|

市场调查报告书

商品编码

1851661

记忆体内:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)In-Memory Database - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

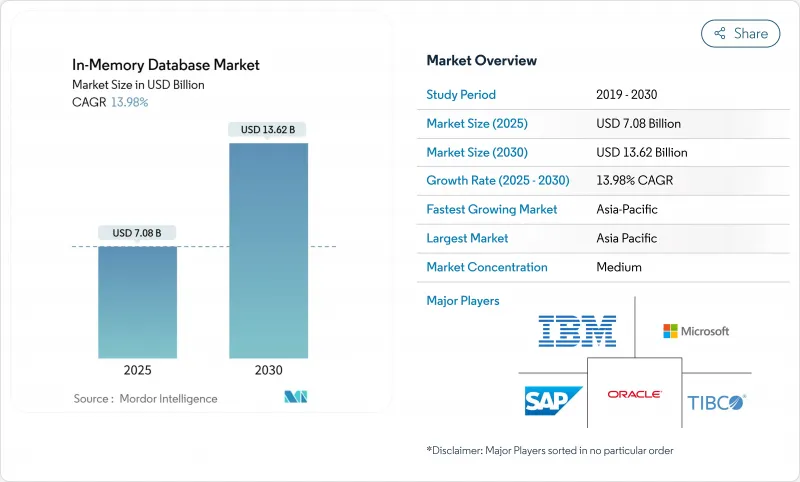

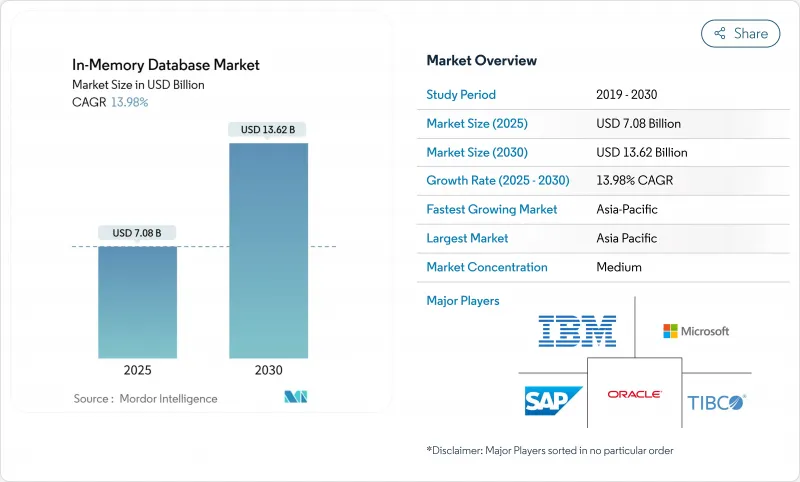

全球记忆体内市场预计到 2025 年将达到 70.8 亿美元,到 2030 年将达到 136.2 亿美元,预测期内复合年增长率为 13.98%。

云端原生微服务、AI推理引擎和串流分析平台对亚毫秒效能的要求不断推动企业向以记忆体为中心的架构转型。 DRAM价格的下降和基于CXL的持久记忆体模组的出现降低了整体拥有成本,使更多工作负载从磁碟系统转移出去。互联汽车和工业IoT工厂的边缘部署进一步刺激了需求,因为本地处理可以避免网路延迟带来的损失。随着传统供应商与超大规模云端的整合不断加深,以及开放原始码分支的蓬勃发展,竞争格局持续变化,为买家提供了避免被供应商锁定的新途径。

全球记忆体内市场趋势与洞察

需要亚毫秒延迟的云端原生微服务

云端原生技术的普及重塑了效能基准,容器化微服务需要微秒的资料存取速度。会话储存、个人化引擎和高频交易平台已从基于磁碟的资料库转向以记忆体为中心的存储,因为毫秒级的延迟会降低转换率和交易利润。 Dragonfly 在 AWS Graviton3E 晶片上实现了每秒 643 万次的运算速度,凸显了资料库层效能的上限。从单体架构迁移到分散式系统的金融机构和数位商务企业已经发现,回应时间的提升转化为实质的营收成长,凸显了这个驱动因素在短期内的重要性。

DRAM 和持久记忆体成本的下降扩大了总体拥有成本 (TCO) 差距。

儘管DDR4和DDR5记忆体模组的全球现货价格持续下跌,三星的CXL混合记忆体模组原型产品却以极具吸引力的成本展现了DRAM等级的延迟和持久性。超大规模营运商将记忆体跨机架共享,从而减少了閒置容量和备份週期。随着记忆体与固态硬碟阵列之间的溢价逐渐缩小,尤其是在服务等级协定(SLA)视窗要求严格的分析工作负载方面,企业纷纷将蓝图转向记忆体内部署。这种趋势在亚太地区的製造地尤其明显,这些工厂将大型历史资料集迁移到记忆体中,用于即时数位双胞胎分析。

由于专有格式而导致的供应商锁定问题令人担忧

2024 年 Redis 授权协议的变更促使 AWS、Google 和 Oracle 转而支持 Linux 基金会旗下的 Valkey 分支。那些为多年资料库计划製定预算的公司不得不将终止成本考虑在内,并推迟了采购週期。为了降低风险,一些公司采用了多资料库编配层,但这些抽象层带来了延迟,部分抵消了记忆体速度的提升。

细分市场分析

到2024年,OLTP(线上事务处理)领域将占据记忆体内市场45.3%的份额,凸显了银行、电子商务和ERP系统等高可靠性事务性工作负载的持续需求。由于关键任务记录仍需符合ACID规范,且企业愿意为亚毫秒的资料提交支付更高的效能溢价,因此市场需求依然强劲。 OLAP(线上分析处理)的应用主要针对成熟的商业智慧前端,但随着分析转向更灵活的引擎,其成长速度有所放缓。

受企业寻求单一平台带来的便利性驱动,HTAP预计将在2025年至2030年间以21.1%的复合年增长率成长。 GridGain的平台在维持对ANSI SQL-99支援的同时,速度比基于磁碟的系统提升高达1000倍。即时风险计算和供应链孪生模型需要并发读写访问,这使得HTAP成为首选架构。这种融合增加了先前营运和分析部门各自独立的预算,推动记忆体内市场朝向统一设计方向发展。

到2024年,本地部署将占总收入的55.4%,因为受监管行业需要完全託管的资料驻留和客製化的高可用性架构。即使公有云日趋成熟,与本地资料库紧密整合的传统企业软体堆迭仍将持续支撑支出。然而,随着数位原民企业采用託管服务以避免基础架构管理,云端采用率仍在持续加速成长。

受联网汽车和工业物联网闸道器的推动,边缘运算和嵌入式设备的普及预计将以23.2%的复合年增长率成长。现代汽车每年产生约300TB的数据,需要车载处理能力来实现自动驾驶功能。 TDengine针对智慧汽车遥测资料实现了比Elasticsearch高10倍的压缩,从而降低了上行传输频宽。製造商正在将类似的策略应用于生产线,以实现故障的即时检测。这种转变表明,曾经仅限于资料中心的效能提升如今在边缘运算中也至关重要,从而扩大了记忆体内市场的规模。

记忆体内市场按处理类型(OLTP、OLAP、HTAP)、部署模式(本地部署、其他)、资料模型(SQL、NoSQL、多模型)、组织规模(中小企业、大型企业)、应用程式(即时事务处理、其他)、最终用户垂直行业(银行、金融服务和保险、南美市场、IT和通讯、其他地区(北美、电信、欧洲)以及地区(北美电信、欧洲市场细分市场。

区域分析

预计到2024年,亚太地区将实现32.2%的最大营收成长,并维持17.1%的复合年增长率。中国、日本和印度的国家工业4.0计画推动了工厂自动化,这需要记忆体内历史资料库来实现亚秒的MES回馈迴路。通用汽车在其MES 4.0部署中连接了超过10万种营运技术,展示了边缘部署的规模。像Nautilus Technologies这样的本土供应商已经开发了自己的关係引擎,从而降低了对海外智慧财产权的依赖。

在北美,一个成熟又充满创新精神的市场正在崛起,Oracle核心领域包括金融服务、超大规模云端运算和自动驾驶汽车研发。 Oracle 和 Google 深化了合作,在 Google Cloud 上原生运作Oracle资料库服务,并将企业级 SQL 功能与人工智慧加速器结合。该地区的创业融资支持了 Dragonfly 等新兴企业,进一步加剧了竞争格局。

在欧洲,遵守 GDPR 的资料主权法规已成为重中之重,推动了混合云端的普及,并促使企业倾向于将本地丛集与本地资料中心的託管服务相结合。为了满足欧盟的居住要求, Oracle已将其 Database@Azure 产品扩展到更多欧盟地区。此外,在严格的隐私框架下,欧洲医疗保健领域也开始采用 HTAP资料库来支援人工智慧诊断。

在中东和非洲,智慧城市对光纤和5G骨干网路的投资推动了工业物联网(IIoT)试验,而即时分析的需求日益增长。在南美洲,采矿业和数位银行引领了这一趋势,低延迟诈骗侦测使得高阶记忆体资料库系统成为必要。儘管这两个地区的绝对支出仍然不高,但这两位数的成长扩大了全球记忆体内市场的多元化。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 需要亚毫秒延迟的云端原生微服务

- DRAM 和持久记忆体每 GB 价格的下降拉大了其与磁碟的总拥有成本差距。

- 在银行、金融服务和电讯采用流分析技术进行诈欺侦测和网路服务品质优化

- 用于加速医疗保健领域 AI/ML 模型服务的 HTAP 架构

- 边缘运算用例(联网汽车、工业物联网)需要嵌入式IMDB

- 市场限制

- 由于专有记忆体内格式而导致的供应商锁定问题令人担忧

- 40TB以上丛集高可用性设计的复杂性

- 限制全球复製的资料主权法律(例如,中国的《资料安全法》、欧盟的《一般资料保护条例》)

- 价值链分析

- 监管或技术环境

- 波特五力分析

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 按处理类型

- OLTP

- OLAP

- 混合事务/分析处理(HTAP)

- 透过部署模式

- 本地部署

- 云

- 边缘/嵌入式

- 按资料模型

- 关係型(SQL)

- NoSQL(键值、文件、图)

- 多重模型

- 按组织规模

- 小型企业

- 大公司

- 透过使用

- 即时交易处理

- 营运分析和商业智慧仪錶板

- AI/ML模型服务

- 缓存和会话存储

- 按最终用户行业划分

- BFSI

- 资讯科技/通讯

- 零售与电子商务

- 医疗保健与生命科学

- 製造和工业IoT

- 媒体与娱乐

- 政府/国防

- 其他(能源、教育等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 台湾

- 韩国

- 日本

- 印度

- 亚太其他地区

- 南美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他南美洲国家

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SAP SE

- Oracle Corp.

- Microsoft Corp.

- IBM Corp.

- Redis Ltd.(Redis Enterprise)

- Aerospike Inc.

- VoltDB Inc.

- Couchbase Inc.

- DataStax Inc.

- Hazelcast Inc.

- MemVerge Inc.

- Altibase Corp.

- GridGain Systems Inc.

- Raima Inc.

- McObject LLC

- Pivotal(VMware Tanzu GemFire)

- Amazon Web Services(Amazon ElastiCache & MemoryDB)

- Google Cloud(AlloyDB, Memorystore)

- Alibaba Cloud(ApsaraDB Tair)

- Huawei Cloud(GaussDB IM)

- Tencent Cloud(Tendis)

第七章 市场机会与未来展望

The global In-Memory Database market size stood at USD 7.08 billion in 2025 and is expected to reach USD 13.62 billion by 2030, advancing at a 13.98% CAGR over the forecast period.

Sub-millisecond performance requirements from cloud-native microservices, AI inference engines, and streaming analytics platforms continued to push enterprises toward memory-centric architectures. Lower DRAM prices and the arrival of CXL-based persistent memory modules have reduced the total cost of ownership, encouraging more workloads to migrate from disk-backed systems. Edge deployments in connected vehicles and Industrial IoT plants further expanded demand because local processing avoids network latency penalties. Competitive dynamics remained fluid as traditional vendors deepened integrations with hyperscale clouds while open-source forks gained momentum, giving buyers new paths to avoid vendor lock-in.

Global In-Memory Database Market Trends and Insights

Cloud-Native Microservices Demanding Sub-Millisecond Latency

Cloud-native adoption reshaped performance baselines as containerized microservices needed data access in microseconds. Session stores, personalization engines, and high-frequency trading platforms shifted from disk-backed databases to memory-centric stores because every millisecond of delay reduced conversion rates or trading profit. Dragonfly demonstrated 6.43 million operations per second on AWS Graviton3E silicon, highlighting the ceiling now expected from database tiers. Financial institutions and digital commerce operators that migrated monoliths to distributed systems saw response-time improvements translate into tangible revenue gains, reinforcing the driver's near-term importance.

Falling DRAM and Persistent Memory Costs Widening TCO Gap

Global spot pricing of DDR4 and DDR5 modules continued to slide, while Samsung's CXL Memory Module Hybrid prototype showed DRAM-class latency with persistence, creating a compelling cost profile. Hyperscale operators pooled memory across racks, reducing stranded capacity and backup cycles. Enterprises pivoted roadmaps toward in-memory deployment because the premium over SSD arrays narrowed, especially for analytics workloads with tight SLA windows. The effect is visible in Asia-Pacific manufacturing hubs where large historian datasets are moved into memory for real-time digital-twin analytics.

Vendor Lock-in Concerns Around Proprietary Formats

Redis's license change in 2024 heightened buyer wariness of proprietary formats, spurring AWS, Google, and Oracle to back the Valkey fork under the Linux Foundation. Enterprises budgeting multi-year database projects factored in exit costs, slowing purchase cycles. To mitigate risk, some adopted multi-database orchestration layers, but those abstractions introduced latency penalties that partially offset memory-speed gains.

Other drivers and restraints analyzed in the detailed report include:

- Streaming Analytics Adoption in BFSI and Telecom

- HTAP Architectures Accelerating AI/ML Model Serving

- High-Availability Design Complexity for Large Clusters

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The OLTP segment held 45.3% of the In-Memory Database market share in 2024, underscoring continued reliance on high-integrity transactional workloads across banking, e-commerce, and ERP systems. Demand persisted because mission-critical records still required ACID compliance, with enterprises paying a performance premium for sub-millisecond commits. OLAP deployments addressed established business-intelligence front ends but grew slowly as analytics shifted toward more flexible engines.

HTAP climbed with a 21.1% CAGR forecast from 2025 to 2030 as firms sought single-platform simplicity. GridGain's platform showed up to 1,000X speed-ups over disk-based systems while retaining ANSI SQL-99 support. Real-time risk calculations and supply-chain twins needed simultaneous read-write access, making HTAP the preferred architecture. The convergence unlocked incremental budget from departments earlier siloed between operations and analytics, pushing the In-Memory Database market toward unified designs.

On-premise installations captured 55.4% of 2024 revenue because regulated sectors required full control over data residency and tailored HA architectures. Legacy enterprise software stacks tightly integrated with on-premise databases, anchoring spending even as public clouds mature. Cloud deployments, nonetheless, have advanced as digital-native firms adopted managed services to avoid infrastructure administration.

Edge and embedded deployments displayed a 23.2% CAGR outlook, fueled by connected cars and IIoT gateways. Modern vehicles generate around 300 TB annually, which demands in-vehicle processing for autonomous features. TDengine achieved 10X compression over Elasticsearch in smart-vehicle telemetry, cutting bandwidth for upstream transfers. Manufacturers applied similar strategies on production lines to detect defects instantly. The shift signaled that performance gains once reserved for data centers were now indispensable at the edge, expanding the In-Memory Database market footprint.

In-Memory Database Market is Segmented by Processing Type (OLTP, OLAP, and HTAP), Deployment Mode (On-Premise, and More), Data Model (SQL, Nosql, and Multi-Model), Organization Size (SMEs, and Large Enterprises), Application (Real-Time Transaction Processing, and More), End-User Industry (BFSI, Telecommunications and IT, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific recorded the largest regional revenue at 32.2% in 2024 and maintained a 17.1% CAGR outlook. National Industry 4.0 programs in China, Japan, and India spurred factory automation that required in-memory historian databases for sub-second MES feedback loops. General Motors linked more than 100,000 operational technology connections in its MES 4.0 rollout, illustrating the scale of edge deployments. Local vendors such as Nautilus Technologies' advanced indigenous relational engines, reducing reliance on foreign IP.

North America formed a mature but innovation-rich market centered on financial services, hyperscale clouds, and autonomous-vehicle R&D. Oracle and Google deepened their partnership to run Oracle Database services natively on Google Cloud, marrying enterprise SQL capabilities with AI accelerators. The region's venture funding supported emerging players such as Dragonfly, intensifying competitive churn.

Europe prioritized data-sovereignty compliance under GDPR, driving hybrid cloud adoption and favoring on-premise clusters combined with managed services in local data centers. Oracle expanded Database@Azure coverage to additional EU regions to satisfy residency rules. The continent also saw healthcare deployments of HTAP databases to power AI diagnostics under strict privacy frameworks.

The Middle East and Africa invested in smart-city fiber and 5G backbones, leading to pilot IIoT deployments that require real-time analytics. South America gained traction in mining operations and digital banking, where low-latency fraud detection justified premium memory-centric systems. Though absolute spend in these two regions remained modest, double-digit growth expanded the In-Memory Database market's global diversity.

- SAP SE

- Oracle Corp.

- Microsoft Corp.

- IBM Corp.

- Redis Ltd. (Redis Enterprise)

- Aerospike Inc.

- VoltDB Inc.

- Couchbase Inc.

- DataStax Inc.

- Hazelcast Inc.

- MemVerge Inc.

- Altibase Corp.

- GridGain Systems Inc.

- Raima Inc.

- McObject LLC

- Pivotal (VMware Tanzu GemFire)

- Amazon Web Services (Amazon ElastiCache & MemoryDB)

- Google Cloud (AlloyDB, Memorystore)

- Alibaba Cloud (ApsaraDB Tair)

- Huawei Cloud (GaussDB IM)

- Tencent Cloud (Tendis)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-native micro-services demanding sub-millisecond latency

- 4.2.2 Falling DRAM and persistent-memory USD/GB widening TCO gap vs. disk

- 4.2.3 Streaming analytics adoption in BFSI and telecom for fraud and network QoS

- 4.2.4 HTAP architectures accelerating AI/ML model-serving in healthcare

- 4.2.5 Edge-compute use-cases (connected vehicles, IIoT) requiring embedded IMDB

- 4.3 Market Restraints

- 4.3.1 Vendor lock-in concerns around proprietary in-memory formats

- 4.3.2 High-availability design complexity for >40 TB clusters

- 4.3.3 Data-sovereignty laws (e.g., China CSL, EU GDPR) limiting global replication

- 4.4 Value Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of macroeconomoic factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Processing Type

- 5.1.1 OLTP

- 5.1.2 OLAP

- 5.1.3 Hybrid Transactional/Analytical Processing (HTAP)

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.2.3 Edge/Embedded

- 5.3 By Data Model

- 5.3.1 Relational (SQL)

- 5.3.2 NoSQL (Key-Value, Document, Graph)

- 5.3.3 Multi-model

- 5.4 By Organization Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By Application

- 5.5.1 Real-time Transaction Processing

- 5.5.2 Operational Analytics and BI Dashboards

- 5.5.3 AI/ML Model Serving

- 5.5.4 Caching and Session Stores

- 5.6 By End-user Industry

- 5.6.1 BFSI

- 5.6.2 Telecommunications and IT

- 5.6.3 Retail and E-commerce

- 5.6.4 Healthcare and Life Sciences

- 5.6.5 Manufacturing and Industrial IoT

- 5.6.6 Media and Entertainment

- 5.6.7 Government and Defense

- 5.6.8 Others (Energy, Education, etc.)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 France

- 5.7.2.3 United Kingdom

- 5.7.2.4 Nordics

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Taiwan

- 5.7.3.3 South Korea

- 5.7.3.4 Japan

- 5.7.3.5 India

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Mexico

- 5.7.4.3 Argentina

- 5.7.4.4 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 Oracle Corp.

- 6.4.3 Microsoft Corp.

- 6.4.4 IBM Corp.

- 6.4.5 Redis Ltd. (Redis Enterprise)

- 6.4.6 Aerospike Inc.

- 6.4.7 VoltDB Inc.

- 6.4.8 Couchbase Inc.

- 6.4.9 DataStax Inc.

- 6.4.10 Hazelcast Inc.

- 6.4.11 MemVerge Inc.

- 6.4.12 Altibase Corp.

- 6.4.13 GridGain Systems Inc.

- 6.4.14 Raima Inc.

- 6.4.15 McObject LLC

- 6.4.16 Pivotal (VMware Tanzu GemFire)

- 6.4.17 Amazon Web Services (Amazon ElastiCache & MemoryDB)

- 6.4.18 Google Cloud (AlloyDB, Memorystore)

- 6.4.19 Alibaba Cloud (ApsaraDB Tair)

- 6.4.20 Huawei Cloud (GaussDB IM)

- 6.4.21 Tencent Cloud (Tendis)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment