|

市场调查报告书

商品编码

1851659

应用安全:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Application Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

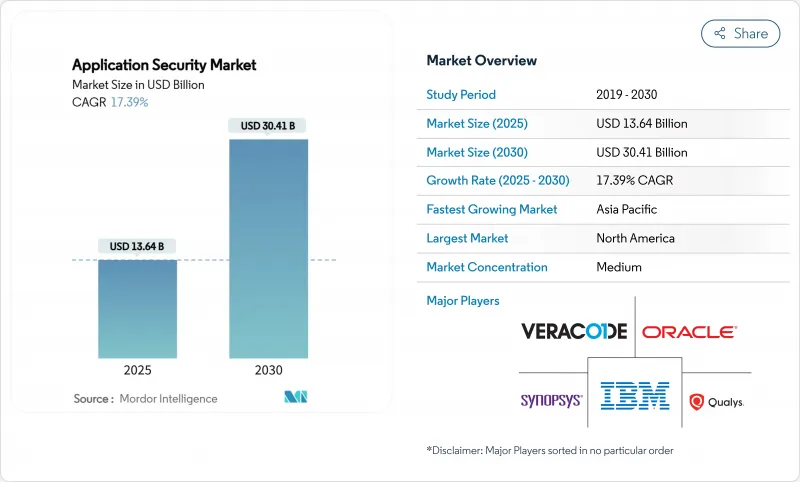

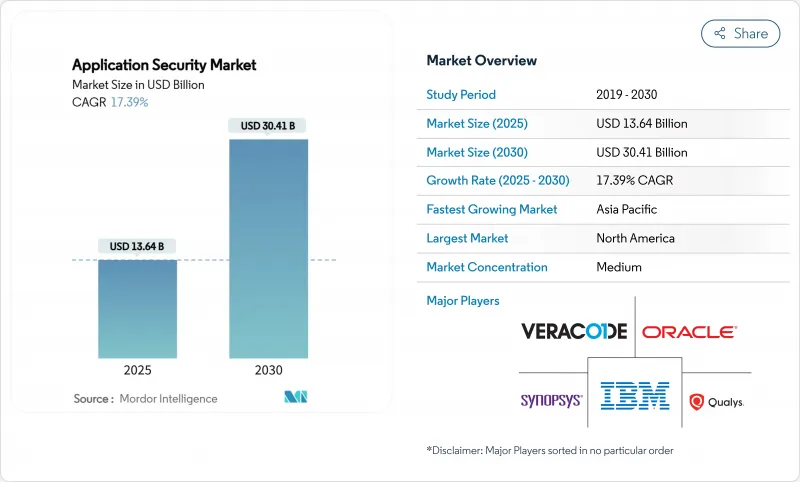

应用安全市场预计将从 2025 年的 136.4 亿美元成长到 2030 年的 304.1 亿美元,复合年增长率为 17.39%。

朝向云端运算、以 API 为中心的软体设计以及不断扩展的监管法规的转变,正在加速各大产业的采用。 API 流量的激增、人工智慧产生程式码的普及以及日益严格的事件揭露规则,都推动了这一成长,迫使企业在开发生命週期的早期阶段加强测试。虽然大型企业仍然是整体支出的主要驱动力,但中小企业 (SME) 的託管平台正在为供应商开闢新的市场。技术融合正在重塑竞争格局,平台供应商正在整合静态、动态和运行时保护,以减少工具的臃肿并提高开发人员的效率。

全球应用安全市场趋势与洞察

基于网路、行动装置和 API 的攻击日益增多且手段日益复杂

到2024年,亚太地区的Web应用程式攻击事件将激增73%,达到510亿起。每年开发超过1000个API的零售商面临着不断扩大的攻击面,这些攻击能够绕过边界控制。 2021年至2023年间,供应链入侵事件将增加431%,显示攻击手段正从直接代码注入转向依赖项滥用。企业正在将运行时应用程式自我保护与行为分析相结合,以应对异常流量模式,而不是依赖静态特征。在製造业,API事件发生率高达79%,证实了攻击者的行动速度远超过大多数操作技术安全计画。

快速采用DevSecOps工具链

随着团队将测试更早融入持续整合流程,DevSecOps 的采用率将从 2020 年的 27% 上升到 2024 年的 36%。像 ArmorCode 这样的平台能够处理数十亿个漏洞发现,并应用机器学习技术来关联漏洞,从而大规模地确定修復优先顺序。儘管取得了这些进展,但仍有 78% 的公司表示存在“左移疲劳”,而冗余工具会向开发人员发送大量警报,加剧了这种疲劳。最有效的方案能够简化整合开发环境中的安全任务,将策略视为版本化的工件,并在提交时自动执行。此外,AI 助理还能在程式码编辑器中提案修復建议,从而减少在开发和安全入口网站之间切换的时间,进一步增强了这种模型的效果。

总拥有成本高,且工具复杂

到2024年,SaaS价格通膨率将达到11.3%,部分供应商的涨幅甚至高达25%。 42%的中小企业仍然缺乏结构化的事件回应计划,这表明预算限制了企业级管理能力的提升。重复部署的扫描器、代理商和策略引擎导致整合技能不足,89%的企业预测,儘管员工人数保持不变,但仍需要招募更多员工。 Contrast One™等託管平台现在将专家服务和工具捆绑在一起,从而降低了管理成本。基于使用量的定价模式也正在兴起,使中小企业能够根据实际测试频率调整支出。

细分市场分析

到2024年,解决方案将占据78.5%的市场份额,这反映出企业对整合套件的偏好。市场领导正在将SAST、DAST、IAST和RASP整合到单一授权中,从而限制工具的分散。统一的仪表板减少了上下文切换,加快了决策速度。服务领域虽然规模较小,但其复合年增长率(CAGR)高达17.9%,超过了更广泛的应用安全市场,并将继续受益于技能缺口。

中小企业由于无力负担专职专家的费用,对託管安全服务的需求正在加速成长。服务提供者透过可预测的订阅定价和基于结果的服务等级协定 (SLA) 来吸引註重成本的客户。对于大型企业,专业服务专注于策略映射、管道整合和红队模拟,以在运行时检验防御措施。供应商还推出了按使用量分级的服务,让客户购买扫描积分而非永久席位,从而提高了漏洞管理预算的透明度。

预计到 2024 年,云端部署将占应用安全市场 65.9% 的份额,复合年增长率 (CAGR) 为 19.3%。 DORA 及相关法规要求在四小时内报告事件,如果没有集中式日誌记录和可扩展的分析功能,很难实现这一目标。云端原生解决方案能够快速部署策略更新,并可轻鬆与容器编配系统整合。

对于需要资料驻留的国防和公共部门工作负载而言,本地部署解决方案仍然很受欢迎。我们看到混合模式正在兴起,例如金融公司将敏感工作负载部署在私人基础架构上,并在开发过程中使用云端扫描器。云端供应商正在投资硬体支援的身份验证和机密运算,以解决长期存在的安全主权问题。目前争论的焦点在于如何确保云端安全态势管理能力的一致性,从而能够识别基础设施层和应用层中的配置错误。

应用程式安全市场按应用程式类型(Web应用安全、其他)、元件(解决方案、服务)、部署模式(云端、本地部署)、组织规模(中小企业、大型企业)、安全测试类型(静态应用安全测试 (SAST)、动态应用安全测试 (DAST)、其他)、最终用户行业(银行、金融服务和保险 (BFSI)、动态应用安全测试 (DAST)、其他)、最终用户行业(银行、金融服务和保险 (BFSI)、区域电子商务、其他地区医疗保健、零售、其他银行、金融服务和保险 (BFSI)、地区医疗保健、零售、其他地区(银行、金融服务和保险 (BFSI)、地区医疗保健、零售、其他银行、金融服务和保险 (BFSI)、地区医疗保健、零售、其他市场预测以美元计价。

区域分析

到2024年,北美将以28.9%的市场份额引领应用安全市场,这主要得益于强有力的监管压力以及财富500强企业平均每年超过2000万美元的安全预算。企业正在整合零信任架构,统一身分、网路和应用程式控制,以支援远端和混合办公模式。随着供应商试行基于人工智慧的漏洞关联工作负载,以缩短平均修復时间,技术中心也积极推进相关工作。

亚太地区预计将在2030年前实现17.5%的复合年增长率,成为成长最快的地区,这主要得益于数位化政府项目、金融科技的日益普及以及网路应用攻击激增73%(预计2024年攻击事件将达到510亿次)。新加坡和印度政府已发布网路安全策略,概述了关键基础设施的最低管理标准。儘管该地区製造业的数位化成熟度较低,但其API安全事件发生率最高,迫使供应商对威胁情报和特定语言的修復资源进行在地化。

欧洲的势头得益于《资料保护法》(DORA)、《网路韧性法》和《一般资料保护规范》(GDPR)等一系列全面的立法。自2025年1月起,金融机构必须实施资讯通信技术风险管理框架,并在四小时内报告资料外洩事件。企业将约9%的IT预算用于资讯安全,但89%的企业预计将增加人手以履行这些义务。资料主权条款鼓励企业在本地处理敏感工作负载,同时允许对较不重要的资料进行云端基础分析,从而推动了混合部署模式的普及。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 基于网路、行动装置和 API 的攻击日益增多,且手段也越来越复杂。

- 快速采用DevSecOps工具链

- 加强监管的趋势(PCI-DSS 4.0、GDPR、DORA 等)

- 第三方/SaaS整合成长

- 根据美国第14028号行政命令,强制揭露SBOM

- 人工智慧产生的程式码会放大未知漏洞

- 市场限制

- 总拥有成本高,且工具复杂。

- 全球安全编码人才短缺

- 过多的误报正在削弱开发者的信任。

- 「左移疲劳」和工具蔓延

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 服务

- 透过部署模式

- 云

- 本地部署

- 按组织规模

- 小型企业

- 大公司

- 按安全检查类型

- 静态应用程式安全扫瞄(SAST)

- 动态应用程式安全测试 (DAST)

- 互动式应用程式安全测试 (IAST)

- 运行时应用程式自我保护 (RASP)

- 软体配置分析(SCA)

- 按最终用户行业划分

- BFSI

- 卫生保健

- 零售与电子商务

- 政府/国防

- 资讯科技和电讯

- 教育

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 埃及

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM

- Synopsys Inc.

- Checkmarx

- Veracode(Thoma Bravo)

- Micro Focus

- Oracle Corporation

- Rapid7

- Qualys

- Palo Alto Networks

- Fortinet

- Trend Micro

- GitLab

- GitHub

- Snyk

- CrowdStrike

- Contrast Security

- WhiteHat Security(NTT)

- Positive Technologies

- SiteLock

- Mend(WhiteSource)

- ArmorCode

- Fasoo

- HCL Software(AppScan)

第七章 市场机会与未来展望

The application security market was valued at USD 13.64 billion in 2025 and is expected to reach USD 30.41 billion by 2030, advancing at a 17.39% CAGR.

Cloud migration, API-centric software design and expanding regulatory mandates are accelerating adoption across every major industry vertical. Growth is reinforced by a sharp increase in API traffic, the widespread use of AI-generated code and heightened incident disclosure rules that force organizations to strengthen testing earlier in the development life cycle. Large enterprises continue to anchor overall spending, yet managed platforms aimed at small and medium enterprises (SMEs) are opening a sizeable new addressable base for vendors. Technology convergence is reshaping competitive dynamics, with platform providers integrating static, dynamic and runtime protection to curb tool sprawl and improve developer productivity.

Global Application Security Market Trends and Insights

Rising Volume and Sophistication of Web, Mobile and API-Based Attacks

Web application attacks in the Asia-Pacific region surged 73% to 51 billion events in 2024, underscoring how attackers now exploit APIs at scale. Retailers developing more than 1,000 APIs yearly confront an enlarged attack surface that bypasses perimeter controls. Supply-chain breaches climbed 431% between 2021 and 2023, demonstrating a pivot toward dependency exploitation rather than direct code injection. Enterprises are integrating runtime application self-protection with behavioral analytics to act on anomalous traffic patterns rather than static signatures. Manufacturing recorded a 79% API incident rate, confirming that adversaries move faster than most operational technology security programs.

Rapid Adoption of DevSecOps Toolchains

DevSecOps penetration rose from 27% in 2020 to 36% in 2024 as teams embed testing earlier in continuous integration pipelines. Platforms processing billions of findings, such as ArmorCode, apply machine learning to correlate vulnerabilities and prioritize remediation at scale. Despite progress, 78% of enterprises report "shift-left fatigue," aggravated by redundant tools that overwhelm developers with alerts. The most effective programs streamline security tasks inside integrated development environments, treating policies as version-controlled artifacts automatically enforced at commit. This model is extending through AI assistants that suggest fixes inside code editors, thereby reducing context-switch time between development and security portals.

High Total Cost of Ownership and Tool Complexity

Software-as-a-service inflation reached 11.3% in 2024, with some vendors lifting prices by 25%.Forty-two percent of SMEs still lack a structured incident response plan, revealing budget constraints that limit enterprise-grade controls. Organizations deploy overlapping scanners, agents and policy engines that demand scarce integration skills, leading 89% of firms to foresee additional staffing needs despite flat headcounts. Managed platforms such as Contrast One(TM) now bundle expert services with tooling to cut administrative overhead. Consumption-based pricing models are also emerging, enabling smaller businesses to align spending with actual test frequency.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Regulatory Mandates

- Growth in Third-Party SaaS Integrations

- Global Shortage of Secure-Coding Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions retained a 78.5% share in 2024, reflecting enterprise preference for integrated suites. Market leaders combine SAST, DAST, IAST and RASP under one license to limit tool sprawl. Consolidated dashboards reduce context switching and speed decision-making, fixing a common pain point cited by development teams. The service segment, though smaller, outran the broader application security market with a 17.9% CAGR and will continue to benefit from skills gaps.

Demand for managed security accelerates within SMEs that cannot afford full-time specialists. Providers use predictable subscription pricing and outcome-based service-level agreements to attract cost-conscious buyers. For large enterprises, professional services focus on policy mapping, pipeline integration and red-team simulations that validate runtime defenses. Vendors also introduce consumption-tiered offerings, letting customers buy scanning credits rather than perpetual seats, bringing transparency to budgeting for vulnerability management.

Cloud deployment controlled 65.9% of the application security market in 2024 and is forecast to advance at a 19.3% CAGR. DORA and related regulations specify four-hour incident reporting, a timeline difficult to meet without centralized logging and scalable analytics. Cloud-native solutions enable rapid rollout of policy updates and integrate easily with container orchestration systems.

On-premises solutions remain prevalent in defense and public-sector workloads that require data residency. Hybrid patterns are growing as financial firms keep sensitive workloads on private infrastructure while using cloud scanners during development. Cloud vendors invest in hardware-backed attestation and confidential computing to address lingering sovereignty concerns. Competition now centers on alignment with cloud security posture management functions that map misconfigurations across both infrastructure and application layers.

Application Security Market is Segmented by Application Type (Web Application Security, and More), Component (Solutions, Services), Deployment Mode (Cloud, On-Premises), Organization Size (SMEs, Large Enterprises), Security Testing Type (SAST, DAST, and More), End-User Industry (BFSI, Healthcare, Retail and E-Commerce, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the application security market with a 28.9% revenue share in 2024, underpinned by strong regulatory pressure and average Fortune 500 security budgets exceeding USD 20 million annually. Enterprises integrate zero-trust architectures that merge identity, network and application controls to support remote and hybrid work. Advancements originate in technology hubs where vendors pilot AI-driven vulnerability correlation workloads, delivering faster mean time to remediation.

Asia-Pacific records the fastest projected 17.5% CAGR through 2030, fueled by digital government programs, rising fintech adoption and a 73% spike in web application attacks that hit 51 billion events in 2024. Governments in Singapore and India release refreshed cyber strategies that map minimum control baselines for critical infrastructure. The region's manufacturing sector, despite lower digital maturity, faces the highest share of API incidents, pushing vendors to localize threat intelligence and language-specific remediation resources.

Europe's momentum hinges on comprehensive statutes such as DORA, the Cyber Resilience Act and GDPR. Financial entities must implement ICT risk management frameworks and deliver four-hour breach notifications from January 2025. Organizations allocate around 9% of IT budgets to information security, yet 89% still anticipate hiring increases to meet these mandates. Hybrid deployment preferences persist because data-sovereignty clauses encourage on-premise processing of sensitive workloads while permitting cloud-based analytics for less critical data.

- IBM

- Synopsys Inc.

- Checkmarx

- Veracode (Thoma Bravo)

- Micro Focus

- Oracle Corporation

- Rapid7

- Qualys

- Palo Alto Networks

- Fortinet

- Trend Micro

- GitLab

- GitHub

- Snyk

- CrowdStrike

- Contrast Security

- WhiteHat Security (NTT)

- Positive Technologies

- SiteLock

- Mend (WhiteSource)

- ArmorCode

- Fasoo

- HCL Software (AppScan)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising volume and sophistication of web-, mobile- and API-based attacks

- 4.2.2 Rapid adoption of DevSecOps toolchains

- 4.2.3 Expanding regulatory mandates (PCI-DSS 4.0, GDPR, DORA, etc.)

- 4.2.4 Growth in third-party/SaaS integrations

- 4.2.5 Mandatory SBOM disclosure post-US Executive Order 14028

- 4.2.6 AI-generated code inflating unknown vulnerabilities

- 4.3 Market Restraints

- 4.3.1 High total cost of ownership and tool complexity

- 4.3.2 Global shortage of secure-coding talent

- 4.3.3 False-positive overload eroding developer trust

- 4.3.4 "Shift-left fatigue" and tool sprawl

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By Security Testing Type

- 5.4.1 Static Application Security Testing (SAST)

- 5.4.2 Dynamic Application Security Testing (DAST)

- 5.4.3 Interactive Application Security Testing (IAST)

- 5.4.4 Run-time Application Self-Protection (RASP)

- 5.4.5 Software Composition Analysis (SCA)

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 Healthcare

- 5.5.3 Retail and E-commerce

- 5.5.4 Government and Defense

- 5.5.5 IT and Telecom

- 5.5.6 Education

- 5.5.7 Others

- 5.6 By Region

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Netherlands

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia_Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 Egypt

- 5.6.5.2.2 South Africa

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM

- 6.4.2 Synopsys Inc.

- 6.4.3 Checkmarx

- 6.4.4 Veracode (Thoma Bravo)

- 6.4.5 Micro Focus

- 6.4.6 Oracle Corporation

- 6.4.7 Rapid7

- 6.4.8 Qualys

- 6.4.9 Palo Alto Networks

- 6.4.10 Fortinet

- 6.4.11 Trend Micro

- 6.4.12 GitLab

- 6.4.13 GitHub

- 6.4.14 Snyk

- 6.4.15 CrowdStrike

- 6.4.16 Contrast Security

- 6.4.17 WhiteHat Security (NTT)

- 6.4.18 Positive Technologies

- 6.4.19 SiteLock

- 6.4.20 Mend (WhiteSource)

- 6.4.21 ArmorCode

- 6.4.22 Fasoo

- 6.4.23 HCL Software (AppScan)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment