的领先地位提供了支撑。

亚太地区是北美以外成长最快的地区。中国、印度、日本和韩国都在投资研发更轻的个人防护装备和国产车装甲。印度的轻型战车计画指定使用复合材料附加套件来减轻车辆重量,这反映出其正在逐步抛弃全钢车体设计。韩国正在将纤维金属层压板整合到其K2「黑豹」坦克中,以提高其防雷性能而不减轻重量。

在欧洲,由于安全情势日益严峻,国防预算受到限制。国际装甲集团等製造商正在保加利亚扩建车辆工厂,以缩短北约合约的前置作业时间。德国已开始测试配备主动防护系统和模组化复合裙板的豹2 ARC 3.0坦克。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 增加全球国防费用

- 推动航太和国防平台减重

- 新兴国家的快速士兵现代化计划

- 研发一种防弹地形机动车辆

- 对自主地面车辆多打击混合装甲的需求日益增长

- 市场限制

- 高昂的加工和品质成本

- 挥发性芳香聚酰胺和超高分子量聚乙烯(UHMWPE)前驱物的供应

- 与全氟烷基和多氟烷基物质 (PFAS) 相关的芳香聚酰胺涂料环境法规

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依纤维类型

- 芳香聚酰胺

- 超高分子量聚乙烯(UHMWPE)

- S-玻璃

- 其他纤维类型(例如,碳纤维、生物基纤维和天然纤维混合物)

- 按矩阵类型

- 聚合物

- 聚合物/陶瓷

- 金属

- 透过使用

- 装甲车

- 防弹衣

- 头盔和脸部防护

- 其他用途(飞机和船舶防护、高性能运动器材等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Atomic-6, Inc.

- Avient Corporation

- BAE Systems

- Barrday Inc.

- CoorsTek Inc.

- DuPont

- Gurit Services AG, Zurich

- Hardwire LLC

- Hexcel Corporation

- Honeywell International Inc.

- Integris

- MKU Limited

- Morgan Advanced Materials

- Plastic Reinforcement Fabrics Ltd

- Point Blank Enterprises, Inc.

- Rheinmetall AG

- Roihu Inc.

- Safariland,LLC

- Southern States, llc

- TEIJIN LIMITED

第七章 市场机会与未来展望

The Ballistic Composites Market size is estimated at USD 3.02 billion in 2025, and is expected to reach USD 4.11 billion by 2030, at a CAGR of 6.37% during the forecast period (2025-2030).

Steady gains come from defense modernization, autonomous vehicle shielding, and the aerospace sector's persistent drive to trim airframe mass without sacrificing crew safety. Demand growth concentrates on lighter yet tougher laminate configurations, wider adoption of hybrid fiber lay-ups, and the migration of advanced composite tooling from the aerospace supply chain into armor production lines. Aramid fibers reinforce much of today's armor solutions, while polymer matrices enable manufacturers to balance multi-hit performance with processing flexibility. North America retains its pole position thanks to the United States Army's high-budget soldier modernisation programs and next-generation vehicle platforms that rely on sophisticated armor architectures. Meanwhile, Asia-Pacific commands attention with accelerated procurement of personal protection gear for large infantry forces. Technology launches such as DuPont's Kevlar EXO, which delivers 30% higher tensile strength than standard aramid, showcase the innovation pace that underpins the ballistic composites market.

Global Ballistic Composites Market Trends and Insights

Rise in Global Defence Expenditure

Defense spending escalation across major economies fundamentally reshapes ballistic composites demand patterns, shifting procurement priorities toward advanced materials that deliver superior protection-to-weight ratios. The United States Army's Ground X-Vehicle Technologies program exemplifies this trend, targeting 50% weight reduction while maintaining survivability through innovative composite armor systems rather than traditional steel plating. This strategic pivot reflects military planners' recognition that future combat effectiveness depends on mobility and agility rather than passive armor thickness. Asian defense markets are experiencing parallel modernization drives, with countries like India integrating advanced ballistic helmets into standard infantry equipment, as demonstrated by MKU Limited's delivery of Kavro Doma 360 helmets to the Indian Army in 2025. The procurement shift toward composite materials creates sustained demand growth that transcends traditional cyclical defense spending patterns.

Lightweighting Push in Aerospace and Defence Platforms

Aerospace and defense manufacturers are pursuing aggressive weight reduction strategies that position ballistic composites as critical enablers of next-generation platform performance. Carbon fiber composites in missile applications demonstrate 40-50% weight reductions compared to aluminum alternatives, enabling extended operational ranges and enhanced payload capacities that directly translate to tactical advantages . The trend extends to extreme-temperature hypersonic systems. In 2025, Canopy Aerospace secured a USD 2.8 million U.S. Air Force contract for reusable thermal-protection tiles that withstand ballistic impact during re-entry. Cross-pollination of thermal and ballistic requirements gives the ballistic composites market new growth vectors.

High Processing and Qualification Costs

The ballistic composites industry faces substantial barriers from complex processing requirements and extensive qualification protocols that significantly inflate production costs and market entry thresholds. NIJ Standard 0101.07, implemented in 2024, introduces more rigorous testing methodologies for ballistic-resistant body armor, requiring manufacturers to invest in advanced testing facilities and extended qualification timelines . Military standards such as STANAG 4569 add further complexity with multi-angle, multi-velocity shot matrices that only a handful of laboratories can deliver. Investment in controlled-atmosphere hot presses, fibre tension rigs, and computerised drape forming lines inflates entry costs, favouring incumbents within the ballistic composites market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Soldier-Modernisation Programmes in Emerging Economies

- Development of Terrain Motor Vehicles With Ballistic Protection

- Volatile Aramid and Ultra-high Molecular Weight Polyethylene (UHMWPE) Precursor Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aramid fibre held 43.69% share of ballistic composites market size in 2024 and is forecast to expand at a 6.40% CAGR. The latest Kevlar EXO fibre improves tensile strength by 30% while maintaining flame resistance, enabling thinner armour panels and improved soldier mobility. UHMWPE is narrowing the gap, appealing to customers that prioritise weight reduction and moisture resistance. S-glass remains prominent in vehicular armour where high-temperature exposure is common. Competitive tension is intensifying as research laboratories demonstrate carbon-nanotube yarns with dynamic strength above 14 GPa, a level that could redefine the ballistic composites market.

Aramid suppliers defend their position through improved surface treatments that enhance matrix adhesion and through partnerships with fabric weavers that can tailor multiaxial lay-ups for multi-hit scenarios. UHMWPE producers are expanding capacity in Asia to stabilise lead times and costs. Hybrid laminates that blend aramid, UHMWPE, and carbon fibres balance tensile strength, delamination resistance, and thermal robustness. Bio-based fibre initiatives, though still niche, attract defence agencies focused on sustainability targets, signalling the long-term diversification path within the ballistic composites market.

The Ballistic Composites Market Report is Segmented by Fiber Type (Aramids, Ultra-High Molecular Weight Polyethylene, and More), Matrix Type (Polymer, Polymer-Ceramic, and Metal), Application (Vehicle Armor, Body Armor, Helmet and Face Protection, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the ballistic composites market with 43.16% revenue share in 2024 and is expected to grow at a 6.51% CAGR through 2030. The Future Long-Range Assault Aircraft program relies on Integris Composites armour fitted into the Bell V-280 Valor airframe, a clear sign of sustained demand. Robust federal defense budgets, resilient supply chains, and university-backed testing infrastructure underpin regional dominance.

Asia-Pacific is the fastest-scaling region outside North America. China, India, Japan, and South Korea invest in lighter individual protection equipment and domestically produced vehicle armour. India's Light Combat Vehicle program specifies composite applique kits to reduce curb weight, reflecting a shift from steel-only hulls. South Korea integrates fibre-metal laminates in K2 Black Panther tanks to improve mine resistance without weight penalties.

Europe revives timid defence budgets amid heightened security concerns. Manufacturers such as International Armored Group operate an expanded vehicle plant in Bulgaria, ensuring shorter lead times for NATO contracts. Germany tests the Leopard 2 ARC 3.0 with an active protection suite and modular composite skirts, pushing demand for interchangeable composite modules across allied fleets.

- Atomic-6, Inc.

- Avient Corporation

- BAE Systems

- Barrday Inc.

- CoorsTek Inc.

- DuPont

- Gurit Services AG, Zurich

- Hardwire LLC

- Hexcel Corporation

- Honeywell International Inc.

- Integris

- MKU Limited

- Morgan Advanced Materials

- Plastic Reinforcement Fabrics Ltd

- Point Blank Enterprises, Inc.

- Rheinmetall AG

- Roihu Inc.

- Safariland,LLC

- Southern States, llc

- TEIJIN LIMITED

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Global Defence Expenditure

- 4.2.2 Lightweighting Push in Aerospace and Defence Platforms

- 4.2.3 Rapid Soldier-modernisation Programmes in Emerging Economies

- 4.2.4 Development of Terrain Motor Vehicles With Ballistic Protection

- 4.2.5 Growing Demand for Multi-hit Hybrid Armour for Autonomous Ground Vehicles

- 4.3 Market Restraints

- 4.3.1 High Processing and Qualification Costs

- 4.3.2 Volatile Aramid and Ultra-high Molecular Weight Polyethylene (UHMWPE) Precursor Supply

- 4.3.3 Perfluoroalkyl and Polyfluoroalkyl Substances (PFAS)-related Environmental Regulations on Aramid Finishing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Fiber Type

- 5.1.1 Aramids

- 5.1.2 Ultra-High Molecular Weight Polyethylene (UHMWPE)

- 5.1.3 S-glass

- 5.1.4 Other Fiber Types (Carbon Fiber, Bio-based and Natural Fiber Hybrids, etc.)

- 5.2 By Matrix Type

- 5.2.1 Polymer

- 5.2.2 Polymer-Ceramic

- 5.2.3 Metal

- 5.3 By Application

- 5.3.1 Vehicle Armor

- 5.3.2 Body Armor

- 5.3.3 Helmet and Face Protection

- 5.3.4 Other Applications (Aircraft and Marine Protection, High-performance Sporting Goods, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Atomic-6, Inc.

- 6.4.2 Avient Corporation

- 6.4.3 BAE Systems

- 6.4.4 Barrday Inc.

- 6.4.5 CoorsTek Inc.

- 6.4.6 DuPont

- 6.4.7 Gurit Services AG, Zurich

- 6.4.8 Hardwire LLC

- 6.4.9 Hexcel Corporation

- 6.4.10 Honeywell International Inc.

- 6.4.11 Integris

- 6.4.12 MKU Limited

- 6.4.13 Morgan Advanced Materials

- 6.4.14 Plastic Reinforcement Fabrics Ltd

- 6.4.15 Point Blank Enterprises, Inc.

- 6.4.16 Rheinmetall AG

- 6.4.17 Roihu Inc.

- 6.4.18 Safariland,LLC

- 6.4.19 Southern States, llc

- 6.4.20 TEIJIN LIMITED

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Development of Bio-Based Ballistic Fibers

![防弹复合材料市场:趋势、机会与竞争分析 [2024-2030]](/sample/img/cover/42/default_cover_5.png)