|

市场调查报告书

商品编码

1851636

茂金属聚乙烯(mPE):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Metallocene Polyethylene (mPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

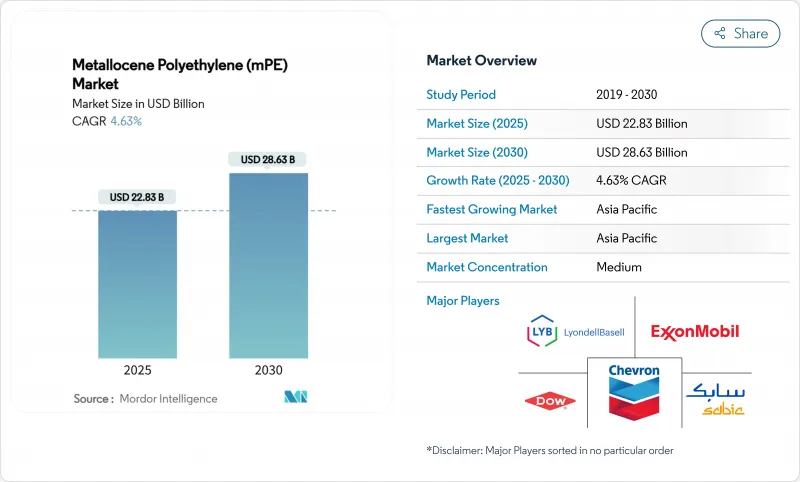

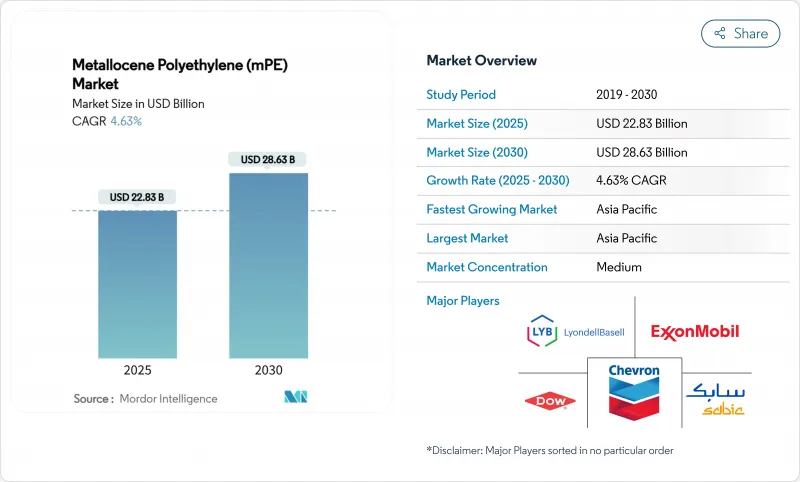

预计到 2025 年,茂金属聚乙烯市场价值将达到 228.3 亿美元,到 2030 年将达到 286.3 亿美元,预测期(2025-2030 年)复合年增长率为 4.63%。

对高透明度薄型薄膜的强劲需求、太阳能板封装生产线的规模化以及农业现代化,共同支撑着这一成长趋势。生产商受益于单活性位点触媒技术,该技术可实现窄分子量分布,从而在薄型薄膜上实现稳定的机械强度和优异的光学性能。中国乙烯产能的扩张、印度电子商务的蓬勃发展以及中东产能的投资,都在共同增强上游供应安全。同时,向循环塑胶的转型正在进行,战略重点是高回收率和生物基原料。因此,茂金属聚乙烯市场预计将在提升性能的同时兼顾永续性目标,使其成为下一代柔性包装解决方案的核心。

全球茂金属聚乙烯(mPE)市场趋势及洞察

对高透明度薄型包装薄膜的需求日益增长

随着加工商不断向更薄的薄膜过渡,同时保持其机械完整性,单活性位点催化剂促进了共聚单体的均匀分布,从而在确保薄膜透明度的同时,也提升了衝击强度。通常情况下,薄膜厚度可减少15-20%,从而降低材料用量和碳排放强度,直接支持品牌所有者的永续性承诺。窄分子量分布还能减少吹膜生产线上的边角料废弃物,提高包装袋产量,并提升加工业者的营运利润率。像Exceed XP这样的优质茂金属等级薄膜具有全年适用的韧性,适用于低温运输物流。同时,全通路零售的快速发展也带来了小包裹处理压力的增加,因此需要更强韧、更轻的薄膜。

包装产业对薄膜和片材的快速应用

随着零售商优先考虑货架效率和降低物流成本,软包装正在食品、家居护理和个人护理类别中取代硬质包装。茂金属聚乙烯具有更强的热黏性和更宽的密封窗口,可减少高速立式成形充填密封设备的洩漏。接触性应用中聚氯乙烯的禁用加速了向可回收聚乙烯混合物的转变,例如PreservaWrap系列产品,该系列产品在不含氯乙烯的情况下,实现了与聚氯乙烯相同的透明度。医疗设备製造商也因其生物相容性而从聚氯乙烯转向茂金属聚乙烯,这增强了医疗保健行业的需求并扩大了该细分市场。

乙烯原料成本波动

原油和天然气价格的波动会影响乙烯价格,挤压特种树脂生产商的利润空间,因为他们需要支付15-20%的催化剂溢价。维修电裂解装置和碳捕集装置会增加资本成本,在原物料价格上涨时造成压力。垂直一体化的中东生产商保持着成本领先优势,而依赖进口的亚洲生产商则面临更大的波动。虽然生物乙烯生产路线可以部分对冲波动,但它们需要同步进行基础设施建设,从而需要前期投资投资。

细分市场分析

到2024年,mLLDPE将占据茂金属聚乙烯市场的59.01%。凭藉其优异的抗穿刺性和抗衝击强度,mLLDPE保持着市场领先地位,即使受到15-20%的下切衝击也不会导致包装破损。许多饮料包装袋生产商将在2024年全面转向使用mLLDPE。在管道涂层领域,mLLDPE的柔韧性降低了捲绕式管道系统搬运过程中开裂的风险。

受开发中国家对压力管道和化学品桶的需求推动,预计2030年,中高密度聚乙烯(mHDPE)的复合年增长率将达到6.65%。抗应力开裂等级的mHDPE也用于吹塑成型的燃料箱和引擎室零件。小众的中高密度聚乙烯(mlDPE)产品线则用于对熔体强度要求极高的特殊流铸膜应用。超高分子量聚乙烯(UHMWPE)技术的进步也正在扩大人工关节和防护设备的市场,从而提升茂金属聚乙烯市场的价值。

预计到2024年,锆茂催化剂的市占率将达到62.75%。锆茂催化剂已在气相和溶液反应器中得到验证,具有良好的操作性能。这项可靠的性能记录缩短了食品接触认证所需的时间。

茂金属体係以5.25%的复合年增长率快速成长,在高温聚合方面表现出色,可显着提高气相聚合效率。近期配体技术的创新降低了90°C以上的活性损失,进一步拓展了商业性潜力。双位点和混合设计可在一步聚合中整合窄分子量和宽分子量组分,从而实现可自订的熔体流变性能。这些技术创新正在进一步丰富茂金属聚乙烯市场的产品线。

茂金属聚乙烯市场报告按类型(茂金属线型低密度聚乙烯(mLLDPE)、茂金属高密度聚苯乙烯(mHDPE) 等)、催化剂类型(单活性位点锆茂、铪茂、Postmetallocene等)、应用(薄膜、片材等)、终端用户行业(包装、农业等)和地区(亚太地区、北美地区等)进行细分。

区域分析

亚太地区将在2024年占据46.21%的市场份额,这主要得益于中国新增180万吨乙烯装置以及印度包装产业的復苏。这些投资将确保该地区加工商获得稳定的原料供应,并加快交货速度。包装、建筑膜材和汽车燃料箱等领域的需求预计都将推动亚太地区对茂金属聚乙烯的需求,使茂金属聚乙烯市场保持在5.71%的复合年增长率。

北美依靠页岩乙烷的成本优势和在催化剂创新方面的领先地位。陶氏化学计画在亚伯达建造的净零排放裂解装置将为低排放气体优质树脂的生产提供支援。墨西哥受益于反向一体化,从美国墨西哥湾沿岸地区进口原料,并将其加工成高附加价值薄膜,用于国内消费和出口。

欧洲日益严格的塑胶法规对需求构成挑战,同时也为可回收软质包装的发展铺平了道路。德国汽车产业优先考虑轻量化,而北欧零售商则倾向采用单一材料结构,以简化机械回收。道达尔能源旗下的阿米拉尔综合体虽然是一家中东公司,但其产品大量供应欧洲,填补了欧洲国内供应的缺口。南美洲以及中东和非洲地区正在崛起,成为快速成长的丛集。巴西温室产业的发展和卡达聚合物综合体的扩建将进一步推动茂金属聚乙烯市场的发展。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对高透明度、薄型包装薄膜的需求不断增长

- 包装产业对薄膜和片材的采用

- 农业多层膜和地工止水膜的发展

- 太阳能电池封装中转向基于mPE的连接层

- 用于客製化等级的催化剂切换式柔性裂解机

- 市场限制

- 乙烯原料成本波动

- 严格的一次性薄膜法规

- 专利后单活性位点催化剂相关的智慧财产权纠纷

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 茂金属线型低密度聚乙烯(mLLDPE)

- 茂金属高密度聚苯乙烯(mHDPE)

- 其他类型(例如,茂金属低密度聚乙烯(mLDPE))

- 按催化剂类型

- 单点锆新世

- 铪茂和Postmetallocene

- 双站点和混合系统

- 透过使用

- 电影

- 床单

- 其他应用(挤压涂布等)

- 按最终用户行业划分

- 包裹

- 农业

- 车

- 建筑/施工

- 医疗保健

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 印尼

- 越南

- 马来西亚

- 菲律宾

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 土耳其

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Braskem

- Chevron Phillips Chemical Company LLC.

- Dow

- Exxon Mobil Corporation

- INEOS

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals, Inc.

- Prime Polymer Co., Ltd.

- PTT Global Chemical Public Company Limited

- SABIC

- SIBUR Holding PJSC

- TotalEnergies

- Univation Technologies, LLC.

- WR Grace and Co.-Conn

第七章 市场机会与未来展望

The Metallocene Polyethylene Market size is estimated at USD 22.83 billion in 2025, and is expected to reach USD 28.63 billion by 2030, at a CAGR of 4.63% during the forecast period (2025-2030).

Robust demand for high-clarity down-gauged films, the scale-up of solar panel encapsulant lines, and modernization in agriculture sustain this growth path. Producers benefit from single-site catalyst technology that yields narrow molecular weight distribution, enabling consistent mechanical strength and superior optical properties at lower gauges. China's ethylene capacity additions, India's e-commerce boom, and capacity investments in the Middle East together reinforce upstream supply security, while ongoing shifts toward circular plastics keep strategic focus on advanced recycling and bio-based feedstocks. The Metallocene polyethylene market therefore marries performance gains with sustainability objectives and positions itself as a core enabler of next-generation flexible packaging solutions.

Global Metallocene Polyethylene (mPE) Market Trends and Insights

Rising Demand for High-Clarity, Down-Gauged Packaging Films

Converters continue to migrate toward thinner films that preserve mechanical integrity, and single-site catalysts facilitate uniform comonomer distribution that yields clarity alongside dart impact strength. Typical gauge reductions of 15-20% lower material use and carbon intensity, directly supporting brand-owner sustainability pledges. Narrow molecular weight distribution also cuts edge-trim waste on blown-film lines and improves bag-making throughput, which increases operating margins for convertors. Premium metallocene grades such as Exceed XP provide year-round toughness suited to cold-chain logistics, while the rapid rise of omnichannel retail elevates parcel-handling stresses that require stronger but lighter films.

Surge in Adoption of Films and Sheets in Packaging Industry

Flexible formats replace rigid containers across food, home-care, and personal-care sectors as retailers prioritize shelf efficiency and lower logistics costs. Metallocene polyethylene delivers stronger hot-tack and wider sealing windows, reducing leakers on high-speed vertical form-fill-seal equipment. Trade bans on PVC in contact applications accelerate transition toward recyclable polyethylene blends, illustrated by PreservaWrap lines that replicate PVC clarity without chloride content. Medical device makers also pivot from PVC to metallocene polyethylene for biocompatibility, which reinforces healthcare demand and widens segment reach.

Volatile Ethylene Feedstock Costs

Swing crude and natural-gas prices cascade into ethylene swings, compressing margins for specialty resin producers who pay a 15-20% catalyst premium. Electrified crackers and carbon-capture retrofits inflate capital cost, adding pressure during feedstock spikes. Vertically integrated Middle Eastern producers retain cost leadership while Asian converters reliant on imports see steeper volatility. Bio-ethylene routes partly hedge volatility yet call for parallel infrastructure build-out, raising upfront cash needs.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Multilayer Agricultural Films and Geomembranes

- Solar-Panel Encapsulant Shift to mPE-Based Tie Layers

- Stringent Single-Use Film Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

mLLDPE commanded 59.01% Metallocene polyethylene market share in 2024. The segment retains leadership thanks to superior puncture resistance and dart impact strength that allow 15-20% down-gauging without packaging failure. Many beverage pouch producers shifted entirely to mLLDPE structures in 2024. In pipe coatings, mLLDPE's flexibility reduces cracking risk during coil-on-reel handling.

mHDPE is forecast to log a 6.65% CAGR through 2030, boosted by pressure pipe and chemical drum demand in developing economies. Stress-crack-resistant grades also penetrate fuel tank blow-molding and under-hood parts. Niche mLDPE lines serve specialty cast-film uses where melt strength is crucial. UHMWPE advances broaden reach into artificial joints and protective gear markets, fortifying value pools for the Metallocene polyethylene market.

Zirconocene catalysts held 62.75% share in 2024. Producers favor their proven operability across gas-phase and solution reactors. Strong track records shorten qualification times, essential for food-contact certifications.

Hafnocene systems, expanding at 5.25% CAGR, excel in high-temperature polymerization that enables faster gas-phase throughput. Recent ligand innovations temper activity drop-off above 90 °C, widening the commercial window. Dual-site and hybrid designs merge narrow and broad molecular fractions in one step, unlocking tailored melt rheology. These innovations further diversify offerings within the Metallocene polyethylene market.

The Metallocene Polyethylene Market Report is Segmented by Type (Metallocene Linear Low-Density Polyethylene (mLLDPE), Metallocene High-Density Polyethylene (mHDPE), and More), Catalyst Type (Single-Site Zirconocene, Hafnocene and Post-Metallocene, and More), Application (Films, Sheets, and More), End-User Industry (Packaging, Agriculture, and More), and Geography (Asia-Pacific, North America, and More).

Geography Analysis

Asia-Pacific led with 46.21% share in 2024, anchored by China's new 1.8 million t ethylene units and India's packaging upturn. These investments ensure feedstock security and shorten delivery time for regional converters. Packaging, construction membranes, and automotive fuel tanks together lifted regional off-take and are expected to keep the Metallocene polyethylene market on a 5.71% CAGR trajectory.

North America relies on shale-linked ethane cost advantages and catalyst innovation leadership. Dow's forthcoming net-zero cracker in Alberta is poised to support premium resin output with low embedded emissions. Mexico secures back-integration gains by importing feedstock from US Gulf complexes and converting into value-added films for domestic consumption and export.

Europe's strict plastic rules challenge demand yet simultaneously open space for recyclable flexible packaging. Germany's auto sector values weight reduction, and Nordic retailers champion mono-material structures that simplify mechanical recycling. TotalEnergies' Amiral complex, though Middle Eastern, channels volumes into Europe, supplementing short domestic supply. South America and the Middle East & Africa remain emerging yet fast-growing clusters. Brazil's greenhouse sector and Qatar's polymer complex expansion add incremental pull on the Metallocene polyethylene market.

- Braskem

- Chevron Phillips Chemical Company LLC.

- Dow

- Exxon Mobil Corporation

- INEOS

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- Prime Polymer Co., Ltd.

- PTT Global Chemical Public Company Limited

- SABIC

- SIBUR Holding PJSC

- TotalEnergies

- Univation Technologies, LLC.

- W. R. Grace and Co.-Conn

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for high-clarity, down-gauged packaging films

- 4.2.2 Surge in Adoption of Films and Sheets in Packaging Industry

- 4.2.3 Growth of multilayer agricultural films and geomembranes

- 4.2.4 Solar-panel encapsulant shift to mPE-based tie layers

- 4.2.5 Catalyst-switch flexible crackers enabling custom grades

- 4.3 Market Restraints

- 4.3.1 Volatile ethylene feedstock costs

- 4.3.2 Stringent single-use film regulations

- 4.3.3 Post-patent IP disputes on single-site catalysts

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Metallocene Linear Low-density Polyethylene (mLLDPE)

- 5.1.2 Metallocene High-density Polyethylene (mHDPE)

- 5.1.3 Other Types (Metallocene Low-density Polyethylene (mLDPE), etc.)

- 5.2 By Catalyst Type

- 5.2.1 Single-site Zirconocene

- 5.2.2 Hafnocene and post-metallocene

- 5.2.3 Dual-site and hybrid systems

- 5.3 By Application

- 5.3.1 Films

- 5.3.2 Sheets

- 5.3.3 Other Applications (Extrusion Coatings, etc.)

- 5.4 By End-User Industry

- 5.4.1 Packaging

- 5.4.2 Agriculture

- 5.4.3 Automotive

- 5.4.4 Building and Construction

- 5.4.5 Medical and Healthcare

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Thailand

- 5.5.1.6 Indonesia

- 5.5.1.7 Vietnam

- 5.5.1.8 Malaysia

- 5.5.1.9 Philippines

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Turkey

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Braskem

- 6.4.2 Chevron Phillips Chemical Company LLC.

- 6.4.3 Dow

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 INEOS

- 6.4.6 LG Chem

- 6.4.7 LyondellBasell Industries Holdings B.V.

- 6.4.8 Mitsui Chemicals, Inc.

- 6.4.9 Prime Polymer Co., Ltd.

- 6.4.10 PTT Global Chemical Public Company Limited

- 6.4.11 SABIC

- 6.4.12 SIBUR Holding PJSC

- 6.4.13 TotalEnergies

- 6.4.14 Univation Technologies, LLC.

- 6.4.15 W. R. Grace and Co.-Conn

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment