|

市场调查报告书

商品编码

1851712

预防资料外泄(DLP):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Data Loss Prevention (DLP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

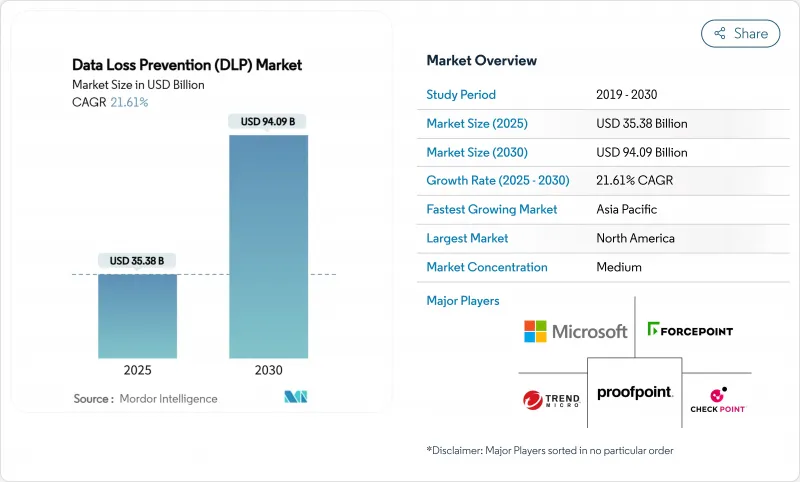

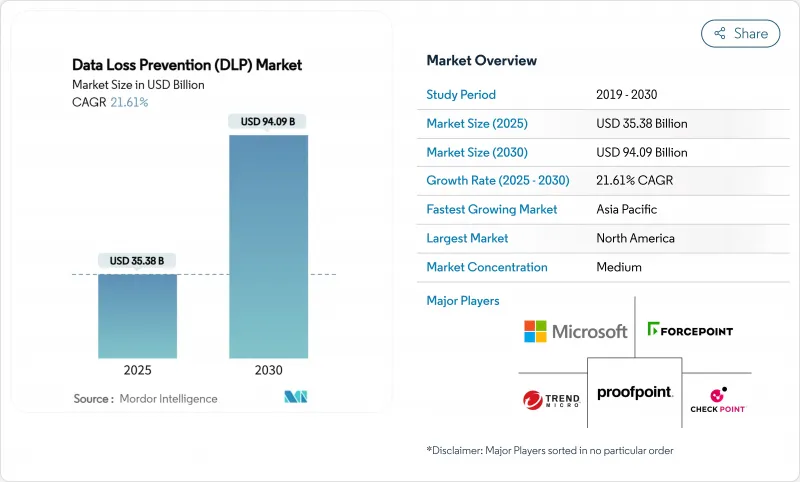

预计到 2025 年,预防资料外泄市场规模将达到 353.8 亿美元,到 2030 年将达到 940.9 亿美元,在此期间的复合年增长率为 21.61%。

监管处罚力度加大、混合职场中敏感资料的分散以及将资料防洩漏 (DLP) 控制整合到零信任和安全存取服务边际平台,是推动 DLP 快速发展的因素。人工智慧驱动的策略调整透过降低误报率和减轻分析师疲劳,进一步加速了 DLP 的普及;而云端交付部署模式则为企业提供了保护其分散式使用者所需的弹性。透过收购将 DLP 整合到更广泛的资料安全解决方案中的供应商整合,凸显了向统一平台策略的转变,该平台能够跨端点、网路和多重云端环境进行检测、分类和保护。

全球预防资料外泄(DLP) 市场趋势与洞察

GDPR 2.0 和 CCPA 修正案加强了对网路安全违规行为的处罚力度

巨额罚款正在改变监管机构的支出重点:TikTok 因违反资料传输控制规定而被处以 5.3 亿欧元(约 6.2418 亿美元)的罚款,这凸显了监管机构愿意对此类违规行为处以创纪录的罚款。同时,英国的《数据(使用和存取)法案》加强了资料处理规则,欧盟的人工智慧法案引入了强制性透明度审核。在加州,《加州消费者隐私法案》(CCPA) 的最新修订扩大了敏感个人资讯的定义,加强了消费者权益,同时也增加了在全美范围内运营的公司的合规风险。如今,企业主管普遍将强大的资料防洩漏 (DLP) 能力视为一项切实有效的风险缓解措施,而非可有可无的网路安全措施,这推动了预防资料外泄市场的成长。

混合办公模式的资料激增增加了终端和云端风险。

IBM 发布的《2023 年资料外洩报告》显示,82% 的资料外洩事件涉及云端数据,凸显了该公司边界防御的薄弱环节。员工越来越多地使用个人设备和核准的SaaS 工具,导致传统控制措施无法有效监控盲点。在製造业等操作技术与 IT 系统融合的产业,生产设备也接入网络,进一步扩大了攻击面。因此,企业正在采用端点资料防洩漏 (DLP) 来实现设备级控制,同时也在多个云端服务供应商之间扩展云端 DLP 规则,从而推动了预防资料外泄市场的需求成长。

多重云端部署的复杂性与技能差距

企业通常经营三到五个云端平台,每个平台都有各自的存取控制和加密方案。安全团队缺乏必要的专业知识,难以协调各项策略,导致引进週期延长,营运成本上升。因此,云端安全人才短缺正在阻碍预防资料外泄市场转型为完全编配的多重云端保护。

细分市场分析

预计到2024年,云端基础的部署模式将占据67.3%的市场份额,并且到2030年,该细分市场预计将保持22.1%的复合年增长率。因此,随着企业采用SASE(安全应用安全扩展)技术,云端服务的预防资料外泄市场规模也将同步成长。云端服务支援远端使用者进行单一主机管理和弹性策略执行,从而减轻了修补程式和硬体更新周期的负担。在国防和关键基础设施等高度监管的产业,本地部署解决方案仍然占据主导地位,因为这些产业的资料必须储存在受实体控制的位置。然而,混合办公模式的现实需求是无处不在的存取检查,而纯粹的本地配置无法有效地满足这一需求,从而限制了其相对增长。

Cloudflare 的 SASE 框架展示了整合式 DLP 如何侦测并阻止安全 Web 闸道和 CASB 流中的政策违规行为,这标誌着架构偏好正向聚合服务转变。快速扩展或应对季节性资料高峰的组织可以从计量型的消费模式中受益,这种模式将成本与使用量挂钩,从而增强了预防资料外泄市场的需求成长动能。

到2024年,端点控制将占总收入的46.7%,并以22.4%的复合年增长率保持增长最快的解决方案地位,这反映了以设备为中心的数据处理的爆炸性增长。生成式人工智慧编码助理的日益普及引入了新的资料外洩途径,而端点代理可以独特地阻止这些途径。研究人员已经展示了“规则文件后门”,这种后门可以绕过传统的审查,并通过看似无害的配置文件走私机密资讯。供应商现在正在将行为人工智慧融入资料保护中,以监控剪贴簿使用情况、萤幕截图和程式码产生模式,从而提高保护的准确性并推动预防资料外泄市场的成长。

网路资料防洩漏 (DLP) 在传输过程中的资料审查方面仍然至关重要,尤其是在复杂的园区网路中;而以储存为中心的工具则用于保护资料中心的大型檔案共用。儘管如此,随着员工在笔记型电脑、行动装置和虚拟桌面上直接接触敏感数据,企业正逐渐倾向采用以终端为先的策略。微软的 Purview 套件将终端策略扩展到浏览器流量和 SaaS 会话,展示了平台供应商如何将资料管治与终端遥测结合。

预防资料外泄市场按部署方式(本地部署、云端基础)、解决方案(网路资料防洩漏、终端资料防洩漏及其他)、最终用户产业(银行、金融服务和保险、IT与通讯、製造业及其他)、应用领域(云端储存安全、电子邮件与协作保护及其他)以及地区进行细分。市场预测以美元计价。

区域分析

预计到2024年,北美将占全球收入的24.2%,这得益于严格的联邦和州政府法规以及资金雄厚的私营部门对零信任项目的投入。美国在网路安全和基础设施安全局的SASE蓝图中纳入了资料防洩漏(DLP)技术,加拿大的隐私权政策体係以及墨西哥不断发展的金融科技生态系统都在推动这一成长。高昂的资料外洩成本和成熟的网路保险市场维持了高阶控制措施的溢价,进一步巩固了北美作为预防资料外泄市场技术试验场的地位。

亚太地区预计将以21.1%的复合年增长率加速成长,这主要得益于快速的数位化进程和各国主权云端法律对资料驻留的强制性要求。中国的《网路安全法》和印度的《数位个人资料保护法》要求进行在地化政策编配,从而推动了该地区对云端交付且符合当地管辖范围的解决方案的需求。日本和韩国正在采用终端资料防洩漏(DLP)技术来保护其製造技术,而东南亚国协则正在转向将DLP与安全Web网关捆绑在一起的云端原生架构。这些法规和威胁的交织使得亚太地区成为预防资料外泄市场最具活力的地区。

欧洲的成长取决于GDPR及其配套法规(例如《数位营运弹性法案》)的实施,该法案提高了金融机构的最低控制标准。德国和英国正透过强劲的银行业和产业部门来支持支出,而法国则在推进其主权云端计划,以支援本地託管的资料防洩漏(DLP)服务。儘管南欧国家的DLP采用速度保持稳定,但欧盟范围内强制执行的「隐私设计」政策正对供应商的DLP产品产生重大影响。云端外包指南中的资料在地化条款正在推动对能够跨国保持策略一致性的平台的兴趣,从而维持预防资料外泄市场的成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- GDPR 2.0 和 CCPA 修正案加强了对网路安全违规行为的处罚力度

- 混合办公模式的资料蔓延加剧了终端和云端风险

- 融合型资料防洩漏 (DLP)、云端存取安全代理程式 (CASB) 和数位讯号处理管理 (DSPM) 平台

- AI辅助策略调整可降低误报率

- 零信任和 SASE蓝图要求整合资料防洩漏

- Gen-AI程式码复製批次会产生新的洩漏途径

- 市场限制

- 多重云端部署的复杂性与技能差距

- 传统本地部署政策的总拥有成本高昂

- 隐私设计促进了对深度内容检查的限制

- 主权云端指令将导致全球政策碎片化

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云端基础的

- 透过解决方案

- 网路资料防洩漏

- 端点资料防洩漏

- 储存/资料中心 DLP

- 其他的

- 按最终用户行业划分

- BFSI

- 资讯科技和电讯

- 政府/国防

- 卫生保健

- 零售和物流

- 製造业

- 其他的

- 透过使用

- 云端储存安全

- 安全的电子邮件和协作

- 智慧财产权保护与原始码管治

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Broadcom(Symantec)

- Microsoft

- Forcepoint

- Proofpoint

- Zscaler

- Trend Micro

- Check Point

- Cisco

- Palo Alto Networks

- CrowdStrike

- Netskope

- Trellix

- Digital Guardian(Fortra)

- CoSoSys

- GTB Technologies

- Spirion

- Safetica

- Code42

- Nightfall AI

- Cyera

- Fortinet

第七章 市场机会与未来展望

The data loss prevention market is valued at USD 35.38 billion in 2025 and is forecast to reach USD 94.09 billion by 2030, translating into a vigorous 21.61% CAGR over the period.

Rapid expansion is rooted in mounting regulatory penalties, the dispersal of sensitive data across hybrid workplaces, and the embedding of DLP controls inside zero-trust and Secure Access Service Edge platforms. Artificial-intelligence policy tuning is further accelerating adoption by trimming false-positive rates and reducing analyst fatigue, while cloud-delivered deployment models deliver the elasticity enterprises need to secure distributed users. Vendor consolidation driven by acquisitions that fold DLP into broader data-security posture offerings underscores a strategic pivot toward unified platforms capable of discovery, classification, and protection across endpoints, networks, and multicloud estates.

Global Data Loss Prevention (DLP) Market Trends and Insights

Escalating Cyber-Breach Fines Under GDPR 2.0 and CCPA Amendments

Maximum penalties are reshaping spending priorities: TikTok's EUR 530 million (USD 624.18 million) fine in 2025 spotlighted regulators' readiness to levy record sanctions for lax data-transfer controls. In parallel, the UK Data (Use and Access) Bill tightens data-handling rules, and the EU AI Act introduces mandatory transparency audits, both driving proactive DLP investment. California's latest CCPA amendments widen the definition of sensitive personal information and strengthen consumer rights, expanding compliance exposure for enterprises operating nationwide. Across jurisdictions, executives now view robust DLP capability as a demonstrable risk-mitigation measure rather than a discretionary cybersecurity layer, propelling the data loss prevention market toward accelerated growth.

Hybrid-Work Data Sprawl Raising Endpoint and Cloud Risk

IBM's 2023 breach report revealed that 82% of incidents involved cloud-resident data, underscoring the erosion of perimeter defenses IBM. Employees increasingly use personal devices and unsanctioned SaaS tools, creating blind spots that traditional controls cannot monitor. In sectors such as manufacturing where operational technology merges with IT systems the attack surface widens as production gear becomes network-connected. Organizations therefore adopt endpoint DLP for device-level controls while extending cloud DLP rules across multiple providers, fuelling demand in the data loss prevention market.

Complexity and Skills Gap in Multi-Cloud Roll-Outs

Firms commonly operate three to five cloud platforms, each with unique access controls and encryption schemes. Security teams struggle to harmonize policies without dedicated expertise, lengthening deployment cycles and inflating operating costs. The shortage of cloud-security talent therefore restrains the pace at which the data loss prevention market can transition toward fully orchestrated multicloud protection.

Other drivers and restraints analyzed in the detailed report include:

- Convergence of DLP with CASB and DSPM Platforms

- AI-Assisted Policy Tuning Slashing False-Positive Rates

- High TCO for Legacy On-Prem Policies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud-based deployment models secured 67.3% market share in 2024, and this segment is projected to sustain a 22.1% CAGR through 2030. The data loss prevention market size for cloud services will therefore scale in parallel with enterprise SASE adoption. Cloud delivery enables single console management and elastic policy enforcement across remote users, mitigating the burdens of patching and hardware refresh cycles. On-prem solutions persist in heavily regulated sectors such as defense or critical infrastructure where data must remain within physically controlled locations. Yet their relative growth is subdued because hybrid-work realities demand anywhere-access inspection that pure on-site deployments cannot deliver efficiently.

Cloudflare's SASE framework illustrates how integrated DLP detects and blocks policy violations within secure web gateway and CASB streams, demonstrating the architectural preference shift toward converged services. Organizations scaling rapidly or dealing with seasonal data spikes benefit from metered consumption models that align cost with usage, thereby reinforcing the demand trajectory of the data loss prevention market.

Endpoint controls accounted for 46.7% of revenue in 2024 and remain the fastest advancing solution at 22.4% CAGR, reflecting the surge in device-centric data handling. The rising prevalence of generative-AI coding assistants introduces novel exfiltration vectors that endpoint agents are uniquely positioned to intercept. Researchers demonstrated a "rules file backdoor" that smuggles secrets via benign-looking configuration files, bypassing conventional reviews. Vendors now embed behavioral AI to monitor clipboard use, screen capture, and code-generation patterns, increasing protection precision and powering growth in the data loss prevention market.

Network DLP preserves relevance for in-flight data scrutiny, especially in complex campus networks. Meanwhile, storage-centric tools protect high-volume file shares inside data centers. Nonetheless, enterprises gravitate toward endpoint-first strategies because employees engage with sensitive data directly on laptops, mobiles, and virtual desktops. Microsoft's Purview suite extends endpoint policies into browser traffic and SaaS sessions, signalling how platform vendors fuse data governance with endpoint telemetry.

Data Loss Prevention Market is Segmented by Deployment (On-Premises, Cloud-Based), Solution (Network DLP, Endpoint DLP, and More), End-User Industry (BFSI, IT and Telecom, Manufacturing, and More), Application (Cloud Storage Security, Email and Collaboration Protection, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 24.2% of global revenue in 2024, anchored by stringent federal and state regulations plus a well-capitalized private sector that budgets for zero-trust programs. United States agencies embrace DLP inside SASE blueprints published by the Cybersecurity and Infrastructure Security Agency, while Canada's privacy regime and Mexico's expanding fintech ecosystem add regional momentum. High breach costs and mature cyber-insurance markets sustain a premium on advanced controls, consolidating North America's role as a technology proving ground for the data loss prevention market.

Asia-Pacific is forecast to accelerate at 21.1% CAGR, catalyzed by rapid digitization and sovereign-cloud laws that mandate resident data storage. China's Cybersecurity Law and India's Digital Personal Data Protection Act compel localized policy orchestration, driving regional demand for cloud-delivered yet jurisdiction-aware solutions. Japan and South Korea deploy endpoint DLP to safeguard manufacturing know-how, while ASEAN economies leapfrog to cloud-native stacks that bundle DLP with secure web gateways. This regulatory and threat-exposure cocktail positions APAC as the most dynamic arena within the data loss prevention market.

Europe's growth rests on GDPR enforcement and complementary statutes such as the Digital Operational Resilience Act, which raise minimum control baselines for financial entities. Germany and the United Kingdom anchor spending through robust banking and industrial sectors, whereas France advances sovereign-cloud projects that favor locally hosted DLP services. Southern European economies adopt DLP at a steadier pace, yet pan-EU privacy-by-design mandates universally influence vendor offerings. Data localization clauses inside cloud-outsourcing guidelines spur interest in platforms capable of maintaining policy fidelity across borders, sustaining incremental gains for the data loss prevention market.

- Broadcom (Symantec)

- Microsoft

- Forcepoint

- Proofpoint

- Zscaler

- Trend Micro

- Check Point

- Cisco

- Palo Alto Networks

- CrowdStrike

- Netskope

- Trellix

- Digital Guardian (Fortra)

- CoSoSys

- GTB Technologies

- Spirion

- Safetica

- Code42

- Nightfall AI

- Cyera

- Fortinet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating cyber-breach fines under GDPR 2.0 and CCPA amendments

- 4.2.2 Hybrid-work data sprawl raising endpoint and cloud risk

- 4.2.3 Convergence of DLP with CASB and DSPM platforms

- 4.2.4 AI-assisted policy tuning slashing false-positive rates

- 4.2.5 Zero-trust and SASE road-maps mandating integrated DLP

- 4.2.6 Gen-AI code copilots creating new exfiltration vectors

- 4.3 Market Restraints

- 4.3.1 Complexity and skills gap in multi-cloud roll-outs

- 4.3.2 High TCO for legacy on-prem policies

- 4.3.3 Privacy-by-design push limiting deep content inspection

- 4.3.4 Sovereign-cloud mandates fragmenting global policy sets

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud-based

- 5.2 By Solution

- 5.2.1 Network DLP

- 5.2.2 Endpoint DLP

- 5.2.3 Storage / Datacenter DLP

- 5.2.4 Others

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Government and Defense

- 5.3.4 Healthcare

- 5.3.5 Retail and Logistics

- 5.3.6 Manufacturing

- 5.3.7 Others

- 5.4 By Application

- 5.4.1 Cloud Storage Security

- 5.4.2 Email and Collaboration Protection

- 5.4.3 IP Protection and Source-code Governance

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Broadcom (Symantec)

- 6.4.2 Microsoft

- 6.4.3 Forcepoint

- 6.4.4 Proofpoint

- 6.4.5 Zscaler

- 6.4.6 Trend Micro

- 6.4.7 Check Point

- 6.4.8 Cisco

- 6.4.9 Palo Alto Networks

- 6.4.10 CrowdStrike

- 6.4.11 Netskope

- 6.4.12 Trellix

- 6.4.13 Digital Guardian (Fortra)

- 6.4.14 CoSoSys

- 6.4.15 GTB Technologies

- 6.4.16 Spirion

- 6.4.17 Safetica

- 6.4.18 Code42

- 6.4.19 Nightfall AI

- 6.4.20 Cyera

- 6.4.21 Fortinet

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment