|

市场调查报告书

商品编码

1851648

自然语言处理:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Natural Language Processing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

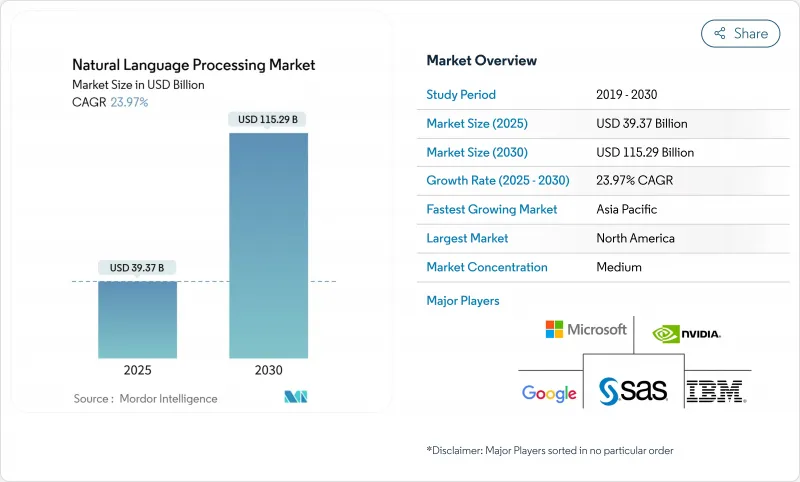

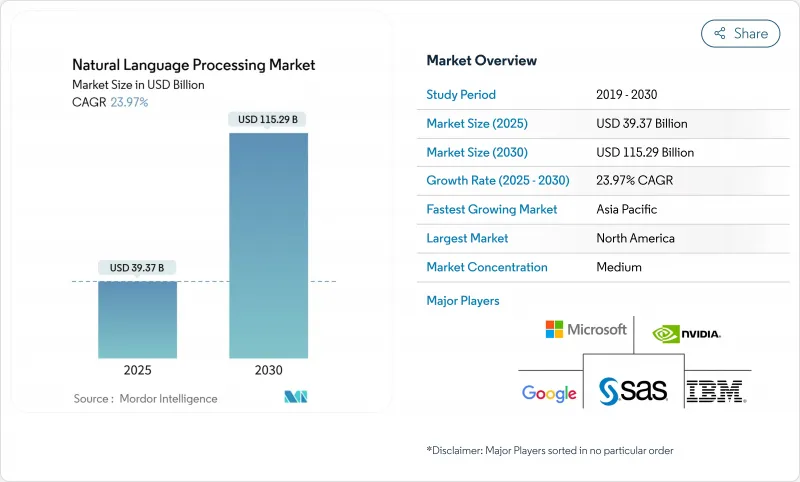

预计到 2025 年,自然语言处理市场规模将达到 393.7 亿美元,到 2030 年将达到 1,152.9 亿美元,预测期(2025-2030 年)复合年增长率为 23.97%。

受生成式人工智慧精准度不断提升以及企业持续增加对话式配置投入的推动,市场需求依然强劲。科技巨头承诺在2025年向人工智慧领域投资3,000亿美元,将增强长期资本的可用性。云端采用率占自然语言处理(NLP)市场的63.40%,预计到2030年,随着企业倾向可扩展的推理基础设施,该细分市场将以24.95%的复合年增长率成长。大型企业占总市场份额的57.80%,而中小企业的采用率预计将以25.01%的年增长率成长,这表明易于使用的云端API正在降低采用门槛。软体仍然是最大的组成部分,占46.00%的份额,但实施服务正以26.08%的复合年增长率增长,反映出对专家模型整合的需求日益增长。北美占全球收入的 33.30%,而亚太地区是成长最快的地区,复合年增长率达 25.85%,这得益于当地语言模式倡议和公共资金的推动。

全球自然语言处理市场趋势与洞察

利用生成式人工智慧提高模型精度

新型大规模语言模式如今能够在复杂任务中维持更低的错误率,使企业能够将更多工作负载投入运作。 Anthropic 的 Claude 家族模式便是其成功的有力证明。随着程式码产生技术在企业中的应用日益广泛,其年收入从 2024 年 12 月的 10 亿美元成长至 2025 年 5 月的 30 亿美元。在医疗保健领域,CHECK 框架将临床语言模型的误判率从 31% 降低至 0.3%,为高风险环境下的自动化合规铺平了道路。金融机构更青睐业界定制的模型,例如 Baichuan4-Finance,它在认证测试中表现优于通用模型,同时保持了广泛的推理能力。由于准确性直接影响监管核准和投资报酬率,企业持续投入预算用于模型的微调和评估流程。

对话式人工智慧在客户支援领域的应用激增

自动化客服人员能够解决大部分第一线咨询,从而显着节省人力成本。 Intercom 在其客服系统中整合 Claude AI 后,实现了 45 种语言 86% 的问题解决率。受阿里巴巴和 HDFC 银行等服务于多语言客户群的企业部署的推动,亚太地区对话式人工智慧市场预计到 2032 年将以 24.1% 的复合年增长率成长。 Teneo.ai 在保持 95% 自然语言理解准确率的同时,实现了每次自动化通话 5.60 美元的成本节约。随着翻译品质的提升,企业正在全部区域部署单一的机器人,而不是各自独立的语言团队,这进一步增强了加速采用该技术的商业价值。

缺乏高品质、无偏的训练数据

特定领域资料集的匮乏阻碍了专业应用的效能。越南透过发布ViGPT解决了本地语言差距问题。欧盟人工智慧法进一步强制要求对高风险系统进行偏见监控,加重了合规负担。医疗保健和金融业面临的挑战尤其严峻,因为隐私法规限制了可用资料池,并有利于拥有专有资料集的公司。

细分市场分析

预计到2024年,云端运算将占据自然语言处理(NLP)市场63.40%的份额,并在2030年之前以24.95%的复合年增长率成长。基于使用量的定价和弹性运算是推动云端运算领先地位的主要因素,因为企业无需投资本地硬体即可尝试产生式工作负载。微软Azure AI服务的年收入超过130亿美元,年增157%。混合模式将推理任务分配到本地集群和公共云端,服务于资料持久性规则严格的监管行业。边缘配置正在为对延迟敏感的任务提供云端运算的补充,充分利用智慧型手机的运算能力,而智慧型手机的总运算能力正以每年25%的速度成长。这种组合表明,NLP市场将围绕特定工作负载的部署模式进行组织,而不是由单一的主导模式主导。

到2024年,大型企业将占据自然语言处理(NLP)市场57.80%的份额,这主要得益于其资料资产和内部人工智慧团队。然而,预计到2030年,中小企业将以25.01%的复合年增长率超越大型企业,因为承包的API使他们能够访问高级模型。研究表明,中小企业最初专注于客户支援和文件处理,之后才会扩展到高级分析。基于API的计量收费消除了前期投资,使中小企业能够快速证明投资回报。相反,大型企业则投入资源进行客製化微调,并建立内部语言学习管理(LLM)中心,以解决合规性和安全性问题。这种脱节将迫使NLP产业在满足中小企业的规模成长和满足大型企业的高价值客製化计划需求之间取得平衡。

自然语言处理市场报告配置(本地部署、云端部署)、组织规模(大型企业、中小企业)、组件(硬体、软体、服务)、处理类型(文字、语音/语音、图像/视觉)、最终用户行业(银行、金融服务和保险、医疗保健/生命科学、IT/电信、零售/电子商务、製造业、其他)和地区进行细分。

区域分析

北美仍将是最大的区域贡献者,预计2024年营收将成长33.30%。微软云端业务营收预计在2025财年第三季达到424亿美元,年增20%,其中人工智慧服务是主要驱动力。资金筹措和更法规环境正在加速企业采用云端技术。

亚太地区预计将以25.85%的复合年增长率成长,这主要得益于政府人工智慧专案和本地语言模型的发展。日本致力于支持东南亚地区的本地语言模型能力建设,显示其正努力减少对外国供应商的依赖。到2032年,该地区对话式人工智慧收入将以24.1%的复合年增长率成长,预示着市场对多语言客户参与工具的需求将持续旺盛。

在欧洲,欧盟人工智慧法案即将生效,该法案鼓励技术创新并要求严格遵守相关规定。预计到2025年第一季,德国人工智慧市场规模将达到100亿欧元,年增25%,其中西门子等公司已实现90%的文件工作流程自动化。该法规详细的风险等级划分有利于能够记录其流程的供应商,从而支持谨慎而稳健的成长。儘管南美洲和中东及非洲地区仍在发展中,但公共云端和智慧型设备的日益普及表明,自然语言处理(NLP)市场仍蕴藏着巨大的潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 利用生成式人工智慧提高模型精度

- 对话式人工智慧在客户支援领域的应用激增

- 将自然语言处理技术整合到嵌入式/边缘设备中

- 为受监管产业推广特定领域的LLM课程

- 汽车和智慧型设备对即时语音辨识的需求日益增长

- 多模态平台模式开启了新的垂直市场

- 市场限制

- 缺乏高品质、无偏的训练数据

- 大型模型的推理成本不断增加

- 跨境资料驻留的合规障碍

- 大规模训练运算的环境足迹

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠疫情的影响及宏观经济放缓

- 投资分析

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云

- 按组织规模

- 大公司

- 小型企业

- 按组件

- 硬体

- 软体

- 服务

- 按处理类型

- 文字

- 言语/声音

- 图像/视觉

- 按最终用户行业划分

- BFSI

- 医疗保健和生命科学

- 资讯科技和电讯

- 零售与电子商务

- 製造业

- 媒体与娱乐

- 教育

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Microsoft Corp.

- Google LLC(Alphabet)

- Amazon Web Services

- IBM Corp.

- NVIDIA Corp.

- OpenAI LP

- Meta Platforms Inc.

- SAP SE

- Oracle Corp.

- Baidu Inc.

- Intel Corp.

- Qualcomm Inc.

- SAS Institute Inc.

- Adobe Inc.

- Salesforce Inc.

- Apple Inc.

- Verint Systems Inc.

- Nuance Communications(Microsoft)

- Cohere Inc.

- Hugging Face

- Grammarly Inc.

第七章 市场机会与未来展望

The Natural Language Processing Market size is estimated at USD 39.37 billion in 2025, and is expected to reach USD 115.29 billion by 2030, at a CAGR of 23.97% during the forecast period (2025-2030).

Continued enterprise spending on generative AI accuracy gains and conversational deployments keeps demand strong, with technology majors committing USD 300 billion to AI investments in 2025, reinforcing long-term capital availability. Cloud deployment holds 63.40% of the NLP market, and the segment is expected to post a 24.95% CAGR to 2030 as organizations favor scalable inference infrastructure. Large enterprises account for 57.80% of overall adoption, yet SME uptake is projected to climb 25.01% annually, signaling that accessible cloud APIs are lowering adoption barriers. Software remains the largest component at 46.00% share, while implementation services, expanding at 26.08% CAGR, reflect growing demand for expert model integration. North America contributes 33.30% of global revenues, though Asia Pacific is the fastest-growing region at 25.85% CAGR, thanks to local language model initiatives and supportive public funding.

Global Natural Language Processing Market Trends and Insights

Generative-AI-powered model accuracy gains

Enterprises are moving more workloads into production because newer large language models can now sustain far lower error rates in complex tasks. Anthropic's Claude family illustrates the jump: annualized revenue rose from USD 1 billion in December 2024 to USD 3 billion by May 2025 as code-generation deployments scaled inside corporations. In healthcare, the CHECK framework cut hallucinations in clinical language models from 31% to 0.3%, opening a path for compliance-ready automation in high-risk settings. Financial institutions prefer sector-tuned options such as Baichuan4-Finance, which outperforms general models on certification exams while preserving broad reasoning ability. Because accuracy drives both regulatory acceptance and ROI, firms continue allocating budgets toward fine-tuning and evaluation pipelines that squeeze incremental gains from every new model release.

Surge in conversational AI adoption in customer support

Automated agents are now resolving a majority of frontline queries, unlocking sizable labor savings. Intercom reports 86% full resolution across 45 languages after embedding Claude AI into its support stack. The Asia-Pacific conversational AI market is expanding at a 24.1% CAGR through 2032, helped by rollouts at Alibaba and HDFC Bank that serve multilingual customer bases. Teneo.ai documents USD 5.60 cost reduction for every call it automates while maintaining 95% natural-language understanding accuracy. As translation quality improves, enterprises deploy a single bot across regions rather than running siloed language teams, strengthening the business case for faster uptake.

Shortage of High-Quality, Bias-Free Training Data

Limited domain-specific datasets impede performance for specialized uses. Vietnam responded by releasing ViGPT to address local linguistic gaps. The EU AI Act further mandates bias monitoring for high-risk systems, raising compliance workloads. Healthcare and finance feel the squeeze hardest, as privacy regulations restrict usable data pools, giving firms with proprietary datasets a head start.

Other drivers and restraints analyzed in the detailed report include:

- Integration of NLP in embedded/edge devices

- Proliferation of domain-specific LLMs for regulated industries

- Escalating Inference Costs for Large Models

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud accounts for 63.40% of the NLP market share in 2024, and the segment is projected to log a 24.95% CAGR to 2030. Usage-based pricing and elastic compute underpin its lead as enterprises experiment with generative workloads without investing in on-prem hardware. Microsoft Azure AI services grew 157% year-over-year to surpass USD 13 billion annualized revenue. Hybrid models serve regulated industries where data residency rules persist, splitting inference between local clusters and public clouds. Edge deployments now supplement cloud for latency-sensitive tasks, leveraging smartphones whose aggregate compute rises 25% yearly. This mix suggests the NLP market will organize around workload-specific deployment rather than a single dominant mode.

Large enterprises held 57.80% of the NLP market share in 2024, sustained by data assets and in-house AI staff. Yet SMEs are expected to outpace with a 25.01% CAGR through 2030 as turnkey APIs make advanced models accessible. Studies note SMEs pivot first on customer support and document processing before scaling to advanced analytics. API-based pay-as-you-go removes upfront capital, allowing SMEs to prove ROI quickly. Conversely, large firms pour resources into custom fine-tuning, spinning internal LLM centers of excellence to navigate compliance and security. This divergence will keep the NLP industry balanced between volume growth from SMEs and high-value bespoke projects at larger corporations.

The Natural Language Processing Market Report is Segmented by Deployment (On-Premise and Cloud), Organization Size (Large Organizations and Small and Medium Enterprises [SMEs]), Component (Hardware, Software, and Services), Processing Type (Text, Speech/Voice, and Image/Vision), End-User Industry (BFSI, Healthcare and Life Sciences, IT and Telecom, Retail and E-Commerce, Manufacturing, and More), and Geography.

Geography Analysis

North America commanded 33.30% revenue in 2024 and remains the largest regional contributor. Microsoft Cloud revenue reached USD 42.4 billion in FY 2025 Q3, up 20% year-over-year, with AI services a key driver. Venture funding and an enabling regulatory setting combine to accelerate enterprise rollouts.

Asia Pacific is projected to post a 25.85% CAGR, propelled by sovereign AI programs and local-language model development. Japan's commitment to support Southeast Asian LLM capacity showcases efforts to cut reliance on foreign providers. Regional conversational AI revenue tracks at 24.1% CAGR to 2032, indicating sustained demand for multilingual customer engagement tools.

Europe advances under the EU AI Act, balancing innovation with stringent compliance. Germany's AI market climbed 25% year-on-year to EUR 10 billion in Q1 2025, with companies like Siemens achieving 90% automation in document workflows. The regulation's detailed risk tiers favor vendors able to document processes, and this supports steady though measured growth. South America and MEA remain nascent, yet rising public-cloud footprints and smart-device adoption foreshadow untapped potential for the NLP market.

- Microsoft Corp.

- Google LLC (Alphabet)

- Amazon Web Services

- IBM Corp.

- NVIDIA Corp.

- OpenAI LP

- Meta Platforms Inc.

- SAP SE

- Oracle Corp.

- Baidu Inc.

- Intel Corp.

- Qualcomm Inc.

- SAS Institute Inc.

- Adobe Inc.

- Salesforce Inc.

- Apple Inc.

- Verint Systems Inc.

- Nuance Communications (Microsoft)

- Cohere Inc.

- Hugging Face

- Grammarly Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Generative-AI-powered model accuracy gains

- 4.2.2 Surge in conversational AI adoption in customer support

- 4.2.3 Integration of NLP in embedded/edge devices

- 4.2.4 Proliferation of domain-specific LLMs for regulated industries

- 4.2.5 Rising demand for real-time speech recognition in automotive and smart devices

- 4.2.6 Multimodal foundation models unlocking new verticals

- 4.3 Market Restraints

- 4.3.1 Shortage of high-quality, bias-free training data

- 4.3.2 Escalating inference costs for large models

- 4.3.3 Cross-border data residency compliance barriers

- 4.3.4 Environmental footprint of large-scale training compute

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 and Macro Slowdown

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises (SMEs)

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Processing Type

- 5.4.1 Text

- 5.4.2 Speech/Voice

- 5.4.3 Image/Vision

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 Healthcare and Life Sciences

- 5.5.3 IT and Telecom

- 5.5.4 Retail and E-commerce

- 5.5.5 Manufacturing

- 5.5.6 Media and Entertainment

- 5.5.7 Education

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Microsoft Corp.

- 6.4.2 Google LLC (Alphabet)

- 6.4.3 Amazon Web Services

- 6.4.4 IBM Corp.

- 6.4.5 NVIDIA Corp.

- 6.4.6 OpenAI LP

- 6.4.7 Meta Platforms Inc.

- 6.4.8 SAP SE

- 6.4.9 Oracle Corp.

- 6.4.10 Baidu Inc.

- 6.4.11 Intel Corp.

- 6.4.12 Qualcomm Inc.

- 6.4.13 SAS Institute Inc.

- 6.4.14 Adobe Inc.

- 6.4.15 Salesforce Inc.

- 6.4.16 Apple Inc.

- 6.4.17 Verint Systems Inc.

- 6.4.18 Nuance Communications (Microsoft)

- 6.4.19 Cohere Inc.

- 6.4.20 Hugging Face

- 6.4.21 Grammarly Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment