|

市场调查报告书

商品编码

1851710

晶圆清洗设备:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Wafer Cleaning Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

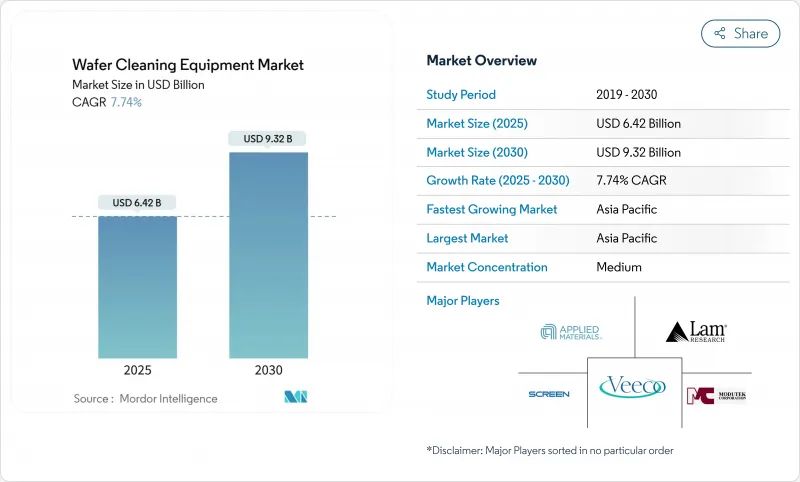

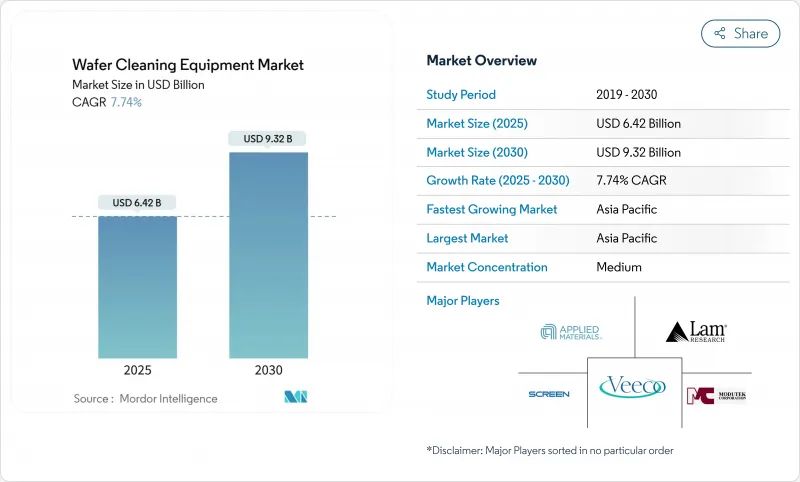

预计到 2025 年,晶圆清洗设备市场规模将达到 64.2 亿美元,到 2030 年将达到 93.2 亿美元,2025 年至 2030 年的复合年增长率为 7.74%。

这一成长反映了半导体产业向1.6奈米製程技术的转型,在该技术中,去除10奈米以下的颗粒是强制性要求。极紫外光刻技术的应用、台湾、韩国、中国和美国晶圆代工厂产能的提升,以及向300毫米碳化硅和氮化镓晶圆的过渡,都在推动晶圆清洗设备市场的整体需求。针对含氟温室气体的环境法规以及不断上涨的超纯水成本正在改变设备的选择标准,但提供节水型和低温解决方案的供应商正在赢得市场份额。市场竞争依然适中,复杂的製程技术、较长的认证週期和服务覆盖范围构成了进入障碍。

全球晶圆清洗设备市场趋势及洞察

3D NAND 和 DRAM 製程节点尺寸的快速缩小将推动对无缺陷前端製程清洗的需求。

2030年实现1000层3D NAND快闪记忆体的量产蓝图需要增加清洗步骤,因为每增加一层都会因颗粒物而导致产量比率下降。 SK海力士已为2028年前的记忆体扩张累计了750亿美元,其中80%将用于高频宽记忆体。 Lam Research推出了Cryo 3.0蚀刻技术,用于减少深沟槽中的聚合物残留。能够实现亚埃级去除精度的设备製造商正受益于层数的增加,从而推动晶圆清洗设备市场的发展。记忆体晶圆厂现在已将设备采购决策与10nm以下製程的去除效率挂钩,从而增强了长期需求。

美国、韩国和台湾地区铸造产能的扩展创造了新的模具安装基础。

《晶片製造和改进法案》(CHIPS Act)在亚利桑那州引发了一场大规模的设备采购浪潮,台积电在该州的工厂需要数千套製程设备。三星和SK海力士在2047年前投资622兆韩元(约4,710亿美元)新建16家工厂,从而增强了其近期的订单週期。东京电子在五年内将研发支出几乎翻了一番,达到1.5兆日圆,以确保下一代晶片的市场机会。产能扩张的重点是3奈米及以下製程,只有先进的晶圆清洗设备市场参与企业才能满足这些设备规格要求。由于设备前置作业时间短且靠近服务中心,全自动清洗平台的订单量立即激增。

对含氟温室气体(F-GHG)排放严格监管

全球半导体产业已承诺逐步淘汰全氟辛酸(PFOA),这缩小了可供选择的化学物质范围。美国环保署(EPA)加快全氟烷基和多氟烷基物质(PFAS)的审查,也为化学物质蓝图增添了不确定性。 2010年至2020年间,欧洲半导体工厂的全氟化合物(PFC)排放减少了42%,主要透过维修衰减模组来实现。如今,设备製造商将洗涤器与闭合迴路化学回收设备捆绑销售,这提高了购置成本,延长了投资回报期,并减缓了晶圆清洗设备市场的成长预期。

细分市场分析

2024年,全自动平台将占总收入的74.5%,这主要得益于先进逻辑生产线对严格污染控制的要求,也使得晶圆清洗设备市场呈现自动化优先的模式。半自动化设备仍主要应用于研发无尘室,而手动系统则仅限于特定或传统製程。在人工智慧驱动的配方优化推动下,全自动设备市场预计将以每年8.5%的速度成长。我们的旋转清洗机SS-3200每小时可处理500片晶圆,同时也能减少去离子水的用量,进而延长更换週期。

机器控制器内建的製程分析功能现在可以储存每个批次数百万个资料点,使工厂能够预测异常情况并防止生产线停机。供应商正在整合预测性维护模组,这些模组可以标记脏污喷嘴和流量不稳定情况。此类数位化工作流程符合智慧製造的要求,并支援高价位。因此,晶圆清洗设备市场的采购决策正在转变,从单纯的资本支出转向以运作和节水指标为驱动的总体拥有成本。

晶圆喷淋生产线凭藉其占地面积小、化学品用量少和配方灵活等优势,助力晶圆清洗设备市场保持成长势头,预计到2024年将占据33.2%的市场份额。低温二氧化碳清洗设备虽然出现时间较晚,但由于近乎零液体排放,实现了12.2%的复合年增长率,成为成长最快的设备。批量浸没式清洗设备在大批量通用生产线中占据一席之地,而批量喷淋式清洗设备则占据了中端市场。洗涤器则有助于去除仅靠化学物质无法清除的厚层氧化物。

东京电子的低温蚀刻技术减少了80%的二氧化碳排放,并印证了其绿色化学概念。 ACM公司的Ultra C Tahoe技术在保持传统製程效能的同时,将硫酸用量减少了75%,已被多家晶圆代工厂采用。如今,技术决策不仅围绕着水资源和温室气体排放指标,也围绕着颗粒计数规范展开,这凸显了单晶圆创新在晶圆清洗设备市场中的战略重要性。

晶圆清洗设备市场依操作模式(自动化、其他)、技术类型(单晶圆喷淋、单晶圆低温、其他)、晶圆尺寸(≤150 毫米、200 毫米、300 毫米和 ≥450 毫米)、应用(智慧型手机和平板电脑、储存设备、其他)、最终用户(代工厂、IDM、OSAT)和(智慧型手机和平板电脑、储存设备、其他)、最终用户(代工厂、IDM、OSAT)和区域(智慧型手机和平板电脑、北美地区、其他)、最终用户(代工厂、IDM、OSAT)和北美地区(智慧型手机和平板电脑、南美洲、其他)、最终用户(代工厂、IDM、OSAT)和北美地区(智慧型手机和平板电脑、南美洲、其他)、最终用户(代工厂、IDM、OSAT)和北美地区(智慧型手机和平板电脑、美国地区、其他)、最终用户(代工厂、IDM、OSAT)和美国细分

区域分析

亚太地区占2024年销售额的72.5%,其中台湾、韩国和中国大陆的丛集投资新增了每月超过770万片晶圆的清洗能力。高雄和新竹晶圆代工厂的扩建推动了近期工具的普及,而受出口限制影响的中国IDM厂商的涌现则促进了国内工具的普及。

北美市场份额因《晶片製造法案》的资助而提升,台积电位于亚利桑那州的工厂和英特尔位于俄亥俄州的工厂都设立了美国本土的服务团队和备件中心,从而改变了晶圆清洗设备市场的供应商选择动态。

欧洲保持了其专业技术领先地位:英飞凌和意法半导体扩大了碳化硅的生产,荷兰推出了价值 1200 万欧元的 ChipNL 中心,共同开发清洗和计量平台,汽车行业的需求推动了强劲的工具更新。

南美洲以及中东和非洲地区的组装厂需求逐步成长。阿联酋和巴西政府为吸引需要本地晶圆清洗服务的后端工厂而推出的激励措施,显示晶圆清洗设备市场将呈现长期的区域多元化趋势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 3D NAND 和 DRAM 製程节点尺寸的缩小将推动对无缺陷前端製程清洗的需求。

- 美国、韩国和台湾地区铸造产能的扩张,创造了新的模具安装基础。

- 向 300 毫米 SiC 和 GaN 功率晶圆过渡需要新的湿式化学工艺

- 采用极微影术需要超低颗粒洁净度(<10 nm)。

- 儘管美国出口限制,中国积体电路製造商仍加快了晶圆厂投资。

- 市场限制

- 对含氟温室气体(F-GHG)排放严格监管

- 干旱频传的半导体工厂超纯水(UPW)成本不断上涨

- 与后端製程中其他干式等离子清洗方法相比,高资本投资强度的方法更为重要。

- 价值链分析

- 监理与技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按操作模式

- 自动设备

- 半自动设备

- 手动设备

- 依技术类型

- 单次进料喷雾

- 单晶圆低温

- 大量浸入

- 批量喷雾

- 洗涤器

- 按晶圆尺寸

- 150毫米或更小

- 200 mm

- 300 mm

- 450毫米或以上

- 透过使用

- 智慧型手机和平板电脑

- 储存装置

- 射频设备

- LED

- 功率分离式元件和积体电路

- CMOS影像感测器

- 最终用户

- 晶圆代工厂

- 整合装置製造商(IDM)

- 半导体组装和测试外包 (OSAT)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 台湾

- 韩国

- 日本

- 印度

- 亚太其他地区

- 南美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SCREEN Semiconductor Solutions Co., Ltd.

- ACM Research Inc.

- MEI Wet Processing Systems & Services LLC

- Modutek Corporation

- Akrion Technologies LLC

- RENA Technologies GmbH

- JST Manufacturing Inc.

- Yield Engineering Systems(YES)Inc.

- AP&S International GmbH

- Semsysco GmbH

- MT Systems Co., Ltd.

- Expertech Systems Inc.

- Samco Inc.

- Naura Technology Group

- Applied Materials

- Tokyo Electron Limited(TEL)

- Kaijo Corporation

- Surpass Industry Co., Ltd.

- Kingsemi Co., Ltd.

- Hwatsing Technology Co., Ltd.

第七章 市场机会与未来展望

The wafer cleaning equipment market size stood at USD 6.42 billion in 2025 and is forecast to reach USD 9.32 billion by 2030, reflecting a 7.74% CAGR during 2025-2030.

The expansion mirrors the semiconductor industry's move toward 1.6 nm process technology, where sub-10 nm particle removal becomes mandatory. EUV lithography adoption, foundry capacity build-outs in Taiwan, South Korea, China, and the United States, and the transition to 300 mm silicon-carbide and gallium-nitride wafers are amplifying demand across the wafer cleaning equipment market. Environmental mandates targeting fluorinated greenhouse gases and rising ultrapure-water costs are reshaping equipment selection criteria, but suppliers offering water-efficient or cryogenic solutions are capturing share. Competitive intensity remains moderate because sophisticated process know-how, long qualification cycles, and service footprints act as barriers to entry.

Global Wafer Cleaning Equipment Market Trends and Insights

Proliferation of 3-D NAND and DRAM Node Shrinks Driving Defect-Free FEOL Cleaning Demand

Mass-production roadmaps toward 1,000-layer 3-D NAND by 2030 multiply cleaning steps because every additional layer increase particle-induced yield loss. SK Hynix earmarked USD 75 billion for memory scaling through 2028, directing 80% to high-bandwidth memory. Lam Research introduced Cryo 3.0 etch to mitigate polymer residues in deep trenches. Equipment makers that deliver sub-angstrom removal precision are benefiting from rising layer counts, lifting the wafer cleaning equipment market. Memory fabs now contractually link tool purchase decisions to demonstrated removal efficiency below 10 nm, reinforcing long-term demand.

Foundry Capacity Expansion in the U.S., Korea and Taiwan Creating New Tool Install Base

The CHIPS Act triggered large-scale tool procurement in Arizona, where TSMC's complex requires thousands of process tools. Samsung and SK Hynix committed 622 trillion won (USD 471 billion) for 16 new fabs by 2047, intensifying immediate order cycles. Tokyo Electron nearly doubled R&D spend to JPY 1.5 trillion over five years to secure next-generation opportunities. Capacity additions focus on 3 nm and below, translating to tool specs that only advanced wafer cleaning equipment market participants can meet. Short tool lead-times and service proximity drove an immediate surge in orders for fully automatic cleaning platforms.

Stringent Discharge Regulations on Fluorinated Greenhouse Gases (F-GHGs)

The global semiconductor industry pledged to phase out PFOA, tightening chemical options. The U.S. EPA's accelerated PFAS review injects uncertainty into chemistry roadmaps. European fabs cut PFC emissions 42% from 2010-2020, mainly by retrofitting abatement modules. Equipment firms now bundle scrubbers and closed-loop chemical recycle units, raising acquisition cost and extending ROI timelines, moderating the wafer cleaning equipment market growth projection.

Other drivers and restraints analyzed in the detailed report include:

- Transition Toward 300 mm SiC and GaN Power Wafers Requiring New Wet-Bench Chemistries

- Adoption of EUV Lithography Necessitating Ultra-Low Particle Cleans <10 nm

- Rising Ultrapure-Water (UPW) Cost in Drought-Prone Semiconductor Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fully automatic platforms generated 74.5% of 2024 revenue thanks to strict contamination-control mandates on advanced logic lines, placing the wafer cleaning equipment market in an automation-first paradigm. Semi-automatic tools persisted in R&D cleanrooms, while manual systems stayed limited to specialty or legacy flows. The fully automatic segment, already dominant, is forecast to compound at 8.5% annually on the back of AI-driven recipe optimization. SCREEN's SS-3200 spin-scrubber processed 500 wafers per hour while cutting deionized-water use, underpinning replacement cycles.

Process analytics embedded in machine controllers now store millions of datapoints per lot, allowing fabs to predict excursions and prevent line stops. Vendors embed predictive-maintenance modules that flag nozzle fouling or flow instability. These digital workflows align with smart-manufacturing mandates, supporting premium pricing. Consequently, the wafer cleaning equipment market sees purchasing decisions shift from capex alone toward total cost-of-ownership anchored in uptime metrics and water savings.

Single-wafer spray lines earned 33.2% revenue share in 2024 by combining small footprint, chemistry savings, and recipe flexibility, helping maintain the wafer cleaning equipment market trajectory. Cryogenic CO2 variants, though newer, registered the fastest 12.2% CAGR outlook on the promise of near-zero liquid discharge. Batch immersion tools survived in high-volume commodity lines, while batch spray occupied the mid-tier. Scrubbers served blanket oxide removal tasks that chemicals alone could not address.

Tokyo Electron's cryogenic etch reduced CO2 emissions 80%, validating green-chemistry claims. ACM Research's Ultra C Tahoe slashed sulfuric-acid use 75% while matching legacy performance, winning multiple foundry installs. Technology decisions now revolve around water and greenhouse-gas metrics as much as particle-count specs, reinforcing the strategic importance of single-wafer innovation to the wafer cleaning equipment market.

Wafer Cleaning Equipment Market is Segmented by Operating Mode (Automatic Equipment, and More), Technology Type (Single-Wafer Spray, Single-Wafer Cryogenic, and More), Wafer Size (<=150 Mm, 200 Mm, 300 Mm, and >=450 Mm), Application (Smartphones and Tablets, Memory Devices, and More), End-User (Foundries, IDM, and OSAT), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 72.5% of 2024 revenue, anchored by cluster investments in Taiwan, South Korea, and China that collectively installed more than 7.7 million wafers per month cleaning capacity. Foundry expansions in Kaohsiung and Hsinchu lifted near-term tool uptake, while China's IDM surge under export controls catalyzed domestic tool adoption.

North America's share rose on TSMC-Arizona and Intel's Ohio investments, leveraging CHIPS Act grants. These fabs specified US-based service teams and spare-parts hubs, altering vendor-selection dynamics inside the wafer cleaning equipment market.

Europe maintained specialty leadership: Infineon and STMicroelectronics expanded SiC output; the Netherlands launched the EUR 12 million ChipNL Centre to co-develop cleaning and metrology platforms. Automotive demand underpins steady tool renewal.

South America, and Middle East and Africa posted nascent demand from assembly plants. Government incentives in the UAE and Brazil aim to attract backend facilities that still need localized wafer cleaning services, hinting at longer-term geographic diversification for the wafer cleaning equipment market.

- SCREEN Semiconductor Solutions Co., Ltd.

- ACM Research Inc.

- MEI Wet Processing Systems & Services LLC

- Modutek Corporation

- Akrion Technologies LLC

- RENA Technologies GmbH

- JST Manufacturing Inc.

- Yield Engineering Systems (YES) Inc.

- AP&S International GmbH

- Semsysco GmbH

- MT Systems Co., Ltd.

- Expertech Systems Inc.

- Samco Inc.

- Naura Technology Group

- Applied Materials

- Tokyo Electron Limited (TEL)

- Kaijo Corporation

- Surpass Industry Co., Ltd.

- Kingsemi Co., Ltd.

- Hwatsing Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of 3-D NAND and DRAM node shrinks driving defect-free FEOL cleaning demand

- 4.2.2 Foundry capacity expansion in the U.S., Korea and Taiwan creating new tool install base

- 4.2.3 Transition toward 300 mm SiC and GaN power wafers requiring new wet-bench chemistries

- 4.2.4 Adoption of EUV lithography necessitating ultra-low particle cleans <10 nm

- 4.2.5 Rapid fab investments by Chinese IDMs despite U.S. export controls

- 4.3 Market Restraints

- 4.3.1 Stringent discharge regulations on fluorinated greenhouse gases (F-GHGs)

- 4.3.2 Rising ultrapure water (UPW) cost in drought-prone semiconductor hubs

- 4.3.3 High capex intensity versus alternative dry plasma cleans in BEOL

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Operating Mode

- 5.1.1 Automatic Equipment

- 5.1.2 Semi-automatic Equipment

- 5.1.3 Manual Equipment

- 5.2 By Technology Type

- 5.2.1 Single-wafer Spray

- 5.2.2 Single-wafer Cryogenic

- 5.2.3 Batch Immersion

- 5.2.4 Batch Spray

- 5.2.5 Scrubbers

- 5.3 By Wafer Size

- 5.3.1 <=150 mm

- 5.3.2 200 mm

- 5.3.3 300 mm

- 5.3.4 >=450 mm

- 5.4 By Application

- 5.4.1 Smartphones and Tablets

- 5.4.2 Memory Devices

- 5.4.3 RF Devices

- 5.4.4 LED

- 5.4.5 Power Discrete and IC

- 5.4.6 CMOS Image Sensors

- 5.5 By End-User

- 5.5.1 Foundries

- 5.5.2 Integrated Device Manufacturers (IDM)

- 5.5.3 Outsourced Semiconductor Assembly and Test (OSAT)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Taiwan

- 5.6.3.3 South Korea

- 5.6.3.4 Japan

- 5.6.3.5 India

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Mexico

- 5.6.4.3 Argentina

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 SCREEN Semiconductor Solutions Co., Ltd.

- 6.4.2 ACM Research Inc.

- 6.4.3 MEI Wet Processing Systems & Services LLC

- 6.4.4 Modutek Corporation

- 6.4.5 Akrion Technologies LLC

- 6.4.6 RENA Technologies GmbH

- 6.4.7 JST Manufacturing Inc.

- 6.4.8 Yield Engineering Systems (YES) Inc.

- 6.4.9 AP&S International GmbH

- 6.4.10 Semsysco GmbH

- 6.4.11 MT Systems Co., Ltd.

- 6.4.12 Expertech Systems Inc.

- 6.4.13 Samco Inc.

- 6.4.14 Naura Technology Group

- 6.4.15 Applied Materials

- 6.4.16 Tokyo Electron Limited (TEL)

- 6.4.17 Kaijo Corporation

- 6.4.18 Surpass Industry Co., Ltd.

- 6.4.19 Kingsemi Co., Ltd.

- 6.4.20 Hwatsing Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment