|

市场调查报告书

商品编码

1851708

环境感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Environmental Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

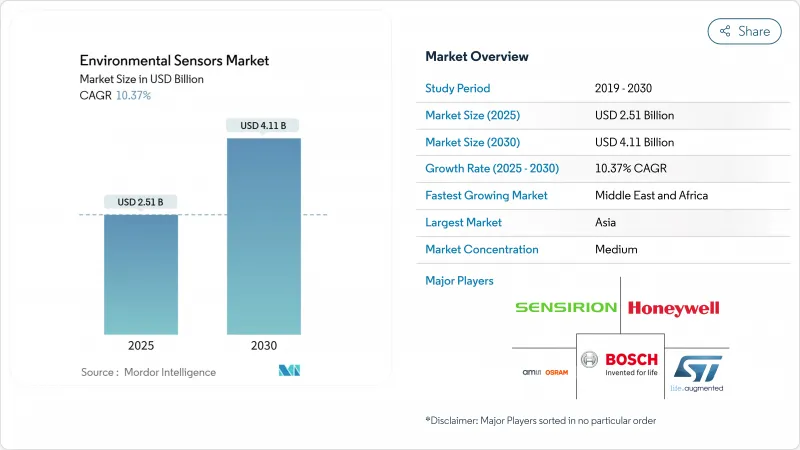

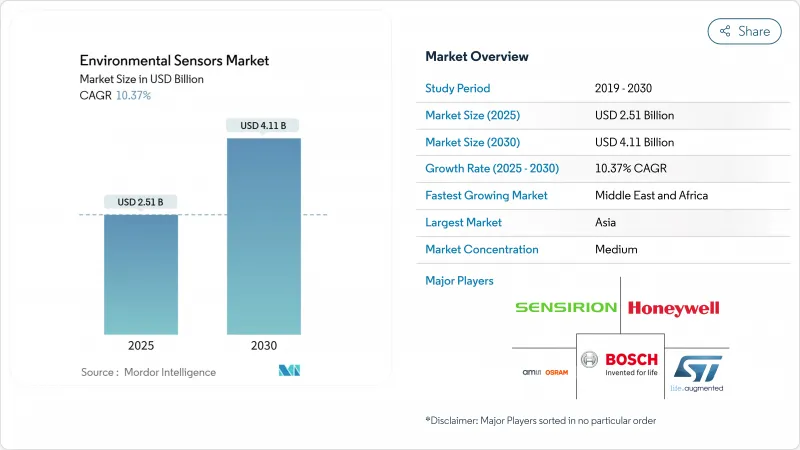

预计到 2025 年,环境感测器市场规模将达到 25.1 亿美元,到 2030 年将达到 41.1 亿美元,年复合成长率为 10.37%。

这一强劲的市场前景反映了严格的监管压力、NB-IoT的快速部署及其在智慧城市、工业IoT和消费级穿戴装置领域日益增长的应用。美国大型加速度计报告公司现在必须揭露范围1和范围2的温室气体排放,并需获得第三方保证,加速了感测器在连续监测领域的应用。在欧洲,修订后的《空气品质指令》将于2025年3月生效,该指令要求成员国即时追踪超细颗粒物,从而推动了对经济高效的感测器网路的需求。亚太地区引领环境感测器市场,这主要得益于中国支持高密度城市监测的NB-IoT基础设施;而北美则在野火探测网路和边缘人工智慧平台方面引领着技术创新。半导体巨头、小众MEMS供应商和云原生物联网公司竞相提供弹性、网路安全和自校准解决方案,市场竞争仍然激烈。

全球环境感测器市场趋势与洞察

NB-IoT技术的日益普及推动了密集型城市感测器网路的发展(亚洲)

中国通讯业者目前营运超过9亿个NB-IoT连接,并计划在2030年将连接数扩展至19亿。这种低功耗、广域化的标准支援10年以上的电池寿命、深层室内穿透能力和授权频谱的可靠性,使市政当局无需挖掘电缆沟即可覆盖高层建筑。从泰国到阿联酋等邻国正在采用这种模式,以加速智慧城市部署和ESG合规。

加强欧盟环境空气品质指令 2023/2119 标准

2025年3月的指令将PM2.5年均浓度限值从25µg/m3降至10µg/m3,并强制要求监测超细颗粒物,这将迫使成员国用密集的感测器群来补充高成本的参考站。即时公共数据存取条款优先考虑能够将测量数据流传输到中央控制面板的物联网模组,从而刺激了对能够达到±5µg/m3都市区雾霾测量精度的校准型MEMS单元的需求。

恶劣户外环境下的校准漂移和维护成本

部署在户外环境中的电化学感测器会因温度波动、湿度波动以及暴露于干扰气体而出现显着的校准漂移,需要频繁重新校准(有时甚至低至每三个月一次)才能保持可接受的精度。这种维护负担会造成巨大的营运成本,在部署的第一年内就可能超过感测器的初始采购成本,尤其是在环境压力会加速感测器劣化的恶劣气候条件下。研究表明,超过90%的感测器在例行检查中仍保持在校准规格范围内,这表明目前的维护计划过于保守,但由于违规的高昂成本,这些计划又是必要的。

细分市场分析

固定式环境感测器在2024年将占总收入的62%,这反映出工厂营运商需要持续证明其符合监管要求。壁挂式或管道式探头可全天候向环境管理系统传输数据,供审核进行范围1检验。可携式设备虽然体积较小,但到2030年将以12.8%的复合年增长率成长,因为紧急服务部门、矿业公司和建筑联合体倾向于快速部署到瞬息万变的工地。国防安全保障部的一项野火试点计画表明,拖车式PM节点提供的前置作业时间比卫星影像快30分钟,检验了行动网路的商业可行性。

可携式正日益成为固定阵列的补充而非替代。例如,公用事业公司为了合规性而安装有线二氧化硫(SO2)阵列,并在维修停机期间移除电池供电的挥发性有机化合物(VOC)侦测器。穿戴式装置仍处于起步阶段,但为消费性电子厂商(OEM)提供了一条以健康为中心的差异化途径,可以将花粉计数和污染警报与健身仪錶板结合。在我们的预测週期内,我们预计结合永久基准和可移动丛集的混合架构将重新定义整个环境感测器市场的采购指南。

采用成熟的电化学电池和非分散红外线(NDIR)光学技术的气体分析仪,用于检测工厂、隧道和锅炉中的一氧化碳(CO)、氮氧化物(NOx)和挥发性有机化合物(VOCs),预计到2024年将占据环境感测器市场份额的26%。同时,随着公共卫生机构收紧PM2.5暴露基准值,颗粒物检测仪器的复合年增长率(CAGR)预计将达到13.5%。受欧盟和加州指令(要求年均PM2.5浓度低于10µg/m3)的推动,PM测量仪器的环境感测器市场规模预计到2030年将达到10.1亿美元。

温度、湿度和压力感测器仍然是应用广泛的环境监测参数,通常与关键气体或颗粒物监测功能整合在多参数模组中。 BoschSensortec的BME688整合了四个实体感测器和板载AI推理功能,可为先前购买分立元件的OEM厂商降低20%的材料成本。融合趋势正在模糊以往的品类界限,推动采购转向综合性的“环境控制包”,而非单一参数的零件。

区域分析

亚太地区引领环境感测器市场,预计2024年营收将成长38%,这主要得益于中国和印度智慧大型企划的推动,这些计画将NB-IoT节点嵌入路灯、公车和学校等设施中。光是深圳一地就运作了超过37,000个空气品质监测箱,并将资料连接到开放资料入口网站。强大的电子供应链正在降低材料成本,使得市政当局能够以不到15,000美元的成本部署一平方公里的监测网路。日本和韩国的工厂正在部署先进的MEMS技术,而澳洲各州则在投资用于应对森林火灾的PM和烟雾监测阵列。

以金额为准。由于美国证券交易委员会(SEC)的气候资讯揭露要求以及加州、奥勒冈州和不列颠哥伦比亚省的野火应对资金,北美环境感测器市场正蓬勃发展。云端边缘合作关係蓬勃发展:Honeywell与亚德诺半导体公司达成的2024年协议将把建筑自动化网关直接连接到Azure IoT中心,从而将整合时间缩短一半。根据CHIPS和《科学法案》提供的联邦拨款将促进网路安全韧体的研发。

对PM2.5和超细颗粒物的更严格监管正在推动400多个城市进行感测器维修。德国正在将环境遥测数据与其工业4.0数位双胞胎连接起来,北欧的公用事业公司则在区域供热柜中安装露点阵列,以减少因冷凝造成的能源损失。在「地平线欧洲」计画下,欧盟基金现在可以报销高达75%的空气品质监测网路成本,从而缩短部署前置作业时间。

中东和非洲目前仅占个位数份额,但年复合成长率高达14.2%。海湾石油国家正在采用连续洩漏检测技术发行与环境、社会和治理(ESG)挂钩的债券,而南非采矿业正在试点使用低成本的颗粒物网,以加强职业安全审核。校准实验室的匮乏仍然是一大障碍,但计划于2026-2027年建成的捐助者资助的参考站将为内罗毕、阿克拉和拉各斯带来大量订单。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- NB-IoT 的普及使得密集型城市感测器网路成为可能(亚洲)

- 欧盟空气品质指令2023/2119标准将加强

- ESG相关产业排放揭露义务(美国证券交易委员会,CSRD)

- 穿戴式装置和听觉装置中多参数感测器模组的应用

- 绿色氢能和电池超级工厂的建设需要湿度/气体感测器

- 利用分散式PM感测器的北美野火早期预警网络

- 市场限制

- 恶劣户外环境下的校准漂移和维护成本

- 新兴国家参考级校准基础设施有限

- 云端连接工业感测器的网路安全和智慧财产权问题

- MEMS元件的商品化导致价格下降

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 固定的

- 可携式的

- 穿戴式装置

- 透过感应类型

- 气体

- 温度

- 湿度

- 压力

- 颗粒物(PM)

- 多参数模组

- 连结性别

- 有线

- 无线的

- 按最终用户行业划分

- 产业

- 医疗保健

- 消费性电子产品

- 车

- 智慧家庭与建筑

- 农业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ams OSRAM AG

- Sensirion Holding AG

- Bosch Sensortec GmbH

- Honeywell International Inc.

- Texas Instruments Inc.

- Analog Devices Inc.

- STMicroelectronics NV

- NXP Semiconductors NV

- TDK Corporation(InvenSense)

- Omron Corporation

- Sensata Technologies Inc.

- AlphaSense Inc.

- Figaro Engineering Inc.

- Banner Engineering Corp.

- Renesas Electronics Corp.

- Teledyne FLIR LLC

- Hanwei Electronics Group Corp.

- Powelectrics Ltd.

- Eurotech SpA

- Omega Engineering Inc.

- Nesa Srl

- Eko Instruments BV

第七章 市场机会与未来展望

The environmental sensors market was valued at USD 2.51 billion in 2025 and is forecast to grow at a 10.37% CAGR, reaching USD 4.11 billion by 2030.

This robust outlook reflects intense regulatory pressure, rapid NB-IoT roll-outs, and widening adoption across smart cities, industrial IoT, and consumer wearables. Large accelerated filers in the United States must now disclose Scope 1 and Scope 2 greenhouse-gas emissions with third-party assurance, prompting accelerated sensor deployment for continuous monitoring. In Europe, the revised Ambient Air Quality Directive effective March 2025 forces member states to track ultrafine particles in real time, expanding demand for cost-effective sensor networks. Asia-Pacific leads the environmental sensors market thanks to Chinese NB-IoT infrastructure that supports high-density urban monitoring, while North America drives innovation in wildfire-detection networks and edge-AI platforms. Competitive intensity remains high as semiconductor majors, niche MEMS suppliers, and cloud-native IoT firms race to deliver resilient, cyber-secure, and self-calibrating solutions.

Global Environmental Sensors Market Trends and Insights

Increased NB-IoT Deployments Enabling Dense Urban Sensor Networks (Asia)

Chinese operators now run more than 900 million NB-IoT connections, and expansion plans aim for 1.9 billion by 2030, giving cities like Shenzhen the backbone for block-level air-quality mapping. The low-power wide-area standard supports decade-long battery life, deep-indoor penetration, and licensed-spectrum reliability, letting municipalities blanket high-rise districts without trenching cables. Neighboring economies from Thailand to the UAE mirror this model to accelerate smart-city roll-outs and ESG compliance.

Tightening EU Ambient Air-Quality Directive 2023/2119 Standards

The March 2025 directive slices the annual PM2.5 limit from 25 µg/m3 to 10 µg/m3 and mandates ultrafine particle tracking, forcing member states to supplement costly reference stations with dense sensor clusters. Real-time public-data access clauses privilege IoT-ready modules that stream measurements to central dashboards, spurring demand for calibrated MEMS units capable of +-5 µg/m3 accuracy in urban smog.

Calibration Drift & Maintenance Costs in Harsh Outdoor Environments

Electrochemical sensors deployed in outdoor environments experience significant calibration drift due to temperature fluctuations, humidity variations, and exposure to interfering gases, requiring recalibration intervals as frequent as every 3 months to maintain acceptable accuracy. This maintenance burden creates substantial operational costs that can exceed initial sensor procurement costs within the first year of deployment, particularly in harsh climates where environmental stressors accelerate sensor degradation. Research indicates that over 90% of sensors remain within calibration specifications during routine checks, suggesting that current maintenance schedules are overly conservative but necessary due to the high cost of compliance failures.

Other drivers and restraints analyzed in the detailed report include:

- ESG-Linked Industrial Emissions Disclosure Mandates (SEC, CSRD)

- Adoption of Multi-parameter Sensor Modules in Wearables & Hearables

- Limited Reference-Grade Calibration Infrastructure in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fixed installations dominated the environmental sensors market size with 62% revenue in 2024, reflecting plant operators' need for uninterrupted proof of regulatory conformity. These wall-mounted or duct-inserted probes feed 24/7 data to environmental management systems that auditors rely on for Scope 1 verification. Portable devices, although smaller in volume, are pacing a 12.8% CAGR through 2030 as first-responders, mining firms, and construction consortia favor rapid deployment along shifting work sites. The Department of Homeland Security's wildfire pilot showed that trailer-mounted PM nodes delivered 30-minute lead times over satellite imagery, validating the business case for mobile grids.

Portables increasingly complement-not replace-fixed arrays. Utilities, for instance, install hard-wired SO2 stacks for compliance, then wheel battery-powered VOC sniffers during maintenance outages. Wearable units remain nascent but give consumer OEMs a route to health-centric differentiation, bundling pollen counts or pollution alerts into fitness dashboards. Over the forecast cycle, hybrid architectures blending permanent baselines with redeployable clusters will redefine procurement guidelines across the environmental sensors market.

Gas analyzers captured 26% of environmental sensors market share in 2024 thanks to mature electrochemical cells and NDIR optics that detect CO, NOx, and volatile organic compounds in factories, tunnels, and boilers. Particulate-matter devices, however, are charting a 13.5% CAGR as public-health agencies tighten PM2.5 exposure thresholds. Environmental sensors market size for PM instruments is forecast to reach USD 1.01 billion by 2030, buoyed by EU and California mandates demanding 10 µg/m3 annual averages.

Temperature, humidity, and pressure chips remain ubiquitous housekeeping parameters, often bundled with primary gas or PM functions inside multi-parameter modules. Bosch Sensortec's BME688 unites four physical sensors plus on-board AI inference, slicing bill-of-materials cost by 20% for OEMs that previously bought discrete components. Convergence blurs historical category lines, steering purchasing toward holistic "environment packs" rather than single-parameter parts.

The Environmental Sensors Market Report is Segmented by Product Type (Fixed, Portable, Wearable), Sensing Type (Gas, Temperature, Humidity, Pressure, Particulate Matter (PM), Multi-Parameter Modules), Connectivity (Wired, Wireless), End-User Industry (Industrial, Medical and Healthcare, Consumer Electronics, Automotive), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the environmental sensors market with 38% revenue in 2024, powered by smart-city mega-projects in China and India that embed NB-IoT nodes in streetlights, buses, and schools. Shenzhen alone operates more than 37,000 air-quality boxes feeding open data portals. Strong electronics supply chains lower bill-of-materials, letting municipalities deploy square-kilometer grids for less than USD 15,000. Japanese and South Korean fabs inject advanced MEMS capacity, while Australian states invest in PM-and-smoke arrays for bushfire response.

North America ranks second by value. The environmental sensors market here gains momentum from SEC climate disclosure obligations and wildfire-defense funding across California, Oregon, and British Columbia. Cloud-edge alliances flourish: Honeywell's 2024 pact with Analog Devices links building-automation gateways directly to Azure IoT hubs, cutting integration times by half. Federal grants under the CHIPS and Science Act funnel R&D toward cyber-resilient sensor firmware.

Europe remains pivotal; tightened PM2.5 and ultrafine norms drive sensor retrofits across 400+ cities. Germany ties environmental telemetry to Industry 4.0 digital twins, while Nordic utilities install dew-point arrays inside district-heating vaults to manage condensation energy losses. Implementation lead times shorten because EU funds now reimburse up to 75% of air-quality network costs under Horizon Europe.

The Middle East and Africa presently represent a single-digit share but exhibit 14.2% CAGR. Gulf petro-states adopt continuous-leak detection for ESG-linked bond issuance, and South Africa's mining sector pilots low-cost PM nets to bolster labor-safety audits. Scarce calibration labs remain a hurdle, but donor-funded reference stations scheduled for 2026-2027 will unlock volume orders across Nairobi, Accra, and Lagos.

- ams OSRAM AG

- Sensirion Holding AG

- Bosch Sensortec GmbH

- Honeywell International Inc.

- Texas Instruments Inc.

- Analog Devices Inc.

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- TDK Corporation (InvenSense)

- Omron Corporation

- Sensata Technologies Inc.

- AlphaSense Inc.

- Figaro Engineering Inc.

- Banner Engineering Corp.

- Renesas Electronics Corp.

- Teledyne FLIR LLC

- Hanwei Electronics Group Corp.

- Powelectrics Ltd.

- Eurotech S.p.A.

- Omega Engineering Inc.

- Nesa Srl

- Eko Instruments B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased NB-IoT Deployments Enabling Dense Urban Sensor Networks (Asia)

- 4.2.2 Tightening EU Ambient Air-Quality Directive 2023/2119 Standards

- 4.2.3 ESG-Linked Industrial Emissions Disclosure Mandates (SEC, CSRD)

- 4.2.4 Adoption of Multi-parameter Sensor Modules in Wearables and Hearables

- 4.2.5 Green-Hydrogen and Battery Gigafactory Build-outs Requiring Humidity/Gas Sensors

- 4.2.6 Wild-fire Early-Warning Networks in North America Using Distributed PM Sensors

- 4.3 Market Restraints

- 4.3.1 Calibration Drift and Maintenance Costs in Harsh Outdoor Environments

- 4.3.2 Limited Reference-Grade Calibration Infrastructure in Emerging Economies

- 4.3.3 Cyber-security and IP Concerns Around Cloud-Connected Industrial Sensors

- 4.3.4 Price Erosion from Commoditization of MEMS Components

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Fixed

- 5.1.2 Portable

- 5.1.3 Wearable

- 5.2 By Sensing Type

- 5.2.1 Gas

- 5.2.2 Temperature

- 5.2.3 Humidity

- 5.2.4 Pressure

- 5.2.5 Particulate Matter (PM)

- 5.2.6 Multi-parameter Modules

- 5.3 By Connectivity

- 5.3.1 Wired

- 5.3.2 Wireless

- 5.4 By End-User Industry

- 5.4.1 Industrial

- 5.4.2 Medical and Healthcare

- 5.4.3 Consumer Electronics

- 5.4.4 Automotive

- 5.4.5 Smart Homes and Buildings

- 5.4.6 Agriculture

- 5.4.7 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ams OSRAM AG

- 6.4.2 Sensirion Holding AG

- 6.4.3 Bosch Sensortec GmbH

- 6.4.4 Honeywell International Inc.

- 6.4.5 Texas Instruments Inc.

- 6.4.6 Analog Devices Inc.

- 6.4.7 STMicroelectronics N.V.

- 6.4.8 NXP Semiconductors N.V.

- 6.4.9 TDK Corporation (InvenSense)

- 6.4.10 Omron Corporation

- 6.4.11 Sensata Technologies Inc.

- 6.4.12 AlphaSense Inc.

- 6.4.13 Figaro Engineering Inc.

- 6.4.14 Banner Engineering Corp.

- 6.4.15 Renesas Electronics Corp.

- 6.4.16 Teledyne FLIR LLC

- 6.4.17 Hanwei Electronics Group Corp.

- 6.4.18 Powelectrics Ltd.

- 6.4.19 Eurotech S.p.A.

- 6.4.20 Omega Engineering Inc.

- 6.4.21 Nesa Srl

- 6.4.22 Eko Instruments B.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment