|

市场调查报告书

商品编码

1851716

内容传递网路(CDN) 安全:市场占有率分析、产业趋势、统计资料和成长预测 (2025-2030)Content Delivery Network (CDN) Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

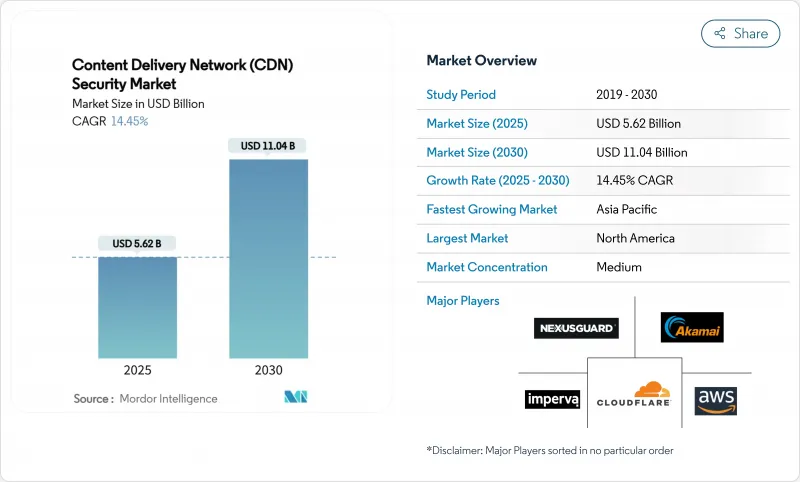

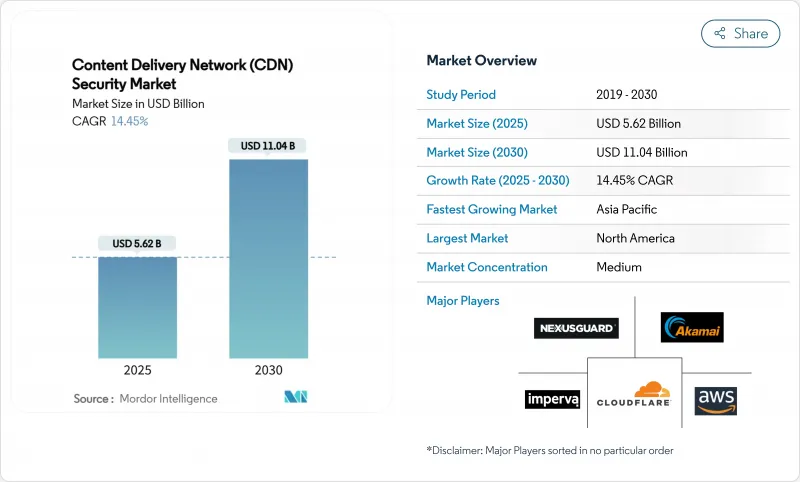

CDN 安全市场预计到 2025 年将创造 56.2 亿美元的收入,到 2030 年将达到 110.4 亿美元,年复合成长率为 14.45%。

攻击量激增、监管期限日益严格以及工作负载向多重云端和边缘环境迁移是推动市场扩张的关键因素。 Cloudflare 的数据显示,2025 年第一季全球 DDoS 事件激增 358%,拦截了 2,050 万次攻击。此后,企业纷纷倡导采用始终在线、基于运作的缓解措施。欧盟《数位营运弹性法案》(DORA) 和 PCI DSS v4.0 等强制性法规增加了合规风险,而 OTT 流量的兴起迫使内容拥有者将安全措施更深入地嵌入到其交付流程中。向云端交付的同步转型正在推动快速部署,云端采用率已达到 65.7% 便是最好的证明。随着现有企业进行整合(例如 Akamai 以 4.5 亿美元收购 Noname),以及 Cloudflare 等专业公司扩展其人工智慧驱动的检测能力以应对不断演变的机器人和爬虫程序,竞争日益激烈。

全球内容传递网路(CDN) 安全市场趋势与洞察

DDoS/L-7攻击的频率和复杂性日益增加

根据 Cloudflare 的远端检测,2025 年第一季网路层攻击年增 509%, Terabit级泛光已司空见惯。多向量攻击宣传活动将 SYN泛光与 Mirai 殭尸网路结合,而 CLDAP 和 ESP 等反射攻击技术分别激增 3488% 和 2301%。地毯式轰炸策略占 2024 年所有攻击的 82.78%,迫使企业采用全天候防御而非流量分流方法。随着地缘政治紧张局势加剧骇客行动主义,金融服务业仍然是主要目标。 Akamai 记录显示,2023 年针对该产业的攻击事件增加了 154%。 CDN 安全厂商目前正在其边缘存取点 (PoP) 整合机器学习主导的异常评分,以区分合法的微突发流量和恶意泛光。

OTT视讯和即时串流媒体流量激增

用户流失与串流媒体缓衝直接相关,促使平台采用多 CDN 架构和 DRM 浮水印技术。 ContentArmor 和 Limelight 已升级取证浮水印技术以减少盗版,并将其直接整合到分送层。 Qwilt 的边缘原生基础设施降低了首帧延迟,但由于其靠近用户,容易受到凭证人员编制和令牌窃取攻击。因此,其安全堆迭整合了会话熵检查和令牌绑定,同时不会增加对直播体育赛事至关重要的延迟预算。

全球网路安全专业人才短缺

在已通报的资料外洩事件中,46%发生在员工人数少于1000人的公司,82%的勒索软体攻击事件也针对同一群体。大学平均拥有1580个公共域,但往往缺乏安全团队来维护这些域的安全。儘管供应商目前提供点击式配置预设和AI故障排查功能,但持续存在的人才缺口阻碍了资源有限的买家对CDN安全市场的接受度。

细分市场分析

大型企业将占2024年总收入的75.4%,这主要得益于其复杂的基础设施和涵盖DDoS攻击、Web应用防火墙(WAF)、机器人程式以及零信任层等的大量安全预算。 NEC为其全球12万名员工部署了Zscaler,以集中管理互联网和私人应用程式的存取。相较之下,中小企业将达到最高成长,复合年增长率(CAGR)将达到14.7%,因为託管云端模式使曾经只有财富500强企业才能使用的工具普及开来。 Cloudflare已与乐天移动合作,为日本的中小企业提供零信任服务。儘管人才短缺和成本意识仍然存在,但简化的控制面板和基于使用量的定价模式正在推动这些服务的普及。

由于PCI DSS v4.0强制要求脚本监控,Web应用防火墙(WAF)到2024年将占据47.2%的市场份额。 Fortinet的FortiAppSec Cloud将WAF与效能分析结合,简化了部署流程。利用人工智慧(AI)解决网页抓取和凭证窃取问题,机器人防护将以15.3%的复合年增长率成长。 Cloudflare的AI Labyrinth产生诱饵页面来捕捉恶意履带,而HUMAN Security则声称透过智慧指纹辨识技术实现了99.9%的侦测准确率。随着攻击者将机器学习武器化,整合WAF、机器人防护和API保护的多层防御机制将塑造CDN安全市场的发展轨迹。

内容传输网路(CDN) 安全市场按组织规模(中小企业、大型企业)、安全类型(DDoS 防护、 网路应用程式防火墙(WAF) 等)、最终用户产业(媒体与娱乐、银行、金融服务和保险 (BFSI) 等)、部署类型(云端、本地部署)和地区进行细分。市场预测以美元计价。

区域分析

到2024年,北美将贡献全球32.9%的收入。成熟的合规体系和高人均网路安全支出推动了Zscaler的普及。奥克拉荷马州部署了Zscaler,拦截了34,000次加密威胁和1760万次政策违规行为。

亚太地区正以15.1%的复合年增长率快速成长。 Akamai预测,2024年,亚太地区网站将遭受510亿次网路应用攻击,增幅高达73%,其中澳洲、印度和新加坡受影响最为严重。乐天行动正与Cloudflare合作,为本地中小企业提供商业化的零信任託管服务。

随着DORA和GDPR加强营运和资料保护要求,欧洲正经历稳定成长。银行正在对API和WAF控制维修,以进行弹性测试;爱沙尼亚资讯系统局则使用Cloudflare来保护其主权数位服务。拉丁美洲和非洲仍在发展中。 CDNetworks目前在20个拉丁美洲国家营运接入点(PoP),覆盖6亿用户,为未来CDN安全市场扩张奠定了基础。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- DDoS/L-7攻击的频率和复杂性日益增加

- OTT视讯和即时串流媒体流量激增

- 企业向多重云端和边缘架构转型

- 监管执行时间和资料保护义务(例如,DORA、PCI DSS v4)

- 边缘接入点集成,嵌入式零信任控制

- 演算法网路成本调控,实现安全整合型CDN

- 市场限制

- 全球网路安全专业人才短缺

- 中小企业始终在线缓解措施的总拥有成本较高

- IPv6流量暴露了传统过滤设备的漏洞

- 边缘接入点能源成本上升减缓了网路扩张速度

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按组织规模

- 中小企业

- 大公司

- 按证券类型

- DDoS防护

- Web应用程式防火墙(WAF)

- 机器人攻击缓解和萤幕抓取防护

- 资料安全和内容完整性

- 其他的

- 按最终用户行业划分

- 媒体与娱乐

- 零售与电子商务

- BFSI

- 资讯科技和电讯

- 医疗保健和生命科学

- 政府/公共部门

- 教育

- 其他的

- 透过部署模式

- 云

- 本地部署

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Akamai Technologies Inc.

- Amazon Web Services Inc.(CloudFront)

- Cloudflare Inc.

- Google LLC(Cloud CDN)

- Microsoft Corp.(Azure Front Door)

- Imperva Inc.

- Fastly Inc.

- Edgio Inc.(Limelight Networks)

- Verizon Media Platform

- Radware Ltd.

- F5 Inc.

- StackPath LLC

- G-Core Labs SA

- Alibaba Cloud(Alibaba Group)

- Corero Network Security plc

- Nexusguard Ltd.

- CDNetworks Inc.

- Neustar Security Services

- Akamai(Prolexic)

- NETSCOUT Systems(Arbor)

第七章 市场机会与未来展望

The CDN Security market generated USD 5.62 billion in 2025 and is on track to reach USD 11.04 billion by 2030, advancing at a 14.45% CAGR.

Escalating attack volumes, aggressive regulatory deadlines, and the migration of workloads to multi-cloud and edge environments are the primary forces behind this expansion. Enterprises now insist on always-on, behavioral-based mitigation after Cloudflare documented a 358% jump in global DDoS events during Q1 2025, equal to 20.5 million blocked attacks. Mandates such as the EU's Digital Operational Resilience Act (DORA) and PCI DSS v4.0 elevate compliance risk, while OTT traffic growth pushes content owners to embed security deeper into delivery pipelines. A parallel shift toward cloud delivery enables rapid deployment, illustrated by the 65.7% share that cloud implementations already hold. Competitive intensity is rising as incumbents consolidate (Akamai's USD 450 million acquisition of Noname) while specialists such as Cloudflare expand AI-powered detection to counter evolving bots and scrapers.

Global Content Delivery Network (CDN) Security Market Trends and Insights

Rising Frequency and Sophistication of DDoS / L-7 Attacks

Cloudflare's telemetry shows network-layer assaults ballooned 509% year-over-year in Q1 2025, while terabit-scale floods are now routine. Multi-vector campaigns combine SYN floods with Mirai botnets, and reflection methods such as CLDAP and ESP have spiked 3,488% and 2,301% respectively.Carpet-bombing tactics, 82.78% of all observed attacks in 2024, force organizations to adopt always-on defenses instead of traffic-divert approaches. Financial services remain the primary target as geopolitical tensions spur hacktivism; Akamai logged a 154% rise in sector-focused events in 2023. CDN security vendors now embed ML-driven anomaly scoring at edge PoPs to distinguish legitimate microbursts from malicious floods.

Rapid Growth in OTT Video and Real-Time Streaming Traffic

Subscriber churn correlates directly with stream buffering, prompting platforms to deploy multi-CDN setups plus DRM watermarking. ContentArmor and Limelight upgraded forensic watermarking to curb piracy, integrating directly into delivery layers. Edge-native infrastructure from Qwilt reduces first-frame latency, but its proximity to viewers exposes surface area to credential-stuffing and token theft. Security stacks therefore integrate per-session entropy checks and token binding without inflating latency budgets crucial for live sports.

Global Shortage of Skilled Cyber-Security Practitioners

Forty-six percent of reported breaches hit firms with under 1,000 staff, and 82% of ransomware incidents target the same cohort. Universities average up to 1,580 public-facing domains yet often lack security teams to harden them. Providers now ship point-and-click configuration presets and AI triage, but a persistent talent gap slows CDN Security market adoption among resource-constrained buyers.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise Shift to Multi-Cloud and Edge Architectures

- Regulatory Uptime and Data-Protection Mandates

- High TCO of Always-On Mitigation for SMEs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises controlled 75.4% of 2024 revenue thanks to complex infrastructures and deep security budgets that span DDoS, WAF, bot and zero-trust layers. NEC rolled out Zscaler for 120,000 global employees to centralize internet and private-app access. Conversely, SMEs show the strongest 14.7% CAGR as managed cloud models democratize tools once reserved for Fortune 500. Cloudflare's partnership with Rakuten Mobile offers packaged zero-trust services aimed at Japan's small-business segment. Talent shortages and cost sensitivities persist, yet simplified dashboards and usage-based pricing unlock adoption.

Web Application Firewalls held 47.2% share in 2024, bolstered by PCI DSS v4.0 script-monitoring mandates. Fortinet's FortiAppSec Cloud combines WAF with performance analytics to streamline deployment. Bot mitigation, expanding 15.3% CAGR, addresses AI-driven scraping and credential abuse. Cloudflare's AI Labyrinth generates decoy pages to trap illegal crawlers, while HUMAN Security claims 99.9% detection accuracy via intelligent fingerprinting. As attackers weaponize machine learning, layered defenses that join WAF, bot and API protection will shape the CDN Security market trajectory.

Content Delivery Network (CDN) Security Market is Segmented by Organization Size (SMBs, Large Enterprises), Security Type (DDoS Protection, Web Application Firewall (WAF), and More), End-User Industry (Media and Entertainment, BFSI, and More), Deployment Mode (Cloud, On-Premises), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 32.9% of global revenue in 2024. Mature compliance regimes and high per-capita cyber spend underpin adoption. Oklahoma's statewide Zscaler roll-out blocked 34,000 encrypted threats and 17.6 million policy violations, proving zero-trust viability at scale.

Asia-Pacific is expanding at a 15.1% CAGR. Akamai logged 51 billion web-app attacks against APAC sites in 2024, a 73% jump, with Australia, India and Singapore worst hit. Rakuten Mobile's partnership with Cloudflare commercializes managed zero-trust for local SMEs, while Japan's cyber insurance market is growing nearly 50% a year.

Europe sees steady growth as DORA and GDPR tighten operational and data-protection requirements. Banks retrofit API and WAF controls for resilience testing, and Estonia's Information System Authority relies on Cloudflare to safeguard sovereign digital services. Latin America and Africa remain nascent; CDNetworks now operates PoPs in 20 LATAM countries to reach 600 million subscribers, laying groundwork for future CDN Security market uptake.

- Akamai Technologies Inc.

- Amazon Web Services Inc. (CloudFront)

- Cloudflare Inc.

- Google LLC (Cloud CDN)

- Microsoft Corp. (Azure Front Door)

- Imperva Inc.

- Fastly Inc.

- Edgio Inc. (Limelight Networks)

- Verizon Media Platform

- Radware Ltd.

- F5 Inc.

- StackPath LLC

- G-Core Labs S.A.

- Alibaba Cloud (Alibaba Group)

- Corero Network Security plc

- Nexusguard Ltd.

- CDNetworks Inc.

- Neustar Security Services

- Akamai (Prolexic)

- NETSCOUT Systems (Arbor)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising frequency and sophistication of DDoS / L-7 attacks

- 4.2.2 Rapid growth in OTT video and real-time streaming traffic

- 4.2.3 Enterprise shift to multi-cloud and edge architectures

- 4.2.4 Regulatory uptime and data-protection mandates (e.g., DORA, PCI DSS v4)

- 4.2.5 Edge PoP consolidation enabling embedded zero-trust controls

- 4.2.6 Algorithmic network-cost steering driving security-integrated CDNs

- 4.3 Market Restraints

- 4.3.1 Global shortage of skilled cyber-security practitioners

- 4.3.2 High TCO of always-on mitigation for SMEs

- 4.3.3 IPv6 traffic exposing gaps in legacy filtering appliances

- 4.3.4 Rising energy costs at edge PoPs slowing footprint expansion

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Organization Size

- 5.1.1 Small and Medium-Sized Businesses (SMBs)

- 5.1.2 Large Enterprises

- 5.2 By Security Type

- 5.2.1 DDoS Protection

- 5.2.2 Web Application Firewall (WAF)

- 5.2.3 Bot Mitigation and Screen-Scraping Protection

- 5.2.4 Data Security and Content Integrity

- 5.2.5 Others

- 5.3 By End-user Industry

- 5.3.1 Media and Entertainment

- 5.3.2 Retail and E-commerce

- 5.3.3 BFSI

- 5.3.4 IT and Telecom

- 5.3.5 Healthcare and Life Sciences

- 5.3.6 Government and Public Sector

- 5.3.7 Education

- 5.3.8 Others

- 5.4 By Deployment Mode

- 5.4.1 Cloud

- 5.4.2 On-Premise

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akamai Technologies Inc.

- 6.4.2 Amazon Web Services Inc. (CloudFront)

- 6.4.3 Cloudflare Inc.

- 6.4.4 Google LLC (Cloud CDN)

- 6.4.5 Microsoft Corp. (Azure Front Door)

- 6.4.6 Imperva Inc.

- 6.4.7 Fastly Inc.

- 6.4.8 Edgio Inc. (Limelight Networks)

- 6.4.9 Verizon Media Platform

- 6.4.10 Radware Ltd.

- 6.4.11 F5 Inc.

- 6.4.12 StackPath LLC

- 6.4.13 G-Core Labs S.A.

- 6.4.14 Alibaba Cloud (Alibaba Group)

- 6.4.15 Corero Network Security plc

- 6.4.16 Nexusguard Ltd.

- 6.4.17 CDNetworks Inc.

- 6.4.18 Neustar Security Services

- 6.4.19 Akamai (Prolexic)

- 6.4.20 NETSCOUT Systems (Arbor)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment