|

市场调查报告书

商品编码

1851630

粉末冶金:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Powder Metallurgy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

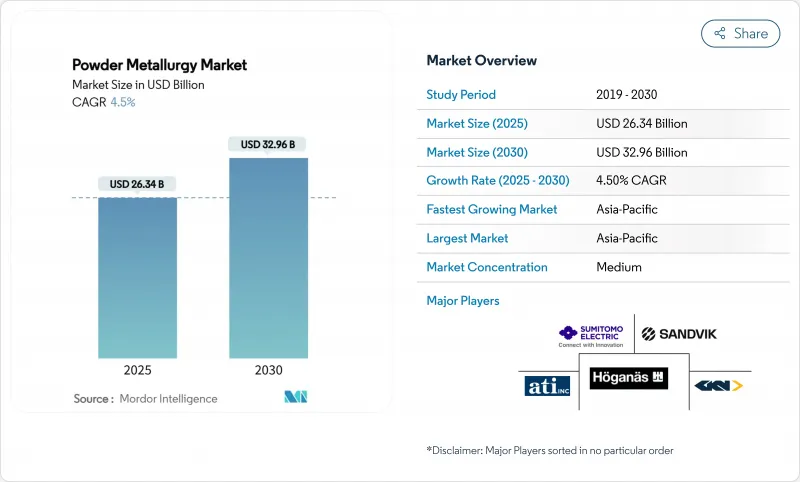

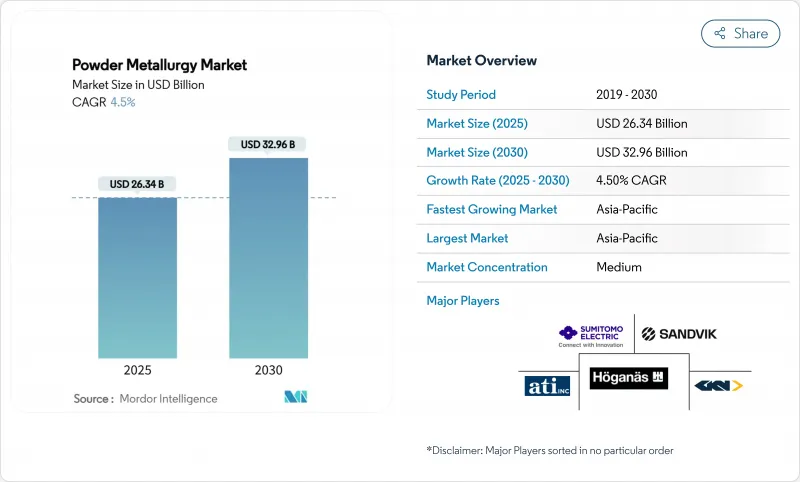

预计到 2025 年,粉末冶金市场规模将达到 263.4 亿美元,到 2030 年将达到 329.6 亿美元,预测期(2025-2030 年)复合年增长率为 4.5%。

推动成长的因素包括交通运输电气化、对复杂轻量化零件的需求,以及在医疗、航太和国防供应链中的稳定渗透。亚太地区占最大份额,随着各国政府加强该地区的材料生态系统,持续吸引新的产能。同时,北美和欧洲的製造商正将重心转向高价值、小批量应用,以弥补传统汽车生产成长放缓的影响。随着积层製造工艺削弱压制烧结製程的主导地位,竞争日益激烈;特种合金供应商则瞄准电动车动力传动系统、航太和整形外科的客户,推出旨在提高效率和永续性的粉末材料。

全球粉末冶金市场趋势与洞察

粉末冶金技术在轻量化电动动力传动系统零件领域日益受到青睐

北美汽车製造商正在重新设计电动动力传动系统,采用粉末冶金马达铁芯、齿轮和热感板,以减少废弃物并缩短加工週期。 GKN粉末冶金公司报告称,2023年订单中有72%为非驱动零件,凸显了其向电气化平台策略的转型。供应商也在投资局部的电池级粉末。软磁复合复合材料可将铁芯损耗降低高达20%,直接提高电动驱动系统的设计效率。随着汽车製造商追求动力总成减重,粉末冶金市场正在抢占曾经由铸造或锻造材料主导的市场。钢基电动驱动粉末的标准化进一步简化了认证流程,并降低了二线供应商的进入门槛。

航太领域对近净成形积层製造零件的需求激增

欧洲引擎和机身供应商正在增加粉末增材製造的消费量,以缩短前置作业时间并减少材料消耗。柯林斯太空公司安装了两台12雷射NXG XII 600设备,将涡轮零件的交付週期从52週缩短至8週。废品率从50%降低到90%以上,提高了存货周转和碳排放强度,使粉末冶金工艺能够与精密铸造工艺相媲美。 SLM Solutions公司专门的适航性框架有助于协调程式参数和合金可追溯性,从而缓解认证瓶颈。随着粉末冶金市场在飞行关键硬体领域占据越来越重要的地位,欧洲服务机构正在扩大镍基高温合金的产能,并开始向用于下一代航空发动机的γ钛粉末领域拓展业务。航太领域对近净成形增材製造零件的需求激增。

高纯度金属粉末价格波动

中国于2025年初对钨、碲、铋、钼和铟实施出口限制,导致现货价格飙升,并给工具钢、温度控管和磁性粉末的分配带来风险。各国政府已推出战略蕴藏量立法予以应对,但新矿和提炼的计划限制了短期缓解措施。买家正在延长合约期限并明确回收流程,但二次供应无法完全抵消地缘政治动盪的影响。在新的矿山产能运作或贸易政策稳定之前,粉末冶金市场将面临短期利润率压力。由于替代品有限,高能耗的超细粉末尤其脆弱。

细分市场分析

2024年,钢材粉末冶金市场占有率占比达79%,预计到2030年将以4.62%的复合年增长率成长。完善的压制和烧结基础设施使大批量生产商能够实现密度超过7.4 g/cm³的产品,从而缩小了与锻钢在机械性能上的差距。同时,先进的烧结硬化配方使得齿轮和同步器轮毂能够以接近最终形状的精度製造,无需二次热处理即可满足电力驱动系统的扭矩负载需求。热等静压也推动了市场成长,该技术能够提高大型钢製涡轮盘的密度,从而增强其在能源和船舶引擎领域的应用前景。

区域分析

预计到2024年,亚太地区将占据全球粉末冶金市场份额的40%,并在2030年之前保持4.8%的最高区域复合年增长率,这主要得益于中国、日本和印度积极的产业政策、投资激励措施以及增材製造设备的快速普及。在中国,3D列印钽椎间融合器已获得国家药品监督管理局(NMPA)的批准,快速的监管发展正在加速该地区先进粉末的应用。

随着电动车动力系统和航太粉末消耗量的调整,北美正在重新调整其市场地位。政府对关键矿物和恶劣环境材料研究的资助将优先用于国内钨、铌和稀土的开采,从而减少对政治敏感进口资源的依赖。

欧洲正透过永续性数位化不断向前迈进。自2018年以来,Hoganas透过转向生物基还原剂和再生能源,已将其碳排放减少了46%,使其粉末产品成为低碳供应链的核心。欧洲的航太巨头对镍和钛合金的需求持续旺盛,而欧盟的国防计画也推动了对耐火材料粉末的需求。东欧的铸造厂正在采用混合烧结-黏结剂-喷射系统,并与西方机械製造商合作,扩大积层製造产能。总而言之,这些趋势巩固了欧洲作为更广泛的粉末冶金市场技术中心的地位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美电动车原始设备製造商加大对粉末冶金技术在轻量化电动动力传动系统总成零件中的应用

- 欧洲航太领域对近净成形积层製造零件的需求激增

- 亚太地区精密医疗植入製造的快速局部化

- 国防现代化计画促进了中东地区高性能耐火材料粉末的采用。

- 在电波和电磁波应用领域的应用日益广泛

- 市场限制

- 由于关键矿物供应受限,高纯度金属粉末价格出现波动。

- 针对安全关键型航太零件的标准化和鑑定通讯协定有限

- 来自先进复杂铝零件铸造技术的竞争威胁

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依材料类型

- 铁

- 有色金属

- 透过製造技术

- 压制和烧结

- 金属射出成型(MIM)

- 积层製造/粉末层熔融

- 等静压

- 透过使用

- 车

- 工业机械

- 电气和电子

- 航太

- 其他用途

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AMETEK Inc.

- ATI, Inc.

- CNPC POWDER

- CRS Holdings, LLC

- Elementum

- Elmet Technologies

- ERASTEEL

- Fine Sinter Co., Ltd.

- GKN Powder Metallurgy

- Hoganas AB

- Kymera International

- LIBERTY Steel Group

- Metalysis

- Miba AG

- Phoenix Sintered Metals, LLC

- Phoenix Sintered Metals, LLC

- Plansee Group Functions

- POSCO

- Powder Alloy Corporation(PAC)

- Resonac Holdings Corporation

- Rio Tinto

- Sandvik AB

- Sumitomo Electric Industries, Ltd.

第七章 市场机会与未来展望

The Powder Metallurgy Market size is estimated at USD 26.34 billion in 2025, and is expected to reach USD 32.96 billion by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

Expansion is supported by electrification of mobility, demand for complex lightweight parts, and steady penetration into medical, aerospace, and defense supply chains. Asia-Pacific commands the largest regional position and continues to attract new capacity as governments strengthen local materials ecosystems. Meanwhile, North American and European producers are pivoting toward high-value, low-volume applications to offset slower growth in conventional automotive volumes. Competitive intensity is rising as additive processes erode the dominance of press-and-sinter, and as specialty alloy suppliers target e-powertrain, aerospace, and orthopedic customers with powders engineered for higher efficiency and sustainability.

Global Powder Metallurgy Market Trends and Insights

Increasing Preference for Powder Metallurgy in Lightweight E-Powertrain Components

North American OEMs are re-engineering e-powertrains with powder-metallurgy motor cores, gears, and thermal plates that reduce waste and shorten machining cycles. GKN Powder Metallurgy reported that 72% of its 2023 order intake came from propulsion-agnostic parts, confirming a strategic shift toward electrified platforms. Suppliers are also investing in localized battery-grade powders; Soft-magnetic composites cut core losses by up to 20%, giving electric-drive designers a direct efficiency gain. As automakers pursue lighter drivetrains, the powder metallurgy market captures programs once dominated by cast or wrought materials. Standardization of steel-based e-drive powders further streamlines qualification cycles, lowering the entry barrier for second-tier suppliers.

Surge in Demand for Net-Shape Additive Metal Components in Aerospace

European engine and airframe suppliers amplify additive powder consumption to compress lead times and material usage. Collins Aerospace installed two twelve-laser NXG XII 600 machines that slash turbine component delivery from 52 to 8 weeks. Scrap reduction from 50% to over 90% improves inventory turns and carbon intensity, making powder routes competitive against precision casting. A dedicated airworthiness framework from SLM Solutions is helping harmonize process parameters and alloy traceability, easing certification bottlenecks. As the powder metallurgy market becomes entrenched in flight-critical hardware, European service bureaus are expanding nickel-superalloy capacity and diversifying into gamma-titanium powders for next-generation aero-engines.Surge in Demand for Net-Shape Additive Metal Components in Aerospace

Volatility in High-Purity Metal Powder Prices

China introduced export controls on tungsten, tellurium, bismuth, molybdenum, and indium in early 2025, triggering a sharp uptick in spot quotes and creating allocation risk for tool-steel, thermal-management, and magnet-grade powders. Governments are responding with strategic reserves legislation, but project timelines for new mines and refineries constrain short-term relief. Buyers are lengthening contracts and qualifying recycled streams, yet secondary supply cannot fully offset geopolitical disruptions. The powder metallurgy market faces near-term margin pressure until fresh extraction capacity comes online or trade policies stabilize. Energy-intensive ultra-fine powder grades remain particularly exposed because of their limited substitutability.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Localization of Precision Medical Implants Manufacturing

- Defense Modernization Programs Stimulating Refractory Powder Adoption

- Limited Standardization and Qualification Protocols for Safety-Critical Aerospace Parts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The ferrous segment controlled 79% of the powder metallurgy market in 2024 and is projected to rise at 4.62% CAGR through 2030, driven by mature tooling, abundant scrap streams, and robust price-performance economics. Extensive press-and-sinter infrastructure allows high-volume producers to hit densities exceeding 7.4 g/cm3, closing mechanical-property gaps with wrought steels. In parallel, advanced sinter-hardening formulas enable near-net-shape gears and synchronizer hubs that meet e-drive torque loads without secondary heat treatment. Growth is reinforced by hot isostatic pressing that densifies large ferrous turbine disks, increasing appeal in energy and marine engines.

The Powder Metallurgy Market Report Segments the Industry by Material Type (Ferrous and Non-Ferrous), Manufacturing Technology (Press and Sinter, Metal Injection Molding (MIM), and More), Application (Automotive, Industrial Machinery, Electrical and Electronics, Aerospace, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific retained 40% of the global powder metallurgy market share in 2024 and is expected to post the highest 4.8% regional CAGR to 2030, backed by aggressive industrial policy, investment incentives, and fast adoption of additive equipment in China, Japan, and India. China's NMPA clearance for a 3-D-printed tantalum interspinal cage highlights rapid regulatory evolution that accelerates local advanced-powder uptake.

North America is recalibrating its position as EV drivetrains and aerospace rebalance powder consumption. Government funds for critical minerals and harsh-environment materials research prioritize domestic tungsten, niobium, and rare-earth extraction, reducing reliance on politically sensitive imports.

Europe advances through sustainability and digitalization. Hoganas has cut carbon dioxide emissions by 46% since 2018 by transitioning to bio-based reductants and renewable electricity, positioning its powders at the center of low-carbon supply chains. Continental aerospace primes maintain demand for nickel and titanium alloys, while EU defense initiatives raise refractory-powder needs. Eastern European foundries adopt hybrid sinter-binder-jet systems, collaborating with Western machine builders to expand additive capacity. Collectively, these trends reinforce Europe's role as a technology nucleus within the broader powder metallurgy market.

- AMETEK Inc.

- ATI, Inc.

- CNPC POWDER

- CRS Holdings, LLC

- Elementum

- Elmet Technologies

- ERASTEEL

- Fine Sinter Co., Ltd.

- GKN Powder Metallurgy

- Hoganas AB

- Kymera International

- LIBERTY Steel Group

- Metalysis

- Miba AG

- Phoenix Sintered Metals, LLC

- Phoenix Sintered Metals, LLC

- Plansee Group Functions

- POSCO

- Powder Alloy Corporation (PAC)

- Resonac Holdings Corporation

- Rio Tinto

- Sandvik AB

- Sumitomo Electric Industries, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Preference for Powder Metallurgy in Lightweight E-Powertrain Components among EV OEMs in North America

- 4.2.2 Surge in Demand for Net-Shape Additive Metal Components in Aerospace across Europe

- 4.2.3 Rapid Localization of Precision Medical Implants Manufacturing in Asia-Pacific

- 4.2.4 Defense Modernization Programs Stimulating Adoption of High-Performance Refractory Powders in Middle East

- 4.2.5 Growing Implementation in Electrical and Electromagnetic Applications

- 4.3 Market Restraints

- 4.3.1 Volatility in High-Purity Metal Powder Prices Due to Critical Mineral Supply Constraints

- 4.3.2 Limited Standardization and Qualification Protocols for Safety-Critical Aerospace Parts

- 4.3.3 Competitive Threat from Advanced Casting of Complex Aluminum Components

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value )

- 5.1 By Material Type

- 5.1.1 Ferrous

- 5.1.2 Non-Ferrous

- 5.2 By Manufacturing Technology

- 5.2.1 Press and Sinter

- 5.2.2 Metal Injection Molding (MIM)

- 5.2.3 Additive Manufacturing / Powder Bed Fusion

- 5.2.4 Isostatic Pressing

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Industrial Machinery

- 5.3.3 Electrical and Electronics

- 5.3.4 Aerospace

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Egypt

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 AMETEK Inc.

- 6.4.2 ATI, Inc.

- 6.4.3 CNPC POWDER

- 6.4.4 CRS Holdings, LLC

- 6.4.5 Elementum

- 6.4.6 Elmet Technologies

- 6.4.7 ERASTEEL

- 6.4.8 Fine Sinter Co., Ltd.

- 6.4.9 GKN Powder Metallurgy

- 6.4.10 Hoganas AB

- 6.4.11 Kymera International

- 6.4.12 LIBERTY Steel Group

- 6.4.13 Metalysis

- 6.4.14 Miba AG

- 6.4.15 Phoenix Sintered Metals, LLC

- 6.4.16 Phoenix Sintered Metals, LLC

- 6.4.17 Plansee Group Functions

- 6.4.18 POSCO

- 6.4.19 Powder Alloy Corporation (PAC)

- 6.4.20 Resonac Holdings Corporation

- 6.4.21 Rio Tinto

- 6.4.22 Sandvik AB

- 6.4.23 Sumitomo Electric Industries, Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing Adoption of Powder Metallurgy Techniques in Medical Sector