|

市场调查报告书

商品编码

1851647

云端监控:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cloud Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

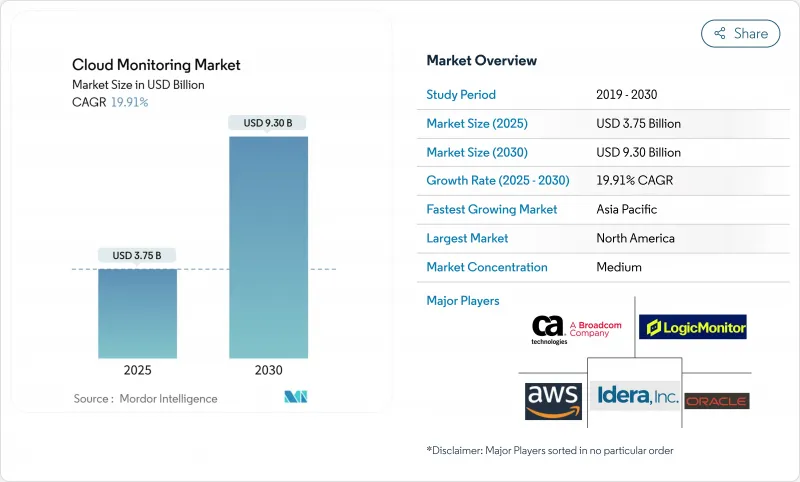

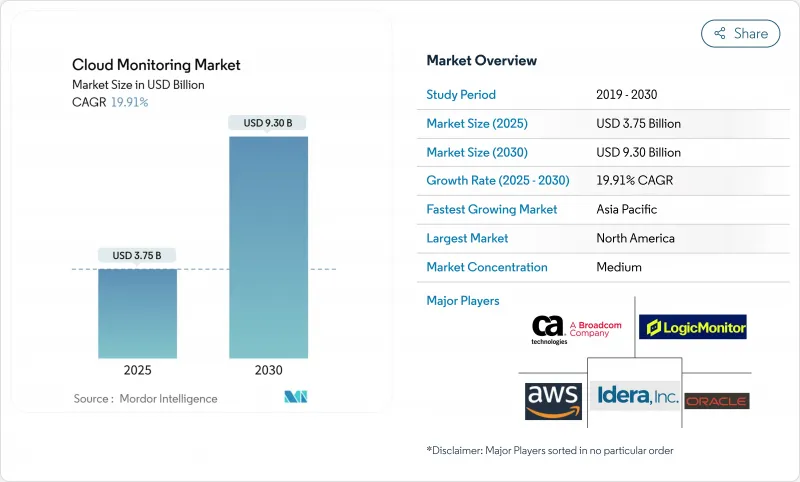

预计到 2025 年,云端监控市场规模将达到 37.5 亿美元,到 2030 年将达到 93 亿美元,预测期(2025-2030 年)的复合年增长率为 19.91%。

多重云端部署加速、AI工作负载可见性、FinOps责任制以及资料主权要求正在重塑供应商的蓝图。企业正在用整合平台取代零散的监控工具,这些平台能够即时摄取日誌、指标、追踪资料、使用者体验和成本讯号。 OpenTelemetry的快速标准化降低了整合摩擦,而AI驱动的异常检测则缩短了平均故障解决时间。支出正从纯粹的基础设施指标转向将技术健康状况与收入影响联繫起来的全端智慧。由于超大规模云端在整合原生工具的同时,也与独立供应商合作以因应混合云环境,竞争格局仍保持适中。

全球云端监控市场趋势与洞察

加速多重云端和混合云端的采用

多重云端采用已过临界点,预计到 2024 年,43% 的金融服务公司将把工作负载分布在两个或多个超大规模云端平台上。每个云端供应商都会汇出自己的指标,导致维运团队面临遥测资料混乱和盲点。因此,能够规范来自 AWS、Azure 和 Google Cloud 资料的统一平台正在取代单云监控器。由于厂商中立的侦测方式能够达到全环境覆盖,OpenTelemetry 代理程式的采用率激增。当相同的交易跨越本地和云端节点时,企业也需要对成本、效能和合规性进行关联分析。这些压力正将混合云可观测性从选购功能提升为必备功能,推动云端可观测性市场朝向更深入的端到端情境发展。

DevOps/SRE 文化与即时可观测性

站点可靠性工程已成为大型企业的主流做法,平均每小时可降低超过 100 万美元的停机成本。团队现在将黄金讯号和服务等级目标 (SLO) 整合到 CI/CD 管线中,以确保缺陷在生产部署之前被发现。与孤立的工具链相比,全端洞察已将停机时间减少了 79%。人工智慧驱动的异常检测透过挖掘日誌和追踪中的事件征兆来增强人类的判断能力。更快的回馈循环也提高了开发人员的效率,而可观测性则直接转化为业务赋能。因此,云端可观测性市场受益于预算从传统 IT 维运转向工程团队。

对容器化无伺服器堆迭的可见性有限

容器仅运作数秒,无伺服器函数无需代理即可启动,这造成了传统监控工具无法填补的空白。 Kubernetes 增加了种子层级的元资料,使得暴力破解收集数据会增加储存成本。分散式追踪技术将微服务之间的请求路径拼接起来,并结合低开销的基于 eBPF 的侦测技术,成为解决方案。 OpenTelemetry 至关重要,但其部署复杂性仍然是资源受限的中小企业难以采用它的主要原因。在承包的检测技术成熟之前,短暂环境中的可观测性差距可能会阻碍云端可观测性市场的复合年增长率。

细分市场分析

到2024年,SaaS平台将占总营收的48%,这印证了市场对无需基础设施开销的承包配置的需求。 PaaS解决方案将成为成长最快的领域,年复合成长率将达到29.90%,因为使用者渴望获得更深入的程式码层级洞察,而无需管理资料撷取器。对于需要在本地部署更靠近受监管资料的混合型设施而言,IaaS工具仍将保持其重要性。随着落后产业转向託管服务,预计2025年至2030年间,SaaS云端可观测性市场规模将成长27亿美元。

PaaS 的发展动能体现在平台工程团队将可观测性整合到其内部开发者入口网站中。领先的技术供应商正在将追踪、混沌测试和 KPI 仪表板直接整合到其建置管道中,从而降低认知负荷。结合 OpenTelemetry 的自动化检测功能,这种协同效应加速了价值实现。因此,云端可观测性市场近三分之一的新增订单来自针对 AI 模式可观测性和成本分析的 PaaS 交易。

涵盖资料湖、关联引擎和使用者体验分析的解决方案套件预计将在2024年占总营收的62%。由于企业难以招募可观测工程师,服务咨询、客户导入和託管可观测性服务以19.30%的复合年增长率成长。在需要确保测量与控制框架一致的受监管垂直市场中,对整合商的需求最高。

供应商蓝图现在包含捆绑式快速入门包,可缩短咨询时间、认证培训和价值验证週期。 LogicMonitor 的 8 亿美元资金筹措用于服务扩展,这表明专业知识如何成为强大的竞争优势。随着框架的演进,经常性服务合约将在云端可观测性市场整体收入中占据更大的份额,从而深化合作伙伴生态系统。

云端监控市场报告按云端服务模式(IaaS、SaaS、PaaS)、组件(解决方案和服务)、部署类型(公共云端、私有云端、混合/多重云端)、组织规模(中小企业和大型企业)、最终用户垂直行业(银行、金融服务和保险、零售、电子商务、IT 和通讯、医疗保健和生命科学、政府和公共部门製造、金融服务和保险

区域分析

北美地区将占2024年总收入的41%,这反映了该地区数十年来DevOps技术的成熟以及在人工智慧领域的巨额投资。金融机构指出,其係统故障造成的损失中位数为每年1,044万美元,足以证明使用高级工具的必要性。儘管主权云的热度有所下降,但隐私权法仍推动着资料驻留功能的发展。随着更换週期的饱和,从2027年开始,成长速度将放缓至10%左右,但人工智慧可观测性的升级将支撑许可证的持续成长。

亚太地区是成长最快的地区,复合年增长率高达21.30%,主要得益于云端优先型新兴企业和政府数位化转型。到2028年,印度的公共云端投资额可望达到255亿美元。新加坡和印尼的可观测性投资报酬率超过114%,显示减少停机时间能够带来高额回报。中国云端市场规模达6.192兆元人民币,其中阿里云占43%的市场份额,推动了在地化资料平台和本土资料湖的建置。

随着GDPR和即将出台的人工智慧法规加强资料保护需求,欧洲的复合年增长率(CAGR)达到15%左右。Accenture报告称,37%的公司正在投资主权云,其中44%的公司计划在未来两年内进一步投资。供应商与区域主机商合作,以确保欧盟境内日誌管道的安全。随着气候变迁报告与绩效指标的融合,能源仪錶板越来越受欢迎。这些区域差异正在推动云端可观测性市场中多样化且注重合规性的部署。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速多重云端和混合云端的采用

- DevOps/SRE 文化以及对即时可观测性的需求

- 人工智慧/机器学习工作负载的爆炸性成长需要GPU等级的监控

- 财务课责与成本与价值优化压力

- 云端碳排放报告永续性仪錶板

- 主权云端和强制资料本地化

- 市场限制

- 对容器化和无伺服器架构的可见性有限

- 全端可观测性平台的整体拥有成本不断上升

- 可观测性工程技能差距

- 由于超大规模 API 速率限制,导致深度遥测资料限流

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过云端服务模式

- IaaS

- PaaS

- SaaS

- 按组件

- 解决方案

- 服务

- 透过部署模式

- 公有云

- 私有云端

- 混合/多重云端

- 按公司规模

- 小型企业

- 大公司

- 按最终用户行业划分

- BFSI

- 零售与电子商务

- 资讯科技/通讯

- 医疗保健和生命科学

- 政府/公共部门

- 製造业

- 其他(媒体、能源、教育)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AWS

- Microsoft

- Google Cloud

- IBM

- Oracle

- Datadog

- Dynatrace

- New Relic

- Broadcom(CA Tech/AppDynamics)

- LogicMonitor

- Splunk

- SolarWinds

- PagerDuty

- Cisco ThousandEyes

- Grafana Labs

- Elastic

- Zenoss

- ScienceLogic

- Idera

第七章 市场机会与未来展望

The Cloud Monitoring Market size is estimated at USD 3.75 billion in 2025, and is expected to reach USD 9.30 billion by 2030, at a CAGR of 19.91% during the forecast period (2025-2030).

Accelerated multi-cloud adoption, AI workload visibility, FinOps accountability, and data-sovereignty mandates are reshaping vendor roadmaps. Enterprises are replacing point monitoring tools with unified platforms that ingest logs, metrics, traces, user experience, and cost signals in real time. OpenTelemetry's rapid standardization is lowering integration friction, while AI-driven anomaly detection shortens the mean time to resolution. Spending is shifting from pure infrastructure metrics toward full-stack intelligence that ties technical health to revenue impact. Competitive intensity remains moderate as hyperscale clouds embed native tooling, yet still partner with independent vendors to address hybrid estates.

Global Cloud Monitoring Market Trends and Insights

Accelerated Multi-Cloud and Hybrid-Cloud Adoption

Multi-cloud usage crossed a tipping point, with 43% of financial-services firms already distributing workloads across two or more hyperscalers in 2024. Each provider exports unique metrics, so operations teams face telemetry sprawl and blind spots. Unified platforms that normalise data across AWS, Azure, and Google Cloud are therefore replacing single-cloud monitors. Adoption of OpenTelemetry agents rose sharply because vendor-neutral instrumentation eases estate-wide coverage. Organisations also need correlated cost, performance, and compliance views when the same transaction spans on-premises and cloud nodes. These pressures elevate hybrid-cloud observability from optional to indispensable capability, pushing the cloud observability market toward deeper end-to-end context.

DevOps/SRE Culture and Real-Time Observability

Site Reliability Engineering is mainstreamed in large enterprises, cutting mean outage costs that exceed USD 1 million per hour. Teams now embed golden signals and service-level objectives into CI/CD pipelines so that defects surface before production rollouts. Full-stack insight lowers downtime by 79% versus siloed toolchains. AI-driven anomaly detection augments humans by surfacing precursors to incidents across logs and traces. Faster feedback loops also boost developer productivity, turning observability into a direct business enabler. The cloud observability market, therefore, benefits from budgets shifting left toward engineering teams rather than traditional IT operations.

Limited Visibility in Containerised, Serverless Stacks

Containers may live for seconds, while serverless functions spin up without agents, leaving gaps that legacy monitors cannot fill. Kubernetes adds torrent-level metadata, so brute-force collection inflates storage bills. Distributed tracing that stitches request paths across microservices, combined with eBPF-based low-overhead instrumentation, is emerging as the remedy. OpenTelemetry is pivotal yet still complex to deploy, explaining slower adoption among resource-constrained SMEs. Until turnkey instrumentation matures, observability gaps in ephemeral environments will drag on the cloud observability market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- AI/ML Workload Explosion Requiring GPU-Level Monitoring

- FinOps Accountability and Cost-to-Value Optimisation Pressure

- Rising TCO of Full-Stack Observability Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SaaS platforms anchored 48% of 2024 revenue, underscoring demand for turnkey deployments that remove infrastructure overhead. PaaS solutions shape the fastest lane, growing 29.90% CAGR as users crave deeper code-level insight without managing collectors. IaaS tools retain relevance for hybrid estates that need on-premises collectors close to regulated data. The cloud observability market size for SaaS is forecast to widen by USD 2.7 billion between 2025 and 2030 as lagging industries migrate to managed services.

PaaS momentum reflects platform-engineering teams embedding observability into internal developer portals. Big-tech vendors integrate tracing, chaos testing, and KPI dashboards directly into build pipelines, reducing cognitive load. Combined with OpenTelemetry auto-instrumentation, this synergy accelerates time to value. Consequently, the cloud observability market records almost one-third of net-new bookings from PaaS deals targeting AI model observability and cost analytics.

Solution suites captured 62% revenue in 2024, covering data lakes, correlation engines, and UX analytics. Services consulting, onboarding, and managed observability grow 19.30% CAGR as enterprises struggle to hire observability engineers. Integrator demand is highest in regulated verticals where instrumentation must map to control frameworks.

Vendor roadmaps now bundle advisory hours, certified training, and quick-start packs that shorten proof-of-value cycles. LogicMonitor's USD 800 million funding earmarked for services expansion signals how professional expertise becomes a key moat. As frameworks evolve, recurring service contracts will comprise a larger slice of the overall cloud observability market revenue, deepening partner ecosystems.

The Cloud Monitoring Market Report is Segmented by Cloud Service Model (IaaS, Saas, Paas), Component (Solution and Services), Deployment Mode (Public Cloud, Private Cloud, and Hybrid/Multi-Cloud), Organization Size (SMEs and Large Enterprises), End-User Industry (BFSI, Retail and E-Commerce, IT and Telecommunications, Healthcare and Life Sciences, Government and Public Sector, Manufacturing, and Others), and Geography.

Geography Analysis

North America commanded 41% of 2024 revenue, reflecting decades-long DevOps maturity and heavy AI investment. Financial institutions cite median outage losses of USD 10.44 million per year, justifying premium tooling. Sovereign-cloud talk is muted, yet privacy laws still nudge data residency features. Growth moderates to low teens after 2027 as replacement cycles saturate, but AI observability upgrades sustain license expansion.

Asia Pacific is the fastest mover at 21.30% CAGR, propelled by cloud-first start-ups and government digital drives. India's public cloud outlay could reach USD 25.5 billion by 2028. Observability ROI tops 114% in Singapore and Indonesia, showcasing high payoff for downtime reduction. China's 6.192 trillion-yuan cloud sector, led by Alibaba Cloud's 43% hold, fuels local-language dashboards and in-country data lakes.

Europe records mid-teens CAGR as GDPR and upcoming AI Act cement data-protection demands. Accenture notes 37% of enterprises investing in sovereign cloud, with 44% planning more within two years. Vendors partner with regional hosts to ensure EU-located logging pipelines. Energy dashboards gain traction as climate reporting merges with performance metrics. These regional nuances collectively propel the cloud observability market toward diverse compliance-aware deployments.

- AWS

- Microsoft

- Google Cloud

- IBM

- Oracle

- Datadog

- Dynatrace

- New Relic

- Broadcom (CA Tech/AppDynamics)

- LogicMonitor

- Splunk

- SolarWinds

- PagerDuty

- Cisco ThousandEyes

- Grafana Labs

- Elastic

- Zenoss

- ScienceLogic

- Idera

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated multi-cloud and hybrid-cloud adoption

- 4.2.2 DevOps/SRE culture and need for real-time observability

- 4.2.3 AI/ML workload explosion requiring GPU-level monitoring

- 4.2.4 FinOps accountability and cost-to-value optimisation pressure

- 4.2.5 Sustainability dashboards for cloud-carbon reporting

- 4.2.6 Sovereign-cloud and data-localisation mandates

- 4.3 Market Restraints

- 4.3.1 Limited visibility in containerised, serverless stacks

- 4.3.2 Rising TCO of full-stack observability platforms

- 4.3.3 Skills gap for observability engineering

- 4.3.4 Hyperscaler API-rate limits throttling deep telemetry

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry Intensity

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cloud Service Model

- 5.1.1 IaaS

- 5.1.2 PaaS

- 5.1.3 SaaS

- 5.2 By Component

- 5.2.1 Solution

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 Public Cloud

- 5.3.2 Private Cloud

- 5.3.3 Hybrid/Multi-Cloud

- 5.4 By Organisation Size

- 5.4.1 SMEs

- 5.4.2 Large Enterprises

- 5.5 By End-User Industry

- 5.5.1 BFSI

- 5.5.2 Retail and e-Commerce

- 5.5.3 IT and Telecommunications

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Government and Public Sector

- 5.5.6 Manufacturing

- 5.5.7 Others (Media, Energy, Education)

- 5.6 By Region

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AWS

- 6.4.2 Microsoft

- 6.4.3 Google Cloud

- 6.4.4 IBM

- 6.4.5 Oracle

- 6.4.6 Datadog

- 6.4.7 Dynatrace

- 6.4.8 New Relic

- 6.4.9 Broadcom (CA Tech/AppDynamics)

- 6.4.10 LogicMonitor

- 6.4.11 Splunk

- 6.4.12 SolarWinds

- 6.4.13 PagerDuty

- 6.4.14 Cisco ThousandEyes

- 6.4.15 Grafana Labs

- 6.4.16 Elastic

- 6.4.17 Zenoss

- 6.4.18 ScienceLogic

- 6.4.19 Idera

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment